How A Larger Down Payment Impacts Monthly Payments*

| Percentage | |

|---|---|

| $200,000 | $1,005 |

*The payment is principal and interest only. To get the total monthly payment for down payments below 20%, add in your property taxes, homeowners insurance and private mortgage insurance .

In general, most homebuyers should aim to have 20% of their desired home price saved before applying for a mortgage. Being able to make a sizeable down payment improves your chances of qualifying for the best mortgage rates. Your credit score and income are two additional factors that play a role in determining your mortgage rate and, therefore, your payments over time.

Mortgage Rates In Ontario

Mortgage brokers and certain lenders can charge different mortgage interest rates depending on the province. Ratehub.ca has a comprehensive page of the best mortgage rates in Ontario. The most current Ontario mortgage rates are already included in the calculator above, so you can trust the numbers we provide to be accurate.

Considerations Before Committing To A Mortgage

WOW: Look at those figures above! The amount of interest you will pay your bank over the period of the loan is outrageous, particularly when we consider what we have done to bail out the banks in our recent history. I know, you have no choice, you need a mortgage but, save what you can, while you can. Use a bigger deposit if you can, repay your mortgage early to save thousands on interest payments. Think about your financial future, when do you really want to pay of that mortgage, the answer should be as soon as possible.

Affordability: Be sure you can really afford to make the Mortgage repayments. Only you really know if you can afford a Mortgage or not and committing to a mortgage which you will struggle to repay will only cause you financial hardship and pain in the future. Remember,

Mortgages: READ THE SMALL PRINT: Your home may be repossessed if you do not keep up your Mortgage repayments .

Shop around: It always pays to shop around and see what deals are available. Most banks and building societies run promotions at various points of the year. Never assume that one lender is better than the other, look for the good deals as they could save you a lot of money.

Borrow Little, Repay Quickly: The best Mortgage is one repaid quickly. A quick repayment means less interest paid and less stress about your debt.

Recommended Reading: How Much Should I Pay Down My Mortgage

How Much Deposit Do You Need

The deposit required by the mortgage lender will depend on the price of the property youre buying and whether youre classed as high or low risk.

Most lenders set the maximum loan to value ratio at 90%, meaning youll need a deposit of 10%.

The LTV shows how much of the property you own outright. Some can accept as little as a 5% deposit, while others will need you to put down more if youre considered higher risk because of issues like bad credit.

Size matters when it comes to residential mortgage deposits, and it can affect the interest rates you get, which affects your monthly repayments.

A larger deposit means a lower LTV, and it increases your chances of getting favourable rates from more lenders as they consider the mortgage a lower risk.

If the total amount of the property youre buying costs £300,000 in the market and lenders need a 10% deposit, youll need to make a £30,000 down payment.

You would then borrow £270,000 from the mortgage lender.

How Does Being Self Employed Effect My Application

There is no reason why being self employed should you leave you at a disadvantage. Being self employed simply means that how you show proof of your income is different to an employed person who may need to show Payslips and there p60 for example. If youre self employed the lender may ask to see 2 years of business accounts and SA302 and your tax year overview from HMRC. A mortgage broker is often useful in these cases as they have an indepth understanding of the lenders requirements.

Read Also: What Is A Pre Qualified Mortgage

Benefits Of Breaking It All Down

Breaking down your interest payments in this way isn’t just an exercise in math. Getting this kind of analysis helps you to better understand how just the cost of your home can significantly impact how much you pay over the life of your loan. Of course, getting the best interest rate possible will help you to save money. However, if you aren’t able to lower your interest rate any further either because you haven’t been able to put together a larger down payment or because you haven’t been able to improve your credit score then focusing on finding the best price for the home of your dreams can help you save.

Use our easy calculator to get the information you need to put you in a stronger position to negotiate with the seller and to create the right budget for you while also buying the home of your dreams. Just plug in the amount of the loan, the interest rate, the length of the loan, and any loan points, origination fees and closing costs. We’ll mail you an easy-to-understand analysis of your interest charges by month and year in plain English. You don’t need to enter any personal information. Just put in your e-mail and get the results in moments!

What If You Cant Afford A House

Theres nothing more frustrating than wanting to buy a home and either getting denied for a mortgage or deciding you cant really afford it. This can be an especially big problem for people who live in areas where housing is very expensive.

