Get Your Paperwork In Order

Gather recent pay stubs, federal tax returns, bank statements and anything else your mortgage lender requests. Your lender will also look at your credit and net worth, so disclose your assets and liabilities upfront.

What to consider: Having your documentation ready before starting the refinancing process can make it go more smoothly.

How We Make Money

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

Understanding Payoff Amounts And Penalties

When you refinance your mortgage, your lender âpays offâ your existing mortgage. As such, the refinancing lender will request a payoff statement from your current mortgage loan holder . This statement varies, but typically includes:

- Principal balance of existing loan

- Interest amount to be paid through the payoff date

- Daily interest charges

- Payoff statement fee

- Any escrow shortages or overages

Many homeowners fail to understand that the mortgage payoff amount is usually higher than the balance owed, due to those pesky interest charges and/or additional fees. One tactic to determine the payoff amount is to add a mortgage payment to your current balance.

Homeowners should also determine whether or not their current lender charges a prepayment penalty fee. Most lenders enact a prepayment penalty if the homeowner pays more than 20% of their mortgage within a year. This can happen if a homeowner sells a home, pays a lump sum or refinances their mortgage.

Pre-payment penalties are usually about 80% of six months interest, which can run in the tens of thousands of dollars. However, it is your right to request a copy of the payoff statement before you choose to enter a refinancing loan.

Also Check: Can You Prequalify For A Mortgage Without Credit Check

What Is Mortgage Refinancing

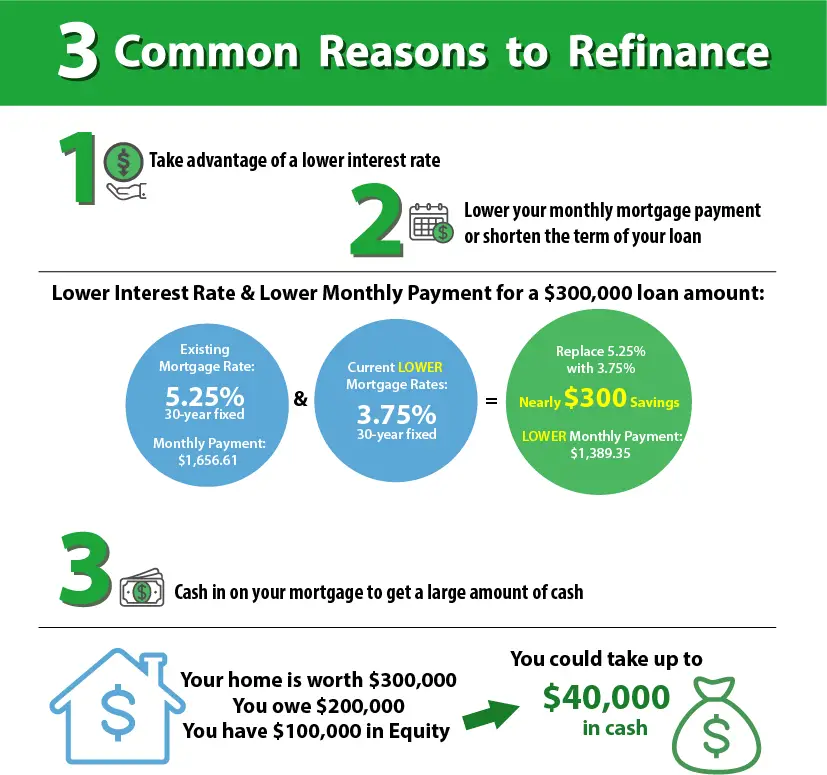

Refinancing a mortgage means you get a new home loan to replace your existing one. If you can refinance into a loan that has a lower interest rate than youre currently paying, you could save money on your monthly payment and interest you pay over the term of the loan. You might also be able to take advantage of a cash-out refinance, which allows you to tap into your home equity essentially as a lower-interest loan.

Times Refinancing Makes Sense

Thanks to simple online refinancing tools that make it easy to shop rates and quickly calculate both the short-term and long-term costs, refinancing your mortgage is always an option.

