Making An Extra Mortgage Payment Each Year

- Some homeowners prefer to make an extra payment each year

- Perhaps related to a tax refund check or from a year-end bonus at work

- This is another good strategy to cut your mortgage term and save lots of money

- And ensure that the bonus money you receive is put to good use as opposed to spent frivolously

You could also make one extra lump sum payment at the beginning of each year, perhaps after receiving your year-end bonus.

So lets say you make a $1,000 bonus payment each year in January, starting in month 13.

That would save you $19,005.22 in interest and shave 85 months off your loan term.

As you can see, there are all types of scenarios that abound here, and which one you choose, if any, is up to you.

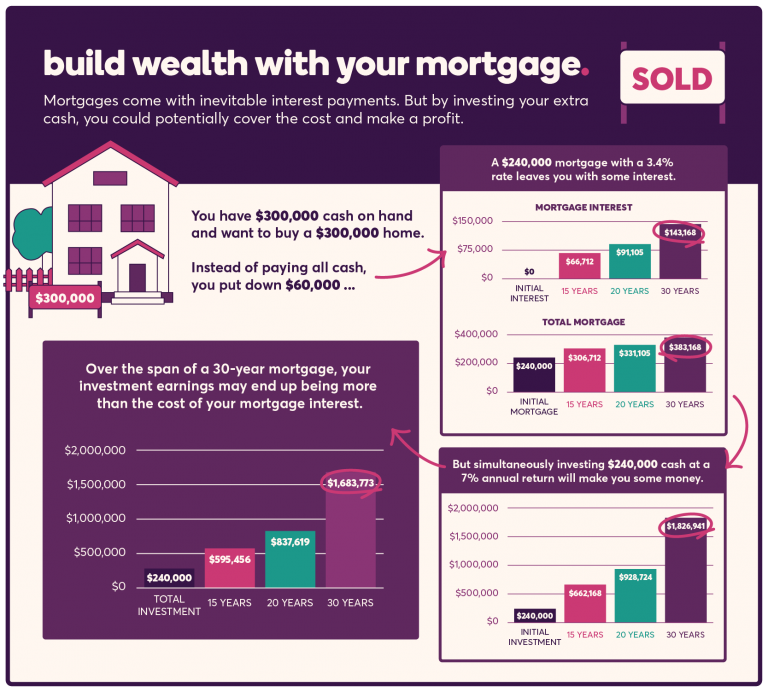

You might argue that mortgage rates are super cheap, and thus determine that making extra payments now makes little financial sense.

Or you could be living in your dream home and not too far from retirement, with the hopes of living free and clear sooner rather than later.

If thats the case, making the extra payments now may be very appealing. Refinancing your mortgage to a shorter term could also make a lot of sense.

Just remember that plans change homeowners are much more likely to move or refinance their loans as opposed to carrying them to term.

So while the math might excite you, it may not actually pan out.

Lower Down Payments Make The Loan More Expensive

The downside of putting less than 20% toward the purchase is that youll have to pay for private mortgage insurance or PMI, which may add more than $100 a month to your payment. You can see what your lender expects to charge for PMI when you receive the Loan Estimate disclosure form the lender is required to send you when you apply for financing.

Federal law requires lenders or mortgage servicers to automatically remove PMI when your principal balance is scheduled to reach 78% of the original value of your home, or when you reach the halfway point in your mortgage payment schedule provided in both scenarios that youre current on your payments and havent missed any.

The law also gives you the right to ask your lender to remove PMI once the principal balance of your mortgage is scheduled to fall to 80% of the original value of your home.

You may also be able to remove PMI by refinancing your loan to reach an 80% principal loan balance, however, refinancing does not always save you money in the long run depending on your lenders refinancing fees and costs. Lenders have their own requirements regarding PMI and loan refinancing, so make sure youre clear what those are.

The other thing to consider is the cost of interest. The more you put down, the less interest youll pay over the course of the loan. The lender also is required to provide you with that information on the Loan Estimate disclosure form when you apply for financing.

