Which Loan Is Cheaper Interest Rate Vs Apr

| Loan 1: $200,000 principal 3.00% fixed interest rate $10,000 fees 3.40% APR | Loan 2: $200,000 principal 3.40% fixed interest rate $4,000 fees 3.56% APR |

|---|---|

|

Loan 1: $200,000 principal 3.00% fixed interest rate $10,000 fees 3.40% APR |

Loan 2: $200,000 principal 3.40% fixed interest rate $4,000 fees 3.56% APR |

|

Time into loan |

|

|

+ $4,000 = $322,960 |

$9,480: Loan 1 is cheaper |

Eventually, you might pay off your mortgage and own your home free and clear, ideally before retirementunless youre the type whos happy to carry a low-rate mortgage so you can have extra cash to invest .

But each time you get a new loan, you pay closing costs all over again, except in the case of a no-closing-cost refinance. That means all the loan fees you pay should really be averaged out over, say, five years or however long you think youll keep the loan, not 15 or 30 years, to give you an accurate APR. You can do this math yourself with an online APR calculator. This same logic can help you determine whether it makes sense to pay mortgage points.

How To Calculate Mortgage Payments

For much of the population, buying a home means working with a mortgage lender to get a mortgage. It can be difficult to figure out how much you can afford and what youre paying for.

You can use a mortgage calculator to estimate your monthly mortgage payment based on factors including your interest rate, purchase price and down payment.

Heres what youll need in order to calculate your monthly mortgage payment:

- Home price

- Repairs and renovations

Understanding Apr Vs Interest Rate

A mortgage APR factors in the various costs of getting a mortgage a mortgage interest rate is simply the amount your lender charges to finance your home purchase.

Both an APR and interest rate are expressed as a percentage of the loan amount. However, the difference between an interest rate and APR is that an interest rate doesnt include any of the fees and points that are part of an APR calculation.

A useful way to compare mortgage offers is to pay attention to interest rates as you shop around. After all, a lender will use your interest rate to calculate the estimated monthly payment for your given loan amount and repayment term.

Still, mortgage lenders are required by law to disclose the annual percentage rate in a mortgage transaction. This is because it measures the full cost of credit, something that interest rates dont take into account.

Consider the following example that compares two different 30-year, fixed-rate $200,000 mortgages. The homes purchase price is $250,000 for both loans, meaning the borrower made a 20% down payment.

Along with origination fees, both loans have mortgage points, which is money a borrower pays upfront to get a lower mortgage rate. One point is equal to 1% of the loan amount, so each point in the example above costs $2,000.