However, there are certain circumstances where it makes more sense than others. It’s up to you to know when to pull the trigger and when to stay put.

Here are a few situations where refinancing is a logical option worthy of further investigation:

Don’t Miss: How Many Rental Property Mortgages Can I Have

When To Refinance Your Mortgage

To determine if you should refinance, crunch the numbers yourself. I think its a good time to refinance if its right for your financial situation, says Michael Chabot, SVP of residential lending at Draper & Kramer Mortgage Corp. Look for savings of at least a half percent and make sure you feel extremely confident youll be able to cover your new monthly payment for the life of the loan.

Also, make sure that youre planning to stay in your house long enough to recoup the refinance cost. It might not be worth spending thousands of dollars in closing costs to refinance a house youre planning to sell soon.

Ultimately, the best time to refinance is the time that works best for your personal financial circumstances and goals. If you can get a lower interest rate and afford the closing costs, a refinance could help you save on your monthly payment. But if youre not feeling certain about your finances or your plans for your house in the coming months, it could make sense to wait a bit to explore a refi.

Stay in the know with our latest home stories, mortgage rates and refinance tips.

In your inbox every Thursday

- A valid email address is required.

- You must check the box to agree to the terms and conditions.

Thanks for signing up!

The Costs Of Refinancing

Refinancing a home usually costs 3% to 6% of the total loan amount, but borrowers can find several ways to reduce the costs . If you have enough equity, you can roll the costs into your new loan . Some lenders offer a no-cost refinance, which usually means that you will pay a slightly higher interest rate to cover the closing costs. Dont forget to negotiate and shop around, because some refinancing fees can be paid by the lender or even reduced.

Also Check: How Do I Get A Copy Of My Mortgage Note

What You Will Need To Refinance Your Home Loan

lBy loans.com.au | Updated on March 02, 2022

Smart Booster Home Loan

The Smart Booster Home Loan is our low rate home loan which allows you to boost your savings, build your equity and own your own home, sooner.

The Smart Booster Home Loan is our low rate home loan which allows you to boost your savings, build your equity and own your own home, sooner.

A home loan is likely to be the biggest purchase you will ever make, so it’s important to understand what paperwork is required to get refinance your home loan.

If you’re already a homeowner, it’s likely youve gone through this process before – but it always pays to double check that you’ve completed all the necessary steps before signing on the dotted line.

What Will Refinancing Cost

It is not unusual to pay 3 percent to 6 percent of your outstanding principal in refinancing fees. These expenses are in addition to any prepayment penalties or other costs for paying off any mortgages you might have.Refinancing fees vary from state to state and lender to lender. Here are some typical fees and average cost ranges you are most likely to pay when refinancing. For more information on settlement or closing costs, see the Consumer’s Guide to Settlement Costs.

Tip: You can ask for a copy of your settlement cost papers one day in advance of your loan closing. This will give you a chance to review the documents and verify the terms.

Application fee. This charge covers the initial costs of processing your loan request and checking your credit report. If your loan is denied, you still may have to pay this fee. Cost range = $75 to $300Loan origination fee. The fee charged by the lender or broker to evaluate and prepare your mortgage loan. Cost range = 0% to 1.5% of the loan principalPoints. A point is equal to 1 percent of the amount of your mortgage loan. There are two kinds of points you might pay. The first is loan-discount points, a one-time charge paid to reduce the interest rate of your loan. Second, some lenders and brokers also charge points to earn money on the loan. The number of points you are charged can be negotiated with the lender. Cost range = 0% to 3% of the loan principal

Appraisal fee.Cost range = $300 to $700Inspection fee.Homeowner’s insurance.

Read Also: Does Usaa Have Mortgage Loans

Can You Refinance Your Mortgage With Bad Credit

While it isnt impossible to refinance your home with bad credit, it could be more difficult. Here are some options to consider:

- Contact your current lender. Because youre an existing customer, your current lender might be willing to give you some wiggle room when it comes to credit requirementsespecially if youve been a good customer and made all of your payments on time and in full. However, be sure to also shop around and compare your options from as many other lenders as possible. This way, you can find the most optimal loan for your situation.

