Summary Of Mortgage Rate And Apr

- The mortgage and the APR are both rates used by banks to calculate charges that apply to borrowing.

- Mortgage rate is the interest rate charged on a principal amount borrowed. The APR is a rate that comprises of the interest to be charged and additional fees such as credit card charges, settlement fees, closing fees and so much more.

- The mortgage rate and the APR differ in that the first is less than the later.

- The mortgage interest rate is paid monthly but the APR is a yearly rate.

- The APR changes when the individual refinances or dells, however the fixed mortgage rate remains constant during refinancing or selling.

When To Use Apr Vs Interest Rate

Be cautious not to overvalue the APR number. APR is most useful if you plan to keep the loan for its entire term.

If you are purchasing a home with plans to move or refinance within 5 to 10 years, it makes more sense to pay attention to interest rates so that you can keep your monthly payments lower, says Auen.

Remember, too, that lenders dont include exactly the same costs in their APR calculations.

Thats why you should ask specifically what is included in your APR so that you can make an accurate assessment when comparing offers, Auen notes.

If you only plan to stay in the home for a few years, comparing the 5year cost of each loan might be more helpful than APR.

The 5year cost projection can be found on page 3 of your Loan Estimate, directly above the APR. It shows the real cost of your loan after 5 years, including loan principal, interest, and upfront costs.

This number will be more realistic for a shortterm borrower than APR, which spreads loan costs over the full loan term often 30 years.

Tips To Remember When Loan Shopping

The main takeaway is that shopping around for a mortgage will help you get your best deal. Its not always easy to compare apples to apples while evaluating mortgage offers, but combing through your loan estimates can help.

Dont just settle on one mortgage lender before doing your due diligence pick three to five lenders. Taking the time to comparison shop can potentially save you thousands in interest over the life of your loan.

Keep the following tips front of mind as you prepare to get a mortgage:

You May Like: How Much Is Mortgage On 1 Million

A Note On Apr And Short

If you’re certain that you’re purchasing your forever home, it makes sense to shop around and choose a mortgage with the lowest APR and more upfront fees because, ultimately, youll pay less to finance your house in the long run.

However, if you dont plan on staying in the home for the long haul, it may make more sense to choose a loan with a higher rate, fewer upfront fees and a higher APR, because you’ll end up paying less during the first few years of the mortgage.

What Is The Interest Rate

Your annual interest rate is a basic look into just the interest you are being charged for a mortgage loan without taking other fees into account. Interest rates are lower than the APR, usually by a few tenths of a percentage point.

Most people shop for lenders and use the interest rate as a way to compare loan offers. By finding the lowest interest rate, you will get the lowest monthly mortgage payment. If you want to know the mortgage loans total cost, you should compare the APR rates quoted to you. The best APR may not be the best rate or lowest payment, but it will be the cheapest over the life of the loan.

Don’t Miss: Does Prequalifying For A Mortgage Affect Your Credit

Should I Look At Apr Or Interest Rate When Comparing Loan Offers

When considering similar loan offers from different lenders, make your comparison using the lenders offered APRs. If a lender is making up for a low advertised interest rate with higher fees, the APR will tell you. If there is a big gap between the APR and interest rate, youll know that lenders fees are high. And if the APR is closer to the interest rate, its a good sign the lender has low fees.

Of course, youll also want to consider other factors before accepting a loan offer, such as a reputation for quality customer service, any prepayment penalties, the loan amount and term length you can receive, and whether you can comfortably afford to make the monthly payment.

What Are The Different Types Of Mortgages

Mortgages come with all sorts of different interest rates and terms. These influence how long it will take to pay off your loan and how much your monthly payments will be.

These are some of the most common types of mortgages home buyers use:

Fixed-rate mortgage

A fixed-rate mortgage has a set interest rate for the life of the loan. With this type of loan, your mortgage rate will never change. Your overall monthly payments could still fluctuate based on property taxes or other factors. But a fixed rate locks in how much youll pay in interest over the course of your loan. And if interest rates drop to below your current rate, you can refinance to a lower rate.

Two of the more popular mortgage terms for fixed-rate loans are 15- and 30-year mortgages.

