Understand The 28/36 Rule

Lenders may determine your ability to afford a new home by using the 28/36 rule. This rule states that:

- Housing expenses should be no more than 28% of your total pre-tax income. This includes your monthly principal and mortgage interest rate, home insurance, annual property taxes, and private mortgage insurance payments .

- Total debt should not exceed 36% of your total pre-tax income. This includes the housing expenses mentioned above as well as credit cards, car loans, personal loans, and student loans, so long as these monthly debt payments are expected to continue for 10 months or more. This does not include other monthly expenses such as groceries, gas or your current rent payments.

In concrete numbers, the 28/36 rule means that a borrower who makes $5,000 a month should not spend more than $1,400 on housing costs every month.

If youre a renter making $5,000 a month, its a good rule of thumb to spend a maximum of $1,400 on rent. However, for a homeowner making the same amount, $1,400 should cover your monthly mortgage payment, as well as homeowners insurance premiums and property taxes.

How Is The Interest On My Mortgage Calculated

Interest on your mortgage is generally calculated monthly. Your bank will take the outstanding loan amount at the end of each month and multiply it by the interest rate that applies to your loan, then divide that amount by 12. Assuming you have an outstanding loan amount of $500,000 and an interest rate of 5% APR, your interest payment for one

How Much Income Do I Need For A 200000 Mortgage

Lets say your ideal home is worth £225,000 and youre able to put up a £25,000 deposit. For a £200,000 mortgage youll need to earn a minimum of £44,500, though to be more comfortably offered this level of mortgage youd probably need to earn closer to £50,000 or above. Its also worth noting that this mortgage would equate to a loan-to-value of 88.9% in this scenario, which means first-time buyer mortgage dealswould be your best bet.

Need to work out your LTV, use our LTV calculator.

Read Also: How To Pay Off Mortgage In 5 Years

Home Affordability And Your Piti Percentage

Lenders use all of these percentages, along with your debts and income, to form a picture of your home buying budget that they call PITI.

PITI is an acronym that describes:

- Principal: How much of your loans principal you can pay each month

- Interest: How much interest will pay to borrow each month

- Taxes: Property taxes you will pay to own a home

- Insurance: Monthly costs to insure your home

Read more about PITI and how it affects how much home you can afford on $50K a year.

