What Personal Factors Affect Mortgage Rates

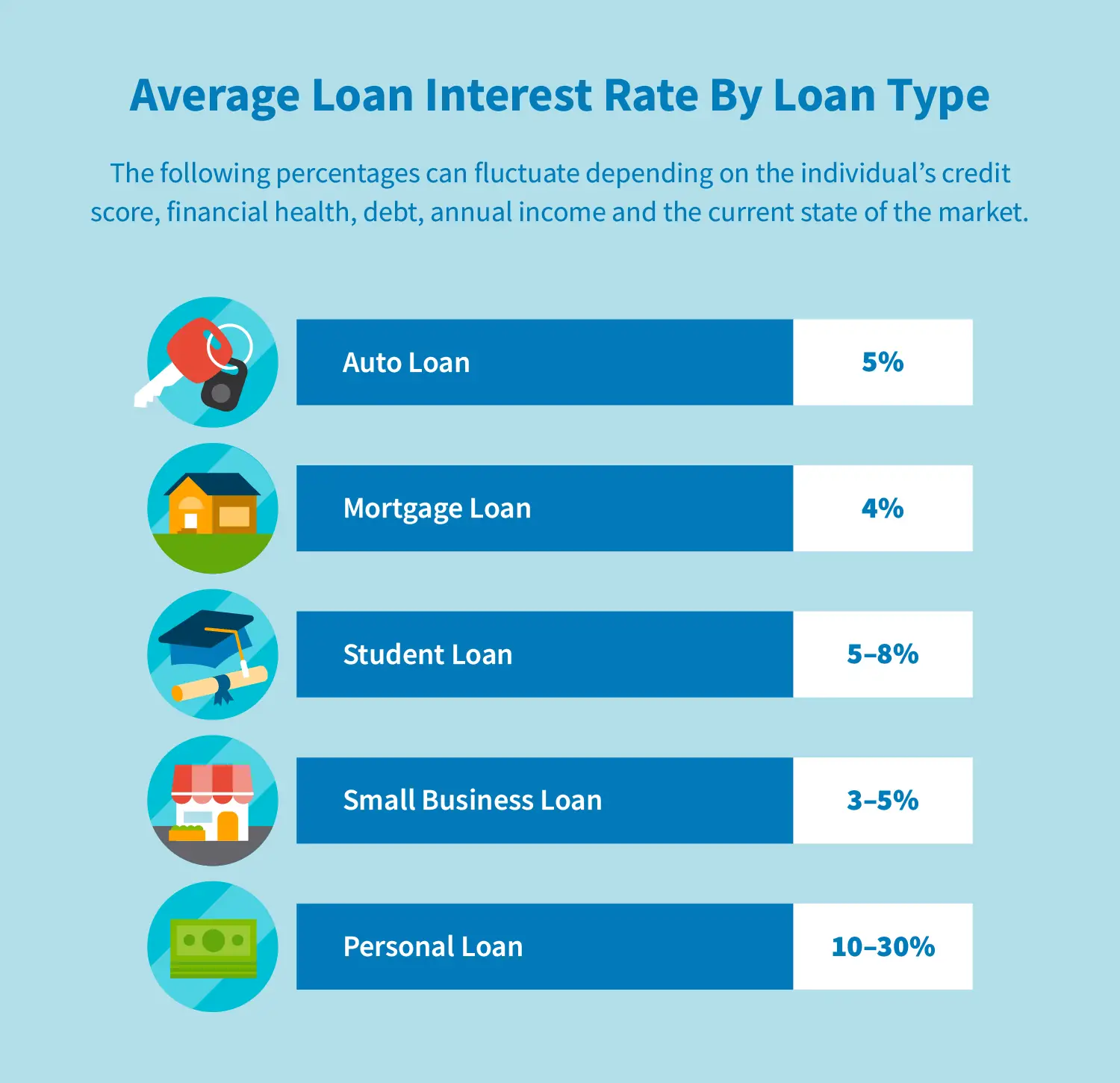

Economic factors aside, many personal factors affect the par rate, or the interest rate before expenses like origination fees are factored in, a mortgage lender will give you. Lenders have interest rates they can charge for the best borrowers, and they adjust rates for the riskier borrowers. Fortunately, you can control your personal factors, which means you can indirectly affect your mortgage rate.

Follow these guidelines to get the best mortgage rate possible.

Increase Your Credit Score

Mortgage rates are highly influenced by a borrowers credit score. Lenders typically offer lower interest rates to borrowers with a higher credit score. The more you can work to increase it, the more likely youll be offered a lower rate. Some action steps to take include making on-time payments and refraining from applying for additional loans at the same time as your mortgage application.

