What Are The Largest Three Credit Bureaus

The three major credit bureaus are Experian, Equifax, and TransUnion. These bureaus collect and maintain consumer credit information and then resell it to other businesses in the form of a credit report. While the credit bureaus operate outside of the federal government, the Fair Credit Reporting Act allows the government to oversee and regulate the industry.

Its worth noting that not all lenders report to the credit bureaus. You may have seen advertisements for loans with no credit check. Because these loans are riskier for the lender, they can justify high-interest rates and faster repayment schedules. Consumers should beware of predatory lenders, especially risky payday loans and other fast-cash loans.

Minimum Credit Scores By Mortgageprogram

The credit score needed to buy ahouse depends on the type of loan you apply for.

Minimum credit requirements forthe five major loan options range from 580 to 680.

- Conventional loan : 620 minimum FICO score

- FHA loan: 580 minimum FICO score

- VA loan: 620 minimum score is typical

- USDA rural housing loan: 640 minimum FICO score

- Jumbo loan : 680 minimum FICO score

Note that FHA loansactually allow credit scores as low as 500. But if your score is below 580, youneed a 10% down payment to qualify. Borrowers with credit scores above 580 onlyneed 3.5% down for an FHA mortgage.

Other requirements to buy a house

Theres more to know than just credit minimums, of course .

In addition to credit scores, lenders evaluate borrowers based on:

- Down payment: Most loan programs require at least 3% down

- Income and employment history: Most lender want to see at least 2 years of steady income and employment

- Savings: Youll need cash to cover the down payment, closing costs, and often cash reserves

- Existing debts: Your debt-to-income ratio compares pre-existing debts like student loans, auto loans, and credit card minimum payments against your monthly gross income. The lower your DTI, the better

- Loan amount: If you have lower credit, your loan amount will likely need to be within FHA loan limits or conforming loan limits

If your credit scoreis weak but you have stable income, a large amount ofsavings, and a manageable debtload, youre more likely to get mortgage-approved.

Is Experian Higher Than Equifax

The main difference is Experian grades it between 0 1000, while Equifax grades the score between 0 1200. This means that there is not only a clear 200 point difference between these two bureaus but the perfect scores are also different, which is 1000 as reported by Experian and 1200 as reported by Equifax.

Read Also: Is 3.99 A Good Mortgage Rate

When Does Discover Report To Credit Bureaus

Like most large financial institutions, Discover seems to report to all three major credit bureaus approximately once per month. This reporting typically occurs around or just after the same time a cardmemberâs monthly billing statement is issued. In some cases, changes to your credit report will appear immediately. In others, changes may take more than a month to appear on a report.

Can I Get A Car Loan With A 600 Credit Rating

A $ 600 loan will not stop you from taking out a car loan, but it can make that debt even more expensive. Read also : What are the cons of a VA loan?. Taking steps to improve your score before applying for a car loan can put you in the drivers seat and make it easier to negotiate better credit.

What is the lowest credit score to buy a car?

In general, you will need at least credit, meaning credit score of 661 or higher, to get a loan at a good price. If you have low debt, you can get a loan, but you may have to pay more on it or get a cosigner.

Can you get approved for a car with 600 credit score?

Unless you have money, it means you need a car loan. It is important that you be aware of how your car loan policy will be different from someone with a high score. You may not have the same options, but you can get a car loan with six hundred loans.

Read Also: What Mortgage Companies Use Experian

What Credit Bureau Does Rocket Mortgage Use

By David KrugDavid Krug is the CEO & President of Bankovia. He’s a lifelong expat who has lived in the Philippines, Mexico, Thailand, and Colombia. When he’s not reading about cryptocurrencies, he’s researching the latest personal finance software.6 minute read

Ready to get the latest from Bankovia? Sign up for our newsletter.

Using Rocket Mortgage, you can apply for a home loan from the comfort of your own home and get pre-approved in just a few minutes. Getting a loan and understanding the mortgage application procedure is essential before purchasing a new house. Despite the fact that some loan companies have great reputations and a variety of lending possibilities, not all of them are made equal.

