What Is A 30

The 30-year fixed-rate mortgage remains a popular one. As its name suggests, this mortgage loan has a term that lasts for 30 years, meaning that you have 3 decades to pay it back through regular monthly payments. It also has a fixed interest rate your loans rate on its first day will be the same as on its last.

When applying for a 30-year mortgage, lenders will consider several factors when determining whether to loan you money. First, theyll study your three-digit FICO® Score, a number that gives lenders a quick snapshot of how well youve handled your credit and paid your bills. Most lenders consider FICO® Scores of 740 or higher to be excellent ones, but you can often qualify for a 30-year mortgage even if your scores are in the lower 600s.

Lenders will also consider your debt-to-income ratio or DTI. This ratio measures how much of your gross monthly income your total debts consume each month. Most lenders want your total monthly debts, including your new mortgage payment, to equal no more than 43% of your gross monthly income.

Mortgage lenders will also pull your three credit reports, each maintained by the national credit bureaus of ExperianTM, Equifax® and TransUnion®. These reports list your open credit accounts and loans and how much you owe each of them. They also list recent missed or late payments, and negative financial events such as recent bankruptcies or foreclosures.

Find out if a 30-year fixed loan is right for you.

See rates, requirements and benefits.

Overview Of Mortgages In The Uk

- The number of mortgages with arrears of over 2.5% of the remaining balance rose by 15 a day from the beginning of the year till March 2021.

- The outstanding value of all residential mortgage loans was £1.56 trillion as of the end of Q1 2021, which is 3.6 % higher than the year before.

- The value of new mortgage commitments is £77.5 billion, which is 15% higher than the year before.

- The proportion of mortgages in arrears fell to its lowest amount since 2007, at 0.94% .

- The value of gross mortgage advances in Q1 2021 was £83.3 billion, 26.5% higher than it was in Q1 2020 and the highest level since Q4 2007.

- In April 2021, the 10-year mortgage rate was 2.58%. This is a slight increase from March 2020 when it stood at 2.36%.

- The average UK house price reached a peak of £256,000 in March 2021.

- There were 469,000 homeowner remortgages from July 2018 June 2019.

- Of those mortgages, 231,000 were equity withdrawn remortgages and 238,000 were refinancing remortgages.

- On average, there are 39,000 homeowner remortgages every month in the UK.

- Over a third of residential loans were remortgages in Q1 2019.

Other Mortgage Tools And Resources

You can use CNET’s mortgage calculator to help you determine how much house you can afford. CNET’s mortgage calculator takes into account things like your monthly income, expenses and debt payments to give you an idea of what you can manage financially. Your mortgage rate will depend in part on those income factors, as well as your credit score and the ZIP code where you’re looking to buy a house.

Read Also: Should You Refinance To 15 Year Mortgage

Is It Worth Refinancing To A 15

You can save money and build home equity faster with a 15-year mortgage than with a 30-year mortgage. But the monthly mortgage payment will be higher on a 15-year mortgage because there is less time to pay off the loan.

Its worth comparing 15-year mortgage rates if youll be able to afford the monthly payments and still have enough money for other needs, such as saving for retirement.

Getting a lower interest rate could save you hundreds of dollars over a year of mortgage payments and thousands of dollars over the life of the mortgage.

When you compare 15-year refinancing offers using the Loan Estimates you receive from lenders, youll feel confident when you identify the offer that has the best combination of rate and fees.

You May Like: Who Is In The Rocket Mortgage Commercial

Forbes Advisors Insight On The Housing Market

Predictions indicate that home prices will continue to rise and new home construction will continue to lag behind, putting buyers in tight housing situations for the foreseeable future.

To cut costs, that could mean some buyers would need to move further away from higher-priced cities into more affordable metros. For others, it could mean downsizing, or foregoing amenities or important contingencies like a home inspection. However, be careful about giving up contingencies because it could cost more in the long run if the house has major problems not fixed by the seller upon inspection.

Another important consideration in this market is determining how long you plan to stay in the home. People who are buying their forever home have less to fear if the market reverses as they can ride the wave of ups and downs. But buyers who plan on moving in a few years are in a riskier position if the market plummets. Thats why its so important to shop at the outset for a realtor and lender who are experienced housing experts in your market of interest and who you trust to give sound advice.

You May Like: How Much Do I Need For A Mortgage

What Is A Good Interest Rate On A Mortgage

A good mortgage rate is one where you can comfortably afford the monthly payments and where the other loan details fit your needs. Consider details such as the loan type , length of the loan, origination fees and other costs.

