Why Are Tiny Houses Illegal

In some states tiny houses are not legal. This is primarily due to local building codes. However, there are plenty of states that tiny houses are legal in. States that allow tiny houses may still have restrictions. Its important to contact the local building office to find out specific regulations and guidelines for the area of interest.

Build It Yourself Or Buy Pre

You might be able to cut your up-front costs significantly by buying a tiny house plan and building the house yourself. Youll need to be confident about your construction skills and have hundreds of hours of spare time. Tumbleweed Tiny Homes offers customizable plans for nine models designed to be on foundations. In addition, Tumbleweed shares 3D tours on the website.

The biggest costs of DIY, besides your time, are materials and tools. According to Tiny Home Builders, you can expect to spend a minimum of $18,000 and $25,000 in materials alone.

You could also buy a pre-owned tiny home and search for listings online. One place to find listings for existing tiny homes is TinyHouseListings.com. As of Nov. 28, 2021, there were approximately 261 tiny houses $30,000 or less located around the United States.

Getting Financing For A Tiny House

Tiny houses show every sign of becoming the next big thing. Unfortunately, they also present some big challenges – such as how to obtain financing.

Unfortunately, it’s very difficult to get a mortgage for a tiny house – at least presently. However, there are a number of other financing options available that you can use to either buy or build your own tiny home – and the demand is rising.

“It’s sort of become somewhat of a phenomenon in the last 6-12 months,” said Todd Nelson, a business officer with Lightstream, the online consumer lending division of SunTrust Bank. “It’s something I hadn’t heard of a year ago and now we’re getting dozens of inquiries a week for these things.”

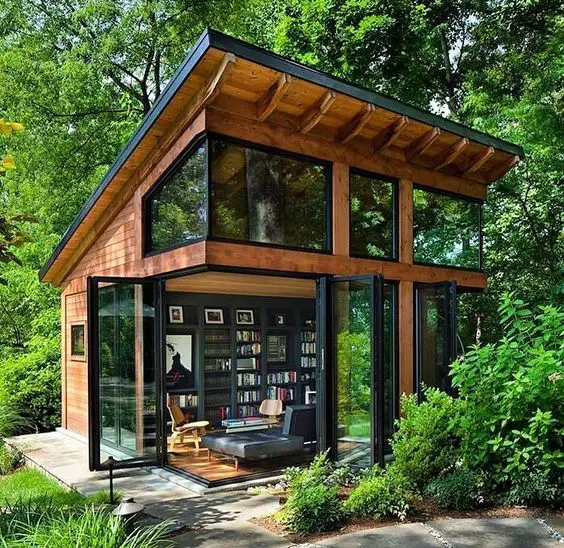

Tiny houses, if you’re not familiar with the trend, are exactly what they sound like. They fit an entire living space – bed, bathroom, kitchen and living room/sitting area – into a footprint that’s often no larger than that of a storage shed. There’s no fixed definition, but a commonly used standard is a dwelling of no more than 400 square feet.

The designs are often quite creative and stylish, like something out of a fairy tale. Naturally, they make highly efficient use of space and commonly offer features such as lofts, foldout beds, and the like.

Recommended Reading: How Long Does Refinancing A Mortgage Take

Building Vs Buying: Considering Your Options And Its Effects On Tiny

Much of the tiny-house movements appeal is the DIY approach to how you live your life, when you retire and what you consume. The best-case financing scenario for a tiny home is to pay entirely with cash. Instead of saving $10,000 $20,000 for a down payment on a 30-year fixed mortgage, you can use those funds to pay for materials to build out your own tiny home. Its the ultimate sweat equity building fairy tale, but its doable, especially if you have construction skills.

Another great scenario is finding a home already constructed in an area with recent sales of other tiny homes built on permanent foundations. If thats the case, you may be able to use a traditional mortgage lender for financing.

If thats not feasible, another option is a credit card. Even with introductory rates, at some point youre most likely going to be paying high interest rates, somewhere around 15.99% 25.99%. Some people enter the tiny-home life entirely on good credit and view their monthly credit card payments as tantamount to a mortgage payment.

Before you go this route, it may be best to look into personal loans, because the interest rate will be better. Our friends at Rocket LoansSM may be able to help you with a loan to finance your tiny-home dream.

With A Good Credit Score You Might Find It Easier To Get A Loan For A Tiny House

Financing a tiny house, getting a secured loan requires excellent credit, 670 or better, and obtaining an unsecured loan requires 580 credit or better. Your interest rate will be lower if you have a good credit history. One of the cheapest options is to save up and buy a tiny house with cash. Aside from the mainstream lenders, some niche lenders specialize in personal lending loans for tiny homes.

Recommended Reading: What Kind Of Mortgage Loans Are There

Ongoing Costs And Incidentals

Heating and cooling bills will be significantly lower than for a traditional home since you’re changing the temperature of a much smaller space. Consider the tiny home’s insulation before you buy or build a well-insulated home will be more comfortable and cost less to heat and cool. Electricity will also cost less since tiny homes don’t have the space for tons of energy-hogging appliances.

