Adjustable Rate Loan Options

FHA ARM, Jumbo ARM, and VA ARM loans feature an initial fixed rate period, after which the rate adjusts. All Adjustable Rate Mortgages adjust based on predetermined guidelines.

We offer a variety of terms:

- 7 Year ARM – offers an initial fixed period of 7 years, then the rate adjusts. The 7 Year ARM is an option for Conventional and Jumbo loans.

- 10 Year ARM – offers an initial fixed period of 10 years, then the rate adjusts. The 10 Year ARM is an option for Conventional and Jumbo loans.

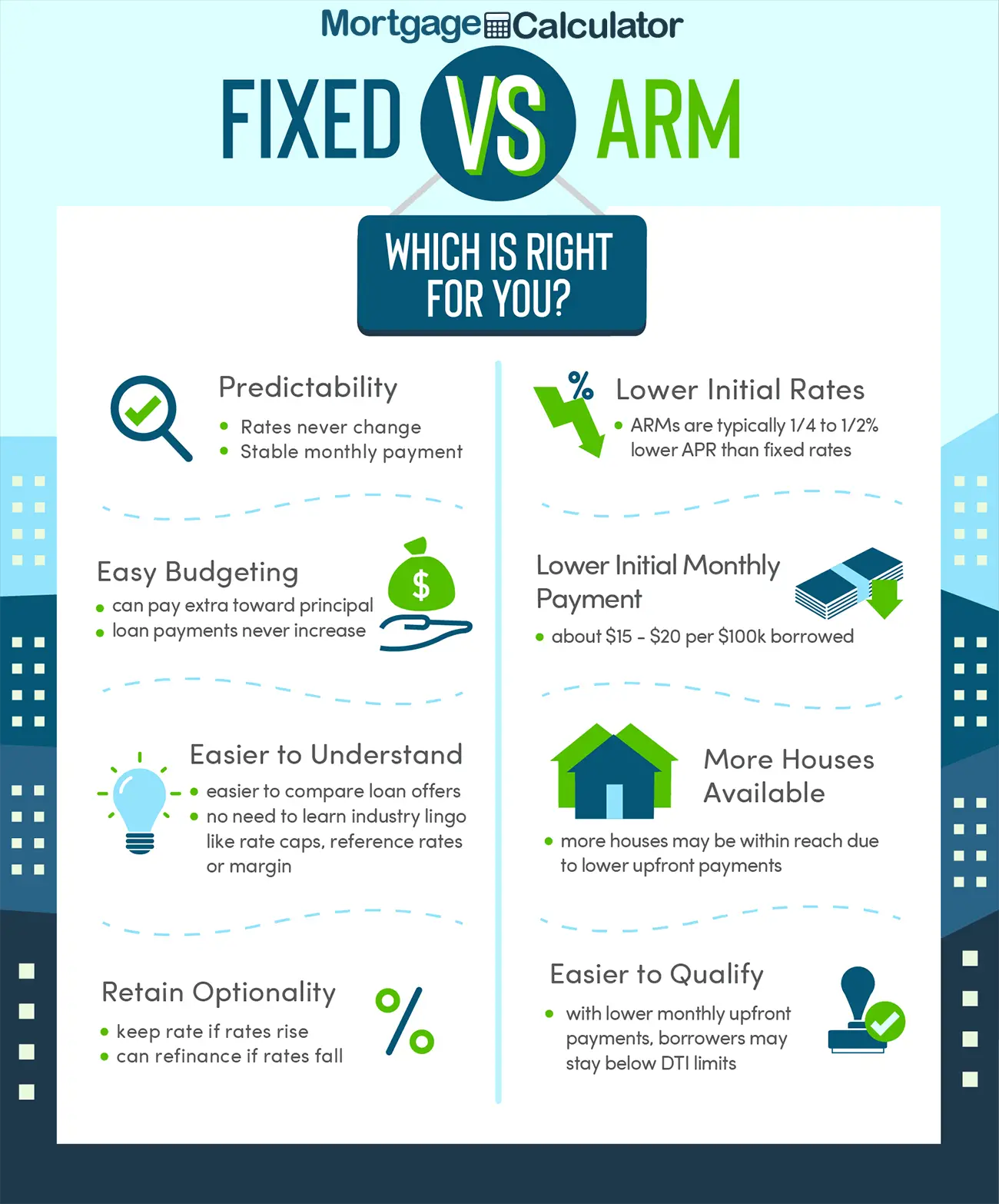

General Advantages And Disadvantages

The initial interest rates for adjustable rate mortgages are often lower than a fixed rate mortgage, which in turn means your monthly payment is lower. If you only plan to stay in your home for a short period of time, an ARM loan might be advantageous to you because you plan on moving or selling your home before your initial mortgage rate adjusts. If you expect your income to increase in the future, you might feel comfortable with the idea of saving money now by having a lower monthly payment but be comfortable with having to make higher payments in the future when your income rises and your ARM adjusts.

ARMs are generally considered riskier because your interest rate can go up after the initial fixed-rate period ends.

What Is A 7/1 Arm

A 7/1 ARM is a mortgage that has a fixed interest rate in the beginning, then switches to an adjustable or variable one. The 7 in 7/1 indicates the initial fixed period of seven years. After that, the interest rate adjusts once yearly based on the index stated in the loan agreement, plus a margin set by the lender. The 7/6 ARM is another common mortgage, which adjusts every six months after the initial period.

Don’t Miss: How Long Does It Take To Do A Reverse Mortgage

The Best Times To Refinance A 7/1 Mortgage