Extra Mortgage Payments Are More Valuable Early On

- You get more value out of extra mortgage payments early on in the loan term

- Because the outstanding balance is larger at the outset

- And early payments are composed mostly of interest

- Any extra payments will lower future interest for the remaining months, which will be more plentiful if you make them during the early years

As you can see, its not that hard to save a ton of money via extra mortgage payments, but it also matters when you start making those additional payments.

Using our $100 example, if you started making extra payments in year six of your 30-year mortgage , youd only save $15,095.21, and shed just 78 months off your mortgage.

Even if you procrastinated for just one year to initiate the extra $100 payment, your total savings would drop to $20,989.55, and only eight years would come off your mortgage term.

In short, the earlier you start making extra payments, the more youll save. This is mainly because mortgage payments are interest-heavy in the beginning of the term.

Also Check: Does Rocket Mortgage Offer Usda Loans

When You Should Make Extra Mortgage Payments

â Youâre in a solid financial position

You have an emergency fund, youâre saving for retirement, you and your family are properly insured, you donât have high-interest debts, and your income is stable. Only when your finances are rock-solid does it make sense to add an extra mortgage payment.

â You want to reduce your expenses

Paying your mortgage early frees up your income and allows you to focus on other goals. For example, if youâre planning on retiring soon, cutting out your monthly mortgage payment will drastically reduce your retirement expenses, helping you live longer on your savings.

How Mortgage Loan Amortization Works

Most mortgage loans are fully amortized. That means theyre paid off in monthly installments over a set period of time. At the end of that period, the loan balance reaches $0.

Loan amortization is the process of calculating the loan payments that amortize meaning pay off the loan amount, explains Robert Johnson, professor of finance at Heider College of Business, Creighton University.

On a fully amortizing loan, the loan payments are determined such that, after the last payment is made, there is no loan balance outstanding, Johnson explains.

If you have a fixed-rate mortgage, which most homeowners do, then your monthly mortgage payments always stay the same. But the breakdown of each payment how much goes toward loan principal vs. interest changes over time.

As a result, each payment has a different impact on your mortgage balance.

You May Like: How Much Would 200k Mortgage Cost

When To Pay Your Mortgage Early

Knowing when to make an early mortgage payment in order to benefit your taxes is going to depend on your individual situation. For example, if you had or expect a large change in your income from one year to the next, that would be a reason to choose to pull the savings into this year, or to defer it to next year.

If your loan payment includes monthly mortgage insurance, then your savings will be even greater because mortgage insurance is also tax deductible. Of course, if you do this strategy now, you will have less of a deduction for the next year. Conventional wisdom, considering the time value of money, says to take savings now rather than later, if all other factors are equal. But consider the possibility both ways.

How Much Can I Save By Prepaying My Mortgage

The benefit of paying additional principal on a mortgage isnt just in reducing the monthly interest expense a tiny bit at a time. It comes from paying down your outstanding loan balance with additional mortgage principal payments, which slashes the total interest youll owe over the life of the loan.

Heres an example of how prepaying saves money and time: Kaylyn takes out a $120,000 mortgage at a 4.5 percent interest rate. The monthly mortgage principal and interest total $608.02. Heres what happens when Kaylyn makes extra mortgage payments.

| Payment method | |

|---|---|

| $89,864 | $9,024 |

Bankrates mortgage amortization schedule calculator can help you determine the impact of extra payments on your mortgage. Click Show amortization schedule to reveal the section that allows you to calculate the effect of additional payments.

Use Bankrates mortgage payoff calculator to see how much interest you can save by increasing your mortgage payments.

You May Like: How Much Does It Cost To Assume A Mortgage

Other Ways To Use Your Extra Cash

Making a lump-sum mortgage payment isn’t your only option if you’re fortunate enough to have extra money. If you choose to pay down your mortgage, you will have opportunity coststhe value of what your money could have done if you hadnt used it to pay down your mortgage. Here are some of the other things you could do with that extra cash:

- Upgrade your home

Four Alternatives To Paying Extra Mortgage Principal

Before you begin making extra principal payments on your mortgage, its best to consider your overall financial goals. Consider how long you plan on living in the home. Assess any money that you can foresee needing in the future . And determine any current debts you are still paying on.

