Fha 30 Year Fixed Mortgage Rates

With an FHA 30 year fixed mortgage, you can purchase a home with a lower down payment and flexible lending guidelines or streamline refinance with less documentation than a traditional loan.

FHA loans are backed by the Federal Housing Administration, that is, the federal government insures them. Rather than issuing mortgages, the FHA offers insurance on mortgage payments so that more people can get the financing they need to buy a house or refinance. However, borrowers are required to pay Upfront Mortgage Insurance and monthly mortgage insurance when obtaining an FHA loan.

Do I qualify for an FHA loan?

For FHA 30 year fixed rate loans, there are low down payment options, gifts are allowed, Streamline Refinances are permitted and there are no penalties for repayment.

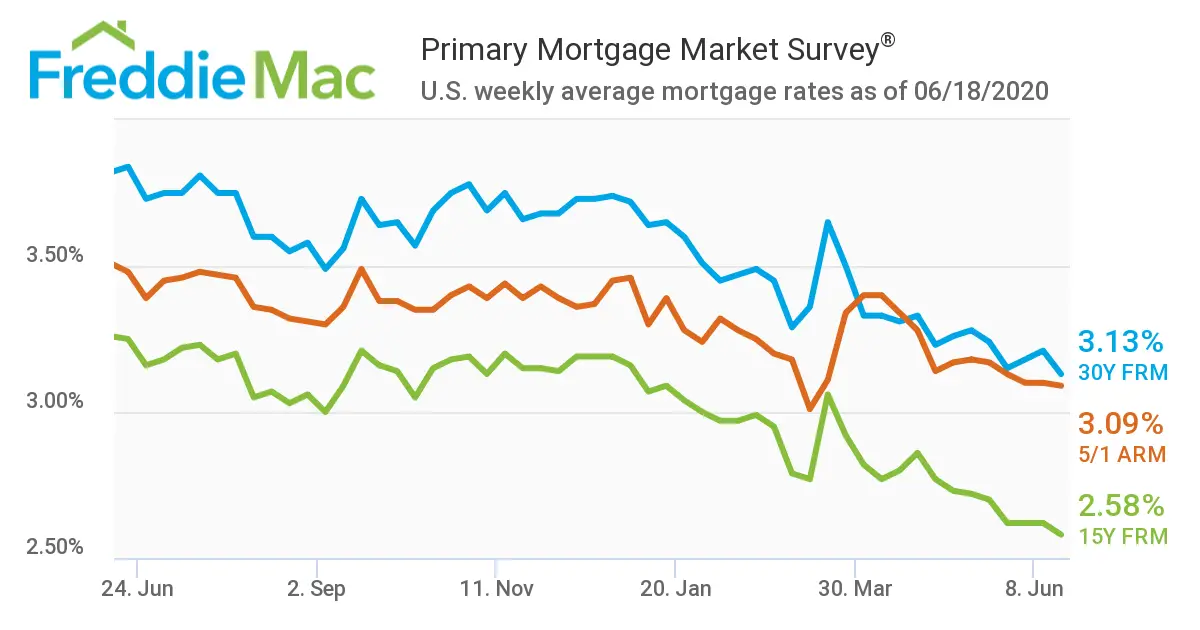

Mortgage Rates Decrease Slightly

Even with this week’s decline, mortgage rates have increased more than a full percent over the last six months. Overall economic growth remains strong, but rising inflation is already impacting consumer sentiment, which has markedly declined in recent months. As we enter the spring homebuying season with higher mortgage rates and continued low inventory, we expect home price growth to remain firm before cooling off later this year.

Average commitment rates should be reported along with average fees and points to reflect the total upfront cost of obtaining the mortgage. Visit the following link for the Definitions. Borrowers may still pay closing costs which are not included in the survey.

How Your Interest Rate Is Determined

In large part, mortgage rates are determined by the economy and overall interest rate market.

Mortgage rates move up or down depending on how much investors will pay for mortgage bonds in a secondary market. The economy is a big factor in that.

During scary economic times, interest rates tend to be low. But they go up when things are looking positive.

On top of that, lenders adjust your rate based on how risky you appear as a borrower.

Less risk to the lender means a lower interest rate for you. More risk, and your rates go up.

Mortgage lenders determine risk and set mortgage rates based on a wide range of factors, including your:

If youre very secure financially, you could be a toptier borrower, meaning you qualify for the very lowest 30year mortgage rates. The further away you are from that happy situation, the higher interest rate youre likely to pay.

