Reach Out If You’re Struggling To Make Your Repayments

While keeping your mortgage repayments down can be a great objective, rising interest rates is making that task more difficult for almost all borrowers at present. In fact, the average monthly repayment has already increased by $610 since April, research from Finder shows.

If you are in a position where you’re starting to experience mortgage stress and you’re having trouble making your repayments, Lees recommends reaching out to your lender as soon as possible.

“If people are experiencing hardship, it’s better to get on the front foot and talk to their bank because all banks have hardship provisions.

“You can go to the bank and ask for some sort of relief and normally they will offer interest-only payments until your circumstances change, even on your owner-occupied property.”

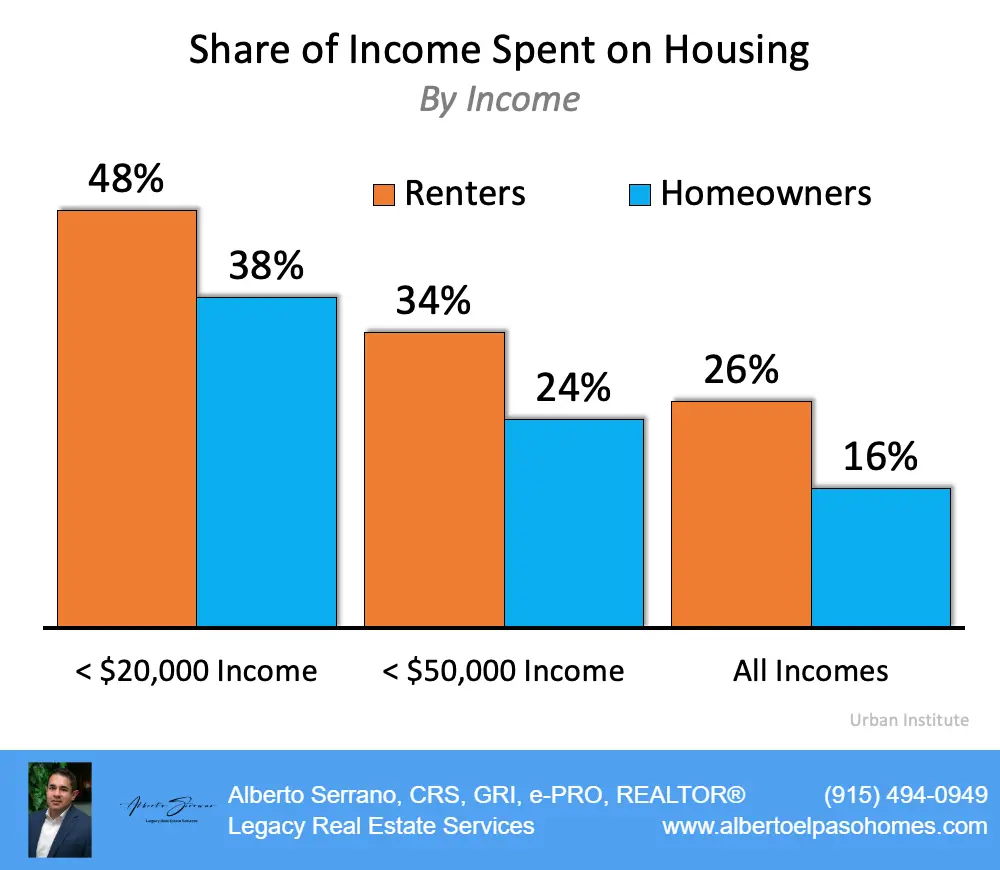

Percentage Of Income That Should Go Towards Your Mortgage

December 22, 2017 by Barron Rothenbuescher

As a general rule of thumb, your monthly housing payment should not exceed 28 percent of your income before taxes. When determining what percentage of income should go to mortgage, a mortgage broker will typically follow the 28/36 Rule. The Rule states that a household should not spend more than 28 percent of its gross monthly income on housing-related expenses. In addition to mortgage payments, housing expenses include property taxes, home insurance and similar expenses. While this is the standard, this percentage is not right for everyone. Some individuals are able to spend more or less depending on their individual circumstances.

What Other Costs Could Be Added To A Mortgage Payment

While the principal and interest will make up the bulk of your monthly mortgage payment, other costs can increase the overall payment amount.

- Private mortgage insurance : If your down payment is less than 20% of the home purchase price, your conventional mortgage lender may require you to buy private mortgage insurance a type of insurance policy that helps secure the lender if a homeowner stops making their monthly house payments. While you can typically have it removed once you reach 20% equity, it will still drive up your mortgage payments at first.

- Property taxes: It is common to have your property tax bundled with your monthly mortgage payment. Those payments typically go into an escrow account and are automatically released when the bill is due. Even if your property tax isn’t bundled, it is still a new cost to account for on a monthly basis.

