How Much Youll Pay In Closing Costs

The total closing costs paid in a real estate transaction vary widely, depending on the homeâs purchase price, loan type and the lender you use. In some cases, closing costs can be as low as 1% or 2% of the purchase price of a property. In other casesâwhen loan brokers and real estate agents are involved, for exampleâtotal closing costs can exceed 15% of a propertyâs purchase price.

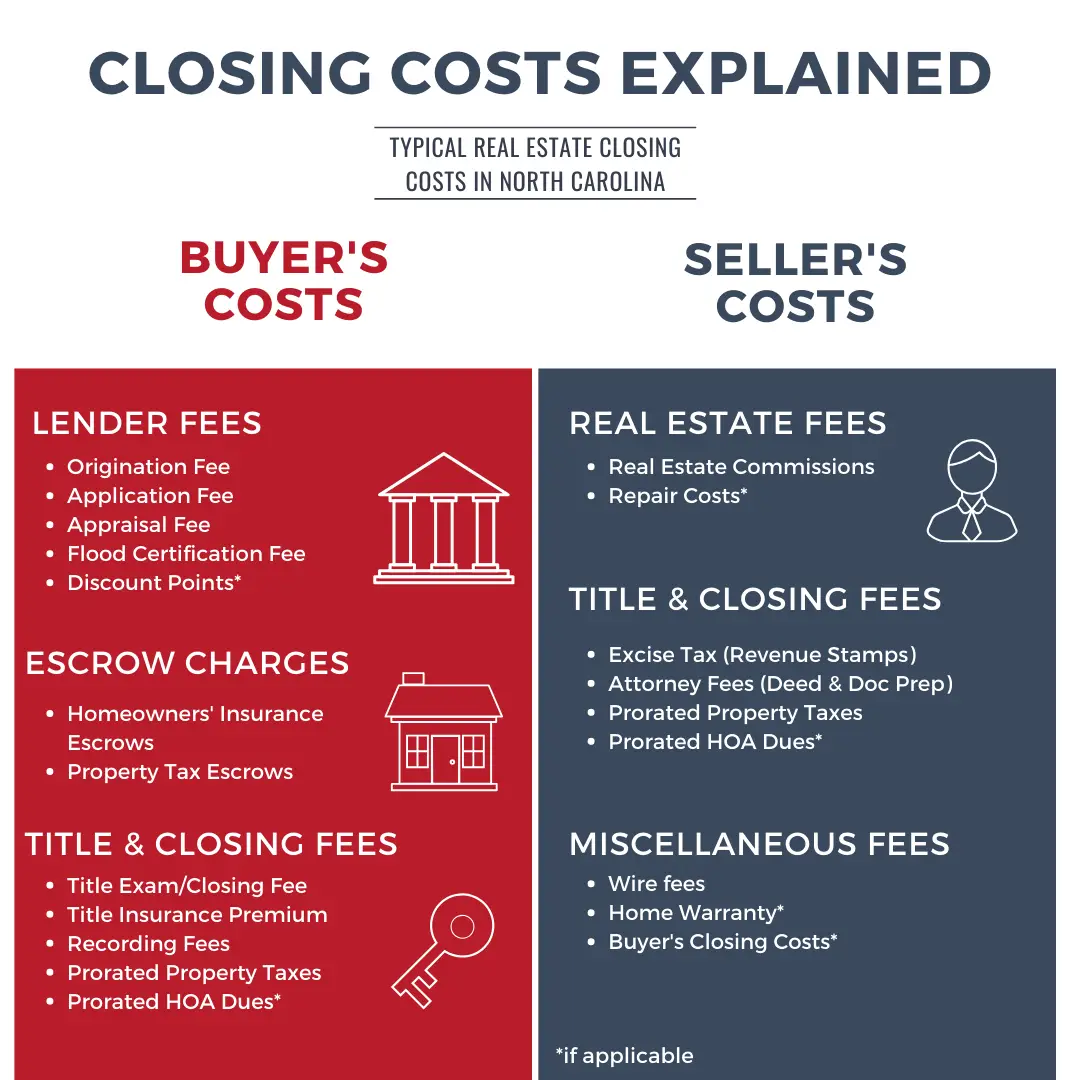

In total, buyers should expect to pay between 2% and 5% of purchase price in closing costs. Their portion of the costs typically includes:

- One or two origination pointsâlender feesâthat equates to 1% to 2% of the loan amount, and usually includes loan origination fees of $750 to $1,200)

- $1,000 or more in loan underwriting fees for things such as an inspection, appraisal, survey and title work

- One or more mortgage discount points if you choose to lower your interest rate by prepaying interest

- Up to 2% of the loan amount as an initial mortgage insurance premium if you decide to use insurance or a government-issued loan that requires it

The specific closing costs of a real estate transactionâand whether costs are the responsibility of buyers or sellersâare all outlined in the disclosure sections of a purchase agreement and determined by the lender and loan type that the buyer selects.