Read Also: Mortgage Rates Based On 10 Year Treasury

What Are Today’s Mortgage Rates

You can see Guaranteed Rate’s mortgage rates today up above, but if this is your first home buying experience, you might have more basic questions. Like “what is a mortgage rate” and “what do today’s mortgage rates mean for you?” Every mortgage comes with the expectation that the amount borrowed will eventually be paid back in full. However, borrowing that much money comes with a cost, and simply paying off the principal loan wont erase your debt.

Just like any other business, lenders need to make a profit on the products they offer, like mortgages and personal loans. Thats why loans almost always come with the added stipulation of interest payments, which act as the cost of borrowing money.

Factors That Affect Your Mortgage Interest Rate

For the average homebuyer, tracking mortgage rates helps reveal trends. But not every borrower will benefit equally from todays low mortgage rates.

Home loans are personalized to the borrower. Your credit score, down payment, loan type, loan term, and loan amount will affect your mortgage or refinance rate.

Its also possible to negotiate mortgage rates. Discount points can provide a lower interest rate in exchange for paying cash upfront.

Lets look at some of these factors individually:

Read Also: Reverse Mortgage For Mobile Homes

Scoring A Low Interest Rate

If you are looking to purchase a home, applying for a home mortgage now might be a good idea. Currently, interest rates are historically low, but as the employment situation and economy improve, you can expect those rates to spike soon.

While the aforementioned factors impact the average interest rate, you can control certain elements and help secure a lower interest rate for a home loan.

What Is The Difference Between The Interest Rate And Apr On A Mortgage

Borrowers often mix up interest rate and an annual percentage rate . Thats understandable, since both rates refer to how much youll pay for the loan. While similar in nature, the terms are not synonymous.

An interest rate is what a lender will charge on the principal amount being borrowed. Think of it as the basic cost of borrowing money for a home purchase.

An represents the total cost of borrowing the money and includes the interest rate plus any fees, associated with generating the loan. The APR will always be higher than the interest rate.

For example, a loan with a 3.1% interest rate and $2,100 worth of fees would have an APR of 3.169%.

When comparing rates from different lenders, look at both the APR and the interest rate. The APR will represent the true cost over the full term of the loan, but youll also need to consider what youre able to pay upfront versus over time.

Don’t Miss: How Much Is Mortgage On 1 Million

Why Its Important To Shop For Multiple Quotes

When youre getting a mortgage, its important to compare offers from a variety of lenders. Every lender will evaluate your financial situation differently. So getting multiple quotes will allow you to choose the offer with the best rate and fees. The rate difference between the highest and lowest rates lenders offer you could be as high as 0.75%, according to a report by the fintech startup Haus.

However, the interest rate isnt the only factor you need to consider when comparing mortgage lenders. The fees each lender charges can vary just as much as the interest rate. So the offer with the lowest rate may not be the best deal if youre paying excessive upfront fees. To compare rates and fees, take a look at the Loan Estimate form that lenders are required to provide within three business days of receiving your application. The Loan Estimate is a standardized form, which makes it easy to compare quotes.

You can visit NextAdvisors comprehensive list of mortgage lender reviews here.

How To Use Our Mortgage Rate Table

Our mortgage rate table is designed to help you compare the rates youre being offered by lenders to know if it is better or worse. These rates are benchmark rates for those with good credit and not the teaser rates that make everyone think they will get the lowest rate available. Of course, your personal credit profile will be a significant factor in what rate you actually get quoted from a lender, but you will be able to shop for either new purchase or refinance rates with confidence.

You May Like: Who Is Rocket Mortgage Owned By

Do I Get A Lower Rate If I Make A Bigger Down Payment

Generally, not. The lowest rates in Canada are typically offered on default insured mortgages. Those are for people who put down less than 20% on their home purchase. Low insured rates are also available to people who transfer their already-insured mortgage to a new lender. Those who put down 20% or more get conventional rates, which are usually higher than insured rates. Occasionally, however, someone putting down 35% or more on a home purchase under $1 million can get great rates similar to high-ratio rates.

