What Happened In November

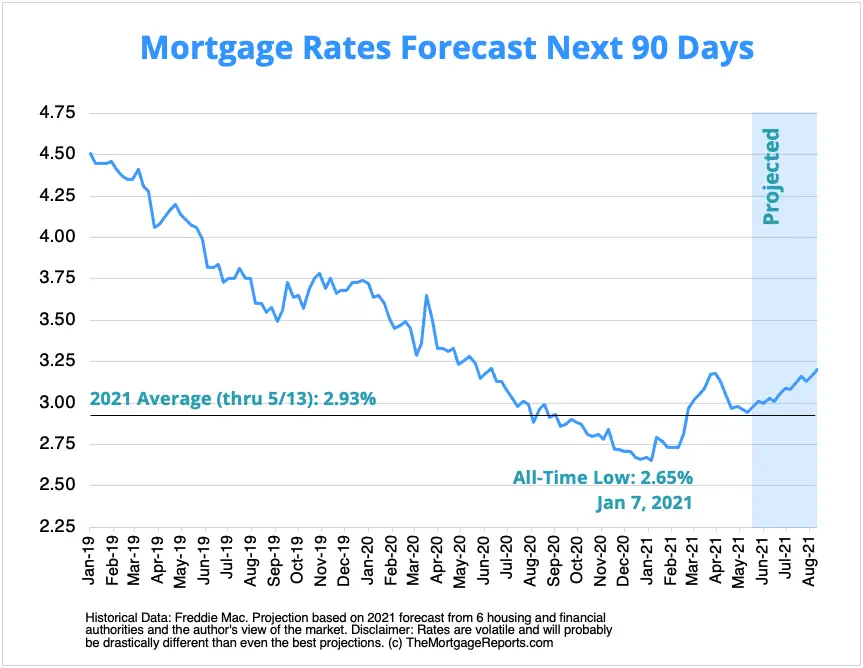

As November dawned, I predicted that inflation would push mortgage rates higher but they wouldn’t rise steeply.

But instead of the slow rise that I expected, mortgage rates meandered up and down most of November. The average rate on the 30-year fixed-rate mortgage was almost the same as October’s despite inflation rising to 6.2%, according to the Consumer Price Index.

About the author:Holden Lewis is NerdWallet’s authority on mortgages and real estate. He has reported on mortgages since 2001, winning multiple awards.Read more

Why You Can Trust Bankrate

Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. Weve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next.

Bankrate follows a strict editorial policy, so you can trust that were putting your interests first. All of our content is authored by highly qualified professionals and edited by subject matter experts, who ensure everything we publish is objective, accurate and trustworthy.

Our mortgage reporters and editors focus on the points consumers care about most the latest rates, the best lenders, navigating the homebuying process, refinancing your mortgage and more so you can feel confident when you make decisions as a homebuyer and a homeowner.

What Rising Mortgage Rates Mean For Existing Homeowners

With rates at their highest point since 2010, fewer homeowners are in a position to refinance just to save money by getting a lower rate. Homeowners who have seen their equity increase significantly in the past few years may be interested in a cash-out refinance to get money for other purposes, such as to pay for major home improvements or to consolidate higher-interest debt like credit cards. Typically you see refinancing activity happening when rates are falling, Roach says.

Higher mortgage rates will likely lead to more homeowners looking into home equity loans or home equity lines of credit as alternative ways to tap into equity without raising the interest rate on the rest of the mortgage, Roach says. I think home equity loans are going to be the hot topic now, he says.

Whether you are looking to refinance or purchase, you can compare lender offers here using this Home Loan Comparison Calculator. You can enter in the loan amount, rate, fees, and term for each offer and see a true side-by-side comparison.

Also Check: How Does Rocket Mortgage Work

What Rising Mortgage Rates Mean For Homebuyers

When youre looking for a mortgage, be sure to shop around. Different lenders will offer different rates, and with the trends moving upward so fast, there might be big differences in what two lenders will give you. I think the best advice for a mortgage shopper if youre thinking about low rates is you need to shop around and you need to look at a lot of different places, Skylar Olsen, principal economist at Tomo, a digital real estate and mortgage company, told us.

Homebuyers facing the double whammy of higher rates and high prices might want to be patient, Roach says. While rates will probably not drop back below 3% again in the near term, they might drop a bit later in the year as markets get a better idea of what the Federal Reserve will do to tame inflation. Perhaps potential buyers can wait for the offseason time and thats a decent chance for more reasonable rates and less frothy home prices, he says.

How We Make Money

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout lifes financial journey.

Bankrate follows a strict editorial policy, so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

Were transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range can also impact how and where products appear on this site. While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service.

Also Check: Rocket Mortgage Requirements

What Is The Difference Between Pre

A pre-qualification is a letter from the lender giving you an estimate of the loan amount that you may be eligible for. Its a monetary first impression to help you begin the process of buying a home.

