Mortgage Lender Vs Bank

Specialized lenders that only do home loans like Rocket Mortgage or Better Mortgage are generally lumped into the bank category.

Theyre direct lenders, just like big banks. However, they dont offer other financial services like credit cards or checking and savings accounts.

These types of lenders typically only do home purchase and refinance loans. They might also offer home equity loans or home equity lines of credit.

Often, though not always, mortgage lenders are less conservative than banks. So they might be more flexible about outsidethebox applicants, like those with lower credit scores or bigger loan amounts.

For instance, New American Funding a mortgage lender allows credit scores as low as 580 for FHA loans, whereas Wells Fargo a big bank requires at least 600.

Another specialized mortgage company, Caliber Home Loans, can do jumbo loans with as little as 5% down payment. Youd be hardpressed to find a big bank that would go so low.

When it comes to rates, theres no hardandfast rule about mortgage lenders vs. banks.

The rate youre offered has more to do with your qualifications credit score, down payment, loan amount than the specific lender. So make sure you shop around with a few different companies to see which can offer you the best deal.

Are Banks My Only Option For A Second Mortgage

Within Canada, for a variety of reasons, citizens are taking full advantage of second mortgages. Whether combining credit cards, paying for home repairs, or buying property, funds from a second mortgage improve a borrower`s situation.

The key question for many borrowers is, of course, who will lend me the money? A hundred, or even fifty, years ago the potential answers to that question were few. Banks had the majority of the loans with credit unions holding a small share of the lending business.

In 2020, there are three categorizations of lenders. The A-lenders are the traditional lending institutions, banks and credit unions. Next are the B-lenders, who despite their B status, often offer a service on a par with the A-class. B-lenders account for a smaller share of the market but can offer better rates and have a lower threshold for entry. They can work with borrowers rejected by the A-class.

Finally, there are private lenders who specialize in bespoke lending arrangements which may carry more risk. These loans can be highly specialized and are used when a different kind of thinking is needed.

Five Benefits Of A Credit Union Mortgage

When it comes to mortgages, credit unions offer several distinct advantages over big banks and other lending institutions. At KeyPoint Credit Union, our home loans meet the needs of our members. Our goal is to help you purchase the home you love, at a rate and monthly payment amount thats comfortable. Here are five primary differences youll find between our mortgages and the competition:

1. Lower Rates

A credit union is owned by its members. If youre not already a member, you become a member when you get a mortgage loan through KeyPoint. Credit unions are not-for-profit, which means that we can use part of our profits to offer lower mortgage rates and fees to our members. According to the NCUAs the average interest rate for adjustable and 15-year fixed mortgages was lower at credit unions versus banks. Visit KeyPoints handy online mortgage estimator to view our current rates and see how they compare.

2. More Flexibility

3. Options for First-Time Buyers

4. Local Service

Many bank mortgages are serviced out-of-state, or later sold to other financial institutions. In contrast, credit unions are often community based and locally serviced. For example, KeyPoint caters to members in the Bay Area and Silicon Valley, and throughout California. Members receive personalized service at any of our local branches, online or by calling our toll-free number.

5. Youre Not Just a Number

You May Like: What Would My Mortgage Payment Be On 150 000

A Short History Of Ontario Public Employees Fcu

Since its inception in 1959 the Ontario Public Employees Federal Credit Union has been serving its members in the ONTARIO, California area with exceptional financial products. You can find their current interest rates on used car loans, new car loans, 1st mortgage loans and interest rates on both fixed and adjustable mortgages here on these pages. Currently led by Charlene Jackson, the Ontario Public Employees FCU has grown its membership to over 2,156 with assets of more than $20,540,794. They have a main office and 1 branch offices. Please see the credit unions website or contact them by phone at 984-8781 or email them at [email protected] to get exact details . There are many other credit unions in the local area. See them all here. .

What Are The Drawbacks Of Credit Union Mortgages

Some of the drawbacks to consider before applying for a mortgage at your local credit union:

- You can only apply at a credit union you are a member in it.

- There are limits to the amount you can borrow up to 320,000 for Dublin, Cork, Kildare, Galway, Louth and Meath and 250,000 for everywhere else. With the house prices at the moment, this amount is very restrictive.

Don’t Miss: How To File A Complaint Against A Mortgage Lender

Do Credit Unions Refinance Mortgages

Refinancing your mortgage is an option most homeowners will think about at some point. As to whether credit unions refinance mortgages, the answer is yes. Whether its worth it depends on a few factors.

