How Is The 1003 Form Used

Lenders in the U.S. use the 1003 Form to evaluate potential applicants, including borrowers seeking refinances, construction-to-permanent loans, conventional loans, VA, FHA, and USDA mortgage loans.The new 1003 Form offers benefits to both borrowers and lenders. For borrowers, the 1003 Form is easy to complete and review, making applying for a mortgage simpler. For lenders, the data that is collected is more relevant, reliable, and flexible.Lenders need to use the 1003 Form to ensure their mortgage loans align with Fannie Mae and Freddie Macs rules and guidelines. Fannie Mae and Freddie Mac buy mortgage loans in bulk from lenders, and using this form helps confirm that the loans qualify for resale

About The Uniform Residential Loan Application

Most lenders will ask you to complete Fannie Maes Uniform Residential Loan Application when you want to buy a home with a conventional, VA, FHA, or USDA loan. Lenders will ask you to complete this form for many types of refinances too. The form will ask you to provide information about

- The type of mortgage and terms of the loan you want.

- The property and purpose of the loan .

- Yourself and any co-borrowers on the loan including your employment history, income and expenses, and assets and liabilities.

Form 1003 will ask you to make certain declarations, such as whether or not you are a U.S. citizen. You will also be asked optional questions about your race, ethnicity, and sex the government uses to monitor compliance with fair housing and other laws. You are not required to answer these questions, you can choose not to answer them, and not answering these questions will not affect your eligibility to have your mortgage application approved.

You and any co-borrowers on the loan will be asked to sign the mortgage application to affirm the information on the form is true and correct to the best of your knowledge.

Reviewing this form in advance can help you understand what information is required before you begin the mortgage application process. For an example of a Uniform Residential Loan Application for a single family home, see the Fannie Mae website.

Section Vi: Assets And Liabilities

This section details your current financial health, or net worth. The two factors that need to be considered are how much you own and how much you owe .

In order to paint a complete picture of your financial health, you will have to provide information regarding your assets, such as:

- Checking and savings account balances

- Retirement accounts

- Other property you may own

Next, you will be responsible for listing information about your liabilities. This includes any monthly debt payments resulting from:

- Child support or alimony

Also Check: How Long Does It Take To Apply For Mortgage

The Nine Sections Of The New 1003 Application Form

The new 1003 form was created to make it easier for borrowers to apply for a home loan. It also gives lenders more information to help them make a more accurate approval decision. Borrowers used to the old Uniform Residential Loan Application will notice one big change right away: no more Roman numerals. Sections I to X are replaced with Sections 1 to 4, with multiple subsections in between.

Heres a breakdown of what each section of the 1003 asks for :

Using The 1003 Mortgage Application As A Lead Generation Tool

In todays technology-driven environment, chances are your lending business has a wide array of online marketing avenues, such as websites and social media profiles. When a borrower visits one of these marketing avenues, the goal is to capture their information to follow up on the potential lead. While basic contact forms are one option, they often slow down the mortgage process, requiring potential borrowers to wait to hear back from you and then resubmit information further down the road.

Instead of the standard contact form, you can benefit from integrating a short-form or full 1003 mortgage application directly into your site, allowing potential borrowers to fill out the information immediately. But what happens when they fill out the form?

Recommended Reading: How To Get Approved For A Higher Mortgage

Section : Financial Information Assets And Liabilities

Youll detail bank account balances, assets you own and money you owe, along with the related monthly payments, in this section. Lenders use this section to determine if you have enough money for the down payment and closing costs, and enough income to cover the new mortgage payment plus any debt you already pay.

Section 2a is where youll list cash-value assets such as:

- Checking, savings and money market accounts

- Retirement accounts, such as 401ks

Section 2b covers assets that you plan to convert to cash or use toward your purchase, such as:

- Profit from the sale of a current home

- Funds you received from the sale of an asset, such as a car

- Earnest money you pay as part of an accepted purchase contract

- Relocation funds from your employer

- Special down payment options, like sweat equity

Section 2c details standard debts that usually appear on your credit report, including:

- Installment financing, such as car or student loans

Section 2d breaks out any other monthly debt obligations like:

- Alimony or child support you pay

- Job-related expenses

What Information Is Needed For A Mortgage Application

There is no reason to be daunted by applying for a mortgage. Your principal job is to gather the information together that the mortgage company will need in order to process your loan application. The information is pretty straightforward, primarily involving your income, assets and liabilities.

Dont Miss: Does Pre Approval For Mortgage Affect Credit

Also Check: How Much Mortgage Can I Afford For 2000 Per Month

Documents Youll Need To Apply For A Mortgage

- Social Security numbers, or individual taxpayer identification numbers for all borrowers.

- Home addresses for at least the past two years.

- Your most recent paystubs covering at least 30 days of income

- Your most recent W-2s , or if self-employed, 1099s or K1s

- Your most recent Federal Tax Returns , including all pages and all schedules. Note: if you are self-employed, you may need to provide both your personal and business tax returns.

- Two to three-months of statements for each of your accounts: Checking, savings, IRA, 401K, credit cards, etc.

- Information on other consumer debt accounts such as car loans or leases and student loans

- Social Security award letter or pension award letter, if applicable

- Year-to-date profit and loss statements and/or balance sheets, if self-employed

- Gift letter if you are using money from parents or relatives to help cover down payment or closing costs

- Landlords name, address & phone number, if you rent

- May also need to show rent/utility payments to document payment history if needed

Depending on the type of home loan you are applying for, and your individual circumstances, you may also need:

Who Uses Form 1003

Most U.S. mortgage lenders use either Form 1003 or Form 65 for evaluating potential applicants. If you’re applying for a purchase loan, refinance, or construction-to-permanent loan, you will likely use this form. You’ll also use it for FHA, conventional, USDA, and VA loans.