Assessing your current financial position and your future goals will help identify the ideal use for additional funds or maybe even prove that paying more on your mortgage is advantageous.

So, conversely, what are the alternatives , and what could the benefits be?

Also Check: Is Fico Score 8 Used For Mortgages

Should You Make An Extra Mortgage Payment

Even if youre excited to get a mortgage, you might also like the idea of owning a home free and clear. Hey, youre not alone. A 30-year mortgage can feel like foreverbut it doesnt have to.

What if you could pay off your mortgage early and keep your monthly payment roughly the same?

This might seem impossible, but the truth is, paying off your mortgage early is easier than many people think, thanks to the power of making an extra principal payment .

Now, an extra mortgage payment isnt going to lower your scheduled monthly payment. This will remain the same until you pay off the loan. It does, however, reduce the amount of interest you pay over the life of the loan.

Basically, your remaining loan balance determines the amount of interest owed. Since extra principal payments reduce your principal balance little-by-little, you end up owing less interest on the loan. And when you owe less interest, youre able to shave years off your mortgage term.

Lets say you have a $200,000 mortgage with a 30-year fixed rate of 3.9%. In this scenario, an extra principal payment of $100 per month can shorten your mortgage term by nearly 5 years, saving over $25,000 in interest payments.

If youre able to make $200 in extra principal payments each month, you could shorten your mortgage term by eight years and save over $43,000 in interest.

What Is Loan Amortization

Loan amortization is the reduction of debt by regular payments of principal and interest over a period of time. For example, if you make a monthly mortgage payment, a portion of that payment covers interest and a portion pays down your principal.

Typically, the majority of each payment at the beginning of the loan term pays for interest and a smaller amount pays down the principal balance. Assuming regular payments, more of each following payment pays down your principal. This reduction of debt over time is amortization.

Recommended Reading: Does Discover Bank Do Mortgages

Start Planning Your Early Mortgage Pay Off

The next step is planning how you intend to pay off your mortgage early. Mortgage calculators are an invaluable resource for visualizing a way forward. They can break down a clear path to follow and a realistic timeline. Call a nonprofit for guidance on approaching and planning your mortgage payoff. They offer free financial advice that will give you a clearer picture of where you stand, clarifying financial strengths and limitations. Consider a debt management plan if you need help understanding your debts and organizing your bills.

About The Author

How Can Making Extra Payments Help

When you make an extra payment or a payment that’s larger than the required payment, you can designate that the extra funds be applied to principal. Because interest is calculated against the principal balance, paying down the principal in less time on a fixed-rate loan reduces the interest youll pay. Even small additional principal payments can help.

Here are a few example scenarios with some estimated results for additional payments. Lets say you have a 30-year fixed-rate loan for $200,000, with an interest rate of 4%. If you make your regular payments, your monthly mortgage principal and interest payment will be $955 for the life of the loan, for a total of $343,739 . If you pay $100 extra each month towards principal, you can cut your loan term by more than 4.5 years and reduce the interest paid by more than $26,500. If you pay $200 extra a month towards principal, you can cut your loan term by more than 8 years and reduce the interest paid by more than $44,000.

Another way to pay down your loan in less time is to make half-monthly payments every 2 weeks, instead of 1 full monthly payment. When you split your payments like this, youre making the equivalent of 1 extra monthly payment a year . This extra payment may be applied directly to your principal balance. Be sure to first check with your lender if this is an option for your loan.

You May Like: What Is An Investment Mortgage

Exercising Additional Payment Options

When you sign on for a 30-year mortgage, you know you’re in it for the long haul. You might not even think about trying to pay off your mortgage early. After all, what’s the point? Unless you’re doubling up on your payments every month, you aren’t going to make a significant impact on your bottom line right? You’ll still be paying off your loan for decades right?

Not necessarily. Even making small extra payments over time can shave years off your loan and save you thousands of dollars in interest, depending on the terms of your loan.

