What Credit Cards Can I Get With Bad Credit

Credit cards such as the Total Visa® Unsecured Credit Card and First Access Solid Black Visa Credit Card are good options when you want a general-purpose credit card even though your credit is bad. These credit card companies can approve cards to high-risk consumers by keeping credit limits low and charging significant fees.

The most important benefit these cards provide is reporting your monthly activity to the three major credit bureaus, thereby giving you the opportunity to improve your credit scores. Thats possible as long as you pay your credit card bills on time and keep your below 30%.

We have reviewed other . In addition, we have reported on secured credit cards for poor credit that are relatively easy to obtain. Secured cards also report your payment activity to the three national credit bureaus.

In return for your deposited collateral, secured cards usually charge low APRs and fees because issuers consider these cards to be low risk. In fact, some secured cards, especially ones issued by credit unions, offer perks for items like travel insurance and purchase protection.

Dispute Errors On Your Credit Report

Before applying for a major loan, such as a mortgage, its a good idea to take a look at your credit report. If you want to know how to raise your credit score 200 points, finding and removing errors is one of the easiest ways.

You may be surprised to learn how often the credit bureaus make mistakes and put incorrect information on your credit report. Pulling a copy of your report gives you an opportunity to identify these errors and dispute them.

For example, you might find an account that doesnt belong to you or records of a missed payment that you didnt actually miss.

Each credit bureau has its own process for letting people dispute errors. If you find a mistake on your credit report, make sure to reach out to the credit bureau to dispute the mistake.

If you can get a missed or late payment removed from your credit report, it can give your credit score a major boost, giving you a better chance of securing a good rate on a mortgage.