An ARM is usually a 30-year term loan with an interest rate that changes over time with market averages. When the interest rate changes depends on the loan. Common ARM terms are 5/1, 7/1, and 10/1. The first number designates the first year your interest rate will change, and the second number is how frequently the interest rate resets after the first time. So a 5/1 ARM adjusts the rate after 5 years and then annually after that. Most ARMs reset annually after the initial adjustment.

Government-backed loan

Recommended Reading: Rocket Mortgage Loan Requirements

Some Fees Not Included

An APR includes several critical charges, but it doesnt account for every charge required to get approved for funding. For example, a credit report fee might not be part of the APR calculation.

No matter what APR is listed on your loan information, you should always read your paperwork thoroughly to know exactly what you are paying.

What Is An Annual Percentage Rate Vs Interest Rates

The APR is important because it can give you a good idea of how much youll pay on an annual basis for the funds borrowed.

Lenders are obligated to disclose the in addition to the interest rate. Since lenders charge different fees, this disclosure was meant to help consumers understand the actual rate for the funds borrowed, which includes the finance charges in addition to the interest rate charged on the principal balance of the loan.

The APR also helps consumers compare overall costs from one lender to the next. Be careful when comparing the APR of a fixed rate loan with the APR of adjustable or variable rate loans, or when comparing the APRs of different adjustable rate loans. You should also know the fees included in the APR, because lender fees and other costs can vary from lender to lender.

You May Like: Does Getting Pre Approved Hurt Your Credit

What Is A Good Apr For A Personal Loan

APRs for personal loans vary depending on your loans term and the current financial market. Lenders will also take into consideration your overall credit score, repayment history, debt-to-income ratio, among other factors. That being said, theres no one-size fits all range that makes for a good APR. Rather, its important to shop around to see what you can qualify for based on your personal finances. With LendingClub Bank, you can check your rate online without impacting your credit score.

LendingClub Bank and its affiliates do not offer legal, financial, or other professional advice. The content on this page is for informational or advertising purposes only and is not a substitute for individualized professional advice. LendingClub is not affiliated with or making any representation as to the company, services, and/or products referenced. LendingClub is not responsible for the content of third-party website, and links to those sites should not be viewed as an endorsement. By clicking links to third-party website, users are leaving LendingClubs website. LendingClub does not represent any third party, including any website user, who enters into a transaction as a result of visiting a third-party website. Privacy and security policies of third-party websites may differ from those of the LendingClub website.

Savings are not guaranteed and depend upon various factors, including but not limited to interest rates, fees, and loan term length.

What Is A Mortgage Rate

A mortgage rate is the interest lenders charge on a mortgage. Mortgage rates come in two forms: fixed or variable.

Fixed rates never change for the life of your loan and in exchange for this certainty, the rate is higher on longer loans.

Variable-rate mortgages can have lower interest rates upfront, but fluctuate over the term of your loan based on broader economic factors. How frequently a variable-rate mortgage changes is based on the loans terms. For example, a 5/1 ARM would have a fixed rate for the first five years of the loan, then change every year after that.

You May Like: Rocket Mortgage Payment Options

What Apr Can You Expect On A Personal Loan

On average, personal loans may have lower APRs than credit cards, according to reports from the Federal Reserve. However, the APR you can expect to receive on a given loan will depend on the lender, loan amount, repayment term, and other factors such as your overall credit score and repayment history, and your debt-to-income ratio.

Before taking out a personal loan, you can typically check your loan offers and compare APRs before deciding on any one lender. You can also compare loan terms and possible monthly payments to see what works best for your budget.

At LendingClub Bank, on average range from as low as 7.04% up to 35.89%, depending on your credit score.1

What Determines My Apr

Because APR includes the interest rate offered on your mortgage, as well as discount points, mortgage origination fees, and other costs associated with obtaining a loan, it is usually higheroften 0.20% to 0.25% greaterthan the interest rate. So, in general, the higher your APR, the higher your payments are over the life of your home loan.

Consequently, its important to check both interest rate and APR when looking for a mortgage, says Dobbs. If youve applied for a mortgage and received a good-faith estimate from a lender, you can find the interest rate on Page 1 under Loan Terms, and the APR on Page 3 under Comparisons, according to the Consumer Financial Protection Bureau.

