How To Get A Mortgage Pre

You can get a mortgage pre-approval from amortgage brokeror directly from most lenders. You will likely have to provide detailed information about your financial situation and verify your income. Documents needed could include bank statements, a verification of employment, your credit report, and your previous tax assessment. Think of it like applying for a mortgage – in order for your lender to give you an accurate estimate, they will need to know whether you can handle the expenses of a mortgage.

Stated Income Or Stated Asset Mortgage

This type of mortgage is based on the income that you report to the lender without formal verification. Stated income loans are sometimes also called low-documentation loans because lenders will verify the sources of your income rather than the actual amount.

Self-employed people should be prepared to provide a list of their recent clients and any other sources of cash flow, such as income-producing investments. The bank may also want a copy of Internal Revenue Service Form 4506 or 8821.

Form 4506 is used to request a copy of your tax return directly from the IRS, thus preventing you from submitting falsified returns to the lender. It costs $43 per return, but you may be able to request Form 4506-T for free. Form 8821 authorizes your lender to go to an IRS office and examine the forms you designate for the years you specify, free of charge.

Everything That A Homebuyer Needs To Get Pre

Bottom Line PersonalConsumer ReportsPrevention

As you search for a home, getting pre-approved for a mortgage can be an important step to take. Consulting with a lender and obtaining a pre-approval letter provides you with the opportunity to discuss loan options and budgeting with the lender this step can serve to clarify your total house-hunting budget and the monthly mortgage payment that you can afford.

As a borrower, its important to know what a mortgage pre-approval does and how to boost your chances of getting one.

Also Check: How Much Of My Mortgage Payment Is Interest

Why Lenders Care About Inquiries

You might wonder what the big deal is to lenders and/or credit bureaus. Why do they care that you have inquires on your credit report? To them it means a potential new loan. If you have multiple new inquiries and they are not all from mortgage lenders, it could be a red flag.

Lets say you suddenly have inquiries for several installment loans and credit cards. A lender may wonder what is going on in your financial life. Are you in some type of crisis and are frantically trying to find money? If so, they will not want to fund a new mortgage in your name. They will need to know beyond a reasonable doubt that you do not have any new loans outstanding.

Oftentimes it can take a few months for loans to start showing up on your credit report. This is why lenders pay such close attention to your inquiries. If they see that there could be new potential loans out there, they may not want to lend to you.

Whats The Difference Between A Hard And A Soft Inquiry

You may have heard a credit check described as a hard or soft inquiry. Both are referring to the act of pulling your credit report to assess your financial behavior. However, there are significant differences between the two.

