Documents Needed To Refinance Mortgage

If youre considering refinancing your home, you must provide proof of your income, assets, employment, and liabilities. Just like you did when you bought your home, you must prove you can afford the new loan. So what documents are needed to refinance your home?

Keep reading to learn everything youll need to refinance

Proof Of Homeowners Insurance

Homeowners insurance covers both the home and the items inside of it in the event of a fire, hurricane, or other type of disaster. Generally, your policy will pay to repair or rebuild your home â or replace your belongings â so you donât have to do so out of pocket.

If you donât have homeowners insurance, and disaster strikes, it could jeopardize your ability to pay your mortgage. So, your lender will ask to see a copy of your homeowners insurance policy as proof that you have enough coverage.

Free Up Money Each Month

If interest rates have fallen since you first got your mortgage, a rate-and-term refinance can replace your loan with a new one that has a lower rate, meaning you pay less to your lender each month.

Theres a significant opportunity to reduce your monthly cash requirements, says Glenn Brunker, president of Ally Home. Depending on the size of your mortgage, it could be $75 or $100 per month, or even several hundred dollars a month.

You May Like: How Much Mortgage Qualify For

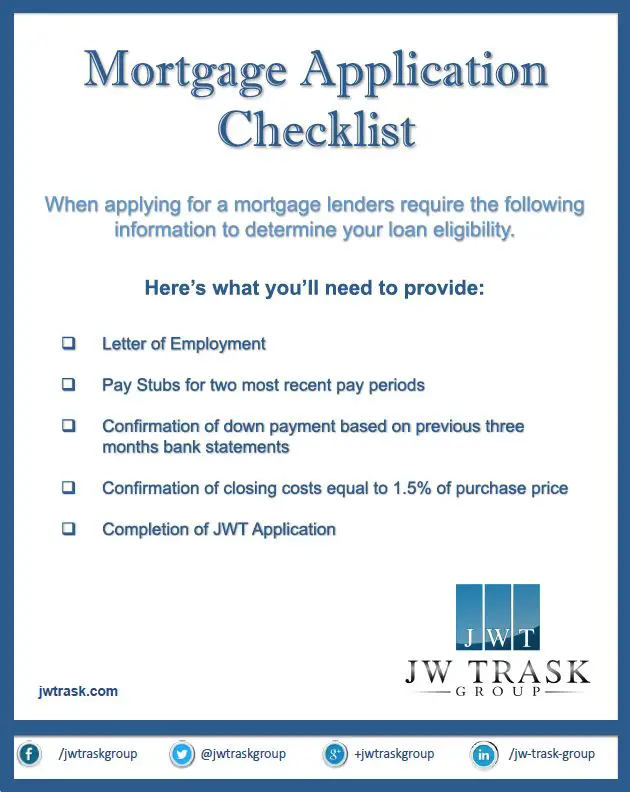

Get Your Paperwork In Order

Gather recent pay stubs, federal tax returns, bank statements and anything else your mortgage lender requests. Your lender will also look at your credit and net worth, so disclose your assets and liabilities upfront.

What to consider: Having your documentation ready before starting the refinancing process can make it go more smoothly.

Tap Equity To Pay Off High

Home equity is the difference between your homes value and your current loan balance, and you can access it with a cash-out refinance. By borrowing more than you currently owe, you can pocket the difference to consolidate maxed-out credit cards or make upgrades to increase your homes value even more.

Read Also: Can You Use A Mortgage To Build A House

Getting You The Best Deal

Mortgage brokers are experts at home loans and understand how to present a mortgage application in the best possible manner. A strong application is usually key to getting a good deal from a bank. Mortgage brokers also have solid relationships with lenders, built over the years, and can negotiate a better deal for you than if you were to apply directly.

For example, when refinancing, your age and retirement plans can determine the loan term you might be eligible for. If you intend to retire in the next 10 years, the lenders may not refinance your loan for a loan term greater than 10 years. However, mortgage brokers can help you in such situations and get higher loan terms by guiding you through appropriate suitable to your personal situation.

