Qualifying Rate For Debt

- Pay attention to the qualifying rate used by the lender

- Which could differ from the note rate on the loan

- If you apply for an adjustable-rate mortgage

- You might be required to qualify at a higher interest rate to account for future rate adjustments

One important thing to keep in mind is the qualifying rate banks and mortgage lenders use to come up with your debt-to-income ratio.

Many borrowers may think that their start rate or minimum payment is their qualifying rate, but most banks and lenders will always qualify the borrower at a higher interest rate to ensure the borrower can handle a larger amount of debt in the future assuming payments rise.

For example, a borrower may be in an adjustable-rate mortgage with a monthly payment of only $1,000, but their fully-indexed payment could quite a bit higher, say $1,500, after the fixed period ends.

For a bank or lender to effectively gauge the borrowers ability to handle debt, especially once the minimum payment is no longer available for the borrower, the lender must qualify the borrower at the higher of the two payments.

This gives the lender security and prevents under-qualified borrowers from getting their hands on mortgages they cant really afford.

Borrowers should also note that most debt cannot be paid off to qualify. If you have debt on credit cards or other revolving accounts and plan to pay them off with your new loan, the monthly payments will likely still be factored into your DTI.

Can A Second Mortgage Eliminate Pmi

A loan option that is rising in popularity is the piggyback mortgage, also called the 80-10-10 or 80-5-15 mortgage.

This loan structure uses a conventional loan as the first mortgage , a simultaneous second mortgage , and a 10% homebuyer down payment. The combination of both loans can help you avoid PMI, because the lender considers the second loan as part of your down payment. A piggyback loan can make homeownership accessible for those who may not yet have saved a down payment.

For an in-depth look at these loans, see our piggyback loan blog post.

The Va Interest Rate Reduction Refinance Loan

The VA Interest Rate Reduction Refinance Loan is another refinance program that waives traditional DTI rules.

Similar to the FHA Streamline Refinance, IRRRL guidelines require lenders to verify a strong mortgage payment history in lieu of collecting W-2s and pay stubs.

The VA Streamline Refinance is available only to military borrowers who already have a VA loan. Homeowners must also show theres a benefit to refinancing their existing home loan either in the form of a lower monthly payment or a change from an ARM to a fixed-rate loan.

Recommended Reading: Does Down Payment Affect Mortgage Rate

Having A Good Dti Isnt Too Hard

Your debt-to-income ratio is one of the most important factors in qualifying for a mortgage.

DTI determines whether youre eligible for the type of mortgage you want. It also determines how much house you can afford. So naturally you want your DTI to look good to a lender.

Luckily, thats not too hard. Todays mortgage programs are flexible, and a wide range of debt-to-income ratios fall in or near the good category. So theres a good chance you can get approved as long as your debts are manageable.

In this article

Add Fixed Monthly Debts

The first step in calculating the debt-to-income ratio is adding up all your existing monthly debt obligations. These expenses may include:

- Student loan payment

- Existing rent or house payment

- Monthly alimony or child support payments

- Wage garnishments or installment payments on back taxes.

Take how much you pay each month for each of these items and add them all together. This is how much you pay each month in debt.

Also Check: What Does Apr Mean On Mortgage Rates

Why Is The Dti Ratio Important

Lenders have a responsibility to determine how likely you are to repay borrowed money. One of the most common ways of doing this is by looking at credit scores. A credit score is a three-digit number that is reflective of the information contained in your credit report. But, lenders can use other means to determine your potential eligibility.

Measuring your DTI ratio is one of the other most popular ways that lenders can measure your ability to repay borrowed money. Your DTI ratio is representative of your personal finances, as it shows how healthy they are and how much cash you have on hand. Generally speaking, the lower your DTI ratio, the better you look in the eyes of lenders.

If you are a first-time homebuyer, theres a strong chance that the amount of debt youre about to take on is the largest amount youll have ever borrowed. Lenders have a few different ways of measuring your ability to make monthly mortgage payments.