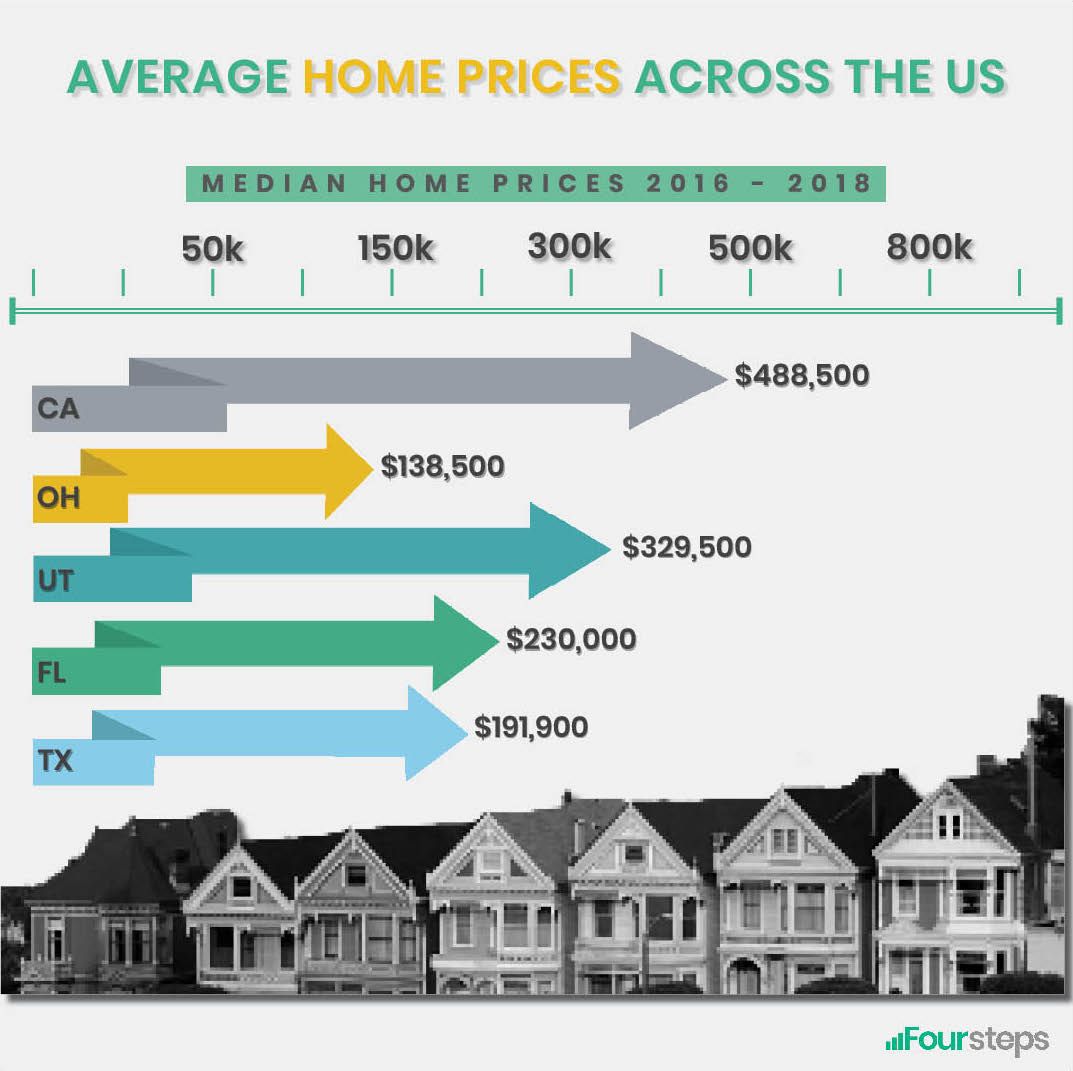

Most Affordable Markets For Homebuyers

According to 2020 data fromZillow Research, record low mortgage rates have helped to boost affordability for potential homeowners. The table below shows the top 10 most affordable markets to live in for December 2020 and is based on a typical home value of no more than $300,000 . The market and share of income spent on a mortgage may fluctuate based on the current mortgage rate, the typical local homeowner’s income and the typical local home value.

You May Like: Can I Refinance My Mortgage With No Closing Costs

How Much Should You Make A Year To Afford A 300k House

A person earning $ 50,000 a year might be able to afford a home worth between $ 180,000 and nearly $ 300,000. This is because salary is not the only variable that determines the budget for buying a home. You also need to consider your credit score, current debt, mortgage rates, and many other factors.

How much should I make to buy a 300k house?

This means that to afford a $ 300,000 home, you would need $ 60,000.

Read Also: How Many Years Of W2 For Mortgage

What Is The Minimum Income Required To Get A Mortgage For 300000 On A Buy

To be eligible for a mortgage buy-to-let lender, you will need to make a minimum of £25,000 a year.

To determine how much they would be willing to lend, most lenders will look at the amount the property will generate in rental income. But they will also expect you to have a personal income of at least £25,000.

Most lenders expect the rental income to be at least 125% of the monthly mortgage payments.

loancorp.co.uk is an information website all of our content is written by qualified advisors from the front line, for the sole purpose of offering great, relevant, and up-to-date information on all things mortgages.

Loan Corporation Ltd is registered in England and Wales No 12797096. ICO Registration Number ZB379648. Trading address is Ropergate House, Ropergate, Pontefract, England, WF8 1JY. We are an officially recognised IAT and can be found on the FCA financial services register, number654425.

The Financial Conduct Authority does not regulate some forms of buy to let mortgage.

Your property may be repossessed if you do not keep up repayments on your mortgage.

Think carefully about securing other debts against your property. If you are thinking of consolidating existing borrowing you should be aware that you may be extending the term of the debt and increasing the total you repay

Fees may be charged dependant on provider.

Recommended Reading: How Do I Become An Underwriter For Mortgage

How To Calculate Affordability

Zillow’s affordability calculator allows you to customize your payment details, while also providing helpful suggestions in each field to get you started. You can calculate affordability based on your annual income, monthly debts and down payment, or based on your estimated monthly payments and down payment amount.

Our calculator also includes advanced filters to help you get a more accurate estimate of your house affordability, including specific amounts of property taxes, homeowner’s insurance and HOA dues . Learn more about the line items in our calculator to determine your ideal housing budget.

What Price House Can I Afford On 30k

If you were to use the 28% rule, you could afford a monthly mortgage payment of $700 a month on a yearly income of $30,000. Another guideline to follow is your home should cost no more than 2.5 to 3 times your yearly salary, which means if you make $30,000 a year, your maximum budget should be $90,000.

