What To Know About Closing Costs

Refinancing your mortgage offers benefits such as lower interest rates, shorter terms, or extra funds from your homes equity. However, it also comes with closing costs.

Closing costs are fees incurred from completing real estate transactions. Generally, they range from 3% to 6% of the total loan amount or mortgage. Below is a breakdown of fees commonly included in refinancing closing costs.

- Application fee: A charge for processing the loan, which may include a credit check or appraisal.

- Origination or underwriting fee: Lenders charge approximately 1% of the loan amount to process and underwrite the refinancing.

- Lenders will review your credit history to determine creditworthiness.

- Appraisal fee: Paid to the appraiser for assessing your propertys fair market value.

- Survey costs: Paid to a surveyor to confirm exact property lines, including shared fences.

- Title insurance premium: Title insurance protects you against possible errors with ownership records.

- Title search fees: Lenders will look at the property record to check for liens, ownership issues, or restrictions.

Closing costs may also include property taxes and homeowners insurance, among others.

Mortgage Refinancing Options For Out

Even borrowers who are unemployed have many refinancing solutions available through CMIs network of private, corporate, individual, and traditional lending partners. Many of these lenders offer mortgage products that are designed for clients who do not have steady income and who have been turned down by banks. A few of the mortgage and refinancing options open to you include:

- 80% financing for equity based second mortgages and second mortgages for borrowers with no documented income

- 80% financing for borrowers with documented income

- Mortgage refinancing with a loan-to-value ratio 80%

- Home equity loans worth 80%, and home equity lines of credit worth between 80%

- Up to 80% financing for second mortgage lines of credit, even without documented income

- Private first and second mortgages

CMI lending partners are willing to look beyond your credit score and employment status, and our brokers will leverage the equity built up in your home to negotiate a mortgage refinance. We can also act on your behalf to negotiate a private mortgage, which means the lender is not associated with a traditional lending institution, and has the liberty to approve terms and conditions that are tailored to your specific needs and financial circumstances.

Get Quotes From Multiple Lenders

Once you have an idea of the type of mortgage you want, you can start loan shopping. One of the best home loan negotiation tips is to get quotes from at least three different lenders. You can do this by working with a mortgage broker who will get quotes from multiple lenders, or you can go directly to banks and mortgage companies.

As you think about how to negotiate mortgage rates, consider not only getting quotes from multiple lenders, but also from a variety of lenders. For example, you may want to apply with at least one credit union, one national bank and one online lender.

You should also keep track of your loan estimates, so you can compare them and position yourself to negotiate.

