Credit Cards Are Unsecured Loans

Besides the segment of secured credit cards that allows beginners to have a credit line equal to a security deposit they pay upfront, the majority of credit cards are unsecured loans.

Unlike a mortgage or a car loan where the bank has collateral to take if the borrower doesn’t make their loan payments, there is nothing the bank or card issuer can collect from you if you’re late on a bill besides interest. With a credit card, borrowers are given a loan without any security that they will pay it back.

“The lack of a physical asset acting as security means more risk for the issuer,” financial expert John Ulzheimer, formerly of FICO and Equifax, tells CNBC Select. “They can’t repo your dinner or your nice vacation that you paid for with your credit card. They take a default as a loss if they can’t collect from you.”

This added risk translates into a higher interest rate to cardholders since it helps banks to subsidize the risk of issuing unsecured credit to millions of people.

Federal student loans, which are backed by government funds if a borrower defaults,also carry less risk than credit cards and thus have lower interest rates. The average 15.78% credit card APR, according to the Federal Reserve’s most recent data, is more than five times higher than the 2.75% federal student loan interest rate for undergraduates for the 2020-21 school year. Even the federal rates for unsubsidized graduate student loans and parent loans don’t come close to credit card interest rates.

Why Term Life Insurance Is A Better Choice Than Mortgage Insurance For Protecting Your Home

1. Considerably lower premiums

Term life insurance premiums are decided by many factors ranging from current age and health to personal habits and medical history. The underwriting process covers all stops, leaving no stone unturned. Thus a healthy person can get a higher coverage at a low premium cost.

Moreover, the premiums remain the same throughout the term. Lender-provided mortgage insurance premiums are guaranteed for only your mortgage term they can go up when you renew your term.

2. Stable payout value

Mortgage insurance coverage declines in conjunction with your mortgage debt. As you pay off your mortgage, the coverage of the insurance benefit you receive decreases.

Term life insurance includes a guaranteed payout if the insured passes away. And the payout doesnt change no matter the amortization period.

3. Get more coverage

When you buy mortgage insurance, it only covers your mortgage value and not a penny more than that. This can be a problem for those who want their families to receive extra benefits after their death. The coverage of a term life insurance policy can be increased to include cash benefits that can go towards keeping your familys future safe.

4. Flexibility to use coverage as desired

The benefits of mortgage insurance go only towards paying out your mortgage. You or your heirs have no say in how the money should be used. So any extra costs such as consumer debt and student loans remain a burden on your family.

5. Guaranteed coverage

Federal Reserve Monetary Policy

On top of the high amount of deposits and fewer opportunities to loan out money, the Fed pushed the reserve requirement ratio to 0% in March 2020. The RRR is the amount that banks must keep based on the deposits they have. If the RRR is 10%, then to lend out $10,000, banks must keep at least $1,000. But with the RRR dropping to 0%, banks could lend out more money with the same amount of deposited money.

In addition, to help the economy during COVID-19, the Fed increased the money supply through its quantitative easing policy in March 2020. By purchasing massive amounts of debt securities, it flooded the economy by $120 billion per month until November 2021. The Fed’s monetary policy combined with the government stimulus programs have also impacted the savings rate.

