What Is Mortgage Required Income

Lenders consider two main points when reviewing loan applications: the likelihood of repaying the loan and the ability to do so .

Nerdwallet.com explains that mortgage income verification, even if they have impeccable credit, borrowers still must prove their income is enough to cover monthly mortgage paymen

Working Out The Size Of Your Deposit

To understand how much you can afford to spend on buying a home, the first step is to draw up your overall budget and understand how much money you have at your disposal to pay for everything. This will depend on the capital or savings you have at your disposal, and how much you can borrow against the property as a mortgage given your income and the size of your deposit.

Know How Much Home You Can Afford

Before you even start looking for a home, you need to know how much you can afford so you donât spend time looking at homes that are out of your price range. When you do that, it’s hard not to feel let down later when you view lower priced homes.

To get an idea of what you can afford, you’ll need to keep these things in mind:

- Your household income

- Your current debts and the monthly payments to carry those debts

- Your monthly housing-related costs, like your mortgage payment, property taxes, home insurance, condo fees, school taxes, utilities and home care costs

- Your closing costs and other one-time costs

- Your spending habits

Recommended Reading: How Much Is The Average Mortgage Insurance

What Is The Required Debt

Online resource Investopiea.com explains that the lower an applicants debt-to-income ratio, the greater the chances that the borrower will be approved for a credit application.

As a customary rule, 43 percent is the highest debt-to-income read DTI ratio a borrower can have and still be qualified for a mortgage.

However, lenders prefer a debt-to-income ratio lower than 36 percent, with no more than 28 percent of that debt as a mortgage or rent payment.

In reality, though, the maximum DTI ratio varies from lender to lender.

What Is A Mortgage

Amortgage is a kind of loan that is used to finance a property. Amortgage is a secured loan, which means that the person whoborrows promises some kind of collateral in the event they cannotrepay that loan in a timely manner. In the majority of cases, thecollateral for a mortgage is the property itself.

Both individuals and businesses use mortgages to finance properties.

The benefit of a mortgage is that it gives you a way to buy some property without having to shell out the entire cost upfront.

Over many years, the borrower pays back the loan plus interest in a series of installments.

In the case when the borrower cannot repay the loan, the mortgage owner has the right to foreclose the property and sell it off to make up the debt.

A mortgage is a specific type of loan, but not all loans are mortgages. The key aspect of mortgages is that they are secured loans and come with some kind of collateral.

Even when you have the funds to pay for the property upfront, it can still be a good idea to secure a mortgage. For example, securing a mortgage can free up funds that you can put into other real estate investments.

There are two major payment components to a mortgage. The monthly principal is the main amount you owe each month and is determined by the amount of the mortgage and the length of the loan terms.

Principal + interest + homeowners insurance + taxes = total monthly payment

Also Check: What To Look Out For With Mortgage Lenders

How Do Lenders Determine Mortgage Loan Amounts

While each mortgage lender maintains its own criteria for affordability, your ability to purchase a home will always depend mainly on the following factors.

Many different factors go into the mortgage lenders decision on homebuyer affordability, but they boil down to income, debt, assets, and liabilities. A lender wants to know how much income an applicant makes, how many demands there are on that income, and the potential for both in the futurein short, anything that could jeopardize its ability to get paid back.

Income, down payment, and monthly expenses are generally base qualifiers for financing, while and score determine the rate of interest on the financing itself.

How Much House Can You Afford The 28/36 Rule Will Help You Decide

You found your dream home, but can you safely afford it? Before you commit to the biggest financial decision of your life, consider the 28/36 rule.

The rule is used by lenders to determine what you can afford, according to Ramit Sethi, best-selling author of I Will Teach You to Be Rich.

Its used by lenders, but its also a really helpful tool for us as individuals to decide how much debt we can afford, Sethi tells NBC News.

The rule is simple. When considering a mortgage, make sure your:

- maximum household expenses wont exceed 28 percent of your gross monthly income

- total household debt doesnt exceed more than 36 percent of your gross monthly income .

In other words, if your maximum household expenses and total household debt are at or lower than 28/36, you should be able to safely afford the home.

Recommended Reading: What Is A Freddie Mac Mortgage

How Much House Can I Afford 50k Salary

A person who makes $50,000 a year might be able to afford a house worth anywhere from $180,000 to nearly $300,000. Thats because salary isnt the only variable that determines your home buying budget. You also have to consider your credit score, current debts, mortgage rates, and many other factors.

What Is The 28/36 Rule And How Does It Affect Your Loan

In the 28/36 rule, the 28 is your housing expense ratio, and the 36 is your DTI, or debt-to-income ratio. When used together, the housing expense ratio is referred to as the front-end ratio, and the DTI ratio is referred to as the back-end ratio.

