How Much Is Homeowners Insurance And What Does It Cover

Homeowners insurance is a combination of two types of coverage:

- Property insurance: protects homeowners from a variety of potential threats such as weather-related damages, vandalism, and theft.

- Liability insurance: protects homeowners from lawsuits or claims filed by third parties for accidents that happen within the home.

In 2019, the average annual cost of homeowners insurance was $1,083 nationwide. The cost of homeowners insurance policy will vary depending on the type of property being insured and the amount of coverage the owner desires. Lenders require that buyers obtain homeowners insurance in order for the insurance premium to be included in the monthly mortgage payment.

Dont Forget To Factor In Closing Costs

All right, dont freak out here. But a down payment isnt the only cash youll need to save up to buy a home. There are also closing costs to consider.

On average, closing costs are about 34% of the purchase price of your home.1 Your lender and real estate agent will let you know exactly how much your closing costs are so you can pay for them on closing day.

These costs cover important parts of the home-buying process, such as:

Dont forget to factor your closing costs into your overall home-buying budget. For example, if youre purchasing a $200,000 home, multiply that by 4% and youll get an estimated closing cost of $8,000. Add that amount to your 20% down payment , and the total cash youll need to purchase your home is $48,000.

If you dont have the additional $8,000 for closing costs, you should hold off on your home purchase until youve saved up the extra cash or shoot a little lower on your home price range.

Whatever you do, dont let the closing costs keep you from making the biggest down payment possible. The bigger the down payment, the less youll owe on your mortgage!

Cfpb Shifting From Dti Ratio To Loan Pricing

Both Fannie Mae and Freddie Mac have allowed higher DTI ratios for buyers carrying significant student debt.

While measuring debt-to-income is useful for getting a baseline feel for what you may qualify for, the CFPB proposed shifting mortgage qualification away from DTI to using a pricing based approach.

What Change did the CFPB Propose?

“the Bureau proposes to amend the General QM definition in Regulation Z to replace the DTI limit with a price-based approach.”

Why Did They Suggest the Change?

“The Bureau is proposing a price-based approach because it preliminarily concludes that a loanâs price, as measured by comparing a loanâs annual percentage rate to the average prime offer rate for a comparable transaction, is a strong indicator and more holistic and flexible measure of a consumerâs ability to repay than DTI alone.”

How Does This Impact Loan Qualification for Low-income Buyers?

“For eligibility for QM status under the General QM definition, the Bureau is proposing a price threshold for most loans as well as higher price thresholds for smaller loans, which is particularly important for manufactured housing and for minority consumers.”

You May Like: How To Pay Off 30 Year Mortgage Early

Bottom Line: Home Affordability Begins With These Key Factors

Dont let rising home prices automatically scare you away. Being able to purchase a property starts with these questions:

Do you pay your bills on time? A history of no late payments will make you look good in the eyes of any lender. Theyll know that they can expect to receive your mortgage payment each month when its due.

Do you have proof of steady income? If you have a steady job that deposits a similar amount into your checking account every two weeks, youre in good shape. Lenders will evaluate your bank accounts, review recent pay stubs and look at your tax forms. If youre self-employed or earn irregular income, youll need to show even more evidence of your earnings likely the past two years of tax returns.

Do you have a low debt-to-income ratio? If youre earning a lot more money than youre paying back for other debt, youre in a good position.

Whats the best mortgage rate you can get? The lower your rate, the more youll save on interest payments. The good news: If you answered yes to the previous three questions, youll likely qualify for the lowest rates a lender can offer.

How Much Of A Mortgage Can I Afford

Generally speaking, most prospective homeowners can afford to finance a property whose mortgage isbetween two and two-and-a-half times their annual gross income. Under this formula, a person earning $100,000 per year can only afford a mortgage of $200,000 to $250,000. However, this calculation is only a general guideline.”

Ultimately, when deciding on a property, you need to consider several additional factors. First, it’s a good idea to have some understanding of what your lender thinks you can afford .

Second, you need to have some personal introspection and figure out what type of home you are willing to live in if you plan on living in the house for a long time and what other types of consumption you are ready to forgoor notto live in your home.

