Mortgage Points: The Bottom Line

Homebuyers can lower their interest rate and pay less each month and over the life of their loan through mortgage points. Even so, buyers who plan to relocate or refinance soon should restrategize since they may not have enough time to break even and start saving.

Bear in mind that points also raise closing expenses. As such, if youre a home buyer paying points, be ready for the increased upfront fees. All in all, as long as a borrower has cash on hand, paying points can be a good method to save money if they plan on staying on their property for a long time.

Can You Negotiate Points On A Mortgage

Yes and no. The answer is yes if youre shopping several different lenders, because discount points tied to a mortgage rate vary from lender to lender based on how they set their pricing. The answer is typically no if you want to negotiate how much a point costs at a specific lender. However, youll typically pay less points if:

- You have a credit score above 740

- You make more than a 3% down payment on a conventional mortgage

- You finance a primary residence single-family home

Are Mortgage Points Right For You

Buying mortgage points is a way to pay upfront to lower the overall cost of your loan and reduce its monthly payment. It makes the most sense if you plan to be in the home for a long period of time. The amount youll save each month is likely to make the upfront cost worth it.

Of course, if you dont plan to stay in a home for a long time, paying points is likely to lose you money overall.

Another consideration is whether you should put money toward points or a larger down payment. A larger down payment can often help you secure a lower interest rate anyway. Additionally, hitting the 20% down payment mark can also let you avoid the additional cost of PMI.

A bigger down payment can get you a better interest rate because it lowers your loan-to-value ratio, or LTV, which is the size of your mortgage compared with the value of the home.

Borrowers should consider all the factors that could determine how long they plan to stay in the home, such as the size and location of the property and their job situation, then figure out how long it would take them to break even before buying mortgage points.

Recommended Reading: What Would Be The Mortgage Payment On 200 000

Are Mortgage Points Tax

While mortgage interest in still tax deductible, the Tax Cuts and Jobs Act of 2017 puts a cap on the amount of mortgage interest that may be deducted. Because discount points are prepaid interest, they may be deducted as part of your home mortgage interest. See the details here.

Heres a tip: When youre loan shopping, ask each lender for two estimates: one for your mortgage closing costs if you buy points, another for the loan without points. Show the estimates to a tax preparer or tax accountant to find out how paying points could affect your taxes.

You Pay The Points Out Of Your Own Funds

This is a common outcome in strong real estate markets and among higher-priced properties. Sellers rarely pay any closing costs under either condition. If so, youll need to budget additional funds for closing.

Lenders will generally accept funds coming from any source, with the lone exception of borrowing. For example, lenders generally wont permit you to take an advance on your credit card to pay the points.

Don’t Miss: When Do You Pay Pmi On A Mortgage

You May Save On Taxes

Since mortgage interest is tax-deductible and points are considered prepaid mortgage interest, you may be able to deduct the cost of the points on your taxes. To understand the deductions you may be eligible for, check out the IRS rules on mortgage point benefits and speak with a qualified tax expert

Should I Buy Mortgage Points

Mortgage points may not be right for every homebuyer. Figuring out the break-even point is a good start, but there’s more to consider before buying points. For example, you’ll need to come up with the money to pay for the points.

Although a point generally lowers your interest rate by 0.25%, the reduction per point can vary depending on the lender, type of loan and market conditions. Make sure to run the numbers that apply to the specific mortgage you’re considering.

Even when you plan to pay for points, you should still get competing mortgage offers to see which rate and terms are best. Paying for points from one lender could decrease your rate, for example, but it could still end up higher than a competitor’s offer.

You may find that the value of each point from the same lender changes as you compare types of loans. Additionally, if you’re considering an adjustable rate mortgage, look to see if the lender will continue to apply the interest rate reduction after your initial fixed-rate period ends.

All that said, the simplest and easiest solution may be to simply put money toward a bigger down payment.

Read Also: Is Phh A Good Mortgage Company

Cons Of Buying Mortgage Points

Buying mortgage points isnt recommended for everyone. If you dont have the extra cash reserves, paying for mortgage points on top of your closing costs and down payment could drain your savings.

If youre purchasing a house and putting less than 20% down on a conventional loan, the added expense of private mortgage insurance may not make much financial sense. It may be better to put those funds towards your down payment.

It could also take a while to break even, which is the time it takes for the monthly savings to pay for the points.

For instance, lets say you purchased 3 mortgage points for $9,000 on a $300,000 home loan financed over 30 years. This lowered your interest rate from 3.5% to 2.75% and saves you $122 per month. However, your break-even point is a little over six years and if you move or refinance before then, you may not recoup that upfront cost.

