How Does A Retired Person Qualify For A Mortgage

Getting a mortgage in later life is not easy. Even if you have plenty of equity in your home, have never missed a mortgage payment, and are still earning a wage.

Lenders are strict about who they offer loans to, and often have upper age limits. This can make securing a new mortgage past 55 more complicated.

Some lenders will give you until 80 or 85 to pay off your mortgage, but others will require a mortgage to be repaid in full by 70.

This means its unlikely youll get a 30-year mortgage, which is generally more affordable in terms of monthly repayments.

All of this means older borrowers have found they have more limited choice when it comes to standard borrowing.

Shorter payment terms can also mean higher interest. This means that if you manage to bag a mortgage in retirement, your monthly repayments are likely to be high.

One reason lenders dont offer mortgages to older borrowers is because its difficult to prove your income in retirement.

While proving a salary is easy, pension income is less straightforward as it can involve lump sums.

That said, lenders are willing to offer mortgages to those who can prove they can afford a home loan in later life.

How To Get A Home Loan After Retirement

There are unique challenges to qualifying as a retiree. Heres how to prep for your home purchase.

There are many reasons you might buy a home in retirement. It may be to downsize to a smaller house, purchase a vacation property, or just move closer to friends and family. Whatever the reason, nows a good time to pull the trigger.

With mortgage rates at record lows , you could find yourself with a lower payment or, better yet, a bigger budget. Either way, youll want to prep before filing your application.

Good news: You can get started on the application entirely online. Multi-lender marketplace Credible can walk you through the process from start to finish. Get started by comparing current mortgage rates and lenders to see how you can save money and time.

Calculate Total Housing Expenses

Housing expenses generally include the mortgage principal and interest, taxes and insurance . But it can also extend to the cost of maintenance, utilities and homeowners association fees. To qualify for a mortgage after retirement, make sure your PITI is less than 28% of your total income.

For example, consider a $900,000 home located in a gated community with HOA fees of $100 per month. If a homebuyer plans to get a $720,000 mortgage and pay $500 per month in property taxes and $300 per month in property insurance, the monthly PITI payment would be just over $4,033.12. Add in the HOA fees, $250 in utilities and $100 in lawn maintenance each month, and the total monthly housing expenses would be around $4383.12.

Recommended Reading: Is Wells Fargo A Good Bank To Get A Mortgage

Reasons For Getting A Mortgage As A Pensioner

When youre retired, there are still several reasons why you might want to take out a new mortgage, or remortgage:

- Get the right home on retirement, you may want to buy your forever home, or one that will suit your needs as you get older

- Improve your current home as above, except you may prefer to enlarge or adapt your existing home to meet your retirement needs .

- Additional retirement income you can use a special type of mortgage to release equity from your home to supplement your other retirement income.

- Pay off an interest-only mortgage if you have come to the end of your interest-only mortgage term, you may need to remortgage to pay off the outstanding balance.

Downsizing Your Current Home

If you currently own a home, you may want to sell it to move into something smaller and more manageable. Downsizing may allow you to use equity to buy something less expensive. Then you can use any leftover money to boost your retirement income. Downsizing can reduce your monthly payments, too. It may also allow you to choose a home that’s better suited to your changing needs, such as fewer stairs or senior-friendly bathrooms. For those with a lot of equity in their current home, this can be a good option.

- Pros: May help you get money from the equity in your home to use towards a new home or to boost your retirement income

- Cons: Locks you into a property when you may want more flexibility in your retirement years

Recommended Reading: Is Quicken Loans A Mortgage Company

How To Get A Mortgage After Retirement

- Copy article link

Whether youre planning to relocate, downsize or finally move into your dream home, you may need to get a mortgage after retirement. Unfortunately, qualifying for a home loan can be difficult for those on a fixed income. Still, its possible for creditworthy homebuyers to purchase a new home by relying on income from retirement accounts and other investments.

If youre retired and considering a mortgage, follow these steps to get started.

