Title Insurance And Search

Required

This fee covers the cost of searching the property’s records to ensure that you are the rightful owner and to check for liens. Title insurance covers the lender against errors in the results of the title search. If a problem arises, the insurance covers the lender’s investment in your mortgage. So, if someone should lay claim to monies owed before that refinance transaction took place, the title insurance will have to pay for it . Cost range = $500 to $800, and sometimes more, depending on the loan amount. Be advised that while you can choose a different title company when refinancing your home, its usually a good idea to use the title company the lender recommends. This is because theyll more than likely have a great working relationship with this third party company and that means lower title cost and quicker turnaround times.

Should You Pay Refinance Closing Costs Out Of Pocket

Take a close look at your financial situation when deciding the best way to pay your refinance closing costs.

If you have sufficient home equity, it might be worthwhile to add your refinance closing costs to your mortgage balance to avoid an out-of-pocket expense.

This also makes sense when you dont have much money saved, or if you dont want to deplete your personal savings when refinancing.

However, rolling closing costs into your loan increases the loan balance, your monthly mortgage payment, and your total interest charges. So if you can spare the cash, it might be better to pay your closing costs out-of-pocket and be done with it.

The Simple Breakdown Without Lender Credits:

- Lender Fees: $1100.00

- Recording Fees: $350.00

Total = $3,310.00

It is important to remember that this is just a generic break down and it does not include any lender credits that might be issued. Also, some refinance transactions dont need an appraisal or sometimes the lender refunds the appraisal fee.

You May Like: How To Remove A Cosigner From A Mortgage

Read Also: What To Look For Mortgage Loan

How To Lower Some Closing Costs

There are ways to reduce your refinancing fees and lower your overall cost to refinance:

Its Becoming Increasingly Common How To Refinance Your Home And Spend $0 At Closing To Do It

With some mortgage refi rates below 3%, many people are likely pondering a refi, but wonder: Can you refinance your home without any money coming out of your pocket at the closing? The short answer is yes, but you will end up paying those closing costs down the road.

Closing costs associated with refinances tend to run about 2-5% of the total principal amount that you owe, and the average closing costs on a refi are upwards of $5,700, according to data from fintech firm ClosingCorp. Closing costs are generally made up of a variety of fees ranging from an origination fee, which the lender charges upfront to process the loan application an appraisal fee title search credit report fee and more. Needless to say, coming up with an out-of-pocket lump sum might make obtaining a refinance difficult for some people which is why a no-closing-cost refinance can be a helpful option.

But in some cases, those fees can be rolled into the loan in whats called a no-closing-cost refinance meaning borrowers dont have to pay anything upfront out-of-pocket to refinance. Of course, no-closing-cost refinances dont mean a borrower is off the hook for all expenses, instead theyre just transferred to the principal or exchanged for a higher interest rate.

Pros and cons of a no-closing cost refinance

Recommended Reading: How Does Making Extra Payments On Mortgage Work

Things To Look Out For When Refinancing

- Extending your loan term may cost you more money in the long run because youre paying interest for a longer period.

- The cost of refinancing may counteract the savings.

- Make sure your new loan terms make both logistical and financial sense for your future plans as a homeowner.

Many homeowners look to refinance their mortgage in an attempt to lower their interest rate or utilize their home equity. Market conditions may have changed, or youve decided youd like to pay off your loan sooner. Although there are different ways to refinance, youll find they all end with closing fees. Before moving forward, evaluate whether the cost to refinance is worth what youll have to pay during closing. If you decide a refinance is right for you, you can speak to a home lending advisor today.

How Much Will I Pay In Refinance Fees At Closing

The amount you’ll pay in refinance fees can vary because different lenders charge different fees. Typically, your refinancing fees are between 2% and 6% of your loan amount. Your lender should provide a loan estimate so you’ll know exactly what it will cost to refinance your current mortgage and secure a new mortgage.

