More Borrowers Making Interest Repayments

However, in my opinion the best reason why this is a more attractive option is because you are not required to make monthly payments on a Reverse Mortgage.

Since there is no requirement of a payment, you can decide how much you would like to pay on a monthly basis and if a month were to come along where you could not afford to pay as much as you normally would, you could forego making a payment altogether.

This is a huge advantage over getting a traditional loan.

If you could not make your full scheduled monthly payment on your traditional loan, your lender would consider you late and then it would ultimately affect your credit rating and if you could not catch up could lead to a foreclosure on the property.

How To Avoid Reverse Mortgage Scams

As you shop for a reverse mortgage and consider your options, be on the lookout for two of the most common reverse mortgage scams:

- Contractor loans Some contractors will try to convince you to get a reverse mortgage when touting home improvement services.

- Veteran loans The U.S. Department of Veterans Affairs doesnt provide reverse mortgages, but you may see ads promising special deals for veterans, such as a fee-free reverse mortgage to attract borrowers.

The best way to avoid a reverse mortgage scam is to be aware and vigilant. If an individual or company is pressuring you to sign a contract, for example, its likely a red flag.

How Interest Repayments Are Applied

Another thing to keep in mind is that pre-payments to reverse mortgage loans are applied to the loan balance in a specific order: first, to accrued mortgage insurance premiums second, to accrued monthly servicing fees third, to accrued interest and last, to the remaining principal balance.

When reverse mortgage borrowers make payments, theyre issued a 1098 statement, typically generated when a reverse mortgage loan is repaid partial or in full.

These interest statements, which break down the amount of mortgage insurance premiums and interest actually paid by the borrower during the prior calendar year, are generated and mailed to borrowers in January of each year, and can be used for income tax filing purposes.

Also Check: What Is The Effect Of Paying Extra Principal On Mortgage

Interest Rate Changes With Variable Reverse Mortgages

Variable rates can change over time as market interest rates change. Rates are based on two key factors:

- Index: Each variable-rate loan is tied to a particular rate index, such as U.S. Treasury rates or the London Inter-Bank Offered Rate .

- : Each lender adds an additional percentage to the index rate, known as the margin. The margin generally stays the same for the entire loan term.

As the interest-rate market changes, so does the rate on variable-rate loans. A reverse mortgage can have either yearly-variable or monthly-variable rates. A yearly-variable rate can change annually, while a monthly-variable rate can change each month.

No matter how often the rate on a variable-rate reverse mortgage can change, theres generally a cap on how much it can increase, both in a single change and over the life of the loan.

Unlike with other types of loans, borrowers of reverse mortgages wont feel the rate increase right away, since they only have to repay the loanincluding the interestonce they leave the home.

What You Should Know About Reverse Mortgage Interest Rates

Topics:Long Term CareRetirement PlanningPotential Partners for Advisors

Its easy to lose focus on interest rates when youre helping your client search for a reverse mortgage loan.

After all, the interest rate wont affect the monthly payment because they wont have to make one .

Reverse loans dont require monthly payments, as the full balance comes due when the last borrower dies or leaves the home.

But reverse mortgage interest rates are still a big deal and should factor into your clients’ borrowing decisions. The interest rate will make a huge difference when the balance comes due and your client or their heirs must decide what to do with the home.

Recommended Reading: What Is A Conditional Approval For A Mortgage Loan

How Does A Reverse Mortgage Work On A Purchase Work

A purchase reverse mortgage supplies the total amount of the loan for which you are eligible at the closing and you would bring the remainder of the funds in to close your purchase. For example, if your purchase price is $200,000 and your reverse mortgage is $120,000, you would bring in $80,000 plus any closing costs, the loan would supply $120,000 at closing and the purchase would close.

Am I Eligible For A Reverse Mortgage

In order to be eligible for a reverse mortgage, typically you must:

- Own your home

- Be at least 60 years of age

- Live in your home for more than half of the year

- Have a single-family home, a 1- to 4-unit building or a federally-approved condominium or planned unit development

- Have no liens on your home or qualify for a large enough cash advance from the reverse mortgage to pay off any existing liens

- If your home needs physical repairs to qualify for a reverse mortgage, qualify for a large enough cash advance from the reverse mortgage to pay for the cost of repairs

You May Like: How To Add A Mortgage Calculator To My Website

Equitable Bank Reverse Mortgage

Equitable Banks reverse mortgage is only for properties in major urban centres in British Columbia, Alberta, Ontario, and Quebec, and for homes with a value of at least $250,000. You must also be 55 years old or older, and live in your home for more than 6 months per year as your primary residence.