Read Also: Why Is Mortgage Cheaper Than Rent

How We Make Money

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

Increase Your Down Payment

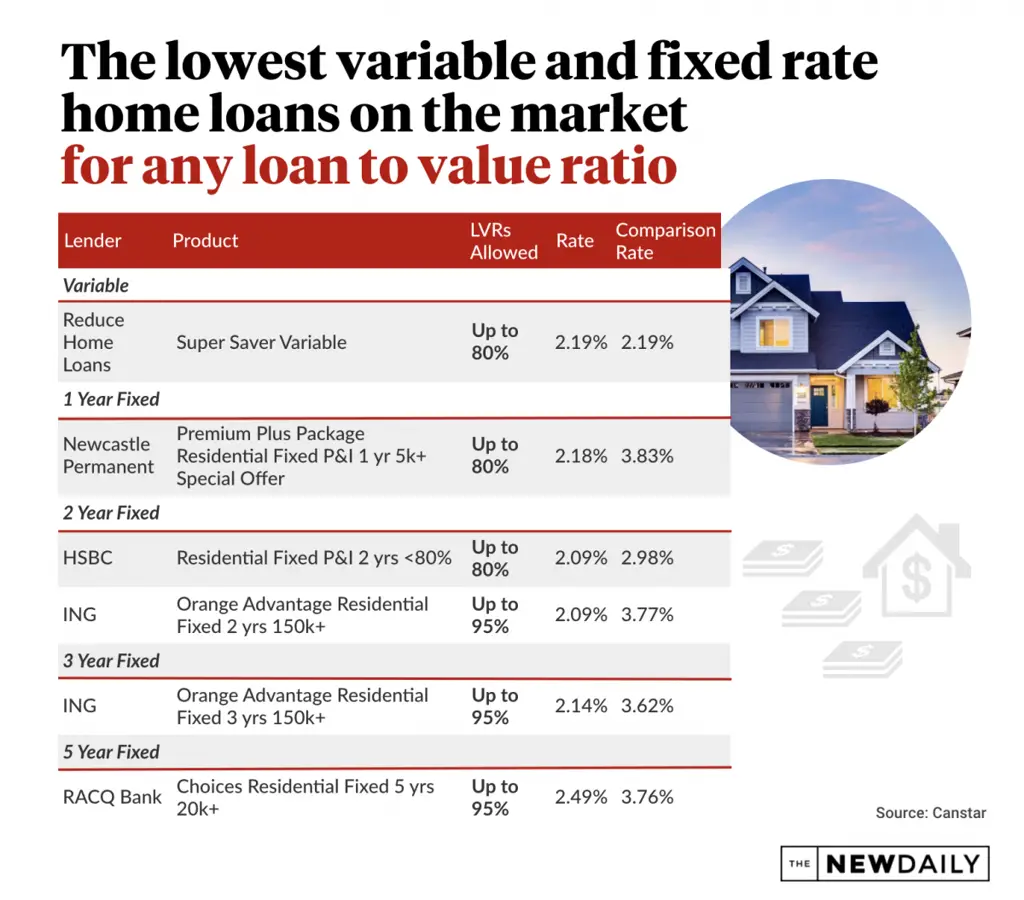

Putting more money into a down payment can help lower your mortgage rate. The more you put down, the lower the loan-to-value ratio . Lenders use the LTV metric to determine risk, and the lower your LTV the better. A lower LTV can translate into a lower mortgage rate. This strategy could mean waiting longer to buy a house so you save up for a higher down payment.

You May Like: Is Taking Out A Second Mortgage A Good Idea

How To Negotiate A Lower Rate For Your Home Loan

Step 1: Are you in the best position to haggle?

Before you begin the negotiations, you may want to take some time to ensure your financial situation is in its most ideal. Home loan lenders typically reserve their most competitive interest rates to ideal borrowers.

Thats not to say you still cant negotiate a lower rate if you dont meet these criteria, but its worth knowing how many you tick to boost your argument. Plus, if youre meeting all the below criteria, you may already be paying your lenders lower home loan rate offering. In that case, you may want to instead consider refinancing as opposed to negotiating.

Being an ideal borrower may include:

- Living in the property

- Reducing your loan-to-value ratio to 80% or below

- Being employed in a full-time role for more than 3-6 months

- Not having missed a mortgage repayment

- Paying principal and interest

- Unsure of your current interest rate? It should appear on your home loan statement, through your online banking platform or banking app.

Step 2: Research your current lenders rates

Your next step will be to hop online to your home loan lenders website or use RateCitys search tool, to find what rates your lender is currently offering new customers.

Generally speaking, a home loan lender will reserve its most competitive rates for new customers to entice them to apply with that provider. If youve been with your lender for a few years, you may currently be paying a higher rate than these new customers.

Closing Costs & Third

You will encounter fees refinancing your mortgage that cannot be negotiated. This includes taxes and fees paid to your State for transfer and recording the deed or a survey. Your appraisal fee cannot usually be negotiated because this is done by an independent appraiser that you have no say in selecting. When it comes to services for title searches and your homeowners insurance, inspections and attorney fees you have a voice in selecting who youre working with, meaning you could shop for services with lower fees. Once you compare third-party fees from several lenders youll get a sense for whats reasonable and which lenders are padding their fees.

Read Also: Can You Mortgage A Tiny House

How To Negotiate Mortgage Rates

Whether youre a first-time home buyer looking for a new home, or a homeowner who wants to refinance your current mortgage, negotiating the best mortgage rate is possible.

However, its not as simple as haggling over percentage points.

To negotiate a better mortgage rate, youll have to prove that youre a creditworthy borrower. And youll have better luck if you come to the table with a lower quote from a different lender in-hand.

Here are four strategies to negotiate for your best mortgage rate before you lock:

We cover each rate-negotiation strategy in more detail below.

But the rule of thumb is this: If you have strong personal finances, and youre willing to get quotes from different lenders, you can usually find a lower rate for your mortgage.

How To Use A Refinance Calculator

There are many free refinance calculators readily available online which can help you determine if refinancing will save you money. With a refinance calculator, you can enter your current mortgage terms, the new proposed mortgage terms and any fees for refinancing. You can try this refinance calculator to see how it works.

