Where Do I Get A Mortgage

You can get a mortgage from a wide variety of lenders, including commercial banks, credit unions, and mortgage loan companies. Some homebuyers engage a mortgage broker, who doesnt lend you the money but instead finds the best lender for you. You may also want to speak to a real estate agent who may have lenders they can recommend. Regardless, make sure you compare the rates of several mortgage lenders before choosing one.

Other Types Of Mortgages

If you find yourself in a unique situation, one of the following mortgage types could be the best fit:

- Construction loan: You need money for building your own home, or for making significant renovations to the home you’re buying.

- Balloon mortgage: Make small monthly payments for a set number of years, then pay off the remaining principal in one lump sum. You might like a balloon mortgage if you want low monthly payments and are confident you’ll have the money for a balloon payment once the loan term is up.

- Interest-only mortgage: Only pay the interest charged on your mortgage for the first few years, then start making regular mortgage payments. As with a balloon mortgage, an interest-only mortgage could be a good option if you want low monthly payments and believe you’ll be able to afford higher payments down the road.

- Reverse mortgage: If you’re age 62 or older, you can receive the equity you’ve built in your home as cash â in a lump sum, in monthly installments, or as a line of credit.

Can You Buy Land With A Mortgage

No. You typically cannot buy land with a mortgage. Instead, you will need to apply for a land loan. Lenders often charge higher interest rates and require higher minimum down payments for land loans because they see these loans as more risky than mortgages. Land loans can have shorter terms than mortgages and can feature balloon payments. Lenders may have higher credit, income, and financial requirements for land loans too. Freedom Mortgage does not offer land loans.

Read Also: Can You Get A Mortgage With Fair Credit Score

Tip #1 Shop Interest Rates & Closing Costs

As for pricing, reverse mortgage lenders are more willing now than ever to help pay costs whenever they can on reverse mortgages. If there is an existing mortgage balance to payoff, there is often room in the value of the loan for the lender to make back money they spend on your behalf when they sell the loan.

Lender credits are allowed by HUD, so shop around and see what is available. Education is key. Knowing your goals will help you procure a loan that is best for you.

A very low margin will accrue the least amount of interest once you start using the line, but if you are looking for the greatest amount of line of credit growth, a higher margin grows at a higher rate.

Getting the least amount of fees on your loan will not help if you plan to be in your home for 20 years, because in that 20 years the interest will cost you tens of thousands of dollars more, thus ruining your goal to preserve equity.

Knowing what you want out of your reverse mortgage will help you choose the best option to meet your long and short term goals.

The Benefits Of An Escrow Account

The biggest benefit of having a Rocket Mortgage® escrow account is that youll be protected during a real estate transaction whether youre the buyer or the seller. It can also protect you as a homeowner, ensuring you have the money to pay for property taxes and homeowners insurance when the bills arrive. Youll find that there are a few other great benefits for home buyers, owners and lenders, too.

You May Like: How Much Do Mortgage Brokers Charge

Different Types Of Fixed

Conventional: The qualifying process is a bit tougherthan other types of loans. Such loans can be approved by banks and private lenders. The minimum credit score requirement is 620 & 43% DTI ratio.

FHA/VA/ USDA: All these fixed-rate mortgages are government-approved. FHA loans can be availed by US Citizens whereas VA loans are meant only for veterans and military servicemen. USDA loans are to facilitate rural borrowers.

Conforming: It is conformed by FHFA and comes with a certain loan limit. The borrower must meet the standards set by FHFA.

Non -Conforming: Such loans also include Jumbo loans and dont require to meet

FHFA standards. The interest and credit score requirement is comparatively higher.

Amortizing: Most the Fixed-rate Mortgages are amortizing loans. It means your monthly installment is subject to both principal and interest rate charges.

Non-amortizing: They are not widely available but offer great benefits in the initial phase such aslow monthly payments including the interest rate. But things can turn around after his introductory period gets over.

