How Do I Choose The Best Mortgage Lender

You should always compare several different lenders when shopping for a home loan. Not only will the rates and fees vary, but the quality of service as well. Regardless of what lender you end up working with, its important to find someone that can help your individual challenges. For example, if youre a military veteran getting a VA loan, youll want to work with someone who has experience with those types of loans.

To find a trusted lender, you can look at online reviews, or even better, ask around. Your real estate agent and friends who recently purchased a home are great sources for mortgage lender recommendations. Try comparing a variety of different mortgage lenders. The best mortgage lender for you may be a bank, credit union, mortgage broker, or an online mortgage lender, depending on your situation.

Also Check: Why Use A Mortgage Broker Instead Of A Bank

Best For No Lender Fees

Who’s this for? It’s common for lenders to charge a number of fees on mortgage applications, including an application fee, origination fee, processing fee and underwriting fee â these fees can end up costing a significant amount during the home-buying process. Ally Bank doesn’t charge any of these fees . You can get pre-approved for a loan in as little as three minutes online and submit your application in just 15 minutes as long as you have all the necessary documents handy.

Ally offers a HomeReady mortgage program that is geared toward low- to mid-income homebuyers that would allow them to put down as little as 3% for a down payment. Applicants must also have a debt-to-income ratio of no more than 50%, their income must be equal to or less than 80% of the area’s median income and at least one borrower must take a homeowner education course.

In addition to this loan option, homebuyers can also apply for a jumbo loan . Customers can also choose between fixed rate and adjustable rate mortgages, and 15-year, 20-year and 30-year loan terms.

Ally Bank customers also take an average of 36 days to close on their home. One important drawback, though, is that Ally mortgage loans are not available in every state â residents of Hawaii, Nevada, New Hampshire and New York would be unable to apply.

How Does The Federal Reserve Affect Mortgage Rates

Home loans with variable rates likeadjustable-rate mortgages andhome equity line of credit loans are indirectly tied to the federal funds rate. When thefederal funds rates increase, it becomes more expensive for banks to borrow from other banks. The higher costs for the bank can mean a higher interest rate on your mortgage. ARM loans that are in their fixed period are not impacted by this increase. However if you suspect a federal increase is about to happen or it has just happened, you’ll want to move fast if you’re looking to make changes or have yet to lock in a fixed-rate mortgage.

Don’t Miss: How To Get A Mortgage After Bankruptcy

What The Forecast Means For You

Lending has become increasingly more costly for homeowners and borrowers alike as mortgage rates continue to rise. Mortgage rates jumped 1.5 percentage points during the first three months of the year, the biggest quarterly climb in 28 years.

Higher interest rates mean higher monthly payments for borrowers. For example, on a $400,000 home with a 5.10% interest rate, the monthly mortgage payment is around $2,172. This doesnt include insurance, taxes or other loan costs. If the rate rises to 6%, the monthly payment jumps to $2,398.

This means time is running out for homeowners who hope to lock in a lower interest rate by refinancing.

Risks Not So Variable

For small increases in the variable rate, your payments may remain the same. The only difference would be an increase in the amount going to pay the interest portion. However, if rates increase significantly, even by 1.5 per cent, the lender may increase your payments.

Before deciding on a variable rate, make sure the lender explains all the possible scenarios. Specifically, find out what interest rate changes will lead to higher payments. You may be able to include the option to lock into a fixed-rate mortgage at any time, but keep in mind that by then the longer-term rates may have changed.

to help determine the savings of going variable versus fixed. You may decide that the advantage isnt enough to pass up the certainty provided by a fixed-rate mortgage.

Recommended Reading: Can You Sell A House With A Mortgage On It

Which Type Of Mortgage Rate Is Best For You

The fixed-rate mortgage is likely the best option if you are risk-averse and prefer simplicity. However, an ARM may be suitable if youre ready to take a little more risk. Of course, your circumstances and goals will also influence your decision. When evaluating mortgage loan risk, its critical to understand whether the interest rate savings are significant enough to explain taking on the additional risk of a hybrid or traditional ARM. The difference between locking in a 0.25 percentage point lower rate and getting a whole percentage point lower rate is far less significant.