On top of all these benefits, working with mortgage brokers, particularly at Home Loan Experts, is usually free. Call us on 1300 889 743 or fill in our , and start your refinancing journey today!

Understanding Mortgage Refinance Requirements

Editorial Note: The content of this article is based on the authors opinions and recommendations alone. It may not have been reviewed, commissioned or otherwise endorsed by any of our network partners.

Homeowners might be able to save on interest, lower their payments or shorten their loan terms when they refinance their mortgage. However, refinance requirements vary depending on why youre refinancing and how your finances look.

Knowing the requirements to refinance a mortgage may save you money upfront and, in some cases, help you avoid the hassle of verifying your income or waiting on a home appraisal.

Read Also: How To Pay Off Mortgage In 15 Years Calculator

Locking In Your Interest Rate

Since interest rates fluctuate frequently, things can change between the day you apply for your loan and the day you close. If you want to protect yourself against rising interest rates and ensure that the loan terms you used to build your budget are locked, you might consider locking in your rate with your lender when you fill out your loan application.

A rate lock is your lenders assurance that the interest rate and discount points are guaranteed until the rate lock expiration date. The lender will provide the terms of the rate lock to you in writing, including the agreed-upon interest rate, the length of the lock and any discount points you choose to pay.

Of course, if you believe that interest rates will decrease in the near future, waiting to lock your rate may make sense to you. In the end, its a personal choice when to lock your rate. The rate must be locked prior to the lender preparing your closing documents. Talk to your lender about the choice that best suits your needs and your preferences.

What You Need To Do To Refinance Your Home

Refinancing your home requires getting a new mortgage. You pay off your current loan and replace it with a new loan that has better rates or terms. This is true even when you are refinancing your home with your current lender. Your lender cannot modify the interest rate or terms of your existing mortgage. You will need to a get a new loan when you refinance with them. Here are other important refinancing requirements youll want to know!

Don’t Miss: How Much Is A 95000 Mortgage Per Month

Prepare The Necessary Documents

Since you will be paying off your old loan and taking out a new one, youll need to submit many of the same documents you provided the first time around. Tax returns and/or W2 forms will show that you have adequate income. Bank and brokerage statements will demonstrate that you have reserves to tide you over through a job loss or an emergency repair, though not all refinances require this documentation.

Do The Math To See If Refinancing Will Pay Off

Before applying for a refi, make sure you understand the costs associated with a new loan. Refinance closing costs typically run between 2% and 5% of the total loan amount. For a refi to make sense, you have to be able to recover these closing costs, as well as save money over the long term.

To determine if its worthwhile, youll need to calculate your break-even point. This refers to how long it will take for the savings from the new loan to surpass its cost. You can calculate the break-even point by dividing the closing costs of the loan by the amount of money you save every month.

For example, if your closing costs are $5,000 and your monthly savings are $100, your break-even point would be 50 months or about four years. In this case, refinancing probably makes sense if you plan on living in your home longer than four years.

An easy way of figuring out if a refi is right for you is using a mortgage refinance calculator.

Don’t Miss: How To Report Mortgage Payments To Credit Bureau

Set A Clear Financial Goal

There should be a good reason why youre refinancing, whether its to reduce your monthly payment, shorten the term of your loan or pull out equity for home repairs or debt repayment.

What to consider: If youre reducing your interest rate but restarting the clock on a 30-year mortgage, you may end up paying less every month, but more over the life of your loan. Thats because the bulk of your interest charges are in the early years of a mortgage.