The minimum amount you can borrow from Equitable Bank’s Reverse Mortgage is $25,000. Equitable Bank offers a no negative equity guarantee, where you will never owe more than the market value of your home when it is sold.

You can choose from a variety of fixed terms, ranging from 6 months to up to 5 years. If you choose a fixed interest rate, you can not schedule payments. Instead, payments will be requested as single advances, with the minimum amount of each payment being $5,000. These payments can be requested at any time.

Payments can be scheduled for up to 20 years if your interest rate is adjustable. Minimum payments depend on the frequency of your scheduled payments, with each payment accruing interest at the current adjustable interest rate at the time of each payment.

Under both the fixed and adjustable interest rate products, there is an initial minimum payment of $25,000.

Are Reverse Mortgage Interest Rates Higher

Reverse mortgage rates usually are higher than interest rates for other types of mortgage loans, such as purchase loans or home equity loans. You also need to factor in additional costs, including the 2% up-front mortgage insurance premium , the 0.5% ongoing MIP, origination fees, and closing costs.

Recommended Reading: How Mortgage Pre Approval Works

Protection Against Rate Increases

Fixed interest rates are set at the time the loan is originated and dont change over the life of the loan. As a result, fixed-rate loans offer protection from future rate increases.

Variable-rate loans, on the other hand, fluctuate based on an index rate. If market interest rates rise in the future, so will the rates on reverse mortgages. This could result in borrowers having to repay more than they anticipated later on.

Understand How Reverse Mortgages Work

A reverse mortgage converts the homes equity into cash payments to the homeowner. You keep title to the home but borrow against its equity. The money received from the lender usually comes in the form of monthly payments or a lump sum and is generally tax-free. The loan does not have to be paid back as long as you live in the home. However, the loan will become due when you die, fail to pay taxes or insurance for the home, let the home fall into disrepair, or sell the home or no longer use the home as your primary residence. The lender cannot sue you or your estate for the loan balance, but it can sell the home. Never let a lender pressure or rush you through the process. Be sure you understand the features and total cost of a reverse mortgage before signing anything.

Also Check: How Much Should You Put Down On A Mortgage

How Much You Are Eligible To Receive

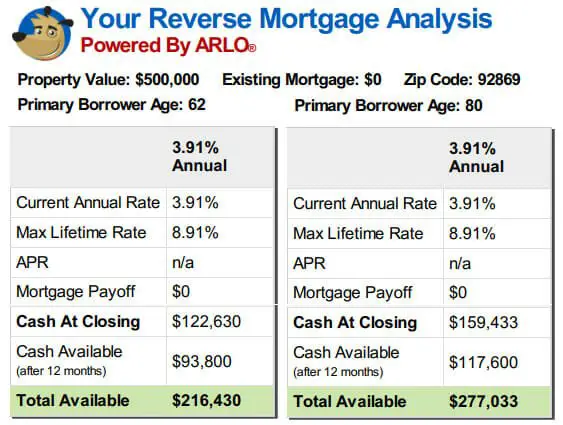

The amount of money you can receive from a reverse mortgage generally ranges from 40-60% of your homes appraised value. The older you are, the more you can receive, as loan amounts are based primarily on your life expectancy and current interest rates.

With a reverse mortgage, several factors dictate the loan amount, including:

- The age of the youngest borrower

- Value of the home or the 2022 lending limit

- The interest rates in effect at the time

Also factoring into the loan amount are:

- Costs to obtain the loan

- Existing mortgages and liens

- Any remaining money belongs to you or your heirs.

-Calculate how much you can get by using ARLOs Reverse Mortgage Calculator

What Is The Average Rate On A Reverse Mortgage

Reverse mortgage rates are not static, and the average rate can fluctuate over time. As of April 2022, HECM rates ranged from 4.81% to 5.18%. For larger reverse mortgages, called jumbo reverse mortgages, they ranged from 5.49% to 6.50%. Non-HECM rates on what are known as proprietary reverse mortgages could be higher, anywhere from 4.90% to the high 6% range as of March 2022.