First, as you approach the process, you should know your credit score. Like any loan, refinancing a mortgage is going to mean taking out a new loan, and your credit score will play a direct role in the interest rate youre offered.

Second, consider the reasons you might refinance. Are you looking to lower the interest rate on your current mortgage? Are you hoping to tap into some built-up equity? Will you benefit in the long run by refinancing and getting a shorter mortgage term? When you know what your goals are in making a choice like refinancing, youll be more clearly able to communicate with lending associates at a community credit union or other financial institution. Answering these questions will also help you reflect on how worth it the process is for you.

Pros Of Credit Unions

1. Higher Interest Rates

generally pay interest rates more than big banks when it comes to savings and other kinds of deposits. However, online banks tend to pay more interest rates compared to credit unions.

As a plus, unions sometimes do pay interest on a chequing account balance

2. Lower Fees

When compared to the big banks, service account maintenance and fees are cheaper. Credit unions offer its members a no-fee chequing account including no-minimum balance banking.

Some Canadian , fees are quite competitive with their big bank rivals.

3. Better Rates

With having the interest of its members at heart, better rates are always offered. Mortgage, credit, and personal loans are offered to its members at competitive rates.

4. Customer Service

are known to provide excellent one-on-one customer services over their competition .

In fact, in the year 2019, Canadas were awarded the top honours in the Ipsos Financial Service Excellence Awards for Customer service. Canadas have received this award for 15 years in a row.

5. Community Development

offer sponsorship to different programs and projects within their local community. These supports are rendered to also indirectly assist their members who reside in the community.

Many of the are caught endorsing actions that will bring about development and sustainability towards its local community.

You May Like: 70000 Mortgage Over 30 Years

Also Check: What Does A Mortgage Attorney Do

How Much A Reverse Mortgage Can Cost

Costs associated with a reverse mortgage may include:

- a higher interest rate than for a traditional mortgage

- a home appraisal fee

- a prepayment penalty if you pay off your reverse mortgage before it is due

- legal fees for closing costs or independent legal advice

The costs will vary depending on your lender. Some fees may be added to the balance of your loan. You may have to pay for others up front.

British Columbia Mortgage Rates

British Columbia is not only internationally renowned for its natural beauty, but also home to several of Canadas largest and most expensive real estate markets.

Mortgage shoppers in British Columbia are able to take advantage of the second-most competitive mortgage market in the countryafter Ontarioand as a result, can often find among the best mortgage rates in Canada.

There are more mortgage brokers per capita competing for business in the province, which also boasts a strong credit union presence. Both of these market segments compete head-to-head with the big banks, stoking competition that helps drive down mortgage rates.

Each individual credit union member is an owner in equal part of the institution.

- Live in a specific geographical area

- Work in a specific field

- Work for a specific employer

- Belong to certain groups

- Have a family member whos already a credit union member

You must hold a minimum number of membership shares of the credit union upon joining, typically for a nominal deposit of somewhere between $5 and $30.

The result is a cooperative structure with a strong framework to help them accomplish their financial goals. For example, member deposits can be loaned out to another member as a home loan, providing the borrower with financial flexibility and a good return to the depositor and the credit union.

Also Check: Can A Cosigner Be Removed From A Mortgage

How Much Money Can I Get From My Home

The amount you can borrow with a reverse mortgage depends on several factors, including your age, the type of reverse mortgage you select, the appraised value of your home, and current interest rates. You may be able to choose among several payment options, such as a single lump sum disbursement, fixed monthly cash advances for a specified time frame, a line of credit that lets you draw down the loan proceeds at any time in amounts you choose, or a combination of monthly payments and a line of credit.

Are The Rates Better

Of utmost concern for most borrowers is the interest rate. Its what determines how much the loan costs you aside from the closing costs, so it makes sense. You want the lowest interest rate possible. Chances are that you can get a lower interest rate from a credit union than you could a traditional mortgage lender or bank and thats for one reason credit unions are non-profit.

Banks and mortgage lenders are in operation to make a profit. They cant just give you the break-even number they have to inflate it so that they make a profit. Without a profit, they probably wouldnt stay in business. Credit unions just need to break-even. They need to reimburse their costs, but thats it they dont care about profit.

Does that mean a credit union always has the lowest rate? It really depends on your situation. If you have a unique situation that would otherwise cause a bank to inflate your rate because of the risk you pose, the credit union probably wins. If its a standard loan without any special issues, the bank or mortgage lender may have a little more wiggle room, making them more competitive.

