How Much Of My Income Should Go Towards A Mortgage Payment

Most people dream of owning a home, whether its a small one in the city or a rural one with a huge property. However, affording a home is difficult and saving up enough money can be challenging. Obtaining a mortgage is a big step, and you likely have many questions. One important thing you will need to know is how much of a mortgage you can afford based on your income. You can use a few different guidelines to discover what percent of your net income should go toward mortgage payments each month.

Change Your Loan Term

Another option is to lengthen your loan term. By making the loan term longer, youre spreading your principal balance across a longer period of time, making monthly payments cheaper, even if it means paying more in interest over the lifetime of the loan.

Ready to buy a home and wondering how much your down payment will be?

Start by getting approved for a mortgage.

What Should I Do If The Lender Refuses To Give Me A Big Enough Mortgage

If various lenders reject your application, its a sign that they dont think you can afford such a big mortgage. Should this be the case, its best to scale down your aspirations rather than desperately search for the one lender that will say yes.

This may be frustrating, but its in your best interest to ensure that youre not financially overstretched because you dont want to have your home repossessed in the future.

Related guides

Don’t Miss: How To Get A Physician Mortgage

What Is The Required Debt

Online resource Investopiea.com explains that the lower an applicants debt-to-income ratio, the greater the chances that the borrower will be approved for a credit application.

As a customary rule, 43 percent is the highest debt-to-income read DTI ratio a borrower can have and still be qualified for a mortgage.

However, lenders prefer a debt-to-income ratio lower than 36 percent, with no more than 28 percent of that debt as a mortgage or rent payment.

In reality, though, the maximum DTI ratio varies from lender to lender.

You May Like: How Much Do You Pay Back On A Mortgage

How Much House Does Dave Ramsey Say I Can Afford

For decades, Dave Ramsey has told radio listeners to follow the 25% rule when buying a houseremember, that means never buying a house with a monthly payment thats more than 25% of your monthly take-home pay on a 15-year fixed-rate conventional mortgage.

At Ramsey Solutions, we also teach people they cant afford to buy a house until they:

- Are completely debt-free

- Have an emergency fund of 36 months of expenses

- Have a down payment of 20% or more

Why is all this important? Because when life happens, an unexpected expense or a job loss could crush someone financially if theyre also trying to get out of debt and pay a mortgage. We dont want that to happen to you.

Read Also: What Is The Difference Between Home Equity And Mortgage

How Much House Can I Afford With A Va Loan

With a military connection, you may qualify for a VA loan. Thats a big deal, because mortgages backed by the Department of Veterans Affairs typically dont require a down payment. The NerdWallet Home Affordability Calculator takes that major advantage into account when computing your personalized affordability factors.

Remember to select ‘Yes’ under ‘Loan details’ in the ‘Are you a veteran?’ box.

For more on the types of mortgage loans, see How to Choose the Best Mortgage.

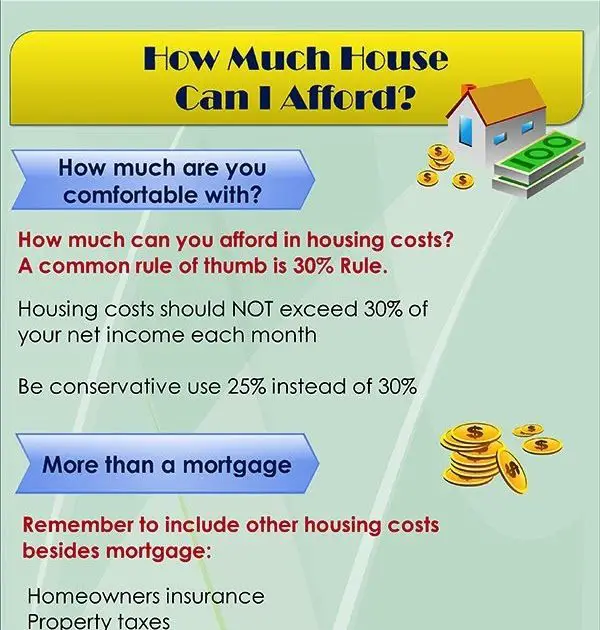

Try The 30% Rule First

If you have a high income or live in an affordable area. Try keeping your rent and utility costs below 30% of your take-home pay.

