Will I Be Charged Fees And Interest On Late Payments

Companies often charge penalty fees and interest on overdue payments, so it can get quite expensive. Some companies will give you a grace period â this starts when the payment is due, and if you pay during this time you wonât be charged late fees. Check your contract with the lender to see if you have a grace period.

Some companies have tiered late fees based on how much you owe. However, there are legal restrictions on what you have to pay. For example, charges of over £12 for late credit card payments may be seen as unfair. If you think youâve been charged too much, speak to your lender first. If you canât come to an agreement with them, you may want to seek free advice from the Financial Ombudsman.

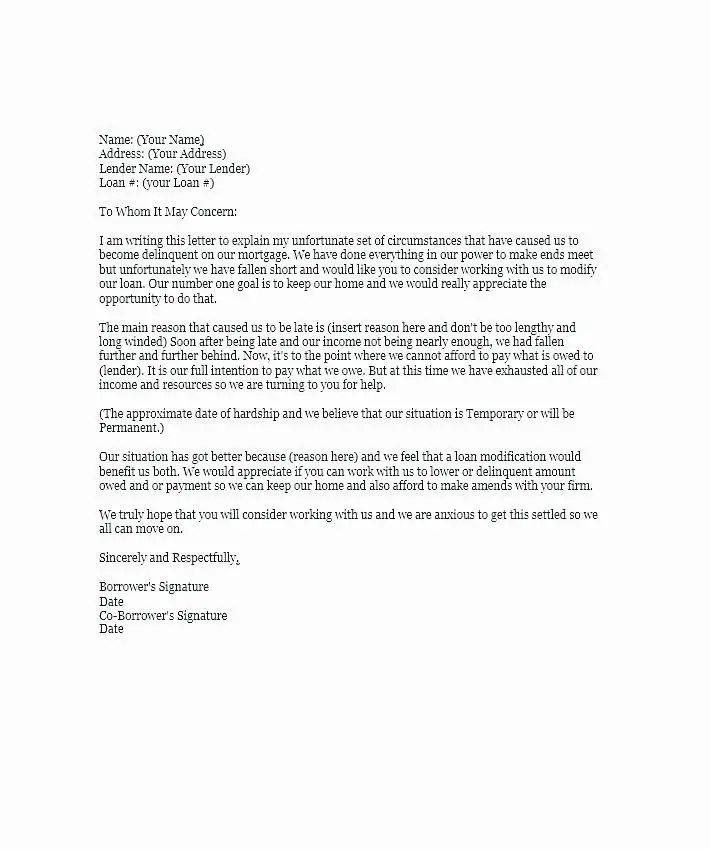

Why Do You Need A Letter Of Explanation For A Mortgage

When lenders review your application for a loan, their goal is to feel confident youll be able to make your monthly mortgage payments. Imagine if you were loaning someone hundreds of thousands of dollars youd probably ask for concrete evidence that youd eventually get that cash back, too.

If your lender asks you to submit a letter of explanation, the request is likely linked to a specific piece of information in your application that raised a red flag. A letter of explanation is simply a way to help resolve that red flag, which might include:

- A job change, particularly in the timeframe leading up to closing

- Issues from your past that appear on your credit report

- A new credit card opening or a high credit card balance

- A large transaction in your bank account

- An unsteady source of income if you are self-employed or an independent contractor, the lender may want a better idea of your earnings

It might be wise to proactively submit a letter of explanation, especially if youre aware of a potential red flag. Put yourself in the shoes of someone reviewing your application: Is there anything that might make you scratch your head?

What Type Of Documentation Do You Need

You should include any documentation that speaks to your case, particularly any records that corroborate your letter of explanation. Whatever you send in the way of documentation, always send copies and keep the originals.

Specific documents will vary based on your situation.

For example, if you were hospitalized and in turn defaulted on payments to creditors, you should include the hospital bills. If these bills were excessive because you didnt have medical insurance, youll need to send proof that you have it now. You can also get a note from your doctor further explaining what happened. Because of HIPAA privacy laws, the underwriter cant contact your doctor directly.

Similarly, underwriters cant ask any questions about your health if youre receiving Social Security Disability Income. According to the Consumer Financial Protection Bureau, unless the SSA benefit letter specifically states that benefits will expire within three years of the loan origination, lenders must treat the benefits as likely to continue.

If you experienced a gap in employment due to a layoff, include your termination letter or evidence that you received unemployment benefits.