While real estate has traditionally been considered a safe long-term investment, recessions and other disasters can test that theoryand make would-be homeowners think twice.

Also Check: What Can My Mortgage Be

What Are The Different Types Of Home Loans

There are several types of home loans, but which one is right for you will depend entirely on what you qualify for and what ultimately makes the most sense for your financial situation. Below are the five most common home loans you will encounter.

Fixed-Rate Loan

Fixed-rate loans have the same interest rate for the entire duration of the loan. That means your monthly home payment will be the same, even for long-term loans, such as 30-year fixed-rate mortgages. Two benefits to this mortgage loan type are stability and being able to calculate your total interest on your home upfront.

Adjustable-Rate Loan

Adjustable-rate mortgages have interest rates that can change over time. Typically, they start out at a lower interest rate than a fixed-rate loan and hold that rate for a set number of years before changing interest rates from year to year. For example, if you have a 5/1 ARM, you will have the same interest rate for the first 5 years, and then your mortgage interest rate will change from year to year. The main benefit of an adjustable-rate loan is starting off with a lower interest rate to improve affordability.

FHA Loan

USDA Loan

This loan type is specifically designed for families looking to buy homes in rural areas. Similar to the FHA loan, this home loan lets lower-income families become homeowners. The loan does not require a down payment, but you will have to get private mortgage insurance.

VA Loan

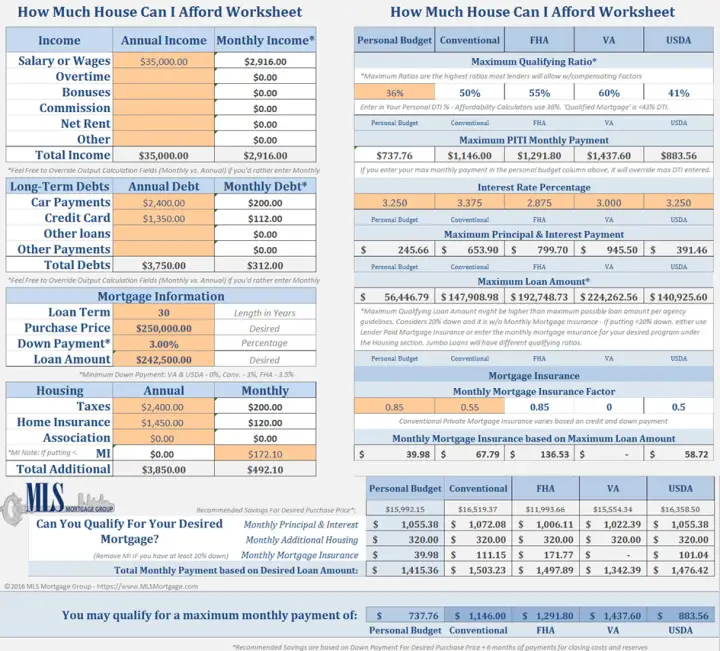

How Much House Can I Afford With An Fha Loan

To calculate how much house you can afford, weve made the assumption that with at least a 20% down payment, you might be best served with a conventional loan. However, if you are considering a smaller down payment, down to a minimum of 3.5%, you might apply for an FHA loan.

Loans backed by the FHA also have more relaxed qualifying standards something to consider if you have a lower credit score. If you want to explore an FHA loan further, use our FHA mortgage calculator for more details.

Conventional loans can come with down payments as low as 3%, although qualifying is a bit tougher than with FHA loans.

Read Also: When It Makes Sense To Refinance Mortgage

Cut Your Loan Costs By Prepaying Principal

This PITI calculator offers another feature that can help you cut your loan costs. See how adding additional principal payments can shorten the life of the loan by years. Determine if you could add to your payment on a monthly or yearly basis, or even just one time. Hit “view results” to see a side-by-side comparison of your regular payment schedule versus the prepayment payment schedule.

This mortgage calculator with taxes and insurance will show you just how much you’ll be paying in interest for the life of the loan under both scenarios, as well as how much you can save by making extra principal payments along the way.