What Credit Score Is Needed For A Home Loan

May 4, 2022

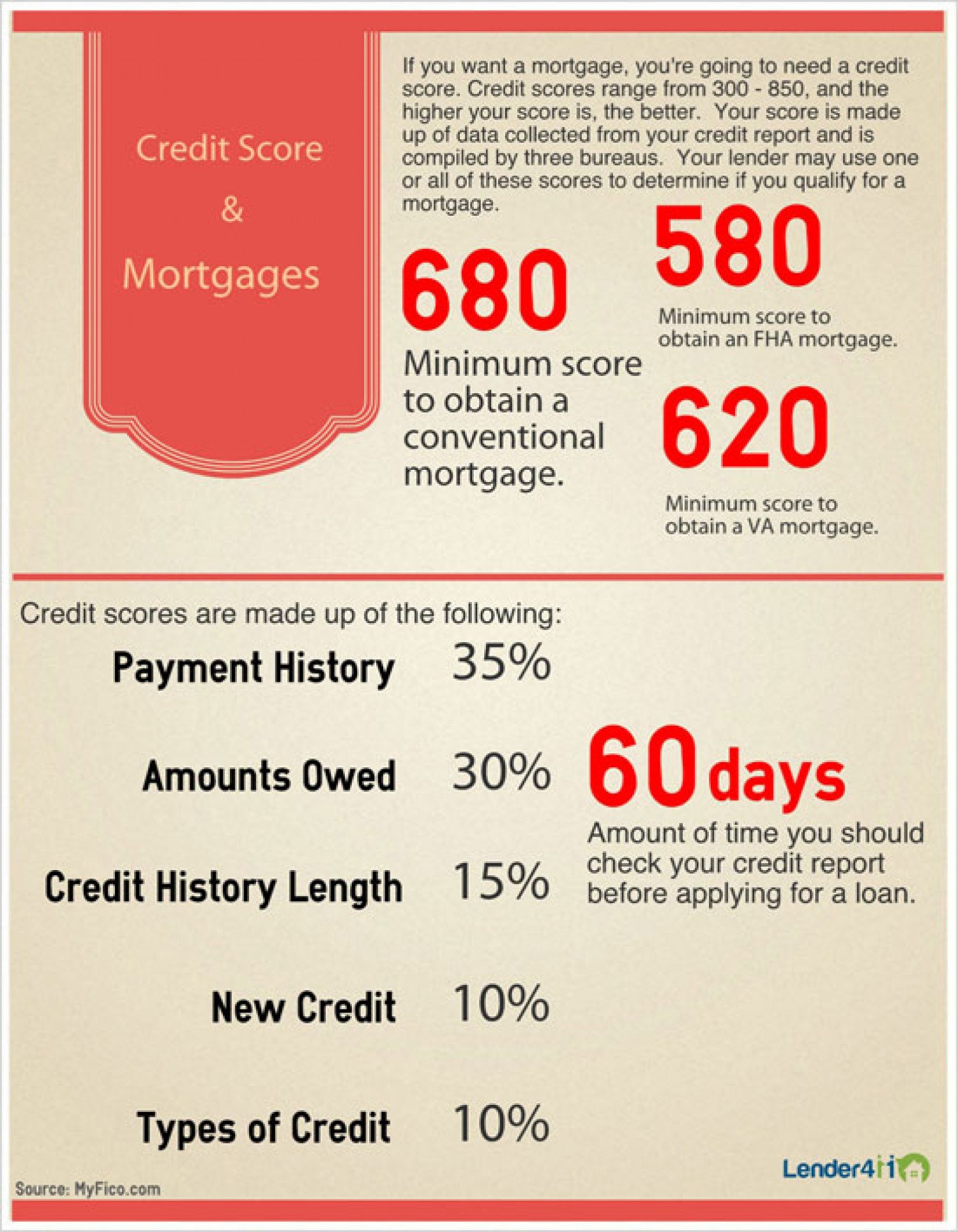

Heres one of the top questions we get asked. Borrowers always want to know what credit score is needed for a home loan. Youll need a credit score of at least 620 to secure a mortgage in most cases. This is the bottom level for the majority of lenders. However, there are options for scores as low as 580.

Also Check: What Is A Conditional Approval For A Mortgage

Can You Get An Rv Loan If You Have Bad Credit

Yes, you can get an RV loan with bad credit. However, youll have fewer loan options and youll be stuck with higher interest rates.

You have several options for places to go to finance an RV, such as banks, credit unions, online lenders, and RV dealerships. Banks tend to have stricter credit requirements, so your best bet is shopping around at credit unions and RV dealerships.

In the table below, weve listed several companies with loans that you can qualify for even if your credit score leaves something to be desired.

Companies That Offer RV Financing for Bad Credit

| Company | |

|---|---|

| – Interest rate: 7.95%18.95% | 550 |

If you have time to spare, consider taking steps to fix your credit before applying for an RV loan.

Even though you can get RV financing for bad credit, youll be able to get much better terms and save hundreds or thousands of dollars on interest if you wait to apply until your score improves.

Home Loans For Low Credit Scores

Home loans are available to low-credit-score consumers who are looking to buy a new home or wish to refinance their current one. In either case, the home serves as collateral for the loan, meaning the lender can foreclose on your home if you default on the loan.

A foreclosure will remain on your credit report for seven years, although the bulk of the damage to your credit score begins to dissipate after a few years.

The lenders reviewed here all offer home loans to folks with bad credit. Because these loans are collateralized, the APRs are typically lower than those for personal loans and credit cards.

| 4 minutes | 8.5/10 |

Homeowners can also arrange a home equity line of credit that acts much like a credit card cash advance. Both are revolving loans that charge daily interest until repaid.

You only pay for the money you borrow, but you can vary your repayment amounts as long as you meet the monthly minimum payment requirements.

Read Also: How Many Bank Statements Are Needed For A Mortgage

What Else Do Mortgage Lenders Consider

Your credit score is a key factor in determining whether you qualify for a mortgage. But its not the only one lenders consider.

- Income: Lenders will also look at your income. They want to make sure you make enough money each month to afford your payments.

- Debt-to-income ratio: Lenders also look at your monthly debts. Lenders vary, but they generally want your total monthly debts, including your estimated new mortgage payment, to consume no more than 43% of your gross monthly income. If your debt-to-income ratio is higher, you might struggle to qualify for a mortgage.

- Down payment: The bigger your down payment, the more likely it is that youll qualify for a mortgage with a lower interest rate. Thats because lenders think youre less likely to stop making your payments if youve already invested a significant amount of your money into your loan. A higher down payment makes your loan less risky for lenders.

- Savings: Lenders want to make sure that you have funds available to make your mortgage payment if your income should unexpectedly dry up. Because of this, most will want to see that you have enough money saved to cover at least 2 monthsof mortgage payments.

- Employment history: Lenders vary, but they usually like to see that youve worked at the same job, or in the same industry, for at least 2 years. They believe youre less likely to lose that job, and that stream of income, if youve built up a longer work history.