Where your housing expense ratio only includes housing expenses, your DTI factors in debt like car loans, student loans and credit cards. If over 36% of your income is being spent to pay off debt, you may have more difficulty getting a home loan. Paying down your debt to lower your DTI will help your chances of getting a mortgage.

You May Like: How To Calculate How Much Of Mortgage Payment Is Principal

Percentage Of Income Rules And Guidelines

Although most personal finance experts recommend the 28% rule, there are several other rules and guidelines that can be helpful in your calculations. With the following percentage of income rules, you can feel confident in determining precisely how much to put toward your monthly payments, so lets get into it.

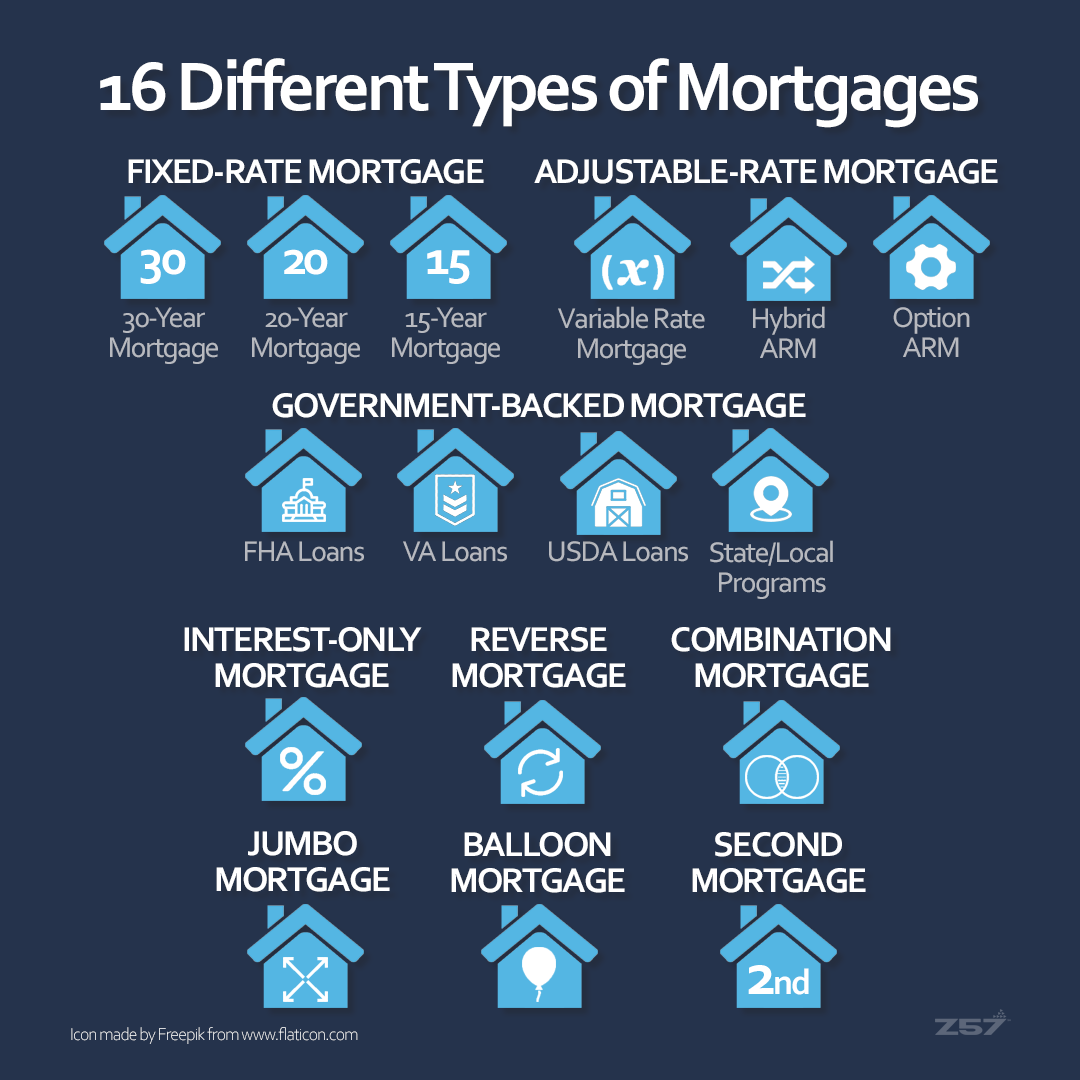

Know Which Mortgage Option Is Right For You

Okay, now lets talk about types of mortgages. Most of them are garbage designed to help you pay for a home even if you cant afford it.