Also, interest rates fluctuate. If rates go down after purchasing mortgage points, then the value of the points would essentially be worthless.

Benefits Of Purchasing Mortgage Points

It goes without saying that paying points comes with some benefits. Here are some of them:

Reduced Interest Rate

If your credit score is low, youll almost certainly pay a higher interest rate on your loan. As such, you should strategize to improve your credit before applying for a mortgage.

This helps lower your rate. Nevertheless, if youd like to buy a house immediately, all hope is not lost. You could still lower your rate by paying points.

Reduced Monthly Payments

Because interest is a core component of your monthly payments, getting a lower interest rate means having a smaller monthly mortgage payment. As such, housing expenditures will occupy less space in your budget. Best part? You can save money faster or spend more on other vital aspects of your life!

Overall, Youll Pay Less.

Don’t Miss: Can Three People Be On A Mortgage

Discount Points Vs Origination Points

There are two different types of mortgage points: origination points and discount points. Discount points represent prepaid interest that can be used to negotiate a lower interest rate for the term of a loan.

Origination points, on the other hand, are lender fees that are charged for closing on a loan. Origination points donât save borrowers money on interest, although they can sometimes be rolled into the balance of a loan and paid off over time. Discount points, however, have to be paid up front.

Mortgage Points: What Are They

Mortgage points are a one-time cost paid to the lender in exchange for a lower interest rate on a home loan. Because the homebuyer is required to pay more money upfront, points raise the closing expenses. At the same time, however, they lower the monthly mortgage payment and lower the total amount of interest paid throughout the loans term.

Also Check: What Is The Trend For Mortgage Interest Rates

Which Is Better Banks Vs Online Mortgage Lenders

Negative mortgage points, also known as lender credits, are the reversal of points, where you minimize your closing costs by increasing your loans interest rate. Using the previous example, if you obtain a $4,000 lender credit or a negative 1 point on a $400,000 mortgage, youll get 1% of the loan amount to assist cover closing expenses.

In comparison to a loan with no lender credits, youll also be charged a greater interest rate. This implies youll pay more interest overall and a greater monthly mortgage payment.

What Does Buying Points Mean In A Mortgage

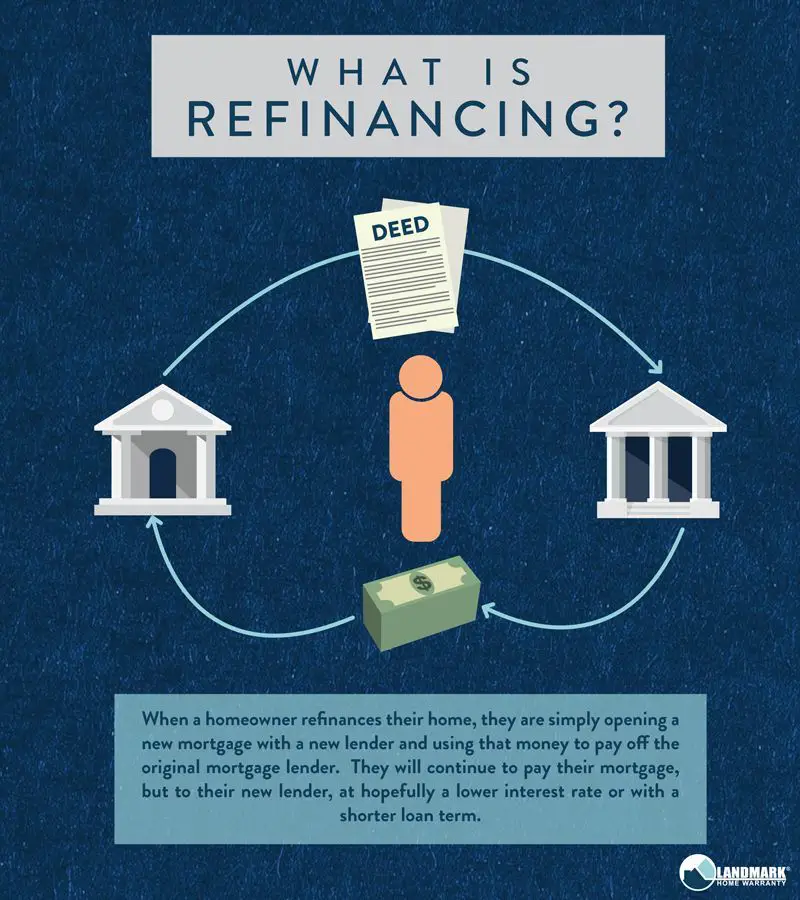

Mortgage points, also called discount points, are an upfront fee that a borrower pays their mortgage lender to cut down the interest rate on their loan.