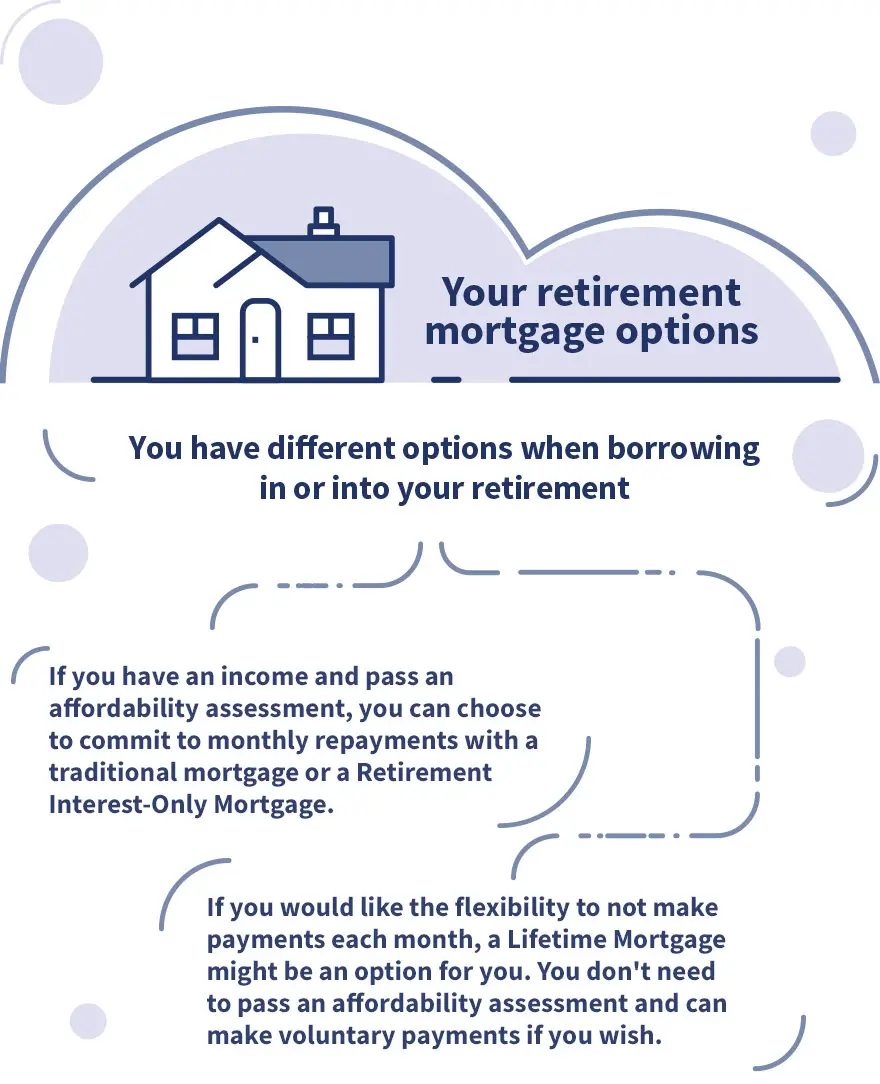

How To Qualify For Retirement Mortgages

Applying for a mortgage during retirement is the same as applying for a mortgage while employed. You need to meet the same basic credit and down payment requirements and document your income based on the type of retirement income you receive.

Below is a breakdown of the documents youll need based on the acceptable types of retirement income:

| Type of income |

|---|

| Proof of eligibility for income How much and how often the benefits are paid Confirmation there is no end date to receipt of the income |

Read Also: How Much Mortgage Could I Qualify For

How Can I Improve My Chances Of Getting A Mortgage As An Older Borrower

Lenders are looking for evidence that you will be able to make the repayments for the entire term of your mortgage. Because you are a riskier bet, its important to demonstrate that you are a responsible borrower with a stable income.

Start by making sure your credit rating is as high as possible. Make sure you are on the electoral roll and that all your information is correct. The better your score, the better deals you can get.

If youre likely to retire during your retirement, gather evidence to show you will have enough income to pay what you owe. This could be proof of the state pension youll receive and any defined benefit or defined contribution pensions.

Having a bigger deposit helps, too, as youll owe less overall. Save up as much as you can to be an attractive proposition to lenders. Paying off any other debts before you apply can also help.

Speaking with a broker and doing your research can also increase your likelihood of getting a mortgage. Consider all the providers out there, and make sure they are appropriate before applying. If you get rejected, it can cause your credit score to drop, so you want to give yourself the best chance of getting accepted the first time.

Whether you are looking to move up the property ladder, downsize or just relocate we can help you find the right mortgage when you move home.

Have A Healthy Income Stream

Though some retirees opt to work part-time, many don’t work at all. So how do you show proof of income if you don’t actually work? You’ll just need to show a lender that you have money coming in each month, even if it’s not coming in typical paycheck form.