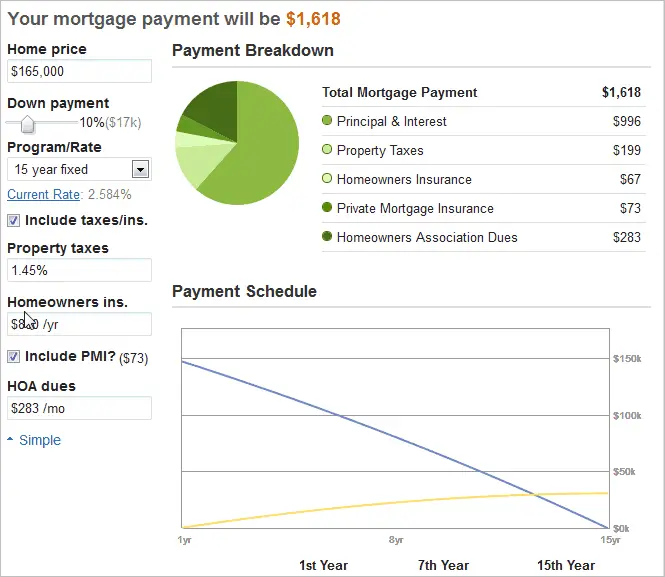

Recommended Reading: What Would My Payment Be On A 15 Year Mortgage

Banks Don’t Need Your Money

When banks need your money, they will raise the savings rate to attract customers. Banks lose money when they pay out higher rates, so they keep them low in order to maximize their profits. Despite the largest increase in the Federal funds rate in 20 years, banks have more money than they need, so they have continued to keep savings rates low.

Typically, high inflation leads to higher interest rates, which translate to higher savings rates as banks compete for more deposits. That hasn’t been the case during 2022. If banks want to decrease deposits, then they will lower interest rates. Until demand for loans picks up and banks see a need for more deposits, interest rates will continue to stay low.

How To Lower Your Interest Rate

![Mortgage Rates & Payments by Decade [INFOGRAPHIC] Mortgage Rates & Payments by Decade [INFOGRAPHIC]](https://www.mortgageinfoguide.com/wp-content/uploads/mortgage-rates-payments-by-decade-infographic-palmetto-mortgage.jpeg)

A common question borrowers have is, Why are student loan interest rates so high? Now that you know the answer, you can focus on reducing your loans interest rates with the following tips:

- Sign up for automatic payments: Many lenders, including federal student loan servicers, offer a 0.25% autopay discount when you agree to have your payments drafted from your bank account automatically each month.

- Refinance your loans: After you graduate, you can start earning a steady income and build your credit. Once youve established yourself, you may qualify for a lower interest rate by refinancing your student loans. Depending on your credit and the loan term you select, you could get a lower rate and save thousands over the life of your loan. Use the student loan refinance calculator to find out how much you can save.

- Add a co-signer to your refinancing application: If you cant qualify for a lower interest rate on your own, you may be able to with the help of a co-signer. A co-signer is someone who agrees to make your loan payments if you cant. Many lenders will offer a lower interest rate to borrowers with strong co-signers because it reduces the risk of the loan.

You can start the refinancing process by checking your eligibility and viewing rates using ELFIs Find My Rate tool.

Read Also: What Does Private Mortgage Insurance Cover

How Do Mortgage Rates Inflation And Home Price Appreciation Interact

Since 1976, mortgage interest rates and home price appreciation have had a positive but weak relationship. That is, higher mortgage rates tend to occur alongside higher home price appreciation, but it is a weak tendency.

So why do we expect home price appreciation to remain robust in the face of such affordability challenges? Because higher mortgage rates, and higher interest rates more generally, have historically been associated with periods of stronger economic growth, higher inflation, lower unemployment, and stronger wage growth. And the causality goes both ways. The Federal Reserve has historically raised interest rates when inflation or growth is higher than desired, so higher inflation, stronger economic growth, lower unemployment, and stronger wage growth have been associated with high home price appreciation.

To visualize how inflation and home price appreciation are related, we measured personal consumption expenditures against home prices. We found that a higher inflation rate is associated with higher home price appreciation and that the association is stronger than that between mortgage interest rates and home prices.

What Credit Score Do I Need To Get A Mortgage

Every loan type has a different minimum credit score to qualify, but just because you beat that minimum doesnt mean a lender will give you a mortgage. Conventional loans backed by Fannie Mae and Freddie Mac, government entities that buy mortgages on the secondary market, require a minimum score of 620. FHA loans require a minimum of 500, with at least 580 needed if you want to put down the lowest down payment of 3.5%. VA loans and USDA loans dont have minimum requirements.

To actually get a loan, you probably want a credit score well above the minimum. Having a score of 700 or higher not only increases your chances of getting approved for a loan, it likely will help bring down your interest rate. If your score is in the 500s or 600s, you may have fewer options, and they could be more expensive in the long run.