Not everyone has the same class of comfort with risk. Evaluate which option works into your lifestyle before deciding on the type of home loan you take out with a lender.

If you are confused about choosing the best mortgage option, you can contact Leap Financial anytime. We have an expert team that will guide and help you throughout your mortgage process.

Tags:

Types Of Mortgage Loans For Buyers And Refinancers

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

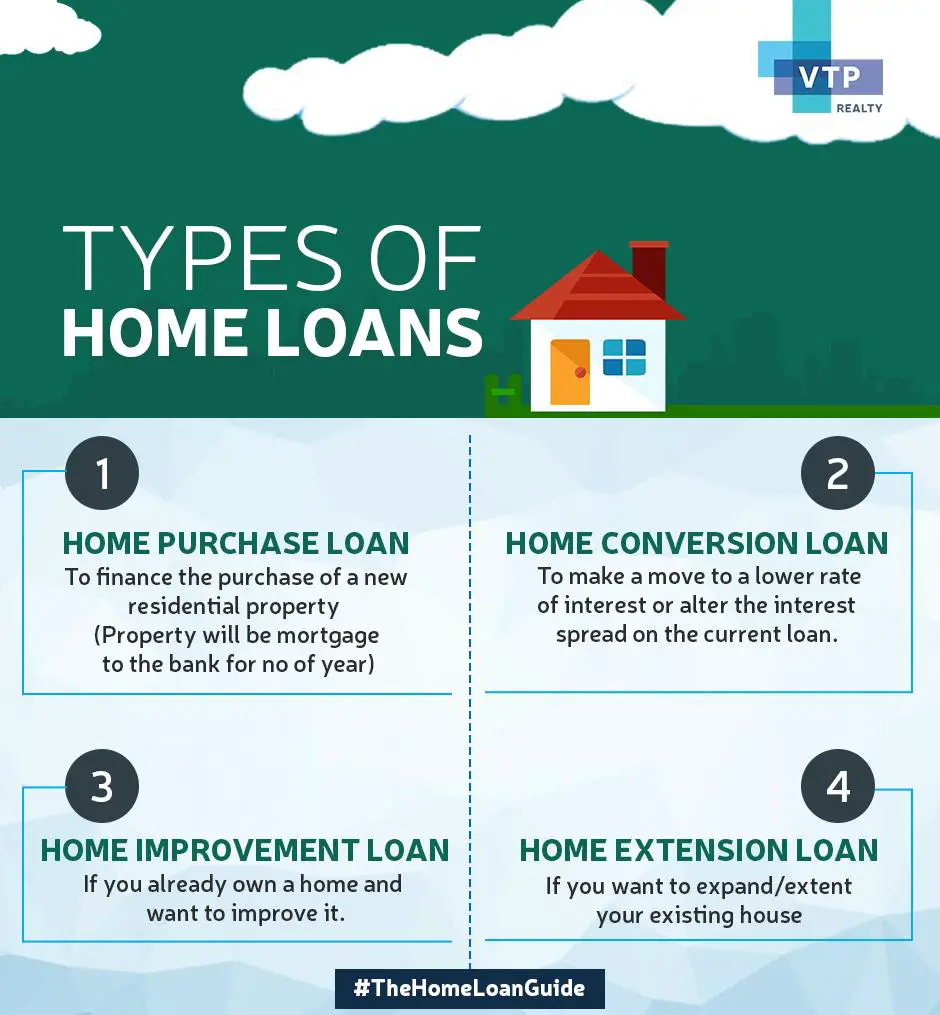

Many types of mortgage loans exist, and they are designed to appeal to a wide range of borrowers’ needs.