People looking to refinance 7-year mortgages are likely wondering about the best time to refinance. The best time depends on your personal situation. Refinancing when rates are low can be beneficial, but it’s never a good idea to postpone a refinance until rates decrease. The market is impossible to predict, and waiting for rates to drop could mean you miss an opportune window to refinance.

Many people choose to refinance before their loan moves to the adjustable-rate period. Others decide to refinance sooner, especially if they plan to move, want to change how their loan is structured, or want to tap into home equity via cash-out refinance. In most cases, you are ready to refinance if you can articulate a specific goal of the refinance whether that be to cut interest rates, pay off the home faster, or reduce monthly payments.

Consider A 5/1 Arm If You:

- Plan to sell or refinance before the adjustable-rate period expires. It may be hard to time a sale exactly with a pending ARM adjustment. Give yourself plenty of lead time to market your home, or make room in your budget for the first payment adjustment.

- Know your income will grow. If youre expecting a raise or bonus, you dont have to worry as much about payment increases.

- Make more than the minimum down payment. A lower loan amount and monthly payment may soften the impact if you cant pay off an ARM loan before it adjusts.

- Can afford the fully indexed payment. In the example above, theres a $1,000-plus bump in your payment if you end up in an ARM longer than expected. Avoid choosing an ARM if the higher payment would strain your budget.

- Know the adjustments of the ARM plan youve selected. Theres a big difference between a five-year ARM with 2/2/5 caps and one with 5/2/5 caps. Review the CHARM booklet, along with the ARM adjustments on each loan estimate, so you know the worst-case payment scenarios.

Also Check: How To Get A Mortgage And Renovation Loan

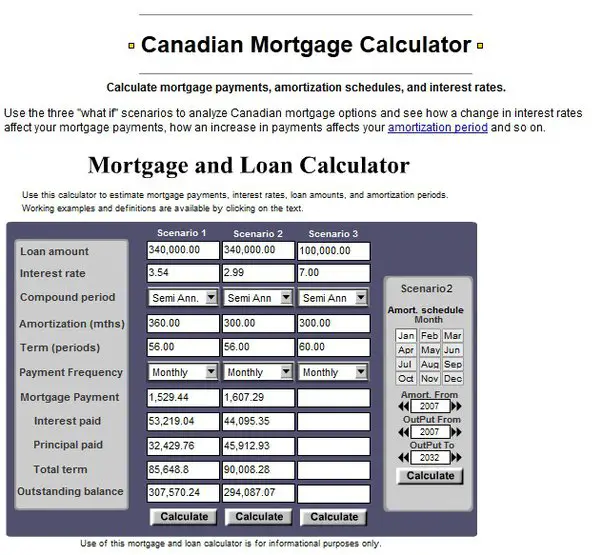

The Math On A 7/6 Arm Loan

For a better understanding of how you can potentially save with an adjustable rate mortgage, lets crunch some numbers.