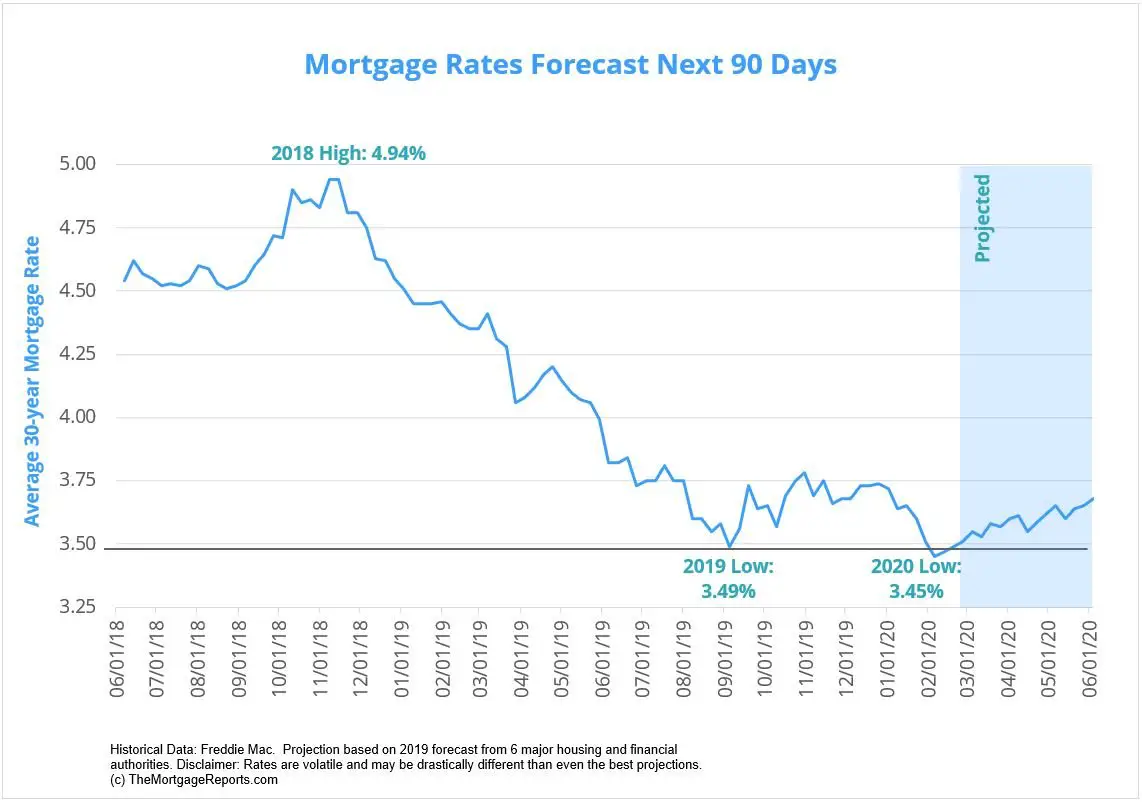

Mortgage Interest Rate Forecast

Mortgage rates have fluctuated consistently over the past year. The rate on a 30-year fixed-rate mortgage dipped as low as 2.65% in January 2021 and reached a high of 3.18% on April 1.

So, what can we expect over the next year?

As long as the economic expectations of a strong rebound and an increase in inflation continue to pan out, the risk will be toward the side of higher interest rates rather than lower rates, says Greg McBride, Chief Financial Analyst at Bankrate.com. But with a much slower growth pace expected in 2022, that might trigger a pullback at some point in the second half of the year. Either way, expect mortgage rates to remain in the 3% 3.5% range throughout.

According to Freddie Macs most recent quarterly report, rates are expected to rise slowly but consistently throughout the year. Reaching 3.2% in quarter two, 3.3% in quarter three, and 3.4% in quarter four.

Mortgage rates are largely tied to the economy. And as the economy continues to improve from the pandemic, mortgage rates will rise. First, the American Rescue Plan Act of 2021 helped increase consumer confidence, as well as the amount of money that families had in the bank.

The early months of 2021 have also seen an increase in the labor market and a decrease in unemployment, helping move the economy in the right direction. And with the most recent CDC updates regarding vaccination numbers and mask guidelines, Americans can see the light at the end of the tunnel for the pandemic.

Recommended Reading: Can You Get A Reverse Mortgage On A Mobile Home

Are Interest Rates And Apr The Same

Interest rates and APR are not the same. An annual percentage rate reflects additional charges associated with your mortgage, which includes the interest. The interest rate reflects the cost homeowners pay to borrow money. These fees include charges such as origination fees and discount points, which is why the APR is typically higher than the interest rate.

Year Fixed Mortgage Rates

In a 30 year fixed mortgage, your interest rate stays the same over the 30 year period while you repay the loan, assuming you continue to own the home during this period. Such mortgages tend to be some of the most popular type of home loan thanks to the stability and lower monthly payments they offer borrowers compared to 15 year fixed mortgages.

Also Check: Chase Recast Mortgage

Are Current Mortgage Rates Good For Buying A Home Right Now

High prices and rising interest rates are being felt by homebuyers, who are seeing their purchasing power dwindle.

