Tips That Can Help Raise Your Credit Scores

Because , building credit takes time. Depending on your individual situation, there may be ways to raise your scores quickly like paying down all your debt in a very short span of time. But if youre starting out with bad credit, even a drastic measure like that may not have the immediate effect youre looking for. No matter what, the most impactful thing you can do for your credit is to create some consistent habits. Here are some tips that can help you raise your credit scores over time.

How To Increase The Value Of Your House Through Renovations

While the housing market may have recently embarked on a period of decline, this is largely short-term in nature and should not completely distract from the fact that the average UK property is now valued at £296,422.

In fact, you may decide to cash in on the value of your home by renovating it and optimising its resale value, although this can be a tricky and challenging pastime that requires a considerable investment.

In this post, well look at the most accessible renovation from the perspective of homeowners, while asking why improving your property represents such a solid investment in the current climate.

Getting Started Why Increase Your Homes Value?

This may sound like an obvious question, but it should be noted that increasing the value of your property requires a significant financial investment.

At the same time, the UK has now entered a technical recession, which is projected to last through 2023 by the Bank of England . This will create a period of negative growth and continue to drag down house prices, potentially lowering values at a time when youre preparing to sell.

So, while selling your home is a good way to leverage value from your most valuable asset when done correctly, it can also be a loss-making exercise if youre not careful.

How to Successfully Improve the Value of Your Home

What Is A Mortgage

A mortgage is a type of long-term loan from a mortgage provider a bank or building society that enables you to buy a property. Its a secured loan for a set amount of money, and your monthly mortgage payment includes added interest at either a fixed rate, or a variable rate. Your mortgage lender has the right to take back and sell the property if you fail to maintain your monthly payments.

Mortgage loans are also used to borrow money against the value of a home you already own , or to purchase a buy-to-let property, or land. The average mortgage term for first-time buyers is for 25 years. There are two main types of mortgage: repayment mortgages are by far the most popular, while interest mortgages allow you to pay interest only you need to pay off the full balance at the end of your mortgage term.

Your mortgage interest rate is the rate of interest you will be charged on your loan, and this is added to your monthly payments. Your mortgage rate is always linked to whats known as the Bank of England base rate. With a variable rate mortgage, the rate generally rises and falls in line with the Bank of England base rate, while a fixed-rate mortgage guarantees the same rate for a set period.

A tracker mortgage has a variable rate that follows the Bank of England base rate exactly. Discount mortgages offer a rate of around one or two percent less than the lender’s standard variable rate, for a set period.

