The Best Time To Get A 30

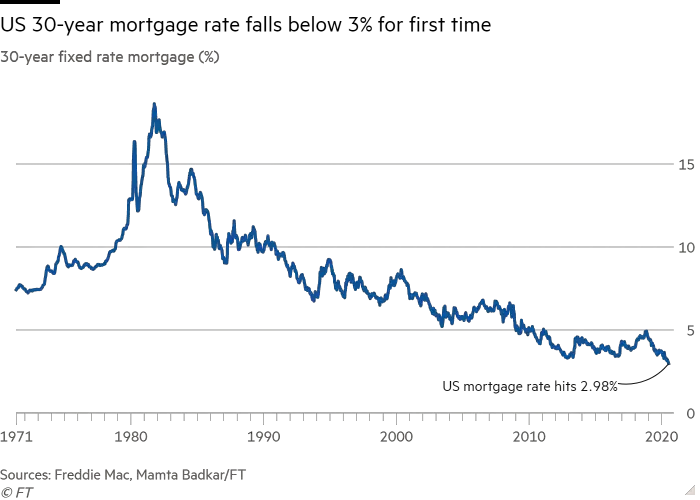

The best time to get a 30-year mortgage is when interest rates are low. Interest rates tend to fluctuate significantly over time. In late 2020 average 30-year rates were below 3%. Prior to the Great Recession rates were above 6% and were as high as 18.45% in October of 1981.

Rates depend on various economic factors, including the following:

What Credit Score Do Mortgage Lenders Use

Most mortgage lenders use your FICO score a credit score created by the Fair Isaac Corporation to determine your loan eligibility.

Lenders will request a merged credit report that combines information from all three of the major credit reporting bureaus Experian, Transunion and Equifax. This report will also contain your FICO score as reported by each credit agency.

Each credit bureau will have a different FICO score and your lender will typically use the middle score when evaluating your creditworthiness. If you are applying for a mortgage with a partner, the lender can base their decision on the average credit score between both borrowers.

Lenders may also use a more thorough residential mortgage credit report that includes more detailed information that wont appear in your standard reports, such as employment history and current salary.

Factors That Affect Your Mortgage Interest Rate

For the average homebuyer, tracking mortgage rates helps reveal trends. But not every borrower will benefit equally from todays low mortgage rates.

Home loans are personalized to the borrower. Your credit score, down payment, loan type, loan term, and loan amount will affect your mortgage or refinance rate.

Its also possible to negotiate mortgage rates. Discount points can provide a lower interest rate in exchange for paying cash upfront.

Lets look at some of these factors individually:

Don’t Miss: Can You Do A Reverse Mortgage On A Mobile Home

How To Get A Low 30

Getting the lowest possible mortgage rate for your 30-year fixed home loan is important if you want to keep your housing costs low. After all, as a homeowner youll be responsible for paying for property taxes, homeowners insurance, maintenance and repairs in addition to making a mortgage payment and paying interest.

To qualify for the lowest and best 30-year fixed mortgage rates, you need to have good credit. Most mortgage lenders look at FICO credit scores when assessing potential borrowers. Based on the FICO scoring model, a good credit score falls in the 670 to 739 range.

Different mortgage lenders have different standards regarding the credit scores that they expect borrowers to have. But in most cases, you wont be able to qualify for a conventional mortgage loan if your FICO credit score falls below 620. If your FICO score falls below that threshold, you do still have options. You can look into getting an FHA loan if you’re a first-time homebuyer or a USDA loan if youre planning on buying a home in a rural area.

Besides having a high credit score, you need to have a low debt-to-income ratio if you want to qualify for a low mortgage rate. Your DTI is the amount of debt youre paying off each month relative to your monthly gross income. Generally, you wont be eligible for a qualified mortgage if your debt-to-income ratio is higher than 43%.

How We Make Money

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout lifes financial journey.