Read Also: What Is The Average Mortgage Payment In Michigan

Your Mortgage Broker Fee

The broker fee you pay when refinancing your home loan is for loan origination, meaning compensation for the brokers work arranging your home loan. What is a reasonable fee to pay for loan origination? Many brokers charge two percent or higher however, a reasonable mortgage broker fee is one percent of your loan amount assuming the broker has not marked up your lowest refinance rates.

The origination fee is easy to find and understand in your loan documents, but what about the hidden markup of the lowest refinance rates? The reason nearly all of your neighbors overpay when refinancing is because of a little known fee called Yield Spread Premium. Whats confusing about Yield Spread Premium is that the fee doesnt come out of your pocket, its paid by your lender.

If You Can Reduce Your Rate Even A Smidge

You might read or hear that refinancing is worth it if you can reduce your mortgage rate by 1% or 2%. But for a big mortgage, a change of just a quarter of a percentage point, or half of one, could result in significant savings, especially if you can minimize lender fees.

Again, consider the break-even point and how long you plan to keep the home.

Also Check: How Can I Remove Pmi From My Fha Mortgage

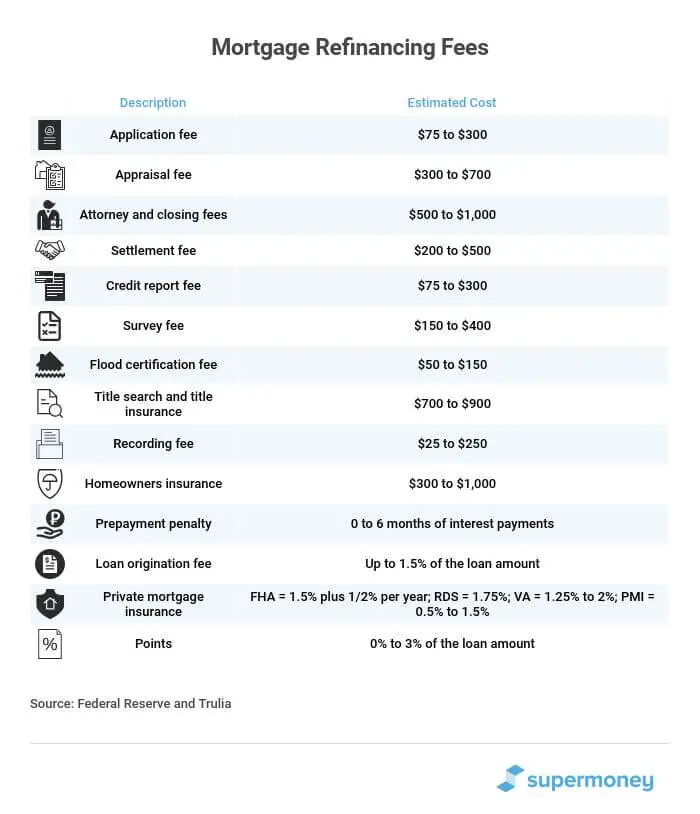

List Of Refinance Closing Costs

Major closing costs youll pay when refinancing a mortgage include:

- Loan origination fee: 1%-1.5% of the loan amount

- Discount points : 0%-1% of loan amount or more

- Application fee: $75-$300

- Recording fees: $25-$250

- Processing and/or underwriting fee: $300-$900 each

- Prepaid taxes and homeowners insurance: varies

These are just the big-ticket items. You can see a full list of typical closing costs and amounts here.

How To Refinance With No Closing Costs

Its possible to avoid closing costs altogether when you refinance. But youll need to understand the benefits and drawbacks of noclosing cost refinance methods because they can wind up costing you more in the long run.

Roll closing costs into your loan

Your lender might allow rolling your closing costs into your mortgage loan if you have enough equity in the home. The benefit of this approach is that you dont pay anything upfront.

