Consult A Pro To Find The Right Home

For help finding houses that fit your budget, or if youre ready to sell your home, consult an experienced real estate agent whose advice will save you time and money.

A buyers agent can help you navigate through the home-buying process. In some cases, they may even be able to help you find a house before it hits the market, giving you a competitive edge. And when it comes to making an offer, your agent will negotiate on your behalfso that you dont pay a penny more than you have to.

You can find a trustworthy real estate agent in your area through our nationwide Endorsed Local Providers network. RamseyTrusted agents understand how important it is to buy a home you can afford. They wont pressure you to consider homes that will bust your budget.

Other Ways To Use Your Extra Cash

Making a lump-sum mortgage payment isn’t your only option if you’re fortunate enough to have extra money. If you choose to pay down your mortgage, you will have opportunity coststhe value of what your money could have done if you hadnt used it to pay down your mortgage. Here are some of the other things you could do with that extra cash:

- Upgrade your home

Lower Down Payments Make The Loan More Expensive

The downside of putting less than 20% toward the purchase is that youll have to pay for private mortgage insurance or PMI, which may add more than $100 a month to your payment. You can see what your lender expects to charge for PMI when you receive the Loan Estimate disclosure form the lender is required to send you when you apply for financing.

Federal law requires lenders or mortgage servicers to automatically remove PMI when your principal balance is scheduled to reach 78% of the original value of your home, or when you reach the halfway point in your mortgage payment schedule provided in both scenarios that youre current on your payments and havent missed any.

The law also gives you the right to ask your lender to remove PMI once the principal balance of your mortgage is scheduled to fall to 80% of the original value of your home.

You may also be able to remove PMI by refinancing your loan to reach an 80% principal loan balance, however, refinancing does not always save you money in the long run depending on your lenders refinancing fees and costs. Lenders have their own requirements regarding PMI and loan refinancing, so make sure youre clear what those are.

The other thing to consider is the cost of interest. The more you put down, the less interest youll pay over the course of the loan. The lender also is required to provide you with that information on the Loan Estimate disclosure form when you apply for financing.

Also Check: How Many Rental Property Mortgages Can I Have

Choose An Accelerated Option For Your Mortgage Payments

An accelerated payment option lets you make weekly or biweekly payments. With this option, youre putting more money toward your mortgage than with a monthly payment.

Accelerated payments can save you money on interest charges. By accelerating your payments, you make the equivalent of one extra monthly payment per year.

Also Check: Does Prequalifying For A Mortgage Affect Your Credit

Refinance With A Shorter

A shorter term on the mortgage means it goes away sooner, but at the cost of a much higher monthly payment and perhaps some out of pocket closing costs. Examine the loan closely.

The monthly payment on a 30-year, $200,000 mortgage at 2.5% would be $790 a month.

The monthly payment on a 15-year, $200,000 mortgage at 2.25 % would be $1,310.

Thats another $520 a month to finish paying off your mortgage 15 years sooner.

30 Years vs 15 Years of Payments| 30 Years of Payments |

|---|

| $235,830 |

| *For a $200k mortgage |

The bottom line on this decision is the bottom line: Can you afford the higher monthly payment of a 15-year loan, or are you better off contributing extra each month when you can to a 30-year payment?

Don’t Miss: What Is The Current Lowest Mortgage Rate

Should You Make An Extra Mortgage Payment

Even if youre excited to get a mortgage, you might also like the idea of owning a home free and clear. Hey, youre not alone. A 30-year mortgage can feel like foreverbut it doesnt have to.

What if you could pay off your mortgage early and keep your monthly payment roughly the same?

This might seem impossible, but the truth is, paying off your mortgage early is easier than many people think, thanks to the power of making an extra principal payment .

Now, an extra mortgage payment isnt going to lower your scheduled monthly payment. This will remain the same until you pay off the loan. It does, however, reduce the amount of interest you pay over the life of the loan.

Basically, your remaining loan balance determines the amount of interest owed. Since extra principal payments reduce your principal balance little-by-little, you end up owing less interest on the loan. And when you owe less interest, youre able to shave years off your mortgage term.

Lets say you have a $200,000 mortgage with a 30-year fixed rate of 3.9%. In this scenario, an extra principal payment of $100 per month can shorten your mortgage term by nearly 5 years, saving over $25,000 in interest payments.

If youre able to make $200 in extra principal payments each month, you could shorten your mortgage term by eight years and save over $43,000 in interest.

What Is Loan Amortization

Loan amortization is the reduction of debt by regular payments of principal and interest over a period of time. For example, if you make a monthly mortgage payment, a portion of that payment covers interest and a portion pays down your principal.