Bankrate follows a strict editorial policy, so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

Were transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range can also impact how and where products appear on this site. While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service.

Recommended Reading: How Much Is Mortgage On 1 Million

How Do 5/1 Arm Rates Compare

The initial interest rates on ARMs are generally lower than those for fixed-rate loans. Often, adjustable rates are about 0.5% lower.

For example, if you were in line for a 3.0% fixed-rate mortgage, you could likely get a 2.5% adjustable rate. That lower rate might mean you could afford a bigger mortgage and a better, more costly home.

But the relationship between fixed rates and adjustable rates is not an iron rule. Sometimes, the gap is a bit wider. And sometimes its a little narrower. There are also periods when ARM rates are actually higher than fixed rates.

So its up to you to check where ARM rates stand in comparison to FRMs at the time when you are deciding which to choose.

You also need to shop around between different lenders for your best possible rate.

The ARM rate lenders can offer you depends on your credit score, credit report, down payment, and home value, among other factors. And you wont know which mortgage lender can offer the lowest rate until youve compared personalized rates from a few of them.

Compare todays 5/1 ARM rates

| Program | |

|---|---|

| 4.968% | Unchanged |

| Rates are provided by our partner network, and may not reflect the market. Your rate might be different. . See our rate assumptions . |

Mortgage Rate Trends In Alberta

Heres a quick look at the trend in Alberta mortgage rates, relative to the lowest national rates, as of year-end.

| Year |

|---|

| 1.95% |

| *As of May 2020 |

Alberta mortgage rates are forecast to follow the national average with a slight premium due to the deeper economic downturn in the province. Regardless, theyre projected to remain relatively low through 2022.

Recommended Reading: 10 Year Treasury Vs 30 Year Mortgage

How Popular Are 30

Thirty-year fixed-rate loans remain the most popular type of financing for homebuyers. Due to its low monthly payments, more people obtain 30-year fixed mortgages. Consumers are likely to qualify for this loan compared to shorter mortgage terms. Though its the longest loan-term available , people take advantage of this option to secure homes they need.

In a comprehensive report conducted by the Urban Institute, 30-year fixed rate loans accounted for 77 percent of new mortgage originations in April 2020. The chart below illustrates how 30-year mortgages take up most of the market share from 2000 to April 2020. The data is based on the Urban Institutes Housing Finance at a Glance: A Monthly Chartbook June 2020.

Thirty-year fixed mortgages are trailed by 15-year fixed-rate loans. According to the same report, it accounted for 14.2 percent of new mortgages in April 2020. Meanwhile, adjustable-rate mortgages represented 2.7 percent of new originations in April 2020. The Other category reflected around 6.1 of the market share. This includes loan options such as 10, 20, and 25-year mortgages.

The pie chart below represents the April 2020 mortgage product market share:

How Big Of A Down Payment Do I Need

Depending on what type of loan you borrow, you may not need to pay a down payment. Some government-backed loans for veterans and farmers may not require a down payment, while conventional loans or Federal Housing Administration loans typically require 3% or more.

To see all your options, visit our loan types page to see what kind of mortgage may be best for you.

Don’t Miss: 70000 Mortgage Over 30 Years

What Is A 5/1 Arm Mortgage

The term 5/1 ARM might sound like industry jargon. But this type of home loan is easy to understand when you break it down.

The acronym ARM stands for adjustable-rate mortgage. It means your mortgage rate can go up and down in line with other interest rates.

This is the opposite of a fixed-rate mortgage loan, which has an interest rate and monthly payment locked in for the life of the loan.

Nowadays, nearly all ARMs are hybrid, meaning theyre not pure adjustable-rate loans. Instead, they have a fixed interest rate for the first few years. And its only after that initial fixed-rate period ends that the rate can float up and down.

ARM interest rate adjustments

The 5 in 5/1 ARM means the rate on these loans is fixed for five years .

