What Are Hoa Fees

Homeowners association fees are common when you buy a condominium or a home thats part of a planned community. Generally, HOA fees are charged monthly or yearly. The fees cover common charges, such as community space upkeep and building maintenance. When youre looking at properties, HOA fees are usually disclosed upfront, so you can see how much the current owners pay per month or per year. HOA fees are an additional ongoing fee to contend with, they dont cover property taxes or homeowners insurance in most cases.

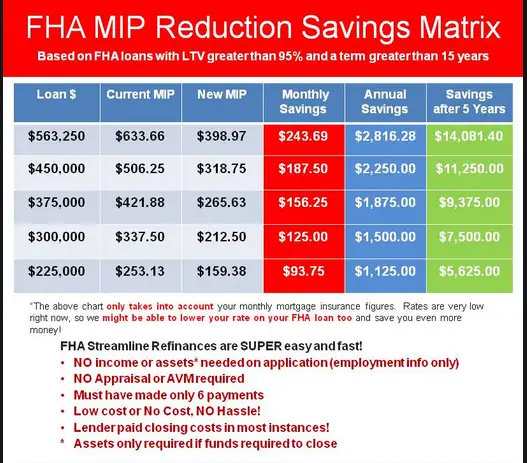

How Much Difference Does $1000 Make

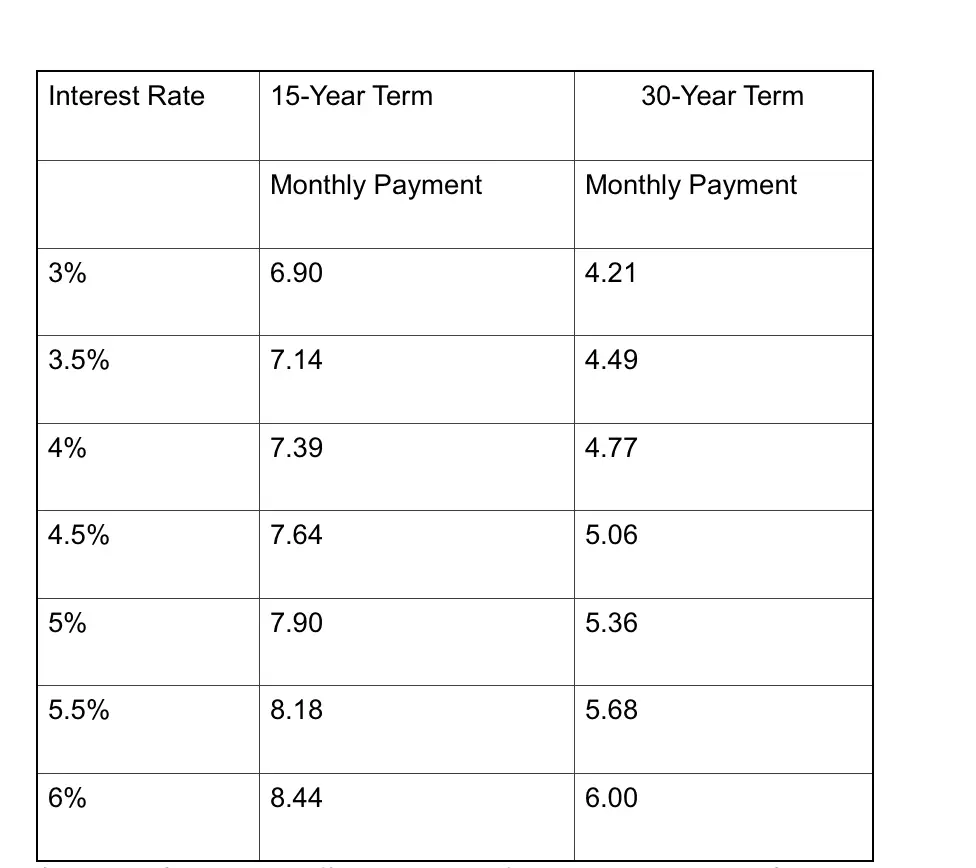

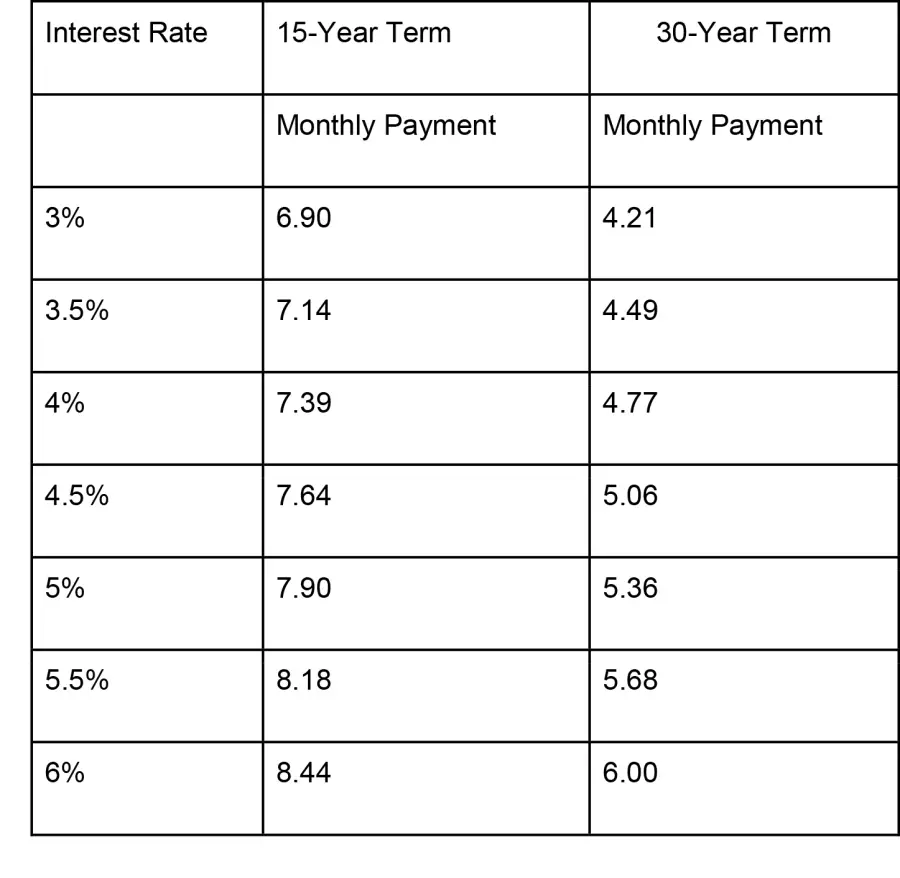

This is a quickie, but a very important question that comes up quite often: How much does a $1000 increase in the loan amount change the monthly payment on a mortgage? Not that much, actually.

Why is this question important in the first place? Buyers and realtors often negotiate contracts in the evenings and the weekends, or at times when the loan officer may not be available, and many buyers panic when they hear the seller countered their offer by a thousand or two thousand dollars thinking this will astronomically affect their payment. Also, many buyers are under the false impression that adding a few thousand dollars to their down payment will have a substantial effect on their monthly payment.

The truth is usually pretty shocking to most people. In every case, the difference in monthly payment is under $10 per month .

The amount of the payment difference per $1000 depends on two main factors: The interest rate and especially the LOAN TERM.

Here are some examples:

On a 30 YEAR LOAN at 5% INTEREST, a $1000 increase in the loan amount will only increase the payment by $5.37 per month. Not that much at all.

On a 30 YEAR LOAN at 6% INTEREST, a $1000 increase in the loan amount only adds $6.00 to the monthly payment.

On a 15 YEAR LOAN at 5% INTEREST, a $1000 increase only adds $7.91 to the monthly payment. And at 6% INTEREST, it adds $8.44 per month.

And likewise, lowering the loan amount by $1000 will result in a savings equal to these amounts as well.

How Much A $1000000 Mortgage Will Cost You

A 30-year, $1,000,000 mortgage with a 4% interest rate costs about $4,774 per month and you could end up paying over $700,000 in interest over the life of the loan.

Edited byChris JenningsUpdated January 5, 2022

Our goal is to give you the tools and confidence you need to improve your finances. Although we receive compensation from our partner lenders, whom we will always identify, all opinions are our own. Credible Operations, Inc. NMLS # 1681276, is referred to here as Credible.

