How To Shop For Mortgage Rates

There are a few things to keep in mind when shopping for mortgage rates:

- Make sure you look at national and local lenders to find the best possible rates.

- Avoid applying for mortgages in multiple places as this can hurt your credit score. Instead, pull your credit report and get a keen picture of your credit history that you can share with potential lenders. Ask them to provide you with the rates based on that information. This way you preserve your credit score while getting the most accurate information for your credit profile.

- Use our rate table to help you identify whether lenders are offering you a competitive rate based on your credit profile.

Qualifying For A 30 Year Fixed Mortgage

Those applying for a 30 year or 15 year fixed mortgage will first be required to be preapproved.

Why you should have a credit preapproval:

Little Details That Matter

** Based on a $350,000 fixed-rate mortgage

- With the chosen term

- With 25-year amortization

- With a $5/month administration fee

- With a $350.00 appraisal fee. The appraisal fee may be adjusted or may not be charged as part of the assessment of your mortgage application. The evaluation fee is not applicable during a renewal.

*** The variation is subject to change without notice.

TM ALL-IN-ONE is a registered trademark of National Bank of Canada.

1. Rates may differ if the amortization period is more than 25 years.Contact an advisorfor more information.

2. APR as of $. APR means “Annual Percentage Rate” and represents the total interest and fees charged by the Bank, expressed as an annual percentage.

3. This term is not available for new loans. It is provided for reference purposes only.

4. Subject to change without notice

5. A capped rate is an interest rate that fluctuates but never exceeds the interest rate cap. The cap is the maximum interest rate you pay on your loan. This rate is offered with a five-year term.

6. Interest income .

- $ for lines of credit of $1 to $4,999.99

- $ for lines of credit of $5,000 or more

7. The special offer on the variable rate is the base rate – spread , and is updated monthly. The offer cannot be combined or stacked with any other offer, promotion or benefit applicable to National Bank mortgages and is not retroactive.

Read Also: How Do You Buy Back A Reverse Mortgage

How To Score The Best Deal On A Mortgage:

- Shop around. Closing costs and rates vary by lender, so get three bids.

- Understand the breakeven point. Thats the moment at which the savings in monthly payments offset the amount of the closing costs. This refinance calculator can help you decide.

- Dont chase the lowest rate. Yes, a low rate and paltry payment are good, but make sure those benefits arent overwhelmed by closing costs.

How Credible Mortgage Rates Are Calculated

Changing economic conditions, central bank policy decisions, investor sentiment, and other factors influence the movement of mortgage rates. Credible average mortgage rates and mortgage refinance rates reported in this article are calculated based on information provided by partner lenders who pay compensation to Credible.

The rates assume a borrower has a 740 credit score and is borrowing a conventional loan for a single-family home that will be their primary residence. The rates also assume no discount points and a down payment of 20%.

Credible mortgage rates reported here will only give you an idea of current average rates. The rate you actually receive can vary based on a number of factors.

Also Check: How Does Costco Mortgage Work

What Do High Rates Mean For The Housing Market

When mortgage rates go up, home shoppers’ buying power decreases, as more of their anticipated housing budget has to go toward paying interest. If rates get high enough, buyers can get priced out of the market completely, which cools demand and puts downward pressure on home price growth.

However, that doesn’t mean home prices will fall in fact, they’re expected to rise even more this year, just at a slower pace than what we’ve seen in the past couple of years.

Even with fewer buyers in the market, those who can afford to buy will still be competing over historically low inventory. When there are more buyers than there are houses available, home prices go up. So while conditions may loosen up a bit due to high rates, we aren’t likely to see a significant drop in prices.

Factors That Influence Mortgage Rates

Many factors influence the interest rate a lender may offer you. Some such as your credit score are in your control. But others you have no ability to affect, such as:

- The economy During financial downturns, the Fed may lower interest rates to try to stimulate the economy. And when the economy is doing well, interest rates can rise.

- Inflation Interest rates tend to move with inflation. When the overall cost of goods and services increases, interest rates are also likely to rise.