Following this guideline means you have more money to pay off debt and save for future expenses.

Renting instead of owning a home gives you the flexibility to move at short notice and not be responsible for property maintenance. But, youre also not building net worth through home equity once you pay off the mortgage.

Of course, you should choose an unsafe place to live to simply keep rent below 30% of your income.

Recommended Reading: What Caused The Subprime Mortgage Crisis

How Do I Budget For A House

The first step to budgeting for a house is to know how much down payment you need. Ideally, youll want to save a down payment of at least 20%. For first-time home buyers, a smaller down payment like 510% is okay toobut then youll have to pay PMI. Whatever you do, never buy a house with a monthly payment thats more than 25% of your monthly take-home pay on a 15-year fixed-rate mortgage . And stay away from expensive loans like FHA, VA and USDA.

After youve set your savings goal, here are some tips on how to save for a house: Pay off all your debt, tighten your spending, hold off on your retirement savings , start a side job, and sell stuff you dont need.

Lets say you want to buy a $200,000 house. Your down payment savings goal is $40,000 . To budget for this house in two years, youd need to set aside $1,700 each month .

Follow The 25 Percent Rule

Theres a straightforward way to make sure you can afford your mortgage while managing your other goals, according to Eve Kaplan, a certified financial planner in New Jersey. Housingincluding maintenanceideally shouldnt consume more than 25 percent of a household budget. This goes for folks who rent, too, Kaplan says.

Mortgage bankers would disagree. They use various calculations to figure out how much you can afford, and the amount is often much higher than financial planners recommend. A common measure that brokers use is the debt-to-income ratio , which, for a qualified mortgage, limits your total debt payments, including your mortgage, student loans, credit cards, and auto loans, to 43 percent.

Lets say you and your spouse make a combined annual income of $90,000, or about $5,600 per month after taxes. Based on your DTI and depending on your other debts, you could be approved for a mortgage of $600,000. That might sound exciting at first, but with a monthly payment of about $3,225, it would eat up more than half your take-home pay.

Following Kaplans 25 percent rule, a more reasonable housing budget would be $1,400 per month. So taking into account homeowners insurance and property taxes, youd be better off sticking to a mortgage of $240,000 or less. If you have enough for a 20 percent down payment, the maximum house you can afford is $300,000.

Don’t Miss: How Much Monthly Payment On 200 000 Mortgage

Conventional Loans And The 28/36 Rule

In the U.S., a conventional loan is a mortgage that is not insured by the federal government directly and generally refers to a mortgage loan that follows the guidelines of government-sponsored enterprises like Fannie Mae or Freddie Mac. Conventional loans may be either conforming or non-conforming. Conforming loans are bought by housing agencies such as Freddie Mac and Fannie Mae and follow their terms and conditions. Non-conforming loans are any loans not bought by these housing agencies that don’t follow the terms and conditions laid out by these agencies, but are generally still considered conventional loans.

The 28/36 Rule is a commonly accepted guideline used in the U.S. and Canada to determine each household’s risk for conventional loans. It states that a household should spend no more than 28% of its gross monthly income on the front-end debt and no more than 36% of its gross monthly income on the back-end debt. The 28/36 Rule is a qualification requirement for conforming conventional loans.

While it has been adopted as one of the most widely-used methods of determining the risk associated with a borrower, as Shiller documents in his critically-acclaimed book Irrational Exuberance, the 28/36 Rule is often dismissed by lenders under heavy stress in competitive lending markets. Because it is so leniently enforced, certain lenders can sometimes lend to risky borrowers who may not actually qualify based on the 28/36 Rule.