Borrowers can lock in a lower interest rate on a purchase or refinance loan and pay less on their mortgage over time. This may make more sense for borrowers who plan to stay in their homes for a long time.

Also Check: What Percentage Of Household Income Should Go To Mortgage

Should You Pay For Mortgage Points

It seems odd to say, but buying mortgage points to lower your interest rate could actually be a complete rip off. Say what? How can a lower interest rate be a bad deal?

For starters, it could be years before you really save any money on interest because of your mortgage points. To see what this would look like, youd first need to calculate whats known as your break-even point.

How Mortgage Points Work

Pamela Rodriguez is a Certified Financial Planner®, Series 7 and 66 license holder, with 10 years of experience in Financial Planning and Retirement Planning. She is the founder and CEO of Fulfilled Finances LLC, the Social Security Presenter for AARP, and the Treasurer for the Financial Planning Association of NorCal.

Mortgage points are used in the loan closing process and are included in closing costs. Origination points are mortgage points used to pay the lender for the creation of the loan itself whereas discount points are mortgage points used to buy down the interest rate of the mortgage.

You May Like: Can I Add Renovation Costs To My Mortgage

What Are The Benefits Of Mortgage Points

The main benefit of buying mortgage points is reducing your loan’s interest rate and thus the amount you’ll pay over the life of the loan. Generally, each point lowers your interest rate by 0.25%, although the exact amount can vary.

Lowering your mortgage interest rate can decrease your monthly payments, making it easier to manage your budget. Additionally, the cost of the points could be an itemizable tax deduction because you’re prepaying mortgage interest. If you meet IRS requirements, you could take the entire deduction during the year you paid the points. Otherwise, you may be able to claim the deduction over the lifetime of your loan.

Some Lenders Also Offer Negative Mortgage Points

You also have the option with some lenders to apply negative points to your mortgage. Essentially, this means you increase your interest rate in order to get a credit you can use to cover closing costs.

For example, if you were taking out a $250,000 mortgage and you applied a negative mortgage point, your interest rate might rise from 3.00% to 3.25% — but you would get a $2,500 credit to cover costs at closing.

While negative points make your home cost more over time, they can sometimes make it possible to afford to close on a home when you otherwise would be tight on cash. Just be aware that it’s a costly option.

In the above example where you raised your rate from 3.00% to 3.25%, your $250,000 loan would result in a monthly payment of $1,088 and the total cost of your mortgage would be $391,686.

Compare that with a monthly payment of $1,054 and a total cost of $379,444 if you hadn’t applied negative points. You’d pay $34 more each month and $12,242 more over 30 years in exchange for having gotten $2,500 up front.

Also Check: What Are Pnc Mortgage Rates

Pros Of Buying Mortgage Points

The biggest benefit of buying mortgage points is lowering the interest rate on your loan, no matter your . This saves you money not only on your monthly mortgage payments but also on total interest payments.

Buying down your rate also reduces the total cost of the home. Paying an extra $3,000 upfront could save you thousands more over the life of the mortgage loan.

Mortgage points are also tax-deductible. The IRS considers mortgage points to be prepaid interest, which may be deductible as home mortgage interest if you itemize deductions. If you deduct all interest on your mortgage, you may be able to deduct all of the points.

Calculate how much you can save on your mortgage payments with Total Mortgage.

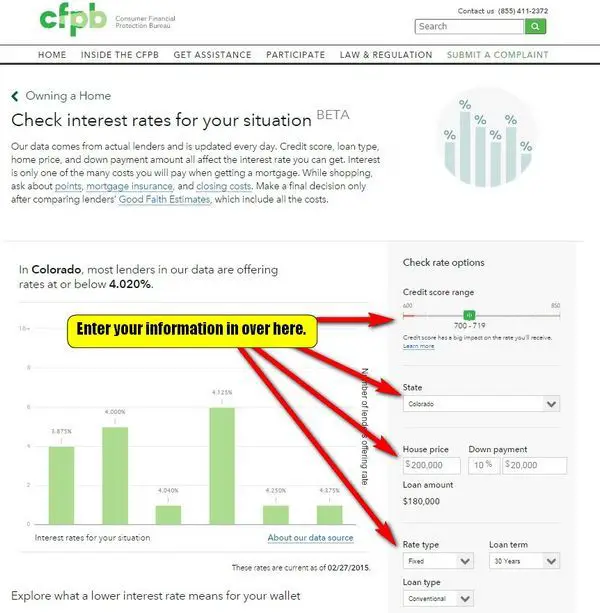

How To Shop For Loans With Mortgage Discount Points

Heres an example. Say one national lender offers a 30-year fixed-rate mortgage at 4.5% with no points. You can knock 0.25% off that and get 4.25% by paying half a discount point.