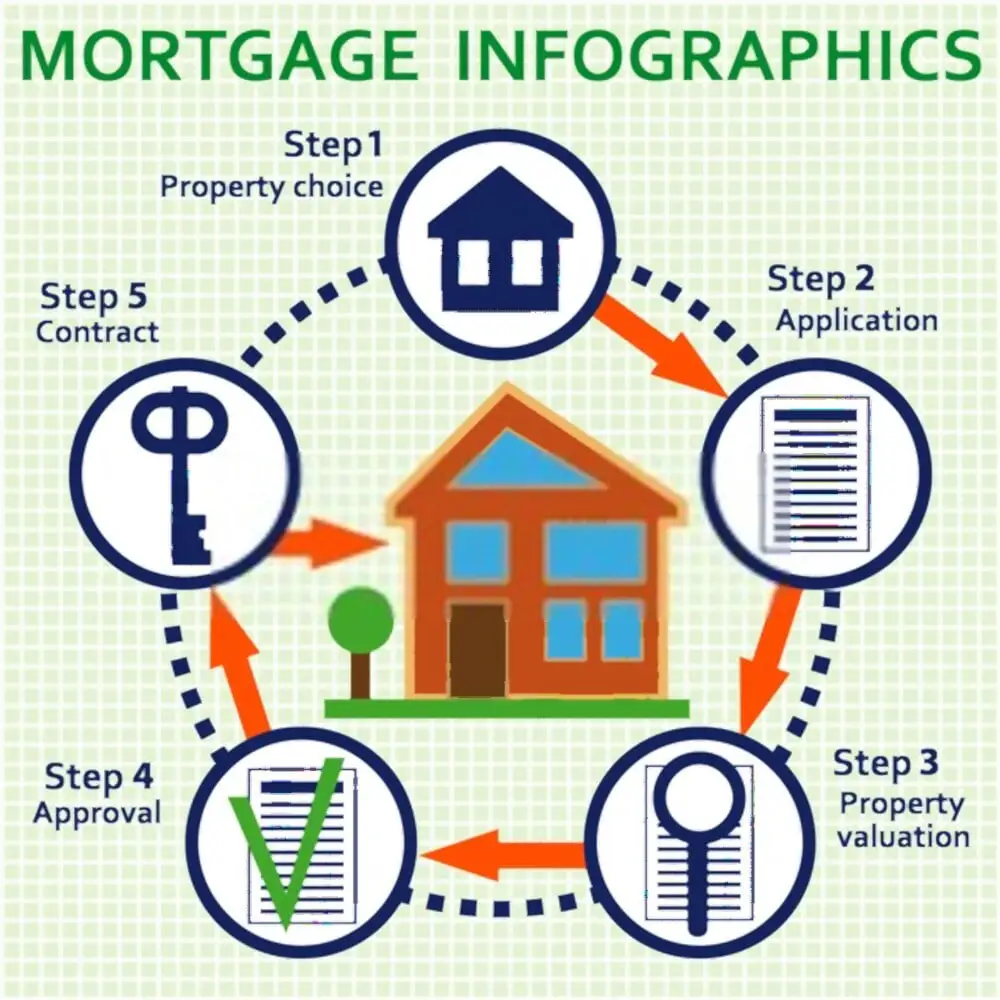

How Do I Get A Mortgage

You will need to:

-

Save a deposit if you are buying your first home. You could use the equity in your property towards the deposit if you own your current home.

-

Find the property you want to buy

-

Get a mortgage in principle, which will let you know approximately how much you could borrow

-

Put in an offer on the property

-

If your offer is accepted, take out the mortgage

Don’t Miss: How Can I Pay My Mortgage With A Credit Card

The Bottom Line: Theres A Lot To Learn When You Decide You Want To Own A Home

Becoming a homeowner isnt easy and its certainly not cheap but its worth the effort. Its important to take the time to familiarize yourself with what a mortgage is before you plunge into the market. Ready to take the first step in your home buying journey? Get started on your mortgage approval today! You can also give us a call at 326-6018.

Get approved to buy a home.

Rocket Mortgage® lets you get to house hunting sooner.

What Are Interest Only And Repayment Mortgages

Most mortgages are repayment mortgages. Your monthly payments will go towards both the interest charged on your mortgage and clearing the outstanding balance. By the end of the mortgage term, you will have paid off the full amount borrowed.

If you get an interest-only mortgage, your monthly repayments only cover the interest owed, so your balance will not go down. At the end of the term, you will need to pay off the full balance. This means you will need to have saved up this amount separately using a repayment vehicle like savings, shares, an ISA or other investment.