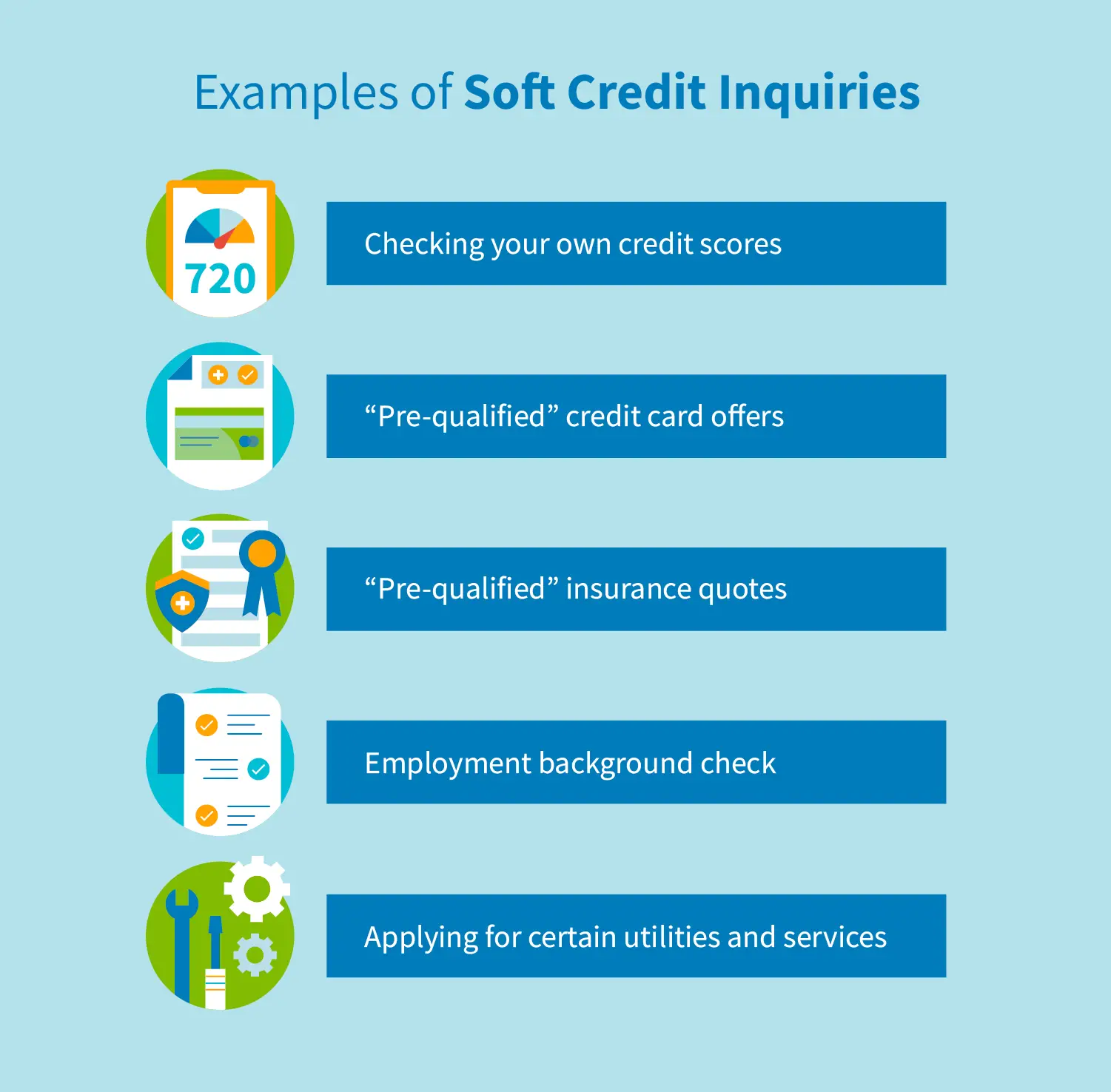

- Soft inquiry on your credit report

When you or someone else checks your credit report but doesnt submit a new application for credit, its considered a soft inquiry or soft pull. Examples include employers checking on potential new hires or credit card companies looking for pre-qualified customers. According to the credit reporting company Experian, these types of inquiries wont affect your credit score.

- Hard inquiry on your credit report

When you actively apply for a new line of credit, such as a credit card or an auto loan, the lender requests your credit report. Your credit score and the financial information on your credit report determine if youll be approved by the lender, as well as the terms of your loan. This credit pull is considered a hard inquiry or hard pull. Unlike soft inquiries, hard inquiries can negatively impact your credit score. But the impact is typically small, and credit scores tend to rebound within a few months if no new negative information gets added to your credit report, according to Experian.

Read Also: How To Buy A Reverse Mortgage Foreclosure

Does Home Loan Pre

When youâre on the hunt for a home, it can feel overwhelming â there are plenty of properties to consider and home loan options to weigh up. This is where home loan pre-approval can come in handy.

But, does getting pre-approved by lenders damage your credit score? In this article, we explain what pre-approval is and how it works, as well as its benefits and how it affects your credit score.

Why You Should Get Pre

Its always a good idea to get pre-approved before shopping for a home. Thats because the pre-approval process helps you:

- Set a budget: Youll be able to establish your price range and shop for homes within your budget, which can save you time.

- Get organized: Because youll have a lot of the paperwork gathered for the official home loan application later, this step helps you prepare for the homebuying process.

- Support your purchase offer: When youre putting in an offer, a mortgage pre-approval letter can help you stand out from other buyers, especially in a bidding war.

- Make a financial plan: If you dont qualify for a pre-approval, youll be able to find out why and create a plan to improve your finances.

Check out: How Long Does It Take to Get Pre-Approved for a Mortgage?

Also Check: Can I Add A Loan To My Mortgage

Does Prequalification Hurt My Credit Score

Editorial Note: The content of this article is based on the authors opinions and recommendations alone. It may not have been previewed, commissioned or otherwise endorsed by any of our network partners.

Whether you need a loan to purchase a home or car, or youre in the market for a new credit card, youll want to take the time to see if you prequalify.

Prequalification provides consumers a way to find out what their chances are of being approved for a new loan or credit product before filling out an application form. Plus, the prequalification process wont negatively affect your the way it will once you formally apply.

What Is A Mortgage Pre

If youre considering buying a house, youre probably wondering how much you can afford. The last thing you want is to fall in love with a house that ends up being out of your budget. Or even worse, to seal the deal on a house you cant comfortably afford.