Two buyers are approved for a $200,000 home loan, with one opting for a 30-year fixed rate mortgage and the other choosing a 7/6 ARM. In this scenario, lets assume the 7/6 ARM interest rate was 2.375% and the 30-year fixed is 3.125%.

Take a look at how much each buyer could possibly pay throughout the first seven years of their loan:

Is An Adjustable Rate Mortgage A Bad Idea

Although adjustable rate mortgages have many advantages, they may not be for everyone because:

- Rising interest rates after initial fixed rate period may put a strain on personal finances.

- Adjustable rates may make it difficult to plan long term.

- Prepayment penalties may prevent borrowers from refinancing or selling.

You May Like: How Do I Qualify For A Second Mortgage

Can I Refinance My 7

If you’re looking to refinance a 7-year ARM, you should know the ins and outs of the process from pros and cons to the best times to refinance. There are numerous refinance loans available, and it’s important to know which will work best for your existing mortgage. So whether you’re looking to refinance an existing 7/1 ARM or are interested in refinancing into a 7-year adjustable-rate mortgage, here is what you should know.

When Were Arms First Offered To Homebuyers

ARMs have been around for several decades, with the option to take out a long-term house loan with fluctuating interest rates first becoming available to Americans in the early 1980s.

Previous attempts to introduce such loans in the 1970s were thwarted by Congress, due to fears that they would leave borrowers with unmanageable mortgage payments. However, the deterioration of the thrift industry later that decade prompted authorities to reconsider their initial resistance and become more flexible.

The Federal Reserve Board. Consumer Handbook on Adjustable-Rate Mortgages, Pages 1014 . Accessed Dec. 23, 2021.

The Federal Reserve Board. Consumer Handbook on Adjustable-Rate Mortgages, Page 15 . Accessed Dec. 23, 2021.

The Federal Reserve Board. Consumer Handbook on Adjustable-Rate Mortgages, Pages 1516 . Accessed Dec. 23, 2021.

The Federal Reserve Board. Consumer Handbook on Adjustable-Rate Mortgages, Pages 1618 . Accessed Dec. 23, 2021.

Also Check: How To Calculate Monthly Mortgage Payment

What Is An Fha 7/1 Arm

The Federal Housing Administration offers two 7/1 ARM options through approved lenders:

- 1% increase annually, and 5% over the life of the mortgage

- 2% increase annually, and 6% over the life of the mortgage

If you have good to excellent credit, youâll have higher approval odds for an FHA 7/1 ARM. This loan option offers a lower down payment requirement and a lower initial interest rate.

| ð° Want to save more money? Find top local agents through Clever Real Estate, save thousands with built-in cash back savings on your home purchase! Learn more. |

When Should You Consider A 7

The most ideal time to consider a7-year ARMis when the APR is lower than a 30-year fixed-rate mortgage. Because 7-year ARMs have a low introductory rate, some home shoppers may choose this loan program with the intention to sell the house orrefinance the mortgagebefore the fixed rate period ends in hopes thatthe value of the houseincreases within the first 7 years. However, not knowing the future can present its own set of risks like:

Before committing to a 7-year ARM, make sure you’re comfortable with thenew monthly paymentamount at the maximum interest rate. Defaulting on your home loan can severelyimpact your credit, and refinancing a 7-year ARM to a fixed-rate mortgage comes with fees that may end up costing you more than your initial savings.

Don’t Miss: What Is The Mortgage On A 3 Million Dollar Home

Arm Rate Caps Mean Protection For The Borrower

Most adjustable-rate mortgages are accompanied by a rate cap, limiting how much your interest rate can increase or decrease.