If you cant afford a home, dont get discouraged. Saving for a larger down payment can help you qualify for a better interest rate and make mortgage payments lower so youre better able to afford monthly costs.

You can also consider options such as looking for a cheaper home you could fix up over time, or buying a home that has room for tenants or roommates who can help you subsidize costs.

Monthly mortgage payment = Principal + Interest + Escrow Account Payment

Escrow account = Homeowners Insurance + Property Taxes + PMI

The lump sum due each month to your mortgage lender breaks down into several different items. Most homebuyers have an escrow account, which is the account your lender uses to pay your property tax bill and homeowners insurance. That means the bill you receive each month for your mortgage includes not only the principal and interest payment , but also property taxes, home insurance and, in some cases, private mortgage insurance.

Don’t Miss: How To Read A Mortgage Loan Estimate

What Is An Amortization Schedule

The process of repaying a loan with interest to the lender is described in an amortization schedule. Each payment is broken down in terms of how much is applied to the principal and how much is interest. The distribution between principal and interest varies over time so the amortization schedule specifically illustrates the changes.

Where To Get A $300000 Mortgage

To get a $300,000 home loan, youll want to get quotes from at least a few different lenders. Though this can be done by reaching out to each mortgage company directly, you can also use an online marketplace like Credible.

Once you receive your quotes, youll want to compare them line by line. You should look at the interest rate, total costs on closing day, any origination fees, mortgage points youre being charged, and more.

After you determine the best offer, you can move forward with that lenders application and submit any required documentation.

Credible makes the process of finding the right mortgage rate easier and more efficient. You can get tailored prequalified rates from our partner lenders simultaneously all with just one form and it only takes a few minutes.

Dont Miss: Are All Mortgage Rates The Same

Don’t Miss: Do Mortgage Lenders Work On Saturdays

What Taxes Are Part Of My Monthly Mortgage Payment

The taxes portion of your mortgage payment refers to your property taxes. The amount you pay in property taxes is based on a percentage of your property value, which can change from year to year. The actual amount you pay depends on several factors including the assessed value of your home and local tax rates.

Apply For A 300000 Mortgage

To find out more about our range of £300,000 mortgages simply make an application with our approved mortgage experts found here on the website. Rates are available from across the market either on a fixed rate or variable rate deal. Mortgages and lenders to suit most credit types and applicants including buy to let property.

Recommended Reading: How To Get A Mortgage For A Second Home

Early Repayment And Extra Payments

In many situations, mortgage borrowers may want to pay off mortgages earlier rather than later, either in whole or in part, for reasons including but not limited to interest savings, wanting to sell their home, or refinancing. Our calculator can factor in monthly, annual, or one-time extra payments. However, borrowers need to understand the advantages and disadvantages of paying ahead on the mortgage.

Early Repayment Strategies

Aside from paying off the mortgage loan entirely, typically, there are three main strategies that can be used to repay a mortgage loan earlier. Borrowers mainly adopt these strategies to save on interest. These methods can be used in combination or individually.

Reasons for early repayment

Making extra payments offers the following advantages:

Drawbacks of early repayment

Short History Lessons Of Mortgages

Before the subprime mortgage crisis of 2008-2009, just about anyone could get a mortgage . Lenders pushed sub-prime loans on people with poor credit knowing they probably could not keep up with the payments and would default on their loans and lose their homes.

The lending habits were not healthy and this led to a sharp increase in those high-risk mortgages ending up in default. This contributed to the most severe recession in decades. Some have blamed lenders for inappropriately approving loans for subprime applicants, despite signs that people with poor scores were at high risk for not repaying the loan. By not considering whether the person could afford the payments if they were to increase in the future, many of these loans may have put the borrowers at risk of default.

I used to work in the Underwriting Department at SunTrust in 2012, and the criteria they used to determine whether to make a loan is more rigorous.

However, that does not mean that millennials would have a tough time getting a mortgage it is just important to do your research first and make sure youre financially prepared to take on a mortgage payment.

In order to get a solid grasp on the terms and processes of buying a home. Take the time to understand the process and requirements of being a first-time home buyer.

1. Do the research

Your credit score and any credit issues in the past few years:

How much cash you can put down:

Shop for loan programs:

2. Prepare the paperwork

3. Find a lender

Recommended Reading: What Fico Version Is Used For A Mortgage

How To Lower Your Monthly Mortgage Payment

- Choose a long loan term

- Buy a less expensive house

- Pay a larger down payment

- Find the lowest interest rate available to you

You can expect a smaller bill if you increase the number of years youre paying the mortgage. That means extending the loan term. For example, a 15-year mortgage will have higher monthly payments than a 30-year mortgage loan, because youre paying the loan off in a compressed amount of time.