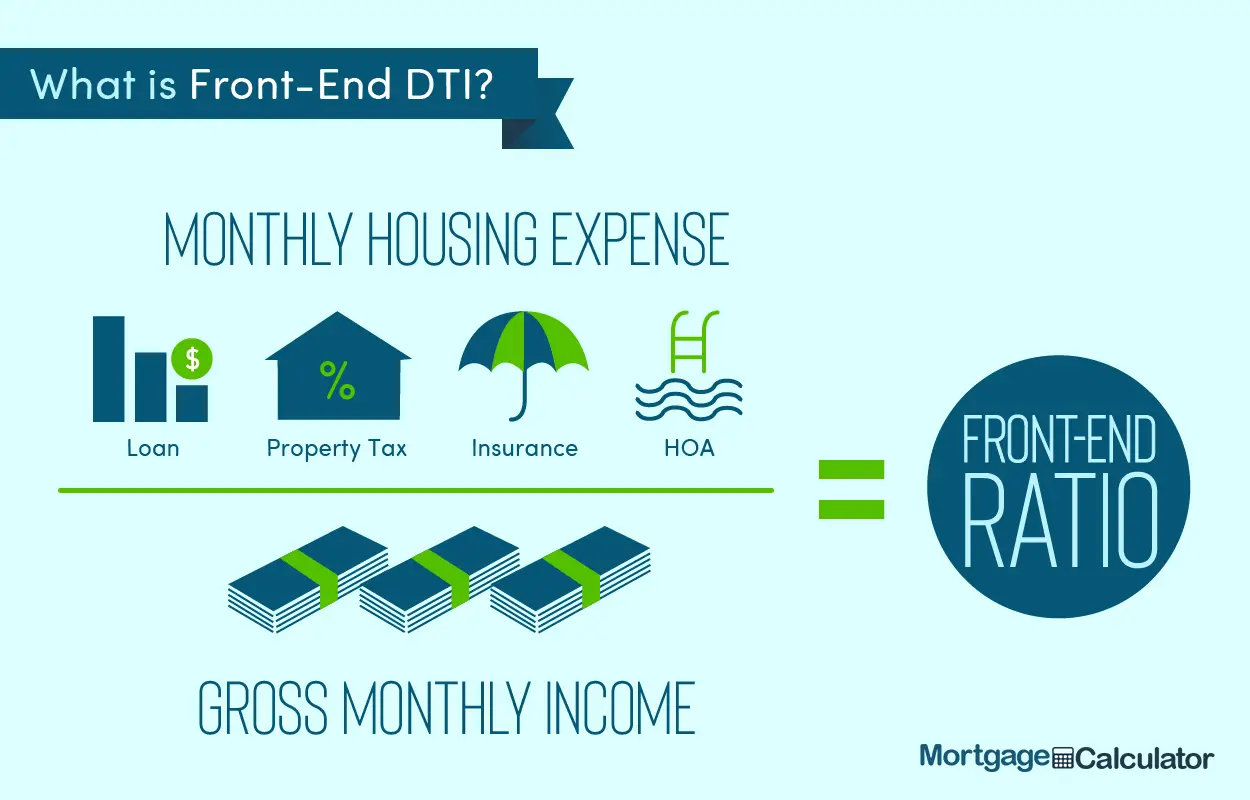

For instance, the front-end ratio is a DTI ratio that predicts how much debt youll take on in the future if you are approved for your mortgage. The front-end DTI ratio only includes your monthly expenses from:

-

Future monthly mortgage payment

-

Homeowners insurance

-

Homeowners association dues

Max Dti Ratio For Va Loans

- VA states 41% is max acceptable DTI

- And 41% max without compensating factors is likely the limit

- Possible to get approved with DTI between 41-50% with compensating factors

- Or even higher in certain cases with exception

For VA loans, the same automated/manual UW rules apply. If you get an AUS approval, the maximum DTI ratio can be quite high.

However, if its manually underwritten then the maximum debt-to-income ratio is 41% . There is no front-end debt ratio requirement for VA loans.

Again, as with FHA loans, if you have compensating factors and the lender allows it, you can exceed the 41% threshold and enjoy higher DTI limits.

Specifically, if your residual income is 120% of the acceptable limit for your geography, the 41% DTI limit can be exceeded, so long as the lender gives you the go-ahead.

In other words, most of these limits arent set in stone, assuming youre a sound borrower otherwise.

Don’t Miss: Will Mortgage Interest Rates Go Up

Pay More Than The Minimum

Any time you owe a debt, if you can afford to pay more than the minimum it will help you chip away at the actual loan balance. By paying only the minimum, you are merely covering the interest on the loan and so your total debt doesnt shrink. Additionally, paying more than the minimum helps to improve your and minimize interest charges, too.

Questions And Answers Regarding The Fha

Are FHA loans just for first-time home buyers?

No, FHA loans are not just for first-time home buyers. They are available to anyone who meets the eligibility requirements, which include a minimum credit score and down payment amount. However, first-time home buyers may be able to take advantage of some special programs that are offered exclusively to them.