Learn more about specific loan type rates| LOAN TYPE |

|---|

How To Calculate A Down Payment Amount

The down payment is the amount that the buyer can afford to pay out-of-pocket for the residence, using cash or liquid assets. Lenders typically demand a down payment of at least 20% of a homes purchase price, but many let buyers purchase a home with significantly smaller percentages. Obviously, the more you can put down, the less financing youll need, and the better you look to the bank.

For example, if a prospective homebuyer can afford to pay 10% on a $100,000 home, the down payment is $10,000, which means the homeowner must finance $90,000.

Besides the amount of financing, lenders also want to know the number of years for which the mortgage loan is needed. A short-term mortgage has higher monthly payments but is likely less expensive over the duration of the loan.

Homebuyers need to come up with a 20% down payment to avoid paying private mortgage insurance.

Recommended Reading: What Is The Average Mortgage Payment In Michigan

Can My Fha Monthly Payment Go Up

Yes. Here are a few instances when your monthly payment can go up, even after youve closed the loan and moved in:

-

If you have an adjustable-rate mortgage, your interest rate can rise after your initial fixed-interest rate term ends.

-

Escrow items built into your monthly payment, such as property taxes or homeowners insurance premiums, are likely to go up over time. While you can’t do much about property taxes aside from moving to a different area you can always shop around for a new homeowners insurance policy.

-

If you run behind on making a monthly payment, you can expect a late payment fee.

How To Calculate Your Mortgage Payments

The calculus behind mortgage payments is complicated, but Bankrate’s Mortgage Calculator makes this math problem quick and easy.

First, next to the space labeled “Home price,” enter the price or the current value of your home .

In the “Down payment” section, type in the amount of your down payment or the amount of equity you have . A down payment is the cash you pay upfront for a home, and home equity is the value of the home, minus what you owe. You can enter either a dollar amount or the percentage of the purchase price you’re putting down.

Next, you’ll see Length of loan. Choose the term usually 30 years, but maybe 20, 15 or 10 and our calculator adjusts the repayment schedule.

Finally, in the “Interest rate” box, enter the rate you expect to pay. Our calculator defaults to the current average rate, but you can adjust the percentage. Your rate will vary depending on whether youre buying or refinancing.

As you enter these figures, a new amount for principal and interest will appear to the right. Bankrate’s calculator also estimates property taxes, homeowners insurance and homeowners association fees. You can edit these amounts or even ignore them as you’re shopping for a loan those costs might be rolled into your escrow payment, but they don’t affect your principal and interest as you explore your options.

Recommended Reading: Is Fairway Mortgage A Broker

How A Larger Down Payment Impacts Monthly Payments*

| Percentage | |

|---|---|

| $200,000 | $1,005 |

*The payment is principal and interest only. To get the total monthly payment for down payments below 20%, add in your property taxes, homeowners insurance and private mortgage insurance .

In general, most homebuyers should aim to have 20% of their desired home price saved before applying for a mortgage. Being able to make a sizeable down payment improves your chances of qualifying for the best mortgage rates. Your credit score and income are two additional factors that play a role in determining your mortgage rate and, therefore, your payments over time.

Estimate Your Monthly Mortgage Payments

In addition to using the above affordability calculator, you may want to check out our monthly mortgage repayment calculator to estimate your monthly payments for various loan scenarios.

The following calculator automatically updates payment amounts whenever you change any loan input, so if you adjust the interest rate, amount borrowed or loan term you will automatically see the new monthly fixed-rate and interest-only repayments.

Total Cost

We also offer a calculator with amortisation schedules for changing loan rates, so you can see your initial loan repayments and figure out how they might change if interest rates rise.

You May Like: How To Calculate 30 Year Fixed Mortgage

What Are Closing Costs

Closing costs are fees related to a real estate transaction. They include things such as loan origination fees, appraisal fees, title searches and insurance, surveys, recording fees, closing attorneys fees and taxes. They typically run anywhere from 3% to 5% of the amount of the loan. Checkout this article to better understand closing costs.