What Causes A Bad Credit Score

While each different credit scoring model has its own scoring ranges, anything below 580 to 600 is generally considered to be a poor score. If you have a bad credit score, this can result in denied loan applications, limited credit card options, and even higher car insurance rates.

- Poor credit is usually the result of one or more of the following:

- Not having enough different accounts

- Payment history: Late payments can particularly count against you

- Unpaid accounts or those that have gone to collections or been charged off

- Too many inquiries in a short period of time

- Too many recent new accounts opened

- A history of bankruptcy and/or judgments

You can also earn a bad credit score if your credit history is limited or nonexistent. If you’ve never opened a credit account of any kind — a credit card, a loan, a charge card such as American Express or even had a medical bill go to collections, chances are that your credit report will be pretty sparse if not blank. If the credit bureaus don’t have any information on your creditworthiness, it’s difficult for a scoring model to calculate a score for you.

Recommended Reading: What Is The Highest Interest Rate For Mortgage

Which Credit Score Do Rv Lenders Use

Most lenders use FICO scores when running credit checks on loan applicants. This means that companies will usually check your FICO score when you apply for financing for a camper, trailer, or RV.

Its difficult to get an RV without a loan

If youre trying to buy a car but you have bad credit, you can just buy a car with cash, avoiding the loan application process entirely. However, getting an RV is harder. Thats because RVs tend to be much more expensive than cars. Unless you recently came into a substantial windfall, buying an RV usually means obtaining financing one way or another.