Don’t Miss: What Is Mortgage Insurance Based On

How To Raise Your Credit Score By 100 Points In 45 Days

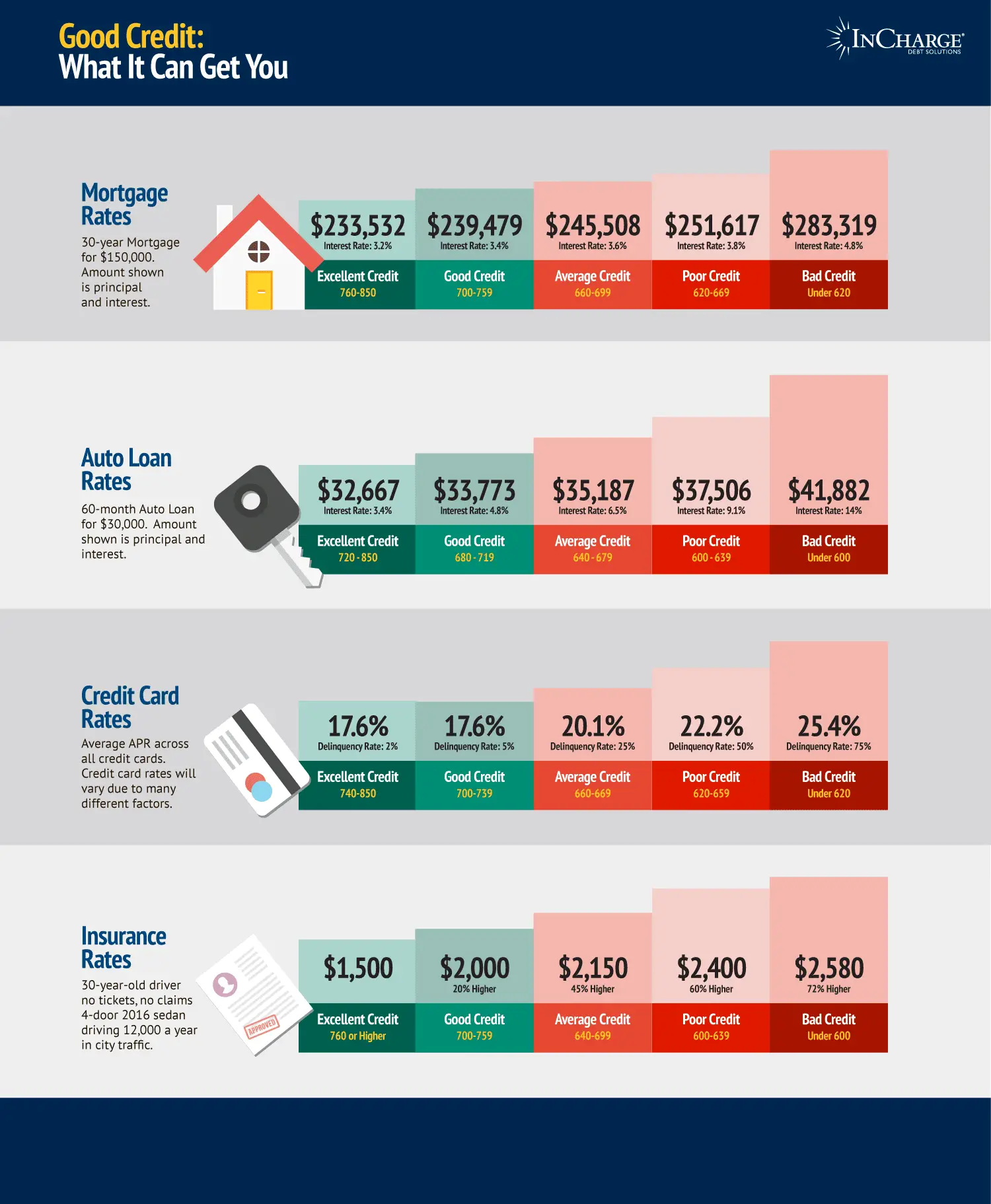

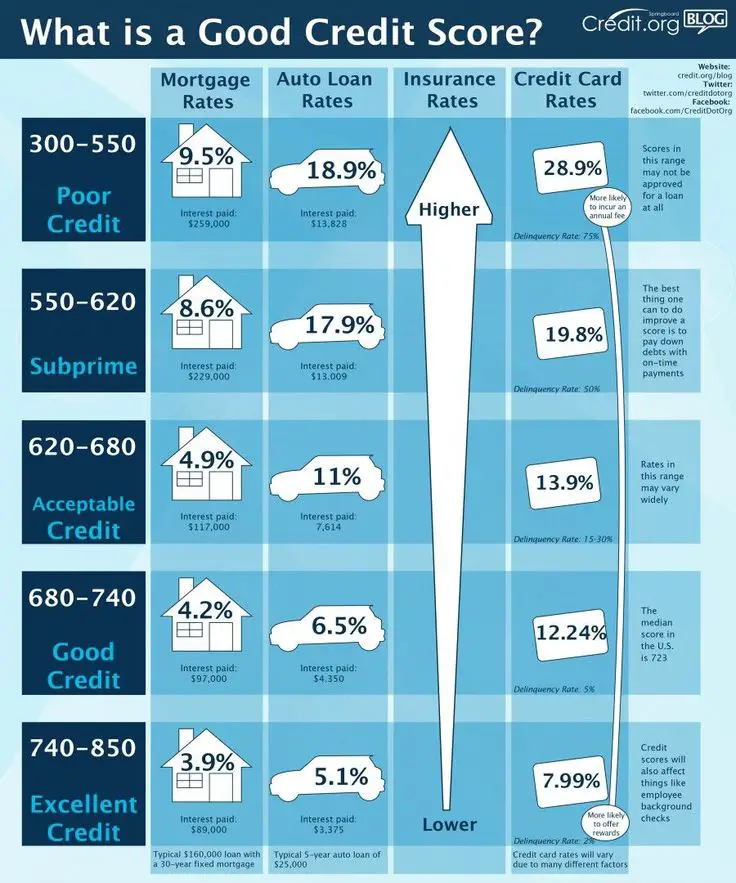

Insurance carriers use credit scores as part of their calculations to determine the level of risk you would pose to them as an insured. They have found a direct correlation between credit scores and claim activity. Knowing that, it’s important to keep your credit scores in good shape so that your insurance premiums stay in line.

How To Repair Your Credit And Improve Your Fico Scores

You can improve your FICO Scores by first fixing errors in your credit history and then following these guidelines to maintain a consistent and good credit history. Repairing bad credit or building credit for the first time takes patience and discipline. There is no quick way to fix a credit score. In fact, quick-fix efforts are the most likely to backfire, so beware of any advice that claims to improve your credit score fast.

The best advice for rebuilding credit is to manage it responsibly over time. If you haven’t done that, then you’ll need to repair your credit history before you see your credit score improve. The following steps will help you with that.