But when you do the math, you find that these mortgages charge you tens of thousands of dollars more in interest and fees and keep you in debt for decades longer than the option we recommend.

Thats why getting the right mortgage is so important! Setting boundaries on the front end makes it easier to find a home you love thats in your budget.

Here are the guidelines we recommend:

- A fixed-rate conventional loan. With this option, your interest rate is secure for the life of the loan, keeping you protected from the rising rates of an adjustable-rate loan.

- A 15-year term. Your monthly payment will be higher with a 15-year term, but youll pay off your mortgage in half the time of a 30-year termand save tens of thousands in interest.

Your mortgage lender will most likely approve you for a bigger mortgage than you can actually afford. Do not let your lender set your home-buying budget. Ignore the banks numbers and stick with your own.

Knowing your house budget and sticking to it is the only way to make sure you get a mortgage you can pay off as fast as possible.

Read Also: How To Find A Good Mortgage

Also Check: How To Pick A Mortgage

Figure Out How Much Mortgage You Can Afford

As a general rule, lenders want your mortgage payment to be less than 28% of your current gross income. Theyll also look at your assets and debts, your credit score and your employment history. From all of this, theyll determine how much theyre willing to lend to you.

However, the amount you may qualify to borrow isnt necessarily what you should borrow. Why? Because lenders are only looking at your past and present situation. They dont take into account your future plans.

Are you thinking of a career change? Do you expect a substantial increase in debt or expenses? Use our mortgage affordability calculator to consider multiple scenarios. Or talk with a mortgage loan officer. They can help you figure out a price range that makes sense for the long term.

Finding The Right Lender

One place to start is with Credible, a site that allows you to get quotes from three lenders in only three minutes. Theres no obligation, but if you see a rate you like for your mortgage or refinancing your mortgage, you can progress to the next step of the application process. Everything is handled through the website, including uploading documents. If you want to speak to a loan officer, you can, of course, but it isnt necessary.