How Big Of A 30

There are a few considerations to look into when determining how much of a mortgage you can afford. While lenders consider factors including your assets, liabilities, and income, your DTI will be the most significant factor in determining how much you can afford. The front-end DTI considers how much of your monthly income goes toward housing expenses. Lenders want to see this ratio at 28% or less.

You May Like: Which Credit Report Do Mortgage Lenders Use

How Do I Find Current 30

NerdWallets mortgage rate tool can help you find competitive 30-year mortgage rates. In the filters above, enter a few details about the loan youre looking for, and youll get a personalized rate quote in moments, without providing any personal information. From there, you can start start the process of getting approved for your home loan. Its that easy

A 30-year fixed-rate mortgage is the most common term of mortgage. It provides the security of a fixed principal and interest payment, and the flexibility to afford a larger mortgage loan because the payments are more affordable theyre spread out over three decades.

What Are Points On A Mortgage

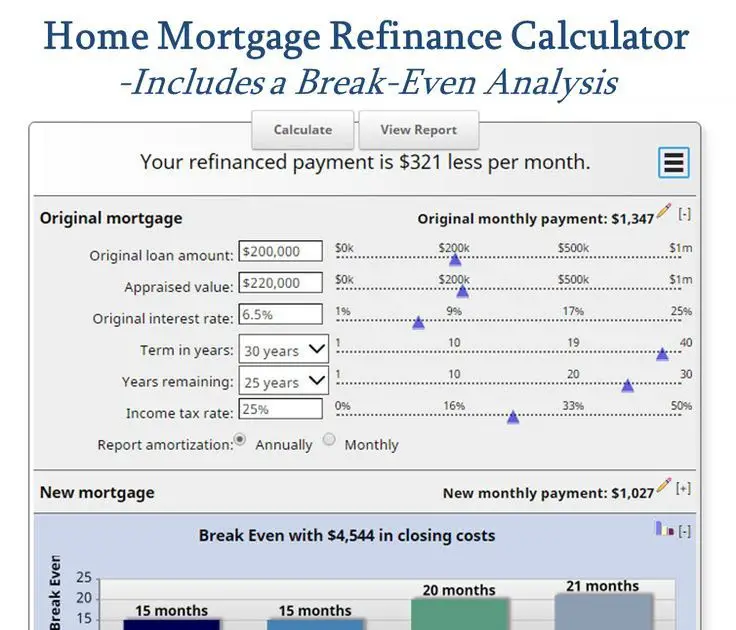

Discount points are a way for borrowers to reduce the interest rate they will pay on a mortgage. By buying points, youre basically prepaying some of the interest the bank charges on the loan. In return for prepaying, you get a lower interest rate which can lead to a lower monthly payment and savings on the overall cost of the loan over its full term.

A mortgage discount point normally costs 1% of your loan amount and could shave up to 0.25 percentage points off your interest rate. The exact reduction varies by lender. Always check with the lender to see how much of a reduction each point will make.

Discount points only pay off if you keep the home long enough. Selling the home or refinancing the mortgage before you break even would short circuit the discount point strategy.

In some cases, it makes more sense to put extra cash toward your down payment instead of discount points if a larger down payment could help you avoid paying PMI premiums, for example.

Don’t Miss: How To Calculate Refinancing Your Mortgage

Is 750 A Good Credit Score

In the scoring models used by most mortgage lenders, credit scores range from 300 to 850. This score range is further divided into tiers, which can help you understand how lenders and others may view your score. FICO® Scores, the most commonly used score among lenders, break into the following five ranges:

- 300 to 579 is considered “very poor”

- 580 to 669 is considered “fair”

- 670 to 739 is considered “good”

- 740 to 799 is considered “very good”

- 800 to 850 is considered “exceptional”

A score of 750 falls in the very good range and shows that you’ve historically done a good job managing your debt as agreed. When considering you for a loan, lenders use your credit score to help gauge how likely it is you’ll pay back your debt on time. A higher credit score tends to predict a higher likelihood that they’ll recoup their debt without issue.

When To Consider A 30

A 30-year fixed mortgage is best for those looking for predictable, relatively low monthly payments. Youll wind up paying more in interest over the life of a 30-year mortgage than a 15- or 20-year one, but because of the longer repayment timeline, your monthly costs will be lower, so the more expensive loan may ultimately be easier on your budget.

Also Check: Can A Discharged Bankrupt Get A Mortgage

How Much Housing Loan Can I Get

Among the factors determining the amount of the housing loan you are eligible for are your income, expenses and savings, the general interest rate level and the location of the home. When drawing down a loan, you should consider how big a monthly payment you could afford without it affecting your standard of living.

