You No Longer Have To Weigh The Cost Of Your Mortgage Against Other Investments

Investing is a balancing act that requires careful planning to avoid working against yourself. Your mortgage is probably the most significant loan you have taken out, and the cost of the interest you are paying adds up over the years and decades.

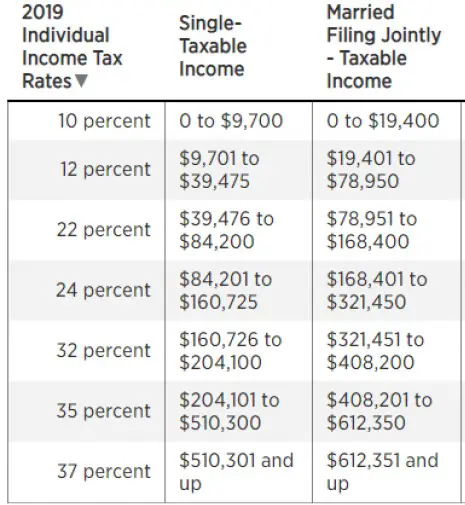

You can and should make certain investments even if you have a mortgagelike your 401K or IRA investment accounts others are less clear. For an investment to make sense while you owe money to the mortgage company, it will need to deliver a rate of return that exceeds your mortgage interest.

Otherwise, you would be better paying the mortgage off early. But if you have paid the mortgage off, you do not need to weigh your investments against your home loanbecause you are no longer paying interest on the loan.

When money is cheap with rock bottom interest rates, the pendulum usually swings in favor of keeping a mortgage. On the flip side, if you have a high mortgage interest rate paying off your mortgage could make more sense.

Of course, if you decide keeping your mortgage makes more sense than paying it off early, you would be foolish not to refinance into a lower interest rate.

You can go for a no points, no closing costs loan, and keep the same amount of years to amortize the mortgage. You will have a lower interest rate while also paying off the loan in the originally scheduled time frame.

Choose An Accelerated Option For Your Mortgage Payments

An accelerated payment option lets you make weekly or biweekly payments. With this option, youre putting more money toward your mortgage than with a monthly payment.

Accelerated payments can save you money on interest charges. By accelerating your payments, you make the equivalent of one extra monthly payment per year.

What If I Make Two Extra Mortgage Payments A Year

If making an additional payment on top of what youd already be paying extra through a biweekly schedule or committing to one annual extra payment is a feasible financial option for you, doing so can be a great way to gain full ownership of your home even faster.

However, you should only consider this option if it wont put your ability to pay for your other financial responsibilities at risk.

Read Also: What Is Considered Income For Mortgage

Will I Be Better Off Using The Money To Buy Something Else

It is possible that you can be confident of earning more from using your savings in some other way than paying off the mortgage. For example, some pensioner bonds pay higher than mortgage rates. You might decide that a second property or stocks and shares will grow in value each year more than the interest rate on your mortgage, but they come with a risk.

How Do I Work Out How Much Money I Will Save By Paying Off The Mortgage

First, you need to find out the monthly interest you are paying on your mortgage. Unless you are on an interest-only mortgage, this is not the same as your monthly mortgage payments, as they will include not just interest but capital repayments also. Either ask your lender what your monthly interest payment is, or calculate it from the interest rate that you are paying. Then find out what interest you are receiving on your savings and how much tax you are paying on that .

Then it is quite simple if your monthly mortgage payment is greater than the interest you are receiving after tax, you will be better off paying off your mortgage. As an example: say you have a £100,000 mortgage at 3%, and £100,000 in a savings account earning 0.5%, and you are a lower rate tax payer. Then the mortgage interest payments are £3000 a year, but the interest you receive is £500 a year . If you use your savings to pay off the mortgage you will be £2,500 a year or about £200 a month better off.

Read Also: How Much To Earn For 200k Mortgage

Drawbacks Of Investing Your Extra Cash

- Higher risk: There is more volatility in the stock market than in the housing market year over year, so you should be sure your investing timeline is long enough to weather ups and downs. You also need to make sure that your investment strategy matches your risk tolerance and youâre mentally prepared to take some hits.

- Increased debt: Choosing to invest your money may not be the best option if you donât like the idea of having debt to your name. Until your mortgage is repaid, you donât actually own your homeâthe bank does. And there will always be some risk that you could lose your home if you arenât able to make the payments.

Reasons To Pay Off Your Mortgage First

The single-biggest reason to prioritize paying down your mortgage is that it saves you money.

Every time you make a mortgage payment, that payment is split into two distinct parts: the principal and the interest. The principal is the amount of money you borrowed and still owe. So, if you borrow $100,000 and repay $25,000, then the principal owed is $75,000. The interest is the fee you pay to the lender in order to borrow that money. Its the cost you pay to use someone elses money to buy an asset.