Recommended Reading: How Much Is Mortgage On 1 Million

What Is Annual Percentage Rate

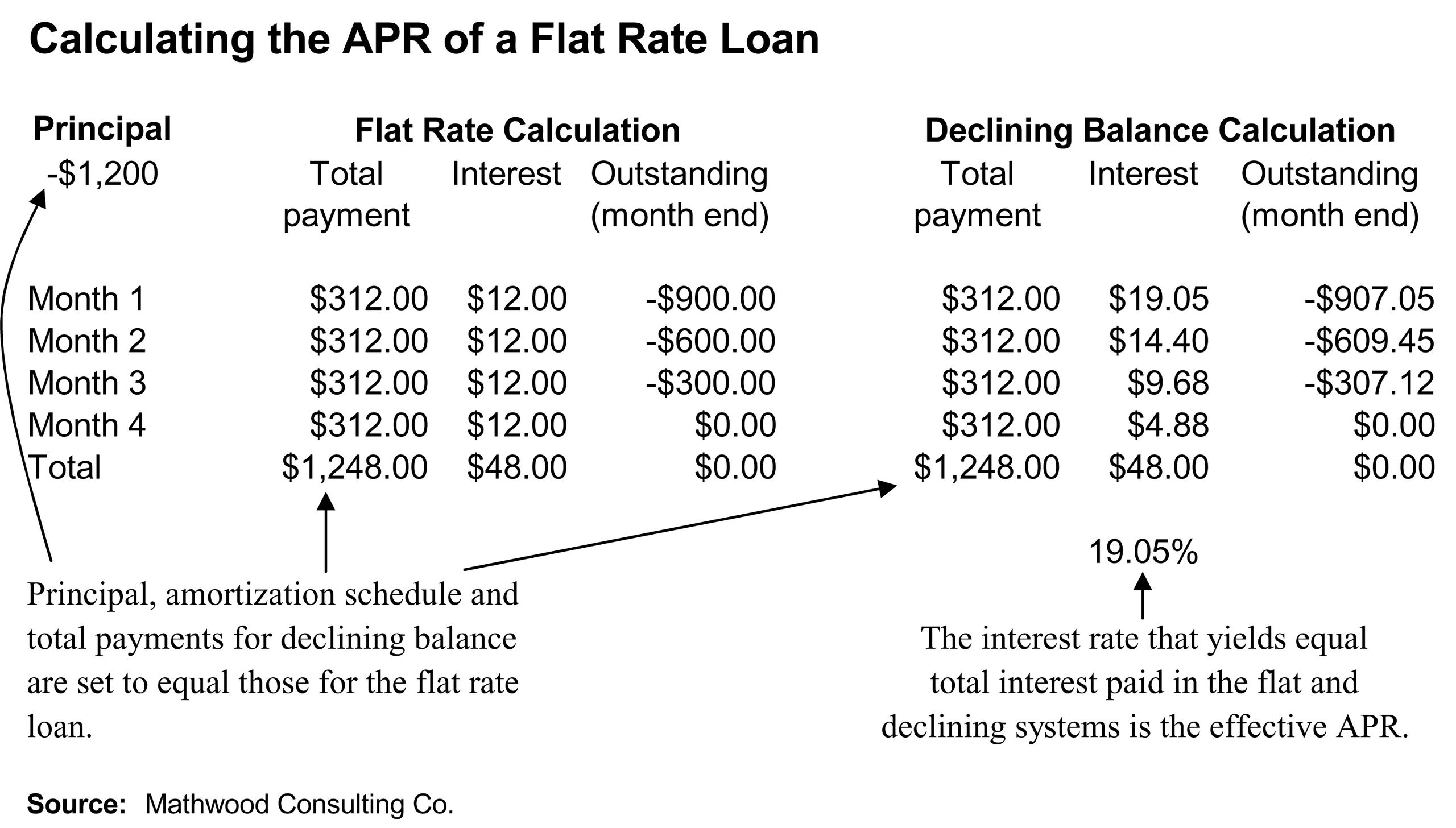

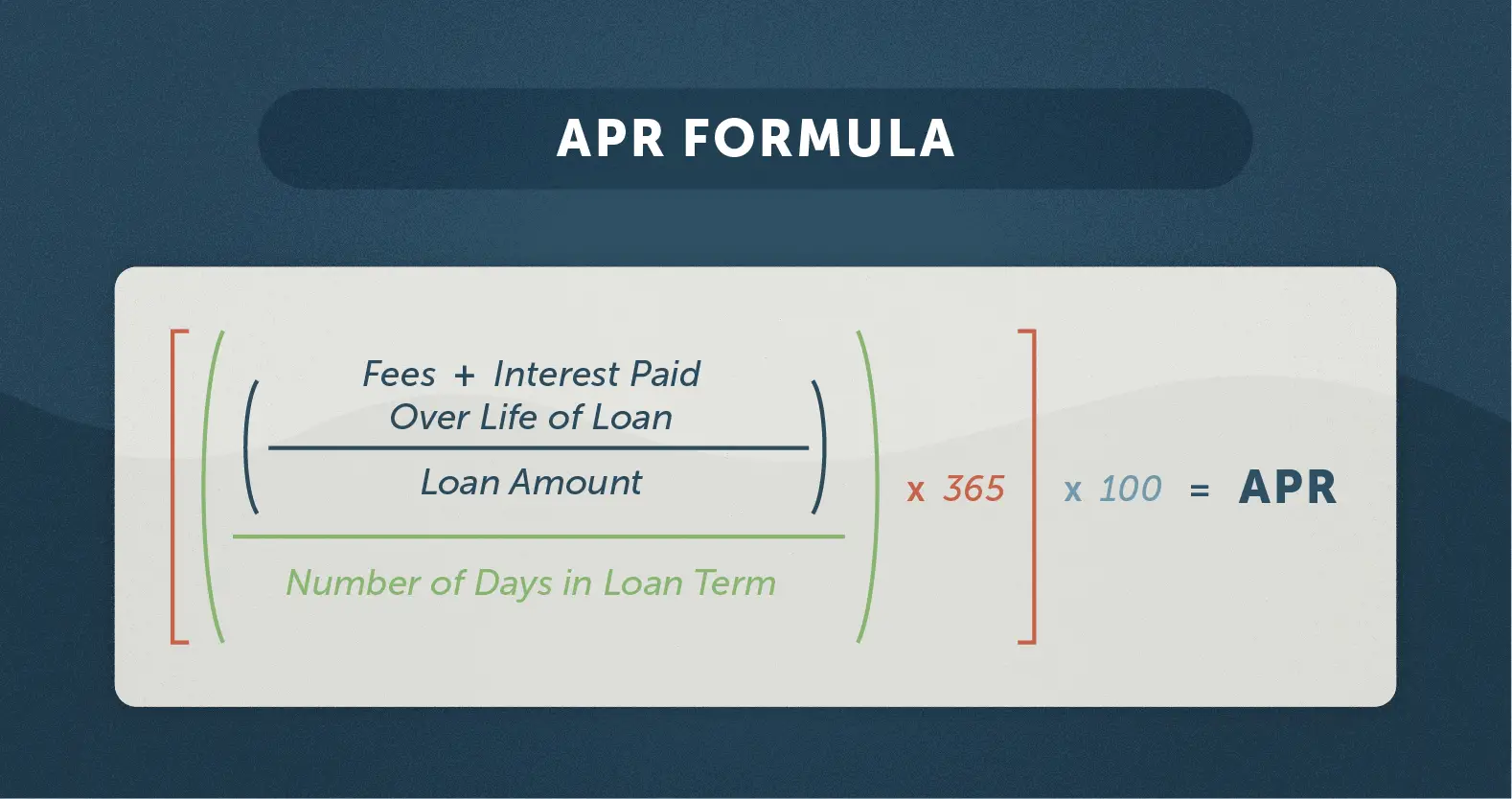

Annual percentage rate refers to the yearly interest generated by a sum that’s charged to borrowers or paid to investors. APR is expressed as a percentage that represents the actual yearly cost of funds over the term of a loan or income earned on an investment. This includes any fees or additional costs associated with the transaction but does not take compounding into account. The APR provides consumers with a bottom-line number they can compare among lenders, credit cards, or investment products.

What Does The Mortgage Payment Include

Mortgage payments consist of principal and interest. The principal amount is the amount you borrowed. The interest is a specific percentage that you accepted before signing your loan, and this goes directly to the lender. When you make additional principal payments , this reduces the amount of interest you owe.

Mortgage interest rates are fixed or adjustable. While fixed rates remain the same throughout the loan period, an adjustable rate mortgage can increase or decrease throughout the length of your loan. When your rate adjusts, your payment changes too. ARMs have rate caps that limit the amount the interest rate can change each year and over the life of the loan. Most ARMs also have an initial fixed rate period before the rate can start to change. For example, homeowners with ARMs might have a fixed rate of 4% for five years, then it may change each year if the index changes..

The rate lenders offer depends on several factors, including:

- The amount you want to borrow

- How much you plan to put down on the loan

- The length of the loan you want

- Your on-time payment history

- The type of loan you want

- Your location

Don’t Miss: Can I Get A Reverse Mortgage On A Condo

Understanding Mortgage Interest Rates

A mortgage payment is made up of the principal and the interest. The principal is the money you borrowed from your lender. The interest is a percentage-based fee that you pay the lender for borrowing that money. Paying the principal reduces the amount you owe, while paying the interest does not.

Rates can be fixed or adjustable. A fixed rate never changes, but the rate for an adjustable rate mortgage, or ARM, can adjust higher or lower while you have your loan. If your rate adjusts, your monthly payment will change. Adjustable rate mortgages typically have caps that limit how much and how often they can change. Most adjustable rate mortgages have a rate thats fixed for a number of years and then can adjust.