- Check the VA refinance program. Servicemembers, veterans and qualifying spouses might be able to refinance through the VA. Keep in mind that while the VA doesnt have a specific minimum credit score, lenders typically require a score of at least 620.

- Consider the FHA refinance programs. Another government-backed option to explore is refinancing through the FHA. The requirements for an FHA refinance are generally much less stringent than other options, and you might be able to qualify with a credit score as low as 500, depending on the program.

- Find a co-signer. Applying with a creditworthy co-signer could make it much easier to qualify for refinancing. A co-signer can be anyone with good creditsuch as a parent, another relative, or a trusted friendwho is willing to share responsibility for the loan. Keep in mind that this means your co-signer will be on the hook if you dont make your payments.

Economic Recovery On The Horizon

In 2020, the pandemic-induced recession and the resulting economic uncertainty caused some homeowners to hold off on refinancing. Because the refinancing process can take several months to complete, those worried about job stability may have felt it best to wait until things were more stable. Economic recovery is on the horizon. Those who might not have been in a position to refinance last year may now have the chance.

Don’t Miss: What Is The Mortgage On A 1.5 Million Dollar House

Proof Of Debts And Credit Information

To prove your trustworthiness as a borrower, youll need to provide your credit score and recent credit reports. However, youll also need to provide some information about the debt that you hold even though it shows up on your credit report.

This means youll need to provide information about current student loans, mortgages, credit cards, auto loans, personal loans, and any other sources of debt.

The Cost Of Refinancing Your House

In general, refinancing includes the following closing costs outlined below:

Application fee. Lenders impose this charge to cover the cost of checking a borrowers credit report, and the initial cost to process the loan request.

Title insurance and title search. This charge covers the cost of a policy, which is usually issued by the title insurance company, and insures the policy holder for a specific amount, covering any loss caused by discrepancies found in the property’s title. It also covers the cost to review public records to verify ownership of the property.

Lender’s attorney review fees. The company or lawyer who conducts the closing will charge the lender for fees incurred, and in turn, the lender will charge those fees to the borrower. Settlements are conducted by attorneys representing the buyer and seller, real estate brokers, escrow companies, title insurance companies and lending institutions. In most situations, the individual conducting the settlement is providing their services to the lender. Borrowers may be required to pay for other legal fees and services related to their loan, which is then provided to the lender. They may want to retain their own attorney for representation in the settlement, and all other stages of the transaction.

Recommended Reading: Can I Get A Mortgage With A 651 Credit Score

What Do I Need To Refinance

Are you ready to refinance your mortgage? Here are the documents a new lender will ask to see:

- Proof of income: paystubs, two years of tax returns, W-2/1099 forms

- Proof of assets: home ownership documents and current home value, bank accounts, investment /retirement accounts

- Statements of debt: credit card statements, school and car loans, other outstanding loans/debt

- Current mortgage statement

How To Refinance Your Mortgage If You Have Bad Credit

Your lowest score from the credit reporting bureaus is likely going to be used for qualification purposes, Allred explains. Because each credit reporting agency can assign you a different score, you could have a wide variation. As a result, many mortgage lenders pull scores from all three bureaus, then base your qualification on the lowest or the middle number.

If you have poor credit, knowing where you stand ahead of time can help you figure out how to improve your score and your overall creditworthiness as a borrower. Here are some strategies to refinance if your credit needs work:

Also Check: How To Shorten Your Mortgage Term

How Have Your Needs Changed

When you signed your mortgage contract, you may have been a brand-new home owner with very different needs than you have today. This is normal! Just like our career and personal needs change over time, it makes sense for your mortgage to evolve too. If your mortgage doesnt feel right for you anymore, youre right to think about making a change. Maybe youre in a place where you think you can start making bigger mortgage payments, or paying more often. Perhaps you want to shorten or lengthen your amortization period. People often find they want to find ways to pay off their mortgage faster without being penalized for it, and that might involve a refinance.

