The Canadian Mortgage Stress Test Explained

By Tamar Satov and Justin Dallaire on July 18, 2022

Most home buyers in Canada will encounter the stress test when applying for a mortgage. Heres how it works and what it means for borrowers.

The Canadian mortgage stress test applies to anyone applying for a mortgage, refinancing their current home loan, or renegotiating the terms of their mortgage contract with a federally regulated lender. And while provincially regulated lenders have more flexibility when it comes to mortgage approvals, many still use the test to evaluate customers financial risk. This means that most home buyers in Canada are subjected to the stress test.

It applies to everyoneyou, me, first-time buyers and 10-time buyers, says Maxine Crawford, a mortgage broker who serves the Greater Toronto Area and elsewhere in Ontario. That includes people who already own a home and need to refinance or renew their mortgage

In spite of its broad application, many Canadians have never heard of the stress test or still dont understand how it works. Heres what you should know before you apply for your next home loan.

Canada Regulator Eyes Tougher Mortgage Rules Amid Bubble Fears

Theophilos Argitis, Bloomberg News

A “For Sale” sign in front of a home in the York neighborhood of Toronto, Ontario, Canada, on Thursday, March 11, 2021. The buying, selling and building of homes in Canada takes up a larger share of the economy than it does in any other developed country in the world, according to the Bank of International Settlements, and also soaks up a larger share of investment capital than in any of Canadas peers. Photographer: Cole Burston/Bloomberg , Bloomberg

— Canadas bank regulator is proposing to tighten mortgage qualification rules to make it more difficult for home buyers to secure financing, a move aimed at easing financial stability risks stemming from a booming real estate market.

The Office of the Superintendent of Financial Institutions said it will set up a new benchmark interest rate used to determine whether people will qualify for an uninsured mortgage to a minimum rate of 5.25%. The current threshold, based on posted rates of the countrys six largest lenders, is at 4.79%.

Sound residential mortgage underwriting is always important for the safety and stability of financial institutions, Jeremy Rudin, head of the Ottawa-based agency, said in a statement. Today it is more important than ever.

The Canadian Real Estate Association calculates prices are up 17% nationally over the past 12 months. Twelve major markets — or about one quarter of the total — have posted price gains of more than 30%.

©2021 Bloomberg L.P.

Youre Ready To Upgrade

As your family grows, so does your lifestyle. Right now, mortgage rates are at a historical low were talking 1.99% for a variable five-year mortgage rate in Ontario. At this rate, a family buying a home for $500,000 with a $125,000 down payment could expect to have a monthly mortgage payment of $1,743.