What Income Verification Documentation Do I Need To Provide For A Refinance

-

Just like with your original mortgage, youll need to provide some documentation to verify your income for a refinance. This will typically include:

- 2 years of personal tax returns

- 2 years of business tax returns

- 2 years of W-2s or 1099s

- 2 months of bank statements

- Proof of any alimony or child support payments

If youre refinancing with Better Mortgage, youll have the option to link your bank accounts and upload your documents digitally. More resources

Home lending products offered by Better Mortgage Corporation. Better Mortgage Corporation is a direct lender. NMLS #330511. 3 World Trade Center, 175 Greenwich Street, 57th Floor, New York, NY 10007. Loans made or arranged pursuant to a California Finance Lenders Law License. Not available in all states. Equal Housing Lender.NMLS Consumer Access

Better Real Estate, LLC dba BRE, Better Home Services, BRE Services, LLC and Better Real Estate is a licensed real estate brokerage and maintains its corporate headquarters at 3 World Trade Center, 175 Greenwich Street, 59th Floor, New York, NY 10007. A full listing of Better Real Estate, LLCs license numbers may be foundhere. Equal Housing Opportunity. All rights reserved.

Better Settlement Services, LLC. 3 World Trade Center, 175 Greenwich Street, 57th Floor, New York, NY 10007

The Better Home Logo is Registered in the U.S. Patent and Trademark Office

Better Cover is Registered in the U.S. Patent and Trademark Office

Recommended Reading: How Long Is The Mortgage Process

The Bottom Line On Documents Needed For Refinancing

If you decide to refinance your mortgage, youâll need to supply documentation that shows different sides of your finances. By preparing ahead of time, you could expedite the process and put yourself in a better position to get approved. Make sure to also ask your lender any questions you have about your refinance checklist â â and then you can be on your way to getting a new loan.

Tap Your Homes Equity

Homeowners with well over 20 percent equity in their home sometimes turn to cash-out refinancing. Thats when you refinance your home loan into a new mortgage for a larger amount to meet a specific financial need and receive the difference in cash. This can make sense if youre considering using the money to invest back into your home through a major remodeling project or to pay off high-interest debt.

Also Check: How To Determine Mortgage Pre Approval Amount

Set A Refinancing Goal

Most homeowners refinance in order to get a lower interest rate and, as a result, reduce their monthly payments. However, thats not the only reason to refinance.

Different loan types offer different advantages.

You may want to switch from an adjustable-rate mortgage to a fixed-rate mortgage to guarantee a permanently lower rate. Maybe you want to switch from a 30-year loan to a 15-year loan to pay off your mortgage faster. If you have enough equity, you may also be able to save on mortgage insurance by switching from an FHA loan to a conventional mortgage.

Perhaps you’ve recently run up against major medical bills, unexpected home repairs or other expenses that are weighing you down financially. If youve built up enough equity in your home, a cash-out refi will not only let you refinance your loan but also take out extra cash.

Knowing what you want to accomplish with a refi will help you determine the type of mortgage product you need. Consider all the options to see which works best for you.

What Is Mortgage Refinancing

Refinancing a mortgage means you get a new home loan to replace your existing one. If you can refinance into a loan that has a lower interest rate than youre currently paying, you could save money on your monthly payment and interest you pay over the term of the loan. You might also be able to take advantage of a cash-out refinance, which allows you to tap into your home equity essentially as a lower-interest loan.

Also Check: What’s An Average Mortgage Interest Rate

Shop Multiple Mortgage Lenders

Getting quotes from at least three mortgage lenders can save you thousands. Once youve chosen a lender, discuss when its best to lock in your rate so you wont have to worry about rates climbing before your loan closes.

What to consider: In addition to comparing interest rates, pay attention to the cost of fees and whether theyll be due upfront or rolled into your new mortgage. Lenders sometimes offer no-closing-cost refinances but charge a higher interest rate or add to the loan balance to compensate.

Proof Of Debts And Credit Information

To prove your trustworthiness as a borrower, youll need to provide your credit score and recent credit reports. However, youll also need to provide some information about the debt that you hold even though it shows up on your credit report.

This means youll need to provide information about current student loans, mortgages, credit cards, auto loans, personal loans, and any other sources of debt.