A lot of online calculators claim that they can tell you how much you can afford, but for most homebuyers, what they end up qualifying for is often less than what their calculator guessed. So whats a more accurate way to figure out your budget? Getting a pre-approval letter from an actual mortgage lender.

Recommended Reading: What Banks Look For When Applying For A Mortgage

You May Like: How Do I Make My First Mortgage Payment

What Is Loan Pre

From the name of it, you might think its an actual approval for a loan. However, while it might be very close to that, its not actually an approval.

Simply put, when you wish to get pre-approval for a loan, you send an application to the lender with the necessary documents. They will then let you know if you are likely to be eligible for a loan or not, and if so, how much.

Getting pre-approved for a mortgage or other type of loan allows you to shop in confidence knowing how much you can afford.

How A Mortgage Pre

Getting a pre-approval for a mortgage before shopping for a home is a smart move. Sellers and realtors will take you more seriously. They know you have gone to a lender and that the lender is willing to lend you money based on specific conditions. Without this simple letter, some sellers or realtors just wont talk to you.

You worry that getting pre-approved will hurt your credit though. Doesnt every inquiry put a ding on your credit history?

While its true, your score does drop every time there is an inquiry, its not by much. Usually you will lose a few points. Its nothing that will make or break your credit in the future.

Recommended Reading: Can A Trust Take Out A Mortgage

How Far In Advance Should You Apply For Pre

Purchasing home insurance, sending in an application to buy, closing on a mortgage the timeline of the home buying process can be confusing. The pre-approval sweet spot is right after you decide you want to buy a home and just before you begin touring. Dont apply before you get serious about home buying, but dont wait until after youve found your dream home to apply for a pre-approval.

Your pre-approval will help guide you to houses you can afford and instill confidence in the seller that you want to buy. Thus, you should attend your first showing with a pre-approval ready to go in the event you fall in love and want to put in an offer. However, getting pre-approved before youre ready to start touring and putting in offers might mean that it expires before you find the one.

What Are The Chances Of Getting Denied A Mortgage After Pre

Not high, if youve stayed within your budget, but it does happen. Remember that pre-approval is a statement that you are considered generally qualified to pay back a mortgage, whereas the actual mortgage approval is on a specific purchase. The lender may believe that you are paying too much or may have uncovered liabilities that they did not find in the pre-approval. Also, if you are not able to pay a certain percentage of the cost in a down payment, typically 20%, then you may have to purchase mortgage insurance, which increases your costs.

You dont have to stay with the lender that gave you pre-approval, so you can consider applying elsewhere, which is a good idea in any case.

Also Check: How Much Is A 180k Mortgage Per Month

What Do I Need To Do To Get Mortgage Pre

You will need to have a valid proof of income, assets, employment, and other documents the lender may require. This can include bank statements and your latest tax assessment. Youralso plays a significant role in determining your eligibility. If you do not have agood credit score, lenders can refuse to approve your mortgageâthe required credit score for a mortgage approval ranges between 300 to 900, but theminimum credit scorerequired by most major banks in Canada is 600 to 700.

Final Thoughts On Getting Pre

Loan pre-approval without a hard check is a great option if you are still shopping around for lenders and you do not wish for every loan request to show up on your credit score.

This way, you will be able to see your options without any riskstherefore increasing your chances of getting your best loan approved.

You can try Stilt for pre-approval without a hard inquiry. The process is simple, and regardless of your status or credit score, the chances of you being accepted are high.

Also Check: Is Sebonic A Good Mortgage Company

What Is Mortgage Prequalification

Prequalification is an early step in your homebuying journey. When you prequalify for a home loan, youre getting an estimate of what you might be able to borrow, based on information you provide about your finances, as well as a credit check.

Prequalification is also an opportunity to learn about different mortgage options and work with your lender to identify the right fit for your needs and goals.

Have A Strong Credit Score

Before applying for a mortgage, its important to make sure your credit score is as strong as possible. A strong credit score is essential for getting pre-approved since lenders like to see that you have a history of managing your finances responsibly. To raise your credit score, make sure you pay all of your bills on time, reduce your amount of debt, and check your credit report regularly to ensure that all the information on it is accurate. Keeping your credit score high will make it easier to get pre-approved for a mortgage.

Also Check: How Much Down Payment For Mortgage

Check Your Credit Report

In addition to providing documentation, youll also have to agree to a hard credit check by the lender. Its important to check your credit report before your lender does, in case there are errors that could impact not only whether you get preapproved but also your ability to get the best mortgage rate.