What Proportion Of Net Income Should I Spend On My Mortgage

Q I’m interested to know what the recommendations are regarding what proportion of our net monthly income should be going on mortgage payments. We’re currently on a very low rate , but we are looking to move to the south east and increase the mortgage.

Based on the amount we’re looking to borrow I’ve calculated monthly repayments at 5% to make sure they’re still affordable, as interest rates can really only go in one direction now, but not sure if I’m still being over-cautious. SH

A There’s nothing wrong with being over-cautious. Making sure that you’ll be able to afford your mortgage if interest rates rise is precisely what the Financial Services Authority would like lenders to do when assessing mortgage affordability. The FSA is worried that current low mortgage rates are disguising the full impact of unaffordable lending and the true extent of consumers’ vulnerability to a rise in interest rates.

As to what proportion of your income should go on mortgage payments, there seems to be a general view that if you spend more than half your income on servicing debt of all types not just mortgage you are heading for trouble. Some experts suggest that the total amount you pay towards your mortgage should not exceed 28% of your gross income. And you should make sure that you don’t go over 36% of gross income for the total amount you spend on all borrowing, including mortgage.

Don’t Miss: Is It A Good Idea To Pay Off Your Mortgage

Know How Much Home You Can Afford

Before you even start looking for a home, you need to know how much you can afford so you donât spend time looking at homes that are out of your price range. When you do that, it’s hard not to feel let down later when you view lower priced homes.

To get an idea of what you can afford, you’ll need to keep these things in mind:

- Your household income

- Your current debts and the monthly payments to carry those debts

- Your monthly housing-related costs, like your mortgage payment, property taxes, home insurance, condo fees, school taxes, utilities and home care costs

- Your closing costs and other one-time costs

- Your spending habits

How The Loan You Choose Can Affect Affordability

The loan you choose can also affect how much home you can afford:

- FHA loan. Youll have the added expense of up-front mortgage insurance and monthly mortgage insurance premiums.

- VA loan. You wont have to put anything down and you wont have to pay for mortgage insurance, but you will have to pay a funding fee.

- Conventional loan. If you put down less than 20%, private mortgage insurance will take up part of your monthly budget.

- USDA loan. Both the upfront fee and the annual fee will detract from how much home you can afford.

Don’t Miss: What Are Adjustable Rate Mortgages Based On

What Is A Good Income To Buy A House

Once again, the answer to this question will depend on where you want to buy and what kind of property you want. Your credit score and DTI will also be important factors in determining what interest rate and loan terms you get from the lender.

The higher your credit score, the better the interest rate you are offered therefore, you might be able to own a higher priced home than someone with a low credit score.

How Lenders Decide How Much You Can Afford

Lenders use a few different factors to see how much home you can afford. They use your debt-to-income ratio, or DTI, to make sure you can comfortably pay your mortgage as well as your other debt. This includes credit cards, car loans, student loan payments and more.

You can calculate your DTI ratio by adding up all your debt payments and dividing it by your gross monthly income. Say your monthly income is $7,000, your car payment is $400, your student loans are $200, your credit card payment is $500 and your current home payment is $1,700. All that together is $2,800. So, your DTI ratio is 40% since $2,800 is 40% of $7,000.

In general, a good DTI to aim for is between 36% and 43%. Some lenders will go higher, but the lower your DTI, the more likely you are to be pre-approved for a mortgage. Different lenders have different DTI requirements, though, so compare multiple mortgage lenders to find one that works for you.

Recommended Reading: Can A Cosigner Be Removed From A Mortgage

How Much House Can I Afford With A Usda Loan

USDA loans for qualifying rural areas are much more flexible than regular loans. They dont require a down payment and can include the mortgage insurance fee in the loan. This means you can actually finance 102% of the value of the house and avoid paying this fee upfront.

Keep in mind, however, that there are parameters for income eligibility and for the price and size of the house itself. Even if you can afford a certain amount, the eligibility might be for a less expensive home.

