How To Choose A Mortgage Lender

You have many options when it comes to choosing a mortgage lender. Banks, credit unions and online lenders all offer mortgages directly, while mortgage brokers and online search tools help you compare options from different lenders.

Its important to make sure you feel comfortable with the broker or company youre working with because youll need to communicate with them frequently during the application processand in some cases, after the loan closes.

You may want to start with the banks or other institutions where you already have accounts, if you like their service. Also, ask your network of friends and family, and any real estate professionals youre working with, for referrals.

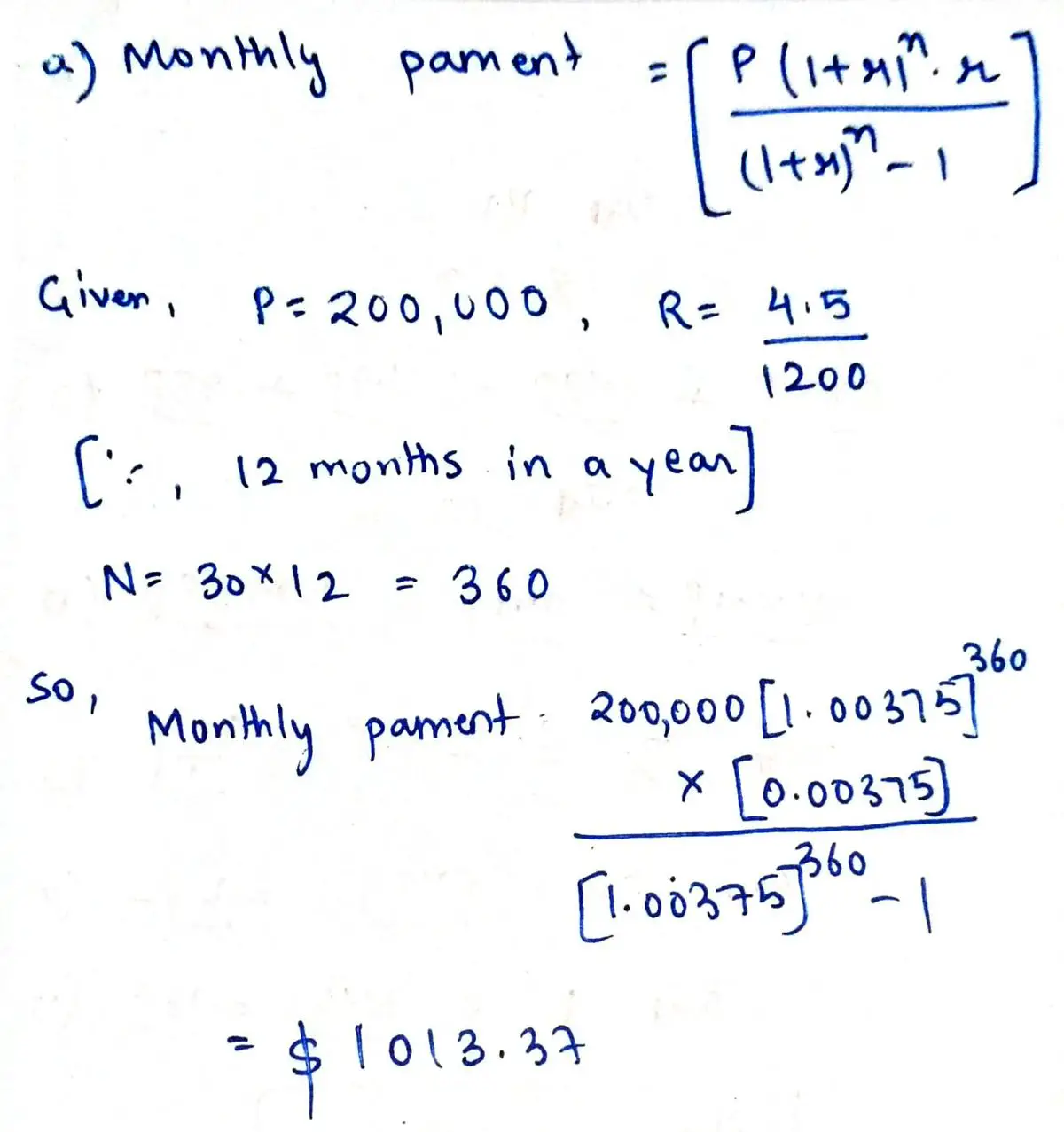

How Much Does A 200000 Mortgage Cost Per Month

There is no one set amount a mortgage of this size costs but as a broad example, for a standard capital and repayment mortgage, over 25 years, using an interest rate of 3% the repayments would be £948 per month.