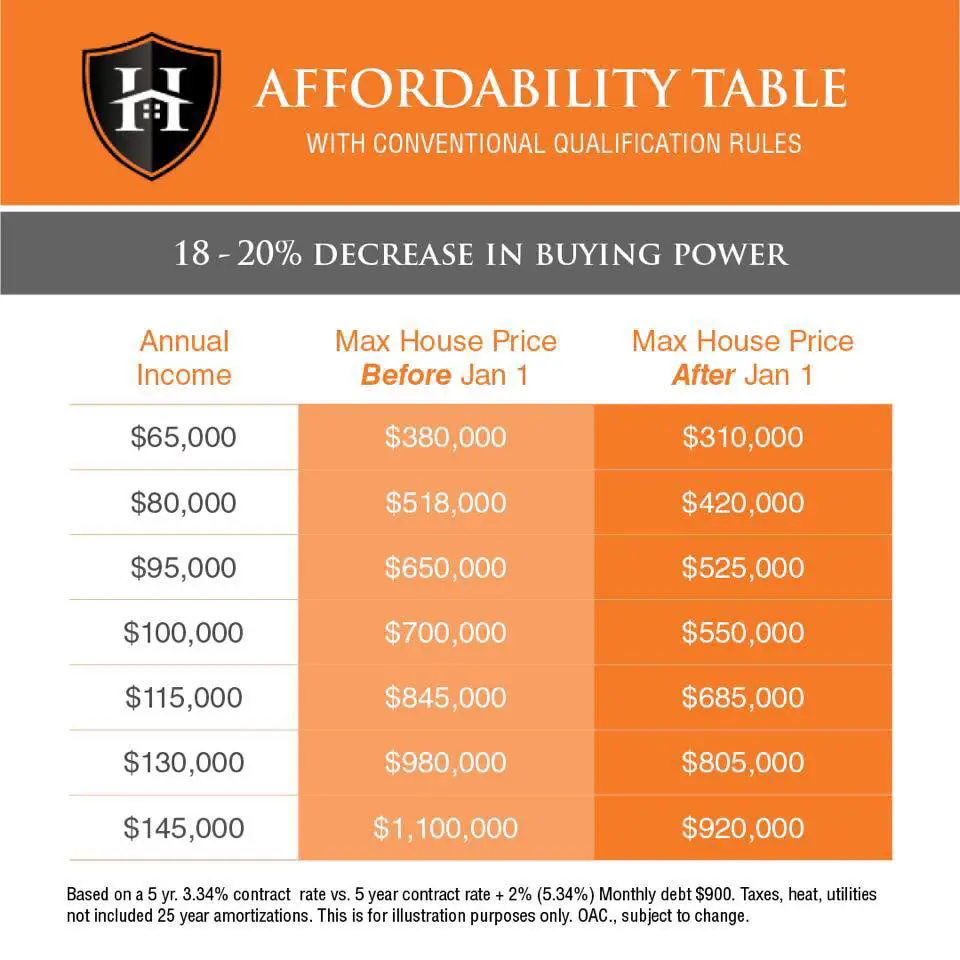

But as of January 1st, that same buyer will have to undergo a stress test prior to qualifying in order to ensure they can afford to pay their mortgage at two percentage points higher . This means they would have to show they can afford to pay a mortgage of $2,165 per month. Thats a difference of $422 a month or $5,064 a year!

. If youve been thinking about making a move, it may be in your best interest to secure a mortgage pre-approval before the new mortgage rules kick in.

Also Check: What Does A Mortgage Include

New Ways To Assess Creditworthiness

Beginning last fall, Fannie Mae and Freddie Mac introduced new ways for loan applicants to have their on-time rent payments reported as part of their credit review, including through bank statements.

This could enable borrowers without a robust credit history to better qualify for a loan by evaluating the rent payment history as part of the credit profile through their automated underwriting engine, says Waring.

Freddie Mac recently announced a new automated income assessment tool for mortgage lenders that allows them to use direct deposit information from bank accounts rather than provide copies of pay stubs or other forms of income verification. Borrowers can provide permission to have their income verified from direct deposits, employer data and tax return data. Automation is anticipated to reduce errors, speed up loan application evaluations and lower costs.

Current Minimum Mortgage Requirements For Conventional Loans

Down payment. Youll need at least a 3% down payment for a conventional loan. The funds can come from a gift or your own money.

Mortgage insurance. Conventional loans with less than 20% down require private mortgage insurance to protect lenders if you default. The higher your down payment and credit score, the lower your PMI will be. You may pay between 0.14% and 2.33% of your loan amount in annual PMI premiums. PMI premiums are normally paid as part of your monthly payment however, PMI can be paid up front in a lump sum at closing.

. Conventional mortgage guidelines require a minimum credit score of 620. Youll snag the best mortgage rates and lower PMI premiums with credit scores of 740 or higher.

Guideline update: Average median credit scoring

Lenders are now allowed to take an average median score to meet the minimum credit score, which is great news for borrowers that need two incomes to qualify but one applicant has a score below the 620 minimum. In the past, that meant a loan denial for a conventional loan. Now, a high credit score borrower can potentially lift a low credit score borrower over the 620 threshold, which could lead to a loan approval thumbs up instead of a hard no.

Employment. Lenders require proof of steady income and need to verify the income is likely to be predictable in the future. Youll typically need to document two or more years of variable income earned from commissions, bonuses or overtime.

You May Like: What Is The Highest Interest Rate On Mortgage

How Will The New Mortgage Rule Affect Canadian Home Buyers

Essentially, the new qualifying mortgage rules will require home buyers to qualify at a rate that is 2% higher than that of their negotiated or contract rate ensuring that the majority of home owners pay a minimum of 20% on a down payment, in addition to having the sustainable ability to afford ongoing payments.