For each type of mortgage listed below, youll see its advantages and the kind of borrower it’s best for. This page concludes with a glossary of terms describing different types of mortgage loans.

Read Also: Is A Timeshare Considered A Mortgage

What To Consider When Getting A Government

If you’re unable to qualify for a conventional loan, or your priority is getting a loan with as low a down payment as possible, government-insured loans can be a great option. They’re ideal for eligible borrowers with low cash savings.

Government-insured loans are also a good option for homebuyers with bad credit. An FHA loan permits credit scores of 580 and above with a down payment of 3.5%, and it sometimes will allow credit scores as low as 500 with a down payment of 10% or more. While VA loans don’t have an official credit score minimum, most lenders require a score of around 620. USDA loans typically require a score of 640 or above, and you can’t earn more than a certain amount .

Keep in mind that not all lenders offer government-backed loans. You’ll need to research local and online lenders to findes that do offer these loans and compare rates before deciding on one.

Factors That Can Affect Your Personal Interest Rate

Itâs important to understand that the best mortgage rate you qualify for may change depending on your unique borrowing profile. Here are some of the factors that influence what mortgage rate you qualify for:

The type of mortgage: If your mortgage is for a refinance, rather than a purchase or renewal, youâll be eligible for higher rates. For individuals with an existing mortgage who have good credit and more than 20% equity in their homes, in addition to refinancing, you can also explore a home equity line of credit .

Your down payment: If youâre purchasing a home andyour down payment is less than 20% of the purchase price and the value of the home you are purchasing is less than $1 million, youâll be required to purchase mortgage default insurance . This insurance is added to your mortgage amount and, while it will cost you money, it will result in a lower mortgage rate as your mortgage is less risky for your lender. If youâre renewing your mortgage, in order to be eligible for the lowest mortgage rates you would have needed to purchase CMHC insurance on the original mortgage.

Your intended use of the property: Your mortgage rate will be higher if you plan to rent your property out vs. live in it as your primary residence.

You May Like: Where Do You Get A Mortgage

How To Compare Mortgage Rates

Borrowers who comparison shop tend to get lower rates than borrowers who go with the first lender they find. You can compare rates online to get started. However, to get the most accurate quote, you can either go through a mortgage broker or apply for a mortgage through various lenders.

The advantage of going with a broker is you do less of the work and youll also get the benefit of their lender knowledge. For example, they might be able to match you with a lender whos suited for your borrowing needs, this could be anything from a low down payment mortgage to a jumbo mortgage. However, depending on the broker, you might have to pay a fee.

Applying for a mortgage on your own is straightforward and most lenders offer online applications, so you dont have to drive to an office or branch location. Additionally, applying for multiple mortgages in a short period of time wont show up on your credit report as its usually counted as one query.

Finally, when youre comparing rate quotes, be sure to look at the APR, not just the interest rate. The APR reflects the total cost of your loan on an annual basis.

The Type Of Interest Rate You Want

Depending on the types of mortgages youre eligible for, you may be able to opt between a fixed-rate or adjustable-rate mortgage. Well explain these in greater detail below, but know that each option has its pros and cons. Fixed-rate loans are more popular and generally lower risk. However, ARMs may be preferable for certain borrowers who can accept a bit more risk, especially if they plan to be in the home for a shorter period.

Also Check: What Is The Government Refinance Program On Home Mortgage

Choose The Right Type Of Mortgage

This is where most articles dive into a bunch of mind-numbing mortgage terms. Just know that there are special types of loans for borrowers:

-

With a military connection.

-

Who would like to live in a rural or suburban area.

-

Who have a lower credit score.

-

Who are buying a house thats a little or a lot more expensive than standard loan guidelines allow.

If you dont exactly fit any of the descriptions above, youre probably a good candidate for the conventional loans most lenders like best.

How Do I Qualify For A Mortgage

While itâs important to think about qualifying for the best rates, you should also give some thought to the basics that youâll need to qualify and get approved for your mortgage. To qualify for a mortgage, here are some of the most important things that prospective lenders will want to see.

