How Much House Can I Afford

How much house you can afford depends on a number of factors. Primarily: your income, current debts, credit score, and how much youve saved for a down payment. You can also afford a more expensive house the lower your mortgage rate is. Use the By Income tab on our mortgage calculator to see exactly how much house you can afford based on your income, down payment, and current interest rates.

How Much House Can You Afford

Before doing business with you, lenders also consider your other monthly debt obligations along with your projected housing expenses. For example, if your monthly expenses include $300 for a car loan, $75 in student loan payments and $125 in credit card bills, you would add these to your $2,000 housing expenses for a total of $2,500. Divide that figure by your $7,000 gross income to arrive at a 35.7 percent ratio. Lenders prefer this so-called “back-end” debt-to-income ratio to be 36 percent or less.

Generally, the smaller your monthly mortgage expense relative to your income, the easier it will be for you to keep up with your payments.

How Do I Calculate My Mortgage Rate

Before we dive deeper into this common question, its important to understand that not everyone will qualify for the exact same mortgage rate. Your qualified mortgage interest rate will be calculated based on a number of financial indicators. In addition, your monthly mortgage payment amount will be unique as a result of fees, insurance, loan amount, loan type and various other factors.

Want to get a detailed estimate of your monthly mortgage payment options? Get your FREE rate and closing cost quote! It includes a breakdown of all monthly costs!

You can get a rough idea of your mortgage rate and monthly mortgage payments by using online mortgage calculators . The interest rates will be based on national or regional averages and you can always search online for the current average mortgage rate. However, its just the average. It is not exactly the rate you will get when you apply for a home loan.

Now, we can discuss some of these key financial factors that will be reviewed when you are applying for a mortgage loan. This is how mortgage lenders will determine your home loan eligibility and calculate your qualified mortgage rate.

Here are some of the items that will have an impact on your interest rate:

Read Also: How To Cut Your Mortgage Term In Half

What Is Mortgage Formula

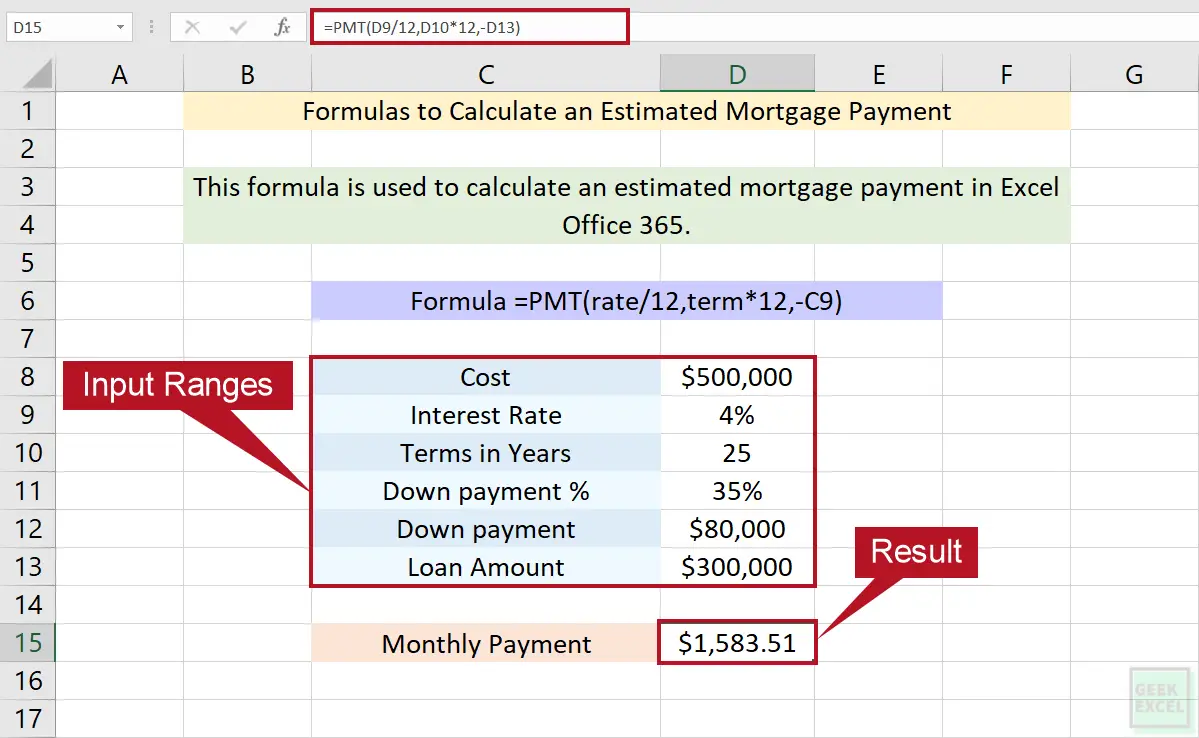

The formula for mortgage basically revolves around the fixed monthly payment and the amount of outstanding loan.