Rocket Mortgage is one of the top mortgage lenders accessible, offering a smooth home financing experience to both first-time and seasoned buyers.

To better understand how Rocket Mortgage works, what sorts of loan packages are available from them, and how they vary from other mortgage lenders, keep reading our Rocket Mortgage review. This will assist you in making an informed choice about whether a Rocket Mortgage loan is the best option for your situation.

Interest Paid By Fico Score

| FICO Score |

Based on the in August 2021

If your credit score is on the lower end, even a small difference in your mortgage score can make a big difference in the cost of your home loan. You could wind up paying more than 20% more each month, which can make it harder to afford a mortgage.

Don’t Miss: Do Mortgage Lenders Work On Saturdays

Can I Get A Va Loan With A 620 Credit Score

Personal Loan Requirements Generally speaking, lenders will need a minimum credit score of 580 to 620 in order to qualify for a VA loan. Fortunately, though, alternatives are available. If the borrower has a sufficient balance, some lenders even allow VA loans with loans as low as 500.

How hard is it to get a home loan with a 620 credit score?

Generally speaking, you will need a mortgage of up to $ 620 to secure a mortgage loan. It is part of the credit system required by most lenders for a standard loan. With that said, it is still possible to get credit with low credit scores, including scores in the 500s.

What kind of loan can you get with a credit score of 620?

The types of programs available to creditors with 620 credit points are: standard loans, FHA loans, VA loans, USDA loans, jumbo loans, and non-premium loans.

What Would A Fico Score Of 810 Be Considered

Your 810 FICO® Score falls in the range of scores, from 800 to 850, that is categorized as Exceptional. Your FICO® Score is well above the average credit score, and you are likely to receive easy approvals when applying for new credit. 21% of all consumers have FICO® Scores in the Exceptional range.

Don’t Miss: How A Reverse Mortgage Works After Death

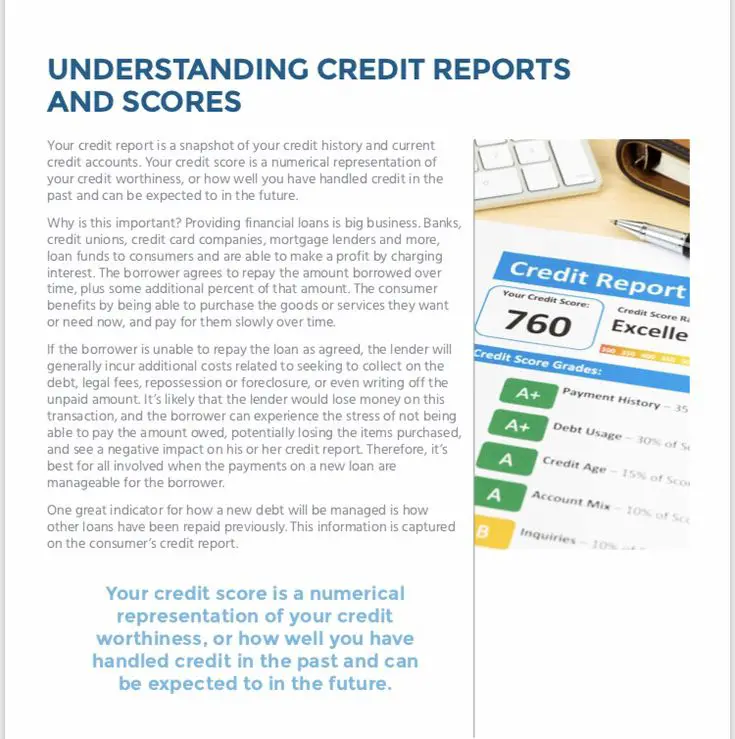

What Factors Go Into A Credit Score

Its important to know your credit score and understand what affects it before you begin the mortgage process. Once you understand this information, you can begin to positively impact your credit score or maintain it so you can give yourself the best chance of qualifying for a mortgage.

While exact scoring models may vary by lender, some variation of the standard FICO® Score is often used as a base. FICO® takes different variables on your credit reports, such as those listed below, from the three major credit bureaus to compile your score. FICO® Scores range from 300 850.

From this information, they compile a score based on the following factors:

- Payment history

What Credit Score Is Needed For A $5000 Loan

What is the required portion of debt required for a $ 5,000 loan? To get your $ 5,000 credit, you must have a FICO 600 or higher.

What credit score do I need for a $8000 loan?

Most lenders need a credit score of 580 or more to be able to access $ 8,000 in personal debt. If you are concerned about qualifying for your loan, you can add a cosigner to increase your chance of approval.

What credit score do I need for a $4000 loan?

Whether you have good credit or bad credit, you may be eligible for $ 4,000 of your credit. To increase your chances of being approved you must have a credit score of 580 or more. If you have low credit scores you should consider adding a cosigner to your application or applying for your secure credit.

Recommended Reading: A Better Mortgage Company Reviews

What Else Do The Lenders Look At

When you apply for a home loan, lenders look at a lot of factors other than your credit history.

One of the most obvious things that lenders look at is your income. If you apply for a $1 million mortgage loan but only make $30,000 a year, the lender is going to know that you have no way to pay the loan back, even if you have perfect credit.

Conversely, someone with a high income may have a better chance of making payments on a $1 million loan, but if they have poor credit it will hurt their chances of qualifying for a loan.

Lenders also look at your debt-to-income ratio, which measures the amount of money you make compared to your monthly bill payments. The lower this ratio, the more money you have available to take on payments for new credit accounts.

If your debt-to-income ratio is too high, it means you dont have extra room in your budget to handle a new loan payment.

Does Wells Fargo Use Fico 9 For Mortgage

While Wells Fargo uses the FICO® Score 9 for some credit decisions, there are many different credit scores available to consumers and lenders. FICO® Scores are credit scores used by most lenders, but different lenders may use different versions of the FICO® Score.

Why do mortgage lenders use FICO 9? The versions of the FICO® Score that are used on mortgage loans and the more recently released versions, such as the FICO® Score 9 and 10, have the same range of 300 to 850. VantageScore, a rival manufacturer of credit scores, also uses that range for its latest VantageScore 3.0 and 4.0 credit score models. Pay down credit card balances.

You May Like: Where Do You Get A Mortgage

Which Fico Score Do Mortgage Lenders Use 2022

Image credit: mortgageinfoguide.com

For an FHA loan, the FICO score is usually between 580 and 553. This program allows you to purchase a house with a down payment of only 3.5%. Even lenders in the FHA program will accept credit scores of 500 or higher, though you will need to pay a 10% down payment if your score falls within that range.

Most mortgage lenders use the FICO Credit Scores 2, 4, and 5 as the standard of reference when determining whether an applicant can afford a home. Each of the 16 FICO Scores has a different version. A variety of models assist lenders in determining credit risk for a variety of types of debt. Other scoring models, such as the VantageScore, are sometimes used by lenders that do not provide the service provided by FICO. Other scoring models may also be used by lenders depending on the type of loan you are applying for. Your credit score is an important factor in determining the interest rate of your loan. A mortgages annual percentage rate , which is calculated as the cost of interest and fees over the life of the loan, is typically determined by the cost of interest and fees.

How Does Credit Score Determine Loan Type

Conventional loans require that you have a higher credit score, while Federal Housing Administration loans are a bit more forgiving when it comes to your score.

With an excellent credit score, you can expect to pay less for your loan because your interest rate will be lower.

Not only will a poor score affect your ability to get a loan, but if you do qualify for one, you could be paying thousands of dollars extra over the life of your loan due to a higher interest rate.

Don’t Miss: What Score Do Mortgage Lenders Use

Mortgage Credit Score Vs Consumer Credit Score

If youve ever applied for a mortgage only to find out that the credit score the lender sees is much different than what youve found pulling your credit scores from Experian or your credit card services, you arent alone.

Mortgage lenders use a different credit scoring model than consumers have access to, which means they may see a different credit score than what you expect.

Heres how they differ.

What Credit Score Do I Need To Get A Mortgage

There isnt a minimum credit score you need to get a mortgage. Because there isnt a universally recognised credit score, there isnt a universally recognised credit score that you need to have to be accepted for a mortgage.