How Much Home Can I Afford

Purchasing a home is a decision that will impact your financial situation for the next 15 to 30 years. Its important to calculate your monthly income and expenses carefully to avoid winding up with a mortgage loan you cant pay in the long run.

And, if youre ready to buy, visit our best mortgage lenders page to find the right lender for you.

How much house you can afford will mainly depend on the following:

- Your loan amount and mortgage term

- Your gross monthly and annual income

- Your total monthly debt or monthly expenses, including credit card debt, student loan payments, car payment, child support, and other expenses

- State property taxes, which are paid annually or biannually and vary by state

- Current mortgage rates and closing costs, which vary by location

- Homeowners association and condo fees

Generally, most new homebuyers will consider taking out a conventional mortgage loan. These loans typically require a down payment of no less than 3% of the property value, a minimum credit score of 620, a debt-to-income ratio of 36% and that the monthly payment doesnt exceed 28% of the buyers pre-tax income.

Lenders will also look at a buyers ability to deal with all the fees and upfront costs associated with buying a home, such as closing costs and insurance fees.

Recommended Reading: Should I Take Out A Mortgage At Age 60

What Is A Jumbo Loan

A jumbo loan is used when the mortgage exceeds the limit for Fannie Mae and Freddie Mac, the government-sponsored enterprises that buy loans from banks. Jumbo loans can be beneficial for buyers looking to finance luxury homes or homes in areas with higher median sale prices. However, interest rates on jumbo loans are much higher because lenders don’t have the assurance that Fannie or Freddie will guarantee the purchase of the loans.

Whats Behind The Numbers

NerdWallets Mortgage Income Calculator shows you how much income you need to qualify for a mortgage. It uses five numbers – home price, down payment, loan term, interest rate and your total debt payments – to deliver an estimate of the salary you need to buy your home. After those first five inputs, you can answer optional questions to refine your result.

Don’t Miss: What Is The Mortgage Rate For A Va Loan

What Are The Most Important Factors That Help Determine How Much House I Can Afford

Figuring out how much you can spend on a home comes down to a few key figures: How much money you earn, how much money you can contribute to a down payment and how much money youre spending each month on other debts. When you apply for a mortgage, a lender will scrutinize every aspect of your personal finances to assign a level of risk on whether youll be able to pay the loan back. The more you can lower your debt-to-income ratio and increase the size of your down payment, the better.

How Much Should You Spend On A Home

Just because a lender will give you a certain loan amount doesnt mean its a smart decision. In fact, borrowing the maximum is often a grave mistake. Whats more, rules of thumb fall short. What DTI ratio might be comfortable for a family earning $250,000 a year might not work for a family earning $75,000 a year, as financial planning guru Michael Kitces has pointed out.

Instead, consider the following factors as you determine whats best for your situation.

Have you accounted for your other financial goals? Here you might consider retirement savings in a 401 or IRA, saving for a childs education, and saving for emergencies.

Are you qualifying for a mortgage based on one or two incomes? If you are using two incomes, do you plan for one spouse to stay home with children at some point? Are both incomes secure, or is there a meaningful risk of losing an income without a ready replacement? If so, the loss of one income should be considered in the decision.

Are you buying a new home or a fixer-upper? If its a fixer-upper, you should consider the costs necessary to renovate the home.

In other words, make sure the proposed mortgage fits in with your lifestyle and other financial goals. Ultimately, remember to ask how much house can you afford while still being able to enjoy the other things in life.

Also Check: What’s An Affordable Mortgage

Types Of Mortgage For First

Youre considered a first-time homebuyer if you have never owned residential property in the UK or abroad. It also applies if youve only owned a commercial property with no attached living space, such as a pub with a small upstairs flat. If you fit this profile, you qualify as a first-time homebuyer.

On the other hand, you are not considered a first-time homebuyer if:

- Youve inherited a home, even if youve never lived in the property since its sold

- Youre buying a house with someone who owns or has previously owned a home.

- Youre having property purchased for you by someone who already owns a house, such as a parent or guardian.

There are a variety of mortgage products which are suitable for first-time buyers. Before finalizing a mortgage deal, look into the following types of mortgages: