When Should You Be Rolling In Your Costs

If you are not debt-free and you have debt such as a car loan, credit card, debt, or student loans, then youre probably not in the best position to be rolling in your closing costs. You should be taking that money and paying down your car, your credit card, or your student loans. Thats the best use of that money.

Break Down Your Loan Estimate Form

The lender is required to give you theloan estimate form within three days of completing a mortgage application, but theres nothing keeping them from giving it to you sooner, so ask for it. This form includes an itemized list of costs, including your loan amount, interest rate and monthly payments. On page two it has a section called Services you can shop for, including:

- Pest inspection

- Survey

- Fees for the title search and the settlement agent, and for the insurance binder

The vendors listed on the form could be your lenders preferred vendors, but youre not required to work with them, and your lender is also required to offer alternatives. You can shop around for lower-priced vendors for different services on your own however, if your independently-selected vendor changes its pricing before closing, youll be on the hook for any increase. If you choose a lender-provided vendor instead, its pricing isnt allowed to change by more than 10 percent from the original quote.

Additionally, if youre buying a home, note that the seller or sellers real estate agent might be the ones who chose the title and escrow provider. If you want to get new vendors in this case, youll need to negotiate the purchase agreement with the seller, not with your mortgage lender.

Rolling Closing Costs Into The Irrrl

The most popular loan here at Low VA Rates is the Interest Rate Reduction Refinance Loan, or IRRRL. With an IRRRL, the VA allows borrowers to roll every single closing cost into the loan balance. Heres how it works:

Lets say youve got $5000 in closing costs. If your loan amount is $100,000 at the time of refinance, and you want to roll your closing costs, youll borrow $105,000 in total. That way, the $5,000 in closing costs will be paid through monthly mortgage payments just like the rest of the loan. Youll also be doing this at a lower interest rate, and your payment could still go down, even though your balance is increasing.

Also Check: Does Rocket Mortgage Sell Their Loans

Stand Out By Covering Closing Costs

However, you might also save money by taking the opposite tack.

Although seller concessions can be nice, theres a flip side: Sellers are often motivated to work with the prospective buyer who has the cleanest offer with the fewest strings attached.

For example, if youre in a situation where there are multiple bids on the home, it may actually work to your advantage to have a lower bid but the ability to pay for your full closing cost, rather than to have a higher bid with concessions included.

We are pretty lucky in our area because, even though we are in a low inventory sellers market, Sajovich said. It is common for sellers to pay for the title insurance policy and to split closing costs. In multiple offer situations, many buyers agents dont realize that the buyer could cover these costs, which puts money in the sellers pocket without increasing purchase price and running the risk of having the appraisal come in low. This is where I often see that an offer price that is $2,000 or $3,000 less than any other offer can still get the house.

Because a lender cant lend you any more than the home is worth, a seller may actually benefit if you dont offer more because youre lowering the risk of the deal falling through later on. If you pay the closing costs for yourself, it makes it that much sweeter.

What’s Your Cash Flow Situation

How much cash you have not to mention how much you need should also play a role in your decision. Do you have the funds to cover the closing costs upfront? Would doing so deplete your emergency savings or leave you lacking in funds needed for repairs? If so, rolling those costs in might be your only option.

On the other hand, if you have plenty saved up or some equity you can pull on from another property, paying closing costs upfront is likely your best bet. It might mean a bigger chunk of change now, but it will reduce your monthly payment and interest costs, ultimately freeing up more cash flow in the future.

Recommended Reading: How Does 10 Year Treasury Affect Mortgage Rates

What Are Closing Costs

Closing is the stage in the house buying process when the previous property owner transfers the title over to you, the new owner. At this point, the buyer has to pay the fees for the services and expenses for finalizing the mortgage. These are the Closing costs and can run between 2% to 5% of the homes market value.

To give an example, if the home is valued at $400,000, you can expect to pay somewhere between $8,000 and $20,000 in closing costs. Here is a closing cost calculator by SmartAsset that you can use to get an estimate.

When you initially submit your loan application, your lender will provide you with a loan quote that includes the terms, estimated mortgage payments, and closing costs.