Lenders offer different rates to different borrowers. The rates youll be offered typically depend on the following:

- How much you want to borrow.

- How much youve saved to pay upfront.

- How many years youll have to repay your loan.

- Whether you usually pay your bills on time.

- The type of loan you choose.

- Where you live.

When you apply for a loan, the rates youre offered can be either floating or locked. A floating rate can change before you close your loan. A locked rate shouldnt change for 30, 45 or 60 days, depending on how long your rate lock lasts. If you wont be able to find a home and complete the loan process in that time frame, you can usually pay a fee to get a longer lock.

What Apr Should I Get For A Mortgage

In many cases, its best to choose a mortgage loan with the lowest APR. However, sometimes a loan offer with a lower APR may require you to pay mortgage points or other fees. You may prefer to use that money toward a down payment or to buy appliances and furniture for your new home. If so, you might consider a loan with a slightly higher APR that doesn’t have mortgage points or other fees. Contact a U.S. Bank mortgage loan officer for help determining the best mortgage loan for your specific needs.

Read Also: Rocket Mortgage Payment Options

How Does Apr Affect Your Mortgage

Your APR can give you insight into how much youll pay for your mortgage in total over the course of your loans term. If you have a 30-year loan, for example, it reflects the annualized total cost of the loan, as if you were paying all costs over the full 30 years.

Find Rates Now Checking rates won’t affect your credit score

Generally, the higher your credit score, the lower you can expect your interest rate to be . Higher credit scores indicate a lower-risk borrower, which allows a lender to offer more favorable terms, including lower interest rates and APRs. Lower credit scores will often result in the opposite.

Find Out: How to Buy a House

How The Annual Percentage Rate Works

An annual percentage rate is expressed as an interest rate. It calculates what percentage of the principal youll pay each year by taking things such as monthly payments into account. APR is also the annual rate of interest paid on investments without accounting for the compounding of interest within that year.

The Truth in Lending Act of 1968 mandated that lenders disclose the APR they charge to borrowers. Credit card companies are allowed to advertise interest rates on a monthly basis, but they must clearly report the APR to customers before they sign an agreement.

Read Also: Rocket Mortgage Conventional Loan

Why Use An Apr Mortgage Calculator

Your lender will figure your APR for you, and will advertise it in loan offers. However, you may wish to see yourself how the APR will vary if you make certain changes in the loan, such as buying more or fewer points. Or you may want to compare loan offers from lenders with different fee schedules and want to see how different fee schedules affect the APR and total cost of the loan.

FAQ: It is also helpful if you: Are working with a tight budget and need to know exactly how much you can afford.

FAQ: You want to compare the true total monthly payment required from two or more providers. For the best way to do this, .

How Mortgages And Aprs Work

Once you begin your homebuying journey, it helps to understand how mortgages and annual percentage rates work. A mortgage APR reflects the total cost of borrowing and includes costs, like mortgage loan interest, mortgage points and other lender fees. The mortgage loan APR will usually be higher than the interest rate because it includes costs and fees, as well as interest. Knowing how to differentiate between mortgage interest rates and APRs can help you select the best loan for your needs.

Read Also: Can You Get A Reverse Mortgage On A Mobile Home

Why Is The Annual Percentage Rate Disclosed

Consumer protection laws require companies to disclose the APRs associated with their product offerings in order to prevent companies from misleading customers. For instance, if they were not required to disclose the APR, a company might advertise a low monthly interest rate while implying to customers that it was an annual rate. This could mislead a customer into comparing a seemingly low monthly rate against a seemingly high annual one. By requiring all companies to disclose their APRs, customers are presented with an apples to apples comparison.

Example Of Mortgage With Different Rates And Aprs

Here are examples comparing different interest rates and APRs for a $300,000, 30-year fixed-rate mortgage:

| $503,235 | $534,463 |

If youre planning to stay in your home for a shorter period and want to purchase discount points to lower your rate, you need to do the math to determine your break-even point. Bankrates mortgage points calculator will help. Simply put, you need to stay in the home long enough to allow enough time for the rate savings to balance out those extra upfront costs.