Recommended Reading: Can You Take A Cosigner Off A Mortgage

What Fees Can My Lender Charge Me

With respect to reverse mortgages under New Yorks Real Property Law sections 280, or 280-a, lenders may only charge those fees authorized by the Department in Part 79.8. All costs and fees must be fully disclosed and reasonably related to the services provided to or performed on behalf of the consumer. Specifically, a lender may charge the following fees, among others, in association with a reverse mortgage loan:

- An application fee

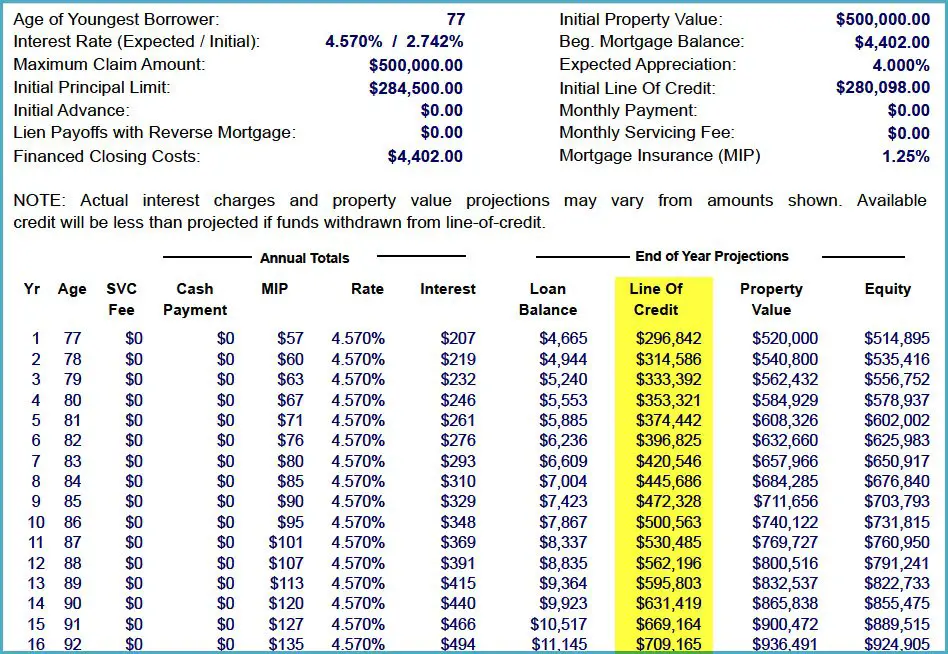

Line Of Credit Growth Rate Example

| Year | |

|---|---|

| 10 | $346,215 |

Since a reverse mortgage is a loan, you accrue interest on the money you borrow. There is no payment required so the balance grows and as the balance grows, so does the amount of interest you accrue.

There is never a payment due with a reverse mortgage, but there is never a prepayment penalty either. Borrowers who do not wish to see their balance grow solely due to the accumulation of interest can make payments of any amount at any time.

The beauty of this is that since there is no payment due, there are no due dates, no minimums due and if it is not convenient to make a payment in any given month even if you want to, there are no negative ramifications to your credit, etc. if you choose not to pay sometimes.

Borrowers have complete control. They can allow their balance to grow, they can keep it level by paying any interest due or they can reduce it by paying more than the accruing interest but they dont have do anything but live in the home as their primary residence, pay the taxes and insurance along with any other assessments and maintain the home.

The last thing borrowers need to consider is the effect the loan will have on heirs.

Recommended Reading: How Much A Month Would A 200k Mortgage Cost

Why You Can Trust Bankrate

Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. Weve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next.

Bankrate follows a strict editorial policy, so you can trust that were putting your interests first. All of our content is authored by highly qualified professionals and edited by subject matter experts, who ensure everything we publish is objective, accurate and trustworthy.

Our mortgage reporters and editors focus on the points consumers care about most the latest rates, the best lenders, navigating the homebuying process, refinancing your mortgage and more so you can feel confident when you make decisions as a homebuyer and a homeowner.