An obvious but still important route to a lower monthly payment is to buy a more affordable home. The higher the home price, the higher your monthly payments. This ties into PMI. If you dont have enough saved for a 20% down payment, youre going to pay more each month to secure the loan. Buying a home for a lower price or waiting until you have larger down payment savings are two ways to save you from larger monthly payments.

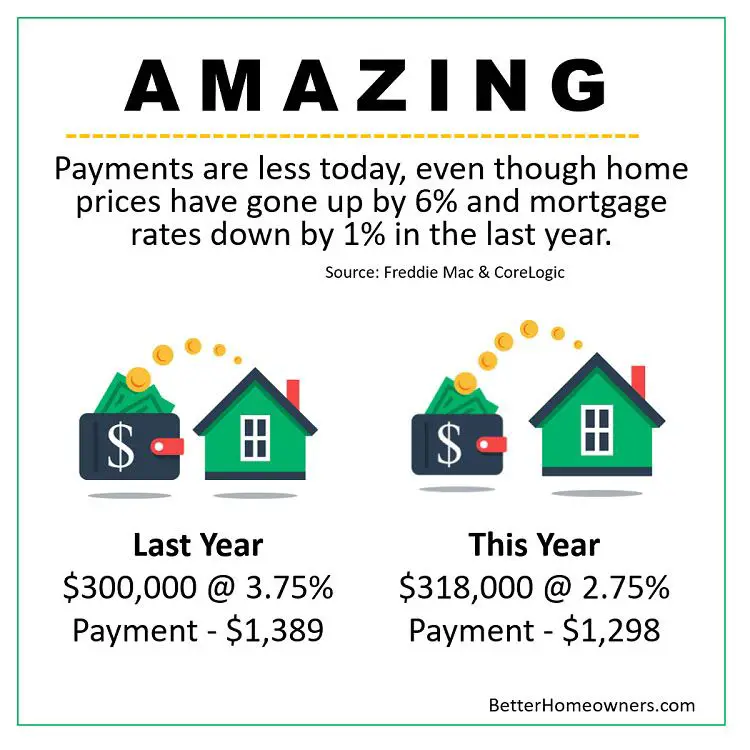

Finally, your interest rate impacts your monthly payments. You dont have to accept the first terms you get from a lender. Try shopping around with other lenders to find a lower rate and keep your monthly mortgage payments as low as possible.

How The Term Affects Repayments

Generally, the longer the mortgage term, the less youll pay each month in repayments.

However, youre likely to pay back more overall because youll pay interest on the loan for a more extended period.

A shorter term means youll pay more per month, but the overall cost of the loan will be lower.

If you have a £300k mortgage with a term of 30 years and an interest rate of 3.92%, youll pay £1,418 monthly and £510k in total.

However, if you get the mortgage for a term of 10 years, youll make monthly payments of £3,026 and pay £363k in total.

Read Also: How Much Will Monthly Mortgage Payment Be

Quickly Estimate The Cost Of Interest Rate Shifts

For any fixed-rate mortgage, select the closest approximate interest rate to your loan from the left column, then scroll look at the payment-per-thousand column for the respective amount to multiply the number by. Then multiply that number by how many hundreds of thousands your home loan is.

- A 3% APR 15-year home loan costs $6.9058 per thousand. If you bought a $100,000 home that would mean the monthly payment would be 100 * $6.9058, so move the decimal places 2 spots to the right and you get a monthly payment of $690.58.

- The total loan cost would be 100 * $1,243.05 Again, move the decimal 2 places to the right & you get $124,305.

- And then if you wanted to figure out the cost of interest you would subtract the $100,000 from $124,305 to get $24,305.

Another way of thinking of the first thousand from the full cost per thousand category is that it includes the thousand you borrowed, so if you subtracted the first thousand from any of these figures that would represent the portion of spending allocated to interest on the loan.