Homeowners Allowed To Go Interest

Ministers met with regulators and banks amid fears borrowers will fall into arrears

Homeowners struggling to pay their mortgage bills will be able to switch to interest-only deals without a formal repayment plan under new plans to help borrowers through the cost of living crisis.

Customers will be able to ditch repayment loans for a temporary period under drafts plans laid out by City watchdog, the Financial Conduct Authority. It announced the plans on Wednesday after attending a roundtable with lenders and the Government to discuss ways to help mortgage borrowers as fears of arrears mount.

The FCA guidance said the plans would help lenders prepare for providing mortgage forbearance at scale.

Interest-only deals were once prevalent but became heavily regulated after millions of borrowers were sold deals before the financial crisis with no plan on how to repay the capital.

However, some 1.8 million homeowners will come to the end of fixed-rate deals in 2023, according to banking trade body UK Finance, and will have to refinance at far higher rates in some cases quadruple their previous deals. This will come as they shoulder the largest drop in real household disposable incomes on record.

For a permanent switch to an interest-only basis, a credible repayment plan would still be required, the FCA said.

Customers switching from an expiring fixed-rate mortgage can switch to a new rate with their lender without undertaking an affordability assessment, the FCA added.

Don’t Miss: What Mortgage Can I Afford On 120k

Regulations And Official Interpretations

Browse Regulation Z on: Interactive Bureau Regulations | eCFR

Main RESPA and TILA provisions and official interpretations can be found in:

- § 1024.17, Escrow accounts and § 1024.37, Forced placed insurance

- § 1024.35, Error resolution procedures and § 1024.36, Requests for information

- § 1024.38, General servicing policies, procedures and requirements

- § 1024.39, Early intervention and § 1024.41, Loss mitigation procedures

- § 1026.20, Disclosure requirements regarding post-consummation events

- § 1026.36, Payment processing and § 1026.41 Periodic statements

- § 1026.40, Continuity of Contact

- Supplement I to Part 1024 and 1026

Canadas New Mortgage Rules Making It Tougher To Qualify

Since the announcement of Canadas new mortgage rules in June of 2022, it has become much tougher to qualify for a mortgage. The new rules, which include a stress test for all borrowers and a cap on how much Canadians can borrow against their home equity, have made it more difficult for people to get approved for a mortgage. This has led to a decrease in home sales and an increase in housing prices, as buyers are forced to compete for fewer available homes. While some people have argued that the new rules are necessary in order to cool down the housing market, others have complained that they are too restrictive and are preventing people from buying homes. Time will tell whether or not the new rules will achieve their desired effect.

Don’t Miss: Can You Get A New Mortgage With An Existing Mortgage

What Is A High

In order to buy Canadian real estate and qualify for a mortgage, buyers must have a minimum down payment of five per cent of the homeâs total purchase price. However, when the homebuyer has less than 20 per cent to make as a down payment, they will need to take out a high-ratio mortgage, which requires mortgage default insurance. This is designed to protect the lender in case of mortgage payment default by the borrower. Insurance premiums can either be paid up front, or added to the mortgage payments.

New Mortgage Rules May Help More Borrowers Get Home Loans In 2021

by Kimberly Rotter |Updated July 19, 2021 – First published on Jan. 22, 2021

Image source: Getty Images

Think your debt means you can’t qualify for a mortgage? This change might make the difference.

To promote access to responsible, affordable mortgages, the Consumer Financial Protection Bureau issued two changes to mortgage standards in late 2020. The new mortgage rules will help more borrowers get home loans.

We spoke with Melissa Stegman, senior policy counsel for the Center for Responsible Lending, to find out whether the new mortgage rules are good for consumers, lenders, or both.

Read Also: How Much Is Mortgage Insurance Monthly

Is My Mortgage Covered

The new CFPB rule applies to mortgages that are federally backed, which includes the types mentioned above. However, home equity loans and lines of credit, reverse mortgages, and loans for investment properties are ineligible. Also, certain small mortgage servicers aren’t required to comply, according to the CFPB. If you are unsure whether you’re eligible, contact your mortgage servicer directly.