- The Federal Reserve The Fed may choose to lower interest rates to stimulate a struggling economy, or raise rates in an attempt to put the brakes on inflation.

- Macro employment trends When many people are out of work, as they were during the months of pandemic lockdown, mortgage rates may fall. As employment increases, interest rates typically also increase.

If youre trying to find the right mortgage rate, consider using Credible. You can use Credible’s free online tool to easily compare multiple lenders and see prequalified rates in just a few minutes.

Have a finance-related question, but don’t know who to ask? Email The Credible Money Expert at [email protected] and your question might be answered by Credible in our Money Expert column.

Read Also: How Much Money Do Mortgage Brokers Make

How Do I Find Current 30

NerdWallets mortgage rate tool can help you find competitive 30-year mortgage rates. In the filters above, enter a few details about the loan youre looking for, and youll get a personalized rate quote in moments, without providing any personal information. From there, you can start start the process of getting approved for your home loan. Its that easy

A 30-year fixed-rate mortgage is the most common term of mortgage. It provides the security of a fixed principal and interest payment, and the flexibility to afford a larger mortgage loan because the payments are more affordable theyre spread out over three decades.

Forbes Advisors Insight On The Housing Market

Predictions indicate that home prices will continue to rise and new home construction will continue to lag behind, putting buyers in tight housing situations for the foreseeable future.

To cut costs, that could mean some buyers would need to move further away from higher-priced cities into more affordable metros. For others, it could mean downsizing, or foregoing amenities or important contingencies like a home inspection. However, be careful about giving up contingencies because it could cost more in the long run if the house has major problems not fixed by the seller upon inspection.

Another important consideration in this market is determining how long you plan to stay in the home. People who are buying their forever home have less to fear if the market reverses as they can ride the wave of ups and downs. But buyers who plan on moving in a few years are in a riskier position if the market plummets. Thats why its so important to shop at the outset for a realtor and lender who are experienced housing experts in your market of interest and who you trust to give sound advice.

Also Check: Does A Mortgage Loan Cover The Down Payment

How Do I Find The Best Mortgage Rate

Finding the best home mortgage rate is a matter of knowing your goals and picking the right tool to get the job done. The best mortgage for you may not always be the one with the lowest interest rate. Factors like how long you keep your home loan will impact your decision.

If you plan on keeping your home loan long-term, then a fixed-rate mortgage is ideal. Mortgage rates today are very reasonable for fixed-rate 10-, 15-, or 30-year mortgages. Locking in a low rate is a smart choice. But you can get lower mortgage rates with some adjustable-rate loans too. If you plan on only keeping your home for a short period of time, then you may be able to pay less interest with an ARM.

How Much Can I Borrow For A Mortgage

The amount of money you can borrow is affected by the property, type of loan, and your personal financial situation.

During the mortgage preapproval process, the lender will look at your overall financial profile to determine how much it will lend to you. A big factor in this process is your debt-to-income ratio . Your DTI is calculated by dividing your total monthly debt payments by your monthly income. In most cases, the maximum DTI is typically 43%. So if you make $5,000 a month, your mortgage payment and other monthly debt payments cant exceed $2,150.

To protect its investment, a lender will typically only let you borrow a certain percentage of a propertys value. So the value of the property can also limit how much you can borrow. Most mortgage loans require a down payment of anywhere from 3% to 20%. You may be able to borrow 100% of the propertys value with certain government-backed loans, like Department of Veterans Affairs Loans or U.S. Department of Agriculture Rural Development loans.

Recommended Reading: What Is The Mortgage Pre Approval Process

When To Consider A 30

A 30-year fixed mortgage is best for those looking for predictable, relatively low monthly payments. Youll wind up paying more in interest over the life of a 30-year mortgage than a 15- or 20-year one, but because of the longer repayment timeline, your monthly costs will be lower, so the more expensive loan may ultimately be easier on your budget.

Current Mortgage Rates: Are Mortgage Rates Going Up Or Down

Since the start of 2022, mortgage rates have risen quickly. Unfortunately, as the year progresses, rates may increase even further, said Jacob Channel, chief economist for LendingTree. That may make buying a home even tougher as home prices continue their upward trajectory.