When the issue is late or missed payments, essential documentation might include credit card or car loan statements, divorce papers or tax documents.

Read Also: Does Goldman Sachs Do Mortgages

Consequences Of Very Late And Missed Mortgage Payments

Though the length of your grace period depends on your mortgage lender, the 15-day timeline is a good general rule. If your payment is more than 15 days late, you’re out of the grace period and you’ll have to pay a late fee. If youâre 30 days late, you can expect the mortgage company to report your late payment to the three major credit bureaus: TransUnion, Experian, and Equifax. This can negatively affect your credit score.

By the 36th day of delinquency, mortgage servicers are required by federal law to contact borrowers by phone or in-person to talk about loss mitigation options such as loan modification, refinancing, and forbearance. The mortgage servicer must mail borrowers available loss mitigation options by the 45th day of delinquency. At 60 days late, you’re hit with another late fee. At 90 days late, youâll start getting foreclosure warnings. At 120 days late, foreclosure proceedings may start.

What Should I Do If Ive Had A Late Payment

If youve made a late payment or missed several payments, dont apply for a mortgage until youve checked your credit score. You should also make your payments before applying. If you apply for a mortgage with missed payments on your credit file, you may struggle.

Dont panic, with the right advice, missed payments can be rectified. Once youve made your payments, ensure you have evidence of having made that payment. This is so that you can show lenders if they pick it up during your mortgage assessment. Its always advised to minimise as much outstanding debt as you can before applying for a mortgage, even if it is a small payment such as a phone bill.

You May Like: How To Lower My Mortgage

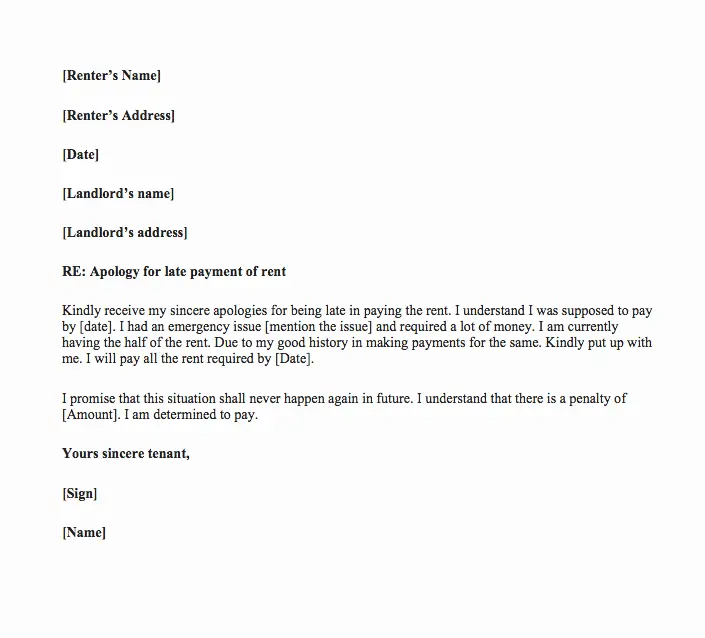

A Model Letter Of Explanation

You’ll want to get a mail or email address to follow up on your phone conversation. Don’t delay. Write your letter of explanation immediately.

You want to write your own letter, in your own words. Don’t use a form letter. Don’t copy. Explain what happened, honestly and with all the details – even if some of the details are not in your favor. Check for spelling and grammar but the words themselves must be from you. If using email, include the employee’s name in the subject line to stand out .

The letter might look like this:

Dear Ms. Smith:

Thank you for taking my call today.

This letter of explanation is to ask Universal-Global Credit to reverse a late fee associated with my account, #123-456-789.

I believe the fee should not be charged for several reasons.

First, I have an excellent payment history with your company.

Second, in the case of the October payment, a medical emergency caused my checking account to be depleted. It would not benefit any of us to receive a bounced check. A copy of my hospital invoice is attached.

Third, you can be assured that in the future I will seek to continue my excellent payment record.

Thank you for your help in this matter.

Sincerely,

Phone: 555-123-4567

How Can I Deal With A Late Payment

Of course, itâs best to avoid a late payment in the first place, but life can be unpredictable. If you canât help missing a payment, you should contact the company as soon as possible. Explain your situation, as they may be able to agree a temporary solution with you. You might also want to get in touch with a debt advice charity such as StepChange.