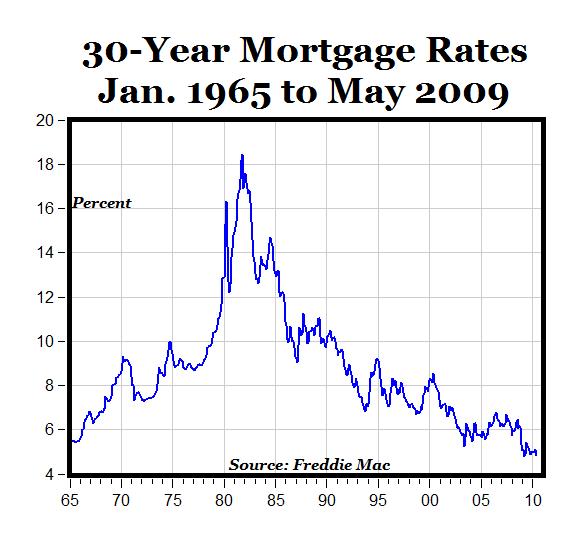

That said, today’s mortgage rates are near historic lows. Freddie Mac’s average rates show what a borrower with a 20% down payment and a strong credit score might be able to get if they were to speak to a lender this week. If you are making a smaller down payment, have a lower or are taking out a non-conforming mortgage, you may see a higher rate. Moneys daily mortgage rate data shows borrowers with 700 credit scores are finding rates around 6.5% right now.

The Latest Mortgage Rate & Housing Market News

Whats Going On With Rising Mortgage Rates?

Mortgage rates have been on the rise since the start of the year and havent stopped yet. A big reason behind the increase is that inflation has remained at its highest level in 40 years. The Consumer Price Index was up 8.2% year-over-year in September lower than August but still well above what markets and the Federal Reserve are comfortable with.

The Feds approach to high inflation has been to raise its benchmark short-term interest rate, a strategy that aims to make borrowing more expensive and encourage saving, driving down demand for goods and services and reducing prices. The Fed last raised its federal funds rate in September, and is expected to do so again in November.

The economic situation has mortgage rates jumping up and down on a daily basis.

The market just cant really decide which way it wants to go in terms of the direction of rates, says Melissa Cohn, regional vice president of William Raveis Mortgage in New York.

Dont expect mortgage rates to plummet until economic conditions change, experts say.

Until we get some sustained evidence that inflation is beginning to recede, the upward pressure on mortgage rates will remain, Odeta Kushi, deputy chief economist at First American Financial Corporation, told us.

What Can Homebuyers Do About Rising Mortgage Rates?

Until youre ready to lock, you need to keep your eye on more than one ball, Cohn says.

Whats Happening With Home Prices?

Don’t Miss: How Much Money Can I Get Preapproved For A Mortgage

Fixed Rate Mortgages Vs Adjustable Rate Mortgages

Fixed-rate mortgages generally have the same benefits. You know how long your loan will last, and for what rate your interest will be for the life of your loan. The only difference is the length of loan you decide upon.

Another refinance product to consider is an adjustable rate mortgage . The terms on ARM loans are shorter than most fixed rate products, and they offer very different benefits than fixed rates. Do you know the difference between these two products?

A fixed rate mortgage is the best selection f youre settled into your career, plan to own your home for many years, or just like the security of knowing what your monthly mortgage payment will be each month.

An adjustable rate mortgage, on the other hand, begin with a lower interest rate for fixed period of time usually 3, 5 or 10, then changes. After your pre-determined period of time, your interest rate will either increase or decrease based on the current market value. The benefit of an ARM is that you will pay significantly lower interest at the start of your loan, making your payments more affordable, but there is less certainty about your monthly payments once the fixed rate has expired.

The best candidates for an ARM loan are:

- Those who plan to see an increase in income

- Anyone aiming to sell their home in the near future

- Anyone coming to the end of a current loan

- Someone who anticipates refi rates will stay consistently low in the years to come.

Should Brits Take A Mortgage Holiday

Our analysis looks at what repayment holidays might mean in the long term for mortgage holders in three different scenarios:

- Scenario 1: First-time buyer, 1 year into their 30-year mortgage of £170,000.

- Scenario 2: Mid-late 30s with a family, with a 20-year mortgage worth £220,000.

