Rate Shopping For Refinance Applicants

Refinance applicants have the most to gain when shopping for a mortgage rate. They certainly shouldnt be shy about it.

Apply online or over the phone with five to 10 lenders. Choose the best rate and fee structure until youve received your best deal.

Lenders love refinance applications: they close quicker and are much easier to process than most home purchase ones. Use that to your advantage.

Theres no penalty for applying for even dozens of lenders within a 14-day window. Thats plenty of time to receive multiple quotes and choose the best one.

The Initial Credit Score Hit

Immediately following getting a new mortgage, expect your credit to suffer. Your credit score is a numerical representation of your ability to pay back a debt obligation. When you take on the largest loan that most consumers will ever have, your score goes down until you prove that you have the ability to pay back the loanand that you will actually make the payments you promised.

Because of this temporary lowering of your score, you may find it difficult to get other loans or get a loan with the credit terms you would expect. Plan to wait at least six months before applying for any loan of significant size.

A mortgage is the pinnacle of consumer credit, where, if you can qualify for a mortgage youre considered a trustworthy borrower.

Dont Miss: Who Uses Equifax For Mortgages

Optimizing Credit In The Futureand Now

Getting a mortgage is a positive opportunity to build your credit, accumulate wealth and live in your own home. Checking your credit score before you begin the application process can help you determine whether it might be a good idea to take time to improve your credit score before submitting your applications.

If your score isnt where you want it to be, check out Experian Boost. This free service lets you add on-time utility, phone and streaming service payments to your credit score calculation, which may help offset a minor dip in your credit score while youre waiting for the positive effects of paying your new mortgage to kick in.

Also Check: How Hard To Get A Mortgage

How Does Your Credit Score Affect Your Mortgage

Whether itâs high, low, or nonexistent, your credit score can shape your mortgage in different ways.

âYour credit score matters because it affects both your interest rate and your ability to qualify for a mortgage,â says Deb Klein, branch manager of Reliability in Lending at Primary Residential Mortgage Inc. based in Chandler, Arizona.