It can be easy to forget or miss a payment on your credit card if youâre not careful, especially when life gets hectic. But there is a simple solution on how to avoid late fees on your credit card: set up a direct debit, ensuring your credit card payment goes out each month automatically. You can set the direct debit so you pay the minimum amount, a fixed amount or the full amount.

If you do get a late payment recorded on your credit report, you can try and balance out its negative impact by taking steps to improve your score. You can keep track of your credit score with a free Experian account â it gets updated every 30 days if you log in.

You may also want to give Experian Boost a try to see if you could get an instant boost to your score. By securely connecting your current account to your Experian account, you can show us how well you manage your money. Weâll look for examples of your responsible financial behaviour, such as paying your Netflix, Spotify and Council Tax on time, and paying into savings or investment accounts.

Also Check: Can I Add My Daughter To My Mortgage

How Letters Of Explanation Help

A letter of explanation can help resolve tricky situations to your satisfaction. If you can write one effectively.

A good letter can help mortgage lenders justify approving you if you’re a marginal or borderline applicant. Your chances of success are highest if you can show that the event causing the problem was out of your control and unlikely to recur. If, for instance, you filed bankruptcy because of a company-wide layoff . And then you found work in a healthier industry .

You should try a letter of explanation to reverse late penalties if you can. Late fees and related charges are major income streams for creditors. According to a 2014 report from the Consumer Financial Protection Bureau, “the majority of debit card overdraft fees are incurred on transactions of $24 or less and that the majority of overdrafts are repaid within three days.

If your history with the creditor is good, and especially if you have had your account for many years, you have a decent chance of catching a break with a good letter.

Be very quick to head off adverse action by contacting your lender if you have a vehicle title loan. One late payment and you might find that your vehicle no longer works.

According to a 2014 report in The New York Times, car loan creditors now use starter interrupt devices which allow them to remotely disable vehicle ignitions when payments are missed. If you are one day late, contact the creditor and follow up with a letter. And pay when you say you will.

Late Payments And Your Credit Score

When you set up an account with a company, youâll usually agree to make monthly payments. Itâs important to meet these payments on time and in full. Otherwise, you may negatively affect your relationship with the company, and reduce your chances of getting credit with other companies in the future.

However, things donât always go according to plan. Perhaps youâve had a hectic month and the bills slipped your mind. Or maybe the car needed repairs and you donât have enough money left over. Whatever the reason, if youâve missed a payment or think youâre going to, there may be steps you can take to reduce the damage.

Read Also: How To Get A Job In Mortgage Lending

Which Lenders Will Consider Your Application

Only a minority of lenders will decline an applicant with late payments on the spot. At the time of writing , these include Santander and the Bank of Ireland, but most other lenders will at least consider offering a mortgage.

Many of the lenders who do offer mortgages to borrowers with a history of late payments attach caveats to the deal. Youll find some examples of this below

- Natwest: Will base their lending decision on your overall credit score and may request extra underwriter scrutiny.

- Nationwide: Will at least consider an applicant with late payments, subject to approval from a senior underwriter.

- Kensington Mortgages: Will only lend if all of the late payments are settled at least six months before the application.

- Pepper Money: Will reject an application if the late payments were on fixed-term agreements in the last six months.

The above is merely a snapshot of the market, but the thing to bear in mind is that there is no best lender for a borrower with late payments on their file.

The right lender for you is the one who is ideally positioned to approve you for a mortgage based on a full picture of your needs and circumstances. The best way to find such a lender is with the help of a specialist bad credit mortgage broker.

Final Advice On Writing A Letter Of Explanation

Youll be asked to submit a pile of documentation during the mortgage loan process, including bank statements, tax returns, pay stubs, and more.

Depending on your financial situation, your lender may also request a letter of explanation. Many first-time home buyers think being asked to provide a letter of explanation means their mortgage application may be doomed.

Remember, this type of request is usually a good thing. The underwriter may be looking for this last item before signing off on your final approval.

When your lender requests a mortgage letter of explanation, remember this first: dont panic.

Next, double-check with your lender on exactly what is being requested.

Then write a clear, concise letter thats free of emotional language, negativity, or excessive detail. Theres a good chance that the next time you hear from your lender, it will be to let you know youre fully approved.

Recommended Reading: How To Purchase A House That Has A Reverse Mortgage

How To Write A Letter Of Explanation

Letters of explanation are a common part of the mortgage application process. Make sure your letter of explanation includes:

- The current date

- The name of your lender

- Your lenders complete mailing address and phone number

- A subject line that begins with RE: and includes your name, application number or other identifying information

- One or more paragraphs that provide information the lender asked for. Be as detailed as possible and include dates, dollar amounts, account numbers, etc.