In order to see these requirements in detail, you can go to the USDA website and look at the qualifying areas and income by county.

Come Up With An Initial Estimate

Using a factor of your household income, you can quickly come up with an initial estimate for how much house you may be able to afford. The total house value should generally be no more than 3 to 5 times your total household income, depending on how much debt you currently have.

- If you are completely debt-free, congratulationsyou can consider houses that are up to 5 times your total household income.

- If less than 20% of your income goes to pay down debt, a home that is around 4 times your income may be suitable.

- If more than 20% of your monthly income goes to pay down existing debts in the household, dial the purchase price to 3 times.

One of the major factors that determines how much house you can afford is your debt-to-income ratiothat is, your monthly debt obligations divided by your monthly income. Generally, lenders like to limit that ratio to around 36%42%. Fidelity’s analysis is slightly more conservative, and uses 36% as a maximum advisable debt-to-income ratio.*

Be cautious. Buying the biggest home you can afford means you have to obtain a large mortgage. This means sizable monthly paymentswhich might make it hard to meet your other financial priorities.

A more conservative approach is to limit your housing costs to about 30% of your income. Families who pay more than this may have difficulty covering other important expenses. Try this simple calculator to find out how much house you can afford.

Also Check: What Is Principal Mortgage Insurance

Improve Your Credit Score

If you have debt, a mortgage lender may still approve your application if you have a very good or excellent credit score.

Payment history is the most important factor in your credit score, so make sure youre paying all your bills on time. You can also request a credit report from one of the three credit bureaus to check for any errors. If you find youve been penalized unfairly, dispute an error with the bureau.

Also Check: Can I Use My Partners Income For A Mortgage

Can I Get A Mortgage If I Have Debt

Having some degree of debt like an auto loan doesnt disqualify you from getting a mortgage. But your DTI certainly will influence how a lender evaluates your loan application. Generally speaking, a lender wont approve you for a mortgage if your DTI is above 43%.

Personally, I advise you to hold off on a mortgage until your DTI is below 40% max. And a 33% DTI is an even better goal before applying for a mortgage. Going into a mortgage with a lower DTI gives you more financial breathing room in the event that unexpected expenses pop up.

Don’t Miss: How Do Rocket Mortgage Rates Compare

How To Calculate Your Home Affordability

There are several methods for figuring out your home affordability. The easiest way is to enter your information into our calculator above. Our home affordability calculator works with either your debt-to-income ratio or your proposed housing budget.

For the first method, youll need your gross monthly income and monthly debts for the second, youll need your desired monthly payment amount. Both methods will require your down payment amount, state, credit rating, and home loan type.

Once youve input all the information according to the method you chose, our calculator will let you know the maximum amount you can pay for a house, as well as your estimated monthly payment.

Ugh This Is Making My Head Hurt

Yup. Mortgages arent fun. Still, a house is one of, if not the, most expensive thing youll ever spend money on so its best to give it a ton of consideration. Being saddled with an unruly mortgage will affect you for years and years. To that end, the more thought you give it now, the less worry youll have later. So remember, the question isnt just How much mortgage can I afford? but How much mortgage do I want? for the long term.

More from SmartAsset

You May Like: What Is Mortgage Rate Vs Apr

House Affordability Based On Fixed Monthly Budgets

This is a separate calculator used to estimate house affordability based on monthly allocations of a fixed amount for housing costs.

In the U.S., conventional, FHA, and other mortgage lenders like to use two ratios, called the front-end and back-end ratios, to determine how much money they are willing to loan. They are basic debt-to-income ratios , albeit slightly different and explained below. For more information about or to do calculations involving debt-to-income ratios, please visit the Debt-to-Income Ratio Calculator.

Because they are used by lenders to assess the risk of lending to each home-buyer, home-buyers can strive to lower their DTI in order to not only be able to qualify for a mortgage, but for a favorable one. The lower the DTI, the more likely a home-buyer is to get a good deal.