You May Like: Can I Get A Mortgage With A 730 Credit Score

Why Is The Percentage Different From The Apr

The annual percentage rate includes fees and points to arrive at an effective annual rate. Because different lenders charge different fees and structure loans differently, the APR is the best way to compare what each lender is offering. For example, Lender A may offer you an astounding 2.0 percent interest rate that sounds far better than Lender Bs 3.5 percent. But Lender A is including points and exorbitant fees. So the APR, or what youll really be paying could be higher for Lender A even though the interest rate is lower. APR helps you compare apples to apples.

How To Shop For A Mortgage

Shopping for a mortgage is not an easy task, and potential homebuyers should not take the process lightly. Instead, they should start well in advance of anticipating purchasing a home, and talk to several potential lenders before agreeing to work with one.

The first step involves doing research on potential financial institution partners. Getting referrals from friends and family, as well as doing independent research with independent resources, like the Better Business Bureau and the Consumer Financial Protection Bureau, can help shed light on how the lender works with homebuyers, experts say.

Taking on a mortgage is often the biggest financial decision that most people make in their lifetime, says Mabrey. As such, potential homeowners should spend as much time preparing for and understanding the mortgage process as they do on finding and selecting their desired home.

Just doing background research often isnt enough. Potential homeowners should also be prepared to evaluate their first impressions of connecting and working with a lender. Some of the most common red flags include not having enough experience to work with a buyers financial profile, not responding to communications in a timely manner, or being unable to provide interest rates in writing.

Stay in the know with our latest home stories, mortgage rates and refinance tips.

In your inbox every Thursday

- A valid email address is required.

- You must check the box to agree to the terms and conditions.

Recommended Reading: Is It Better To Get Mortgage From Credit Union

Where Can I Get A Mortgage

If youre prepared to make the jump into homeownership, youll likely need to get a mortgage. Take a look below at the various methods you can use to get a loan to buy your home:

Mortgage Bankers

Mortgage bankers are the primary route that most Americans will take when seeking out a mortgage. Theres a wide range of companies that fit under this heading, including banks, credit unions and online lenders, like Rocket Mortgage and SoFi.

These lenders can then be split into two subcategories: retail lenders and direct lenders. The only essential difference between them is that retail lenders offer financial products beyond just mortgages, while direct lenders specialize in mortgages. In other words, a retail lender might have deposit accounts, investing accounts and car loans, whereas a direct lender would not.

Portfolio Lenders

Contrary to the large-scale approach utilized by mortgage bankers, portfolio lenders lend their own money by their own rules. This could be beneficial, as these lenders arent bound by the same strict regulations and investor interests that mortgage bankers often are. If you need a jumbo loan, it might be easier to get one through a portfolio lender.

Hard Money Lenders

Wholesale Lenders

Correspondent Lenders

How Much Mortgage Can I Afford

The Balance has an online mortgage calculator to help you figure out how much home you can afford based on your income and your debt situation. Enter your information into the calculator, and you’ll get an idea of the monthly payment and total loan amount you can aim for. A mortgage professional can also help you determine how much you can afford as part of the preapproval process.

Read Also: How Much Is A 95000 Mortgage Per Month

How Does Net Metering Work

In states that offer net metering , you can sell your excess solar energy back to your utility company in exchange for credits that offset the cost of your energy usage. You may generate excess solar power when it is clear and sunny out, but see less energy than is necessary to power your home when it is cloudy or rainy. By selling your excess energy back to the utility grid, you’ll be able to use the credit to cover the cost for any electricity you need to use. You end up paying only for the “net” energy, or the difference between how much you sold and actually used.

Mortgage Insurance Protects The Lender Not You

Mortgage insurance, no matter what kind, protects the lender not you in the event that you fall behind on your payments. If you fall behind, your credit score may suffer and you can lose your home through foreclosure.

There are several different kinds of loans available to borrowers with low down payments. Depending on what kind of loan you get, youll pay for mortgage insurance in different ways:

Also Check: Why Do Mortgage Lenders Need Bank Statements

Breaking Down A Mortgage Payment

When you make your monthly mortgage payment, each one looks like a single payment made to a single recipient. But mortgage payments actually are broken into several different parts.

The two primary parts of every mortgage payment are principal and interest. How much of each payment is for principal or interest is based on a loans amortization. This is a calculation that is based on the amount you borrow, the term of your loan, the balance at the end of the loan and your interest rate.