Read Also: How Much Does 1 Extra Mortgage Payment Save

Our Recommended Percentage Of Income For Mortgage

At Rocket Mortgage®, the percentage of income-to-mortgage ratio we recommend is 28% of your pretax income. This percentage strikes a good balance between buying the home you want and keeping money in your budget for emergencies and other expenses. However, its important to remember that you dont need to spend up to your monthly limit. Think of 28% as the ideal amount you should spend monthly on your total mortgage payment. Remember to include your principal, interest, taxes, insurance and homeowners association dues in your total before you sign on a loan.

The Reality Of Mortgage Payments

The fact is the amount you’ll be paying every month to your mortgage company includes more than just the loan itself. Every month you’ll be paying the loan’s principal as well as the interest on the loan, your real estate taxes, and homeowner’s insurance.

And if you do not put 20 percent down on the home from the start, you may also have private mortgage insurance tacked on every month.

How much of your income should go toward your mortgage?

You need to have a rough estimate of all of these figures in order to know how much house you can afford – and to figure out if you can cover the monthly payments over time.

You take out a $150,000 mortgage with a $716 per month payment. Your real estate taxes equal $4,000 and your homeowner’s insurance equals $900 per year. This means $333 per month for real estate taxes and $75 per month for homeowner’s insurance. Your total mortgage payment equals $1,124, or $408 more than the principal and interest alone.

If you have PMI on top of this payment, it could add $100 or more onto your payment. The once affordable $716 mortgage payment suddenly looks much less affordable.

Take a look at mortgage rates in your area . This will give you an idea of what your monthly mortgage payment will be. You can use it to crunch some numbers to figure out how much you can afford.

Free Bonus Section

Recommended Reading: How Much Does Fannie Mae Pay For Mortgages

How To Calculate How Much House You Can Afford

To figure out how much house you can afford, all you need to do is crunch a few numbers. If math isnt your thing, hang in there. Ill walk you through it step by step.

And for you married folks, make sure you and your spouse look at the results together. You need to be on the same page when it comes to your budget and whats realistic for your money situation. After all, shopping for your home sweet home will feel very unifying and exciting once you both have a shared vision.

To calculate how much home you can afford, simply follow these five steps.

Finding The Right Lender

One place to start is with Credible, a site that allows you to get quotes from three lenders in only three minutes. Theres no obligation, but if you see a rate you like for your mortgage or refinancing your mortgage, you can progress to the next step of the application process. Everything is handled through the website, including uploading documents. If you want to speak to a loan officer, you can, of course, but it isnt necessary.

As you shop for a lender, remember that every dollar counts. Youre committing to a monthly mortgage payment based on the rate you choose at the very start. Even small savings on your interest rate will add up over the years youre in your house.

Fiona is another great place to get started since they allow you to shop and compare multiple rates and quotes with minimal information, all in one place. Youll input the amount of the loan, your down payment, state, mortgage product type, and your credit score to get mortgage quotes from multiple lenders at once.

Don’t Miss: How To Buy A Reverse Mortgage Foreclosure

Mortgage Payments Arent Your Only Homeownership Cost

Theres more to homeownership cost than your monthly payment. More on that later. But what makes up your monthly payment itself?

Mortgage professionals use the acronym PITI to cover some of the main ones. That stands for:

- Principal: The amount by which you reduce the amount you borrowed each month.

- Interest: The cost of borrowing.

- Taxes: The property taxes you have to pay.

- Insurance: Homeowners insurance. Plus, depending on where you buy, possibly flood, earthquake or hurricane cover.

None of these is optional and if you fall far behind on any of them, youll be in breach of your mortgage agreement and subject to action by your lender.

How Credit Score And Down

Every lenders priority is to maximize its chances of getting its money back with as little expense as possible. They want to be as sure as they can that borrowers are ready, able and willing to make timely monthly payments.

Luckily, this protects most borrowers from taking on mortgages that they cant afford or are incapable of maintaining.

You May Like: What Do I Need For A Mortgage Pre Qualification

Learn About Other Types Of Loans

Most of these guidelines are in relation to conventional loans, but you may qualify for another type of loan. There are a few mortgage programs that allow people with low credit scores or savings to still purchase a home. VA loans and FHA loans have less strict requirements than conventional loans, so its worthwhile to look into them if you dont think you will qualify for a conventional loan.