- Any supporting documents that provide identification and back up your claims

- Your full legal name as it appears on your mortgage application, signed and printed

- Your spouse or partners name if theyre on the loan application with you

- Your full mailing address and 10-digit phone number

- A polite closing

The key to writing a great letter of explanation is to keep it short, simple and informative. Be clear and write with as much detail as you can since someone else will need to understand your situation. Avoid including irrelevant information or answers to questions the underwriter didnt ask. Be polite, but not overly friendly, and dont use emotional language.

After you finish writing the letter, edit for typos or grammatical errors. Send the letter in a timely manner to keep your mortgage application on track.

Your Lender Asked For A Letter Of Explanation What Now

When you apply for a home loan, your lender will do a deep dive into your financial history. Depending on what it finds in your bank statements or credit report, additional documentation may be necessary.

You may be asked for a letter of explanation during the application process. Fear not. Letters of explanation are fairly standard and nothing to worry about.

However, you want to make sure you write this letter correctly, as it could be crucial to your mortgage approval.

Heres everything you need to know so you can hit a home run with your letter of explanation.

In this article

- An address discrepancy on your credit report

- Derogatory items in your credit history

- Late payments on credit cards or other debts

- Overdraft fees on an account

There are many other situations where an LOX may be requested, too.

If you need to write one, be sure to ask your loan officer what exactly the underwriter wants to see, and whether you need to provide any supporting documentation along with the letter.

Recommended Reading: What Qualifies As A Jumbo Mortgage

What Is The Difference Between Missed And Late Payments

A missed payment is when you fail to pay one or more scheduled payments entirely, whereas a late payment is a payment made after the due date has passed.

A record of a late payment will show on your with a 1 next to it, showing that the payment arrived one month late. As more payments are missed, this number will increase to show the number of months that a payment has been left outstanding. However, once the payment has been made this number will freeze.

Whilst a payment that is paid a couple of days or even weeks late may not be recorded on your , it is not worth risking late payments. So if youre serious about securing a mortgage with late payment history, take care to always make your payments on time and remember to allow at least three working days for payments to be received and processed.

Can I Make A Mortgage Payment On A Credit Card

Most mortgage lenders don’t accept credit card payments. If you have a Mastercard you may be able to pay your mortgage through a payment processing service or money transfer card, but you’ll have to pay a fee.

Life happens! And sometimes a bad couple of months can hit your finances. Using credit cards to pay your mortgage isn’t a sustainable way of borrowing, so you should get financial advice if you’re struggling to keep up with repayments.

Don’t Miss: What Is The Current Interest Rate On An Fha Mortgage

Unusual Or Erratic Banking Activity

Lenders like predictability. Regular work income deposits and a steadily growing savings account are indicators of reliable financial behavior. But overdrafts and large withdrawals or transfers between accounts can suggest financial stress. Unexplaineddeposits can also be problematic since the source is unknown and could indicate undisclosed debt.

You may also need to submit a letter of explanation if you have a joint bank account but are applying for a mortgage solo.

| ð¡ Talk to a top local agent in your area.Clever Real Estateâs free agent matching service has helped thousands of home buyers find the perfect real estate agent to guide them on their journey.No cost. No pressure. Just good, helpful advice. |

What Is A Mortgage Servicer

Did you know theres a difference between your lender and your servicer? The lender is the company that you borrow the money from typically a bank, credit union, or mortgage company. When you get a mortgage loan, you sign a contract and agree to pay back the lender.

The servicer is the company that handles the daily management of your account. Sometimes, the lender is also the servicer. But often, the lender arranges for another company to act as the servicer. Its important to know your mortgage servicer because its the company that

- processes your mortgage payments

- answers questions about your loan balance and payment history

- pays your insurance and taxes, if you have an escrow account. An escrow account is where you set aside money to pay insurance and taxes. The account is managed by the servicer, who ensures that the lender knows the money is there to pay those bills when theyre due. To find the name of your servicer, check your mortgage statement or your coupon payment book. Its not uncommon for your servicer to change. Within a few weeks of the change, youll get notices from your old servicer and your new one. The notices give you the contact information for the new servicer, the date they start accepting your payments, and what to do if you have a question or complaint.

Also Check: What Are The Payments On A $200 000 Mortgage