Don’t Miss: What Is Ltv Mortgage Mean

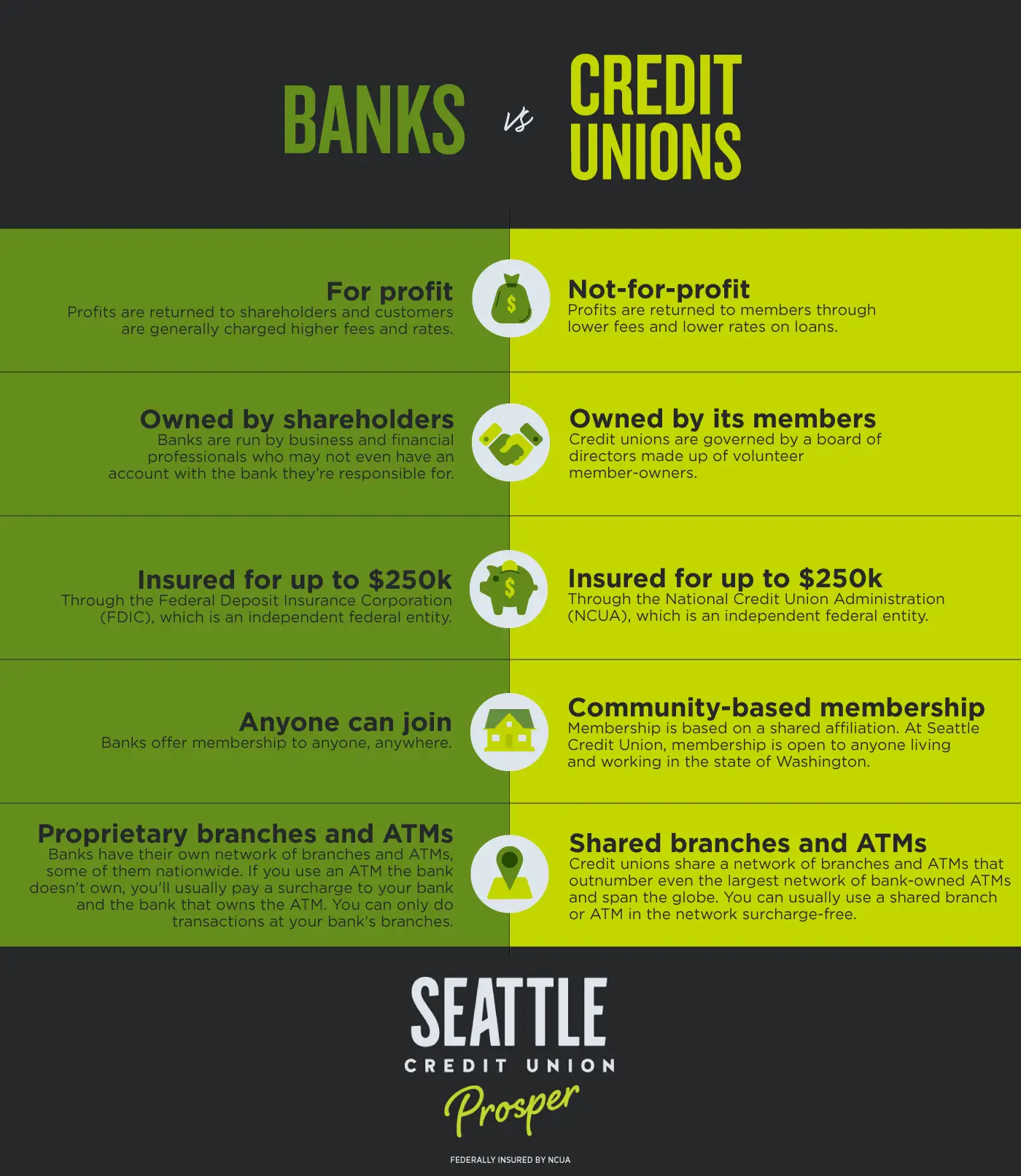

Lets Compare Bank Vs Credit Union

Products of a Bank vs Credit Union

A similar suite of basic products is offered by banks and credit unions. For eg, almost all banks or credit unions offer basic checking and savings accounts, and in regards to some products they differ.

A wider range of saving accounts is more likely being offered by credit unions. Credit unions also commonly offer savings accounts for kids and teens.

On the other hand, Banks are more likely to offer more specialized high-end products like wealth management, investments, or business accounts.

Getting Mortgage from Bank vs Credit Union

A credit union guarantees lower fees and interest rates be it mortgages, credit cards, personal loans, or other financial products Credit unions often offer lower interest rates and compared to the average bank.