How Can I Estimate My Mortgage Rate

You can view todays interest rates to see where you might fall. If you arent sure what type of loan youd qualify for, consider getting preapproved to determine where you fall. But if you know your credit score and your approximate LTV ratio, you can estimate your interest rate using todays mortgage rates.

Also Check: What’s The Mortgage Rate Now

Purchase Plus Improvement Program

If the home youre buying requires renovation, the Purchase Plus Improvement program through Maine Housing, a single mortgage that finances both the purchase and renovation, may help. The program provides $500 to $35,000 for home improvements, depending on who is completing the work, with the amount rolled into the mortgage so you can pay it off over time.

To qualify, the total cost of the home and the project must fall within purchase price limits. A fee of 6 percent of the construction costs applies, and the only certain projects are eligible, such as adding a garage, making energy efficiency improvements or increasing the accessibility of the home. Upgrades such as installing a deck or swimming pool do not qualify.

Why Do Different Mortgage Types Have Different Rrates

Each type of mortgage has a different rate because they have varying levels of risk. One of the primary sources of income for lenders is the money they earn from the interest you pay on your mortgage. For this reason, lenders consider the amount of risk associated with each loan when they set the interest rate. This is referred to as risk-based pricing and is premised on the idea that riskier loans like 30-year mortgages should carry a higher rate.

One of the reasons for this is that its easier to predict what will happen in the economy in the short-term than it is in the long-term. Similarly, theres more risk that something will happen to negatively affect your ability to repay the loan, for instance, if you lose your job or theres an economic downturn.

Also Check: Are Reverse Mortgages Good For Seniors

How Are Mortgage Rates Determined

In general, mortgage rates are determined by economic factors. These include the Federal Reserve benchmark interest rates and the job market. Mortgage rates aren’t directly tied to Fed rates, but they tend to trend in the same direction. If the job market is poor and fewer people are working, rates will drop to attract buyers.

Lenders then look at factors like credit score and history, income, and total debts to determine what mortgage rate to offer specific borrowers.

Shopping For Mortgage Rates

Shopping for a mortgage can be a stressful and time-consuming experience. Make it less so by getting your thoughts and the information you need to be organized before you get started. This will also help you identify and deal with any problems that could make getting a loan more difficult. This will put you in the best position possible to get a favorable mortgage interest rateand make sure that it is the best you can do. That quiets that looming thought what if theres something better?

You May Like: How Much Mortgage 200k Salary

How Much Mortgage Can I Qualify For As A First

If youve built a good credit history and your finances are in good shape, being a first-time home buyer shouldnt limit how much you can borrow. You can use the Quicken Home Affordability Calculator to estimate how much house you can afford, based on the maximum mortgage you may qualify for. Or you can talk to a loan originator at your lender.

How To Find The Best Mortgage Rate For You

Different lenders will look at your financial circumstances in different ways.

For example, a lender that specializes in FHA loans will rarely raise an eyebrow if your credit score is in the 580 to 620 range. But one that caters to super-prime borrowers likely wont give you the time of day.

Ideally, you want a mortgage lender that is used to dealing with people who are financially similar to you. And the best way to find your ideal lender is by comparing loan offers. Heres how to do that.

Don’t Miss: Where To Compare Mortgage Rates

What Mortgage Rate Can I Expect

Question:

“I’m looking to purchase my first home and what I’ve been trying to do as of late is determine what I can actually afford. I’ve listed some background information below, and curious if anyone has a good sense of what type of rate I would get on a 30 year fixed. Does the rate vary based on the amount of the loan and/or the down payment? Again my main goal here is to find out if I can get a reasonable mortgage and if so what rate, and then compare that + other home ownership costs with what I’m currently owning.

- Home Price: Looking in the range of $350-$500k.

- Current Rent : $2375 monthly, not including utilities.

- Area: We currently rent in the Seattle area which as many people know is booming right now. I’m not looking to purchase in the city because frankly the idea of buying a small condo for $600k is not appealing but rather 30 min to an hour outside of the city.

If there are other factors I should consider, please let me know your thoughts!”

Answer:

Let’s look at a few of factors that go into determining your interest rate:

Down Payment: As far as effecting your rate, if you put 20% down, you’ll have a lower rate and you won’t have to pay monthly mortgage insurance. If you put less than 20% down, you will have to pay a monthly mortgage insurance premium and your rate will be higher because your loan will be considered higher risk.

