When Balancing Early Mortgage Repayment And Other Financial Responsibilities Works

You should have a robust household emergency fund before you think about paying extra cash toward your mortgage. An unexpected auto bill, medical expense or other cost can upset your budget if you dont have any liquid cash.

While its possible to take cash out of your home equity with a refinance, this process takes time, which you may not have in an emergency. Make sure you have plenty of money set aside for emergencies before you put any extra toward your mortgage loan.

You may want to put off paying off your mortgage if you have another big expense coming up. Your priority should be putting money into your 401 or IRA. You might also want to consider diverting your extra money into a childs college fund or into savings for an upcoming vacation or wedding.

Theres no point in paying off your mortgage if it means going back into debt in the future.

You Dont Have Retirement Savings

If you dont have money put aside for retirement or IRA account), that should probably be a priority. The longer you wait to put money towards retirement, the more compound interest that you miss out on. Depending on your situation, it might be best to begin investing in your retirement for a while before worrying about getting rid of your mortgage faster.

The Benefits Of Overpaying Your Mortgage

If you can afford to make extra payments, overpaying your mortgage means you pay less interest in the future and pay off your mortgage sooner. This means you could save a lot of money.

On a £150,000 mortgage at 5% with 25 years remaining, paying off a £5,000 lump sum reduces the interest by £11,500 and means you would repay it 18 months earlier.

Overpaying when interest rates are low means youll have a smaller mortgage too if there are higher interest rates in the future.

But depending on your circumstances, there are some other questions you need to ask yourself.

Read Also: Why Are 15 Year Mortgage Rates Lower Than 30 Year

Hold Off On Home Renovations

After buying a house, especially if its not brand new, many people want to renovate. While this can potentially increase value and make your home more personalized, its good to stick with one big goal at a time.

In order to pay off a mortgage in five years, its essential to give all of your extra money and attention to this. Then, after youve paid off the house, it will be easy to save up for renovations and other big home projects.

This obviously applies to any other significant money goals, as well. Rather than trying to pay for several big things at once, stick with one for the best results.

What If I Make 2 Extra Mortgage Payments A Year

Soif making 1 extra mortgage payment a year can have such a big impact, what about making 2 extra mortgage payments a year?? What could that do?

Lets continue on with our $300,000 loan example. Your interest is 5%, its a 30-year loan, and your payment is $1,610.

What if you paid an extra $3,220 a year toward your mortgage ? When would you pay it off and how much interest would you save?

Recommended Reading: What Would My Payment Be On A 15 Year Mortgage

Commit To Making One Extra Payment A Year

The average American gets about $2,833 in their tax refund, according to the IRS. For most people, this is more than enough money to cover an extra mortgage payment every year.

You can put your tax return to good use and make an extra mortgage payment. On a $150,000, 30-year loan with a 4% interest rate, a single extra payment every year will help you pay off your mortgage 4 years early.

How To Pay Off Your Mortgage Early

8 Min Read | Aug 30, 2022

So youre eager to join the nearly 40% of American homeowners who actually own their home outright.1 Can you imagine that?

When the bank doesnt own your house and you step onto your lawn, the grass feels different under your feet. Thats freedom. And when you dont have a mortgage payment, you can supercharge your retirement savings.

But the problem is youre currently stuck dragging around that ball and chain called a mortgagejust like most homeowners. How can you pay off your mortgage early?

Dont worry. Well show you how to pay off your mortgage faster so you can finally join the ranks of debt-free homeowners. Lets get started.

You May Like: What Is An Investment Mortgage

Recast Instead Of Refinancing

You might even want to consider mortgage recasting. Recasting is different from refinancing because you get to keep your existing loan. However, you have to make a lump sum toward the principal.

The bank will then adjust your loan schedule to reflect your new balance . The lump sum will cause you to have a shorter loan period. While you have to pay a closing cost when you do a refinance, there are fees you have to pay associated with recasting.

The difference is tremendous. Recasting involves only paying hundreds of dollars at closing while refinancing usually involves having to pay thousands of dollars.