Is it possible to gift the down payment?

Yes, the down payment can be gifted. The gift must be from a family member or friend and must be documented in order to prove the source of the funds.

How can I obtain the best mortgage interest rate?

There are a few things you can do to get the best mortgage interest rate:

1. Shop around. Compare rates from different lenders before you decide on one. 2. Get pre-approved. This will show lenders that you’re serious about getting a loan and that you’re a good risk. 3. Keep your credit score high. Your interest rate will be lower if your credit score is better. 4. Make a large down payment.

Is my credit score high enough for an FHA home loan?

There’s no definitive answer, as your credit score is just one factor that lenders consider when approving a mortgage. That said, a credit score of 580 or higher is generally considered to be acceptable for an FHA home loan. So if your credit score is in that range, you should be good to go.

What is the maximum amount I can borrow for an FHA home loan?

What is the difference between conventional and FHA loans?

Don’t Miss: How To Become A Reverse Mortgage Specialist

What If You Have A High Dti Ratio

If your DTI is higher than 41%, the above residual income rule may be able to help you. With 20% more in residual income per month, you can qualify for a VA loan even with a higher-than-allowable debt-to-income ratio.

However, if coming up with that extra residual income is not possible, you can also work on improving your DTI instead.

To do this, you would need to either reduce your debts or increase your income. This might entail getting a side gig, having your spouse seek employment, or, if theyre already employed, asking for a raise or more hours.

Searching for a lower-priced home or making a larger down payment can help, too. The less you need to borrow, the smaller your mortgage payment will be. Since your mortgage payment is a big part of your back-end DTI, buying a more affordable home can help lower it, improving your chances of qualifying for the loan.

Add Up Your Minimum Monthly Payments

The only monthly payments you should include in your DTI calculation are those that are regular, required and recurring. Remember to use your minimum payments not the account balance or the amount you typically pay. For example, if you have a $10,000 student loan with a minimum monthly payment of $200, you should only include the $200 minimum payment when you calculate your DTI. Here are some examples of debts that are typically included in DTI:

- Your rent or monthly mortgage payment

- Any homeowners association fees that are paid monthly

- Auto loan payments

- Student loan minimum payment: $125

- Auto loan minimum payment: $175

In this case, youd add $500, $125, $100 and $175 for a total of $900 in minimum monthly payments.

Read Also: How To Find Best Mortgage Broker

This Number Gives Lenders A Snapshot Of Your Financial Situation

Sarinya Pingamm / EyeEm / Getty Images

If youre applying for a mortgage, one of the key factors mortgage lenders will look at is your DTIor debt-to-income ratio.

That ratio, which shows the amount of your income that will go towards debt payments, gives lenders a snapshot of your entire financial situation. That helps them understand what you can comfortably afford in terms of a mortgage payment.

Understand Your Dti Ratio Before Seeking Mortgage Approval

Entering the real estate market for the first time can be daunting. Before doing so, its important that you have your finances in order. After checking your credit report, you can look into determining your DTI ratio.

The DTI ratio measures how much of your income goes toward debt. The lower the DTI, the more likely lenders are to approve you for a mortgage. Understanding your DTI allows you to better determine the maximum amount that you can spend on a home.

If you have a high DTI, there are some things that you can do to lower it. Focus on reducing your overall debt. You can either put down a larger down payment or reduce your back-end debt by using a tool like Tally, which can help you pay down your current credit card balances.

Recommended Reading: How To Find A Reputable Mortgage Lender

Dti And Getting A Mortgage

When you apply for a mortgage, the lender will consider your finances, including your credit history, monthly gross income and how much money you have for a down payment. To figure out how much you can afford for a house, the lender will look at your debt-to-income ratio.