- Scenario 3: Older homeowner, with 7 years left to pay their remaining mortgage balance of £55,000.

| £788.72 |

Matthew Boyle, mortgage specialist, reflects on the the housing market through the pandemic

“The UK’s coronavirus lockdown saw the housing market and the mortgage market effectively paused during spring 2020. Many lenders cut the number of products they had on offer, particularly at higher LTVs, as they concentrated on their existing mortgage customers and dealing with mortgage holiday requests.

However, as property viewings and sale completions started to return post-lockdown, the housing market has shown to be surprisingly robust in terms of asking prices. In turn, we are beginning to see a larger number of mortgage deals become available to home buyers again. Despite a flat few years in the country’s house-selling sector, the size of the UK’s mortgage market has remained steady. In the third quarter of 2019, the outstanding value of all residential mortgage loans stood at £1.49 trillion 3.9% higher than it was a year earlier.

What is the size of the mortgage market?

You May Like: What Is A Good Ratio Of Mortgage To Income

How Do Fixed Rate Mortgages Work

Fixed rate mortgages lock in the interest rate you pay over the duration of the fixed term. The result is that youll know exactly what your monthly repayment will be for the entirety of the fixed term, regardless of whether the Bank of England changes interest rates or not.

This way you can manage your finances and know how much youll have left over to put into savings or use for other purposes like going on holiday.

While a fixed rate mortgage will provide certainty on what your monthly mortgage outgoings will be, do bear in mind that BoE interest rates could go down as well as up during your fixed term, but your payments will always remain the same.

Fixed rate mortgages also tend to be more expensive the longer you tie your fixed in rate for, so youll need to weigh this up when deciding what type of mortgage you want to apply for.

Fixed rate mortgages also tend to have fewer extra features, such as options to lower your interest payments by using on offset account. However, this can vary from lender to lender.

The Bottom Line: Shorter Terms Are Best If You Can Afford It

Mortgage loans with shorter terms are always the best financial deal because of the amount of money youll save in interest payments. Remember, though, that you should only apply for a short-term mortgage if you can comfortably afford the higher monthly payment. If you can, and youre interested in paying less in interest, it makes sense to consider either a 20-year or 15-year mortgage.

Get approved to buy a home.

Apply online for expert recommendations and to find a solution that works best for you.

Recommended Reading: Are Taxes And Insurance Included In Mortgage

More Financial Flexibility Than A 15

With a 20-year mortgage, it may take longer to build up equity in your home and pay off your loan, but your monthly payments are significantly lower than theyd be with a 15-year term. While some people like the idea of getting rid of debt faster, others believe its better to have more financial flexibility.

How much lower would your monthly payments be with a 20-year term compared to a 15-year term? Suppose youre looking for a $350,000 loan to purchase a home, and your lender tells you they can offer you a 20-year mortgage with an interest rate of 4.38% or a 15-year mortgage with an interest rate of 4.25%.

If you choose the 20-year term, your monthly payments would be $2,190.73, but if you select the 15-year term, your payments would jump to $2,632.97 each month. By getting a 20-year mortgage, you save $442.25 each month and have the flexibility to choose how to use the funds.

Choosing the 15-year mortgage may ultimately put you at risk of defaulting. If your financial circumstances change due to job loss or unexpected medical bills, you may find that you cant pay the full amount.

However, with a 20-year mortgage, you can use the savings from your lower monthly payments to build up an emergency fund, invest or pay for daily expenditures. Furthermore, even if you choose a 20-year term, you can still make larger payments than youre required and pay off your mortgage early.

The Surprise Mortgage Rate Drop

In 2018, many economists predicted that 2019 mortgage rates would top 5.5 percent. That turned out to be wrong. In fact, rates dropped in 2019. The average mortgage rate went from 4.54% in 2018 to 3.94% in 2019.

- At 3.94% the monthly cost for a $200,000 home loan was $948

- Thats a savings of $520 a month or $6,240 a year when compared with the 8% longterm average

In 2019, it was thought mortgage rates couldnt go much lower. But 2020 and 2021 proved that thinking wrong again.

Recommended Reading: How Much Does A Mortgage Appraisal Cost

Other Mortgage Costs To Keep In Mind

Remember that your mortgage rate is not the only number that affects your mortgage payment.