Fixed Monthly Mortgage Repayment Calculation = P * r * n /

where P = Outstanding loan amount, r = Effective monthly interest rate, n = Total number of periods / months

On the other hand, the outstanding loan balance after payment m months is derived by using the below formula,

Outstanding Loan Balance=P * /

You are free to use this image on your website, templates etc, Please provide us with an attribution linkHow to Provide Attribution?Article Link to be HyperlinkedFor eg:Source: Mortgage Formula

You May Like: Can You Get Preapproved For A Mortgage Without Hurting Your Credit

Can I Clear My Mortgage With Early Repayment

Paying off your mortgage early has the big advantages that you cut the total cost of your mortgage and own your own home sooner.

If your savings earn less interest than you pay on your mortgage, it makes financial sense to put that money towards your mortgage, while retaining some savings for emergencies.

However, do check your lenders rules about repayments, to avoid charges. Many lenders limit overpayments to up to 10% of the outstanding mortgage balance each year.

The disadvantage of mortgage early repayment is that you cant use the money for something else such as clearing more expensive debts, or ploughing into investments and pensions.

It can also be hard to get money out again, unless you go to the time, trouble and expense of remortgaging or selling the property.

If you are wondering whether you should pay off your mortgage early or invest the money instead check out our article here.

Don’t Miss: How To Find An Old Mortgage Account Number

Should I Choose A Long Or Short Loan Term

It depends on your budget and goals. A shorter term will allow you to pay off the loan quicker, pay less interest and build equity faster, but youll have a higher monthly payment. A longer term will have a lower monthly payment because youll pay off the loan over a longer period of time. However, youll pay more in interest.

How Much Is The Mortgage Payment On

We calculated mortgage payments for the following home prices using a 10% down payment and a 5% fixed interest rate . Sample payments include principal and interest only.

$100,000 house $520/month$400,000 house $2,090/month$500,000 house $2,600/month

Your own monthly mortgage payment will probably be different than the examples shown above. Thats because monthly payments depend on your exact interest rate, down payment, and more. But you can use these samples as a point of reference to see how payments compare for various loan sizes.

Also Check: Can You Get A Mortgage With No Job

How Does A Mortgage Payment Calculator Work

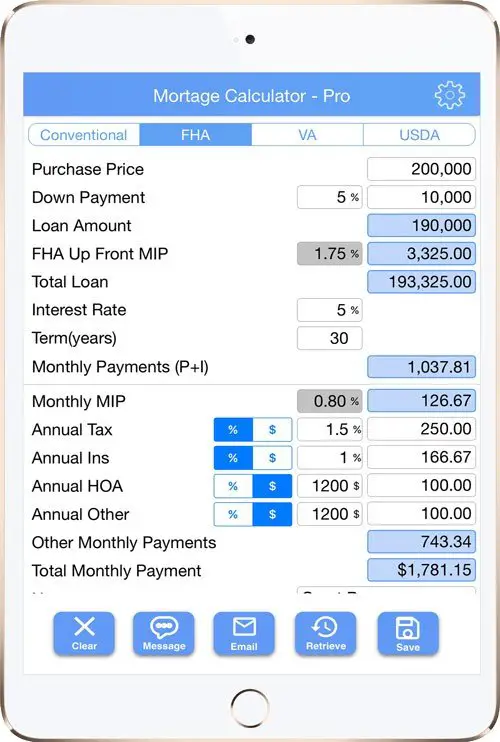

Our mortgage payment calculator estimates your total monthly mortgage payment, including: Principal, Interest, Property taxes, Homeowners insurance, and HOA dues, if applicable.

Mortgage calculators determine your monthly principal and interest based on your loan amount, loan term, down payment, and interest rate. These factors are used to make a payment schedule. It shows how the loan amount will deplete over the course of your mortgage, with regular monthly payments.

In addition, The Mortgage Reports uses national and state databases to estimate your monthly payments for taxes and insurance. Actual numbers will vary. But its important to include these costs in your estimate, as they can add a few hundred dollars per month to your mortgage payment.

Ontario Mortgage Regulations Taxes And Fees

Most taxes and fees are set at the provincial, or even municipal level. In Ontario, purchasers are responsible for obtaining Ontario mortgage rates, paying the provincial sales tax for CMHC insurance, and covering Ontario land transfer taxes.