You May Like: Reverse Mortgage Manufactured Home

What Determines My Interest Rate

Even saving a fraction of a percent on your interest rate can save you thousands of dollars. As the prime rate goes up and down, so do purchase APRs on mortgages and other debt. If you can purchase a home when you can lock in a good APR, youll save a lot of money on interest charges over the life of your mortgage.

In addition, youll find different APRs from different lenders. Shop around to make sure you get the best deal.

Six key factors affect the interest rate most mortgage lenders offer at a given time:

Here’s How Discount Points Work

One discount point costs 1% of your loan amount. While one point will typically reduce the interest rate by less than 1%, even a small interest rate reduction can lower your monthly payment and the amount of interest you pay over the life of a fixed-rate loan. Discount points may also be tax deductible .

Before buying discount points, consider:

- How much money you can pay upfront – make sure you have enough money to make a down payment, pay closing costs, and still be able to manage other expenses for your new home.

- How long you plan to stay in your new home – the longer you stay in your home, the more you may be able to benefit from buying discount points.

- How much can you pay each month – if you dont have a lot of money to pay upfront and can handle a slightly larger monthly payment, you might be better off not buying points.

Also Check: Can You Get A Reverse Mortgage On A Manufactured Home

How To Choose A Home Loan Thats Right For You

Having a hard time choosing between loans based on the interest rate versus APR? If you have the cash upfront but would prefer to have lower monthly payments, it might be worth it to you to shop for the lowest interest rate, even if the APR is slightly higher. In 10 years, youll be thankful for that lower interest when youre paying a smaller bill.

On the other hand, if you need all of your cash on hand for the down payment, you might need to pay a slightly higher interest rate with fewer fees at closing. It also matters how long you plan to stay in the house.

Every loan has a break-even point, where the extra fees you paid upfront are balanced out by a lower interest rate. If your break-even point for a loan with a higher APR and lower interest rate is seven years, but you plan to sell the house in five, youre getting a better deal with a loan with a higher interest rate and lower fee.

In the end, to get the best deal on a home loan, youll want to look at the interest rate, APR, and any details you can get about what fees have been included in those numbers.

How We Make Money

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout lifes financial journey.

Bankrate follows a strict editorial policy, so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

Were transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range can also impact how and where products appear on this site. While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service.

Also Check: What Does Gmfs Mortgage Stand For

Costs Not Included In Apr

The Federal Reserve sets which costs must be disclosed in the APR. But some costs do not need to be included, although itâs up to the lenderâs discretion. These include:

-

For mortgages only: Appraisals, home inspections, property survey fees, and title examination and title insurance fees

-

For all types of loans, including mortgages: Credit report, document preparation fees, fees for late payments, overdraft fees, notary fees

Dont Settle For A Mortgage With Lender Fees

With most mortgage lenders, closing costs comprise lender fees and third-party fees. But at Better Mortgage, we never charge lender fees, so there are no loan officer commissions, lender origination fees, application fees, or underwriting fees.

The competitive interest rate that you get will be accompanied with an APR that isnt inflated by unnecessary costs, which can equal thousands of dollars over the life of your loan.

Ready to get a Better Mortgage experience? Get your custom rates today.

This blog post is for informational purposes only, and is not intended to provide, and should not be relied upon for tax, legal or accounting advice.

- More

Don’t Miss: Reverse Mortgage On Condo

How Does Apr Work

When you apply for a loan, there is a cost involved with borrowing that money. APR is the percentage of interest for these services that is paid over the life of the loan.

Ultimately, APR is used as an informational tool to help you compare offers from various lenders. Youll want to look for a loan with the lowest APR offer. Loans with a lower APR will cost you less to borrow over time than a loan with a higher APR would. Its important to note that APR is influenced by your . As with most credit-related matters, the higher your score, the lower the APR applied to your loan. Because of this, it can be a good idea to work on improving your score before taking out a loan, if you can afford to wait.

Thanks to the Truth in Lending Act of 1968, lenders are required by law to disclose the APR for any loan they offer before the transaction is finalized. This makes it easier for customers to compare APRs as they shop around. The one caveat to keep in mind is that, because not every lender includes the same fees in their APR, you may have to do a bit more research into the terms and conditions to determine the true value and cost of a loan offer.