Typically, the majority of each payment at the beginning of the loan term pays for interest and a smaller amount pays down the principal balance. Assuming regular payments, more of each following payment pays down your principal. This reduction of debt over time is amortization.

You May Like: How Fast Can You Get A Mortgage Loan

Investing The Cash Instead

If you have excess cash burning a hole in your pocket, consider the opportunity cost of paying down your mortgage early instead of using the funds to invest elsewhere. While you will save on a portion of the interest expense, you may be better off investing the money instead, especially if your interest rate is low.

Consider your interest expense relative to your long-term return expectations. If a homebuyer can get a 30-year fixed mortgage for 2.85% and their long-term assumption for investment returns is 6%, theyre using leverage to achieve a better financial outcome. After all, you won’t enjoy the benefits of paying down your mortgage early until you’re living debt-free, but the average buyer only lives in the house for 10 years.

Bring Your Lunch To Work

Sure, bringing a peanut butter and jelly sandwich to work every day isnt as fun as going to a restaurant with your coworkers. But trading lunch out for eating in can make you a lean, mean, mortgage-free machine.

Suppose packing your lunch frees up $100 to use toward your mortgage every month. Based on our example above of the $220,000 loan, that $100 in lunch money will help you pay off your mortgage almost five years ahead of schedule and save you over $27,000 in interest!

Cant quite spare a whole $100 from your food budget? No worries. Even small sacrifices can go a long way to help pay off your mortgage early. Put Andrew Jackson to work for you by adding just $20 to your mortgage payment each month. Based on our example, youll pay your mortgage off a year early, saving over $6,000 in the process.

Read Also: Can I Combine My Mortgage And Home Equity Loan

Is There A Disadvantage To Paying Off A Mortgage

A: Paying your mortgage off early and closing out an account could impact your credit score. Mortgages are considered “good debt,” and paying it off extremely early could negatively affect your score. But, remember, you can alwaysrefinance to a shorter-termif you are determined to pay it off sooner. In addition, you could possibly get a lower interest rate in the process and be able to pay your loan off sooner.