Don’t Miss: How Low Of A Credit Score For A Mortgage

How Does Interest On Payday Loans Work

You may have heard about payday loans and their unreasonably high interest rates. But how can these loans have rates that are so high?

A payday loan is a small, short-term loan used when money is needed immediately. Borrowers are expected to repay the loan when they receive their next paycheck. To encourage quick repayments, lenders will often use extremely high interest rates as service fees.

For example, apayday loan might be as low as $100 with repayment due in 2 weeks. If this loan carries a $15 fee, then the APR will be around 400%.

Unlike credit cards and mortgages, this fee is not repaid over the course of a year. Although $15 may not seem like much, it is a high interest rate compared to the $100 you initially borrowed.

How does $115 result in an approximate 400% APR rate?

$15 is 15% of the $100 borrowed. The APR is the annual percentage rate, so 15% must be multiplied by the number of days in a year:

.15 = 54.75

Divide the answer by the length of the loan .

54.75/14=3.910.

Move the decimal point to the right two places to get your APR. So a $15 charge for a 2-week loan of $100 means the APR is 391%.

Pay Attention To Loan Fees

The catchall term for the fees you pay to get a mortgage is closing costs. Everything from the prepaid property taxes to your appraisal fees fall into this category. Certain closing costs vary by loan size, but overall you can expert to pay 3% to 6% of the total loan balance.. Your closing costs play a crucial role in determining your annual percentage rate . In other words, the higher your closing costs, the higher your APR will be..

Also Check: Can I Get A Mortgage At Age 70

Reverse Mortgage Insurance Faq

Itâs important to make sure you understand the different aspects of mortgage insurance when getting a reverse mortgage.

Can you cancel reverse mortgage insurance?

In general, you cannot cancel reverse mortgage insurance. If you have an HECM, then insurance from the FHA is required throughout the life of the loan. The only way to get out of paying reverse mortgage insurance premiums is to pay off the loan.

Can you shop around for reverse mortgage insurance?

Reverse mortgage insurance on HECMs is handled by the FHA, which means that shopping around isnât an option. For non-HECMs, your lender can advise you on acceptable insurance providers.

/1 Arm Mortgage Rates

A 5/1 ARM has an average rate of 4.52%, which is an addition of 7 basis points compared to last week.

An adjustable-rate mortgage is ideal for individuals who will sell or refinance before the rate changes. If thats not the case, their interest rates could end up being significantly higher after a rate adjusts.

For the first five years, a 5/1 ARM will typically have a lower interest rate compared to a 30-year fixed mortgage. Keep in mind that depending on how much your loans rate adjusts, your payment has the potential to increase by a large amount.

Don’t Miss: What Would Be The Mortgage Payment On 250 000

What Is A Mortgage Rate

A mortgage rate is the interest lenders charge on a mortgage. Mortgage rates come in two forms: fixed or variable.

Fixed rates never change for the life of your loan and in exchange for this certainty, the rate is higher on longer loans.

Variable-rate mortgages can have lower interest rates upfront, but fluctuate over the term of your loan based on broader economic factors. How frequently a variable-rate mortgage changes is based on the loans terms. For example, a 5/1 ARM would have a fixed rate for the first five years of the loan, then change every year after that.

How Does A Mortgage Work

A mortgage is a type of secured loan where the property often your home is the collateral. So youll never be able to take out a mortgage without having some sort of real estate attached to it. Mortgage loans are issued by banks, credit unions, and other different types of lenders.

Aside from paying the loan back, you pay for a mortgage in two ways: fees and interest. Interest is paid on your loan balance throughout the life of the loan and is built into your monthly payment. Mortgage fees are usually paid upfront and are part of the loans closing costs. Some fees may be charged annually or monthly, like private mortgage insurance.

Mortgages are repaid over what is known as the loan term. The most common loan term is 30 years. You can also get a mortgage with a shorter term, like 15 years. Short-term loans have higher monthly payments but lower interest rates. Mortgages with longer terms have lower monthly payments, but youll typically pay a higher interest rate.