What Are The Other Upfront Costs Of Reverse Mortgages

Like with a traditional mortgage, borrowers will typically have to pay one-time upfront costs at the beginning of the reverse mortgage loan. These costs include:

- Origination fees

- Real estate closing costs that can include an appraisal, title search, surveys, inspections, recording fees, mortgage taxes, credit checks and other fees

- An initial mortgage insurance premium: There is an initial and annual mortgage insurance premium charged by your lender and paid to the Federal Housing Administration. Mortgage insurance guarantees that you will receive your expected loan advances. This insurance is different and in addition to what you have to pay for homeowners insurance.

You can pay these costs in cash or by using the money from your loan. If you use your loan proceeds to pay for upfront costs, you wont have to bring any money to the closing, but the total amount of money youll have available from the reverse mortgage loan proceeds will be less.

Also Check: What Are The Drawbacks Of A Reverse Mortgage

Use A Broker To Find Your Lowest Rate

The Reverse Mortgage rate of interest on your loan is important, but it is only one factor of many that will determine the overall cost. Other factors include: whether you draw the funds as a lump sum, cash reserve or a regular instalment plan any ongoing Reverse Mortgage fees and your longevity risk how long you will need the Reverse Mortgage loan for.

Consult a Seniors First Reverse Mortgage broker to fully understand the interest charges associated with this credit product. Our team will help find your lowest rate from our panel of lenders.

How Much Does A Reverse Mortgage Cost

The closing costs for a reverse mortgage arent cheap, but the majority of HECM mortgages allow homeowners to roll the costs into the loan so you dont have to shell out the money upfront. Doing this, however, reduces the amount of funds available to you through the loan.

Heres a breakdown of HECM fees and charges, according to HUD:

- Mortgage insurance premiums There is a 2 percent initial MIP at closing, as well as an annual MIP equal to 0.5 percent of the outstanding loan balance. The MIP can be financed into the loan.

- Origination fee To process your HECM loan, lenders charge the greater of $2,500 or 2 percent of the first $200,000 of your homes value, plus 1 percent of the amount over $200,000. The fee is capped at $6,000.

- Servicing fees Lenders can charge a monthly fee to maintain and monitor your HECM for the life of the loan. Monthly servicing fees cannot exceed $30 for loans with a fixed rate or an annually adjusting rate, or $35 if the rate adjusts monthly.

- Third-party fees Third parties may charge their own fees, as well, such as for the appraisal and home inspection, a credit check, title search and title insurance, or a recording fee.

Keep in mind that the interest rate for reverse mortgages tends to be higher, which can also add to your costs. Rates can vary depending on the lender, your credit score and other factors.

Recommended Reading: How To Get A Mortgage After Chapter 7

How Much You Can Receive

A reverse mortgage is a loan that allows borrowers to use a portion of the equity in their homes to obtain cash that requires no monthly repayment for as long as the borrower continues to live in the home and meet the loan requirements.

Borrowers still must pay their taxes, insurance and any other property assessments as well as maintain the homes in a reasonable manner just as with any other loan.

Lets break that down. Borrowers are eligible to receive a portion of the equity in their home.

You do not get 100% of the value of your home and because borrowers can live in the home, often for many years without making a payment, that amount will be less than 50% of the value of the home.

How much you will be eligible for will depend on several factors that are built into a calculator that HUD uses .

The borrower age, the property value or the HUD maximum lending limit, current interest rates, and if the transaction is a purchase, the purchase price will all affect the amount for which the borrower is eligible.

The formula HUD uses takes into consideration actuarial tables since a 62-year-old borrower has a much greater propensity to accrue interest over their remaining life expectancy than an 80-year-old borrower.

If you look at the examples below, you can see what the difference would be in the proceeds between two borrowers living in the same valued homes with the same interest rate on their loans, but one borrower is 62 years of age and one is 80.

How Can I Get The Best Interest Rate On A Reverse Mortgage

To get the best reverse mortgage interest rate for your client, shop around. Getting a few quotes will give you a sense of what a reasonable rate looks like based on your client’s circumstances, and if you get an outlier either very high or low you can ask the lender more detailed questions about the rate.

Some interest rate factors are beyond your client’s control, such as their age, location, the appraised value of the home, and current market rates.

So, its important to control the factors you can influence, including shopping around and making an informed decision about how to structure the loan proceeds.

Read Also: Can You Have Two Mortgage Loans