Related Articles

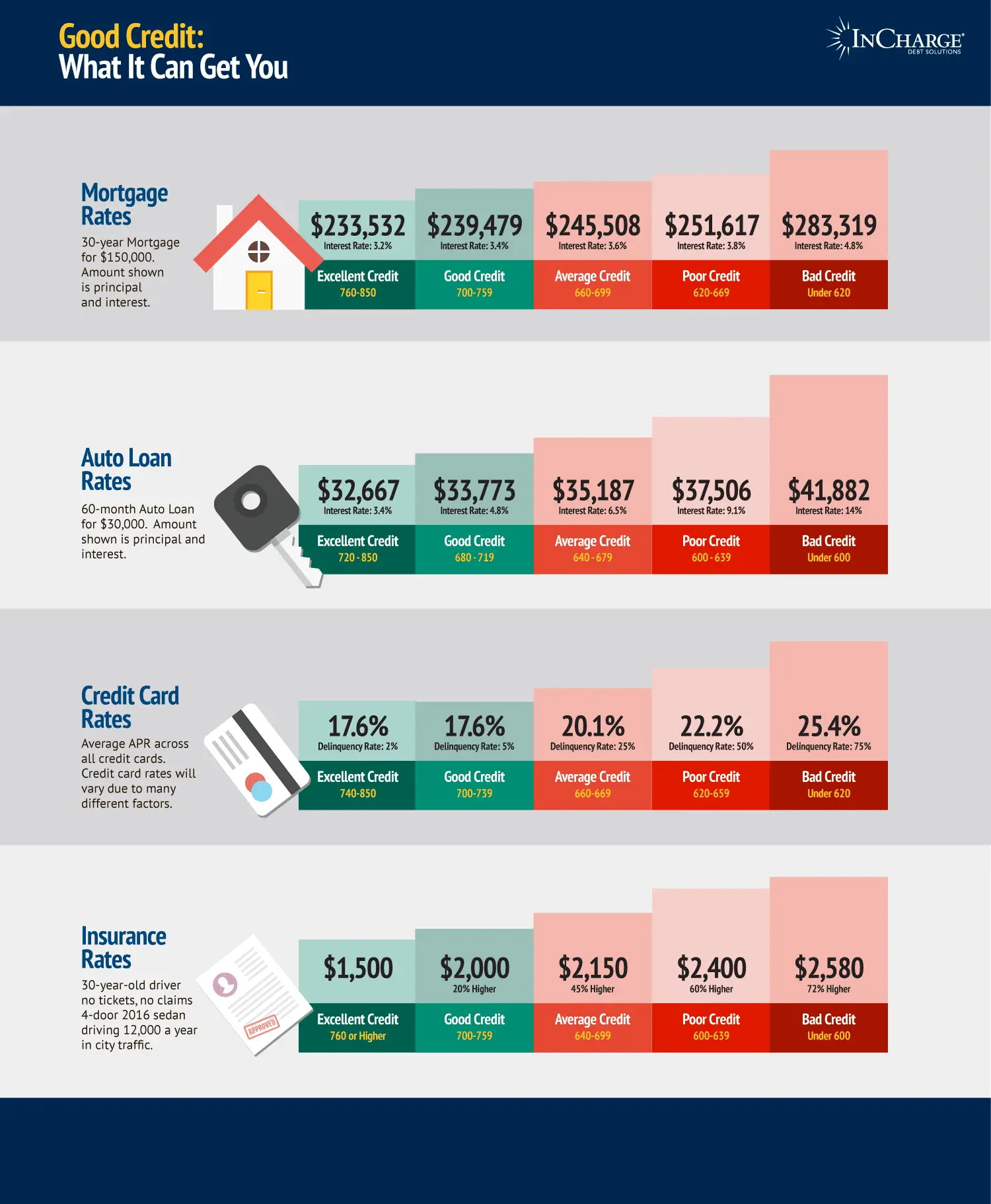

Find The Best Interest Rate

Interest rates determine how much you spend on interest in addition to the principal. Generally, the higher the rate, the more you pay over the length of your mortgage. So, its important to choose a mortgage with a rate that fits into your repayment plan.

Mortgages come in 2 interest rate categories:

- Fixed-rate mortgages lock your rate for an entire term. This makes it easy to track how much principal you pay back each month

- Interest rates on variable-rate mortgages can change at any time your rate could be higher or lower, depending on the market. But lower interest rates mean you pay more on the principal and pay off your mortgage faster

Interest rates vary on different mortgages, depending on their features. For example, you pay a higher interest rate on mortgages with cash-back benefits. With a cash-back mortgage, in addition to the mortgage principal you get a percentage of the mortgage amount in cash. You can use this money to buy investments, pay for a special event or renovate your home. But cash-back mortgages aren’t available at all financial institutions.

Recommended Reading: Can I Get A Mortgage Without A Full Time Job

Making 1 Extra Mortgage Payment A Year: What Is The Impact

Derek

Are you thinking about making 1 extra mortgage payment a year? Did you hear that it cuts a bazillion years off the term of your mortgage? Is that actually true? And should you start making these extra payments?

These are great questions! And theres actually another good one that you may be asking What if Im already halfway into my mortgage payments? Is it still worth it for me make these extra payments?

Yup, well answer this too. Lets hit it!

Dont Miss: Who Is Rocket Mortgage Owned By

Make More Frequent Payments

It could be one extra mortgage payment a year, two extra mortgage payments a year, or an extra payment every few months. Whatever the frequency, your future self will thank you. Maintain these additional payments over an extended period of time and you’ll likely eliminate several years from your term.

A quick note here: there is no best day of the month to pay your mortgage. Both the principal and interest amounts decrease over time, whether you make payments on the 1st, 15th, or a date in between.

Don’t Miss: How Do You Figure Out Your Mortgage Payment

How To Make An Extra Mortgage Payment

There are multiple methods of making extra mortgage payments here are 3 that might work for you:

Before you decide that youre going to start making extra mortgage payments each year, make sure that you are financially healthy. Its a good idea to apply extra dollars to paying off high-interest debt and to investing in 401ks, etc. before applying those dollars to your mortgage. Depending on what your financial goals are, you may determine that making those extra payments is the right move for you. It may take some time before you see the full benefits of your diligence, but when you reach your goals sooner, it could be worth it.

Read Also: Is A Home Loan A Mortgage

Making An Extra Mortgage Payment Each Year

- Some homeowners prefer to make an extra payment each year

- Perhaps related to a tax refund check or from a year-end bonus at work

- This is another good strategy to cut your mortgage term and save lots of money

- And ensure that the bonus money you receive is put to good use as opposed to spent frivolously

You could also make one extra lump sum payment at the beginning of each year, perhaps after receiving your year-end bonus.

So lets say you make a $1,000 bonus payment each year in January, starting in month 13.

That would save you $19,005.22 in interest and shave 85 months off your loan term.

As you can see, there are all types of scenarios that abound here, and which one you choose, if any, is up to you.

You might argue that mortgage rates are super cheap, and thus determine that making extra payments now makes little financial sense.

Or you could be living in your dream home and not too far from retirement, with the hopes of living free and clear sooner rather than later.