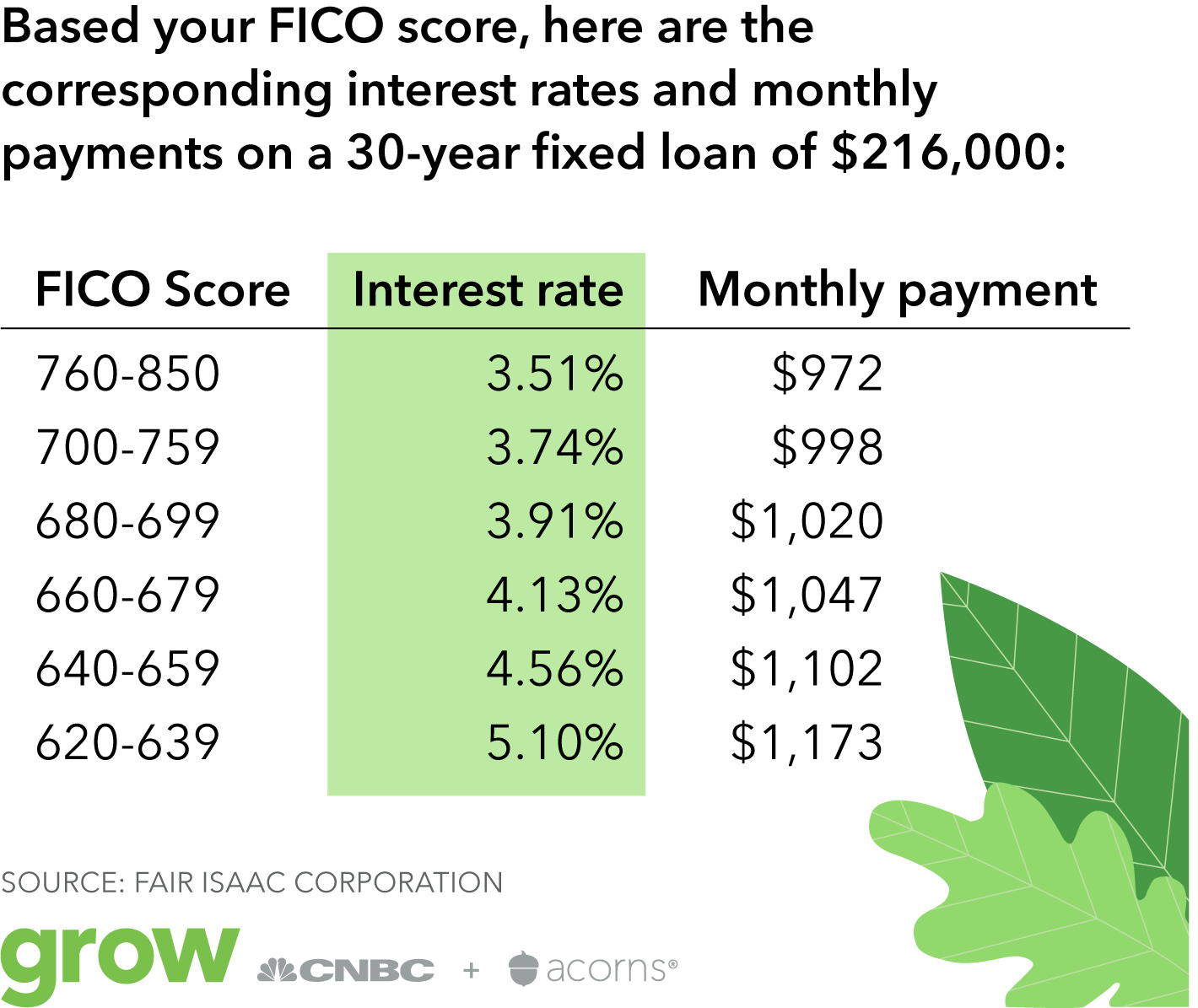

How Your Credit Score Affects Your Interest Rates

Knowing your credit score is the first step in getting the best rates on your mortgage. While mortgage interest rates are currently at an all-time low, they drop even lower when your credit score is above 760.

According to FICO, the current interest rate for a 30-year fixed mortgage is 2.377% APR for a 760+ borrower, and 3.966% for a borrower with a score between 620 and 639 .

This 1.589% savings in APR may seem negligible. But it means saving about $260 per month on your mortgage, or $3,120 per year and roughly $93,600 over the lifetime of the loan.

If you currently have a mortgage and are interested in seeing if you can switch to a better rate, look into the pros and cons of refinancing your home.

Recommended Reading: What Is Escrow Means Mortgage

Buying A House With Bad Credit

Having bad credit is different than having no credit.

If your low credit score comes from collections, write-offs, and late and missed payments, bad credit will get your loan denied.

If your credit score is low because youve failed to make loan payments on time, or you keep all your credit card balances maxed out, a lender isnt likely to overlook these issues.

Youll probably need to take a year or so and work on improving your credit score before you can get serious about buying a house.

What Credit Score Do You Need For Approval

For the most part, the minimum credit score needed for a personal loan approval will depend on the lender. Some lenders will tell you upfront what their minimum requirements are. Payoff Personal Loan, for example, requires a FICO score of 640 or higher for approval.

While lenders might approve loans to consumers with a wide range of scores, the terms will likely be better for those with higher scores.

“If you have a 760 credit score, they’ll give you different terms versus if you have a 580 credit score,” Droske says. “If you have a 580 credit score, a lender may still give you a loan, but they’ll adjust the terms accordingly because you’ll be seen as a riskier borrower.”

Having a higher credit score usually means you can be approved for lower interest rates and more favorable loan terms.

But while your credit score is an important piece of the puzzle, keep in mind that you’ll also need to provide some other crucial pieces of information like your annual income, employment status, social security number and details on how you’d like to use the loan.

“Before you have a bunch of different lenders run your credit, ask if they have a credit score requirement and what it is,” Droske says. “You can also ask what scoring model they use so you can see for yourself if your credit score currently falls in their required range.”

Read Also: What Income Can Be Used To Qualify For A Mortgage

How Credit Score Impacts Your Mortgage: Examples

Theres often a stark difference between mortgage interest rates at the highest and lowest ends of the credit score spectrum. And that equates to a big difference in monthly mortgage payments and long-term interest costs for homeowners.

Here are a few examples to show how your those differences in credit score can impact your mortgage costs.

Why Your Credit Score Matters To Lenders

Your credit score helps lenders determine your ability or inability to repay the mortgage . Lenders also examine your debt-to-income ratio , the percentage of monthly debt obligations relative to how much income you bring in.

To illustrate, if you earn $4,000 per month, and have $1,250 in credit card, loans, housing and other payments, your DTI ratio would be 31 percent. The ideal ratio is less than 36 percent, though some lenders will accept more with a higher down payment.

You May Like: How To Apply For A House Mortgage

Length Of Credit History

If youve made consistent and timely payments on your credit card for years, its easier to determine that youre a reliable borrower. However, if youve made payments for only a few months, your ability to pay back debt isnt as established. A longer credit history is generally better for your credit score.