You won’t have the enormous property tax bills that come with traditional homeownership. Still, if you live in a state with personal property taxes, you’ll likely pay an annual personal property tax on your tiny house as an RV or trailer. You may be able to deduct the personal property tax on your federal tax return if you itemize your deductions. But without the massive expense of mortgage interest, you might not have enough deductions to come out ahead from itemizing and end up taking the standard deduction.

A couple of other costs some tiny-home owners find themselves with are fines for violating local housing and zoning laws and monthly storage-space rental for excess personal belongings. Additionally, even if the house is smaller, it’s no less essential to insure it. As such, it’s worth considering one of the best tiny house insurance policies currently available.

How Long Can You Finance A Tiny Home

If you use a personal loan for tiny house financing, you may be able to secure terms up to 12 years. Most lenders offer terms based on the loan amount. For example, if you want to get a $5,000 personal loan, you probably wont qualify for a 12-year term. However, if you borrow $40,000 or seek a $50,000 personal loan, you may qualify for a long-term personal loan.

You May Like: What Is Veterans Mortgage Relief Program

Can You Move Your Tiny Home

Lets say youre living in your tiny home, financed with the best-case option for your circumstances but a couple of years down the road, you decide you want to move or your employer wants to relocate you. Well, youre on wheels, so it shouldnt matter, right?

Unfortunately, it does. If its a domestic move, the American Tiny House Association has pulled together a state-by-state directory of tiny-home rules and regulations. Every municipality, town and state can have different laws and codes. Essentially, theres no national policy.

For instance, in most counties across the U.S., county-wide building restrictions say you must build homes over 1,000 square feet, unless youre somewhere like Park County, Colorado that has a building code variance.

Both Home Equity Lines Of Credit And Home Equity Loans Can Be Helpful If You Are Interested In Purchasing A New Tiny House

Financing a tiny house, financing terms will differ if you choose a home equity loan or a home equity line of credit. You may be able to tap your home equity to build a tiny house if you already own a house. Using your primary residence as a security for your home equity loan or HELOC instead of the tiny house is a great idea. As a result, if you have trouble repaying the loan, your main home could be seized to satisfy the debt.

Be aware that you may only be able to borrow a certain amount. The repayment terms of home equity loans, for instance, are typically between five to 30 years. You must be careful before selecting a tiny house financing option based on your financial situation. But, terms and conditions apply on HELOCs, since they are real estate secured loans, you may need to have an existing building with a foundation.

You May Like: What Is The Mortgage On A 3 Million Dollar Home

The $100000 Tiny Mortgage

As tiny houses grow, their costs also increase. Its entirely possible to have a tiny house with land and a foundation as well as a $100,000-plus price tag. For example, a 750 sq. ft. house priced at $134 a square foot means the cost is $100,500. In this situation, owners may want to look at FHA financing, a VA mortgage or conventional loan.

Are there any special problems when financing tiny houses?

How your loan size affects your mortgage rate: and what to do about it

All real estate must meet certain standards to get a mortgage. The property must be seen as real estate with a recorded title and plat. If there are no property taxes its not real estate. It must meet zoning requirements and it must be built to building code standards thus the importance of the IRC recognition.

If youre buying a manufactured home then the builder or developer might provide financing. But, as always, shop around for mortgage rates and terms.

How Do I Use The Equity In My Section To Purchase A Tiny House

Banks will typically lend up to 80% of the value of a section that has utilities attached to it. So if you own a section that is valued at $500,000 but only owe $300,000 , you could borrow another $100,000 and purchase a tiny home. The banks would find this acceptable because even if you removed the tiny home, you would still only owe 80% of the remaining section.

Read Also: How Fast Can I Get A Mortgage Approved

Pros And Cons Of Tiny Living

Downsizing to a tiny home presents many opportunities to save money and reduce clutter, but the move also means losing space and privacy. The cost to build a tiny home can add up quickly, especially if you need land to build on, but it may still be less expensive than a traditional home.

| Pros | |

|---|---|

|

Freedom to travel |

Tiny home regulations and laws vary widely Generally not eligible for a traditional mortgage May not have room for guests Some RV parks dont allow them Lack of space and privacy (especially for families Land to build on can be expensive |

If You Can Get A Mortgage Should You

Just because its possible to get a mortgage for a tiny home, that doesnt mean you should.

Although mortgages do offer longer repayment terms than other financing options and lower interest rates, they will take away some of the main benefits of living the tiny lifestyle. This includes the freedom to take the house with you wherever you want, and the potential to get a property at a dirt-cheap price.

So, if those two factors are the main reason youre looking into tiny homes, you may want to look into other financing options that are more flexible, and less of a headache to secure.