This table scales by 1/8th of a percent from 2% to 10%. At the lower end 0%, 0.5% & 1.0% are added to highlight how little banks pay depositors relative to what they charge creditors. And at the top end 15%, 20% & 25% were added to show how extreme the spread is between deposits and what a credit card might charge a borrower.

| Interest Rate |

|---|

Whats The Monthly Payment On A $300000 House

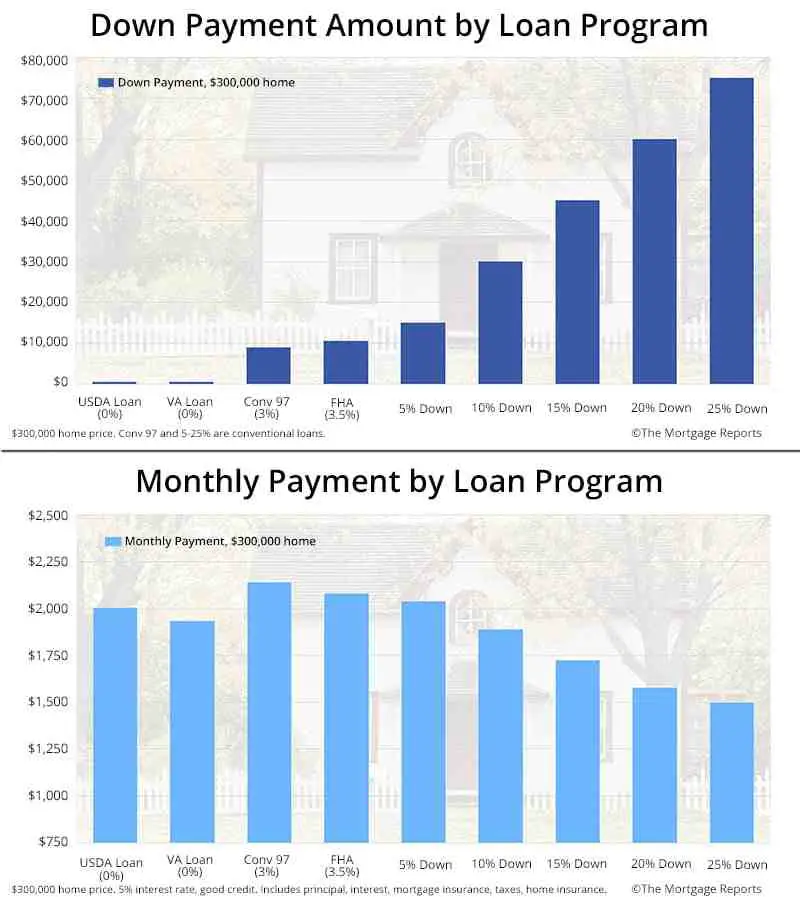

We can turn to The Mortgage Reportsmortgage calculator to model the monthly payments on a $300,000 home.

Note: The below examples include only loan principal and mortgage interest. Were ignoring things like property taxes, homeowners insurance, and homeowners association dues because they vary so widely from place to place.

You can use the calculators to model your own options using todays mortgage rates.

Weve used the same mortgage rate for each example. But different types of mortgages have different rates. And mortgage rates may well have changed by the time you read this.

We also specified the minimum down payment for a $300K house in each case. But you can input whatever you have saved.

Read Also: How To Calculate Commercial Mortgage Payment

How Can We Help You

The Independent review organisation Reviews.co.uk report that 100% of reviewers recommend Lending Expert

Lending Experts

Were mortgage experts. This means we know our stuff when it comes to all types of mortgages. We know where the best rates are and have access to exclusive deals just for Lending Expert customers.

Huge Market Comparison

Were not tied to one lender which means we can search the wider market to find you the cheapest mortgages from across the UK.

Lending Expert is an FCA regulated credit broker which means you can be assured you are dealing with a legitimate and reputable finance company.

Flexible Lending

If you have bad credit or have previously been refused a mortgage we can consider your application. Whatever your circumstances please get in touch and we’ll do our best to help find you the perfect mortgage deal.

Do Your Own Research For A $300k Mortgage

Our final piece of advice is simple: do your own research. Were confident that weve put together a solid guide here for a 300k mortgage, but its not the be-all and end-all. We dont tackle your specific financial or personal situation , nor can we provide advice for every single location on the planet. And ultimately, a lot of what weve said is subjective and a matter of opinion.

We recommend taking the resources and advice weve pointed you to and then doing some more leg work. That final call to buy a home is ultimately yours to make.

Don’t Miss: Who Is United Wholesale Mortgage