There are three different ARM rate capsinitial, period, and lifetime rate caps.

- An initial interest rate cap limits how much interest rates can increase at the end of your initial, fixed-rate period.

- A periodic rate cap limits how much your mortgage interest rate can increase from one adjustment period to the next adjustment period.

- A lifetime interest rate cap limits how much your interest rate can increase over the entirety of your home loan term.

Lets look at an example of an ARM loan with a 5/2/5 rate cap structure.

- Your rate can rise up to 5% above the initial rate.

- The rate can adjust up to 2%each subsequent year.

- Your rate can never adjust more than 5% higher than your initial rate.

How 7/1 Arm Rates Stack Up Against Other Mortgage Rates

Homebuyers who take on 7/1 ARMs usually have mortgages with 30-year terms. But many of them pay off their mortgages before the initial seven-year period comes to an end.

Compared to the standard 30-year and 15-year fixed-rate mortgages, 7/1 ARMs traditionally have lower interest rates, at least within the first seven months of the loan term. That low initial interest rate can make the 7/1 ARM an affordable mortgage option for homebuyers. But its important to make sure the maximum interest rate outlined in your mortgage contract will also fit into your budget, in case it ever raised to that point after the initial seven-year fixed term.

Borrowers with 7/1 ARM mortgages also have an advantage over those with 5/1 ARMs or 3/1 ARMs. After all, their mortgage rates are fixed for a longer period of time. Thats why homebuyers tend to look at 7/1 ARM mortgage rates during periods when interest rates are high.

After 84 months pass, borrowers with 7/1 ARMs will likely find themselves with a higher interest rate. If your interest rate ends up impacting your mortgage payments to the point where its too expensive for your budget, you may have to consider refinancing. Another option is selling your home. The last thing youd want to happen is defaulting on your home loan as that will severely impact your credit. Therefore, if youre planning on using a 7/1 ARM, its essential to know your finances.

Don’t Miss: How Long To Be Approved For Mortgage

How The 7/1 Arm Works

- You get a fixed interest rate for the first seven years of the loan

- After that the rate becomes annually adjustable for the remaining 23 years of the 30-year loan term

- Many borrowers dont keep their mortgage/home that long so you may never actually face a rate adjustment

- Its an option to consider alongside the more popular 30-year fixed

A 7/1 ARM is an adjustable-rate mortgage with a 30-year term that features a fixed interest rate for the first seven years and a variable rate for the remaining 23 years.

Lets break it down. During the first seven years of the loan term, the mortgage rate is fixed, meaning it wont change from month-to-month, or even year-to-year.

So if the starting interest rate is 3%, thats where it will remain until its first adjustment in month 85.

For all intents and purposes, the loan program offers borrowers fixed rates for a very lengthy 84 months.

During the remaining 23 years, the rate is adjustable, and can change just once per year. Thats where the number 1 in 7/1 ARM comes in.

This makes the 7-year ARM a so-called hybrid adjustable-rate mortgage, which is actually good news.

You essentially get the best of both worlds. A lower interest rate thanks to it being an ARM, and a long period where that rate wont change.

It affords you two additional years of fixed payments when compared to the 5/1 ARM. And those 24 extra months might come in handy

Current Mortgage Refinance Rates

Theres good news if youve been considering a refinance because the mean rates for 15-year fixed and 30-year fixed refinance loans slumped. If youve been considering a 10-year refinance loan, just know average rates also sank.

The average refinance rates are as follows:

Compare countrywide home loan rates from various lenders .

Also Check: Can You Add Money To Mortgage For Improvements

See Other Mortgage Types

| Avg. Days on Market | Home Costs as % of Income |

|---|

Methodology A healthy housing market is both stable and affordable. Homeowners in a healthy market should be able to easily sell their homes, with a relatively low risk of losing money. In order to find the big cities with the healthiest housing markets, we considered the following factors: stability, affordability, fluidity and risk of loss. For the purpose of this study, we only considered U.S. cities with a population greater than 200,000.

