Mortgage Rates Where You Live

Mortgage or refinance rates depend on different factors, including where you live. To better understand what rates you may qualify for, including what the average mortgage or refinance rate is in your area, take a look at Credit Karmas marketplaces for mortgage rates and mortgage refinance rates as well as our latest state-specific guides.

Can I Get Mortgage Pre

Its unlikely. Initial qualification without a full credit check may be possible with some lenders at that point, they may be interested simply in whether you have both the income to pay back a mortgage and no credit red flags. But to get full-scale pre-approval will likely require a credit check.

Its important to know how long pre-qualification and pre-approval will be in effect. Different lenders assign different times for which their letters of pre-qualification or pre-approval are good, from 30 to as many as 120 days.

Remember that multiple checks for credit history can negatively affect your credit rating, so you dont want to have them repeated often. For the same reason, you shouldnt apply for it until youre ready to start seriously home shopping. Many lenders and real estate agents can help you get a range of what you can afford in a general sense, so that you can avoid going through the pre-qualification or pre-approval process only to learn that theres nothing in your market that you can realistically afford or want.

Does Money Actually Talk

But what about big money and high credit scores? Dont they always mean instant mortgage approvals?

With big money, the issue is often big expenses. If you make $75,000 a year, but have $25,000 in credit card balances, $60,000 in student loans, and $30,000 in auto loans, youll make lenders wince.

If a lender allows as much as 43 percent of your gross monthly income for debts , it means you can spend $2,687 on credit card bills, car payments, student debts, and housing costs.

The chart below shows the average DTI of approved loans according to Ellie Mae:

With $25,000 in credit card balances, you might be required to repay two percent of the outstanding debt, a total of $500 a month. Add in one percent for student debt and a $475 monthly cost for an SUV, and that leaves $1,112 for housing a number that wont work for many borrowers.

Read Also: How Long Is The Mortgage Process

Don’t Miss: How To Get Rid Of Escrow On Mortgage

Dont Get Preapproved Too Far In Advance

When you receive your preapproval letter, it will probably say its good for 30 to 90 days. Since thats a relatively short period, youll probably want to wait to get preapproval letters until youre ready to start seriously shopping for a home. And remember, a preapproval is only a conditional approval. If you rack up more debt, change jobs or reduce your savings, you could get denied when you go to get final mortgage approval.

Home Inspection & Final Negotiations: Approximately 3

Your home inspection appointment will take a few hours once its scheduled. The schedule will depend on the home inspectors availability. If the home is currently occupied, the schedule will also depend on the owners availability to allow the inspector inside.

Once your inspection is complete and youve reviewed the results, youll usually have the opportunity to negotiate repairs with the seller. This can take a few days to complete.

You May Like: How Soon Can You Take Out A Second Mortgage

Can You Get Pre

Absolutely. When itâs time to get a pre-approval letter, itâs in your best interests to shop around among multiple lenders. Different loans can offer dramatically different terms and rates, so make sure to survey all the possibilities before you commit to one. Working with multiple lenders will also give you an idea of what it feels like to work with each institution, so you can find the right culture fit.

Better yet, if multiple lenders are competing for your business, they may offer you incentives like waived application fees, better rates, or other perks.

What Are The Chances Of Getting Denied A Mortgage After Pre

If youve stayed within your budget, not high, but it does happen. Remember that pre-approval is a statement that you are considered generally qualified to pay back a mortgage, whereas the actual mortgage approval is on a specific purchase. The lender may believe that you are paying too much or may have uncovered liabilities that they did not find in the pre-approval. Also, if you are not able to pay a certain percentage of the cost in a down payment, typically 20 percent, then you may have to purchase mortgage insurance, which increases your costs.

You dont have to stay with the lender that gave you pre-approval, so you can consider applying elsewhere, which is a good idea in any case.