Likewise, a 7/1 ARM has a fixed rate for seven years and a 10/1 ARM is fixed for the first 10 years. There are other, shorter versions, including 1/1 and 3/1 ARMs, but these are far less common.

The /1 refers to the frequency with which the lender can adjust the rate. In this case, it means your mortgage rate can go up or down once per year.

The amount your 5/1 ARM rate will change each year depends on how the broader interest rate market is trending.

But even if rates skyrocket, your lender cannot increase your rate indefinitely nor can it fall too much. Thats because ARM interest rates are subject to caps and floors, which limit the amount your rate and payment amount can change.

5/1 ARM loan terms

Current Mortgage Rates For June 20 202: Rates Go Up

Today, the average interest rate for a 30-year fixed mortgage is at almost 6%. See how that affects your mortgage plans.

A couple of mortgage rates are higher again today, with 15-year fixed and 30-year fixed mortgage rates both climbing substantially. We also saw an inflation in the average rate of 5/1 adjustable-rate mortgages.

Mortgage rates have been consistently going up since the start of this year, and are expected to keep climbing throughout 2022. In general, interest rates are dynamic — they rise and fall on a daily basis depending on economic factors, including inflation and the federal funds rate, which the Federal Reserve has already increased three times this year. Because the Fed plans to keep hiking interest rates in order to contain inflation, prospective homebuyers will likely be able to lock in a lower rate now rather than later this year. Interviewing multiple lenders to compare rates and fees will help you find the best option for your financial situation.

Keep in mind that home prices come down not only to interest rates but a variety of factors. While we can’t predict in the long term how the Fed’s policies will impact the housing market, higher rates means that homebuyers will in the short term be dealing with steeper monthly payments.

Read Also: Rocket Mortgage Loan Types

Mortgage Rate Trends: Whats Behind The Recent Rate Movement

Various economic factors have led to an increase in mortgage rates this year. Persistently high inflation is a big reason, Jacob Channel, senior economic analyst at LendingTree told us. According to the Bureau of Labor and Statistics May inflation report, inflation recently reached 8.6%, its highest level in 40 years. The Federal Reserve increased its benchmark short-term rate by 50 basis points in May and by 75 basis points in June because inflation remained higher than expected.

A spike in mortgage rates preceded the Feds announcement after the inflation report was released. I think what were seeing is that lenders had already anticipated that the Fed was going to raise the Fed funds rate by 75 basis points and they began to preemptively push mortgage rates up, Jacob Channel, senior economist at LendingTree, told us.

We have a lot of factors like that that are putting upward pressure on mortgage rates, Channel says. Financial markets are still reacting to the COVID lockdown in China and the invasion of Ukrainian territory by Russia. The volatility has been through the roof, Shashank Shekhar, founder and CEO of InstaMortgage, told us. The market has been adjusting to a new news cycle practically every single day.

What You Should Know About Adjustable

Adjustable-rate mortgage loans are inherently riskier than fixed-rate mortgages. Although your introductory rate may be ultra-low, theres a good chance rates could rise at some point in your loan term.

A higher interest rate means a bigger monthly mortgage payment. And if rates rise enough, a homeowner could get priced out of their home which is a dangerous position to be in.

The risk of rising rates is the main reason most home buyers choose a fixed-rate mortgage over an ARM. However, if you know youll move or refinance before the introductory period ends, an ARM may offer a lower interest rate and savings on your mortgage payment.

If youre considering an ARM for its money-saving benefits, here are a few things you should know about this type of mortgage before opting in.

ARM rate caps make these loans less risky than you think

Today, most adjustable-rate mortgages come with rate caps. These reduce your exposure to risk by limiting the amount your rate can rise in any given year and over the life of the loan.

Rate caps are usually expressed like this: 2/2/5.

Following is the meaning for each, in order:

Still, caps are there to protect you.