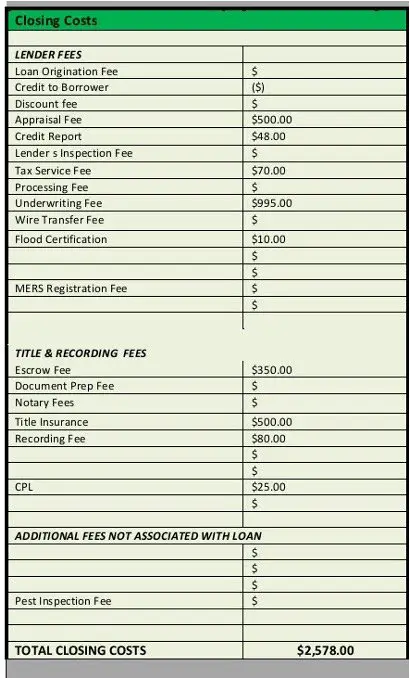

Here is a sample estimated closing cost breakdown for a home purchase price of $400,000 2-unit duplex with 20% downpayment and no mortgage points in Pierce County, Washington state. It can give you a ballpark estimate of the fees that you can expect in your loan quote.

What Is A No

Lets dive a little deeper into the definition of a no-closing-cost mortgage. When you buy a home, there are a number of different costs and fees that go into what is broadly referred to as closing costs. The amount can vary, but depending on a variety of factors, they can quickly become pretty substantial. Applying for a no-closing-cost mortgage helps with these fees, as the lender will commit to paying them up front and making their money up on the back end by charging a higher interest rate for the duration of the loan.

Read Also: Does Prequalifying For A Mortgage Affect Your Credit

Can You Finance Closing Costs Into Your Usda Home Loan

Yes, there are a couple approaches to this. One is to essentially build the costs into your purchase offer and ask for a seller credit. While far less common, in some cases it might be possible to roll the closing costs on top of the loan. If the home appraises for a higher value than the purchase price, your lender could increase your loan amount to cover your closing costs.

How We Make Money

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

You May Like: Reverse Mortgage For Mobile Homes

Rolling Your Closing Costs Into Your Mortgage Loan: Yay Or Nay For Investors

Get our 43-Page Guide to Real Estate Investing Today!

Real estate has long been the go-to investment for those looking to build long-term wealth for generations. Let us help you navigate this asset class by signing up for our comprehensive real estate investing guide.

Many mortgage lenders offer what they call no-closing cost loans mortgages you can roll your closing costs into rather than paying them upfront. As an investor, these loans can be tempting. After all, they reduce the amount of money youll need upfront to buy a property. They also free up cash flow, ensuring you have plenty of funds to finance any repair, rehab, or marketing costs on the tail end. But make no mistake: These mortgages arent perfect. In fact, they could actually cost you more in the long run.

Are you considering a no-closing cost loan for your next investment purchase? Heres what youll want to think about.

Can I Roll Closing Costs Into My Mortgage

Asked by: Regan Johnston

In simple terms, yes you can roll closing costs into your mortgage, but not all lenders allow you to and the rules can vary depending on the type of mortgage youâre getting. If you choose to roll your closing costs into your mortgage, youâll have to pay interest on those costs over the life of your loan.

You May Like: Requirements For Mortgage Approval

Also Check: 10 Year Treasury Yield And Mortgage Rates

Refinancing: When Are Closing Costs Due

If youre refinancing an existing mortgage, your closing costs are due at least one day before the loan is funded. This gives the lender enough time to disburse all the proceeds when the mortgage is funded. As your closing date approaches, your lender will tell you how and when to pay your closing costs.

You dont need to pay a down payment because you made your down payment when you initially purchased the home. Other differences include the cost of title feesthese are lower when you refinance because the owner of the property isnt changing.

What Is My Financial Position In Life

This is the big question to ask yourself when deciding what to do about closing costs. But either way, if you roll your closing costs in, you can always decide not to later. You can still write that check six months down the line and it will go directly against your balance.

If you have any questions about this or if you have any questions youd like us to answer on our podcast, you can email your questions to or give us a call at . Be sure to ask us for a free quote on your next mortgage. Well personally work with you and help you through the whole process.

Thanks for listening and reading the Mortgage Brothers Show. Let us know if you have any questions youd like us to answer on this podcast. You can email your questions to or .

Be sure to ask us for a free quote on your next mortgage. Well personally work with you and help you through the whole process.

Signature Home Loans LLC does not provide tax, legal, or accounting advice. This material has been prepared for informational purposes only. You should consult your own tax, legal, and accounting advisors before engaging in any transaction. Signature Home Loans NMLS 1007154, NMLS #210917 and 1618695. Equal housing lender.

Recommended Reading: Chase Recast Mortgage

Who Needs A No Closing Cost Mortgage

Borrowers with limited fundsIf you have limited funds and dont have enough money to pay for the closing costs after the minimum required down-payment, then you should look into a no closing cost mortgage.

Borrowers who dont plan on staying in their home long-termIf you plan on staying in the property for no more that 3-5 years, you should consider a no closing cost mortgage since it takes 3-5 years to recuperate the standard closing costs associated with a mortgage.