Repayments on mortgages can be impacted by the following factors, both directly and indirectly:

Loan Type And Interest Rate

The type of mortgage you choose can affect the mortgage rate youre offered and therefore the sum you can borrow. The differences tend not to be huge, but every bit helps when youre paying interest on a large sum over a long time.

Lets take a single month, June 2021, as an example that shows those differences. We got our figures from the ICE Mortgage Technology Origination Insight Report.

Here were the average interest rates across three major loan types:

- All loans: 3.22%

- FHA loans: 3.23%

- VA loans: 2.92%

The differences can be even greater if you choose a shorter-term loan rather than a 30-year one, or if you opt for an adjustable-rate mortgage .

Recommended Reading: Where To Find Lowest Mortgage Rates

What Does A $200000 Monthly Mortgage Payment Include

The payment of a mortgage loan contains some essential elements that must be taken into account, which will be defined below:

- Principal: It is understood as the money that is paid off with the intention of reducing the balance.

- Interest: basically, it is the money that a debtor is obliged to pay for the mortgage loan requested. The exact am

- o0unt will be established in the interest rate.

- Escrow costs: In some cases, escrow costs are included, which cover items such as mortgage insurance, property insurance and homeowners insurance.

How To Pay Less Interest On An Existing Loan

If you already have a mortgage, there’s an easy way for you to lower its interest rate and save yourself money in the course of paying it off — refinancing. When you refinance, you swap your existing home loan for a new one.

Refinancing generally makes sense when you can shave at least 1% off of your loan’s interest rate. And the higher your credit score, the more likely you’ll be to qualify for a competitive refinance rate.

Many homeowners are shocked to see just how much mortgage interest costs them over time. If you want to pay as little of it as possible, make a decent-sized down payment on your home , take out a loan with as short a term as possible, and make an effort to boost your credit score. Doing so could really save you a bundle.

Don’t Miss: What Mortgage Can I Afford On 120k

Who Benefits From Interest

Many of Kleins clients are purchasing homes that are designated as jumbo mortgages, meaning loans that exceed the limits set by government-sponsored mortgages like the FHA mortgage. For those higher loan amounts, we do interest-only because its more of a financial planning tool for how theyre going to use their cash flow. Those clients may want to explore the interest-only mortgage calculator.

Interest-only loans can also be good for people who have a rising income, significant cash savings and a high FICO score and a low debt-to-income ratio.

Your Monthly Mortgage Payment Will Depend On Your Interest Rate And The Loan Term You Choose

The monthly payment on a $200,000 mortgage will depend on your mortgage rate and loan term. Lower rates and longer terms mean lower payments.

Home prices have skyrocketed over the past year, with the median price for an existing home now exceeding $360,000, according to data from the National Association of REALTORS®. But home prices can vary widely, and you can find a house for significantly cheaper in many areas.

If youre looking for a $200,000 mortgage, the price you can afford depends on factors like your credit, the type of loan, and the interest rate. Lets go over what the monthly payment on a $200,000 mortgage could be, and what to know before closing on the loan.

Dont make the mistake of only getting one quote for a mortgage rate. Credible makes it easy to compare mortgage and mortgage refinance rates from multiple lenders.

Read Also: How Much Is A 300 000 Dollar Mortgage

How Does A Mortgage Work

A mortgage is a secured loan that is collateralized by the home it is financing. This means that the lender will have a lien on your home until the mortgage is paid in full. After closing, youll make monthly paymentswhich covers principal, interest, taxes and insurance. If you default on the mortgage, the bank will have the ability to foreclose on the property.

What Happens If You Default

Ten years ago, there was a terrible problem with people getting overextended & defaulting on loans. The problem was that low variable interest rate loans fueled speculators that got burned when the rates increased as they tried to roll into a fixed rate. The ugly truth for those people was that they either ended up doing a short sale or having their homes foreclosed upon because in many housing markets the price of homes shaply declined. Today, when your home value doesn’t match your loan, you are considered to be under water. If you owe more than your home is worth because it dropped in value and you have a variable rate loan, you will not be able to roll it to a fixed rate loan, leaving you with a sad decision to make.