Read Also: How To Sell A Mobile Home With A Mortgage

Your Communitys Zoning Laws

In a nutshell, zoning laws regulate how land is used and developed in a certain area or community. Zoning laws also dictate the minimum square footage or size that a property must have for it to be placed on a certain plot of land.

For a mortgage lender to approve you for the loan, your tiny house must be in compliance with your intended neighborhoods zoning laws.

How Many Years Can You Finance A Tiny Home

The length of your loan term usually depends on the type of loan you use. If you use a personal loan you may find loan terms up to 12 years. However, if you use a secured loan you may find terms up to 30 years. The terms available can also depend on the amount you borrow and what you qualify for. While you may be searching for the longest term available, you should keep in mind that longer terms may equal higher total loan costs. For example, lets say you are offered a seven year personal loan at 8.99% for $25,000. In this scenario, you would pay close to $8,800 in interest after 84 payments. Compare this to a ten year personal loan offer at 7.99% for $25,000. In this scenario, you would pay close to $11,400 in interest after 120 payments. Although the interest rate and monthly payment are lower in the second scenario, the total loan cost is higher.

You May Like: How Low Are Mortgage Rates

Parking Wheeled Models Can Also Be Expensive

Just because your house has wheels doesnt mean you can park it anywhere you want.

One of the most common places you can park your tiny home is at an RV park, which also comes at a cost. Weismann points out the issues here:

The lowest Ive seen for RV parks is probably $350 a month and thats going to be in a very remote area, which isnt so bad. The problem, however, comes if you choose a park thats close to the city or another urban area. Those can be as high as $1,000 a month.

But Mortgage Lenders Not Necessarily On The Bandwagon

Lenders, being cautious, have not been thrilled with the tiny house movement. They see several problems.

- In many areas, there is a minimum home size. Houses which are too small are not allowed. Zoning laws often prohibit houses which do not meet a certain size requirement.

- Not all tiny houses are real estate. If its on wheels its personal property. Theres a difference between financing real estate and personal property such as a mobile home.

- Tiny houses generally mean small mortgages. Since lenders have built-in fixed costs small mortgages are often unattractive to them and costly to borrowers.

Now, however, things are changing.

In New Hampshire, for example, you can have an accessory dwelling unit on a property. It cant be more than 750 sq. ft., but thats enough for a residential unit with a bathroom and kitchen and much bigger than a lot of tiny houses. Because this is a state-wide measure it has precedence over local rules. In addition, efforts are underway in a number of states to enact legislation broadly allowing tiny houses.

Whether you want to live in someones backyard, or off the grid, there is the matter of financing.

How can you get a mortgage to pay for tiny houses?

Also Check: What Is The Average Cost Of A Mortgage Refinance

Can I Finance A Tiny Home With Bad Credit

While you may qualify for some lenders with bad credit, you should expect high interest rates. In addition, lenders may charge high origination fees. In some cases, an individual may want to convert to tiny home living to save money, pay off debt, and rebuild their credit. Although tiny homes are cheaper than traditional homes, you may still need financing to purchase one. If you have bad credit you should consider renting a tiny home or saving up enough cash to purchase one outright.Another option you may have is to apply for a personal loan with a cosigner. Applying for a personal loan with a cosigner may increase your chance of approval. In addition, you may qualify for a lower interest rate. Ideally, a cosigner should have good credit and solid income. If a cosigner has similar or worse credit than yourself, they may not increase your chance of approval. When you sign into a loan with a cosigner, you are equally responsible for repayment. If you do not have a willing cosigner, you may need to rebuild your credit before applying for tiny house financing.

Tiny Home Finance Gains Acceptance

We live in a world where most things are standardized. Milk is sold by the quart, plumbers get paid by the hour, and such things as single-family homes, townhouses, condo apartments, and properties with two-to-four units are financed and refinanced in huge numbers each year. In the housing mix we now have tiny houses, an ownership movement which has only emerged in the past few years.

Because tiny houses are new, different and small, lenders are not likely to be familiar with them. But this situation is now changing because the market for such properties is increasingly accepted.

You cannot occupy a structure without a Certificate of Occupancy. Until recently such certificates were entirely unavailable for small homes.

As evidence take a look at your local housing codes. In most cases, you cannot occupy a structure without a Certificate of Occupancy. Until recently such certificates were entirely unavailable for small homes. Now, however, the folks who write the rules, the International Code Council , has added small homes to International Residential Code . The result is that local governments are more open to tiny house approvals and the occupancy certificates they require.

Also Check: Can You Have Two Mortgage Loans

Resale Value Is Usually Low

One of the reasons many lenders are hesitant to finance tiny homes is because they have a low resale value. Since many tiny homes are built on wheels and have the capability to be moved, they depreciate in value similarly to cars or RVs. Like other vehicles, they are vulnerable to wear and tear associated with use over time. Besides depreciating in value, wear and tear that may require maintenance is another thing to consider when adding up the costs associated with buying a tiny home.