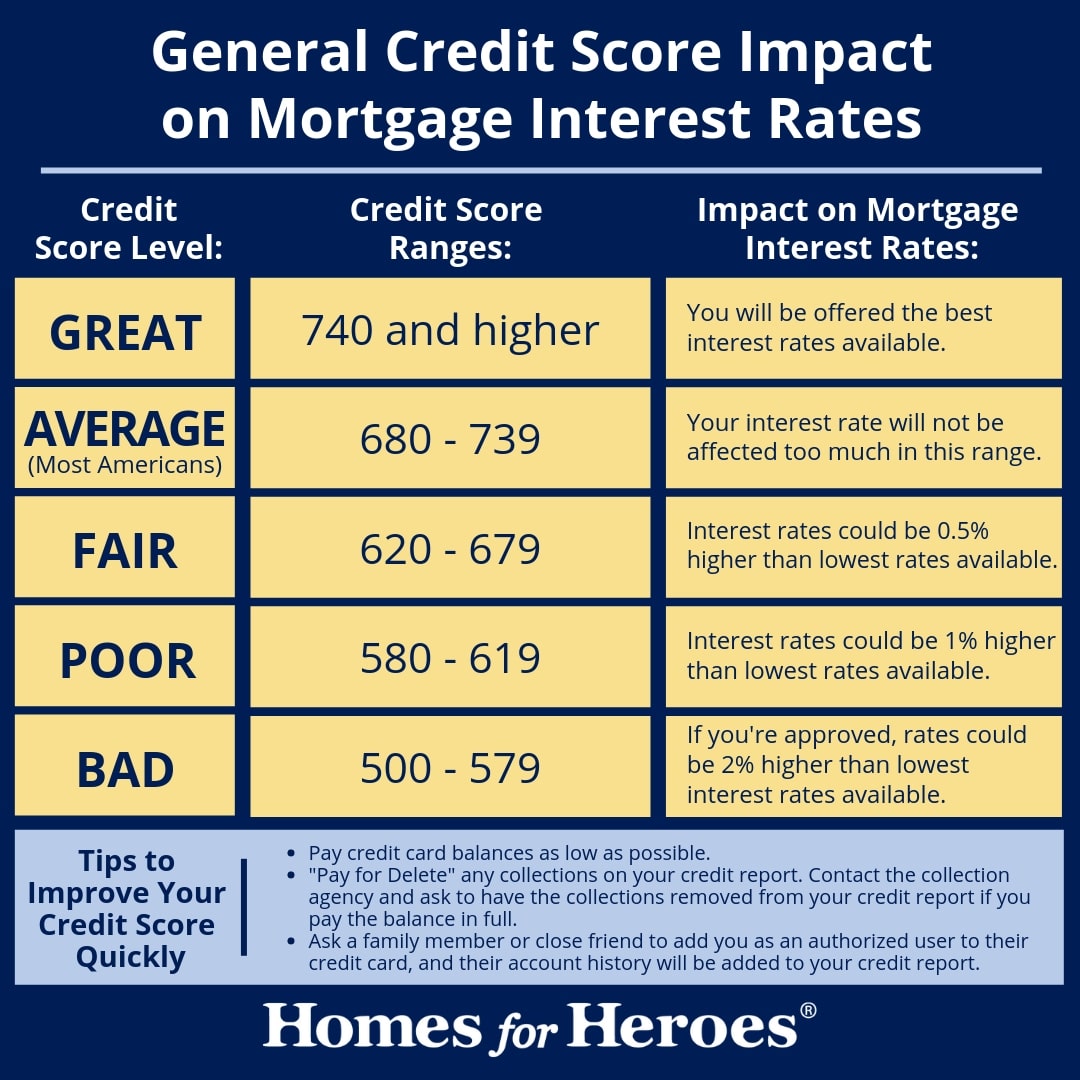

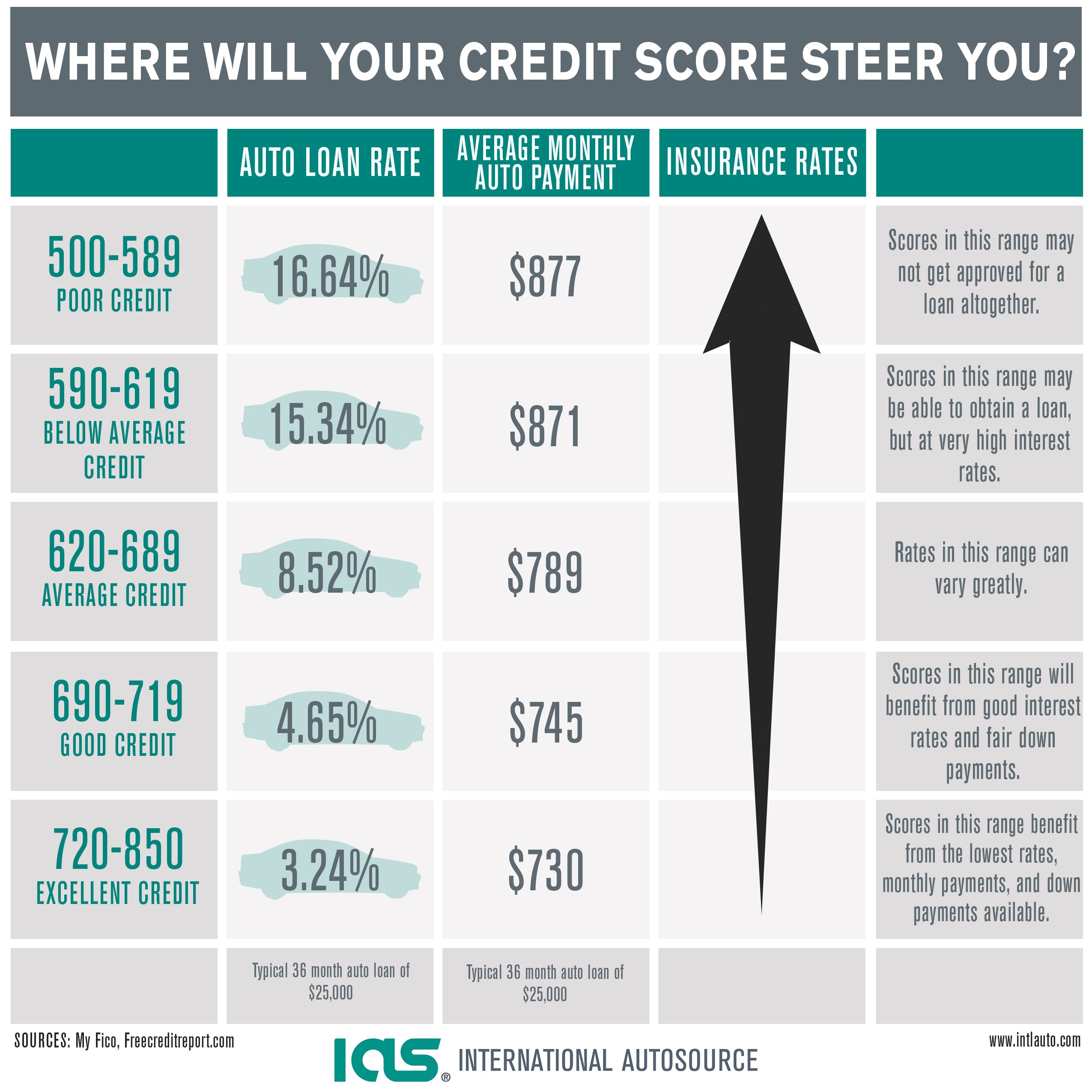

Borrowers with lower credit scores often wind up with higher mortgage rates, which means paying more in interest to take out a loan. Those getting a mortgage with an excellent credit score generally score lower interest rates and a better overall deal.

âWhen lenders pull an applicantâs credit score, three scores are received, one from each credit bureau,â Klein says. âLenders will then use the middle score to determine your mortgage interest rate.â

If you want to get a mortgage, check your credit report to know where you stand and make sure all the information is accurate.

Once Your Mortgage Is Finalized

Once your mortgage is finalized, youre officially a new homeowner. What does that mean for your credit score? In the beginning, your credit score will likely drop because credit scoring models dont yet have any proof that youll successfully make the payments. Another drop can occur due to the new account causing your average account age to decrease.

On the other hand, if you dont have any installment loans yet, a mortgage can improve your score by diversifying your .

Recommended Reading: Why Do I Need A Lawyer To Refinance My Mortgage

Recommended Reading: Does Getting Pre Approved For Mortgage Hurt Credit

Why Credit Scores Matter To Mortgage Lenders

When you take out a mortgage, your lender is allowing you to borrow a large sum of money that it eventually wants back â with interest, of course. So, before it approves your loan, the lender will investigate your financial history to assess how reliable you are as a borrower.

âIn a real-world scenario, if a friend asked you for a loan, but they rarely pay you back fully or take forever to return the money to you, how likely are you to say yes the next time they ask?â

Brett Bivenour, chief technology officer at FasterFi by Nationwide Mortgage Bankers based in Columbus, Ohio

Your credit score is a number that signifies how likely you are to repay a loan on time. Itâs a major factor in your financial profile that influences the interest rates youâre qualified for.