Using the information you provided, I ran a scenario through our Mortgage Calculator with the following parameters:

What To Do If I Have A High Foir

Well, there is not much you can do. One way is to close some of the existing loans. I understand that this may not be an option. The other option is to have a joint applicant with you. With a joint applicant , the EMI burden gets divided and the loan eligibility may increase.

Banks will do what they want to do. However, they do not know as much about you as you do. Moreover, they dont care much. If you dont repay the loan, they will take away the asset. You need to be very clear where you are headed. For instance, if you foresee lack of stability in your job, you should refrain from increasing your loan liability. Now, the bank may not be aware of this uncertainty and be ready to give you the loan but you need to be responsible. I have covered such aspects inthis post.

You May Like: What Is The Maximum Fha Loan Amount In Texas

You May Like: What Are Basis Points In Mortgage

How To Improve Your Credit Score Before Applying For A Mortgage

There are several ways you can improve credit relatively quickly. Taking a few simple steps prior to applying for a mortgage could help increase your chances of approval and may help you lock in a favorable low interest rate.

If you aren’t sure where your credit stands, get a free copy of your credit report and scores from Experian to understand what lenders will see when they consider your application and what areas of improvement you may have.

What Are Points On A Mortgage Rate

Mortgage points represent a percentage of an underlying loan amountone point equals 1% of the loan amount. Mortgage points are a way for the borrower to lower their interest rate on the mortgage by buying points down when theyre initially offered the mortgage.For example, by paying upfront 1% of the total interest to be charged over the life of a loan, borrowers can typically unlock mortgage rates that are about 0.25% lower.

Its important to understand that buying points does not help you build equity in a propertyyou simply save money on interest.