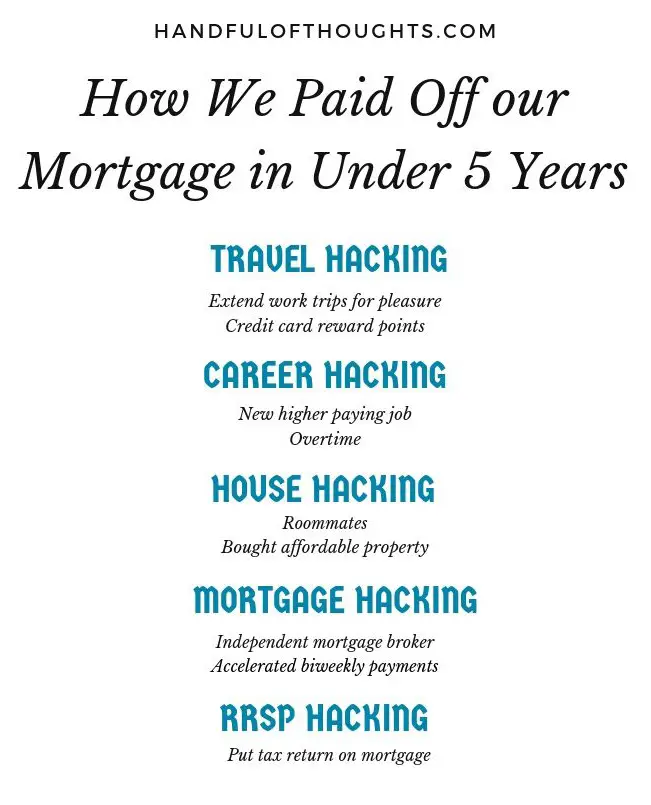

Here Are Our Top Tips On How To Pay Off Your Home Loan In 5 Years:

- Borrow a realistic amount to fit your goal – Your choice on properties might be limited as the amount you can borrow will be less if you wish to reach that 5-year goal. With the median sale price for a house in Newcastle landing at approximately $1.2 million, you need to consider where you buy and how much your property will set you back.

- Save a decent deposit – Having a sizeable deposit will lessen the amount you will need to borrow and take a lot of stress off. Remember, just because you have a larger deposit doesnt mean you should borrow more.

- Increase the frequency and amount of your repayments – Make sure your repayments are also set to automatically come out at an amount that fits your monthly budget, but also your set timeline to pay down the loan. Try and increase repayments and add lump sums when possible as these could drastically decrease the cost and life-span of your home loan.

- Purchase an investment property – You might consider renting out your new property, so you can ultimately flip it for a better return . Once your property is paid down you have the option of moving in once your tenancy agreement lapses, or selling the property and using the profits to buy your next place.

Don’t Miss: How To Get A Mortgage With Bad Credit

Bring Your Lunch To Work

Sure, bringing a peanut butter and jelly sandwich to work every day isnt as fun as going to a restaurant with your coworkers. But trading lunch out for eating in can make you a lean, mean, mortgage-free machine.

Suppose packing your lunch frees up $100 to use toward your mortgage every month. Based on our example above of the $220,000 loan, that $100 in lunch money will help you pay off your mortgage four years ahead of schedule and save you nearly $27,000 in interest!

Cant quite spare a whole $100 from your food budget? No worries. Even small sacrifices can go a long way to help pay off your mortgage early. Put Andrew Jackson to work for you by adding just $20 to your mortgage payment each month. Based on our example, youll pay your mortgage off a year early, saving over $6,000 in the process.

Celebrate Your Wins And Milestones

The goal of paying off your mortgage early is a big, serious commitment, and one that you should stay focused on consistently. However, there will be times that you just dont want to think about it one more minute.

In that case, take a short break from it. You still have to live your life in a way that is manageable and doesnt drive you crazy, right? In addition, it is really difficult to stay motivated without any sort of attaboys or attagirls along the way.

Schedule a celebration at different milestones along the way. Perhaps after you pay off $5,000 or $10,000 of principal, you will go out for a nice dinner at a favorite restaurant. Maybe after you have paid off $25,000 of the principal, you decide to take a long weekend away, an adventure in a place you have never been. Celebrate these wins, even when they are small ones because small wins add up to the BIG win later.