Recommended Reading: How To Get A Mortgage Loan With No Credit

A Higher Credit Score Could Increase What You Can Borrow

Your has a big part to play in how much you can borrow. In the most extreme cases a low credit score could prevent a mortgage lender from even considering you or, more likely, a low score could mean that the lender uses a lower multiple of your income to decide how much you can borrow.

Thats why youll want to make sure your credit score is up to scratch before you even consider applying for anything. Our guide on improving your credit rating will be able to help you with this.

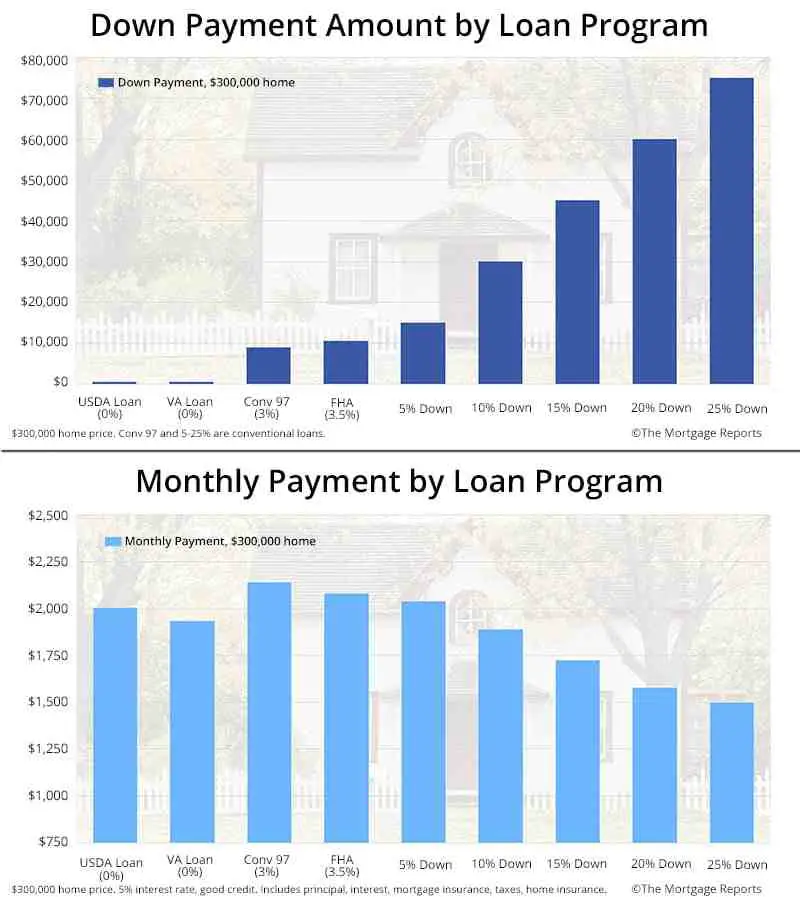

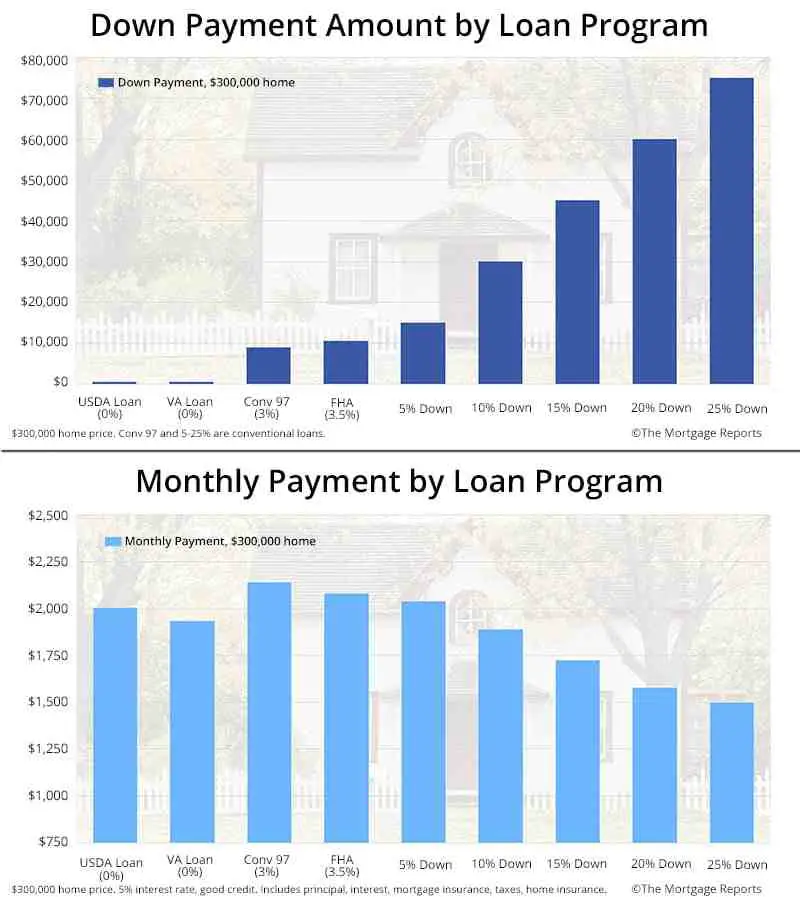

Should I Put 20% Down On A $300k House

When does 20% make sense as the down payment for a $300,000 house? The brief answer is: When you can afford it.

Putting down 20% on a home purchase earns you real advantages because:

- You dont have to pay for private mortgage insurance

- Youre likely to get a lower mortgage interest rate than those with smaller down payments

- Youll have lower monthly payments because youre borrowing less. Your loan amount is $240,000 with 20% down as opposed to $291,000 with 3% down

- Youll have a far lower total cost over the loan term

A bigger down payment can also earn you some extra wiggle room when qualifying for a mortgage. For example, suppose a lender wants a minimum credit score of 700. You might get away with a score a few points below that if youre putting 20% down.

Recommended Reading: What’s The Longest Mortgage You Can Get

Why You Need A Good Credit Score For A Mortgage

In order to qualify for a mortgage, you have to show the lender how your credit score stands. Your credit score is based on how well you handle managing debt and how much of it you have outstanding at any given time. You can request a free credit report from each of three major credit reporting agencies Equifax®, Experian®, and TransUnion® once each year at AnnualCreditReport.com or call toll-free 1-877-322-8228.

Its important that these numbers are good in order to get approved for a mortgage so make sure there are no late payments on your credit report and that youre paying off any balances as soon as possible.

Do You Have Enough Income

To afford a home, you must have enough income to cover your mortgage payments as well as your usual expenses and other debt obligations. This is a big deal because it reveals how predictable your finances are, which is crucial in making monthly payments. You have increased chances of securing approval if you have a stable long-term job with high income, which is why lenders verify your employment status.