If you are seeking a conventional mortgage, youll need a credit score of at least 620 to qualify. But thats a bit like saying a D is a passing grade. Ideally, youd want a much higher credit score to get the best loan terms.

Credit bureaus consider your credit very good if your score is between 740 to 799, and if you have 800 or more, your credit is considered excellent. Having credit in these thresholds could mean a significantly lower interest rate than a credit score in the good range. The higher your credit score, the lower your interest rate on a mortgage.

If you dont have a high credit score, you may still qualify for preapproval if you try a federally-backed or specialized loan program, like an FHA loan, that allows for a lower credit score, such as 580.

Under federal law, youre entitled to a free copy of your credit report from each credit bureau once per year. These can be obtained at AnnualCreditReport.com.

Does Getting Preapproved Hurt Your Credit

Theres one key step you should take to boost your odds of landing your dream home: getting preapproved for a mortgage loan with a lender.

If you do this, sellers will view you as a more attractive buyer. If they receive multiple offers, sellers are more likely to choose buyers who are preapproved for a mortgage than they are those who have not yet obtained financing.

But does getting preapproved for a mortgage hurt your three-digit FICO credit score? Slightly, but the dip in your credit score will be temporary. And the advantages of getting preapproved far outweigh the small hit to your score.

Also Check: What Are Different Types Of Mortgage Loans

Does The Interest Rate Depend On The Length Of Mortgage Pre

Yes. The length of time your offered interest rate is locked-in for after pre-approval plays a role in determining your interest rate. The longer the time, the more risky it is for the lender as they still have to offer you the lower rate even if their other rates increase. However, this is not the main factor that determines your interest rate: other important factors include your credit score, whether your documents are complete, and your financial situation. In general, if a lender deems you to be a risky borrower who may lack the ability to pay them back, your interest rate will be higher.

Hard Vs Soft Inquiries

Its crucial to know the difference between each of these before you start mortgage shopping because it directly affects you and your credit score. Organizations perform soft inquiries or soft credit checks to do a background check or to send you gift offers for loans in the mail. Soft inquiries are usually not initiated by you and as such they commonly have zero effect on your credit score.

Hard inquiries are more detailed credit reports that are requested by you, or on your behalf. These come into play when youre applying for a new loan, such as a , mortgage, or auto loan. When you initiate a credit check in this way, youre essentially requesting a new loan. This is exactly what happens during the pre-approval process.

You can expect a hard inquiry on your credit when you apply for a pre-approval. The credit bureaus can see that youre applying for a loan and they evaluate your credit accordingly. They take a look at your current loan status and your payment history and go from there.

It is pretty common for people to see a difference in their credit score when house shopping and getting pre-approved. However, dont panic its usually a pretty tiny drop, nothing that cant be fixed quite easily with good credit habits over time.

Need help fixing your credit?

Don’t Miss: How Much Time Is Left On My Mortgage

When Should You Get A Mortgage Preapproval

You should get a mortgage preapproval if youre serious about looking for and making an offer on a home within the next two months. Preapproval letters are good for 30 to 60 days, according to the Consumer Financial Protection Bureau .

If it takes you longer than a month or two to find a home, the lender may need to update your preapproval with more recent pay stubs and bank statements. If your house hunt takes more than 90 days, the lender may also need to pull a new credit report, which may impact your credit score.

Learn More About The Benefits Of Prequalification And Preapproval

As you look for a home, you may be asked to get prequalified or preapproved. Before you start, its important to understand the difference.

When you want to talk to a lender to establish a general range of home prices, you can get prequalified, which is simply a lenders estimate of what you could potentially borrow.

This can be completed easily and conveniently online, in person, or over the phone in just a few minutes with basic information like your income and expected down payment.

When you want to give yourself a competitive edge over other buyers in the market, you can get preapproved. Having a preapproval lets sellers know that you already qualify for the home financing which greatly increases your chance of having your offer selected.

Unlike prequalification, preapproval is a more specific estimate of what you could borrow from your lender and requires documents such as your W2, recent pay stubs, bank statements and tax returns.

The lender will then use these documents to determine exactly how much you can be preapproved to borrow.

Once youre preapproved, youll have 90 days to find a home you love. Then you can lock your rate and complete your application.

Whether you choose to get prequalified or preapproved, you will have a better sense of whats in your price range and can hunt for a house with confidence.

Don’t Miss: How Much Are The Fees To Refinance A Mortgage