Check out what kind of credit score you need to get the best mortgage rates, according to myFICO:

What Credit Score Will Get Me Approved For A Mortgage

At Better Mortgage, we currently provide loans to customers with a credit score of 620 or above . If you have a lower credit score and a flexible timeline, you may want to wait and try and raise your credit score before applying, so you can qualify for a better interest rate. On the other hand, if rates are low and you already have a credit score around or above 720, it may be more financially advantageous to take advantage of a low rate environment rather than waiting to raise your score. It never hurts to see how much youre pre-approved for and check out todays rates, especially when our quick pre-approval only uses a soft credit pull.

Don’t Miss: Can Low Credit Score Get Mortgage

How Your Mortgage Affects Your Credit Score

A Tea Reader: Living Life One Cup at a Time

Financial gurus are constantly warning consumers to keep their in tip-top shape if theyre planning to purchase a home in the near future. The higher your credit score, the more likely you are to get the best mortgage rates. A mortgage calculator can show you the impact of different rates on your monthly payment. Once you have the mortgage, however, it can affect your credit score going forward.

Having A High Cibil Score Can Get You A Lower Rate Of Interest

CIBIL score is an important factor that is taken into consideration by lenders at the time of offering you a loan. Having a higher CIBIL score not only makes you eligible to avail a loan but also helps you in getting a lower rate of interest. A CIBIL score is a numerical representation of your ability to repay the credit. It is computed by TransUnion CIBL credit bureau after considering your past payments, credit history, current and old credit accounts, among others. An interest rate is one of the most important factors a borrower considers while availing a loan.