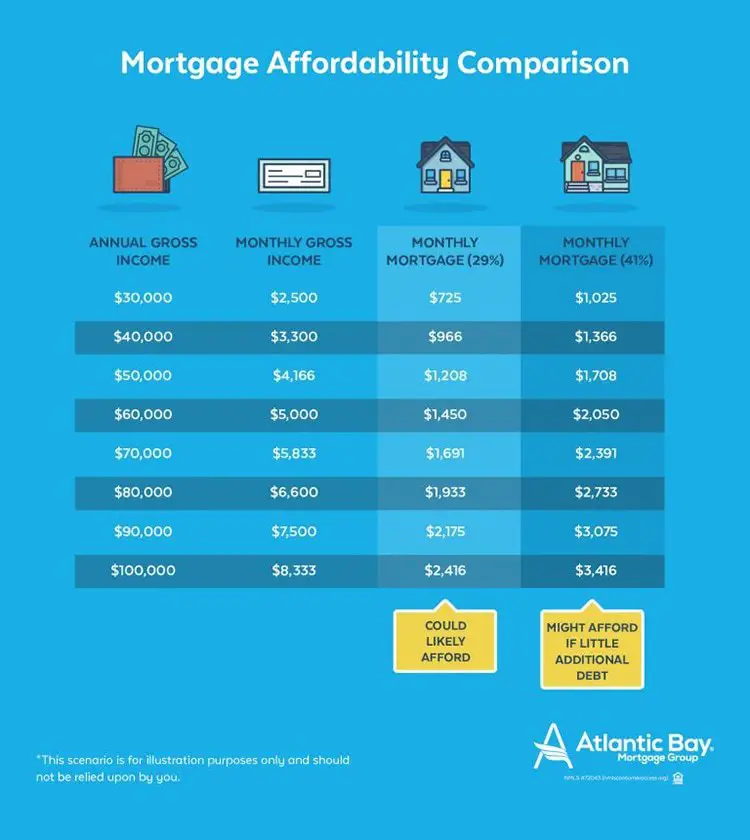

Figure Out How Much Mortgage You Can Afford

As a general rule, lenders want your mortgage payment to be less than 28% of your current gross income. Theyll also look at your assets and debts, your credit score and your employment history. From all of this, theyll determine how much theyre willing to lend to you.

However, the amount you may qualify to borrow isnt necessarily what you should borrow. Why? Because lenders are only looking at your past and present situation. They dont take into account your future plans.

Are you thinking of a career change? Do you expect a substantial increase in debt or expenses? Use our mortgage affordability calculator to consider multiple scenarios. Or talk with a mortgage loan officer. They can help you figure out a price range that makes sense for the long term.

Don’t Miss: How Much Is A 230k Mortgage

Online Animated Gif Converter

Sometimes, you dont have the time to get to your own computer. If you still want to turn your video into an animated GIF, Img2Go has your back!

Since this animated GIF converter is an online service, you can access it from anywhere as long as you have an internet connection.

Plus, Img2Go is optimized for mobile usage! Thus, you can even use it from your smartphone, tablet, or someone elses computer.

Rate this tool4.3/ 5

You need to convert and download at least 1 file to provide feedback

Feedback sent

You May Like: What Is Aag Reverse Mortgage

What Is The Required Debt

Online resource Investopiea.com explains that the lower an applicants debt-to-income ratio, the greater the chances that the borrower will be approved for a credit application.

As a customary rule, 43 percent is the highest debt-to-income read DTI ratio a borrower can have and still be qualified for a mortgage.

However, lenders prefer a debt-to-income ratio lower than 36 percent, with no more than 28 percent of that debt as a mortgage or rent payment.

In reality, though, the maximum DTI ratio varies from lender to lender.

Don’t Miss: What Factors Into Mortgage Approval

What If You Just Dont Have Enough For A Down Payment

If you dont have enough savings for a 20 percent down payment, then you need to keep saving, Sethi says. If you are struggling to save, he advises creating a sub-savings account.

A sub-savings account is an automated account that directly deposits small amounts from your paycheck into a savings account, so you dont even have to think about it, he says.

A lot of people say Hey, Im cut to the bone, I cant really save, he says. Well, it turns out when you automate this money you never even see it. It actually adds up pretty quick.

And dont underestimate the power of the side hustle, he says.

Convert Mp4 To Gif On Windows With Easeus Video Editor

All you need is the source video and EaseUS Video Editor, a user-friendly and professional video editing program that enables you to convert MOV to GIF, convert MP4 to MP3, and many more conversion. You can get high-quality GIF animation fast and export the files in 1080P.

Except for format conversion, this YouTube video editor also supports all the basic video editing functions. You can add subtitles to video, add texts/special effects/metadata/filters, crop, rotate, merge videos, and more. It still allows you to extract audio from video and save in MP3 and AAC.

The guide below explains how to convert MP4 to GIF step by step. You can also follow the instructions to transfer other video formats to GIF. Download EaseUS Video Editor for Windows and start creating GIFs right away!

Steps to convert MP4 to GIF on Windows in 1080P with EaseUS Video Editor:

Step 1. Importing Video File

After starting EaseUS Video Editor first thing to do is simply dragging the target file to the media library. You also can right-click on the file and left click import video to do the same thing.