Seniors are generally entitled to benefits from Social Security. Plus, you may have:

- A pension that pays you regularly

- Investment income from a brokerage account

- A retirement plan, like an IRA, that you can take regular withdrawals from

All of that counts as income for mortgage approval purposes, because it shows that you’re capable of making payments on a loan.

Also Check: What Percentage Of Mortgage Is Interest

Do Lenders Have A Maximum Age Limit For Mortgages

There is no set rule for age limits on mortgages, but lenders tend to have their own cap, some of which can be as low as 55. Lenders are trying to be more open-minded and take into account that people are now living and working for longer. Some high-street lenders will have age limits as high as 85. High-street mortgage providers tend to offer lower interest rates but they may not offer as much flexibility.

Smaller lenders, like local building societies or private banks, can offer more flexible lending criteria and some have no upper age limit at all. The interest rates may be higher, but a mortgage broker can help you access a large pot of lenders and assess your options to find the best one for you.

Which Factors Affect The Timing Of Life Insurance Death Benefit Payouts

Some of the factors that affect the timing of a life insurance death benefit payout are in your control, like submitting accurate paperwork on time. Others are outside of your control, like state laws and regulations and the policyholders cause of death.

Claims naturally take a little while to pay out. That is because a life insurance death benefit is often a large sum of money, and insurers want to confirm that the information is accurate and the beneficiary is eligible for the benefit before they make the payment.

Recommended Reading: How To Calculate Mortgage Payment In Excel

Should You Carry Your Mortgage Into Retirement

Part of the rosy picture associated with retirement is the thrill of kissing that monthly mortgage payment good-byeon the presumption you’ll have paid it off by then. Lately, there has been a shift in thinking that has seen many financial planners suggest that retirees continue to carry a mortgage into and throughout retirement. Reinvest the money from your home equity, and suddenly you’ll have a stream of new income, making your golden years a little more golden.

Well, there can be some drawbacks. Carrying a mortgage in retirement can be a good idea in certain situations, but it is certainly not a one-size-fits-all solution for increasing retirement income.

Fannie Mae Senior Home Buying Program

Both Fannie Mae and Freddie Mac have policies that allow eligible retirement assets to be used to qualify under certain conditions.

Fannie Mae lets lenders use a borrowers retirement assets to help them qualify for a mortgage.

If the borrower is already using a 401 or other retirement accounts for retirement income, the borrower must demonstrate that the income received from that asset is going to continue for at least three years.

If the borrower is not already using the asset, the lender can compute the income stream that asset could offer.

Also Check: What Is Current 30 Year Fixed Rate Home Mortgages

Qualifying For Loans In Retirement

For self-funded retirees who are earning most of their income from investments, rental property, and/or retirement savings, lenders typically determine monthly income using one of two methods:

The lender then adds in any pension income, Social Security benefits, annuity income, and part-time employment income.

Keep in mind that loans are either secured or unsecured. A secured loan requires the borrower to put up collateral, such as a home, investments, vehicles, or other property, to guarantee the loan. If the borrower fails to pay, the lender can seize the collateral. An unsecured loan, which does not require collateral, is more difficult to obtain and has a higher interest rate than a secured loan.

Here are 10 borrowing optionsas well as their pluses and minusesthat retirees can use instead of taking funds from their nest egg.

While it can be harder to qualify to borrow in retirement, its far from impossible.

Mortgages For Over 50s

Getting a mortgage once youre aged over 50 should be relatively straightforward. Most lenders offer standard terms for people in this bracket. That means you should be able to get a mortgage for 25 years at a competitive interest rate. You might be asked to show your predicted pension income, especially if youll still be paying the loan off once you retire. Think about what is realistic, and whether you still want to be making payments in your 70s. Borrowing over a shorter term could mean youre mortgage-free more quickly.

Recommended Reading: When Do Mortgage Rates Come Out

How Long Does It Take To Get A Life Insurance Payout

Most people can expect a life insurance payout in 14 to 60 days. Factors that affect the timing of the payout include cause of death, beneficiary status and incorrect paperwork. Sometimes the life insurance company needs additional information before completing a payout.

If youre waiting for a life insurance payment, it could take anywhere from two weeks to two months. In some cases, the process goes smoothly, and beneficiaries receive payment in just a few weeks, but in other cases, the insurance company may request additional clarification or information. Some factors that may cause delays include when you file a claim, outdated beneficiary information and state laws.