When Recasting Makes Sense

If making a lump-sum mortgage payment is in the cards for you and you’re also trying to decide whether or not to recast your mortgage, heres how to tell if it might be a good option for you:

- You’re ahead on paying off your mortgage or will be soon.

- You’re OK with paying an administrative fee of $150 to $500.

- You’ve contacted your lender to see whether you qualify for a mortgage recast.

- You already have a lower interest rate than what you could get through a refinance.

- You want a smaller monthly payment, but you don’t want to refinance your mortgage.

Don’t Miss: What Is Home Mortgage Interest Rate

Why You Can Trust Bankrate

Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. Weve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next.

Bankrate follows a strict editorial policy, so you can trust that were putting your interests first. All of our content is authored by highly qualified professionals and edited by subject matter experts, who ensure everything we publish is objective, accurate and trustworthy.

Our mortgage reporters and editors focus on the points consumers care about most the latest rates, the best lenders, navigating the homebuying process, refinancing your mortgage and more so you can feel confident when you make decisions as a homebuyer and a homeowner.

Is There A Disadvantage To Paying Off A Mortgage

A: Paying your mortgage off early and closing out an account could impact your credit score. Mortgages are considered “good debt,” and paying it off extremely early could negatively affect your score. But, remember, you can alwaysrefinance to a shorter-termif you are determined to pay it off sooner. In addition, you could possibly get a lower interest rate in the process and be able to pay your loan off sooner.

Related Articles

Don’t Miss: What Is Current Commercial Mortgage Rate

Recasting Your Mortgage Might Not Be An Option

Before making a big one-off payment on your loan, ask your lender if they’re willing to recast your mortgage. The lender is not required to do this, and some loans arent eligible, so it might not be an option. Youll want to understand the process and whether this is possible before making any extra payments on your loan.

Choose Accelerated Weekly Or Accelerated Biweekly Payments

If you switch to an accelerated weekly payment schedule, you’ll increase your mortgage payments from 12 to 52 payments annually a payment every week instead of monthly, and one extra monthly payment every year.

If you switch to an accelerated biweekly payment schedule, youll increase your mortgage payments from 12 to 26 annually a payment every 2 weeks instead of monthly, and one extra monthly payment every year.

Recommended Reading: What Would Be The Mortgage Payment On 200 000

Benefits Of Paying Mortgage Off Early

Many people struggle when deciding whether to pay off their mortgage or build up savings, but in the long run, the benefits of getting free from that mortgage really shine through. For one, having one debt paid off means being able to handle any short-term debts such as credit cards. You also end up saving money if you pay off your mortgage earlier, avoiding additional interest that would have otherwise accrued. Your financial stability is bolstered by cutting out these future payments and also by your ability to better endure turbulent housing market conditions.1

Ways To Pay Off Your Mortgage Early

Okay, you probably already know that every dollar you add to your mortgage payment puts a bigger dent in your principal balance. And that means if you add just one extra payment per year, youll knock years off the term of your mortgageplus save thousands of dollars in interest.

To get serious about paying off your mortgage faster, here are some ideas to help:

Don’t Miss: How To Make Biweekly Payments On Your Mortgage

Amortization Affects Only Principal And Interest

Note that your amortization schedule affects only the principal and interest portion of your mortgage payment.

Regular payments include other homeownership costs, too, like homeowners insurance, property taxes, and if necessary, private mortgage insurance and/or homeowners association dues.

Payments for these other expenses will not change with your amortization schedule. However, they will change throughout the loan term. For example:

- Your property tax bill will change as your local government increases or decreases tax rates and as the tax value of your property changes

- Your homeowners insurance premium could change, especially if you decide to switch insurers

- Your mortgage insurance premiums should change each year as your total principal balance decreases. And if you have a conventional loan, you can cancel your private mortgage insurance completely once youve paid off 20 percent of the loan

- HOA dues can often increase, too, as HOA boards reevaluate fees each year

Mortgage lenders add these costs onto your principal and interest payments because lenders have a financial interest in keeping these bills paid.