In general, the interest on a mortgage loan is expressed as a percentage. And the calculation of how much you owe is amortizedmeaning the period of time youre paying it back. This enables the lender to calculate the expected earnings of their risk , as well as establish a timeline for when the loan will be repaid in full. Plus, it helps you and your lender determine how much interest will be paid during the total lifetime of the loan. The most common amortization schedule for new mortgage loans in Canada is 25 years, although you can drop it down to five years or, in some cases, increase it to more than 25 years.

Now, anyone with access to a simple mortgage calculator will point out that reducing the number of amortization years will prompt an increase in your monthly mortgage payments. So for that reason, this isnt a viable option for many homeowners.

You May Like: How Does A Retired Person Qualify For A Mortgage

Paying Off Your House May Reduce Financial Liquidity And Flexibility

If you take a big chunk of cash, either from a bank account or from your investments, and use it to pay off your house, you are taking “liquid” assets and making them “illiquid” .

If a lot of your net worth is in your house, there are only a few ways to “free it up”:

- Sell the house and downsize .

- Take out a home equity loan or line of credit .

- Take out a reverse mortgage.

I’m not going to go into these in detail , but suffice it to say that none of them are easy or cheap.

Con: You May Have To Pay A Prepayment Penalty

Potential prepayment penalties are another drawback to consider. Some lenders charge fees if you pay off your loan too early, as it eats into their ability to make a profit.

These fees vary, but generally, it’s a small percentage of the outstanding loan balance. These penalties are typically only charged if you’re very early on in your loan term usually within the first three to five years, according to the Consumer Financial Protection Bureau. Not all mortgage lenders charge prepayment penalties, though, so make sure to check with yours if you’re considering paying off your loan in full.

Also Check: When To Refinance Home Mortgage

What Are Some Other Important Things Homeowners Should Know

Chris Chen: If you have a mortgage interest that is much higher than the current rates, or if you have a variable rate mortgage and you expect to stay in your house for a long time, there is still time to refinance. Although the financial community has been expecting higher interest rates for a long time now, this has not yet come through for mortgage rates. Take advantage of lower rates while you can.

James Kinney: Paying off the mortgage is like investing in a very illiquid asset. You can’t easily tap the funds. It is important you have emergency funds available in an easily accessible account before applying funds to mortgage pay-down. If you might need access to the funds, it might be a good idea to have a home equity line of credit in place, which would allow you to borrow the money back in the event it is needed for an emergency.

Want to Know More, Contact Me:808-397-9132

Chris Chenis a certified financial planner at Insight Financial Strategists in Waltham, Massachusetts.

James Kinney is a certified financial planner and the founder of Financial Pathways in New Jersey.This article originally appeared on NerdWallet.

What Percent Of Retirees Own Their Homes

Homeownership rate in the U.S. 2021, by age The homeownership rate among Americans under 35 years was 37.8 percent in the second quarter of 2021. In contrast, almost 80 percent of those aged 65 and older owned their home. The homeownership rate is the proportion of occupied households which are occupied by the owners.

Recommended Reading: How Do You Buy Down A Mortgage Rate

How Does Paying Off Your Mortgage Early Fit Into Your Retirement Plan

The answer to this question will be different for everyone.

If you know you want to stay in this house during retirement, paying it off now so you don’t have to make monthly payments in retirement might be the right move.

But if you’re, say, 10 years away from retirement and haven’t started investing yet, investing will be a better use of the money than paying off the mortgage early.

Get Rid Of Your Private Mortgage Insurance

After having paid off higher interest debts and having only your mortgage payment to focus on, your first goal should be to get rid of your PMI if you have one. If you did not pay 20% of your homes value, chances are you have to pay PMI. This is a type of insurance your mortgage company would require you to have to minimize their risk of taking you on a as a client.

PMI is generally not required after you have paid off 20% of your homes price. Therefore, the sooner you pay the 20%, the sooner you can request the PMI be removed. An appraisal is sometimes required to remove PMI. But once that hurdle is done, you now have one less monthly expense. Instead, you can apply that extra monthly amount towards your principal balance.

You May Like: What Is A 30 Year Fixed Jumbo Mortgage Rate

Should You Pay Off Your Mortgage Early

By Romana King on December 15, 2021

There are some serious advantages to paying off your largest debt early. But to make the best choice, first consider your options.

Lets face it, we all dream of a debt-free life, and paying off your mortgage can be a big part of that. Even if its a distant goal, its fun to imagine the financial freedom that comes with settling one of lifes biggest loansyour mortgage.

Thats just one of the reasons paying off mortgage debt should be on every homeowners priority list. It can also save you tons of money in interest fees. That doesnt mean you dont have other potentially lucrative options, though. To determine if you should prioritize your mortgage debt, youll need to consider both the pros and the cons of paying off your mortgage. Is it better to pay on your mortgage now to save on fees later, or to invest your money instead?

To help, take a read of these scenarios.