Negotiate With Your Lender

The saying it never hurts to ask applies to mortgage lenders as well. For example, your lender may be willing to waive a courier or wire transfer fee for you upon request. Though you wont always get something waived, theres always a chance you could. Dont be afraid to negotiate with your prospective lender. The worst they can do is say no.

Should You Refinance With A No

Whether to refinance your mortgage is a complicated decision, and the answer may differ according to each situation. The best way to decide if you should refinance at all is to run the numbers. Look at the total one-time closing costs that youll have to pay, then compare that number to the amount youll save each month with your mortgage payment. If it will cost you $2,000 to refinance and youll save $200 with every payment, then youll pay back those costs in 10 months.

You can do the same sort of analysis when deciding if you should use a no-closing-cost mortgage refinance. But in this case, you also need to look at how rolling the closing costs into your loan affects your monthly payment. Youll want to ask questions such as Is it worth it to me to pay $1,000 now to save $25 each month for the remainder of the term of my mortgage?

Having an idea of how long you plan to stay in your current home can help inform your decision-making process as well. While you never know when your situation can unexpectedly change, if you already know that youre planning on moving in a few years, then a refinance makes less sense. Since most refinances have you pay some up-front costs in exchange for lower monthly payments, if you are planning on staying only briefly, then making back those initial costs will be difficult.

You May Like: What Can My Mortgage Be

Todays Mortgage Refinance Rates

Theres good news if youve been considering a refinance because the mean rates for 15-year fixed and 30-year fixed refinance loans shrank. Shorter term, 10-year fixed-rate refinance mortgages also slumped.

Take a look at todays refinance rates:

Here are mortgage rates for different styles of loan.

J Total Closing Costs

D + I = J. This is the total of all your closing costs. It represents the sum of all your loan costs and all your non-loan costs. This is roughly the amount you should budget for, since it represents the lenders estimate of what you will owe at closing time.

Weve gone through some of the most common fees that make up your total closing costs. You can generally expect the total to be between 1 and 5% of the price you are paying to buy your home. Payment for closing costs can sometimes be financed with your loan, in which case it will be subject to interest charges. Alternatively, you can pay your closing costs in cash, similar to your down payment.

Read Also: What Is Amortization Schedule Mortgage

How Much Are Closing Costs For The Seller

As we mentioned, buyers arenât the only ones who will pay closing costs. Letâs take a look at some of the common closing costs for sellers.

Property-related fees

- Homeowners Association fees: Any HOA fees get paid by the seller through the closing date.

- Real estate agent commission: The seller will typically pay for both the buyerâs and the sellerâs real estate agent commissions.

- Recording fees: Depending on the state, the seller may be responsible for covering recording fees associated with the change of ownership.

- Transfer tax: A cost thatâs usually paid for by the seller to transfer the title of the home to the new owner.

Taxes and insurance

- Prorated property taxes: Property taxes that accumulate up to the date of the sale are the responsibility of the seller.

- Ownerâs title insurance: To protect the buyer from issues with the homeâs title, the seller sometimes pays for ownerâs title insurance. This one-time purchase is good for as long as the buyer owns the home.

Miscellaneous fees

- Attorney fees: If an attorney assists the seller with the sale of their home, they will be responsible for paying the attorney fees on closing day.

- Escrow fees: Often, the buyer and seller share this fee. It covers the cost of the escrow companyâs services for transferring ownership of the property.

How Much Are Closing Costs Plus: How To Avoid Closing Costs

Whether youre a first-time homebuyer or have purchased property before, if you get a mortgage to buy a home, youll have to pay closing costs. These fees, paid to third parties to help facilitate the sale of a home, typically total 2% to 7% of the homes purchase price. So on a $250,000 home, you can expect the amount to run anywhere from $5,000 to $17,500.

Now that you have a sense of the ballpark numbers, heres everything homebuyers and home sellers need to know about closing costsfrom why closing costs are so high to who pays closing costs and even how to get closing costs waived.

Read Also: Are There 20 Year Mortgage Loans

What Is A No

With interest rates at historic lows, you may be thinking about refinancing your mortgage. You will typically spend a few thousand dollars in closing costs as part of the transaction. These closing costs can include lender fees, recording fees, taxes, home appraisal costs, and more.