On the other hand, rolling these upfront costs into your new mortgage increases your loan balance, meaning youll pay interest on this additional amount. This can result in paying thousands more over the life of the loan.

Be aware, too, that rolling closing costs into the loan is an option only with certain types of mortgages.

For example, a VA loan only allows borrowers to roll the VA funding fee into their loan. Similarly, an FHA refinance can include only the upfront mortgage insurance fee. Other closing costs must be paid upfront.

Ask the lender to pay your closing costs

Another noclosingcost refinance method is to ask for lender credits. This limits your outofpocket costs, but youll pay a higher mortgage rate in exchange.

Lender credits are typically better for homeowners who will keep their new mortgage for only a few years. After that, the higher interest cost can start to outweigh the upfront savings.

If you plan to keep your refinanced loan longterm, rolling closing costs into the mortgage balance might make more sense.

Don’t Miss: How Do I Qualify For A Zero Down Mortgage

Know Your Credit Score

Knowing your allows you to begin repairing it when necessary. To refinance your mortgage, your credit score will need to be good to excellent, generally 700 or better. Requesting a credit report from one of the major credit bureaus or through Chase Credit Journey, which is free for Chase customers, will show you your credit score, along with the information that creditors are reporting to it.

The steps to repairing your credit score arenât tricky, but they do take time, commitment and often require you to reevaluate how you are using your credit and your spending habits.

Focusing on these five factors can help put you in a good position for refinancing.

Occasionally, it is better to wait and apply for a loan once your credit score is higher, as this can make you eligible for lower interest rates and put you in an overall better position financially.

Dont Miss: How Can I Get Help With My Mortgage

Closing Costs For Refinancing: Here’s What You Need To Know

When you take out a mortgage refinance loan, you’re required to pay closing costs for refinancing. The costs vary by lender, as well as location and other factors. Some lenders may advertise no-closing-cost mortgage refinance loans, but you’ll always pay closing fees one way or the other.

If you don’t pay them up front, you’ll either pay a higher interest rate or the costs will be rolled into your loan. Here’s what you can expect when it comes to closing costs for refinancing your mortgage.

Jump To

You May Like: Can You Use 1099 As Proof Of Income For Mortgage

Some Borrowers Are Exempt

Not everyone will have to pay the new fee. If your principal balance is less than $125,000 you are exempt. Borrowers refinancing VA loans and FHA loans also are exempt from this fee. If youre buying a home and taking out a new home loan, youre also exempt.

The only mortgages that are required to pay are those that lenders sell to Fannie Mae and Freddie Mac. But you may not know at the time you apply for a loan whether your lender intends to sell your mortgage to either GSE.

You May Like: Can You Include Renovation Costs In A Mortgage

When Refinancing Makes Sense

Refinancing your mortgage can be a wise move for many reasons, most notably lowering your interest rate or your monthly payments. It can also help you pay down your mortgage sooner, access your homes equity or get rid ofprivate mortgage insurance .

But there are closing costs associated with refinancing, so it probably makes more sense to refinance if you know youll be keeping your home for some time. You can determine the break-even point for a potential refinance, or how long it will take for savings from a new mortgage to surpass any closing costs. Find out what those costs will be and divide them by the monthly savings youll realize with the new mortgage.

The Forbes Advisor mortgage refinance calculator can help you run the numbers to see if its a good time for you to refinance.

Don’t Miss: How To Lower Your Mortgage Payment Without Refinancing

What Do All These Refinance Terms Mean

When it comes to refinancing, there are a number of words and terms that you should become familiar with when learning how to refinance your mortgage. Many of them are key variables that youll want to take into consideration to determine whether refinancing makes sense for you.

Heres a glossary of the most important refinancing terms:

Interest rate: This is the amount of money that your bank or credit union charges each year for lending you money in a mortgage. Its expressed as a percentage . The lower your interest rate, the less youre paying in interest. When you begin the process of refinancing your mortgage, you can typically get a mortgage rate lock, which guarantees that youll be able to get the current interest rate on your new mortgage while you proceed through the refinance process.