For those purchasing in Toronto, a second set of municipal land transfer taxes apply in addition to the state tax, as well as an overseas speculation levy for properties in the Golden Horseshoe.

Don’t Miss: How Often Do Fico Mortgage Scores Update

Calculate The Monthly Interest Rate

The interest rate is essentially the fee a bank charges you to borrow money, expressed as a percentage. Typically, a buyer with a high , high down payment, and low debt-to-income ratio will secure a lower interest rate the risk of loaning that person money is lower than it would be for someone with a less stable financial situation.

Lenders provide an annual interest rate for mortgages. If you want to do the monthly mortgage payment calculation by hand, you’ll need the monthly interest rate just divide the annual interest rate by 12 . For example, if the annual interest rate is 4%, the monthly interest rate would be 0.33% .

What Is An Interest

An interest-only mortgage is a home loan that allows you to only pay the interest for the first several years you have the mortgage. After that period, you’ll need to pay principal and interest, which means your payments will be significantly higher. You can make principal payments during the interest-only period, but you’re not required to.

Recommended Reading: What Is Mortgage Insurance Based On

Comparing Common Loan Types

NerdWallets mortgage payment calculator makes it easy to compare common loan types to see how each type of loan affects your monthly payment. We source the latest weekly national average interest rate from Zillow, so you can accurately estimate and compare your monthly payment for a 30-year fixed, 15-year fixed, and 5/1 ARM.

To pick the right mortgage, you should consider the following:

How long do you plan to stay in your home?

How much financial risk can you accept?

How much money do you need?

15- or 30-year fixed rate loan: If youre settled in your career, have a growing family and are ready to set down some roots, this might be your best bet because the interest rate on a fixed-rate loan never changes.

In general, for a 30-year fixed loan, you will have the lowest monthly payment but the highest interest rate. However, with a 15-year fixed, youll have a higher payment, but will pay less interest and build equity and pay off the loan faster.

If other fees are rolled into your monthly mortgage payment, such as annual property taxes or homeowners association dues, there may be some fluctuation over time.

5/1 ARM and adjustable-rate mortgages: These most often appeal to younger, more mobile buyers who plan to stay in their homes for just a few years or refinance when the teaser rate is about to end.

What Would You Like To Do

Your approximate payment is $*.

|

Mortgage default insurance protects your lender if you can’t repay your mortgage loan. You need this insurance if you have a high-ratio mortgage, and its typically added to your mortgage principal. A mortgage is high-ratio when your down payment is less than 20% of the property value. Close. |

|---|

You May Like: How Do Mortgage Payments Work

Add All Fixed Costs And Variables To Get Your Monthly Amount

Figuring out whether you can afford to buy a home requires a lot more than finding a home in a certain price range. Unless you have a very generous and wealthy relative who’s willing to give you the full price of your home and let you pay it back without interest, you can’t just divide the cost of your home by the number of months you plan to pay it back and get your loan payment. Interest can add tens of thousands of dollars to the total cost you repay, and in the early years of your loan, the majority of your payment will be interest.

Many other variables can influence your monthly mortgage payment, including the length of your loan, your local property tax rate and whether you have to pay private mortgage insurance. Here is a complete list of items that can influence how much your monthly mortgage payments will be:

Calculate Your Monthly Payment

Use our free mortgage payment calculator to find out how much you’ll pay each month:

Mortgage Calculator

- Paying a 25% higher down payment would save you $8,916.08 on interest charges

- Lowering the interest rate by 1% would save you $51,562.03

- Paying an additional $500 each month would reduce the loan length by 146 months

If you want to do the math by hand, you can calculate your monthly mortgage payment, not including taxes and insurance, using the following equation:

M = P /

P = principal loan amount

i = monthly interest rate

n = number of months required to repay the loan

Once you calculate M , you can add in the monthly property tax and homeowners insurance premium, if you have them. These are fixed costs that aren’t determined by how much you borrow from the bank, so they can easily be added to the monthly cost.

Don’t Miss: How Long Is A Mortgage Rate Lock Good For

How Can I Get Assistance Buying A Home

There are quite a few opportunities to get financial assistance with buying a home. If its your first time or if you havent owned a home in the last three years start by exploring the first-time homebuyer loans and programs that cater to your state or city. There are also grant programs, many of which are tailored to help low- and moderate-income borrowers with money that does not have to be paid back. Additionally, you might be able to get assistance based on your line of work. For example, teachers and emergency service workers, like police officers and firefighters, can qualify for the Good Neighbor Next Door program, which lets qualifying individuals buy HUD-approved properties for 50 percent off their purchase price.

