Mortgage Programs That Allow Unemployment Income To Qualify

Most conventional and government-backed home loan programs allow you to use unemployment income in certain situations. You still have to meet the minimum mortgage requirements for your credit score, down payment and debt-to-income ratio for each loan type.

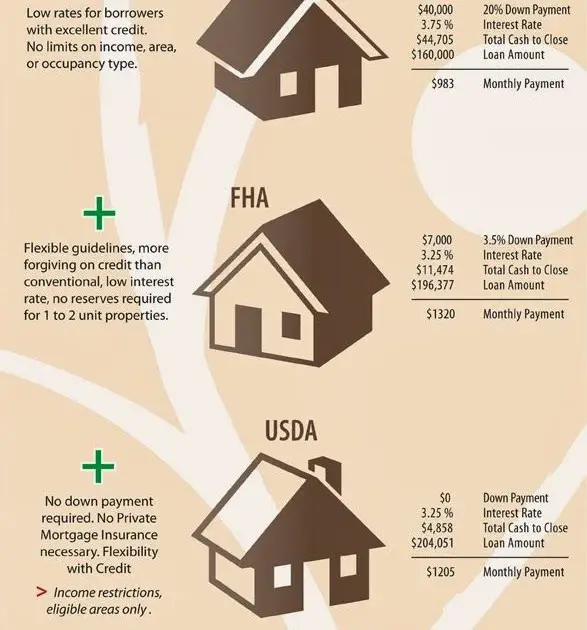

Take a quick look at the guidelines for acceptable unemployment income based on the different home loan types below:

| Mortgage program | |

|---|---|

| FHA loan |

|

| VA loan |

|

| USDA loan |

|

Income Requirements To Qualify For A Mortgage

Technically, there is no minimum dollar amount of income you need to qualify for a mortgage either during coronavirus or otherwise. But the 28/36 rule says home buyers should spend no more than 28 percent of their income on housing and no more than 36 percent of their income on combined debt payments.

If you’re applying for a mortgage loan to take advantage of low mortgage rates as a first-time buyer or refinancing from an adjustable-rate to a fixed rate, your debt-to-income ratio can play a big part in whether you’re able to get approved after a layoff.

Your DTI may have been relatively low while you were working but if your income took a hit because of how the virus has impacted the economy, your ratio may be much higher now.

The good news is there are other things you can use to persuade a lender to approve you for a mortgage even if you’ve been laid off. Low debt levels, a good to excellent credit score, a larger down payment, significant cash savings and/or investment accounts can all help to lower your risk profile for mortgage loans.

What Do You Need To Qualify For A Unemployment Loans With No Job Verification In Canada

While you may not be required to verify your job, you will need to provide a few personal and financial documents to qualify for an unemployment loan.

- Personal Identification All lenders will require a piece of government issued ID with a photo. This includes a passport, drivers license or any other card that can prove your name and address. Some lenders may even ask for your SIN number.

- Proof Of Income If youre unemployed but recieve income through non-traditional means like CCB, CPP, OAS, DTC, social assiatnce or some other government program, youll need to provide documents to prove that,

- Bank Statments Lenders will often require your last 3 bank statements to calculate your debt to income ratio and assess whether you can afford the loan.

Also Check: Can You Use A Mortgage To Build A House

What If You Just Got A New Job

If youâve just begun a new job, itâs a bit hit-or-miss how lenders will view your new employment opportunity. More often than not, lenders like to see a two-year work history at the same company or within the same industry. Once you have a job though, lenders do view your job as permanent and ongoing which works in your favor.

If you only had a brief employment gap after a long history of steady employment, youâll likely find a lender who wonât hold that against you. Again, responses to this situation may vary, which is why itâs important to shop around for the right mortgage loan. You can prequalify for a loan with more than one lender to get an idea of what loan amount each lender is likely to approve you for. Then you can focus on applying for mortgages with the lenders who are more likely to give you a favorable loan amount and interest rate.

Will An Employment Gap Hurt My Chances For Mortgage Approval

Employment history is a very important aspect of a mortgage application. Mortgage loans are usually for substantial sums of money and lenders want to reduce the risk that borrowers will default. One sign that a borrower will be consistent in making their mortgage payments is if they have a stable two-year history of employment. But what if you have gaps in your work history? Can you still qualify for a mortgage?

You May Like: Can I Throw Away Old Mortgage Papers

Unemployed And Claiming Benefits

Its possible to get a mortgage if youre unemployed and claiming benefits, but only under certain circumstances.

Mortgage approval wont be easy and your options will be very limited. This is because there arent many lenders that are willing to lend to unemployed applicants, even if you can afford to repay the mortgage with the benefits you receive.

The good news is that there are lenders that will consider you. Furthermore, benefits can be used towards your income and affordability assessment. Depending on the amount of income you receive, a mortgage may well be possible.