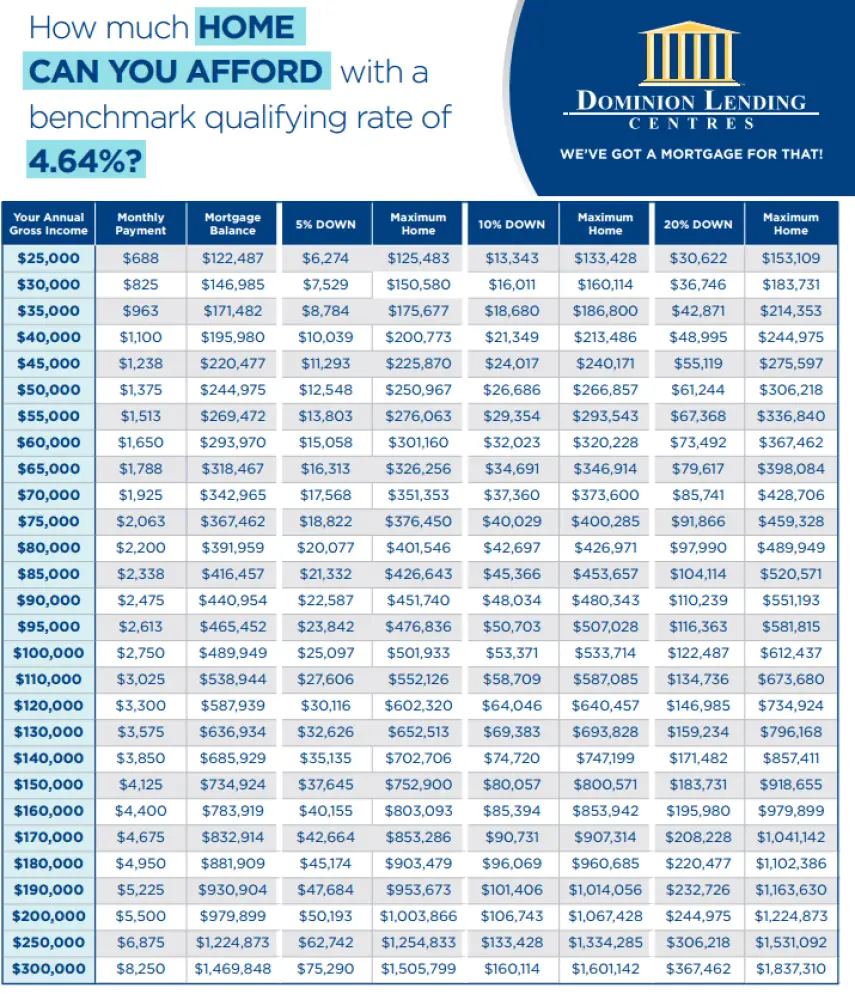

What Does It Mean For Home Buyers

These new mortgage rules mean that your purchasing power could be reduced by as much as 20%, as compared to when there was no stress test . When applying for a mortgage today, the amount that you qualify for doesnt depend on the rate that the lender is offering. For example, if they are offering a 4% interest rate, your affordability will be determined based on a rate of 6%, since the stress test stipulates that the bank use a qualifying rate thats either 2% more than the offered rate or 5.25% whichever number is higher. As a result, the amount that you can borrow could be significantly smaller.

Its also likely that millennial buyers, who have statistically lower salaries than other demographics, wont be able to borrow as much as before. Plus, since theyre less likely to bring home equity into a new home purchase, they often have less purchasing power.

You May Like: How Is Debt To Income Ratio Calculated For A Mortgage

The Stress Test At A Time Of Rising Interest Rates

At the height of the pandemic, when fixed and variable rates fell into the 1% to 2% range, most borrowers faced a qualifying rate of 5.25%.

But with the recent jumps in the benchmark rate, almost everyone who has to qualify based on the stress test is qualifying at a rate higher than 5.25%, notes Matt Imhoff, a mortgage agent with Mortgages.ca. For example, obtaining a variable rate of 4.7%equal to the prime rate at the time of this writingnow requires qualifying at 6.7%. Youd have to subtract pretty hard to get down to 5.25%, says Imhoff. So my opinion is, you really need a good reason to be getting a mortgage today.