Don’t Miss: How To Get A Va Mortgage

Pitfalls Of Paying Off Your Mortgage Early

Many homeowners think that they should pay off their mortgage early to get out of debt, but does it always make sense?

You do not want to pay off your mortgage and end up low on cash. Its much easier to take cash out of a checking account when needed than it is to refinance by pulling it out of your home loan.

Ask yourself if youll need liquid cash in the near future. If the answer is yes, youre better off putting your extra money in savings not toward your mortgage.

Always have a small savings buffer to help you pay for immediate expenses.

Dont Miss: What Is The Mortgage Rate For Bank Of America

Reduce Your Balance With A Lump

An alternative to recasting is to make lump-sum payments to your principal when you can.

Have you inherited money, earned large bonuses or commission checks, or sold another property? You could apply these proceeds to your mortgages principal balance and be debt-free a lot sooner.

Since VA and FHA loans cannot be recast, lump-sum payments might be the next best thing. Also, youll save yourself the bank fee for recasting.

With some mortgage servicers, you must specify when extra money is to be put toward principal. Otherwise the extra money could be split between the interest and the principal as it is divided within a regular monthly mortgage payment.

Check with your servicer if you dont know how additional payments will be applied.

You May Like: Does Mortgage Prequalification Affect Credit Score

You Have No Retirement Savings

Saving for retirement should be a priority for you. If you dont have money set aside in a retirement account, whether you opt to use a 401 or an IRA, now is the time to start saving and investing. Even if youre only in your 30s, waiting five years or more to start saving will cause you to miss out on significant earnings from compound interest alone.

And since the stock market has historically had returns that average about 10%, you can likely make more through an investment for retirement than from paying off a mortgage with a low interest rate.

How To Pay Off Mortgage In 2 Years

What if youre absolutely sick of your mortgage? You want it gone and you want it gone as fast as possible.

What about 2 years? Lets enter that into the Early Mortgage Payoff Calculator to get the numbers on how to pay off a mortgage in 2 years .

Whoa. You ready for this one?

To pay off a $300k mortgage off in 2 years, youd need to make extra monthly payments of $11,551. That a pretty steep dollar figure!

But, if you can do it and you want to do it, then more power to ya!

You May Like: How To Calculate Yearly Mortgage Interest

Not Having Enough Savings

Its no use paying off your mortgage if you dont have enough savings.

Why? Because if you have an emergency that sets you back, and you dont have savings, that will leave you with more debt to pay off.

Its a good idea to save up an emergency fund, at least, before you commit to paying off your home in five years. That way, you protect yourself from further debt, which would move your payoff timeline further away.

Related: Is a bigger emergency fund always better?

Choosing Your Next Steps

If youve decided that paying off your mortgage is the best option for you, your next step is to make sure there are no prepayment penalties included in your loan terms. You can find this information on Page 1 of your closing disclosure. Additionally, confirm that your lender is applying all extra payments toward your principal balance, not interest. You may have to make a request in writing or follow a special process when sending in extra principal payments. Youre getting rid of a huge monthly bill and building a substantial amount of home equity when paying off your mortgage early.

If, on the other hand, you decide to stick with your scheduled mortgage payments, make a concrete plan for how youll use the extra money that wont be going toward the mortgage. It may be tempting to treat it like spending money, but bulking up retirement accounts, an emergency fund or long-term investments will likely better serve your financial goals.