Mortgage Rate Forecast: What Is Driving Mortgage Rate Change

The surge in mortgage rates so far this year is due to a variety of economic factors. Persistently high inflation is a big one, Jacob Channel, senior economic analyst at LendingTree told us. Julys inflation report shows 8.5%inflation year-over-year. Thats lower than Junes 9.1%, a sign that inflation is starting to cool.

Though still high, in response, the Federal Reserve increased its benchmark short-term interest rate to combat that inflation. The Fed raised rates by 50 basis points in May, 75 points in June, and by 75 basis points in July.

Recently, we saw mortgage rates surge after the inflation report and ahead of the Feds announcement. I think what were seeing is that lenders had already anticipated that the Fed was going to raise the fed funds rate by 75 basis points and they began to preemptively push mortgage rates up, Jacob Channel, senior economist at LendingTree, told us.

Energy prices are half responsible for these increases, Dawit Kebede, senior economist for the Credit Union National Association, said in a statement. There are signs that some of the main drivers of inflation are easing, such as lower oil and other commodity prices in July, slower wage growth, and declining supply chain pressures. However, service price increases led by housing and pent-up demand for vehicles will keep inflation elevated in the coming months.

Read Also: How To Make A Mortgage Payment With A Credit Card

What Are The Risks

One of the major risks of refinancing your home comes from possible penalties you may incur as a result of paying down your existing mortgage with your line of home equity credit. In most mortgage agreements there is a provision that allows the mortgage company to charge you a fee for doing this, and these fees can amount to thousands of dollars. Before finalizing the agreement for refinancing, make sure it covers the penalty and is still worthwhile.

Along these same lines, there are additional fees to be aware of before refinancing. These costs include paying for an attorney to ensure you are getting the most beneficial deal possible and handle paperwork you might not feel comfortable filling out, and bank fees. To counteract or avoid entirely these bank fees, it is best to shop around or wait for low fee or free refinancing. Compared to the amount of money you may be getting from your new line of credit, but saving thousands of dollars in the long run is always worth considering.

- Refinancing Risks Have Not Become Smaller There have been reports that risks are diminishing when refinancing. This article argues against that idea.

- Refinancing Won’t Fix the Housing Market How massive amounts of refinancing is affecting the country as a whole.

What You’ll Need

To apply for a refinance loan, youll need to provide your lender with documentation to help verify your employment history, creditworthiness, and overall financial situation. If youre applying with someone else , they will also need to provide the same documents. Be prepared to provide the following:

- Bank statements for all financial accounts, including investments

- If self-employed, a copy of 2 years tax returns and your most recent quarterly or year-to-date profit/loss statement

- Most recent monthly statement for any mortgage, home equity loan or line of credit you hold on your home

Your lender may require more documents, depending on your circumstances and the type of mortgage for which youre applying. You can expect your lender to ask you details about your employment and financial history. With your permission, your lender will also run your credit report as part of the process.

Be sure to take your time and carefully fill out the application as completely and accurately as possible. Not disclosing credit problems up-front or holding back requested documents will only delay the process and potentially prevent approval of the mortgage, so its to your benefit to fully disclose everything about your finances.

Recommended Reading: What Is The Easiest Mortgage Loan To Get

When Is A Cash

A cash-out refinance is a great option for homeowners who need on-hand cash, meet the requirements of the refinance loan and generally need no more than 80% of their homes equity. Because of their lower interest rates, cash-out refinances can be a better option than financing with a credit card.

If youre not sure whether a cash-out refinance is right for you, our refinance calculator may be able to help.

You’ve Had Your Mortgage For A Long Time

The amortization chart shows that the proportion of your payment that is credited to the principal of your loan increases each year, while the proportion credited to the interest decreases each year. In the later years of your mortgage, more of your payment applies to principal and helps build equity. By refinancing late in your mortgage, you will restart the amortization process, and most of your monthly payment will be credited to paying interest again and not to building equity.

Amortization of a $200,000 loan for 30 years at 5.9%

Read Also: How To Watch Rocket Mortgage Classic