Apart from evaluating your income, you may also submit any additional proof of income. Note that extra income is only accepted by lenders if it can get funds from those sources for at least three years. Heres a list of eligible sources of additional income:

- Payment from part-time work

- Stocks, bonds, and mutual funds

- Certificates of Deposit

You May Like: How Much Mortgage Can I Afford Nerdwallet

How Much Mortgage Loan Insurance Would You Need To Pay If You Offer The Minimum Down Payment

Mortgage loan insurance protects the lender if you start missing payments and cant make them up within a reasonable timeframe. As mentioned, most lenders require you to buy CMHC insurance if you put less than 20% of a homes price down.

Your premium will usually be 0.6% 6.5% of your total borrowed amount, based on your loan-to-value ratio or LTV . It can be paid upfront in a lump sum or divided amongst your mortgage payments. Essentially, if you offer a lower down payment, youll have to pay a higher mortgage insurance premium.

So, if youre only able to make a minimum 5% down payment on a $300,000 house, the Canada Mortgage and Housing Corporation will charge you $11,400 for insurance.

Loans Canada Lookout

Also Check: Whats Needed To Apply For A Mortgage

Factors That Impact Affordability

When it comes to calculating affordability, your income, debts and down payment are primary factors. How much house you can afford is also dependent on the interest rate you get, because alower interest ratecould significantly lower your monthly mortgage payment. While your personal savings goals or spending habits can impact your affordability,getting pre-qualified for a home loancan help you determine a sensible housing budget.

You May Like: How Long Does A Mortgage Loan Application Take

The Homebuyers Guide To Qualifying For A Mortgage

Buying a house is one of the largest purchases people make in a lifetime. Its an expensive proposition, with most consumers relying on loans to acquire their own home. And since mortgage payments typically take decades to pay down, it requires financial commitment and a level of stability. With this in mind, mortgage lenders assess your financial disposition and creditworthiness to make sure you can afford to make regular payments.

The following guide will walk you through the basic qualifying process to secure a mortgage. Well also rundown the primary financial requirements you must satisfy before you can buy a home. This includes factors such as your credit score, income, and debt-to-income ratio, to name a few. Finally, using our calculator above, well provide an example of how you can estimate your required annual income in order to purchase a home with a specific amount.