If thats the case, making the extra payments now may be very appealing. Refinancing your mortgage to a shorter term could also make a lot of sense.

Just remember that plans change homeowners are much more likely to move or refinance their loans as opposed to carrying them to term.

So while the math might excite you, it may not actually pan out.

Also Check: How To Get Pre Approved For A Mortgage

Should I Refinance Or Just Pay Extra

With mortgage interest rates near record lows, refinancing your current mortgage might seem like a no-brainer. Millions of homeowners could lower their monthly payments and save on long-term interest.

But what if you already have an ultra-low rate? Or youre nearly done paying off your home loan?

In some cases, starting your mortgage over with a refinance wont make sense. Luckily, you can still save on interest and potentially pay off your home early by paying extra toward your mortgage.

Heres how to choose the right strategy.

Early Mortgage Payoff Examples

Imagine a $500,000 mortgage with a 30-year fixed interest rate of 5%. If you paid an extra $500 per month, youd save around $153,000 over the full loan term and it would result in a full payoff after about 21 years and three months.

If you had a $400,000 loan amount set at 4% on a 30-year fixed, paying an extra $100 per month would save you nearly $30,000 and youd pay off your loan two years and eight months early.

If you had a $300,000 loan amount set at 4.5% on a 30-year fixed, paying an extra $250 per month would save you almost $70,000 and youd pay off your loan seven years and six months ahead of schedule.

Or consider a $600,000 loan amount set at 6% for 30 years. Paying an extra $1,000 per month would save a homeowner a staggering $320,000 in interest and nearly cut the mortgage term in half. To be more precise, itd shave nearly 12 and a half years off the loan term.

The result is a home that is free and clear much faster, and tremendous savings that can rarely be beat.

The list goes on and the savings may shock you. While most people tend to be alarmed by the amount of interest they pay the bank over 30 years, its equally shocking how much you can save simply by paying a little extra.

Recommended Reading: Can I Get A Mortgage After Filing Chapter 7

What Are The Current Terms Of Your Mortgage

Before you attempt to pay off your mortgage early, its important to gain a concrete sense of the conditions you established with your mortgage lender. Knowing the length of your loan term will help you determine how long it will take you to pay off your mortgage if you make the minimum payment each month. Being aware of your interest rate will tell you how much interest youre currently paying on the remaining balance of your mortgage principal.

You should also see whether you agreed to a fixed- or adjustablerate mortgage. If you have an ARM loan, youll want to know how market rates have changed since you first obtained your mortgage. If market rates are higher, paying off your mortgage early may be the right move.

Ready To Apply For A Mortgage In Wa Or Co Or Id

Do you have questions about home loans? Are you ready to apply for a mortgage to buy a home? If so, Sammamish Mortgage can help. We are a local mortgage company from Bellevue, Washington, serving the entire state, as well as Oregon, Idaho, and Colorado. We offer many mortgage programs to buyers all over the Pacific Northwest and have been doing so since 1992. Contact us today with any questions you have about mortgages.

Read Also: How To Make A Mortgage Payment With A Credit Card

Make An Extra Mortgage Payment Every Year

Throw all or a portion of new-found money like a year-end bonus or inheritance at the mortgage. The earlier into the loan you do this, the more of an impact it will have. In a typical 30-year mortgage, about half the total interest you pay will accumulate in the first 10 years of your loan. That is because your interest rate is calculated against the very high principal amount you owe in the early years.

How Does Prepaying Your Mortgage Actually Work

bySensible StaffApril 25, 2017

When you make an extra payment on your mortgage, that money goes directly toward reducing the balance on your loan. Because of how the loan is structured, the extra payment triggers a cascade effect that speeds up the repayment of the loan. In what follows, I discuss the mechanics of your mortgage and illustrate exactly how prepaying works. Armed with this information, in my next article, I will focus on how prepaying your loan can be thought of as a financial investment. Although I focus on home loans, the following analysis is readily applicable to all types of fixed-payment debt such as student and auto loans.

How does your mortgage work?

You pay your home loan on a fixed repayment schedule of regular installments over a specified period. This process is referred to as amortization. Assuming you dont make any extra payments towards the loan, amortization of a fixed rate mortgage is rather straightforward. A 30-year fixed rate mortgage with a 4% interest rate means a $2,387 monthly payment on a $500,000 loan. This monthly payment is fixed, meaning it never changes over the duration of the loan. Although the total monthly payment is fixed, the interest portion of each payment and the part that goes towards the balance will vary each month. The total payment is your principal and interest payment .

Interest payment = Interest rate X Beginning of period loan balance

How does prepaying your mortgage work?

Phone: 573-4131

Read Also: Can You Get A Mortgage To Cover Renovations