A $1,000,000 mortgage could be your ticket to a Midwestern mansion or a Bay Area bungalow. Whatever type of home youre after, a substantial income and top-notch credit can help you get the jumbo mortgage you need.

In addition to your down payment, youll need money to cover the loan origination fee, home appraisal, and other closing costs. But here, well focus on the monthly payment you can expect under different scenarios as well as how much a $1,000,000 mortgage might cost in the long run.

If youre applying for a $1,00,000 mortgage, heres how much that loan should cost you each month with interest:

Don’t Miss: How Do I Figure My Mortgage Payment

How To Use Our Mortgage Payment Calculator

The first step to determining what youll pay each month is providing background information about your prospective home and mortgage. There are three fields to fill in: home price, down payment and mortgage interest rate. In the dropdown box, choose your loan term. Dont worry if you dont have exact numbers to work with – use your best guess. The numbers can always be adjusted later.

For a more detailed monthly payment calculation, click the dropdown for Taxes, Insurance & HOA Fees. Here, you can fill out the home location, annual property taxes, annual homeowners insurance and monthly HOA or condo fees, if applicable.

How To Calculate Your Mortgage Payment

- M = the total monthly mortgage payment.

- P = the principal loan amount.

- r = the monthly interest rate. This is the annual rate that your lender provides divided by 12 months.

- n = the number of monthly loan payments. This is the number of years of your loan multiplied by 12.

To see this formula in practice, let’s say you’re purchasing a $200,000 home with a 30-year loan and putting down 20 percent. The lender offers an interest rate of 4 percent. To calculate “P,” you would first subtract 20 percent from the $200,000 home price to get a total amount borrowed of $160,000. Then, to calculate your monthly interest rate, or “r,” you would divide the annual interest rate by 12. In this scenario, the monthly interest rate would be .0033 percent. Finally, to get “n,” you would multiply your loan term by 12 to get the total number of months for your mortgage, which in this case would be 360. Your monthly principal and interest payments would be around $763. Homeowners insurance and property taxes are not included.

Don’t Miss: How Much Down Payment For Mortgage

How Do Property Taxes Work

When you own property, youre subject to taxes levied by the county and district. You can input your zip code or town name using our property tax calculator to see the average effective tax rate in your area.

Property taxes vary widely from state to state and even county to county. For example, New Jersey has the highest average effective property tax rate in the country at 2.42%. Owning property in Wyoming, however, will only put you back roughly 0.57% in property taxes, one of the lowest average effective tax rates in the country.

While it depends on your state, county and municipality, in general, property taxes are calculated as a percentage of your homes value and billed to you once a year. In some areas, your home is reassessed each year, while in others it can be as long as every five years. These taxes generally pay for services such as road repairs and maintenance, school district budgets and county general services.

Also Check: When To Refinance Your Mortgage Dave Ramsey

How Does A Mortgage Work

A mortgage is a secured loan that is collateralized by the home it is financing. This means that the lender will have a lien on your home until the mortgage is paid in full. After closing, youll make monthly paymentswhich covers principal, interest, taxes and insurance. If you default on the mortgage, the bank will have the ability to foreclose on the property.

Don’t Miss: What Is A Satisfaction Of Mortgage

Calculate By Using $1000

Visit the National Association of Realtors at Realtor.com for an online calculator that lets you enter $1,000 as the loan amount. Hover over “Mortgage” on the top bar and select “Home Finance.” On the “Home Finance” page, click “Mortgage Calculator” under “Tools and Calculators.”

Enter 1,000 in the “Loan Amount” space, since you are calculating the interest for every $1,000. Select the interest rate and the length of the mortgage in years.

What Is Principal And Interest

The principal is the loan amount that you borrowed and the interest is the additional money that you owe to the lender that accrues over time and is a percentage of your initial loan. Fixed-rate mortgages will have the same total principal and interest amount each month, but the actual numbers for each change as you pay off the loan. This is known as amortization. You start by paying a higher percentage of interest than principal. Gradually, youll pay more and more principal and less interest. See the table below for an example of amortization on a $200,000 mortgage.