A good credit score – You should have a credit score of 680 or higher to qualify for the best mortgage rates, but to qualify for a mortgage at all, youâll need a credit score of at least 560. In addition to looking at your credit score, prospective lenders will also consider any derogatory information from your credit report, such as any missed payments . If you have bad credit, generally defined as a credit score of less than 660, you are unlikely to qualify for the best mortgage rates, and instead youâll need to use a sub-prime mortgage lender like Equitable Bank or Home Trust. If your credit score is even less than 600, you will most probably need to use a private lender like WealthBridge. Sub-prime mortgage lenders are happy to work with people with a poor credit history, but they will charge higher mortgage rates. It’s a good idea to have a detailed understanding of how your affects your ability to obtain a mortgage.

Read Also: Can I Use Disability Income To Qualify For A Mortgage

What Is A Good 30

A 30-year fixed-rate mortgage is a home loan that maintains the same interest rate and monthly principal-and-interest payment over the 30-year loan period. With a rate that lasts the length of the loan, youll want the best rate you can get. Since your rate is most directly impacted by your credit score and down payment, youll want to make sure your credit file is accurate and make a down payment thats as much as you can easily afford.

Getting a good deal on a mortgage is like getting a good deal on a car. You do online research, you talk with friends and family, and then you comparison-shop. That last step, which involves applying with multiple lenders, is the most important step.

When you compare loan offers using the Loan Estimates, youll feel confident when you identify the offer that has the best combination of rate and fees.

A Freddie Mac report concluded that a typical borrower can expect to save $400 in interest in just the first year by comparison-shopping five lenders instead of applying with just one lender. Over several years, comparison-shopping for a mortgage can save thousands of dollars. Thatll give you something you can brag about.

The 30-year fixed isnt your only option. The 15-year fixed loan is common among refinancers. Adjustable-rate mortgages have low monthly payments during the first few years of the loan, making them popular for high-dollar loans.

Read Also: How To Calculate Percentage Of Mortgage

The Home You Want To Buy

The location and price of the home you want to buy may dictate what type of mortgage you can choose. For example, if youre looking at a home thats very expensive for your area, you may be limited to a jumbo loan, which exceeds the baseline conforming loan limit set by the federal government. If youre considering a U.S. Department of Agriculture loan, youll only qualify if the home you purchase is in an eligible rural area.