This has put many would-be buyers in a difficult situation where they can no longer rely on low rates to offset the high asking prices of homes on the market today, Channel said.

Also Check: How To Pay Off Mortgage In 15 Years Calculator

What Borrowers Say About Better Mortgage

NerdWallets lender star ratings assess objective qualities, including rates, fees and loan offerings. To assess borrowers subjective experiences with lenders, NerdWallet has gathered customer satisfaction ratings from J.D. Power and Zillow.

-

Better Mortgage receives an 859 out of 1,000 in J.D. Powers 2021 Primary Mortgage Origination Satisfaction Study. The industry average for origination is 851.

-

Better Mortgage receives a customer rating of 4.4 out of 5 on Zillow, as of the date of publication. The score reflects more than 850 customer reviews.

Current Mortgage Rates: Are They Good For Buying A Home Right Now

Despite the dramatic increases, mortgage rates remain at relatively normal levels and are still considered historically favorable mortgage rates.

Home prices are also on the rise, and as rates increase, that will also contribute to the rising cost of home ownership. Prices are up significantly from before the pandemic, with a combination of limited supply of homes, higher costs to build homes and massive demand from buyers leading to the surge.

Its also important to remember that while mortgage rates are important, and the difference of a point or so can mean a lot of money over a 30-year mortgage, experts advise against trying to time the market to get the best mortgage rate. Focus on finding the right house, and do it when your personal lifestyle and financial situation indicate its the right time.

Be sure to get quotes from different lenders to ensure youre getting the best deal, experts say. The rate highly impacts your monthly affordability for as long as you will hold this home, Skylar Olsen, principal economist at Tomo, a digital real estate and mortgage company, told us. It is actually a critical piece of this decision, and that takes shopping around.

Don’t Miss: How Much Money Should You Spend On Mortgage

What Is The Best Mortgage Loan Type

The best mortgage is the one that helps you meet your housing needs for as little financing costs as possible. There are a few factors to consider when it comes to getting the right mortgage.

Some experts recommend getting a 15-year mortgage because youll pay far less interest and be debt-free in half the time compared to a 30-year loan. With a 30-year loan, your monthly payments can be significantly lower, but youll pay much more in interest over the loans life. So its a tradeoff.

There are also tradeoffs in choosing a government-backed versus a conventional loan. For example, FHA mortgages can have lower requirements than conventional loans. But unlike conventional loans, FHA loans require mortgage insurance even if your loan-to-value ratio drops below 80%.

If you want a set interest rate for the life of the loan and more stable monthly payments, then a fixed-rate mortgage is ideal. The interest rate on a fixed-rate mortgage never changes.

Regardless of what loan type you go with, remember, its not the loan you have to keep forever. Even if you stay in the same home for the rest of your life, you can refinance your mortgage to take advantage of better terms or rates.

Better Mortgage Review: Variety Of Loan Types

Better offers a variety of fixed- and adjustable-rate purchase and refinance loans, including conventional loans with 3% down payments and 10%-down jumbo loans. Better doesn’t offer USDA or VA mortgages, or home equity loans or lines of credit.

However, Better has partnered with Notable Finance to offer the “Better Home Card,” a credit line of up to $50,000 for use on home-related purchases or home improvements. Customers who closed a purchase or refinance mortgage with the lender may be eligible.

Better guarantees and cash offer program: The lender offers a guarantee that your purchase loan will close on time if it doesnt in most cases Better will pay you $2,000. This guarantee is available in the states where Better originates loans, except for New York.

Better also offers a program that enables prospective home buyers in certain markets to make cash offers. To take advantage of the program, a buyer needs to get preapproved for a mortgage with Better. After the mortgage is underwritten, a buyer works with the agent to make an all-cash offer on a home. When a seller accepts the offer, Better pays cash for the home, and the buyer can move in while the mortgage is being processed. Once the home loan is finalized, the buyer purchases the property back from Better at the original sale price. Buyers save on fees if they work with a Better real estate agent and finance the purchase with a Better mortgage.