Fortunately, while select cities like Toronto & Vancouver have ran up in prices, most of the housing market in Canada rarely contains bubbles. If you focus on getting the best fixed rate loan that you can & don’t chase prices in the few core hot markets, you will likely never experience the type of trouble that people had during that time period.

If you are unsure if you are running ahead of yourself, check out Garth Turner’s Greater Fool blog, which details some of the recent astromical home price rises seen in parts of Vancouver & Toronto, along with the justifications people make while over-extending themselves.

Recommended Reading: Can You Have Two Mortgage Loans

Where Can I Find A Mortgage Calculator

Theres a huge number of variables when it comes to getting a mortgage your credit history, income sources, deposit size and monthly outgoings being just a few of them. As such, calculators can only give you the most general idea of what is available.

Getting the expert advice is the best way to find out if youre eligible for a £200k mortgage, or what repayments on a £200k mortgage might cost you.

Speak to one of the brokers we work with to get the best advice for your unique circumstances they can help clear up the confusion and connect you with the right lender for you.

Service Loan Savannah Ga

1. Service Loan Co 7400 Abercorn St Savannah, GA Loans Get directions, reviews and information for Service Loan Co in Savannah, GA. Service Loan Co. 7400 Abercorn St, Savannah, GA 31406. 354-8335. Find complete information about Service Loan Co in Savannah 7400 Abercorn St, Savannah, GA 31406, United

You May Like: How To Budget For Mortgage

$200000 House At 325%

| $433 |

Mortgage Tips

- Get a free copy of your to make sure there are no errors which might negatively affect your credit score.

- Shop around. Make sure to get multiple mortgage quotes. Over 30 years, a difference of 0.25% in APR might end up being over $10,000 in extra payments!

- Bigger down payments are better. You can often qualify for a mortgage with as little as 3.5% down. But, unless your down payment is at least 20%, you will likely have to pay Private Mortgage Insurance . This can add significant cost to the price of the mortgage.

Can I afford a $200,000 house?

Traditionally, the “28% rule” means a person should not spend more than 28% of their pre-tax income on total housing costs.

Let’s assume that taxes and insurance are 2% of the house price annually. Here’s how much you’d have to make to afford a house that costs $200,000 with a 3.25% loan:

| % Down |

|---|

What Is Principal And Interest

The principal is the loan amount that you borrowed and the interest is the additional money that you owe to the lender that accrues over time and is a percentage of your initial loan. Fixed-rate mortgages will have the same total principal and interest amount each month, but the actual numbers for each change as you pay off the loan. This is known as amortization. You start by paying a higher percentage of interest than principal. Gradually, youll pay more and more principal and less interest. See the table below for an example of amortization on a $200,000 mortgage.

You May Like: Will Mortgage Rates Stay Low

What Are The Repayments On A 200000 Mortgage

The answer, of course, is not the same for everybody, which is why bespoke advice is crucial.

For a start, every lender is different, along with every borrowers and circumstances there are many factors that can affect your monthly repayments.

Two main factors will have a bearing on how much the repayments cost: the term of the mortgage and the interest rate that the lender gives you.

This table shows how your monthly repayments can vary, based on the term and the interest rate.

| £200,000 Mortgage Repayments |

|---|

How To Find An Affordable Home

Would-be buyers in expensive areas may need to think creatively about how to buy a home. For example, if you live in a high-cost area and are planning to buy a home for your family you can try getting an FHA loan or find a seller willing to do a rent to own.

A rent to own is when a tenant rents the house for an extended period of time and then, after all those months are up they can purchase it. Youll still need to make monthly payments on rent as you would owning your own home but how much is different depending on how many years youre renting the property before the home purchase.

Its often less expensive than buying up front, or you can also find a seller willing to give a private mortgage. Or you may have to look for a smaller home in a more affordable area or a condo.

Recommended Reading: When Does It Make Sense To Refinance Mortgage

Mortgages And Monthly Repayments

If you want to borrow £200,000 to purchase a property, read our guide to see what your repayments could be.