A CIBIL score falls in the range of 300-900. Majority of lenders consider a CIBIL score of 750 and above as ideal. If you want to have easier access to credit, your CIBIL score should be closer to 900. Lenders like banks and non-banking finance companies prefer giving loans to people who have a high credit score as they have a lesser probability of turning a defaulter.

Read Also: How Much Money Should Go To Mortgage

How Does My Credit Score Affect My Ability To Get A Mortgage Loan

Your credit score, as well as the information on your credit report, are key ingredients in determining whether youll be able to get a mortgage, and the rate youll pay.

Your and your are two different things. Your credit score is calculated based on the information in your credit report. Higher scores reflect a better credit history and make you eligible for lower interest rates.

You have many different credit scores, and there are many ways to get a credit score. However, most mortgage lenders use FICO scores. Your score can differ depending on which credit reporting agency is used. Most mortgage lenders look at scores from all three major credit reporting agencies Equifax, Experian, and TransUnion and use the middle score for deciding what rate to offer you.

Errors on your credit report can reduce your score artificially which could mean a higher interest rate and less money in your pocket so it is important to check your credit report and correct any errors well before you apply for a loan.

Your credit score is only one component of your mortgage lenders decision, but its an important one.

Other factors include:

- The amount of debt you already have

- How much you have in savings

- Your total assets

How To Build Your Credit Score

Here are some of the best ways to build your credit score:

Make payments, including rent, credit cards, and car loans, on timeKeep your spending to no more than 30% of your limit on credit cardsPay down high-balance credit cards and consider balance transfers to free up credit.Check for any errors on your credit report and work toward fixing them.Shop for mortgage rates within a 30-day period. Too many spread-out inquiries can lower your score.Work with a credit counselor or a lender to build your credit.

The best way to build your credit score is to look at your balance-to-limit ratio, Keller says. For example, if you had a credit card with a $10,000 limit, and I pull your credit and youve got $8,000 charged on that and your credit score is a 726, if I can get you to pay down that credit card to 30% or less down to $3,000 your credit score would jump substantially.

Article Source:

*The views, articles, postings and other information listed on this website are personal and do not necessarily represent the opinion or the position of Big Valley Mortgage.

Don’t Miss: Can You Do A 40 Year Mortgage

When You Pay Off Your Mortgage

When you make your final mortgage payment and own your home free and clear, what will happen to your credit? The loan will be marked closed in good standing on your credit report for 10 years. As for your credit score, dont expect any dramatic change.

Closing a mortgage has very little impact on your credit score, unlike closing a revolving credit card, which can hurt your score by reducing your available credit. However, you may see a drop if the mortgage was your only installment loan, as it will impact your credit mix.

Modified date: Jun. 2, 2022

Its no surprise that your credit scores are instrumental in getting approved for a mortgage. Even so, you may not realize just how many ways your credit scores affect mortgage rates and all aspects of the mortgage application process.

Your credit scores affect the kinds of mortgages you can be approved for, how much you can borrow, the mortgage rates youll pay and even how much youll pay for private mortgage insurance.

When it comes to conventional financing at least, you will be required to have a credit score of at least 620 in order to be eligible for a loan. The higher your credit score is beyond that, the better the terms will be.

Lets take a look at some of the ways your credit scores affect mortgage rates

Whats Ahead:

Factors That Influence Your Credit Score

Each credit-reporting agency uses their own proprietary formula to calculate credit scores. Your credit score is calculated based on the following factors:

- Past Payment History â Late or missed payments, overdue accounts, bankruptcies and any written off debts will all lower your credit score

- How much debt you have as a percentage of your available credit will also affect your credit score

- How long youâve had accounts open

- New Credit Requests â How recently and how often youâve applied for new credit

- Types of Credit â Having a mix of credit is best, such as a credit card, an auto loan and a line of credit

Read Also: How Much Mortgage Will I Qualify For

What Is A Credit Score And Why Does A Higher Score Mean More Favorable Rates

If you took your entire relationship with debt and boiled it down to a number between 300 and 850, youd have your credit score. Equifax, TransUnion, and Experian are the three major credit bureaus, but they all use similar criteria to create a credit score. Your FICO score, created by Equifax, is most lenders preferred credit score, but all of these scores may be considered when evaluating creditworthiness. When generating your score, credit bureaus weigh payment history, debt volume, the age of your credit, credit diversity , and credit inquiries. So if youre monitoring your credit, paying on time, and using less than 30% of your total credit, you should be well on your way to a high score.