Recommended Reading: Reverse Mortgage Mobile Home

What Is Interest On A Personal Loan

Personal loans lenders charge interest rates ranging between roughly 2.49% to upwards of 24% . The average personal loan interest rate for two-year loans is currently 9.46% according to Q1 2021 data from the Federal Reserve.

Interest rates are expressed as a percentage applied to your remaining monthly balance. The rate determines how much you pay to borrow money over the lifetime of the loan. A two-year loan, for instance, gets paid back over a period of 24 monthly installments. Each month, a portion of your payment gets applied to the balance you still owe, while another percentage gets applied toward interest, or the fee you pay to borrow.

Interest rates can be fixed or variable .

Watch Out For Apr On Adjustable

- Because the fully-indexed rate is merely estimated

- Using a fixed margin and a variable index that may change

- Disclosures often read APR may increase after loan consummation due to changes in the index

If youre shopping for an adjustable-rate mortgage, you may see that the .

This is essentially because lenders calculate the fully indexed rate by combining the margin and associated mortgage index.

And since mortgage indexes are so low at the moment, they assume youll have a lower rate than your original start rate once the loan adjusts, which may or may not be the case.

A lot can change in a few short years and the fully-indexed rate may indeed be higher.

Dont bank on the fully-indexed rate being lower because rates are historically close to rock-bottom and probably wont stay that way for long.

Of course, most homeowners only hold onto adjustable-rate mortgages for a handful of years before refinancing or selling, so it might not matter too much. That monthly payment might be more important.

When it comes to fixed-rate mortgages, lenders will have a more difficult time making the math favorable, which is why youll typically see APR that exceeds the interest rate unless its a no cost refinance.

And while interest rates are generally low on FHA loans, the effect of the required upfront MIP and annual mortgage insurance can make the APR skyrocket in a hurry. In other words, they arent as cheap as they appear.

Recommended Reading: Does Rocket Mortgage Sell Their Loans

Using The Loan Estimate To Compare Mortgage Offers

When you apply for a mortgage, the lender is required to give you a three-page document called a Loan Estimate. Page 3 of the Loan Estimate has a “Comparisons” section that lists not only the APR but also how much the loan will cost in the first five years: the loan costs, plus 60 months of principal, interest and any mortgage insurance.

In the earlier example, Loan A would cost $62,033 in the first five years, and Loan B would cost $62,290. So Loan A would cost $257 less in the first five years. Even though Loan A has a higher APR, it would be the better deal if you kept the loan for just five years.

When you get multiple loan offers, line up the “Comparisons” sections of the Loan Estimates side by side to help you decide.