Where Can You Find A Mortgage

Financial companies offer mortgages banks and building societies lend most UK mortgages.

There are two ways you can source your mortgage

Direct

You can get a mortgage directly from the lender use our comparison tables to find the right one for you.

Through a broker

Alternatively, you could find a mortgage and get advice from a mortgage broker or independent financial adviser. Some are whole-of-market, which means they can offer mortgages from every lender, and some offer exclusive deals.

Case Study – Kate’s Experience

makes finding a mortgage really easy – simple to search and sort, and very clear!

Kate Fletcher, from Trustpilot

Read Also: How Long Of A Mortgage Should I Get

When Should You Get A Mortgage

In so many words, the time to get a mortgage is when you’re buying a house but can’t afford to pay the entire price of the home in full and upfront. Think about it this way: If you’re looking to buy a house, you most likely won’t want to pay the full price of the home right then and there, and in cash.

The way to bypass that gigantic one-time transaction is by offering to pay a portion of the home’s value upfront this is called making a down payment while also taking out a loan from a bank to cover the rest of the home’s price. The money you’re borrowing from the bank will need to be repaid with interest and in exchange, you’ll get to occupy the home and renovate it as you wish.

Pay Attention To The Numbers

Because youre paying more up front, the reduced interest rate will only save you money over the long term. The longer you plan to own your new home, the better the chance that youll reach the break-even point where the interest you’ve saved compensates for your initial cash outlay. If you have a shorter-term plan, have limited cash, or would benefit more from a bigger down payment, paying points may not benefit you.

Your mortgage loan officer can help you decide whether paying points is an option for you.

Read Also: How Long Till I Can Refinance My Mortgage

Why You Can Trust Bankrate

Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. Weve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next.

Bankrate follows a strict editorial policy, so you can trust that were putting your interests first. All of our content is authored by highly qualified professionals and edited by subject matter experts, who ensure everything we publish is objective, accurate and trustworthy.

Our mortgage reporters and editors focus on the points consumers care about most the latest rates, the best lenders, navigating the homebuying process, refinancing your mortgage and more so you can feel confident when you make decisions as a homebuyer and a homeowner.

What Goes Into A Mortgage Payment

Your mortgage payment is the amount of money that you pay towards your mortgage each month. Mortgage payments are made up of four main costs referred to as PITI. Those costs are:

- Principal: This is the amount of money that is left on the balance of the loan. Your principal is factored into the monthly payments and is lowered over the course of the loan. You can make extra payments towards your principal which will help you to pay your mortgage off early and save you interest over time.

- Interest: The amount of interest that you will pay each month is determined by your interest rate and the principal amount.

- Taxes: No matter where you live, youll need to pay property taxes on your home. The amount youll pay is determined by several factors including your property’s assessed value and local tax rates.

- Insurance: There are two types of insurance that you will likely need to pay. The first is homeowners insurance which covers loss and damage to your property, as well as your assets inside the home. Mortgage insurance, on the other hand, is required for borrowers who make smaller down payments and is used to protect the lender. Depending on the loan you have, your mortgage insurance will either be Private Mortgage Insurance or Mortgage Insurance Premium . If you have a USDA loan, these have guarantee fees that function like mortgage insurance.

Both your taxes and insurance will be paid from your escrow account which is set up by your lender at the time of closing.

Also Check: Who Should I Get A Mortgage From

Get Your Finances In Order

Having a strong financial profile will increase your chances of being approved for a loan, and help you score a lower interest rate. Here are some steps you can take to beef up your finances:

- Figure out how much home you can afford. The general rule of thumb is that your monthly home expenses should be 28% or less of your gross monthly income.

- Find out what credit score you need. Each type of mortgage requires a different credit score. Requirements can vary by lender, but you’ll probably need a score of at least 620 for a conventional mortgage. You can increase your score by making payments on time, paying down debt, and letting your credit age.

- Save for a down payment. Depending on which type of mortgage you get, you may need as much as 20% for a down payment. Putting down even more could land you a better interest rate.

- Check your debt-to-income ratio. Your DTI ratio is the amount you pay toward debts each month, divided by your gross monthly income. Many lenders want to see a DTI ratio of 36% or less, but it depends on which type of mortgage you get. To lower your ratio, pay down debt or consider ways to increase your income.