Don’t Miss: Are There Income Requirements For A Reverse Mortgage

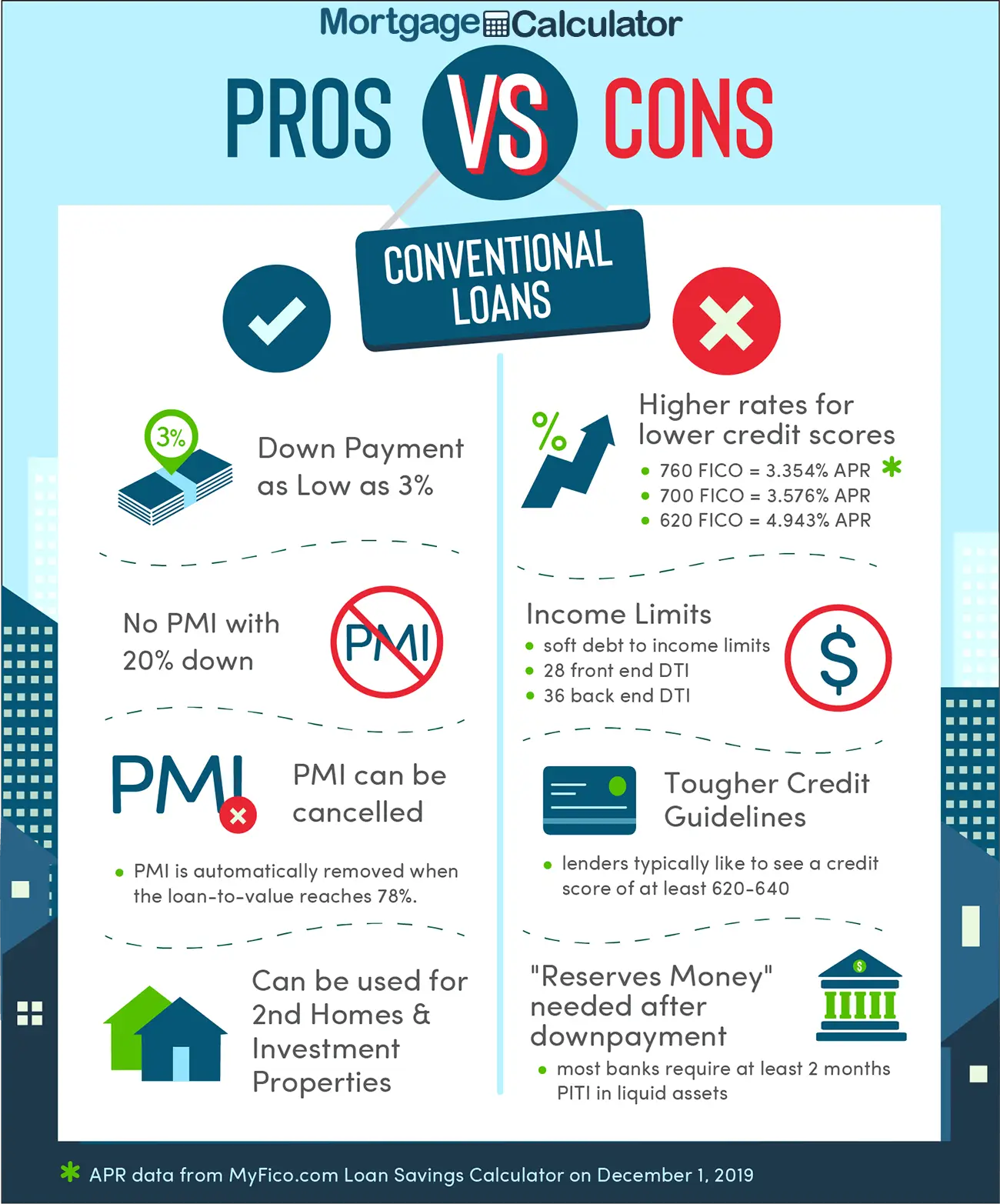

Pros Of Conventional Loans

- Can be used for a primary home, second home or investment property

- Overall borrowing costs tend to be lower than other types of mortgages, even if interest rates are slightly higher

- Can ask your lender to cancel private mortgage insurance once youve reached 20 percent equity, or refinance to remove it

- Can pay as little as 3 percent down on loans backed by Fannie Mae or Freddie Mac

- Sellers can contribute to closing costs

What Are Points On A Mortgage Rate

Mortgage points represent a percentage of an underlying loan amountone point equals 1% of the loan amount. Mortgage points are a way for the borrower to lower their interest rate on the mortgage by buying points down when theyre initially offered the mortgage.For example, by paying upfront 1% of the total interest to be charged over the life of a loan, borrowers can typically unlock mortgage rates that are about 0.25% lower.

Its important to understand that buying points does not help you build equity in a propertyyou simply save money on interest.

Recommended Reading: Why You Should Get Pre Approved For A Mortgage

S To Getting A Mortgage

Raise Your Credit Score As Much As Possible

Any lender will be more likely to work with you if you have a good or excellent credit score. You can raise your score by making sure that you stay current on debt payments. You should use as little of your available credit as possible. Be careful about many new credit cards or loans you attempt to obtain because your credit score will go down a little every time you do so. If you see anything on your credit report that does not belong, contact the credit reporting company right away.

Read Also: What Does Paying Points Mean On A Mortgage