These rates do not hinder your financial flexibility.The same applies to fees, which are comparatively reasonable because they dont charge you with appraisal, origination, processing, tax service, and underwriting fees.

As per the National Credit Union Administration, the median credit score to secure a mortgage with a credit union was 753, which is lower than the score for banks.

This means that you dont need the perfect credit score to secure a mortgage from the credit union.

Interest Rates of Bank vs Credit Union

Because this will generate more profits for its owners banks often have poor interest rates. This is not necessarily always the case.

Safety with Bank vs Credit Union

The Credit Union Mortgage Process

The reason why you might prefer working with a credit union to secure your mortgage starts before a mortgage rate is even determined. It often begins with the process.

If youre currently a member of a credit union, they have access to your financial data, so theres often less information that needs to be provided during the application. This frequently leads to a more manageable and speedier approval process.

Also, the high-quality customer service credit unions are known for having what you need to make it through a time that might be a bit stressful. While buying a home can be exciting, the process can sometimes be time-consuming and nerve-wracking, so working with people who strive to make it as smooth as possible for you makes everything better.

Read Also: Why Get A Reverse Mortgage

What Does It Mean To Refinance A Mortgage

If your mortgage is already held through your local credit union, all it takes to get the process started is to call them and initiate the process. Refinancing basically is a way for people to take out another loan on their home, where the second loan supersedes the initial loan.

Its done for a handful of reasons, but most people are looking to lower their monthly payments by getting a new loan with a better interest rate. Sometimes, people want to be able to pay off the loan more quickly and opt to shorten the term of their home loan to a 15-year instead of the initial 30-year term. Some people want to take advantage of some of the equity or value that they have built into their homes. This may be so they have some money on hand for a larger purchase or for covering the costs of renovations, refurbishing parts of the home, or other reasons.

Its important to note that when refinancing, you dont have to work with the current holder/servicer of your mortgage. Its possible to refinance with another lender who is licensed to do so in your state.

Ppp Forgiveness Application Deadline

Congress passed The Economic Aid Act which changed the deferment period from 6 months post covered period to 10 months post covered period. For example, if your covered period ended June 30, 2021, under the new guidelines the earliest your first loan payment wouldnt be due until April 2022, and you have until then to request forgiveness. Please use the following calculation to help you identify when your forgiveness will be due:

- PPP borrowers may select a covered period anywhere from 8 weeks to 24 weeks.

- RCU is automatically calculating your loan due date based on a 24-week covered period, if you intend on using a shorter covered period please inform us immediately as this will impact your due date.

- Your correct deadline will be reflected in your online banking account.

If all or part of your PPP loan is not forgiven, your first loan payment will be due the first of the following month after a decision is made by the SBA.

You May Like: How Soon Will I Pay Off My Mortgage Calculator

Top Credit Unions In British Columbia

As mentioned earlier, British Columbia is home to a large and healthy contingent of credit unions operating in the province. In fact, three of the five biggest cooperative lenders in the country lend in British Columbia.

Some of the top British Columbia credit unions include:

- Coast Capital Credit Union

- Prospera Credit Union

- Salmon Arm Savings Credit Union

Some of the lowest mortgage rates in British Columbia can often be found from credit unions, particularly through their mortgage promos during the busy spring homebuying season.

If youre shopping for a home, dont rule out a mortgage from one of British Columbias top credit unions. If youre able to grab a great mortgage deal, it could be worth making the switch from your big bank or existing financial institution.

The Education Of The Retiree

Perhaps the most difficult challenge facing the credit union in meeting the retirement needs of its members is educating them about pension plans. I have found that the best way to achieve this is to divide the educational process into two phases. Phase 1 is the provision of self-help materials that allow the retiree to learn how a pension plan works in general and what their own plan might look like. In Phase 2, the retiree, in consultation with a credit union advisor, develops a detailed plan tailored to the individualâs needs, abilities and preferences.

Donât Miss: How Does 10 Year Treasury Affect Mortgage Rates

Recommended Reading: How Much Mortgage Can You Afford Rule Of Thumb

What Is A Mortgage Lender

A mortgage lender is a financial institution or mortgage bank that offers and underwrites home loans. Mortgage lenders set the terms, interest rate, repayment schedule and other key aspects of your mortgage. Before you can get a loan, mortgage lenders will verify your creditworthiness and ability to repay a loan.

Mortgage lenders are one of the most important parties involved in the mortgage process. They are typically the first party that a prospective buyer will work with.