Who Should Be Rolling In Their Closing Costs

Someone who is totally debt-free and has their emergency fund fully funded and their retirement account going. Basically, if they have excess money. Our answer to that person is: If you dont have to dont. If you can afford it, why would you stop there. How much money do you have in your bank account? If youve got $100,000 sitting there making 0.5% interest dont roll in your closing costs, bring that money to closing and an extra $20,000 to drop that mortgage down. Youd probably save close to $50,000 or $60,000 over the lifetime of the loan.

You May Like: Rocket Mortgage Payment Options

Should You Pay Closing Costs Up Front

The upside of writing a check for your closing costs when you finalize your mortgage is that you don’t have to take on more debt when you buy a home. If you roll your closing costs into your loan, you pay interest on them. Pay them up front, and you don’t, which keeps your monthly payment lower.

On the other hand, if money is tight and you’re already spending a lot of your savings on a down payment, you may be better off rolling closing costs into your loan. Also, if you’ve managed to secure a low interest rate on your mortgage, it may not hurt to just lob an extra few thousand dollars into your home loan.

Wrapping Your Closing Costs Into A Refinance

First, you should understand the consequences of rolling your closing costs into your loan. Sure, it will save you money upfront. You wont have to come up with thousands of dollars. But if you look at what those closing costs turn into over the life of the loan, you may want to rethink your choice.

If you borrow the money to cover your closing costs, you pay interest on that money. Lets say you took out a loan for $200,000, but wanted to wrap your $10,000 of closing costs into it. You just increased your loan to $210,000. You now pay interest on $210,000. That $10,000 in closing costs just became much more as you take 30 years to pay it off.

If you still want to do it, youll need to make sure you have enough equity in the home. Each loan program has a maximum LTV that theyll allow. If your outstanding principal balance brings you below that LTV and adding the closing costs to the balance still keeps you below it, you may be able to wrap the costs into your loan.

Each lender has their own requirements regarding this. Some require a certain credit score and/or debt ratio in order to take the risk of increasing your loan amount just to cover the closing costs.

Recommended Reading: What Is The Max Home Loan I Can Get

Also Check: Who Is Rocket Mortgage Owned By

Readers Ask: Can Closing Costs Be Rolled Into A Mortgage

Most lenders will allow you to roll closing costs into your mortgage when refinancing. When you buy a home, you typically dont have an option to finance the closing costs. Closing costs must be paid by the buyer or the seller .

Contents

Should You Roll Closing Costs In A Mortgage

Well, it depends.

It is important to understand the consequences when you are including your closing costs into the mortgage.

If you choose to roll it in the loan amount, then you are paying interest on the closing cost for the entire loan period.

Lets say you are buying a $300,000 home that requires you to put down $12,000 as closing costs during settlement. If you choose to roll this additional amount into your mortgage, you will end up paying $21,378 over the 30-year period considering a 4.3% rate.

Also, when you are taking a higher loan amount, your LTV increases. This will, in turn, reduce your stake in the property. When you look to sell your property in the future, you will end up making a lower profit.

Here are my two cents If you are short on cash, and not able to pay the closing costs out of pocket, it is fine to include it in your mortgage otherwise, paying it upfront is always the better alternative.

Read Also: Recast Mortgage Chase

How To Know If Refinancing Is Worth The Cost

When you add up all of the fees and costs associated with refinancing your mortgage, you could be looking at paying thousands of dollars. So, how do you know if refinancing your mortgage is worth it?

Although this answer will vary depending on your unique situation, it really boils down to what you hope to get out of refinancing your home loan.

Down Payment Vs Closing Costs

In Canada, your down payment amount is put toward the home’s total purchase price, while the mortgage usually covers the rest. The down payment must be at least 5% of the purchase price if the home is worth $500,000 or less. Homebuyers must pay 10% of the purchase price for amounts higher than $500,000 to $999,999. Buyers must have a down payment of 20% for homes worth $1 million or more.

On the other hand, closing costs pay for many of the services you require in the homebuying process, such as lawyer fees, taxes, and inspections. Unlike your down payment, none of these expenses turn into equity they are upfront costs.

Recommended Reading: Chase Recast

How Can I Better Prepare For And Compare Closing Costs

If youre looking to find low closing costs on your mortgage, there are several closing costs estimators online that you may find helpful as you budget for your dream home.

However, you cant rely solely on these tools to give you an accurate picture of your closing costs when buying a house. How closing costs are calculated will vary from lender to lender and province to province, so its in your best interest to do some research upfront to get a better idea of what to expect.

While your biggest concern might be cheap closing costs when taking out a mortgage, buying a house requires understanding how closing costs work. If you dont, you could be in for an expensive surprise.