Ask Us A Question

We know everyone’s circumstances are different, that’s why we work with mortgage brokers who are experts in all different mortgage subjects.Ask us a question and we’ll get the best expert to help.

No impact on credit score

4.8 out of 5 stars across Trustpilot, Feefo and Google! Our customers love Online Mortgage Advisor

Author:Pete Mugleston– Mortgage Advisor, MD

If you want to buy a property that requires a £200,000 mortgage, youll likely want to know how much that will cost you each month.

In this article, we look into what this level of borrowing will cost on a monthly basis as well as the factors that affect repayments. We identify how you could potentially minimise your borrowing costs in addition to other fees you should factor into your property purchase.

The following topics are covered below…

How A Broker Can Help You Reduce Your Repayments

All mortgage applicants want to minimise their monthly repayments, particularly ones that want to borrow at a relatively high level such as £200k. To do so, you need to apply to a lender that will give you the lowest interest rate possible.

This is why using a broker can be such a good idea. The brokers we work with have in-depth knowledge and experience of the market which means their help can quickly pinpoint the right lender for you. Theyll know which provider will offer a mortgage with the cheapest repayment plan you can secure.

If you get in touch well arrange for a mortgage specialist to contact you straight away.

Recommended Reading: Can I Make A Large Payment On My Mortgage

Income Needed For A $ 200000 Mortgage

How Much Income Do You Need for a $ 200,000 Mortgage? This is the question many homebuyers ask themselves. And the answer depends on several factors like your creditworthiness and the amount of the down payment.

This is how you can determine if you have enough income to pay for a $ 200,000 home loan.

Check your eligibility to buy a home. Start here

In this article

Read Also: How Much Is An Application Fee For A Mortgage

Tips To Maximize Your Home Buying Budget

We started with the question, How much income do I need for a $200K mortgage? And we have demonstrated that theres no easy answer.

What we can do is give you some tips for maximizing your home buying budget on your current income.

Of course, its difficult for anyone to do all these things at once. But start where you can.

Even a small improvement in your credit score or DTI can make a big difference in your home buying budget. Remember, every little bit counts!

Don’t Miss: What Does Private Mortgage Insurance Cost

Can My Monthly Payment Go Up

Your monthly payment can rise in a few cases:

You have an adjustable-rate mortgage in which your payment stays the same for an initial term and then readjusts annually.

If you have an escrow account to pay for property taxes or homeowners insurance, because those taxes or insurance premiums may increase. Your monthly mortgage payment includes the amount paid into escrow, so the taxes and premiums affect the amount you pay each month.

You may have been assessed fees. Check your mortgage statement or call your lender.

Must reads

What Is The Required Debt

Online resource Investopiea.com explains that the lower an applicants debt-to-income ratio, the greater the chances that the borrower will be approved for a credit application.

As a customary rule, 43 percent is the highest debt-to-income read DTI ratio a borrower can have and still be qualified for a mortgage.

However, lenders prefer a debt-to-income ratio lower than 36 percent, with no more than 28 percent of that debt as a mortgage or rent payment.

In reality, though, the maximum DTI ratio varies from lender to lender.

Recommended Reading: How To Find Remaining Mortgage Balance On A Property

Common Misconceptions About Homeownership

There are many misconceptions about how difficult it is to become a homeowner. Its important to understand the facts before you start and how they apply to your individual situation so that you dont get overwhelmed or discouraged.

If you have less than 20 percent saved for a down payment, you should add PMI to the list of housing costs when youre figuring your budget.

Low income families can get down payment assistance from the government and non-profits. Before you go all-in with your house hunting. Decide if now is the right time for you to buy a home.

In any event, mortgage rates are currently at a historic low, the average rate on 30-year mortgages stood at 3.04 percent this week, unchanged from last week, according to Bankrates weekly survey of large lenders. If youve been thinking about becoming a homeowner, it may be time to take the plunge and buy now before interest rates rise again.

Most first-time buyers have to dip into savings or investments to have enough for a down payment. And if you have or student loan debt, be aware that some lenders may not approve your mortgage application because of how high the total monthly payment is.

Dont wait to start saving for a down-payment on your home. The sooner you begin putting money towards this goal, the easier it will be for you to become a homeowner.