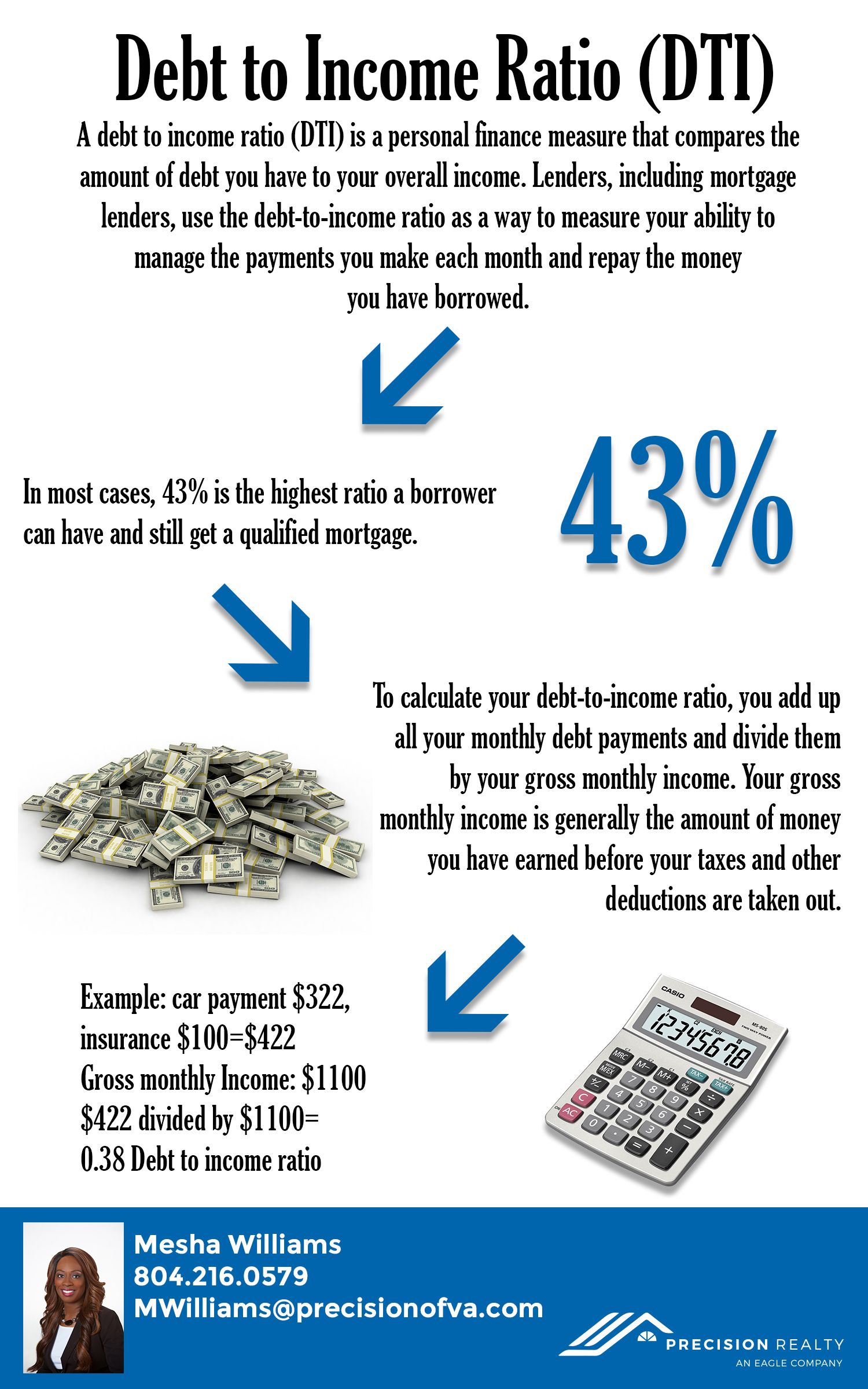

Expressed as a percentage, a debt-to-income ratio is calculated by dividing total recurring monthly debt by monthly gross income.

Lenders prefer to see a debt-to-income ratio smaller than 36%, with no more than 28% of that debt going towards servicing your mortgage. For example, assume your gross income is $4,000 per month. The maximum amount for monthly mortgage-related payments at 28% would be $1,120 .

Your lender will also look at your total debts, which should not exceed 36%, or in this case, $1,440 . In most cases, 43% is the highest ratio a borrower can have and still get a qualified mortgage. Above that, the lender will likely deny the loan application because your monthly expenses for housing and various debts are too high as compared to your income.

What Is An Ideal Debt

The choice of an ideal debt-to-income ratio for a mortgage is highly dependent on the lender, type of loan, and other mortgage requirements. However, most lenders prefer borrowers with a front-end ratio of not more than 28% and a back-end ratio not higher than 36%. In most cases, you will need to have a DTI score of not more than 50% to qualify for a home loan.

Recommended Reading: Is 3.99 A Good Mortgage Rate

Read Also: How Do Points Work For Mortgage

Getting A Loan With High Dti Ratio Faq

What is the highest debt-to-income ratio to qualify for a mortgage?