In some cases, you may be able to pay extra for a float down rate option, which protects you if market interest rates fall while youre in the middle of refinancing by allowing you to release your rate lock and re-lock at a lower rate.

Annual percentage rate : This is the actual cost of a loan to a borrower. It differs slightly from the interest rate as it includes not just interest, but also additional costs charged by the lender. Again, its expressed as a percentage, and lower is better.

Whats The Cost Of Resetting Your Loan Term

Refinancing very often means resetting the clock on your mortgage. Suppose you bought your home or last refinanced five years ago and chose a 30-year, fixed-rate mortgage . Now you want to refinance to another, similar, 30-year loan. Youll end up paying for your home over 35 years: five on the old loan and 30 on the new one.

Thats great in some ways. The longer you have to pay back any loan, the lower each payment should be. And, in this case, youll be making 420 monthly payments instead of 360 .

So those monthly payments will be lower, even if you were to refinance at the same mortgage rate. And the payments are likely to be even lower if you get a lower mortgage rate than you were paying previously.

The But here is inevitable. Theres always a downside. In this case, its that youll be paying interest on your mortgage for 35 years instead of 30 years. You may be paying less each month but youre going to pay considerably more in the end.

Heres an example:

Assume youre purchasing a home with a starting loan of $250,000 at a rate of 4%. This chart illustrates how youll pay if you ride out the original loan, in comparison with the costs if you refinance the $222,000 balance at the five-year mark to a rate of 3.5%. Your monthly costs will go down but will be spread out over another thirty years, meaning you might end up paying more in the long run. In this case, refinancing would cost an additional $720 over the life of your loan.

| Original Loan |

| $420, 560 |

Also Check: How Much Income To Qualify For 1 Million Mortgage

Where To Start Your Mortgage Refinance

Now that you have an idea of the costs, fees, and even the process to refinance, your next step should be a 10-minute call to an American Financing mortgage consultant. There are never any upfront fees to consider. Plus, we have access to every loan in the industry, so you can feel confident your refinance needs are being met quickly and are in line with your budget. Make the call today: 910-4055!

What Are Refinance Closing Costs

Closing costs are lender fees and third-party fees you pay when getting a mortgage. You have to pay these on a refinance just like you did on your original mortgage.

Closing costs arent a set amount, though. They vary depending on where you live, your loan amount, your lender, the loan program, whether or not youre cashing out your home equity, and other factors.

You May Like: How Do Mortgage Loan Officers Make Money

Average Cost Of Amortization

For our analysis, we evaluated the average cost of refinancing a $160,000, fixed-rate 30-year mortgage, originated in 2011 at 4.45%, at a rate of 4% today. We found that refinancing today reduces your monthly payments by $35 and results in $5,885 of savings over the life of the new loan. Assuming average closing costs of $4,345, it would take a little over ten years to recoup those fees.

While it may make sense to refinance today at 4%, this may not be the case as the years go on. Also, if you were to sell your home at an intermediary date after refinancing, the savings may be partially or entirely eliminated by transaction costs.

| Original Mortgage | |

|---|---|

| 11.33 Years | closing costs exceed savings |

Closing costs are not the only cost incurred during a refinance. Depending on the purpose or timing of the refinance, interest expenses incurred during the amortization of the new loan can sometimes exceed the benefit of refinancing. These expenses should be regarded as additional charges and pose the greatest hidden cost for borrowers. When deciding whether to refinance, its helpful to weigh the reduction in monthly payments against the overall savings over the life of the loan.

Average Cost of Refinancing into an Adjustable Rate Mortgage

Average Cost of Refinancing from a 30-Year Mortgage into a 15-Year Mortgage

| Original Mortgage | |

|---|---|

| $47,422 | $27,300 |

Average Cost of a Cash-Out Refinance