You May Like: How Many Times Can I Apply For A Mortgage

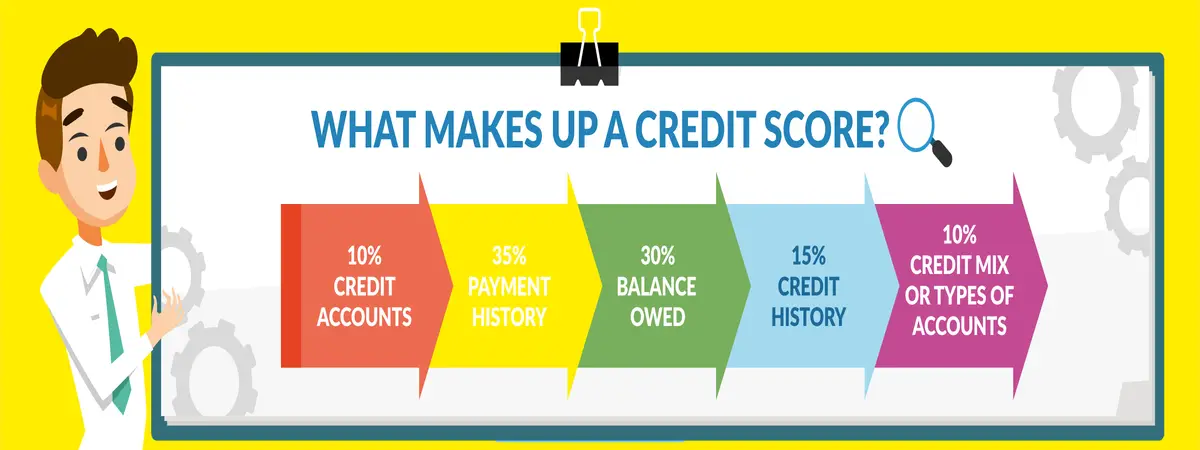

How Does An Application For A Mortgage Affect My Credit Score

A prequalification calls for a soft credit pull, which tells the lender your ballpark score but doesnt affect the credit score. A soft pull presents a range that shows where your score falls on a spectrum from poor to excellent. This is used in the prequalification process to give you an idea of what you could qualify for and acts as a reality check in some cases.

When you apply for preapproval or underwritten preapproval, the lender will do a hard credit inquiry, which does affect your credit score and will likely temporarily lower your score by a few points.

Checking your credit score multiple times in a short amount of time such as when applying for multiple credit cards, shopping around for a vehicle loan, or applying for mortgages with different lenders can negatively impact your credit score. Some credit-scoring models count multiple inquiries within a two-week period as one inquiry, but the actual guidelines depend on which credit-scoring model the lender uses. This is especially true for credit pulls for mortgage applications taken around the same time.

Bottom line: if youre shopping for a mortgage, make sure youre not applying for other forms of credit at the same time as this can affect your credit score and, therefore, your ability to qualify for your mortgage.

What Is A Credit Rating

Your credit rating is a ranking that indicates your financial health at a specific point in time. It compares the risk you pose for lenders to that of other Canadians.

Your overall credit rating is an important factor in determining the type and amount of credit you may be eligible to receive at any given time. Thats why its so important to establish and maintain the highest rating possible.

Recommended Reading: How Is Mortgage Amount Determined

How Long Does It Take For Underwriting To Approve A Loan

As a general rule, underwriting will usually approve your purchase application within a week of your loan officer receiving your complete application, including all required documentation. The underwriter themselves should be able to underwrite your purchase application within 72 hours of submission from your loan officer.

However, there are many factors that can slow this process down. First, if your application is incomplete, that will add days to the process as you and your loan officer work to gather the necessary documents. There are also internal staffing factors and external factors like weather, holidays, and seasonal rushes, that can affect your timeline.

Beginning Of The Mortgage

The first step is to have a statement from a lender stating that they can lend you the money to purchase the home. This process is quick if you have all the necessary documents and the mortgage agreement is already chosen.

Of course, the lender has verified your credit and financial life and evaluated that you have the right profile to acquire the loan.

Don’t Miss: What Is The Rate Of Interest For Mortgage Loan

Schedule A Home Inspection

While an appraisal gives you an estimate of the homes value, the home inspection is an in-depth visual examination of the property to uncover any issues that may need fixing. While inspections arent always required by the lender, its always wise to have one prior to closing on your new home. After all, inspections can uncover red flags that may indicate an issue that will become a bigger problem if its not addressed.

The home inspection can also help you understand the inner workings of your future home, so we recommend attending and asking questions as you see fit. Home inspections usually occur within a few days of contacting an inspector and take a couple of hours to perform. From there, the inspector will need to create a report, which can take up to a few days depending on the property.

Depending on what the inspector finds, you may need to go back to the negotiating table and rework the offer. If there are significant problems within the home, you may want the seller to fix them before you close or lower the purchase price to help pay for the cost of repairs. These negotiations can potentially lengthen your purchase timeline.

How Long Does It Take Between Mortgage Valuation And Offer

Once the mortgage valuation survey has been received from the surveyor, the lenders underwriter will have everything at hand to make the final decision and take the application forward to a mortgage offer.

When the lender is willing to go to offer you will be mailed the formal mortgage offer. The solicitor carrying out your conveyancing will also be sent their own copy of the mortgage offer. It can take up to 17 days to receive an offer .