A refinance calculator will help you figure out how much money youll save on a monthly basis and over the life of your loan, and whether its worth the costs of acquiring a new mortgage.

Also Check: What Is The Average 15 Year Fixed Mortgage Rate

How To Renegotiate A Mortgage: The Ultimate Guide

Can you renegotiate your mortgage to get better terms without refinancing? Its possible. Banks do renegotiate mortgage contracts in certain situations. However, you need to give your lender a good reason.

Heres everything you should know and mortgage renegotiations including valid reason lenders accept, the process, and answers to frequently asked questions.

Tip: Use A Mortgage Calculator And Pull Your Credit History

Using a mortgage calculator can help you understand how down payment, credit score, and interest rate impact your mortgage payment.

Additionally, if you havent checked your credit history, you can do so by requesting free copies of your credit reports from the three major credit bureaus: TransUnion, Equifax, and Experian.

Recommended Reading: What Are The Top Mortgage Companies

What Is A Mortgage Rate Lock

When you receive a mortgage loan offer, a lender will usually ask if you want to lock in the rate for a period of time or float the rate. If you lock in, the rate should be preserved as long as your loan closes before the lock expires.

If you dont lock in right away, a mortgage lender might give you a period of timesuch as 30 daysto request a lock, or you might be able to wait until just before closing on the home.

Make sure you get multiple mortgage loan offers and see which lenders mortgage interest rate offer is the best one. Once you find a rate that is an ideal fit for your budget, lock in the rate as soon as possible. There is no way to predict with certainty whether a rate will go up or down in the weeks or even months it sometimes takes to close your loan.

Current 30 Year Mortgage Rate Retreats

The average rate for a 30-year fixed mortgage is 6.88 percent, down 5 basis points over the last week. A month ago, the average rate on a 30-year fixed mortgage was higher, at 7.22 percent.

At the current average rate, you’ll pay a combined $657.26 per month in principal and interest for every $100,000 you borrow. That’s $3.35 lower, compared with last week.

Don’t Miss: How To Calculate Self Employed Income For Mortgage

Take Advantage Of Your Customer Loyalty

Your loyalty as a customer could be one of your greatest negotiation tools. If youve been with your lender for a long time and have a positive history with them, you may be able to use this to your advantage.

Come into the negotiation prepared and with the facts ready. You can tell them how many years youve been with them and prove your reliability as a borrower by highlighting your repayment history.

How To Estimate Closing Costs

At the beginning of the loan process, your lender will send out a Loan Estimate, which includes a closing cost estimate for your loan. Once your loan is approved, youll receive a Closing Disclosure, which includes a breakdown of your closing costs. Lenders are legally obligated to provide these documents so that you know how much the loan will cost.

We recommend you hold onto the documents as they are evidence of your loan, but if you do misplace any documentation, you can ask your lender for copies directly. With On Q Financial, Inc., you have access to the Simplicity by On Q Financial app, which allows you to view your estimated loan costs from your phone at any time.

Don’t Miss: Where Can I Buy Mortgage Insurance

Who Pays Closing Costs

Most closing costs are typically paid by the buyer, who will pay around 2 to 5% of the purchase price in closing costs. Closing costs do differ by location, so the costs in your area may vary. Although the buyer is responsible for paying the closing costs, you can negotiate for the seller to contribute towards the closing costs as well. First, you will need to determine how much you need.

Should I Refinance My Mortgage Instead Of Renegotiating It

You may wonder if refinancing your mortgage is a better option than renegotiating it, and it may be. Heres a quick look at the pros and cons:

Here is a list of the benefits and the drawbacks to consider.

Pros

- Take advantage of rates and terms that save you money if you qualify.

- A cash-out refinance can let you liquidate home equity.

Cons

- Refinancing fees apply which can be thousands of dollars.

- Qualifying can be difficult .

- Your existing loan may have a prepayment penalty.

- Lengthy application and approval process.

If you qualify for an offer that helps you to save money overall and/or monthly, refinancing is worth considering.

Don’t Miss: What Is A Typical Monthly Mortgage Payment

Negotiate The Price Instead

You can choose to pay more for the home and have the seller pay your closing costs. This is similar to rolling the closing costs into your loan, but in this case, you may not have to pay the full amount of closing costs if you can negotiate on the price.