With a pre-approval, you have an actual statement from the lender saying that you qualify for a specific mortgage amount. The pre-approval gives you a competitive advantage when looking for a home because it lets the seller know that you are able to make an offer for their home

Caveats About Markets And Rates

Before the pandemic and the Federal Reserves interventions in the mortgage market, you could look at the above figures and make a pretty good guess about what would happen to mortgage rates that day. But thats no longer the case. We still make daily calls. And are usually right. But our record for accuracy wont achieve its former high levels until things settle down.

So use markets only as a rough guide. Because they have to be exceptionally strong or weak to rely on them. But, with that caveat, mortgage rates today might rise. However, be aware that intraday swings are a common feature right now.

Also Check: Can You Get Preapproved For A Mortgage Without Hurting Your Credit

Beleaguered House Hunters Are Now Watching Mortgage Rates Spike Too

U.S. shoppers have faced sticker shock as goods from cars to steak to gasoline have gotten much costlier, in some cases very rapidly.

Now, consumers can add mortgages to the list. While interest rates are still quite low by historical standards the average mortgage rate was in the double digits for most of the 1980s economists say the sudden jump could be a shock to buyers and potentially the broader economy.

The most common average interest rate jumped by more than half a percentage point since March 10, according to Freddie Macs weekly Primary Mortgage Market Survey. That amount 0.57 percent, to be precise might not sound like very much, but as mortgage rate movements go, a leap of more than half a percentage point in two weeks is eye-catching.

This data is tracked to the hundredth of a percentage point, or basis point. In any given week-to-week stretch, average rates move up or down in increments that are often less than 10 basis points, or one-tenth of one percent. The average rose above 4 percent for the first time since 2019 only a week ago, when it ticked up to 4.16 percent on March 17.

This is a volatile time in markets, said Mike Fratantoni, the chief economist at the Mortgage Bankers Association. Rates are jumping more than would be typical. For a potential borrower, thats really challenging.

What Are Points On A Mortgage

Discount points are a way for borrowers to reduce the interest rate they will pay on a mortgage. By buying points, youre basically prepaying some of the interest the bank charges on the loan. In return for prepaying, you get a lower interest rate which can lead to a lower monthly payment and savings on the overall cost of the loan over its full term.

A mortgage discount point normally costs 1% of your loan amount and could shave up to 0.25 percentage points off your interest rate. The exact reduction varies by lender. Always check with the lender to see how much of a reduction each point will make.

Discount points only pay off if you keep the home long enough. Selling the home or refinancing the mortgage before you break even would short circuit the discount point strategy.

In some cases, it makes more sense to put extra cash toward your down payment instead of discount points If a larger down payment could help you avoid paying PMI premiums, for example.

Recommended Reading: Mortgage Recast Calculator Chase

Are Todays Higher Rates Temporary Or Here To Stay

As mentioned above, fixed rates have continued their ascent over the past week, rising another 10 to 25 bps. Among the big banks, TD, BMO and National Bank of Canada delivered fresh rate increases.

Average deep-discount uninsured 5-year fixed rates are now hovering just shy of 4.00%.

With fixed mortgage rates potentially heading above the 4% mark, and variable rates expected to follow and narrow the spread in the coming months, some are questioning if higher rates are here to stay or if this is a temporary spike.

The question now is whether we have entered a new era of steadily rising bond yields or whether this is just a short-term blip before we revert to our economys long-term trends of low growth, low inflation, and low rates,wrote mortgage broker Dave Larock of Integrated Mortgage Planners.

There is no guarantee that the past is prologue, but it seems reasonable to assume that the sources of todays inflation pressures will eventually subside, and when they do, inflation could fall dramatically along with bond yields, and the mortgage rates that are priced on them, he added.

This is an important consideration for borrowers who are faced with the difficult decision of going fixed or variable.

Those choosing a long-term fixed rate run the risk of locking in at a peak, similar to what happened to borrowers in the spring of 2020 when fixed rates rose, but eventually fell back to record lows.

How Todays Rates Compare To Historical Levels

Heres a look at how current mortgage rates compare to the last 22 years.

Mortgage rates have gone up quite a bit in the past few months, and it can be jarring to see what they are now compared to where theyve been the past two years and even most of the last decade. But if you look back a bit further, before the Great Recession, 5% rates were favorable.

Recommended Reading: Can You Refinance A Mortgage Without A Job

Expect Mortgage Rates To Rise In 2022 Economists Say

Canadians looking to buy a home can expect mortgage rates to soon be on the rise, experts say.

The Bank of Canadas recent forecast is a good indication of why, said Don Drummond, economist at Queens University and former chief economist for TD Bank. The Bank of Canada announced Wednesday that while its current policy rate remains steady at 0.25 per cent, it will likely increase as early as the second quarter of next year.

According to Drummond, mortgage rates are bound to follow suit, particularly variable ones.

The variable rates will go up quite quickly, they could even go up in anticipation of the bank action, Drummond told CTVNews.ca in a phone interview on Thursday.

He predicts the Bank of Canadas short-term interest rate will increase by about 0.75 percentage points by the end of 2022. Eventually, he anticipates the rate will be anywhere between 1.75 and 3 per cent by the end of 2023, which he describes as a more normal rate. He expects variable mortgage rates to move up in lockstep.