How Do I Calculate My Home Equity

To calculate your home’s equity, divide your current mortgage balance by your home’s market value. For example, if your current balance is $100,000 and your home’s market value is $400,000, you have 25 percent equity in the home. Using a home equity loan can be a good choice if you can afford to pay it back.

Read Also: How To Lower Your Mortgage Payment Without Refinancing

Contact Your Current Creditors For Financial Assistance

Since the pandemic, people have been able to find more financial assistance from:

- Utility providers

If you’re struggling to keep up with your bills, call your creditors and explain your situation. They may offer paused payments, deferment, forbearance, new repayment plans, or other forms of financial relief.

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

You May Like: Should I Refinance My 30 Year Mortgage

Apply To The Right Lender

Because different lenders have different restrictions on who theyâll lend to, you should try to apply to one whoâll treat your application favourably. Ask individual banks about their policies or speak to a mortgage broker, who should be able to tell you which banks are most likely to allow your loan application.

Develop A Financial Plan

If unemployment has caused you to have to dip into your savings or accumulate more credit card debt, creating a financial plan can be a great way to get back on track once you have found employment again. This plan should include an outline of your income and the amount you owe, as well as how much you would like to save each month. Using a budgeting app such as Mint or a method like the 50/30/20 method can help you pay down debt and save for that down payment you need.

Don’t Miss: Should You Buy Mortgage Points

You Earn Investment Income

If you receive a substantial sum of money every month from stock dividends, capital gains or other investments, you might be approved for a mortgage. One caveat: Loans approved based on investment income tend to have higher interest rates, says Todd Sheinin, a loan officer at Homespire Mortgage in Gaithersburg, Maryland.

How To Get A Mortgage With A Seasonal Income

If youre seasonally employed and work only part of the year, you may have trouble qualifying for a mortgage to purchase or refinance a home. Whether your work is truly around a season, such as landscaping or snow removal, or something you do on the side, this type of employment can be categorized as sporadic.

This wont disqualify you from a mortgage, but it does make the process a little tricky. Heres what you need to know to get a mortgage with seasonal income.

Take the first step toward the right mortgage.

Apply online for expert recommendations with real interest rates and payments.

Dont Miss: What Ticket Number Is Pa Unemployment On

Don’t Miss: How Much Do I Have Left On My Mortgage Calculator

Can You Get A Mortgage Without A Job

If youre currently unemployed, you may be asking: Can I get a mortgage without a job? After all, lenders typically want to see proof of employment before theyll approve a home loan. Similarly, you might also be wondering: Can you refinance your home if you are unemployed? Thankfully, the answer to these questions is yes, you can refinance or get a home loan without a job although, you will need to satisfy some lender requirements.

What Happens If You Lose Your Job During The Mortgage Process

Losing your job is one of the most stressful life events you can experience. And theres never a good time to suddenly find yourself unemployed. But what happens if you lose your job when youre in the middle of buying a home? Should you give up on your plans to secure a mortgage? Not necessarily. You have options, and its important to review them carefully before making a decision.

Read Also: Can A Mortgage Include Renovation Costs

Can Unemployment Benefits Count As Income On A Mortgage Application

Anyone receiving unemployment benefits will most likely not be allowed to count them as a source of income. Typically, lenders will require proof of at least two years of income from a steady source.

Mortgage lenders need to verify that sources of income on an application are likely to continue for the next three years.

There are several documents mortgage lenders will need from homebuyers:

- The last two years W2 forms.

- The last two years income tax returns, if self-employed.

- Bank statements.

So while someone on unemployment benefits might have a lengthy work history and an adequate down payment, they cannot show steady future income.

Additionally, most states allow unemployment benefit eligibility for a maximum of 26 weeks, falling below the three-year threshold.

Home Equity Line Of Credit

A HELOC is similar to a home equity loan, but instead of getting your money in a lump sum, you gain access to a revolving line of credit against your equity.

How it works: All HELOCs begin with a draw period, and you can use your line of credit and spend against your home equity. You also only need to pay for any accumulated interest during the draw period.

Example: If you have $50,000 worth of equity in your home, a HELOC might give you a credit line with a limit of up to $45,000.

What to keep in mind: Once the draw period ends, you pay back the balance on your HELOC in fixed monthly payments. These come in addition to any mortgage payments you make each month. Make sure that you can make your payments before you take a HELOC. Rocket Mortgage® does not offer HELOCs at this time.

You May Like: How Do I Apply For Unemployment Benefits In Louisiana

Don’t Miss: How Much Of Your Income Should Go To Your Mortgage

Getting The Straight Answer On Being Able To Qualify For A Mortgage With Having Multiple Jobs And Employment Gaps In The Past 24 Months

Remember that all lenders need to meet the minimum agency mortgage guidelines of FHA, VA, USDA, FANNIE MAE, FREDDIE MAC.