Bad credit? Rocket HomesSM can help.

Create a Rocket Account to check your credit and learn how to improve your score.

How To Improve Your Credit Scores

Its clear that good credit scores are one of the more important factors when trying to gain mortgage approval. Its also a factor in calculating the interest rate youll be given, so having a high credit score can also save you thousands of dollars over the course of your amortization. Therefore, its best to get your credit scores in the best shape you can manage before you apply with any lender. Here are a few simple things you can try that may help improve your credit scores.

- Paying bills on time and in full

- Do not carry a large amount of unpaid debt

Also Check: How To Apply For Mortgage Assistance

Whose Credit Score Is Used On A Joint Mortgage

A joint mortgage allows two or more people to purchase a home together, and both buyers fill out a joint mortgage application.

One of the main benefits of applying for a joint mortgage is that youll have more income to put toward your home purchase.

Including two earners on your application means you’re more likely to be approved for a mortgage, you may be able to borrow more money and you could purchase a more expensive home.

What Makes Up Your Credit Score

The FICO credit scoring model interprets the information found in your credit report. Some parts of your credit history are more important than others and will carry more weight on your overall score.

Your FICO score is made up of the following:

- Payment history: 35% of your total score

- Total amounts owed: 30% of your total score

- Length of credit history: 15% of your total score

- New credit: 10% of your total score

- Type of credit in use: 10% of your total score

Based on this formula, the largest part of your credit score is derived from your payment history and the amount of debt you carry versus the amount of credit available to you. These two elements account for 65% of your FICO score.

To put yourself in the best position to qualify for a mortgage, focus on these areas first. Pay your bills on time whenever possible, and try to reduce your credit utilization ratio.

Your credit utilization ratio compares the total amount of credit available to you against your current balances try to keep it under 30%.

This will improve your FICO scores and mortgage loan terms measurably.

Read Also: How Does A Home Equity Conversion Mortgage Work

First Lets Talk About Credit Scores

Your credit score can range from 300 at the low end to 850 at the high end. A score of 740 or above is generally considered very good, but you dont need that score or above to buy a home. Credit scores are maintained by the national credit bureaus and include debt like credit cards, auto loans or student loans.

Your score is influenced by many factors, but the two biggest are whether you pay your bills on time and how much debt you owe. Having a credit score based on these factors gives lenders a quick way to see if youre likely to pay your future bills like your mortgage, for example.

Effects Of Credit Scores On Your Quality Of Life

People with high credit scores are lavished with low-interest rates, access to the best credit cards, housing and even career opportunities.

Subprime borrowersâor those with credit scores typically in the 580 to 669 range, can be denied loans, housing and jobs. Theyâre often left with higher credit card and mortgage interest rates compared to their high-scoring peers.

Using data that reflects bias perpetuates the bias, critics say. A recent report by CitiGroup states that the racial gap between white and Black borrowers has cost the economy some $16 trillion over the past two decades. The report offers some striking statistics:

- Eliminating disparities between Black and white consumers could have added $2.7 trillion in income or +0.2% to GDP per year.

- Expanding housing credit availability to Black borrowers would have expanded Black homeownership by an additional 770,000 homeowners, increasing home sales by $218 billion.

- Giving Black entrepreneurs access to fair and equitable access to business loans could have added $13 trillion in business revenue and potentially created 6.1 million jobs per year.

Read Also: Can You Add A Name To A Mortgage

What Types Of Mortgages Does Quicken Loans Offer

While noting that they offer diverse loan options, Quicken Loans says it specializes in plain vanilla mortgages, which are generally defined as easy-to-close home loans.

That means average to excellent credit scores, W-2 borrowers with steady employment history, and no major red flags.

This isnt to say they wont fund loans for self-employed borrowers or those with a checkered past, but they specialize in the former.

They offer all types of home loans, including conventional , along with FHA loans, VA loans, and USDA loans.

Quicken also offers jumbo loans that exceed the conforming loan limit, with down payments as low as 10%.

They offer all types of financing on primary residences, second homes, and investment properties, on properties up to 40 acres.

With regard to transaction type, you can take out a purchase loan, a rate and term refinance, or a cash out refinance to pay off things like student loans or credit card debt.

They also have some less conventional stuff like their YOURgage that sets you pick the length of your mortgage term.

So ultimately, no matter what type of mortgage youre looking for, Quicken Loans should have available options.