Step 2. Add to Project

The next step is adding video files to the project. After adding source file to media, you can either left-click on Add to Project or you can drag and place it.

Step 3. Exporting the File

After adding a source to Project it will appear on the timeline. Then you can export the video file, it will direct you to another window.

Step 4. Save as GIF

Recommended Reading: How To Make A Mortgage Payment With A Credit Card

When Income Gets Complicated

For most borrowers, calculating income is easy and so is proving it. Borrowers simply look at their pay stubs or W-2 to determine how much they make and then show these documents to potential lenders as proof. Remember, however, that any income you can prove counts when qualifying for a mortgage. Money you receive from pensions, alimony, disability payments, renting out property or investing can all factor into your calculations.

If you’re self-employed and receive a 1099 rather than a W-2, you may have to calculate your income a bit differently. Your income may change from month to month, which makes budgeting harder. To determine your monthly income, you’ll need to divide what you make in a year by 12. This will show your average monthly income and help you determine how much house you can afford. When applying for a loan, expect the lender to ask for your 1099 forms and tax returns for at least two years. When filing your taxes, watch your deductions. Deducting business expenses lowers your tax liability, but it also lowers your adjusted gross income . If you plan to get a mortgage, it may be advantageous to take a tax hit for a year or two and keep your AGI high for lenders.

References

Purchase What You Can Afford

Indeed, given the tight inventory, there are numerous temptations for borrowers to overspend on a home, which some borrowers may find difficult to ignore. Dont expect income growth to help you grow into that payment and get used to it, Goldstein advised. If youre expecting a $500-a-week extra income from a side job or overtime and it doesnt materialize, youre in big trouble.When it comes to your appetite for borrowing, dont go in with your eyes bigger than your stomach, says Bruce McClary, senior vice president of communications at the National Foundation for Credit Counseling . The larger the home and the loan, the higher the commission paid to a realtor or mortgage broker. Its fantastic if you get approved for something that is more than 28 percent of your monthly income, McClary says. Someone might try to convince you that you can still afford that. That is why McClary recommends that consumers contact a HUD-approved housing counselor. They are sponsored by the United States Department of Housing and Urban Development and will provide free home buying advice as well as a reality check you may require. Related article on mortgages:

Don’t Miss: How Much Conventional Mortgage Can I Afford

Change Your Loan Term

Another option is to lengthen your loan term. By making the loan term longer, youre spreading your principal balance across a longer period of time, making monthly payments cheaper, even if it means paying more in interest over the lifetime of the loan.

Ready to buy a home and wondering how much your down payment will be?

Start by getting approved for a mortgage.

Mortgage Payment Rules And Methods

So, how do you calculate how much you can afford per month for mortgage payments?

You can use mortgage calculation methods to help you gauge how much of your income should go toward your mortgage. The calculation depends on your personal income, other financial goals and debts. Lets take a look at a few calculations you can use:

- The 28% rule: The 28% rule specifies that your mortgage payment shouldnt be more than 28% of your monthly pre-tax income. To find your maximum mortgage payment with the 28% rule, multiply your monthly income by 28%. Lets say you have a monthly income of $6,000. In this case, you would calculate:

$6,000 x 0.28 = $1,680 .

In a more thorough examination of the 28% rule, you could also calculate the 28/36 rule, which states that your mortgage payment shouldnt be more than 28% of your monthly pre-tax income and 36% of your total debt.

- The 35%/45% model: The 35%/45% model says that your total monthly debt, including your mortgage payment, shouldnt be more than 35% of your pre-tax income, or 45% more than your after-tax income. To calculate it, multiply your gross monthly income before taxes by 35%. Next, deduct your taxes from your gross monthly income and multiply by 45%. You can pay special attention to the range between these two figures.

Lets say you make $7,000 before taxes and $5,000 after taxes. Your calculation will look like this:

$7,000 x 0.35 = $2,450

$5,000 x 0.45 = $2,250

$6,000 x 0.25 = $1,500

Read Also: What Is The Current Interest Rate For 15 Year Mortgage

What Should I Do If I Am Spending Too Much On My Mortgage

If you are concerned that youre spending too much of your monthly income, there are a handful of different options to consider:

- Take a fresh look at your budget and determine whether youre stretching it too far in order to pay off your mortgage early

- Rent out a room in your home to bring in some extra cash each month

- Get a second job or pursue a side hustle

- Look at a cash-out refinance but only if it makes sense financially for you

- Downsize to a home thats more affordable

If youre a homeowner who is looking for a way to cover more expenses so you can stay on top of your mortgage payments, you also might want to consider a Hometap Investment you can tap into your equity to receive cash while staying in your home. Take our five-minute quiz to see if a Hometap Investment might be a fit to help you reach your financial goals.