Lenders then use that score as a guide to offer interest rates and terms for each borrower. If you think of a loan as a bet, the credit score is the odds of the lender being paid back in full. Rather than denying a mortgage application, lenders adjust the rates and terms to make sure their bet is safe. If a borrower has a high credit score, they can offer more favorable rates and terms because its a relatively safe investment. If a borrower has a fair to good credit score, lenders may raise the rates they offer by fractions of a percentage as a way to hedge against a possible default.

For example: Take a homebuyer with a 20% down payment applying for a 30-year-fixed loan to purchase a $200,000 home in New Jersey.

Difference Between Best Credit Poor Credit

All told, youre looking at a difference of about 1.6 percent between the top of the credit range and the 620 range on a 30-year fixed-rate mortgage. That works out to a difference of about $100 per month per $100,000 of mortgage amount between the best credit and worst , according to Fair Isaac. For example, a borrower with a $300,000 mortgage would pay about $1,400 a month at 4 percent interest, versus $1,700 at 5.6 percent.

It should be stressed that there are a variety of factors that affect your interest rate besides your credit score. Among these are the size of your down payment, the type of loan youre getting, where you live, any discount points paid, etc. Rates also will vary from lender to lender for the same customer, so it pays to shop around and compare all costs of the mortgage, and not just interest rates.

Recommended Reading: How To Pull My Credit Report

Read Also: Can You Refinance Mortgage And Add Credit Card Debt

What Credit Score Do I Need For A Mortgage

There isnât a specific credit score you need for a mortgage, and thatâs because there isnât just one credit score.

When you make an application for a mortgage or other type of credit, lenders work out a credit score for you. This is to help them decide if they think youâll be a risk worth taking if youâll be a responsible, reliable borrower and likely to repay the debt. Usually, a higher score means youâre seen as lower risk â the more points you score, the more chance you have of being accepted for a mortgage, and at better rates.

Loan Types & Credit Requirements

The good news if you have less-than-perfect credit is that not all loans require the same credit scores.Conventional and jumbo loans typically give the best rates only to those with high credit scores – conventional to those with scores above 720 and jumbo to those with scores of 760 or better. Government-backed loans, however, are much more forgiving when it comes to credit score. With FHA loans, you can get the best rates as long as your score is above about 700 and you may still be able to qualify for a loan with a score of 500. VA loans dont even require a minimum credit score, although lenders still like to see a score around 620 or higher. Department of Agriculture loans will accept credit scores as low as 640.

In most loan situations, you also have the option to pay more points to pay down your interest rate. So even if you have poor credit but you have a cash reserve, you could buy your rate down closer to the level you might receive with a great credit score.

Although lenders also use your income, assets and debt-to-income ratio in determining your interest rate, your credit score plays a major role in that process. Understanding how credit scores work and how they are used can help you get your best rate and save the most money over time.

Read Also: How Much Can My Mortgage Payment Be

Make Sure Its A Fico Score

One final thing the variances in rates described above are based on FICO credit scores the ones lenders typically ask for when evaluating a borrower for a mortgage. However, if you order your credit score from one of the three credit rating agencies, theres a good chance it will be based on a proprietary rating system and not a FICO score.

These proprietary systems can produce scores that vary significantly from a FICO score and may give a consumer the impression their credit is better than it is. You can obtain your Equifax or Transunion FICO score for free through MyFico.com or for a fee from either company just make sure the score youre obtaining is specifically identified as your FICO score. You cannot obtain your FICO score from Experian, as it no longer provides customers with FICO scores but will only provide them with scores produced by alternative credit scoring systems.

Why Your Credit Score Impacts Your Mortgage Rate

Your credit score reflects your past credit usage, which lenders use to measure how responsible you are with credit. It speaks to your past payment and debt management habits, and it gives lenders an idea of what they can expect if they loan you money to buy a home.

As such, credit scores directly influence what mortgage rate a lender offers you. Higher credit scores will usually mean a lower interest rate , while lower scores will usually receive higher rates.

Learn More: Comparing Credit Score Ranges

Read Also: How To Get Approved For A Larger Mortgage