Recommended Reading: Where Are Mortgage Interest Rates Going

Mortgage Rates Are Based On Your Credit Score

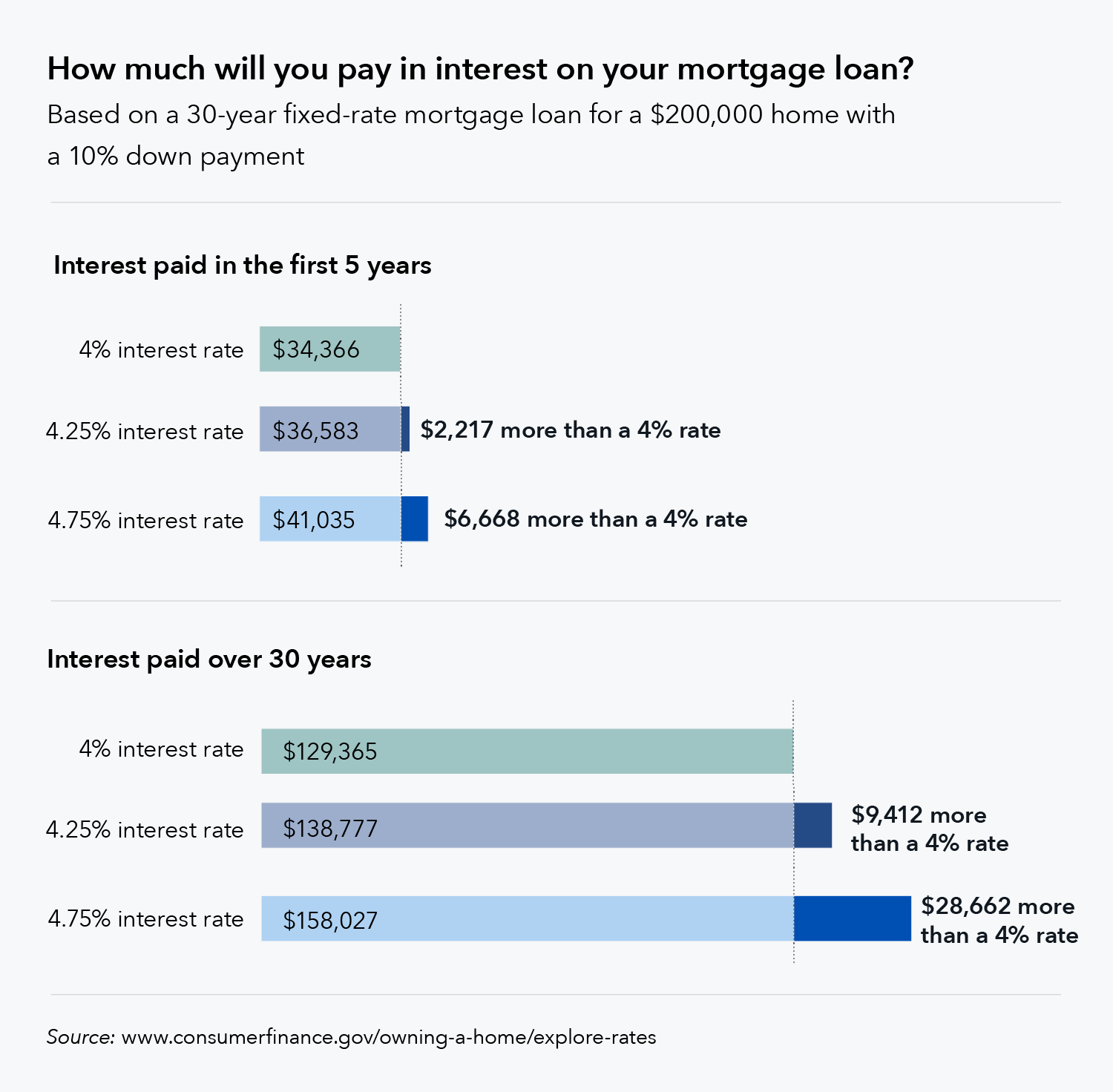

- The illustration above should give you an idea of the importance of credit scores

- When it comes to mortgages even a small difference in rate can equate to thousands of dollars

- Someone could have a rate 0.75% higher based on credit score alone

- So be sure all 3 of your credit scores are as high as possible before you apply!

The graphic above is based on real advertised rates from Zillows marketplace for a $400,000 loan amount at 80% loan-to-value for a 30-year fixed on an owner-occupied, single-family residence.

While interest rates are even lower today, the same sliding scale rule applies.

Those with higher credit scores will get the lowest mortgage rates available, while those with lower credit scores will have to settle for higher rates.

Notice that the interest rate is a full 0.75% higher for a borrower with a 620 FICO score versus a borrower with a 740+ FICO score. That can equate to a lot of money over time.

One thing that determines what mortgage rate youll ultimately receive is credit scoring, though its just one of many factors, known as mortgage pricing adjustments, used to price your loan.

Along with credit scoring is documentation type, property type, loan amount, loan-to-value, and several others.

Each pricing adjustment is essentially applied based on risk, so a borrower with a high-risk loan must pay a higher mortgage rate than a borrower who presents low risk to the lender. This is how risk-based pricing works.

What Are Mortgage Points

Also known as discount points, this is a one-time fee or prepaid interest borrowers purchase to lower the interest rate for their mortgage. Each discount point costs one percent of your mortgage amount, or $1,000 for every $100,000 and will lower the rate by a quarter of a percent, or 0.25. For example, if the interest rate is 4 percent, purchasing one mortgage point will reduce the rate to 3.75 percent.

Recommended Reading: What Is The Government Refinance Program On Home Mortgage

Are Mortgage Rates High Right Now

Rates have been higher a lot higher than they are today. In October of 1981, for example, average rates topped 18 percent. Forty years later, in October of 2021, average rates on 30-year mortgages were below 3 percent. So, most homebuyers today are paying rates much closer to record lows than to record highs.

Tim Lucas

Editor

Understanding Different Mortgage Rates

If you’re going to buy a home, you’ll likely need a mortgage. It will probably be the biggest loan you’ve ever taken outand getting it wrong can be a mistake that will cost you for years. So getting it right means educating yourself. Start by checking our mortgage rates tables, which are updated on a daily basis. Then, read below to learn more about how the mortgage market works, which type of mortgage to choose, how to find and lock in the best rate, and more.

You May Like: Can You Refinance 1st Mortgage Only

How Long Should My Mortgage Be

When applying for a mortgage, the type of loan will usually determine how long youll have your mortgage. For instance, you can choose from conventional mortgages on 15-year and 30-year terms. With a shorter term, youll pay a higher monthly rate, though your total interest will be lower than a 30-year loan. If you have a high monthly income as well as long-term stability for the foreseeable future, a 15-year loan would make sense to save money in the long-term. However, a 30-year term would be better for someone who needs to make lower monthly payments.

Buying Your First Home In 2022

Even under normal conditions, buying a house presents challenges of one sort or another for buyers. Buying a house in 2022 comes with a number of challenges.

One factor has been a dwindling supply of homes in some parts of the country. This stems from a combination of some sellers taking their home off the market and increased demand for homes in many areas. In some cases, sellers may have decided that this isnt a good time to move, or perhaps theyve encountered a financial situation that has led to this decision. Due to the pandemic, many families have decided to move out of congested urban areas and into suburban areas. In many cases, the lower supply and increased demand have resulted in higher prices and stiff competition.

Also Check: How To Cut Your Mortgage Term In Half