Don’t Miss: How Much Should I Pay Down My Mortgage

How Long Does Mortgage Underwriting Take

Each situation is different, but underwriting can take anywhere from a few days to several weeks. Missing signatures or documents, and issues with the appraisal or title insurance are some of the things that can hold up the process. Be very responsive to requests for information, and if you need more time to gather requested documents, continue to communicate status with your mortgage loan officer.

How We Make Money

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout lifes financial journey.

Bankrate follows a strict editorial policy, so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

Were transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range can also impact how and where products appear on this site. While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service.

Don’t Miss: What Is A Good Mortgage Interest Rate

The Bottom Line: Preapproval Is The First Step Toward Homeownership

Buying a house is a major undertaking, and in the current market, itll take you about a year or more to go from your current home into a new one. The first step is getting preapproved to show agents and sellers that youre ready to buy.

Ready to become a homeowner? Start your Verified Approvalprocess today!

1 Participation in the Verified Approval program is based on an underwriters comprehensive analysis of your credit, income, employment status, debt, property, insurance and appraisal as well as a satisfactory title report/search. If new information materially changes the underwriting decision resulting in a denial of your credit request, if the loan fails to close for a reason outside of Rocket Mortgages control, or if you no longer want to proceed with the loan, your participation in the program will be discontinued. If your eligibility in the program does not change and your mortgage loan does not close, you will receive $1,000. This offer does not apply to new purchase loans submitted to Rocket Mortgage through a mortgage broker. This offer is not valid for self-employed clients. Rocket Mortgage reserves the right to cancel this offer at any time. Acceptance of this offer constitutes the acceptance of these terms and conditions, which are subject to change at the sole discretion of Rocket Mortgage. Additional conditions or exclusions may apply..

Get approved to see what you can afford.

Rocket Mortgage® lets you do it all online.

When To Get A Pre

Mortgage pre-approval letters are typically valid for 60 to 90 days. Lenders put an expiration date on these letters because your finances and credit profile could change. When a pre-approval expires, youll have to fill out a new mortgage application and submit updated paperwork to get another one.

If youre just starting to think about buying a home and suspect that you might have some difficulty getting a mortgage, going through the pre-approval process can help you identify credit issuesand potentially give you time to address them.

Seeking pre-approval six months to one year in advance of a serious home search puts you in a stronger position to improve your overall credit profile. Youll also have more time to save money for a down payment and closing costs.

When you are ready to make offers, a seller often wants to see a mortgage pre-approval and, in some cases, proof of funds to show that youre a serious buyer. In many hot housing markets, sellers have an advantage because of intense buyer demand and a limited number of homes for sale they may be less likely to consider offers without pre-approval letters.

You May Like: What Is A Mortgage Holder

How Fast Can You Get Pre

Unlike pre-qualification, which can be acquired in as little as an hour, pre-approval can take as long as 7-10 days. A lot of that depends on you, and a lot depends on your lender.

On your end, you not only have to fill out an application, you also have to produce all the required documentation. Most lenders will demand proof of income, which means tax returns and payroll stubs. You also must provide proof of employment, and a detailed list of all debts youâre currently repaying, including car and home loans, credit card bills, and student loans youâll also need supporting documents for each loan. On top of all that, you must provide recent bank statements detailing all your assets.

A few other documents could make the difference between a speedy pre-approval, or one that drags on. If a friend or family member will help you with the down payment, acquire a signed gift letter from them that spells out your arrangement. Appending marriage or divorce documents to your application could add further clarity to your financial situation and including a complete credit history might also speed things up.

While a fast pre-approval is important, it’s also important to ensure you’re getting a good deal. It pays to shop around for a lower interest rate – especially if you’re searching well in advance. Fill out the form below to get instantly matched with licensed local lenders in your area.

Be Honest About Your Finances

Theres no hiding it if youre not truthful about your income, credit history or assets. Instead, include notes and explanations for anything that may stand out on your credit report or statements, such as a missed payment. Its a simple thing you can do to help the underwriter make a quicker decision.

Knowing what to expect during the mortgage underwriting process can make it easier to navigate. The more prepared you are, the better off youll be. So, keep your debt in check, stay in touch with your lender and be honest about your finances. All these steps will bring you closer to becoming a happy homeowner.

Lets get you closer to your new home.

An experienced mortgage loan officer is just a phone call or email away, with answers for just about any home-buying question.