Also Check: What Kind Of Mortgage Can I Afford

Why Are Student Loan Interest Rates So High Compared To Other Debt

As you start researching your student loan options, you may be surprised by how high the interest rates can be. Even some federal loans, well-known for low interest rates, can be expensive. For example, Parent PLUS Loans are now at 7.54%.

Student loan interest rates can be significantly higher than youd see for other forms of debt, such as car loans and mortgages. Consider these numbers:

- The average interest rate for a 30-year fixed-rate mortgage was 5.51% as of July 14, 2022.

Why is student loan interest so high compared to these forms of debt? There are a few reasons:

Why Are Mortgages Rates So Low Right Now

In a nutshell, interest rates on fixed-rate mortgages are closely intertwined with the stock market and the how the economy is faring. When the stock market is shaky and as of late its been on a scary downward spiral investors shift their money into the U.S. Treasury bond market instead. Treasury bonds are considered a safer investment because theyre issued by the U.S. government.

Ultimately, Treasury yields are linked to mortgage rates. When Treasury yields goup, so do interest rates. And when yields go down, such as from bond pricesgoing up from an influx of investment, so do interest rates.

Its no wonder mortgage rates have plummeted from 3.71 percent in February to 3.29 percent in March as the 10-yearTreasury yield has also dropped in that timeframe.

With lower mortgage rates, consumers areincentivized to buy houses, which is good news as it could help bolster theeconomy during this tumultuous time.

Also Check: What Is A Hero Mortgage Loan

Why Are Mortgage Interest Rates Important

Your mortgage interest rate determines how much the balance of your loan will grow each month. The higher the interest rate, the higher your monthly repayments.

Interest rates are always calculated as a percentage of your mortgage’s balance.

If you have a repayment mortgage – which most people do – you’ll pay a set amount of your balance back each month plus interest on top of that. Those with interest-only mortgages pay interest but none of the -capital.

Whats That In Dollars

Say youre getting a 30-year, fixed-rate mortgage with a loan amount of $300,000.

Someone with the lowest of those APRs would pay around $300,000 in interest over the life of the loan according to FICO. But someone whose score is in the 620-639 range would pay closer to $410,000 in total interest payments for the same home price. So over time, what might look like a relatively small rate difference can add up to huge savings.

You May Like: Can I Get A Mortgage If Self Employed

How Do Home Loans Amortize

Monthly mortgage payments consist primarily of two components: principal and interest. Principal is the loan amount borrowed, and interest is the additional money that is owed to the lender for borrowing that amount. For example, if you take out a $200,000 mortgage, your beginning principal balance is $200,000. Because of interest, the amount you will owe in total will be higher. So if a homeowner with a $200,000 mortgage takes on a 30-year fixed-rate mortgage with a 4% interest rate, he or she would pay about $343,700 in total over the loans life. The $143,700 in interest payments equals almost 72% of the $200,000 principal.

The process of paying off your mortgage is known as amortization. Fixed-rate mortgages have the same monthly mortgage payment of the life of the loan, though the amount you pay in principal and interest changes because interest payments are calculated based on the outstanding balance of the mortgage. Thus, the proportion of each monthly payment shifts from primarily interest to primarily principal over the course of the loan. A breakdown of the loan amortization schedule for a 30-year fixed-rate mortgage of $200,000 with a 4% annual interest rate is shown below.

Current Mortgage Refinance Rates

Refinancing became a bit more expensive today as 30-year fixed and 15-year fixed refinance mortgages saw their mean rates increase. If youve been considering a 10-year refinance loan, just know average rates also made gains.

The refinance averages for 30-year, 15-year, and 10-year loans are:

Find current mortgage rates for today.

Recommended Reading: What Will Mortgage Rates Do Tomorrow

Which Mortgages Come With The Lowest Interest Rates

Generally, the interest rates on fixed-rate mortgages will be higher than those on offer from variable deals.

This is because you’re paying a bit more for the security of knowing what your repayments will look like every month.

The same thinking applies with longer fixed-rate deals of five years or more. The lender is taking on a bigger risk by offering these deals as rates in the wider market might rise during that time, so a longer-term fixed rate will often be higher than a shorter-term one.