Don’t Miss: How To Sell A Private Mortgage Loan

What Documents Do I Need For A Refinance

In this crazy, competitive home mortgage market, rates are still at all time lows! If you are entertaining the idea of refinancing your current mortgage now is the time to check with your mortgage lender. Your mortgage lender will run through several scenarios for you depending on your desire and need to refinance and its all simply advice.

Remember, you can refinance for many different reasons. To save money, have more money to spend, take cash out to remodel or consolidate debt. Its really a personal choice about your need or desire to refinance. Here are the most common reasons people will refinance.

- Lower current mortgage interest rate

- Lower monthly payments

- Lock into a fixed rate

- Change a fixed rate

- Refinance with cash out

- Stop paying PMI

So, while rates are historically low, its a smart idea to meet with your mortgage lender and review your options. A mortgage review is always wise, especially if you can save money or use your money to better meet your needs.

Anytime you meet with a mortgage lender to discuss a mortgage or a refinance its always smart to go prepared. Bankers like to see your financial history to make sure you have a history of paying your bills and to make sure you have proper income to pay your mortgage going forward. Providing financial documents will help your mortgage banker answer all your questions and give you the advice you will need to refinance.

Here are the documents you may need when applying for a mortgage refinance.

Get Your Mortgage Paperwork In Order

You need a lot of documentation that proves your financial readiness to refinance.

The documents you should have handy include your latest pay stubs, the last two years of W-2s, information about your current home loan, as well as information on property taxes and home insurance.

If youre self-employed or have a non-traditional job, have two years of bank statements available. You may also need a profit and loss statement from your bank, the last two years of 1099 forms and client invoices as proof of income.

A lender may have additional documentation requirements depending on their initial assessment of your finances. Once you have decided on a lender, find out about any other requirements so you can get it together ahead of time. Doing so will make the application process a lot smoother.

You May Like: What Fees Are Associated With Refinancing A Mortgage

Check Your Credit Score And History

Mortgage lenders use your credit score to determine how likely you are to replay your new home loan. Higher credit scores generally fetch lower interest rates, which can save you thousands of dollars over the life of the loan.

You can obtain a free credit report through various online vendors, including annualcreditreport.com.

Do this months before attempting a mortgage refinance. And correct any errors you see in your credit report long before applying, says Whitman. Even making small changes on your report can improve your credit score and result in a better interest rate.

Many lenders require a minimum credit score of 620 to refinance a conventional loan. While there are no credit minimums set for FHA loans and VA loans, lenders will have their own criteria so its important to shop your rate around to get the best deal.

If Youre Applying For A Mortgage Its A Good Idea To Start Prepping Your Financial Documents

Lenders will request paperwork for your mortgage application that proves things like how much money you make and your debts. The exact forms you need for a home loan depend on your situation. For example, someone who is self-employed will likely have to provide different forms than someone who is employed by a company.

Although the exact forms might vary, Todd Huettner, owner of Huettner Capital, a residential and commercial real estate lender, says a lender can get a good sense of your likelihood of being approved by checking out your recent pay stubs, bank statements, W-2 forms and tax returns.

Huettner says that with these documents, hes able to make a good assessment of the borrower. These documents allow me to tell what they can and cannot do with a very high level of certainty, he says.

Depending on your unique financial situation, here are seven mortgage documents you might need when applying for a home loan.

Don’t Miss: How Do I Get Mortgage Insurance

Proof Of Debts And Credit

Along with the above documents needed to refinance, lenders must determine what debts and credit you have outstanding. Youll disclose this information on your application, but they must have proof with a tri-merge credit report.

When you apply for a mortgage, the lender asks for your permission to pull your credit from all three credit bureaus Trans Union, Equifax, and Experian. They use this information as a baseline to determine your eligibility for a loan.

Along with the information provided on the credit report, you may need to provide your most recent account statements for any liabilities with a different payment amount than the credit report shows or if you recently paid off any accounts still showing a balance on the credit report.

The information provided in the credit report helps lenders calculate your debt-to-income ratio to ensure you qualify for the loan.