Key Takeaways

Life insurance claims are typically paid out in two weeks to two months.

Some factors that can delay a claim include incomplete or inaccurate paperwork, cause of death and contestability clause.

While theres usually no deadline to file a claim, filing a claim sooner means receiving the benefit in a shorter amount of time.

Compare Life Insurance Rates

Ensure you are getting the best rate for your insurance. Compare quotes from the top insurance companies.

Usda Housing Repair Loan

If you meet the low-income threshold and plan to use the money for home repairs, you may qualify for a Section 504 loan through the U.S. Department of Agriculture. The interest rate is only 1% and the repayment period is 20 years. The maximum loan amount is $40,000, with a potential additional $10,000 grant for older, very-low-income homeowners if its used to remove health and safety hazards in the home.

To qualify for USDA Housing Repair Loan, the borrower must be the homeowner and occupy the house, be unable to obtain affordable credit elsewhere, and have a family income that is less than 50% of the area’s median income. To qualify for a grant, they must also be 62 or older and unable to repay a repair loan.

Also Check: What To Look For When Applying For A Mortgage

What Is The Oldest You Can Still Get A Mortgage

Theres no legal limit on the maximum age you can be when applying for a mortgage. However, many lenders impose their own rules.

Typical mortgage age limits are:

-

under 65 to 80 to take out a mortgage

-

under 70 to 95 when the mortgage term ends.

So even if you are below the maximum age when you get a mortgage, you might have to opt for a shorter term. For instance, if you get a mortgage at 65, lenders might say it can only last 15 or 20 years, meaning monthly repayments would be higher, though, on the upside, you would pay less interest.

Find The Best Mortgage For You

Most mortgage lenders have loan programs that make it possible for seniors to buy a home or refinance their current home.

However, not all lenders are experienced in issuing mortgages to retirees.

Prior to choosing a lender, make sure to ask a few screening questions. In addition to getting the lowest mortgage rates, youll want to know how the lender qualifies retirement income, as well as how they calculate qualifying income from assets.

A few questions asked upfront can help you find an experienced lender to process your application and get you the best deal.

Recommended Reading: How Much Down Payment For Mortgage

Toronto Can Create An Expensive Lifestyle

Living in Toronto is an expensive place supporting lifestyle for many families. The choice is, do you sell your home or do you get some sort of financing to help a family in early inheritance? Most people want to help their kids while theyre still alive, but dont want to sell their house. So the reverse mortgage allows that type of utility. So somebody who might be wanting to work with you, Lawrence, is relying on their parents for a down payment. There is the ability for the parents to provide that down payment money through something like a reverse mortgage, and then it can be used to pay for medical expenses.

This pandemic is highlighted that going to seniors residence is not optimal for most people. So most families would prefer to have their seniors live in their current home. So their home theyve been in for 50 years. Its a family place, but in-home care is expensive. So how do you cover that? You can get a reverse mortgage and so the interest rate almost becomes secondary. And then you also understand this concept is you borrow the money. Yes, the interest accumulates, but youre also holding on to an amazing asset, which is Toronto real estate, which 10 years from now anyway, is going to go up in value.

Can I Apply For A Mortgage In Retirement

Home-buying trends and the challenges that retirees face when purchasing a home can change, adapting to shifting retirement ages. If youâre retired or close to retirement, you may be thinking about buying a home for one of a number of reasons, including remortgaging, moving elsewhere, buying to let, downsizing your home or helping out your children or grandchildren to buy a property of their own.

Anyone applying for a mortgage is typically assessed to see if theyâre able to afford the loan repayments and to repay them on time. Among the criteria that lenders typically look at when assessing a mortgage application is your income. Just because youâve retired and no longer have a steady stream of income doesnât mean that youâre automatically disqualified. Some lenders are willing to accept applications from applicants over the age of 65, according to this article from August 2016. Itâs likely that youâll still have to prove that youâll receive funds regularly, such as from your pension.

If youâre thinking about applying for a mortgage in retirement, you may want to consider speaking to your family and friends first, as they may have useful ideas of suggestions to help with your purchase or living situation. You may also want to consult with an independent financial adviser to see if your getting a mortgage may impact your finances in other ways, for example, when it comes to taxes, benefits or investments.

You May Like: How Much Interest Am I Paying On My Mortgage