We measured stability with two equally weighted indicators: the average number of years people own their homes and the percentage of homeowners with negative equity. To measure risk, we used the percentage of homes that decreased in value. To determine housing market fluidity, we looked at data on the average time a for-sale home in each area spent on the market – the longer homes take to sell, the less fluid the market. Finally, we calculated affordability by determining the monthly cost of owning a home as a percentage of household income in each city.

Affordability accounted for 40% of the healthiest markets index, while each of the other three factors accounted for 20%. When data on any of the above four factors was unavailable for cities, we excluded these from our final rankings of healthiest markets.

How We Determine Mortgage Rates

We use Bankrates daily mortgage interest rate data for our mortgage rate trends. These overnight rates are based on a specific borrower profile, which only includes loans for owner occupied homes with 20% equity or more. Bankrate is part of the same parent company as NextAdvisor.

The table below compares todays average rates to what they were a week ago, and is based on information provided to Bankrate by lenders nationwide:

| Loan term |

|---|

Don’t Miss: What Percentage Of Household Income Should Go To Mortgage

Why Is An Adjustable

Adjustable-rate mortgages arent for everyone. Yes, their favorable introductory rates are appealing, and an ARM could help you to get a larger loan for a home. However, its hard to budget when payments can fluctuate wildly, and you could end up in big financial trouble if interest rates spike, particularly if there are no caps in place.

/6 Arm: Requirements And How It Works

What does a retired couple with 6 years left on their mortgage have in common with a young homeowner planning on changing jobs soon? Both might benefit from a 7/6 adjustable-rate mortgage for their home.

A 7/6 ARM offers flexibility and a low interest rate for 7 years, which borrowers can take advantage of by saving money on interest and paying off their mortgage before the rates change.

Here are the details regarding the 7/6 ARM and how it works.

Recommended Reading: What Would We Qualify For Mortgage

Expect Your Income To Rise

If you expect your income to rise in the next few years, an adjustable rate mortgage may not seem like much of a risk. The extra money coming into your bank account can absorb the additional costs if the indexs average interest rates go up by the end of your fixed rate term.

While you might not want to spend that extra hard-earned income on mortgage interest payments, you wont be as affected if the economy turns against you. You can never be sure about long-term economic changes, so expecting greater income in the future might provide some additional assurance.

When Does A 7/1 Arm Adjust

If you were to close your loan on July 1, 2022, the first rate adjustment will happen on July 1, 2029 that is, seven years later.

At this time, the payments of your loan are recalculated going forward based on the then-prevailing interest rate. Its anybodys guess whether the new rate will be higher or lower than the initial rate. Then, a year later on that same date, the loans rate will reset again, and so on each year throughout the term of the loan.

Don’t Miss: How To Shop For Home Mortgage Loan

Factors To Consider When Comparing 7/1 Arm Rates

As youre shopping around and taking a look at 7/1 ARM mortgage rates, there are several things that youll need to keep in mind. Since mortgage rates are tied to an index, theyll increase as the interest rates in the index go up after the conclusion of your initial 84-month period. If you’re not sure whether your salary will increase within the next seven years or whether itll be high enough to cover the cost of a more expensive mortgage bill, you might need to look into mortgage products with permanently fixed interest rates.

Its important to find out how often your mortgage rate will change and whether there are any prepayment penalties charged if borrowers pay off their mortgages early. Youll also need to know whether theres a rate cap.

If you want the lowest possible rate on your 7/1 ARM, it helps to have a good credit score, a stable source of income, cash savings and a low debt-to-income ratio . Lender requirements can vary, so youll need to check with a specific lender to find out whether theres a minimum credit score you need to have. As a general rule, its best to keep your debt-to-income ratio below 36% if youre going to be applying for a mortgage.

If all else fails, you could try convincing your lender to lower your mortgage rate by offering to make a larger down payment or paying for mortgage points. One point can reduce your mortgage rate by up to 0.25%.