You May Like: How To Report Mortgage Payments To Credit Bureau

Bury Delinquencies With Timely Payments

Late payments can stay on your credit history for seven years, but they’re most damaging when they first occur. If you have a recent late paymentor you’ve just paid off some delinquenciestry to wait at least six months before applying for a mortgage.

This six-month period will allow the older delinquency to fall further down your record and look less damaging. Meanwhile, six months of on-time payments can help your credit score build back up again.

Build Credit With A Credit Card

If you follow the other advice on this list, you can actually use a credit card to build credit. How? Use a credit card to pay for your regular expenses, such as rent/mortgage or car payments. Setting up autopay ensures that you make these payments on time.

As long as you stay on top of your credit card balance, this data will add to your positive payment history, which can raise your credit score and also help mitigate late payments and other financial blemishes. There’s no limit to how much this can boost your credit, though this method is the slowest and is unlikely to give you a 40-point boost in only a month or two.

Read Also: How To Get A Job In Mortgage Lending

Check Your Credit Reports

When you apply for a home loan, the mortgage lender will look for three main things. The first is that youand your spouse if you apply jointlyhave a steady income. The next consideration will be how much of a down payment you can make. The final piece is whether you have a solid .

Your credit history lets lenders know what sort of borrowing you’ve done and whether you’ve repaid your debts on time. It also tells them whether you’ve had any events such as a foreclosure or bankruptcy.

Checking your credit report will let you see what the lenders see. You’ll be able to find out whether theres anything thats hurting your credit.

To check your credit report, request reports from the three credit bureaus: Experian, TransUnion, and Equifax. Since you don’t know which credit reporting agency your bank will use to evaluate your credit history, you should get a report from all three.

How Quickly Can You Improve Your Fico Score

If all you need is error correction, you may see your FICO increase in a matter of days. However, there is no guarantee that correcting errors will make your score go up.

Paying down significant amounts of debt say, dropping your credit utilization rate from 80% to 20% can also bump your score up rapidly.

But if your credit report is littered with late payments collections or other serious problems, Gardner says it can take up to 12 months to raise your score. You must first demonstrate a consistent payment history.

Don’t Miss: Is It Good To Pay Off Mortgage Early

Check For Errors On Your Credit Report

One of the fastest ways to improve your credit score is to remove errors on your credit report. These errors can negatively impact your credit score, which means that correcting them can give your score a much-needed boost.

You are entitled to a free credit report once a year from the three major credit bureaus:

Some third-party providers offer credit monitoring, which alerts you to suspicious activity and lets you respond immediately to fraudulent charges.

Monitoring addresses the problem directly, but it can still take some time before the error completely disappears from your credit history. Checking your credit report regularly can help you identify these issues rapidly and protect your record from errors.

According to a report from the Federal Trade Commission , nearly 1 out of 100 of consumers had an error that cost them 25 points or more on their credit report. But if you dispute a large error, you could improve your score by as much as 100 points, depending on how low your score was prior to the dispute.

What Credit Score Do You Need To Buy A House In 2021

A lot of first-time home buyers worry that their credit scores are too low to buy a home. First, know that whether your credit score is good or bad is subjective and wont affect your home-buying. Second, mortgage lenders are bound by specific rules which determine what credit scores you need to buy a house, and those rules vary by your loan type.

Conventional loans are the most common loan type. On the credit score scale, which ranges from 350-850, conventional loans require a credit score of at least 620. Other loan types allow for lower credit score minimums, and some mortgage programs have no credit score requirement whatsoever.

Read on for details by loan type, or jump to learn more about your credit score:

Recommended Reading: How To Get Approved For A Higher Mortgage

How Can You Quickly Improve Your Credit Score

Improving credit scores can take time and you likely won’t see a huge increase overnight. However, you can potentially speed up the process by having our revolving credit as much as possible to lower your credit utilization percentage inaccurate things removed , or being added as an to someone else’s old account with perfect payment history, ideally with a low utilization rate. Ideally, this is done by a friend or relative, and they do not even have to give you the card.

Be wary of that advertise instant credit repair or anything else that seems too good to be true.

Have A Mix Of Credit And Loan Account Types

A mix of Credit Accounts = 10% of your FICO Score

10% of your credit score is made up of the mix of account types you have. If all you have are credit cards, your credit rating will be lower than if you had a deathly mix of credit.

Auto loans, mortgage loans, credit cards, store cards, personal loans. Its good to have a few different types of credit and loan accounts to really maximize your credit score.

Don’t Miss: What Is A Bad Mortgage Rate

Find A Mortgage Broker

Once you’ve benchmarked a good rate using an online calculator, you need to find out if a qualified, independent mortgage broker can beat it. Their job is to scour the market to find you a good deal and they know about different lenders’ criteria. They can also advise you on any home buying schemes that you might be eligible for.