Also Check: Can I Get Approved For A Mortgage

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

About These Rates: The lenders whose rates appear on this table are NerdWallets advertising partners. NerdWallet strives to keep its information accurate and up to date. This information may be different than what you see when you visit a lenders site. The terms advertised here are not offers and do not bind any lender. The rates shown here are retrieved via the Mortech rate engine and are subject to change. These rates do not include taxes, fees, and insurance. Your actual rate and loan terms will be determined by the partners assessment of your creditworthiness and other factors. Any potential savings figures are estimates based on the information provided by you and our advertising partners.

Trends and insights

What Is A Good Mortgage Rate

Rates have been on the rise since the beginning of 2022, but are still in the favorable range. If youre considering a refinance, a good mortgage rate is considered 0.75% to 1% lower than your current rate. New homebuyers can also benefit from the latest mortgage rates as they are comparable to rates prepandemic rates.

Even if youre getting a low interest rate, you need to pay attention to the fees. Hidden inside a good mortgage rate can be excessive fees or discount points that can offset the savings youre getting with a low rate.

Recommended Reading: How To Determine My Mortgage Payment

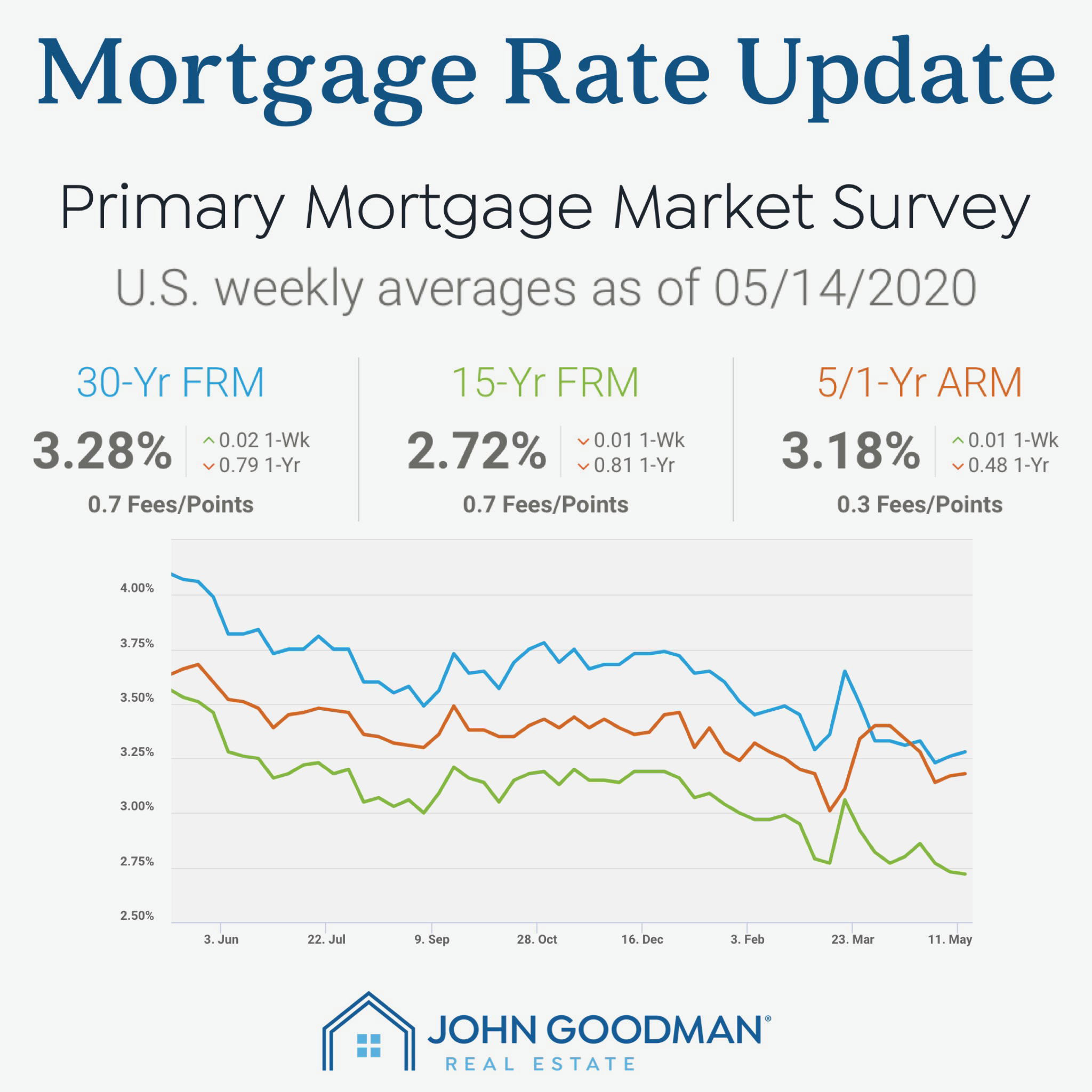

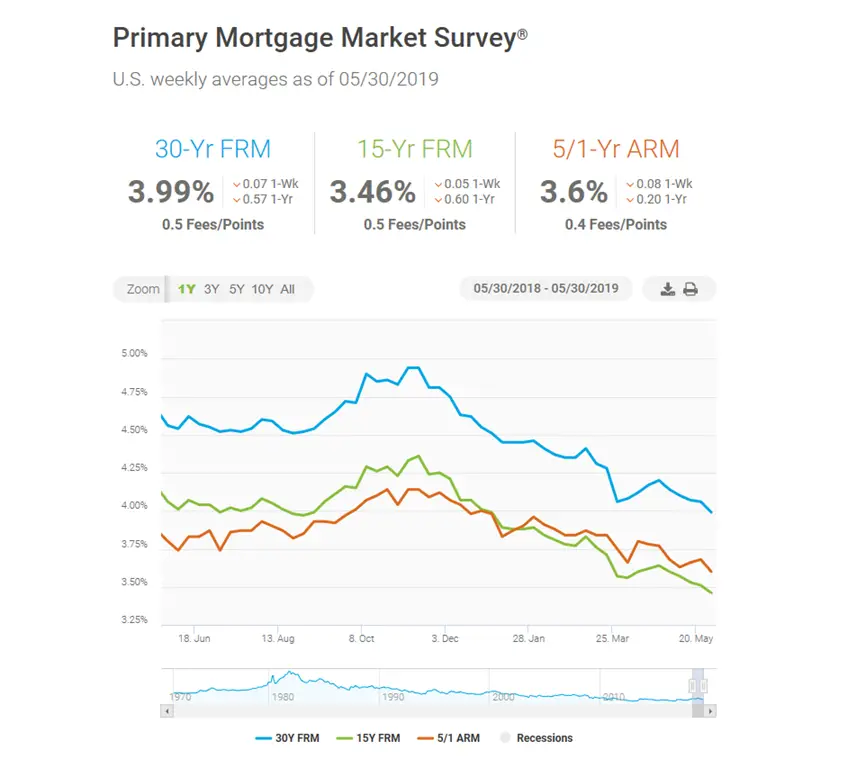

How Mortgage Rates Have Changed Over Time

Todays mortgage interest rates are well below the highest annual average rate recorded by Freddie Mac 16.63% in 1981. A year before the COVID-19 pandemic upended economies across the world, the average interest rate for a 30-year fixed-rate mortgage for 2019 was 3.94%. The average rate for 2021 was 2.96%, the lowest annual average in 30 years.

The historic drop in interest rates means homeowners who have mortgages from 2019 and older could potentially realize significant interest savings by refinancing with one of todays lower interest rates. When considering a mortgage or refinance, its important to take into account closing costs such as appraisal, application, origination and attorneys fees. These factors, in addition to the interest rate and loan amount, all contribute to the cost of a mortgage.

Are you looking to buy a home? Credible can help you compare current rates from multiple mortgage lenders at once in just a few minutes. Use Credibles online tools to compare rates and get prequalified today.

Thousands of Trustpilot reviewers rate Credible “excellent.”