That doesnt mean that this is the wrong time to buy a house, just be sure youre not panic buying. Dont rush into a home purchase because youre afraid rates or prices will increase forever. Instead, if its the right time for you to purchase, then take the time to find the right home for you at a price you can afford.

Owning a home is a better choice if you plan on staying for a long time. By giving yourself more time in the home, youll be able to weather the inevitable market fluctuations. Purchase a home with a monthly payment you can comfortably fit in your budget. According to experts, you shouldnt spend more than 28% of your pretax income on housing.

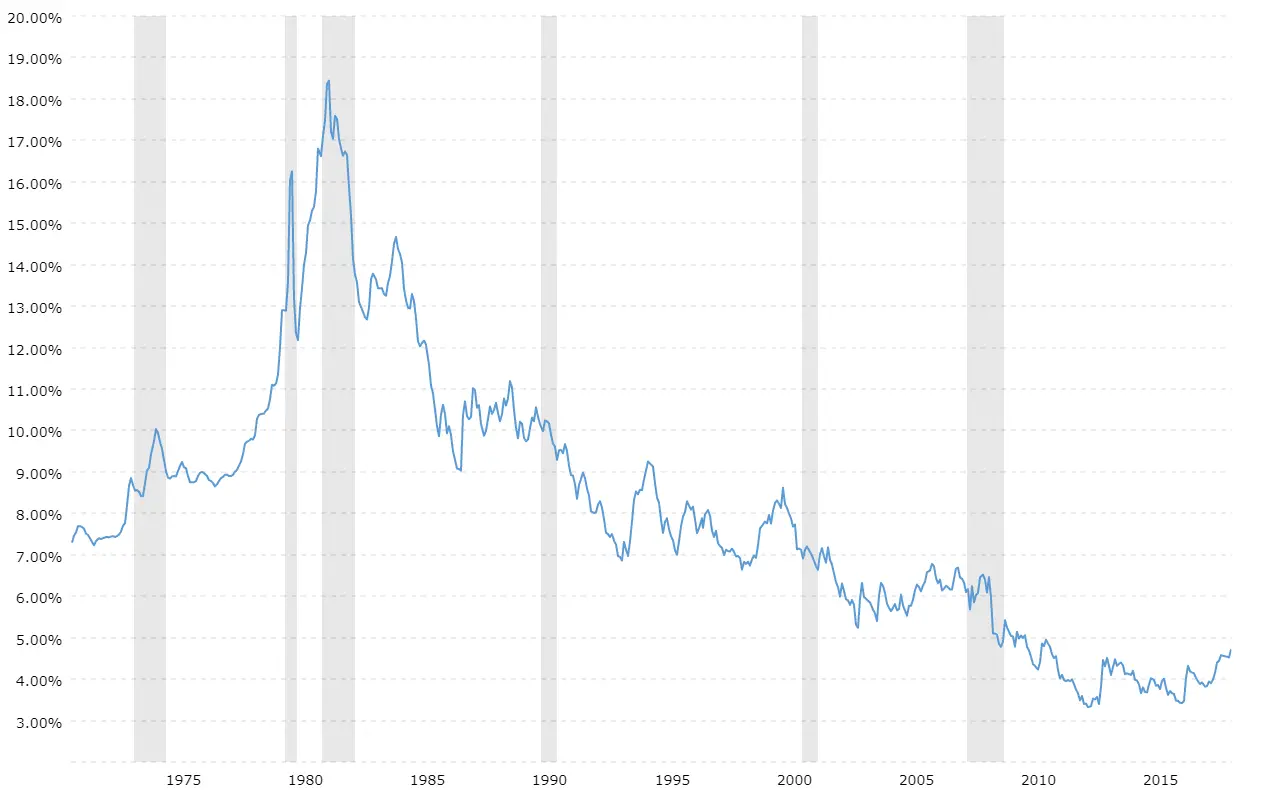

Historical Mortgage Rates Chart: Trends Over Time

Despite recent rises, todays 30year mortgage rates are still ultralow from a historical perspective.

Freddie Mac the main industry source for mortgage rates has been keeping records since 1971.

Between 1971 and December 2020, 30year mortgage rates averaged 7.89%.

But between January and October of 2021, they averaged just 2.93%.

Even if rates keep rising, many experts predict they wont go above 4% in 2022. That means home buyers and homeowners should keep enjoying rates that are about half the historical average.

Don’t Miss: Can You Get A Reverse Mortgage On A Condo

How Do You Lock In Your Va Loan Interest Rate

Buyers have to be under contract in order to be eligible for a rate lock. Once thats in hand, the timeline can vary depending on a host of factors, including the type of loan, the overall economic environment and more.