In a no-cost mortgage, sometimes referred to as a no-fee mortgage, the lender absorbs the up-front costs by either raising the balance of the loan or charging a higher interest rate.

Can You Roll Closing Costs Into Mortgage

In simple terms, yes you can roll closing costs into your mortgage, but not all lenders allow you to and the rules can vary depending on the type of mortgage you’re getting. If you choose to roll your closing costs into your mortgage, you’ll have to pay interest on those costs over the life of your loan.

Also Check: How Much Interest I Pay On Mortgage

The Importance Of Budgeting

Creating a realistic budget in advance and sticking to it can help you be more confident at the closing and avoid unexpected surprises down the road. The more you can map outâand spread outâyour expenses and payments, the more effective you will be in managing your overall costs. But before you can put together an accurate budget, you need to know how much you can afford.

Another budgeting tip you may want to consider: Many real estate and mortgage experts recommend setting up a separate account to help you more easily manage funds earmarked for closing and moving costs.

How To Budget For Closing Costs

Before you start looking at homes, get preapproved for a mortgage so you understand what your closing costs could be and how much home you can afford.

Since a number of factors, such as the type of loan, type of property, type of occupancy and your credit score can determine what your closing costs might be, try to be as specific as you can with the mortgage lender, says Brett Warren, director of residential mortgage lending at Hyperion Bank in Philadelphia.

Closing costs are often higher than most borrowers initially assume they are, Warren says.

With that in mind, budget with the high end 5 percent of the loan in mind. Between paying for movers, handing over a down payment and checking off all your other expenses, the run-up to closing day carries a hefty price tag, so being prepared is key.

Read Also: When Should You Prequalify For A Mortgage

How Closing Costs Affect Your Mortgage Interest Rate

Mortgage loan pricing is flexible. You can choose the fee structure that works best for your financial situation.

For instance, maybe you want the lowest interest rate and monthly mortgage payment possible and youre willing to pay extra upfront to get it.

Or, you might accept a slightly higher interest rate if your lender will cover the closing costs and get your out-of-pocket expense to zero.

You should be aware of your options so you can choose the structure thats most affordable for you.

What Are Some Common Closing Costs For Homebuyers

- Loan origination fee What the lender charges the borrower for administrative services, such as processing the application, underwriting and funding the mortgage loan.

- Typically less than $30, this is a fee a lender can collect before providing you with a loan estimate.

- Appraisal fee Service fees covering an assessment determining how much your property is worth.

- Home inspection fee Typically ranging between $300 and $500, a home inspection provides an assessment of the physical condition of a house.

- Title service fee Costs related to the premium for the lenders title insurance policy and lenders service fees for issuing title insurance.

- Recording fee Fees your local government issues for recording your deed, mortgage and documents related to your home loan.

- Prepaid expenses Includes property taxes, interest until your first payment is due and homeowners insurance. Your mortgage lender may set up an escrow account to pay these expenses. Depending on where you live, an escrow account could be required by law.

Read Also: How Do I Become A Mortgage Loan Officer

Whats Included In Closing Costs

When you first see your Good Faith Estimate or Closing Disclosure Statement, it can be a little overwhelming the list of individual line items seems to stretch on and on. Heres a list of the most common closing costs in alphabetical order, including the general amount of the charge and purpose for the cost.

What You Need To Know About Closing Costs

During closing, youll need to review and sign loan and other paperwork to finalize the home purchase process, as well as pay some upfront costs.

- Your closing costs, which will depend on your lender, type of mortgage, and home location, may cost thousands of dollars theyre typically 2 to 5% of your home purchase price.Estimate your costs.

- Closing costs can be paid by you, the home seller, or the lender.

- You may be able to use monetary gifts from family for all or a portion of your closing costs.

Read Also: What Is The Average 15 Year Mortgage Rate

What Is The Difference Between Prepaid Costs And Closing Costs

Prepaid costs and closing costs can become confusing because they are typically paid at the same time. The closing costs are the fees you will pay for the services provided during the closing of your home. The payments from your closing costs will pay for all the service providers involved along the way, such as lawyers, lenders, appraisers, and title companies.

Another distinction between prepaid costs and closing costs is that the seller may pay the closing costs, but the buyer is always responsible for the prepaid amount.

Specific Mortgage Closing Costs

As far as the specific sums that will be included in your mortgage costs, here is what you should expect.