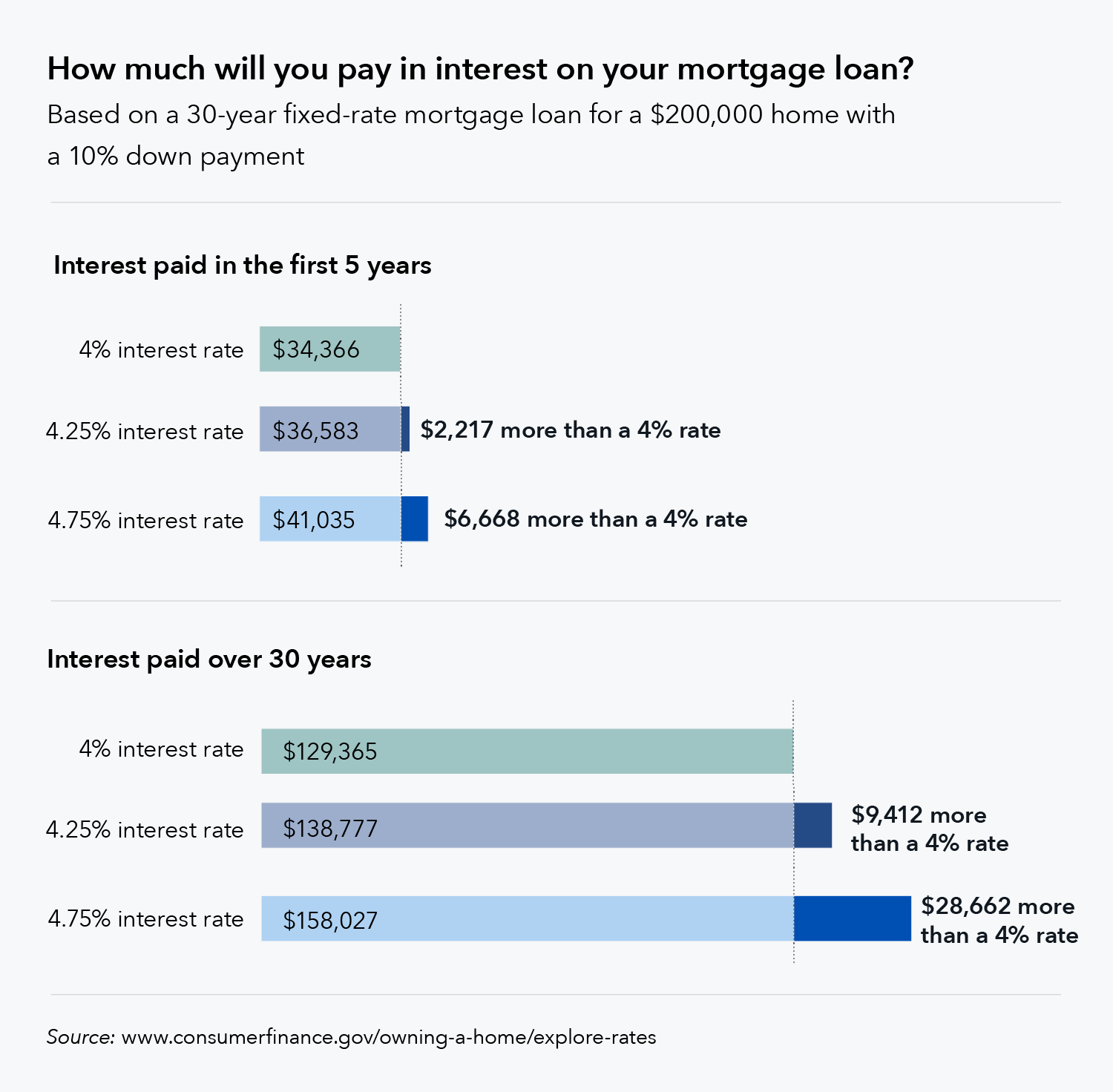

As you shop for a lender, remember that every dollar counts. Youre committing to a monthly mortgage payment based on the rate you choose at the very start. Even small savings on your interest rate will add up over the years youre in your house.

Fiona is another great place to get started since they allow you to shop and compare multiple rates and quotes with minimal information, all in one place. Youll input the amount of the loan, your down payment, state, mortgage product type, and your credit score to get mortgage quotes from multiple lenders at once.

You May Like: Are Reverse Mortgages Good For Seniors

Why Calculate Mortgage Affordability

When youre looking to buy a home, its handy to know how much you can afford. Being able to calculate an estimate of how much youre able to borrow is an important part of setting your budget.

You also need to determine if you have enough cash resources to purchase a home. The cash required is derived from the down payment put towards the purchase price, as well as the closing costs that must be incurred to complete the purchase. We can help you estimate these closing costs with the first tab under the mortgage affordability calculator above.

Taken together, understanding how large a mortgage you can afford to borrow and the cash requirements involved will help you determine what kind of home you should be on the look out for. To learn more about mortgage affordability and how our calculator works, have a read of the information below.

How Much Mortgage Can You Afford

Borrowers need to decide for themselves how much of a housing payment they can really afford. Although the Rule of 28 is a good place to start, developing a realistic future budget for your life as a homeowner is a smarter route.

As you build a future budget, start with your current monthly expenses. A realistic budget should include all of the modern necessities that you are unwilling to part with. For example, consider the costs of your cell phone and gym membership alongside your grocery and gas expenses.

In addition to your current expenses, add other costs specifically related to your new foray into real estate. A few commonly overlooked expenses include property taxes and routine home repairs.

If you take the time to map out a realistic budget ahead of time, that can help avoid the conundrum of being house poor. Essentially, house poor is a term for borrowers who can technically afford their mortgage payments, but the larger payment necessitates big cuts in other areas of their budget. For example, the borrower may have a beautiful home but not enough income to cover home repairs or new furnishings.

It is important to strike a balance between living in a beautiful home and having space in your budget to stop and smell the roses.

Check out our free home affordability calculator if you need help setting up a realistic budget. Youll find a streamlined calculator to help you set a budget that works for your finances.

You May Like: When Paying Off A Mortgage Early

How To Qualify For A Bigger Mortgage

If you dont qualify for the mortgage you need to buy your ideal home, there are ways to increase what youre eligibility.

To start, work on improving your credit score. If you can qualify for a lower rate, it will allow you to buy in a higher price range.

For example: Say the maximum mortgage payment you can afford is $1,500. At a 5% rate, thatd give you a home buying budget of about $280,000. If you could qualify for a 3% rate instead, youd get a loan of $356,000 nearly $70,000 more.

You can also increase your income either by taking on a side gig or putting in extra hours at work. Reducing your debts will also put you in a better position to get a bigger loan. The more income youre able to free up each month, the more the lender will be willing to loan you.

Also Check: How Much Do Points Cost On Mortgage

Mortgage Payments Arent Your Only Homeownership Cost

Theres more to homeownership cost than your monthly payment. More on that later. But what makes up your monthly payment itself?

Mortgage professionals use the acronym PITI to cover some of the main ones. That stands for:

- Principal: The amount by which you reduce the amount you borrowed each month.

- Interest: The cost of borrowing.

- Taxes: The property taxes you have to pay.