When youre estimating your home buying budget, you also need to account for:

- Private mortgage insurance or FHA mortgage insurance premiums

- Homeowners insurance

When you get pre-approved, youll receive a document called a Loan Estimate that lists all these numbers clearly for comparison. You can use your Loan Estimates to find the best overall deal on your mortgage not just the best interest rate.

You can also use a mortgage calculator with taxes, insurance, and HOA dues included to estimate your total mortgage payment and home buying budget.

Some Real Estate Markets Cooling As Mortgage Rates Hit 20

Burbank Inflation, soaring mortgage rates and record high prices are making it difficult for many Americans to buy a home. But there could be some relief in sight, as skyrocketing rates have helped cool some of the nation’s hottest housing markets.

According to Freddie Mac, the average rate on a 30-year fixed-rate mortgage now sits at 6.92%, the highest it has been since 2002, and more than double what it was just a year ago. Housing affordability is down 29% from a year ago, according to the National Association of Realtors. Consistent rate hikes from the Federal Reserve are also putting pressure on the real estate market.

Nationwide, home prices soared 43% in two years, according to the S& P CoreLogic Case-Shiller Index.

But now, in cities that had those massive spikes, prices are dropping.

“We have seen mortgage rates double in just this year. And in some markets, we are starting to see prices go down from those sky-high levels,” CBS News business analyst Jill Schlesinger said.

The fastest cooling markets are Seattle, Las Vegas, San Jose, San Diego, Sacramento and Denver, according to S& P. Holding strong are Chicago, Albany and Milwaukee.

“A year ago, people were buying homes sight unseen, multiple offers,” Los Angeles real estate agent Craig Strong told CBS News. “It’s a good time to put an offer on a house at a lower number.”

Also Check: Should I Have A Mortgage In Retirement

Todays Mortgage Rates And Your Monthly Payment

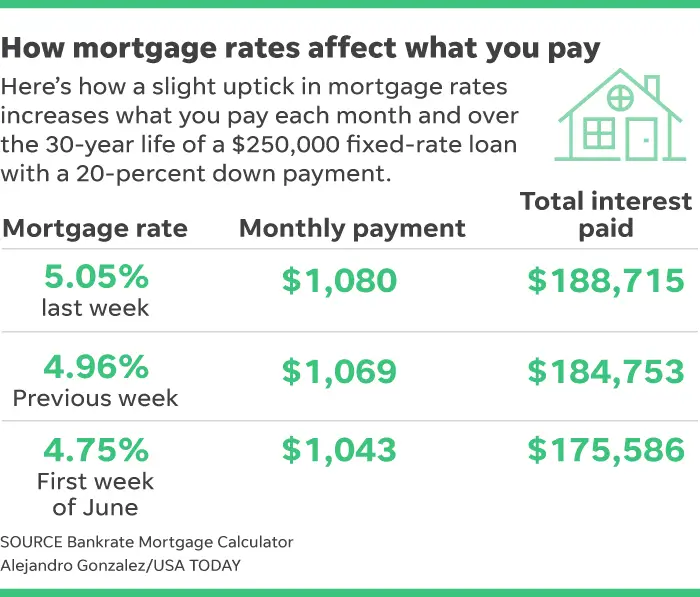

The rate on your mortgage can make a big difference in how much home you can afford and the size of your monthly payments.

If you bought a $250,000 home and made a 20% down payment $50,000 you would end up with a starting loan balance of $200,000. On a $200,000 home loan with a fixed rate for 30 years:

- At 3% interest rate = $843 in monthly payments

- At 4% interest rate = $955 in monthly payments

- At 6% interest rate = $1,199 in monthly payments

- At 8% interest rate = $1,468 in monthly payments

You can experiment with a mortgage calculator to find out how much a lower rate or other changes could impact what you pay. A home affordability calculator can also give you an estimate of the maximum loan amount you may qualify for based on your income, debt-to-income ratio, mortgage interest rate and other variables.

Other factors that determine how much you’ll pay each month include:

Loan Term:

Choosing a 15-year mortgage instead of a 30-year mortgage will increase monthly mortgage payments but reduce the amount of interest paid throughout the life of the loan.

Fixed vs. ARM:

The mortgage rates on adjustable-rate mortgages reset regularly and monthly payments change with it. With a fixed-rate loan payments remain the same throughout the life of the loan.

Taxes, HOA Fees, Insurance:

Homeowners’ insurance premiums, property taxes and homeowners association fees are often bundled into your monthly mortgage payment. Check with your real estate agent to get an estimate of these costs.