Don’t Miss: How Does 10 Year Treasury Affect Mortgage Rates

Can You Pay Off A 30

Thirty years seems like a long time. If you buy a house when youre 35-years-old and get a 30-year mortgage, your last payment will be scheduled for right around the time you reach the retirement age of 65. One thing worth knowing about a 30-year mortgage is that just because you can take 30 years to pay it off doesnt mean you are obligated to do so. Many lenders may let you pay off your loan early. Some do charge a pre-payment or early payment penalty. Before you pay extra on your mortgage, double-check to confirm that your lender wont penalize you for doing so.

If you are interested in paying off your mortgage early, there are multiple ways to do so. If you get paid biweekly, you can try making biweekly payments on your mortgage, instead of monthly. Divide your monthly payment in half and pay one half when you get your first paycheck of the month and the second when you get paid the second time. Since there are 26 biweekly pay periods in a year, youll end up paying 13 months worth of your mortgage, rather than 12.

Another option is to add on an additional amount when you schedule your monthly payment. Even paying an extra $100 or $200 per month consistently can shave years off your mortgage.

Comparing Different Mortgage Terms

The 30-year fixed mortgage is the most popular loan for homeowners. This type of loan has a number of advantages, including:

- Lower monthly payment: Compared to a shorter term, such as 15 years, the 30-year mortgage offers lower payments spread over time.

- Stability: With a 30-year mortgage, you lock in a consistent principal and interest payment. Because of the predictability, you can plan your housing expenses for the long term. Remember: Your monthly housing payment can change if your homeowners insurance and property taxes go up or, less likely, down.

- Buying power: With lower payments, you can qualify for a larger loan amount and a more expensive home.

- Flexibility: Lower monthly payments can free up some of your monthly budget for other goals, like saving for emergencies, retirement, college tuition or home repairs and maintenance.

- Strategic use of debt: Some argue that Americans focus too much on paying down their mortgages rather than adding to their retirement accounts. A 30-year fixed mortgage with a smaller monthly payment can allow you to save more for retirement.

That said, shorter term loans have gained popularity as rates have been historically low. Although they have higher monthly payments compared to 30-year mortgages, there are some big benefits if you can afford the upfront costs. Shorter-term loans can help you achieve:

Recommended Reading: Who Is Rocket Mortgage Owned By

How We Chose The Best 30

In order to assess 30-year mortgage rates, we first needed to create a credit profile. This profile included a credit score ranging from 700 to 760 with a property loan-to-value ratio of 80%. With this profile, we averaged the lowest rates offered by more than 200 of the nations top lenders. As such, these rates are representative of what real consumers will see when shopping for a mortgage.

Keep in mind that mortgage rates may change daily and this data is intended to be for informational purposes only. A persons personal credit and income profile will be the deciding factors in what loan rates and terms they are able to get. Loan rates do not include amounts for taxes or insurance premiums and individual lender terms will apply.

Types Of 5 Year Arm Rates

Most loan programs offer ARMs as well as FRMs. The main exception is USDA loans, which are available only as 30-year, fixed-rate mortgages .

Although fixed-rate loans are more popular by far, ARM versions are also available for these major loan options:

- Conventional loans Home loans not guaranteed by the federal government

- Conforming loans Mortgages that conform to rules created by Fannie Mae and Freddie Mac, as well as those actually owned by Fannie and Freddie

- Jumbo loans Mortgages above the conforming loan limit, which can have loan amounts in the millions

- FHA loans Low-down-payment and low-credit loans backed by the Federal Housing Administration

- VA loans Zero-down-payment loans for veterans and service members, backed by the Department of Veterans Affairs

- Shorter-term loans You might choose a 10- or 15-year mortgage instead of the usual 30-year one. ARMs are often available for those

Not all lenders offer all flavors of mortgages. And some may decide not to provide ARM versions of all the loans they offer.

But, as long as you qualify for the mortgage you want, you should be able to find it as an ARM. You just might have to shop around a little more than someone looking for a fixed-rate home loan.

Also Check: Reverse Mortgage Mobile Home