- However, lenders can have higher lending standards of their own called lender overlays

- Therefore, not all lenders have the same lending requirements on government and/or conventional loans

- This is where many borrowers may get conflicting answers to questions asked

- Borrowers should study the basic agency mortgage guidelines before shopping for a mortgage

- This way, they will know if they meet the minimum agency guidelines of the loan program they are applying

- If they are told they do not qualify, borrowers will know whether they do not meet the minimum agency guidelines or they do not qualify with the individual lender due to their overlays

Gustan Cho Associates has no lender overlays on government and/or conventional loans.

Dont Miss: Where To Go To File For Unemployment

So What Really Happens In 2022 If I Lose My Job Before Closing A Mortgage

Depending on the reason behind losing your job, you may still be able to purchase property. However, it is also likely that the lender will delay closing or cancel your approval of a type of mortgage loan .

Keep in mind that getting pre-approved for a loan does not guarantee closing. This just means that you can likely be approved by completing the mortgage process.

Therefore, any change that affects your income, employment, or credit prior to closing affects your mortgage qualification.

To better understand what happens in if you lose your job before closing on a mortgage loan, we invite you to learn more about the requirements to apply for a mortgage in New Jersey and our tips on what not to do when applying for a mortgage loan.

Read Also: How Much Will Lenders Give For Mortgage

How To Refinance Or Get A Mortgage With No Job

Refinancing your mortgage while youre unemployed isnt impossible, but it will take a little more effort and creativity to accomplish. Unfortunately, lenders often wont accept unemployment income as proof of income for your loan. Here are some strategies you can use to help you refinance your loan without a job.

Recommended Reading: File For Unemployment Tennessee

Can I Get A Mortgage On Jobseekers Allowance

![Personal Loans for Unemployed: Do They Exist? [Video] Personal Loans for Unemployed: Do They Exist? [Video]](https://www.mortgageinfoguide.com/wp-content/uploads/personal-loans-for-unemployed-do-they-exist-video-personal-loans.jpeg)

Yes, there are lenders that accept applicants receiving Jobseekers Allowance . If youve been claiming JSA for over a year, then mortgage approval can become difficult. This is because you may appear overly dependent on the income you receive from benefits.

If you already have a mortgage, the Department of Work and Pensions offer support for mortgage interest . This is to help with your mortgage payments while youre not in full-time employment. You will be charged interest so do check the terms and conditions with the DWP beforehand. Our experts can also help you with this.

You May Like: Do Banks Use Gross Or Net Income For Mortgage

How To Avoid Debt During The Coronavirus Crisis

If you already have a mortgage loan and youve been laid off, there are some things you can do to manage debt until youre able to return to work. Kessler said the first step is to communicate with your lenders to make them aware of your financial situation so they can work with you to find a solution.

For example, you may be able to take advantage of federal mortgage forbearance if you have an eligible loan. You can defer payments for up to 180 days if you have a government-backed loan, which includes FHA, VA and USDA loans, in addition to loans owned by Fannie Mae and Freddie Mac.

The Federal government has put a lot of pressure on lenders to allow homeowners to go into forbearance thus giving them time to catch up on their financials, and not having to worry about paying their mortgage during COVID, Kessler said.

Applying for unemployment benefits or assistance programs can help you bring in some income for the short-term. The CARES Act expanded unemployment to include federal emergency benefits as well as benefits for self-employed individuals and people who arent eligible for traditional unemployment.

You May Like: 10 Year Treasury Vs 30 Year Mortgage

What Happens If I Lose My Job Before Closing On A Mortgage

- Post category:Real estate

A common question in our office is: what happens if I lose my job before closing on a mortgage? You are in the right place to get a clear answer.

Losing your job within days of buying a home in New Jersey or another state can be truly nerve-wracking, especially if you dont have an alternative source of income.

Getting a new job can alleviate this situation, but it doesnt guarantee that your lender will give you a home loan when youre on trial at your new job.

Our experienced real estate attorney in New Jersey has been resolving real estate matters for over 10 years. Curbelo Law with offices in Ridgewood and Newark can become your legal trustable support.

Don’t Miss: Is It Better To Pay Off Your Mortgage Or Not

Tips For Buying A Home

- Buying a home will likely factor into your larger financial plan, which means you may want to consult with a financial advisor. Finding a qualified financial advisor doesnt have to be hard. SmartAssets free tool matches you with up to three financial advisors who serve your area, and you can interview your advisor matches at no cost to decide which one is right for you. If youre ready to find an advisor who can help you achieve your financial goals, get started now.

- Figure out how much house you can afford. With that number in mind, create a monthly budget and start saving for your down payment and closing costs.

Can You Get A Mortgage With A Low Income

Yes. For those borrowers looking into low-income home loan options, your best bet might be an FHA mortgage, Gravelle said. FHA loans are insured by the government and offer flexible credit qualifying requirements and loan terms such as low down payment, low interest rates, and low closing costs to help more people achieve homeownership.

You May Like: How Many Times Can Refinance A Mortgage