However, remember that some mortgages are only available directly from lenders, so a broker wont be able to highlight those. Even for first-time buyers, the trick is to become knowledgeable yourself. Keep your eyes on the wider picture by looking at individual lenders and checking current deals, using an online comparison website.

Its important to find a mortgage broker you’re comfortable with on a personal level. Your estate agent might recommend one, but youre not obliged to choose them. You also need to be aware of the hard sell watch out if your broker is pushing you to buy MPPI , bundled buildings / contents insurance, or life cover. Youll get a better deal elsewhere. For a more detailed look at why it can be a good idea to go with a broker, you can take a look at this article from onlinemortgageadvisor.co.uk.

Why Your Credit Score Impacts Your Mortgage Rate

Your credit score reflects your past credit usage, which lenders use to measure how responsible you are with credit. It speaks to your past payment and debt management habits, and it gives lenders an idea of what they can expect if they loan you money to buy a home.

As such, credit scores directly influence what mortgage rate a lender offers you. Higher credit scores will usually mean a lower interest rate , while lower scores will usually receive higher rates.

Learn More: Comparing Credit Score Ranges

Read Also: Are There Zero Down Mortgages

Be Careful About Applying For Credit

Every time you apply for credit whether thats a credit card, a mobile phone contract, or you want to pay monthly for your car insurance, for example the company will search your credit report before making a decision. They will do whats known as a hard search, which means the search is recorded on your file.

Too many of these searches in a short period of time makes you look desperate for credit, and can lower your credit score. If possible, its best to try to avoid making any applications for credit as much as six months before you think youll be applying for a mortgage.

Above 760 The Benefits Of A Higher Score Are Diminishing

As you read this guide and begin to think about the changes you want to make to improve your credit, its important to remember that it can take time.

Lowering your utilization drastically can quickly improve your credit, but dont get discouraged if you dont see a change overnight. Its also important to remember that you dont need to have a perfect credit score of 850 in order to receive the perks of a high score. Many lenders consider a score of 760 to be perfect enoughmeaning having a perfect 850 wont get you a better rate.

Finally, if you dont have credit and have been rejected for new cards, it can seem impossible to start building credit. If thats the case for you, youll want to look into applying for a secured card. This is an entry level card that requires a deposit as collateral.

You May Like: How Do You Switch Mortgage Companies

Reduce Your Use Of Available Credit

Since 30% of your score is calculated based on your credit utilization ratio meaning how much of your available credit youre using at a given time reducing your credit card balance is an easy way to boost your score. In fact, ideally you should be paying off your balance in full every month.

Try to keep your total credit utilization ratio below 30% to avoid hurting your credit score. To improve your score, keep it under 7%. Heres an example: If the combined credit limit of all of your credit cards is $5,000, you should have a balance of less than $1,500 at all times. To boost your score, youll want a balance of less than $350.

If you have multiple credit cards, as many people do, credit monitoring tools can keep track of your utilization ratio for you.

Another way to improve your ratio is by boosting your credit limit. Ask your credit card company for an increase online or by phone, but be sure your credit score wont be affected.

Pitfalls To Avoid When Working On Your Credit Scores

When it comes to building credit, its easy to get overly focused on ways to raise your credit scores fast. The truth is that building credit takes time. So take a step back and make sure your strategy doesnt do more harm than good.

Here are a few donts to keep in mind.

- Dont apply for a bunch of new credit cards just because you want to increase your credit utilization. Even though this might help lower your credit utilization ratio, it could also make you look like a risky borrower thanks to the new hard inquiries on your reports.

- For the same reason, dont take out a loan just to improve your credit mix. Only apply for a new loan if you actually need it.

- Dont carry a balance on your credit card just so you can build credit. Carrying a balance can lead to unnecessary interest charges, and it might actually hold your scores down by increasing your credit utilization ratio.

- Dont cancel your credit card after you pay it off unless you have a good reason to do so. Closing your credit card will hurt your length of credit history, so its better to leave it open, even if youre not using it anymore. Of course, if having a card tempts you to spend more, or it comes with an expensive annual fee, you might want to rethink this conventional wisdom.

Read Also: How Much Mortgage Can I Afford With 120k Salary

What Lenders Are Looking For

Lenders will typically turn to your credit score to assess what kind of borrower you are. Each of the three credit-reporting agencies uses a formula to calculate your credit score based on the information in your report, and it may vary slightly from agency to agency. However, since you donât have a , you wonât have a .

You may still be able to use the information contained in this formula if you want to apply for a no-credit home loan. That information will give you a clue concerning what mortgage lenders are looking for. The percentages of the components of the credit history that are used in the calculation of a credit score are:

- Payment history: 35%

Donât Miss: How Much Should You Borrow For A Mortgage