Mortgage Insurance Mortgage insurance, for those who must pay it, represents the largest single item included in loan closing costs in Canada. As noted in our guide to mortgage insurance, CMHC mortgage insurance or mortgage insurance from another insurer is required for all mortgages where the buyer cannot put a 20 percent down payment on his or her home purchase. Mortgage insurance will cost up to 2.75 percent of the loan amount depending on the size of your down payment. The larger your down payment, the less you will have to pay in mortgage insurance premiums.

Land Transfer Tax Another significant portion of your closing costs will be your Land Transfer Tax, which is levied by most provinces to pay for provincial services. Some municipalities, such as Toronto, have an additional Land Transfer Tax as well. In any case, your Land Transfer Tax can average as high as 1.5 percent of your propertys value depending on where you buy and how much your property is worth.

Legal Fees/Notary Fees You will pay a lawyer to prepare your loan contract, and you may also need the services of a notary to close your loan. Legal fees pay for these services, and they are charged per the hour according to how long document preparation takes. Typically, you can expect to pay around $500 to $1000.

Don’t Miss: How Much Are Mortgage Payments On 150 000

Why Theres No Such Thing As Typical Closing Costs

The reason for the huge disparity in closing costs boils down to the fact that different states and municipalities have different legal requirementsand feesfor the sale of a home.

If you live in a jurisdiction with high title insurance premiums and property transfer taxes, they can really add up, says David Reiss, research director at the Center for Urban Business Entrepreneurship at Brooklyn Law School. New York City, for instance, has something called a mansion tax, which adds a 1% tax to sales that exceed $1 million. And then there are the surprise expenses that can crop up, like so-called flip taxes that condos charge sellers.

How Can I Avoid Paying Va Loan Closing Costs

If expensive closing costs are preventing you from purchasing a home with a VA loan, there are a few options you can explore like seller concessions, closing cost assistance and lender credits. Compare the pros and cons of each option in the table below, then talk to a VA lender to discuss which is the best route for you.

| Pros |

|---|

You May Like: Can You Get A Mortgage In A Different State

***miscellaneous Fees That Are Not Applicable In All States***

State Tax/Stamps Mortgage In some states there are state charges whenever you do any type of Real Estate transaction including Refinances. These are state or county specific charges that are required to be paid and are usually based on the dollar amount shown on the Deed or Mortgage.

Intangible Tax This is just like the State Tax/Stamps Mortgage and is required for all Real Estate Transactions in some states. Again the example is Florida where there is a mandatory state charge. Other States such as Texas, Illinois, Pennsylvania and New Jersey have other miscellaneous additional charges not seen on all Good Faith Estimates as they are either local or state fees that vary from transaction to transaction but usually do not add up to be too significant as far as the dollar amount of the cost.

Closing Costs V Concessions

One of the big benefits of VA loans is that sellers can pay all of your loan-related closing costs. Again, theyre not required to pay any of them, so this will always be a product of negotiation between buyer and seller.

In addition, you can ask the seller to pay up to 4 percent of the purchase price in concessions, which can cover those non-loan-related costs and more. VA broadly defines seller concessions as anything of value added to the transaction by the builder or seller for which the buyer pays nothing additional and which the seller is not customarily expected or required to pay or provide.

Some of the most common seller concessions include:

- Having a seller cover your prepaid taxes and insurance costs

- Having a seller provide credits for items left behind in the home, like a pool table or a riding lawn mower

- Having a seller pay off your collections, judgments or lease termination fees at closing

In some respects, as long as you stick to that 4 percent cap, the skys the limit when it comes to asking for concessions.

VA buyers are also subject to the VA Funding Fee, a mandatory charge that goes straight to the VA to help keep this loan program running. For most first-time VA buyers, this fee is 2.30 percent of the loan amount, provided youre not making a down payment. Buyers who receive VA disability compensation are exempt from paying this fee.

Recommended Reading: How Much Is A Mortgage Per Month

Compare Loan Estimates And Closing Disclosure Forms

When you get your initial loan estimate, review it with a fine-tooth comb. If youre unsure about what a fee entails or why its being charged, ask the lender to clarify. A lender who cant explain a fee or pushes back when queried should be a red flag.

Likewise, if you notice new fees or see noticeable increases in certain closing fees, ask your lender to walk you through the details. Its not uncommon for closing costs to fluctuate from preapproval to closing, but big jumps or surprising additions could impact your ability to close. This is especially true for new items that may not have appeared on prior estimates.

Be wary of a lender adding on unnecessary junk fees that duplicate existing ones or that havent been disclosed in advance.