You May Like: How To Get A Mortgage Denial Letter

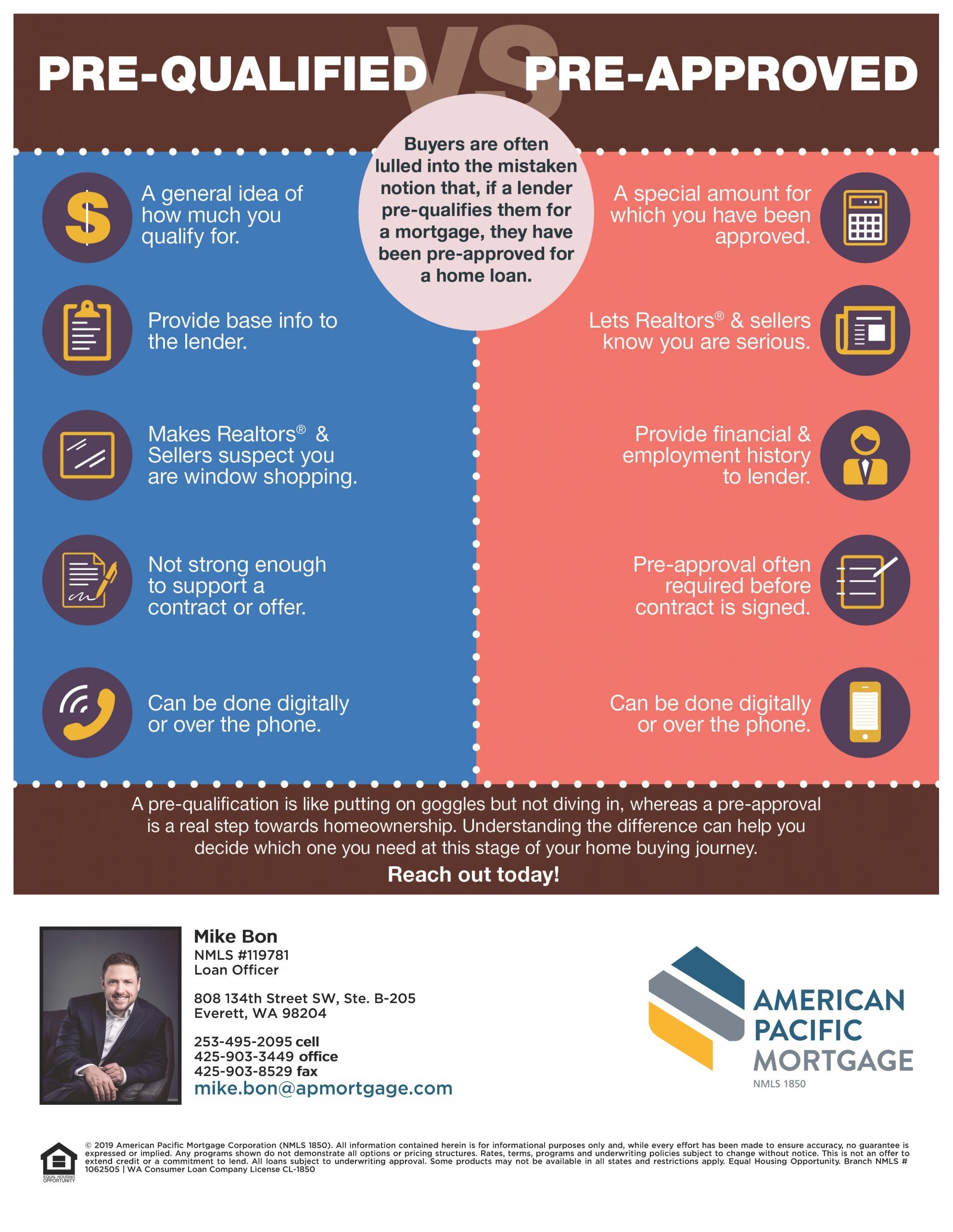

Understand The Difference Between Pre

A mortgage pre-qualification is often a basic financial evaluation. A TD mortgage pre-approval on the other hand, is in-depth. It includes a more thorough assessment of your finances. It also offers a rate hold of up to 120 days , while a pre-qualification does not. Plus, if you apply for a TD mortgage pre-approval online, it has no impact on your credit score. These benefits make a pre-approval an important part of the mortgage process.

How Long From Valuation To Mortgage Offer

Most of us can expect to wait 2-4 weeks from mortgage application to mortgage offer. From the point of the mortgage valuation to mortgage offer usually takes a few days to more than a week depending on how busy the lenders surveyors are.

If the lender is happy with your personal financial situation, and the outcome of the valuation survey, they will make you a formal mortgage offer.

You May Like: What Is The Monthly Mortgage On A 350 000 Home