Understanding the Mortgage Qualifying Process

How Much Should I Spend On A House

Anaffordability calculatoris a great first step to determine how much house you can afford, but ultimately you have the final say in what you’re comfortable spending on your next home. When deciding how much to spend on a house, take into consideration your monthly spending habits and personal savings goals. You want to have some cash reserved in your savings account after purchasing a home. Typically, a cash reserve should include three month’s worth of house payments and enough money to cover other monthly debts. Here are some questions you can ask yourself to start planning out your housing budget:

Read Also: What Is A Bad Mortgage Rate

Lets Start With The Basics

Gross annual household income is the total income, before deductions, for all people who live at the same address and are co-borrowers on a mortgage. Enter an income between $1,000 and $1,500,000.

A down payment is the amount of money, including deposit, you put towards the purchase price of a property.

Minimum down payment amounts:

- For homes that cost up to $500,000, the minimum down payment is 5%

- For homes that cost between $500,000 and $1,000,000, the minimum down payment is 5% of the first $500,000 plus 10% of the remaining balance

- For homes that cost over $1,000,000, the minimum down payment is 20% or more depending on property location

For down payments of less than 20%, home buyers are required to purchase mortgage default insurance.

A down payment is the amount of money, including deposit, you put towards the purchase price of a property.

Minimum down payment amounts:

- For homes that cost up to $500,000, the minimum down payment is 5%

- For homes that cost between $500,000 and $1,000,000, the minimum down payment is 5% of the first $500,000 plus 10% of the remaining balance

- For homes that cost over $1,000,000, the minimum down payment is 20% or more depending on property location

For down payments of less than 20%, home buyers are required to purchase mortgage default insurance.

Selecting your province or territory helps us personalize your mortgage results.

Enter your total monthly payments towards any car loans, student loans or personal loans.

Should I Speak To A Mortgage Broker

Mortgage brokers remove a lot of the paperwork and hassle of getting a mortgage, as well as helping you access exclusive products and rates that arent available to the public. Mortgage brokers are regulated by the Financial Conduct Authority and are required to pass specific qualifications before they can give you advice.

Call or request a callback

Mortgage Advice Bureau offers fee free mortgage advice for Moneyfacts visitors that call on 0808 149 9177. If you contact Mortgage Advice Bureau outside of these channels you may incur a fee of up to 1%. Lines are open Monday to Friday 8am to 8pm and Saturday 9am to 1pm excluding bank holidays. Calls may be recorded.

Your home may be repossessed if you do not keep up repayments on your mortgage.

Don’t Miss: What Is The Best Way To Apply For A Mortgage

How To Calculate Your Required Income

To use the Mortgage Income Calculator, fill in these fields:

-

Mortgage interest rate.

-

Recurring debt payments. Heres where you list all your monthly payments on loans and credit cards. If you dont know your total monthly debts, click No and the calculator will ask you to enter monthly bill amounts for:

-

Car loan or lease.

-

Personal loan, child support and other regular payments.

Monthly property tax .

Monthly homeowners association fee .

Mortgage Required Income Calculator

The best way to think about how much home you can afford is to consider what your maximum monthly mortgage can be. As a general rule of thumb, lenders limit a mortgage payment plus your other debts to a certain percentage of your monthly income, which can be approximately 41%.

The amount a borrower agrees to repay, as set forth in the loan contract.

Also Check: How Calculate Pmi In A Mortgage

Monthly Payments On A $300000 Mortgage

At a 4.5% fixed interest rate, your monthly mortgage payment on a 25-year mortgage might total approximately $1,667.50 a month, while a 10-year mortgage might cost approximately $3,109.15 a month.

Note that your monthly mortgage payments may differ slightly depending on the type of interest rate , your mortgage term, payment frequency, taxes and possible other fees.

-

See your monthly payments by interest rate.

Interest

Recommended Reading: What Credit Score Is Best For Mortgage

If I Make $50k A Year How Much House Can I Afford

As a rule of thumb, a person who makes $50,000 a year might be able to afford a house worth anywhere from $180,000 to nearly $300,000.

Thats because annual salary isnt the only variable that determines your home buying budget. You also have to consider your credit score, current debts, mortgage rates, and many other factors.

Just to show you how much these different variables can affect your home buying power, take a look at a few examples below.

Don’t Miss: How Do You Assume A Mortgage

How Much Income Is Needed For A 300k Mortgage

To afford a $300,000 mortgage, you need to make between $50,000 and $75,000 a year. The average Australian earns somewhere between $55,000 and $85,000 a year, which means a 300K mortgage is affordable for most Australians. While you may think you should be able to afford a larger mortgage with a $50,000 a year income, most experts recommend you only spend 30% of your disposable income on your mortgage repayments to avoid financial stress.