According to the Consumer Finance Protection Bureau , 43% is often the highest DTI a borrower can have and still get a qualified mortgage. However, depending on the loan program, borrowers can qualify for a mortgage loan with a DTI of up to 50% in some cases.

What is a good debt-to-income ratio?

While lenders and loan programs all have their own DTI requirements typically, a good DTI is 36% or lower.

What happens if my debt-to-income ratio is too high?

Borrowers with a higher DTI will have difficulty getting approved for a home loan. Lenders want to know that you can afford your monthly mortgage payments, and having too much debt can be a sign that you might miss a payment or default on the loan. If youre in this situation, try to pay down or restructure some of your bigger debts before applying for a home loan.

How to lower your debt-to-income ratio

A commonsense approach can help reduce your DTI before beginning the home buying process. Increasing the monthly amount you pay toward existing debt, avoiding new debt, and using less of your available credit can all help lower DTI. Recalculating your DTI ratio each month will help you measure your progress and stay motivated.

Debt-to-income vs credit utilization

Pay Off Debt And Limit Your Spending

Now, for the first lever of your DTI: the debt thats weighing you down.

Look for ways to affordably accelerate debt repayment and start making a plan to reach your target DTI, says the NFCCs McClary. You can adjust your budget to pay more than the minimum payments, but that may take some time to get you to the results you seek.

You might trim unnecessary expenses from your monthly budget, for example, to pay down credit card or other debt at a faster pace. Minimizing your current spending will also allow you to avoid taking on additional debt.

More tips from McClary

-

If youre doing well financially, consider using savings or liquidating assets to lower your debt balances.

-

If youre delinquent on debt, contact a NFCC-approved nonprofit credit counseling agency to get your accounts current and get an affordable repayment plan.

Don’t Miss: What Are Mortgage Lender Fees

What Monthly Debt Is Used To Calculate Debt To Income Ratio

Back-end DTI includes all your minimum required monthly debts including the anticipated mortgage payment.

Back-end DTIs also include any required minimum monthly payments that a lender finds on your credit report.

This covers debts such as credit card balances, loan balances from school and auto loans, and personal loan balances.

The majority of lenders place a greater emphasis on the figure that represents your back-end DTI since it provides them with a more comprehensive view of your monthly expenditures.

Fha Debt To Income Ratio Chart

This chart will indicate what DTI is acceptable based upon your credit score. This also talks about some compensating factors that may be needed to qualify for the higher DTI levels. Keep in mind this is just a basic guideline and it would be best to discuss your personal scenario because you still may qualify despite what this chart says.

| Minimum Credit Score |

|

Also Check: How To Figure Out Mortgage Rates

Tips For Getting A Mortgage

- If you cant get a mortgage for the amount you want, you may need to lower your sights for now. But that doesnt mean you cant have that dream home someday. To realize your housing hopes, consider hiring a financial advisor who can help you plan and invest for the future. SmartAssets free tool matches you with up to three financial advisors in your area, and you can interview your advisor matches at no cost to decide which one is right for you. If youre ready to find an advisor who can help you achieve your financial goals, get started now.

- The debt-to-income ratio is just one of several metrics that mortgage lenders consider. They also look at your credit score. If your score is less-than-stellar, you can work on raising it over time. One way is always to pay your bills on time. Another is to make small purchases on your credit card and pay them off right away.

Whats The Difference Between Front

Mortgage lenders often look at your front-end and back-end debt-to-income ratios when they review your loan application. Your front-end DTI includes just your housing costs in relation to your income. Lenders frequently want your front-end debt-to-income ratio to be below 28%.

Your back-end DTI includes your housing costs as well as the cost of other monthly debt payments on student loans, car loans, credit cards, and more in relation to your income. Mortgage lenders frequently want your back-end debt-to-income ratio to be below 36%.

Read Also: How To Make My Mortgage Payment Lower

Next Steps To Finding The Right Mortgage

Whatever your DTI is, its important you shop around for your mortgage loan. Terms, rates, and eligibility requirements can vary from one lender to the next, so considering a variety of lenders is critical if you want to find the right loan for your situation.

Credible Operations, Inc. can help you compare multiple lenders at once and get a mortgage pre-approval today.

Credible makes getting a mortgage easy

- Instant streamlined pre-approval: It only takes 3 minutes to see if you qualify for an instant streamlined pre-approval letter, without affecting your credit.

- We keep your data private: Compare rates from multiple lenders without your data being sold or getting spammed.

- A modern approach to mortgages: Complete your mortgage online with bank integrations and automatic updates. Talk to a loan officer only if you want to.