But a 4.125% rate costs an additional point. Paying more doesnt necessarily get you a better deal.

When shopping for a mortgage with discount points, the easiest way to compare offers is to decide how much you want to spend, then see who offers the lowest rate at that price.

Alternatively, you can decide what mortgage interest rate you want, and see which lender charges the least for it.

Read Also: What Is Needed To Get Approved For A Mortgage

What Are Origination Points

A different type of mortgage point that you might have to pay is an “origination point.” Origination points won’t reduce your interest rate they’re fees you pay to the lender for agreeing to provide and process your loan. Sometimes origination points are called an “origination fee.” These points vary from lender to lender and are sometimes negotiable, but not usually.

This article focuses mainly on discount points.

Mortgage Discount Points Vs Apr

![Mortgage Rates & Payments by Decade [INFOGRAPHIC] Mortgage Rates & Payments by Decade [INFOGRAPHIC]](https://www.mortgageinfoguide.com/wp-content/uploads/mortgage-rates-payments-by-decade-infographic-brian-oneill-exp.jpeg)

Buying discount points on your mortgage is effectively a way of prepaying some of your interest, and looking at the annual percentage rate can help you compare loans with different rate and point combinations. The APR incorporates not just the interest rate, but also the points you pay and any fees the lender will charge. Check out a quick explanation from Greg McBride, CFA, Bankrate chief financial analyst:

Recommended Reading: What Are The Interest Rates On A Mortgage

What Is The Breakeven Point

To calculate the breakeven point at which this borrower will recover what was spent on prepaid interest, divide the cost of the mortgage points by the amount the reduced rate saves each month:

$4,000 / $56 = 71 months

This shows that the borrower would have to stay in the home 71 months, or almost six years, to recover the cost of the discount points.

The added cost of mortgage points to lower your interest rate makes sense if you plan to keep the home for a long period of time, says Jackie Boies, a senior director of Partner Relations for Money Management International, a nonprofit debt counseling organization based in Sugar Land, Texas. If not, the likelihood of recouping this cost is slim.

You can use Bankrates mortgage points calculator and amortization calculator to figure out whether buying mortgage points will save you money.

What Are Origination Fees

Why do so many lenders quote an origination fee? To get a true no point loan, lenders must disclose a 1% fee and then give a corresponding 1% rebate. Wouldnt it make more sense to quote a loan at par and let the borrower buy down the rate?

The reason lenders do it this way is because of the disclosure laws in the Dodd-Frank Act. If the lender does not disclose a certain fee in the beginning, it cannot add that fee on later. If a lender discloses a loan estimate before locking in the loan terms, failure to disclose an origination fee will bind the lender to those terms.

This may sound like a good thing. If rates rise during the loan process, it can force you to take a higher rate. Suppose you applied for a loan when the rate was 3.5%. When you are ready to lock in, the rate is worse. Your loan officer says you can get 3.625% or 3.5% with the cost of a quarter of a point . If no points or origination charges show up on your loan estimate, the lender wouldnt be able to offer you this second option. You would be forced to take the higher rate.

Don’t Miss: What Is Considered A Large Deposit For A Mortgage

Are Discount Points Worth It

It may make sense to pay discount points when youre buying a long-term investment property or a home you plan to hold for many years, says Ann Thompson, a retail sales executive at Bank of America, because youll save after breaking even.

Heres an example from Thompson to help demonstrate how long it can take to benefit from buying a point. Say youre taking out a $400,000 loan. One discount point would cost $4,000 paid at closing assume you can afford that on top of your other closing costs.

Based on mortgage rates the day she was interviewed, Thompson said buying a point would save roughly $57 a month on that $400,000 mortgage. By dividing the cost of the point by the monthly cost , you determine how many months it would take you to make up the cost of buying the point. In this example, its about 70 months, or almost six years.

That means if you planned to stay in the home for six years, youd break even, and any longer than that, youd save money. But if you moved out before then, youd have lost money by buying points.