You May Like: What’s The Mortgage Interest Rate Now

When To Buy Mortgage Points

Buying mortgage points might make sense if any of the following situations apply to you:

- You want to stay in your home for a long time. The longer you stay in your home, the more it makes sense to invest in points and a lower mortgage rate. If youre sure youll have the same mortgage for the long haul, mortgage points can lessen the overall cost of the loan. The longer you stick with the same loan, the more money youll save with discount points.

- Youve determined when the breakeven point is. Do some math to figure out when the upfront cost of the points will be eclipsed by the lower mortgage payments. If the timing is right and you know you wont move or refinance before you hit the breakeven point, you should consider buying points.

How To Calculate Your Breakeven Point

Lets run through a quick example using the numbers referenced earlier.

If you have a $200,000 loan amount, going from a 5.125% interest rate to a 4.75% interest rate saves you $46 per month. As mentioned earlier, the cost of 1.75 points on a mortgage with a $200,000 loan amount is $3,500. If you divide the upfront cost of the points by your monthly savings, youll find that your breakeven point is about 76 months , which is equal to roughly 6 years and 3 months. So, if you plan to stay in your house for longer than that amount of time and pay off your loan according to the original schedule, it makes sense to buy the points because youll save money in the long run.

How To Get Your Finances Ready To Buy A House

Take stock of your finances to see if youre ready to apply for a mortgage. Make sure that you can provide evidence of at least two years worth of regular income, and figure out your total assets, debt and monthly expenses.

Check your credit reports. If you want to apply for new credit cards or other loans, keep in mind that these applications may add inquiries to your credit history and could lower your scores. Plan to apply for other types of credit well in advance of applying for a mortgage or wait until after youve closed on your home loan.Home affordability calculator

Ask lenders what information they need from you to issue a mortgage preapproval letter, and confirm that you have the documents on hand.

Read Also: How To Invest In Mortgages

Increase Your Credit Score

The higher your credit score, the greater your chances are of getting a lower interest rate. To increase your credit score, pay your bills on time, pay off your debt and keep your overall balance low on each of your credit accounts. Don’t close unused accounts as this can negatively impact your credit score.

How Much House Can You Afford

Before doing business with you, lenders also consider your other monthly debt obligations along with your projected housing expenses. For example, if your monthly expenses include $300 for a car loan, $75 in student loan payments and $125 in credit card bills, you would add these to your $2,000 housing expenses for a total of $2,500. Divide that figure by your $7,000 gross income to arrive at a 35.7 percent ratio. Lenders prefer this so-called “back-end” debt-to-income ratio to be 36 percent or less.

Generally, the smaller your monthly mortgage expense relative to your income, the easier it will be for you to keep up with your payments.

Also Check: Can You Buy A House With A Reverse Mortgage

What Controls A Variable Interest Rate

Variable interest rates change based on your lendersprime rate, which is controlled by your lender. If your lender increases their prime rate, then your variable interest rate will increase.

Lenders will usually only change prime rates to match movements in theBank of Canadas policy interest rate. If the lenders funding cost increases, such as through the Bank of Canada increasing their policy rate, then the lender will in turn increase variable mortgage rates. Prime rates are generally similar or identical between different lenders, with all Canadian banks currently having a prime rate of 2.45% as of July 2021.

Yourvariable mortgage rateis priced at a discount or a premium to your lenders prime rate.

Recommended Reading: Rocket Mortgage Loan Types

Get The Best Interest Rate You Can And Pick Your Mortgage Term

Dont start worrying about exact interest rates until you find a place you love, advises Davis. Then start speed dating mortgage lenders to get at least three different quotes. Each quote will likely include different closing costs as well.

Some will pad the interest rate to give you no closing costs, said Davis. Some people will pad the closing cost to give you a lower interest rate. Not all quotes will look the same, so the more your shop around, the more likely you are to find a lender that fits your needs.

Dont be afraid to source quotes from a variety of different sized lenders as well, says Watson who notes:

Sometimes the local bank in your area will have special discounts for first-time homebuyers or young families moving into certain neighborhoods.