We recommend letting your agent handle communication with the seller. By leaving all face-to-face communication to your agent, not only will you avoid making some critical mistakes, but you will also be able to avoid looking too enthusiastic about the house.

Consider A Streamline Refinance Program

Streamline refinance loan programs exist to keep your mortgage in line with todays best mortgage rates.

This wont work with a conventional loan. But if you have a government-backed mortgage like an FHA, USDA or VA loan be sure to ask your current lender about a streamline refi.

In many cases, you wont need a new home appraisal or a credit check. This saves money on your closing costs.

You couldnt get a cash-out refinance, and streamline refinances will work only on the same type of loan: For instance, an FHA streamline wont work on a VA loan and vice versa.

If you do have a conventional loan, check out Freddie Macs Refi Possible or Fannie Maes RefiNow programs which could save on closing costs.

Also Check: How To Get Out Of Your Mortgage

Know What It Means To Negotiate A Mortgage

If youre applying for a mortgage for the first time or renewing your current one, youll find posted mortgage rates advertised at financial institutions. You may not realize, however, that you can always get a better rate than the one posted, as long as you negotiate.

For example, if the posted five-year fixed rate is 3%, youd be able to negotiate the interest rate down a bit. Besides the interest rate, you can also negotiate some of the contract details, such as prepayment options and cash-back benefits. What youre able to get really comes down to your negotiating skills.

Mortgage Services That Alleviate The Financial Stresses Of Unemployment

The services offered by our mortgage experts will facilitate your search for a suitable mortgage product, so that you can concentrate on taking advantage of the opportunities afforded by your mortgage refinance, including:

- Consolidating and controlling your debts

- Lowering your regular loan payments

Thanks to the network of lenders that work with us at Canadian Mortgages Inc., unemployment does not mean you will lose your home. We will show you how to negotiate a mortgage refinance if you have lost your job, and help you with loan repayment strategies and debt management so that you can keep your economic life in order and focus on more important issues.

You May Like: What Is The Best Type Of Mortgage Loan

Here Are Some Tips For The Negotiation Itself:

Be firm, polite and get straight to the point by saying that you would like a home loan interest rate reduction. This is when you can start justifying your request by:

- Explaining why youre a responsible borrower

- Comparing what youre paying as a loyal customer to what new customers pay

- Mentioning the lower rates competitors are offering .

Which Refinancing Closing Costs Can You Negotiate

Mortgage disclosures may contain a variety of fees those imposed by the lender, those required by the government, those paid to third parties like a title company, and prepaid expenses like property taxes and homeowners insurance.

As mentioned earlier, these fees are disclosed in a Loan Estimate. By law, mortgage lenders must issue one within three business days of receiving your mortgage application.

This schedule helps you identify fees to negotiate.

Many in-house lender fees and third-party vendor fees are negotiable when refinancing.

Section A of your Loan Estimate lists the lender charges. Regardless of what the lender fees are called processing, underwriting, or origination its the total cost that matters.

Borrowers and home buyers can save money on closing costs by negotiating the lowest total lender charge for their interest rate.

You can also save money by negotiating third-party vendor fees, which can include home appraisers, credit reporting agencies, home inspectors, escrow services, and title insurers.

Some of these third-party services are negotiable, and others are not.

Third-party fees listed in Section B are not negotiable, while providers listed in Section C can be chosen by the borrower, and its those fees that may be negotiated during closing.

Also Check: Do Mortgage Lenders Make Commission

Why You Have To Shop To Negotiate Rates

Mortgages are a lot more regulated than they used to be. As a result, individual loan officers have less flexibility to change rates from customer to customer.

Thats why we talk about tactics like comparing Loan Estimates and purchasing discount points to lower your rate rather than trying to bargain with your loan officer.

In todays real estate market, some lenders are more efficient than others. They lower operating costs by using online applications and digital processing. And those overhead savings often get passed on to customers.

Other providers do such high volume that they can afford to charge lower lender fees and rates, and still turn a profit.

And most every lender has some sort of niche with different types of mortgages. Some are friendlier toward low-income or low-credit borrowers, some are better for self-employed people, some have jumbo loans or FHA loans, and so on.

So, shopping around doesnt just give you leverage for negotiating a lower mortgage rate. It also helps you pinpoint mortgage lenders that specialize in the type of loan you need. And that lender will be more likely to give you a competitive rate, regardless.