- Insurance: Homeowners insurance. Plus, depending on where you buy, possibly flood, earthquake or hurricane cover.

None of these is optional and if you fall far behind on any of them, youll be in breach of your mortgage agreement and subject to action by your lender.

Also Check: Is A 10 Year Mortgage A Good Idea

Claiming Rental Income To Qualify For A Mortgage: How Do Lenders View It

See Mortgage Rate Quotes for Your Home

As a landlord or aspiring real estate investor, its possible that a lender will let you use rental income to qualify for a mortgage. Whether they actually do so will depend on your ability to provide proof of income, or if it’s for a new rental, proof of the earnings potential of the property. Lenders have to adhere to specialized guidelines when making their decision. Read on to learn more about these stipulations, as well as how they may impact your eligibility.

Be Prepared For Closing Costs

A long list of small closing costs can add up quickly. But dont despair. Your mortgage loan officer can help you figure out the best way to cover these costs. You may even be able to roll them into your mortgage.

Early in the loan process, youll get an itemized list of these costs. It will include standard expenses such as appraisal fees, title fees and the first year of your home insurance premium payments. Depending on your specific loan and state requirements, there will be other costs as well.

You May Like: What Determines Your Mortgage Interest Rate

Percentage Of Income That Should Go Towards Your Mortgage

December 22, 2017 by Barron Rothenbuescher

As a general rule of thumb, your monthly housing payment should not exceed 28 percent of your income before taxes. When determining what percentage of income should go to mortgage, a mortgage broker will typically follow the 28/36 Rule. The Rule states that a household should not spend more than 28 percent of its gross monthly income on housing-related expenses. In addition to mortgage payments, housing expenses include property taxes, home insurance and similar expenses. While this is the standard, this percentage is not right for everyone. Some individuals are able to spend more or less depending on their individual circumstances.

Do I Need To Find A Tenant And Have A Written Lease Agreement Before I Apply

Regarding the potential rental income, you do not need a lease or renter in place. The market rent is not determined by the amount on a lease, but by the appraiser. The appraisal will include one of the following:

- For a one-unit property – Single-Family Comparable Rent Schedule .

- For two to four-unit properties – Small Residential Income Property Appraisal Report with your appraisal report.

The appraiser will list the fair market rent for the subject property on these forms. This is determined by comparable rental properties in the area.

You May Like: How To Become Mortgage Agent

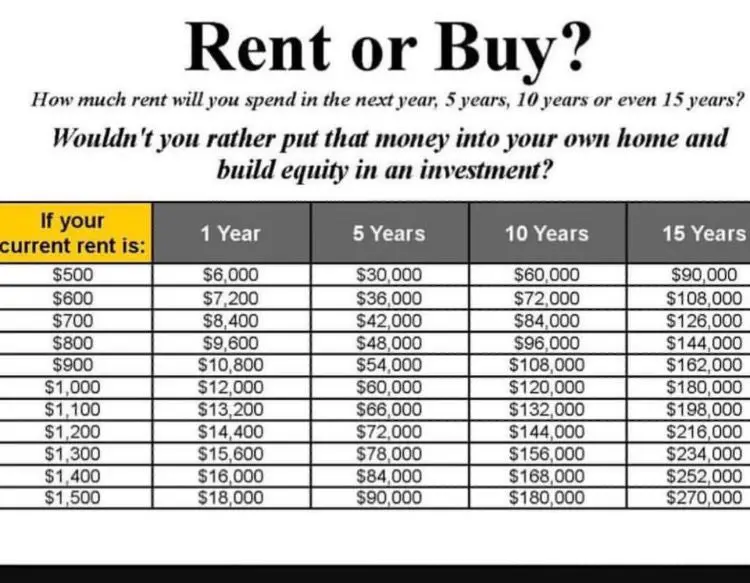

When Should I Start Saving For A House

As soon as you think youre ready to buy a house, start saving for one! For reference: Youre only ready if youre debt-free and have an emergency fund of 36 months of living expenses. Itll probably take some intense saving over a period of timewere talking a year or two just to save for a down paymentso youll want to get started right away.

Mortgage Housing Expense Ratio

Mortgage lenders use a host of assessment criteria before they make loan decisions. Before approving you, your mortgage lender will look at your housing expense ratio, which is composed of your anticipated total mortgage payment versus your gross, or pretax, monthly income. Generally, your housing expense ratio shouldn’t exceed 28 percent of your gross monthly income. For example, if your monthly income is $5,000, your total monthly mortgage payment, including taxes and insurance, shouldn’t exceed $1,400 .

Recommended Reading: How To Use Rental Income To Qualify For Mortgage