Typically, a larger down payment will lead to a lower interest rate, since your loan is smaller and less of a risk to take on. The bigger your down payment, the less youll borrow overall, meaning youll save money in the long term. For a closer look at how your down payment influences interest rate, check out the Consumer Financial Protection Bureaus interest rate calculator.

Your credit or FICO, score, on the other hand, can have a much larger impact on your interest rate. Heres how much youd pay in interest on a median-priced home based on your credit score:*

| FICO Score |

- Mean less wiggle room for savings, emergencies, or job instability.

30-year mortgages:

You May Like: Which Type Of Loan Is Best For Mortgage

What Are Mortgage Points And How Much Do They Cost

A mortgage point sometimes called a discount point is a fee you pay to lower your interest rate on your home purchase or refinance.

One discount point costs 1% of your home loan amount. For example, if you take out a mortgage for $100,000, one point will cost you $1,000. Purchasing a point means youre prepaying the interest to have a smaller monthly payment.

Points are paid at closing, so your lender will calculate the cost of any points you agree to purchase and add those charges to your other closing costs.

For each discount point you buy, your interest rate will be reduced by a set percentage point. The per-point discount youll receive varies by lender, but you can generally expect to get a .25% interest rate reduction for each point you buy. Most mortgage lenders cap the number of points you can buy. Generally, points can be purchased in increments down to eighths of a percent, or 0.125%.

For example, lets say you take out a $200,000 30-year fixed-rate mortgage at 5.125%. Your lender offers you an interest rate of 4.75% if you purchase 1.75 mortgage points. On a $200,000 loan, each point costs $2,000, which means that 1.75 points will cost $3,500.

If you choose not to buy mortgage points, your interest rate will remain at 5.125%. Over 30 years, without paying down the loan early, the cost of the loan, with interest, is $391,809.

What Percentage Of Your Income Should Go Towards Your Mortgage

Your salary makes up a big part in determining how much house you can afford. On one hand, you may want to see how much you could afford with your current salary. Or, you may want to figure out how much income you need to afford the house you really want. Either way, this guide will help you determine how much of your income you should put toward your mortgage payments every month.

Also Check: How To Figure Out How Much A Mortgage Would Be

How To Calculate Extra Mortgage Payments

Using our Mortgage Payment Calculator, you can crunch the numbers and discover how much you could save in interest, or how much you would need to pay each month to pay your loan off sooner.

For example, according to the calculator, if you have a 30-year loan amount of $300,000 at a 4.125% interest rate, with a standard payment of $1,454, if you increase your monthly payment to $1,609, you could pay your loan off five years and one month earlier while saving $43,174 during the loan’s lifetime.

Conforming Loans Vs Non

Conforming loanshave maximum loan amounts that are set by the government and conform to other rules set by Fannie Mae or Freddie Mac, the companies that provide backing for conforming loans. A non-conforming loan is less standardized with eligibility and pricing varying widely by lender. Non-conforming loans are not limited to the size limit of conforming loans, like a jumbo loan, or the guidelines like government-backed loans, although lenders will have their own criteria.

Don’t Miss: How Can You Pay Your Mortgage With A Credit Card

What Are My Monthly Payments

Use the Mortgage Calculator to get an idea of what your monthly payments could be. This calculator can help you estimate monthly payments with different loan types and terms. You may be able to afford more depending on factors including your down payment and/or the purchase price. The calculator will estimate your monthly principal and interest payment, which represents only a part of your total monthly home expenses. Additional monthly costs may include: real estate taxes, insurance, condo or homeowners association fees and dues, plus home maintenance services and utility bills.

Recommended Savings

Add All Fixed Costs and Variables to Get Your Monthly Amount

Calculator Disclaimer

How To Choose A Mortgage Lender

You have many options when it comes to choosing a mortgage lender. Banks, credit unions and online lenders all offer mortgages directly, while mortgage brokers and online search tools help you compare options from different lenders.

Its important to make sure you feel comfortable with the broker or company youre working with because youll need to communicate with them frequently during the application processand in some cases, after the loan closes.

You may want to start with the banks or other institutions where you already have accounts, if you like their service. Also, ask your network of friends and family, and any real estate professionals youre working with, for referrals.

Also Check: How To Cut A 15 Year Mortgage In Half