If you’re ready to see where rates are right now, or if you have more questions, contact a home loan specialist at 1-800-884-5560 or start your VA Home Loan quote online.

There’s no obligation, and you’ll be one step closer to owning your brand new home.

Open Vs Closed Mortgages

You may often notice a significant difference in mortgage rates betweenopen and closed mortgages. Open mortgages allow you to make principal prepayments at any time without any charges or penalties, which makes it very flexible. This flexibility is counterbalanced by open mortgage rates being higher than closed mortgage rates.

Choosing a closed mortgage can let you access much lower mortgage rates at the risk of prepayment penalties if you go over your lenders annual prepayment limit. Things like selling your home or a mortgage refinance can cause you to have to pay significant prepayment penalties. This could be avoided with an open mortgage, but youll have to pay a higher mortgage rate.

Don’t Miss: Chase Recast

How Do 30year Mortgage Rates Compare To Other Loan Types

Todays 30year mortgage rates like all current rates are lower than theyve been in most of U.S. history.

Even so, 30year mortgage rates often look higher than other rates youll see advertised.

You can generally find lower mortgage interest rates if you opt for:

- A shorter-termloan Shorterterm home loans have lower rates than 30year FRMs because investors dont hold the risk of carrying your debt for as long. However these loans have much higher payments, since youre repaying the same amount of money over a shorter time period

- An adjustable-rate mortgage Adjustablerate mortgages have a fixed interest rate for the first few years. Then, the rate can change with the market. These loans typically offer lower introductory rates than 30year loans. But that rate could rise later on, so you lower mortgage payment is not guaranteed to continue

Despite their slightly higher rates, most borrowers opt for a 30year fixed mortgage over a 15year FRM or an adjustablerate mortgage.

The stability and predictability that come with fixed rates and low payments are hard to beat.

Why Veterans United

Locking in your interest rate at the right time is key, which means it’s essential to find a lender who understands your needs and the forces that shape VA loan interest rates.

Some lenders try to entice borrowers with unbelievably low rates that are nearly impossible to qualify for. We’ll work within your financial means and give you an accurate and realistic quote.

With Veterans United, there are no hidden costs or locking fees. By speaking with a Veterans United loan specialist, you’re given total transparency when it comes to your interest rate.

Are you a first-time homebuyer? Read our next section for more information aboutpurchasing your first home with a VA Loan.

Read Also: Rocket Mortgage Vs Bank

How To Get A 30

Here are the steps youâll need to take to get a 30-year mortgage in Canada.

Save for your down payment: Youâll need enough cash for a 20% down payment, plus the closing costs of buying your new home. Depending on location, closing costs can be between 1% and 5% of the total purchase price.

Find a home in your price range: Once youâve saved diligently, youâll need to figure out how much you can afford. Use our mortgage affordability calculator to work out how much you can afford to buy with your current savings making up at least a 20% deposit.

Find a mortgage provider: While most mortgage providers will offer non-insured, 30-year mortgages, youâll still need to find the best product for you. With a longer amortization period, your mortgage rate will be especially important, so be sure to compare mortgage rates between lenders.

What Is A Good 30

A 30-year fixed-rate mortgage is a home loan that maintains the same interest rate and monthly principal-and-interest payment over the 30-year loan period. With a rate that lasts the length of the loan, youll want the best rate you can get. Since your rate is most directly impacted by your credit score and down payment, youll want to make sure your credit file is accurate and make a down payment thats as much as you can easily afford.

Getting a good deal on a mortgage is like getting a good deal on a car. You do online research, you talk with friends and family, and then you comparison-shop. That last step, which involves applying with multiple lenders, is the most important step.

When you compare loan offers using the Loan Estimates, youll feel confident when you identify the offer that has the best combination of rate and fees.

A Freddie Mac report concluded that a typical borrower can expect to save $400 in interest in just the first year by comparison-shopping five lenders instead of applying with just one lender. Over several years, comparison-shopping for a mortgage can save thousands of dollars. Thatll give you something you can brag about.

The 30-year fixed isnt your only option. The 15-year fixed loan is common among refinancers. Adjustable-rate mortgages have low monthly payments during the first few years of the loan, making them popular for high-dollar loans.

You May Like: Reverse Mortgage For Condominiums

Are The Lowest Mortgage Rates Usually Online

For the last few years, the best rates in Canada have usually been found online. Thats because internet-based lenders have been more competitive and often accept smaller profit margins. Even big banks are now joining the bandwagon with special pricing for online mortgage shoppers. RATESDOTCA tracks dozens of lenders and aggregates the best deals all in one place.