The variable rate is keyed off the chartered banks prime rate, and the prime rate is keyed off the Bank of Canadas policy rate, so the variable rate would move up to the same degree, he explained.

Robert Hogue, a senior economist with the Royal Bank of Canada, predicts an increase of closer to 0.5 percentage points in the central banks interest rate by the end of next year, but sees a rise in variable mortgage rates nonetheless as a result.

Check Your Refinance Options Even If Youre Not Sure Youd Qualify

According to Black Knights September Mortgage Monitor, nearly 12 million homeowners could still qualify to refinance and cut their interest rate by at least 0.75%.

And yet, many homeowners hesitate to refinance because they dont think theyd be eligible or because refinance closing costs are too high.

Lenders recognize these challenges. And Fannie Mae and Freddie Mac are working to address homeowners refi concerns.

Two new refinance programs, Fannie Maes RefiNow and Freddie Macs Refi Possible, are expanding refinance opportunities to low- and moderate-income homeowners.

If you make average income for your area and have a high mortgage interest rate, you might qualify to refinance with reduced closing costs.

To learn more about these programs and check your eligibility, read:

You May Like: Chase Mortgage Recast Fee

When Will We Reach The Bank Of Canadas Neutral Rate

Much hinges on when the Bank is able to reach its target neutral rate, which is the level where the economy is at full strength and inflation is on target, or 2.25% in the BoCs case.

In practice, as they begin a tightening cycle, central bankers dont know with certainty where the neutral rate lies, but they know it when they see it, CIBC economists wrote in a note entitled Canadian rate hikes: Wheres the finish line?A slowing in the economy that threatens to take the economy away from a starting point of full employment, or a drop in inflation to below target, can be signposts that rates are above neutral.

The question is, how likely is a forthcoming recession, which could end up reversing Bank of Canada rate hikes and sending mortgage rates lower again? Closely watched indicators are signalling a growing risk that a downturn could be on the horizon.

Last week, 10-year U.S. Treasury yields fell below 2-year yields. When the rate of short-term bonds drops below longer-term bonds, thats known as yield inversion and often serves as a warning of an upcoming recession.

With the yield curve implying rising recession risk, theres a fair likelihood that prime rate may fall back to its 10-year mean within 36 to 48 months, rate analyst Rob McLister noted.

Having said that, McLister added that inflation could prove far more persistent than central banks expect, which could leave rates above neutral for most of the next five years.

Historical Canada Mortgage Rates

Looking at historical mortgage rates is a good way to understand which types of mortgage attract higher rates. They also make it easier to understand whether weâre currently in a low or higher rate environment, relatively speaking.

Here are some of Canadaâs mortgage rates for different types of mortgage over the past five years.

| 2016 |

Don’t Miss: Reverse Mortgage Manufactured Home

What Are Todays Mortgage Rates

Low mortgage rates are still available. Connect with a mortgage lender to find out exactly what rate you qualify for.

1Todays mortgage rates are based on a daily survey of select lending partners of The Mortgage Reports. Interest rates shown here assume a credit score of 740. See our full loan assumptions here.

Selected sources:

Popular Articles

Resources

How Much Can I Save By Comparing Mortgage Interest Rates In Canada

Because of the significant amount of money being borrowed under a mortgage, even the slightest difference in the mortgage interest rate may result in you saving money over the course of a mortgage term, and even more over an entire amortization period. While the mortgage rate is a very important consideration, you should also be sure to evaluate the terms and conditions of each type of mortgage to make sure you choose the right one for you.

Don’t Miss: Can You Get A Reverse Mortgage On A Mobile Home

Fewer Refis More Purchases

With rates trending upward, the refinancing boom of 2020 is slowing dramatically, says Michael Fratantoni, chief economist at the Mortgage Bankers Association. He expects refi volume in the fourth quarter of 2021 to plunge to barely a third of the levels seen in the fourth quarter of 2020.

While mortgage rates will rise enough to discourage refinancing, theyll remain low enough to make homebuying attractive, Fratantoni says. He predicts record-breaking purchase mortgage volumes in 2021, and then again in 2022 and 2023.

Were anticipating a very strong housing market, he says.

What Is The Difference Between The Interest Rate And Apr On A Mortgage

Borrowers often mix up interest rate and an annual percentage rate . Thats understandable, since both rates refer to how much youll pay for the loan. While similar in nature, the terms are not synonymous.

An interest rate is what a lender will charge on the principal amount being borrowed. Think of it as the basic cost of borrowing money for a home purchase.

An represents the total cost of borrowing the money and includes the interest rate plus any fees, associated with generating the loan. The APR will always be higher than the interest rate.

For example, a loan with a 3.1% interest rate and $2,100 worth of fees would have an APR of 3.169%.

When comparing rates from different lenders, look at both the APR and the interest rate. The APR will represent the true cost over the full term of the loan, but youll also need to consider what youre able to pay upfront versus over time.

Also Check: 10 Year Treasury Yield Mortgage Rates