Don’t Miss: How Much Mortgage Qualify For

Pay Your Mortgage Faster And Pay Yourself While You Do It

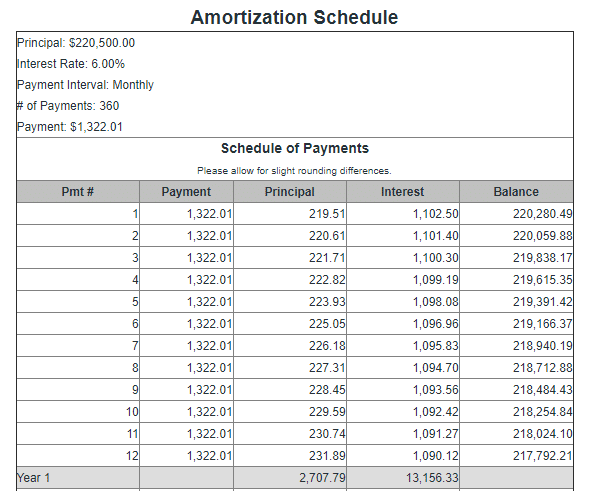

Did you know that the interest you pay on your mortgage can double the cost of your home? It seems shocking, but think about it: youre paying 30 years worth of interest on a six-figure loan. No wonder its so hard to afford a place of your own.

But theres a simple way to take a machete to that massive pile of interest and potentially put tens of thousands of dollars back in your pocket. Just make modest but regular extra payments toward what you borrowed , especially in the early years of homeownership.

We know what youre thinking: Pay even more every month? But wait until you see the math! Youll build equity and own your home free and clear faster, of course. But whats really impressive is how much you get back in interest. Every extra payment on principal is like making an investment with a guaranteed return.

Read on, and well explain how it works and show you how making payments on principal can easily double your money. The key thing to understand is your loans amortization schedule.

Cut Back On Your Spending

When you want to put more money towards your mortgage, youll likely have to cut back on other things that to be able to afford to do so. Limiting your other monthly expenses is an amazing way to pay off your mortgage more quickly. For example, if you have multiple monthly subscription services, you can start by cutting out the ones that you use the least.Remember, these spending cuts dont have to be permanent once your mortgage is paid off, you can always go back to what you were spending money on before. Cutting back on spending is a temporary measure so that you can focus on paying off your mortgage.

You May Like: How To Get A Mortgage After Bankruptcy

One Extra Payment A Year

Making one additional payment per year offers the same benefits as making biweekly payments. You not only pay down your mortgage principal faster, you save thousands of dollars in the long run. There are several ways to swing one extra payment each year:

- Use your tax refund or bonus.

- Put a little aside each month and make one extra payment in December.

- Take on a side hustle you enjoy, and dedicate your earnings to an extra mortgage payment.

Refinance For A Shorter Loan Period

Most home loans are for 30 years. If youve been paying the mortgage and decided your money needs to be freed up for other purposes, you may want to consider refinancing for a shorter period.

The shorter the loan period for repaying the loan, the higher the monthly payment will be, so really consider your circumstances. Maybe you cant afford to refinance a loan if you still have 15 years to go.

But if youre 10 years away or less, it may be worth checking into. Also, a shorter repayment period means less interest over the life of the loan.

Recommended Reading: What Is A Mortgage Bond

Get Completely Out Of Consumer Debt

If you have

- student loans..

basically anything thats not a home mortgage debt, youre going to want to tackle that first .

Why?

Because a home typically goes up in value. Any of the items above will not go up in value. And, the items above are likely a lower dollar amount, so you can pay them off much faster than you could a house. All great reasons to tackle the above list first and the home mortgage last.

What I did was use a debt snowball template .

- I lined up my debts from smallest to largest

- I entered the interest rates and the minimum payments

- Then, the tool showed me how quickly I would pay off all my debt

- If I didnt like the answer I saw, I could see what adding extra payments would do to the payoff timeframe

What To Factor Into Your Budget

Youll want to make your budget the way you usually would with expenses and savings. Youll likely want to save still and invest in addition to paying off your mortgage, although you may be putting less money in those categories than usual.

Related: Easy Tips for Starting a Budget

Its important that while you add a lot of money to the home payoff section of your budget, you dont forget about everyday life. Youll still have many expenses to pay for like groceries, phone bills, and utilities.

You may choose to skip the grand vacations or pricey dinners out for now, but be sure to take care of your basic needs before putting more money towards your home.

After you do your regular budget expenses, see what you have leftover to add to your mortgage payment. If it isnt as much as youd like, you can try these ideas.

Read Also: Can You Get A Mortgage If You Have Debt