You Might Want To Pay Off Your Mortgage Early If

- Youre trying to reduce your baseline expenses: If your monthly mortgage payment represents a substantial chunk of your expenses, youll be able to live on a lot less once the payment goes away. This can be particularly helpful if you have a limited income.

- You want to save on interest payments: Depending on a home loans size and term, the interest can cost tens of thousands of dollars over the long haul. Paying off your mortgage early frees up that future money for other uses. While its true you may lose the tax deduction on mortgage interest, you may still save a considerable amount on servicing the debt. Youll have to reckon with a decreasing deduction anyway, as more of each monthly payment applies to the principal.

- Your mortgage rate is higher than the rate of risk-free returns: Paying off a debt that charges interest can be like earning a risk-free return equivalent to that interest rate. Compare your mortgage rate to the after-tax rate of return on a low-risk investment with a similar termsuch as a high-quality, tax-free municipal bond issued by your home state. While mortgage rates are currently low, theyre still higher than interest rates on most types of bondsincluding municipal bonds. In this situation, youd be better off paying down the mortgage.

- You prioritize peace of mind: Paying off a mortgage can create one less worry and increase flexibility in retirement.

You May Like: Is A 5 Mortgage Rate Good

Alternatives To Prepaying Your Mortgage

If youre not sure if you should pay your mortgage off early, consider these other options to maximize your dollars:

- Refinance your mortgage get a lower interest rate and possibly reduce your monthly payment amount.

- Fund your childs education by contributing to an education savings plan.

- Build an emergency fund.

- Pay off high-interest credit cards, personal loans or student loan debt to save a bundle in interest.

Start Smart And Maximize Your Down Payment

While its possible to get away with only putting 5% to 10% down on a home purchase, the single biggest cost-cutting measure you can do is to maximize your down payment. Not only will you owe less, reducing the overall interest you pay, but youll also avoid having to pay mortgage loan insurance premiumsa fee buyers pay for the privilege of putting less than 20% down on a home. This insurance doesnt protect you, the buyer, but the bank should you default on your mortgage loan.

One good way to maximize your down payment is to use the federal Home Buyers Plan, which lets you withdraw up to $35,000 in a calendar year from your registered retirement savings plan to put toward a home you will live in or build.

Don’t Miss: What Is A Current Mortgage Rate

If You Lose Your Job You Could Be Screwed

Lets drive home again the point that your home is not a liquid asset. There are only two ways to get cash out of the home:

We just discussed how borrowing money against your home will virtually defeat the purpose of paying it off early. But there is an additional complication if you lose your job: its unlikely that you will be able to obtain a loan against your home if youre unemployed.

During a period of prolonged unemployment, your only choice may be to sell your house in the event that cash is especially tight.

Once again, a plan to pay off your mortgage early should come with a companion commitment to building up a large emergency fund that will see you through a time of prolonged unemployment.

Will All Your Cash Be Tied Up In The Mortgage

Before taking a large chunk of your wealth and using it to pay off your mortgage early, dont forget to look at liquidity. Your home is considered a non-liquid asset because it can take months or longer to sell the property and access the capital.

If you start paying down your mortgage too fast, you risk depleting your liquidity, says Amanda Thomas, CFP, a client advisor at Mission Wealth in Santa Barbara, California. The kind of liquidity you have is important, too.

One approach is to have an emergency fund, as well as assets like stocks, mutual funds, U.S. Treasuries, bonds and marketable securities available in a taxable investment account. That way, in addition to having money tied up in tax-advantaged retirement accounts and your home, you still have some liquid cash or other investments that are easy to convert to cash in a pinch.

Bowen suggests maintaining a cushion that protects you for at least six months before you consider using a large portion of your liquidity to retire your mortgage early.

You May Like: How Long Can I Lock In A Mortgage Rate

Pros And Cons Of Paying Off A Mortgage Early

| Pros | |

|---|---|

|

You’ll pay less in interest over time You can reduce your long-term foreclosure risk You can free up more income for other goals |

You’ll take money away from other goals You could strain your monthly budget Your credit score can be negatively impacted by a closed account You’ll lose the ability to deduct interest payments at tax time |

Paying Off The Mortgage Virtually Eliminates Foreclosure Risk

Anytime you have a mortgage, there is a possibility that it will be foreclosed in bad economic times, as happened in the 2009-09 housing crisis, and this is a threat to many amid the Coronavirus pandemic.

People without mortgages rarely lose their homes to foreclosure, but it happens. Usually, it’s because they lose their homes for relatively small amounts of unpaid back taxes or other liens.

Recommended Reading: What’s Refinancing A Mortgage

What Are Your Available Refinancing Options

If you opt to refinance, finding the strategy that’s best for you is essential. Compare different mortgage companies‘ refinance product offerings.

Remember that one refinance option can be more appropriate for a specific circumstance than another, such as accessing your home equity. Determining your objectives is crucial before continuing with the refinancing procedure for this reason.

Some of the most popular refinancing alternatives are shown below.