There are a few different credit referencing agencies in the UK who can give you a credit score. Because of this, you could have a different score depending on which credit reference agency you have an account with. That means there isnt a particular credit score you need to get a mortgage.

In this Guide, youll find all the information you need for understanding what kind of credit score you might need to get a mortgage, plus links to lots of other helpful guides to how your credit affects your mortgage application.

In this Guide, youll find:

You May Like: How Does The 10 Year Treasury Affect Mortgage Rates

Also Check: What Is A Mortgage Holder

Which Fico Score Do Mortgage Lenders Use

If you are using a free credit monitoring service and think you know what your credit score is, you might be surprised when you apply for a loan and your mortgage lender comes back with a different set of credit scores.

This can happen because there are actually many different credit scoring models used by lenders. In fact, there are 16 different FICO Scores with dozens of variations of each score.

Each credit scoring model interprets the information in your credit profile differently, aiming to give lenders the information they need to approve your home loan application. Most mortgage lenders use the FICO Credit Scores 2, 4, or 5 when assessing applicants.

Mortgage lenders who offer conventional mortgages are required to use a FICO Score when they underwrite your loan application for approval. The specific scores used by each bureau are as follows:

- Experian:FICO® Score 2, or Experian/Fair Isaac Risk Model v2

- TransUnion:FICO® Score 4, or TransUnion FICO® Risk Score 04

- Equifax:FICO® Score 5, or Equifax Beacon 5

Each of these credit scoring models comes from FICO, the company that over 90% of lenders use. Its important to know which model your lender will use because you might be applying for a loan that has a minimum credit score requirement, like an FHA loan or VA loan.

When Does Citi Report To Credit Bureaus

Citi reports to all major credit reporting bureaus. Credit card issuers usually report to agencies at the same time your monthly billing statement is issued or soon after. In some cases, changes may be reflected right away in your credit report but in others, it may take more than a month to update.

Recommended Reading: What Does It Mean To Take Out A Mortgage

Want A Mortgage The Credit Score Used By Mortgage Companies Will Surprise You

Shutterstock

If you are applying for a mortgage, your credit score will be a critical part of the process. You could get rejected with a credit score that is too low. And once approved, your score will determine the interest rate charged. Someone with a 620 might have to pay an interest rate that is as much as 3% higher than someone with a 740. But what credit scores do mortgage lenders actually use? The answer might surprise you.

Much Older Versions Of FICO

Fannie Mae and Freddie Mac are government-agencies that purchase the majority of mortgages originated in the country. These agencies set the rules and underwriting criteria for the loans that they purchase, including what credit scores should be used. Surprisingly, the agencies require much older versions of the FICO credit score. According to a review of the agency Selling Guides by MagnifyMoney, these are the scores that matter:

- From the Equifax credit bureau: FICO Version 5

- From the Experian credit bureau: FICO Version 2

- From the TransUnion credit bureau: FICO Version 4

Even though FICO has just recently introduced Version 9 of its score, most mortgage lenders will still be using a much older credit score.

Watch on Forbes:

Which Older Version Of FICO Will Be Used?

How Do I Get A Good Credit Score ?

What If My Mortgage Is Not Purchased By Fannie Mae or Freddie Mac

What Credit Bureau Does Each Bank Check In Canada

by DCTAon December 2, 2016

Whenever you apply for a credit product in Canada, the lender will check your credit history from one or both of the two credit bureaus in Canada: TransUnion or Equifax. Since each credit check negatively impacts your credit history, its important to know which lender pulls what, helping you stack your credit churning appropriately and limiting the damage to any particular credit bureau.

An X indicates the bureau used by the creditor. TransUnion is indicated in green, while Equifax is indicated in red. Most creditors only pull one bureau, with the exception of Capital One, who pulls both. A blue tab with a number indicates that the creditor may also pull from that bureau. An explanatory note for any blue and numbered entry is provided after the table.

If you have a different experience than listed, please comment, and Ill update the table accordingly.

Also Check: 70000 Mortgage Over 30 Years

Also Check: What Is Mortgage Jumbo Loan