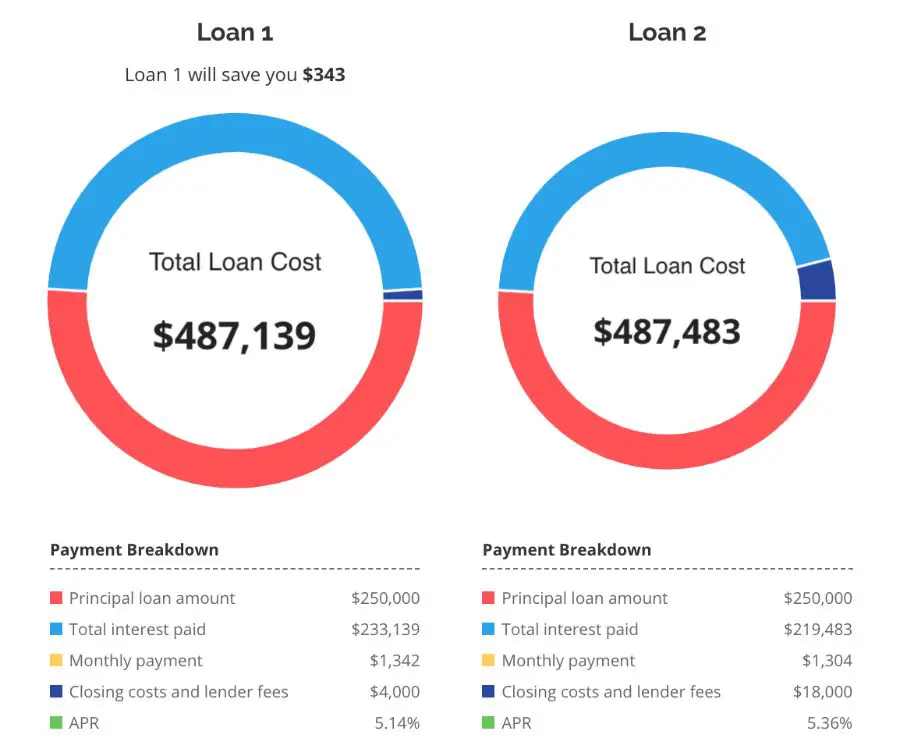

Which Loan Is Cheaper Interest Rate Vs Apr

| Loan 1: $200,000 principal 3.00% fixed interest rate $10,000 fees 3.40% APR | Loan 2: $200,000 principal 3.40% fixed interest rate $4,000 fees 3.56% APR |

|---|---|

|

Loan 1: $200,000 principal 3.00% fixed interest rate $10,000 fees 3.40% APR |

Loan 2: $200,000 principal 3.40% fixed interest rate $4,000 fees 3.56% APR |

|

Time into loan |

|

|

+ $4,000 = $322,960 |

$9,480: Loan 1 is cheaper |

Eventually, you might pay off your mortgage and own your home free and clear, ideally before retirementunless youre the type whos happy to carry a low-rate mortgage so you can have extra cash to invest .

But each time you get a new loan, you pay closing costs all over again, except in the case of a no-closing-cost refinance. That means all the loan fees you pay should really be averaged out over, say, five years or however long you think youll keep the loan, not 15 or 30 years, to give you an accurate APR. You can do this math yourself with an online APR calculator. This same logic can help you determine whether it makes sense to pay mortgage points.

Read Also: Does Chase Allow Mortgage Recast

Mortgage Apr = More Accurate Representation Of Loan Cost

- The APR is a more accurate representation of how much the home loan will cost you

- Because it factors in points and other lender fees you might pay

- This is why its important to look beyond just the interest rate offered

- But its not perfect either

As noted, the mortgage APR is basically the true cost of the loan, or at least a bit more accurate than a simple interest rate. Ill explain why with a basic example.

Lets look at an example of interest rates and APR:

Mortgage Rate X: 4.50%, 4.838% APR Mortgage Rate Y: 4.75%, 4.836% APR

The advertised mortgage rate X is 4.50%, but requires that two mortgage points be paid it also has $2,000 in additional closing costs, which pushes the APR to 4.838%.

Meanwhile, advertised mortgage rate Y is offered with no points and just $1,000 in closing costs, so the APR is 4.836%, just below that of mortgage rate X.

So even though one advertised mortgage rate might be lower than another, once closing costs are factored in, it could actually end up costing you more.

Thats why its very important to consider both the APR and interest rates.

At the same time, the monthly mortgage payment on mortgage rate X will still be cheaper each month because of the lower interest rate.

For example, if the loan amount in our example is $200,000, the monthly principal and interest mortgage payment would be $1,013.37 on mortgage rate X versus $1,043.29 on mortgage rate Y.

Why Its Important To Shop For Multiple Quotes

When youre getting a mortgage, its important to compare offers from a variety of lenders. Every lender will evaluate your financial situation differently. So getting multiple quotes will allow you to choose the offer with the best rate and fees. The rate difference between the highest and lowest rates lenders offer you could be as high as 0.75%, according to a report by the fintech startup Haus.

However, the interest rate isnt the only factor you need to consider when comparing mortgage lenders. The fees each lender charges can vary just as much as the interest rate. So the offer with the lowest rate may not be the best deal if youre paying excessive upfront fees. To compare rates and fees, take a look at the Loan Estimate form that lenders are required to provide within three business days of receiving your application. The Loan Estimate is a standardized form, which makes it easy to compare quotes.

You can visit NextAdvisors comprehensive list of mortgage lender reviews here.

Read Also: Reverse Mortgage On Condo