Denise Laframboise, from LaframboiseMortgage.ca in Brooklin, Ont., adds that home buyers who were pre-approved for a mortgage before the BoCs most recent rate hike may need to revisit the maximum they can afford to spend on a home. The mortgage broker says clients are now qualifying for mortgages that are 10% to 15% smaller than what they could have been approved for prior to the July rate increase. And even if youve obtained a rate holdconfirmation that your rate will not change for a specified amount of timeyou might still encounter challenges getting financing.

New Mortgage Lending Rules Are Goinginto Effect Friday That Aim To Put An End To The Worst Mortgage Lending Abuses Of The Past

The new rules are designed to take a “back to basics” approach to mortgage lending and lower the risk of defaults and foreclosures among borrowers, according to the Consumer Financial Protection Bureau, which issued the new rules.

“No debt traps. No surprises. No runarounds. These are bedrock concepts backed by our new common-sense rules, which take effect today,” said CFPB director Richard Cordray in remarks prepared for a hearing Friday.

Mortgage lenders are being asked to comply with two new requirements: The Ability to Repay rule and Qualified Mortgages. Here’s how they will impact borrowers:

Ability to Repay

- Lenders must determine that a borrowerhas the income and assets to afford to make payments throughout the life of the loan. To do so, the lender may look at your debt-to-income ratio, which is how much you owe divided by how much you earn per month, including the highest mortgage payments you would be required to make under the terms of the loan. To calculate your debt-to-income ratio, add up all your monthly obligations — including student loan, credit card and car payments, housing costs, utilities and other recurring expenses — and divide it by your monthly gross income.

Qualified Mortgages

“We think the new rules are balanced and well-drawn. They will offer consumers protection without limiting credit to qualified borrowers,” said Gary Kalman, the policy director for the Center for Responsible Lending.

You May Like: When Is The Best Time To Pay Off Your Mortgage

Mortgage Affordability Under The New Rules

An example using Ratehubs Mortgage Affordability calculator:

Old Rules: Assuming a 20% down payment, 5-year fixed mortgage rates of 2.84%, and a 25-year amortization a family with an annual income of $100,000 can afford a home worth $693,405.

New Rules: Applying the new stress-test, the family must qualify for the mortgage using the greater of 4.89% and 4.84% . Therefore, with a 20% down payment, a 5-year fixed rate of 4.89%, and a 25-year amortization, the family can now afford a home worth $591,537.

The difference is that under the new rules, the familys affordability has dropped by $101,868 . A bank that was willing to lend them $700,000 before is now only able to loan them approximately $600,000.

Canadian Real Estate And The New Mortgage Rules

Canadian real estate has been a tough nut to crack for some homebuyers, and those with less than 20 per cent as a down payment now face another challenge, with Canada Mortgage and Housing Corp. announcing tighter qualification rules for borrowers of high-ratio mortgages. The move was in response to the economic vulnerabilities sparked by global pandemic. The changes, which include lower debt thresholds and higher credit ratings, came into effect on July 1, 2020. If youâre in the market to buy a home but have less than 20 per cent as a down payment, hereâs what you should know.

Read Also: A Mortgage Loan Originator Is Defined As

How Does This Differ From The Pre

The previous mortgage stress test guidelines were slightly less stringent, as buyers needed to qualify for financing at either the rate on offer plus 2%, or the Bank of Canadas five-year benchmark rate of 4.79%, whichever was higher.

In other words, this recent change will only affect borrowers offered a mortgage rate under 3.25% in which case the qualifying rate used will now be 5.25% as opposed to somewhere between 4.79% and 5.25%. For everyone else, there is no changethe qualifying rate remains 2% above the offered rate.

To put that into real terms, if youre hoping to take out a $500,000 mortgage with a 25-year amortization, and the lender offers you a five-year fixed rate of 2%, youd now have to show you could afford payments of $2,979.59 , as opposed to $2,848.54 before June 1 , even though your actual payments would be much lower at $2,117.26 .

On the other hand, if the lender offers you a rate of 3.5%, you will have to show you could afford payments of $3,051.96 , even though your actual payments would be $2,496.35 .