Recommended Reading: How Much Will A Mortgage Lender Lend Me

Understanding Your Mortgage Payment

Monthly mortgage payment = Principal + Interest + Escrow Account Payment

Escrow account = Homeowners Insurance + Property Taxes + PMI

The lump sum due each month to your mortgage lender breaks down into several different items. Most homebuyers have an escrow account, which is the account your lender uses to pay your property tax bill and homeowners insurance. That means the bill you receive each month for your mortgage includes not only the principal and interest payment , but also property taxes, home insurance and, in some cases, private mortgage insurance.

Don’t Miss: How Long Does Mortgage Underwriting Take

How Do You Calculate A Loan Payment

The first step to calculating your monthly payment actually involves no math at all its identifying your loan type, which will determine your loan payment schedule. Are you taking out an interest-only loan or an amortized loan? Once you know, youll then be able to figure out the types of loan payment calculations youll need to make.

With interest-only loan options, you only pay interest for the first few years, and nothing on the principal balance the loan itself. While this does mean a smaller monthly payment, eventually youll be required to pay off the full loan in a lump sum or with a higher monthly payment. Most people choose these types of loan options for their mortgage to buy a more expensive property, have more cash flexibility, and to keep overall costs low if finances are tight.

The other kind of loan is an amortized loan. These loan options include both the interest and principal balance over a set length of time . In other words, an amortized loan term requires the borrower to make scheduled, periodic payments that are applied to both the principal and the interest. Any extra payments made on this loan will go toward the principal balance. Good examples of an amortized loan are an auto loan, a personal loan, a student loan, and a traditional fixed-rate mortgage.

Read Also: Rocket Mortgage Requirements

New Mortgages Interest Only Mortgages And Interest Rate Rises

Itll give you a simple, ballpark figure to show you the monthly payments youd pay on:

- new mortgages

- intertest only mortgages

- your mortgage if there was an interest rate rise.

You can also adjust the mortgage term, interest rate and deposit to get an idea of how those affect your monthly payments.

To get started all you need is the price of your property, or the amount left on your mortgage.

MoneyHelper is the new, easy way to get clear, free, impartial help for all your money and pension choices. Whatever your circumstances or plans, move forward with MoneyHelper.

Read Also: Can I Get A Mortgage Loan After Chapter 7

How Much Mortgage Can You Afford

There are many rules of thumb for mortgage affordability. A mortgage lender might determine a home loan is affordable if your debt-to-income ratio is 43% or lower. Others set the maximum DTI at 36% or 50%. But affordability is a personal decision. How much are you comfortable spending on a mortgage? Lenders dont consider your goals, family plans or lifestyle when evaluating your loan application.

How To Account For Closing Costs

Once you’ve calculated the total principal and interest expense on your mortgage, factoring in closing costs or fees will be straightforward. Since closing costs are paid in full when you close on the loan, you can simply add them to your overall loan cost without using any long formulas. Some examples of upfront closing costs include the following:

- Mortgage lender fees

- Third-party mortgage fees

- Prepaid mortgage costs

While there may be other categories of upfront fees, the process for calculating them remains the same: Just add them to the total cost of the mortgage loan. Keep in mind that this will exclude any added monthly expenses paid in escrow, like taxes or homeowner’s insurance. Our next section explains how to factor in monthly expenses.

You May Like: What Is A Good Tip On A Mortgage

Using An Online Calculator

You can find online mortgage calculators to determine all these values on numerous financial news and information sites, as well as through some lenders. If you prefer not to type your information into a website, you can also find templates for Microsoft Excel and other spreadsheets to do the job for you.

How A Larger Down Payment Impacts Monthly Payments*

| Percentage | |

|---|---|

| $200,000 | $1,005 |

*The payment is principal and interest only. To get the total monthly payment for down payments below 20%, add in your property taxes, homeowners insurance and private mortgage insurance .

In general, most homebuyers should aim to have 20% of their desired home price saved before applying for a mortgage. Being able to make a sizeable down payment improves your chances of qualifying for the best mortgage rates. Your credit score and income are two additional factors that play a role in determining your mortgage rate and, therefore, your payments over time.

You May Like: Can You Roll Student Loan Debt Into A Mortgage

Getting Started With Calculating Your Mortgage

People tend to focus on the monthly payment, but there are other important features you can use to analyze your mortgage, such as:

- Comparing the monthly payment for several different home loans

- Figuring how much you pay in interest monthly and over the life of the loan

- Tallying how much you actually pay off over the life of the loan versus the principal borrowed, to see how much you actually paid extra

Use the mortgage calculator below to get a sense of what your monthly mortgage payment could end up being,