Fannie Mae and Freddie Mac purchase mortgage loans in bulk. They either hold these loans as their own or resell them to investors as part of mortgage-backed securities. Either way, the loans they purchase must comply with all internal guidelines. Lenders can ensure their loans align with Fannie and Freddies rules by using Forms 1003 or 65. This will make the loans eligible for resale by these government-sponsored entities.

Read Also: What Is The Current Interest Rate For Interest Only Mortgages

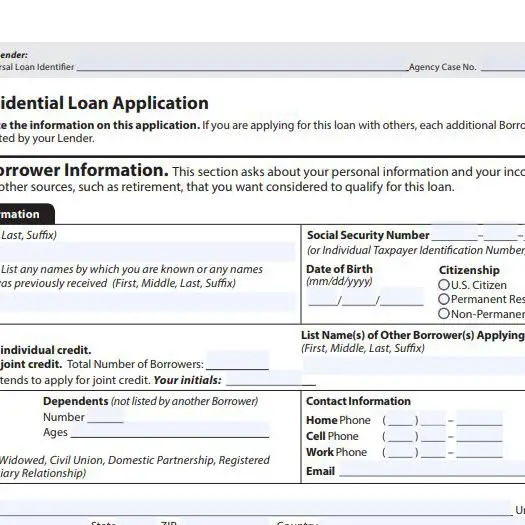

Section : Borrower Information

This section asks for personal information, including employment, income and past addresses.

Section 1a is all about personal details, including:

- Your name, social security number, date of birth and citizenship status

- Whether youre applying by yourself or with someone else

- Your marital status and how many dependents you have

- Contact information including cellphone, work phone and email address

- Your current address and prior address, if youve lived at your current address for fewer than two years

Section 1b and 1c gather employment and income details including:

- Current employer information, including contact numbers and start date

- Details about any self-employment

- Whether youre employed by a family member or party to the mortgage transaction

- Your current and prior monthly income

Section 1d only applies to borrowers with less than two years in their current position.

Section 1e gives you a place to add any other types of income you receive, including:

- Income sources that arent listed on the form

Section V: Monthly Income And Combined Housing Expense

In this section, you will need to detail all forms of income. You’ll use your gross income, which is what you make before taxes and deductions. Make sure to include information regarding bonuses, commissions, freelance or 1099 work, child support, rental property payments, and other forms of income. In addition, you will be expected to enter your current rental or mortgage payment information under the “combined monthly housing expense” category.

As part of this section of your mortgage loan application, most lenders will require you to sign IRS Form 4506-T, which allows them to request a transcript of your tax returns.

Read Also: How Long Do You Have To Have Mortgage Insurance

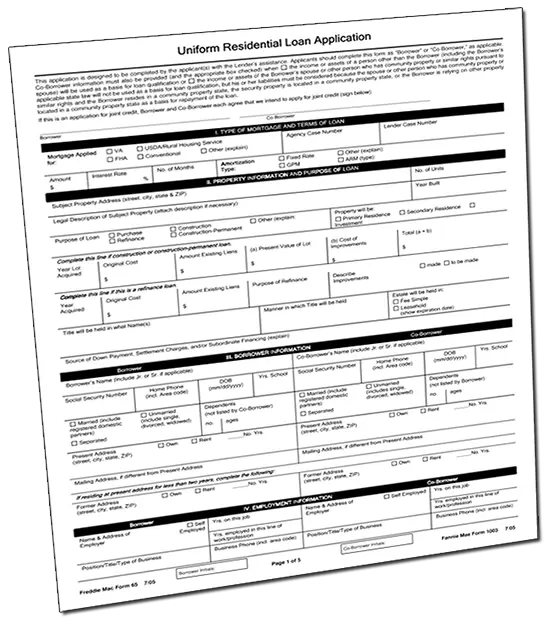

What Is A 1003 Form

You may hear this term used by a mortgage professional when they say, Please sign the 1003 Form, or, Your income is listed on page 2 of the 1003 Form.The 1003 Form is Fannie Maes form number for the Uniform Residential Loan Application . Freddie Mac refers to this as Form 65. The URLA, 1003, and Form 65 are all the same forms and serve as a mortgage loan application. The Uniform Residential Loan Application is currently a multi-page document that collects the essential information for processing your mortgage application. It details the loan terms and information about the borrower, such as income, employment, assets, and expenses. It also requests information that the U.S. government regulates.

Add & Remove Any Field

We offer a completely customizable form configuration tool that will allow you to add and remove any section or fields from your 1003 form. Remove redundant information and unnecessary fields from your form to make it easier for your borrowers to fill out, and increasing the likelihood of them doing so. Weve made it easy for your, so you can make it easy for your borrowers.

Recommended Reading: Can You Use Land As Collateral For A Mortgage

Documents Needed For Your Mortgage Application

Lenders like Freedom Mortgage will also typically ask you to document the information on your mortgage application by providing copies of financial records.

- For income verification, we may ask for copies of W-2 forms from current and previous employers, recent pay stubs, and income tax returns. If you are self-employed, we may ask for copies of your personal and business federal tax returns, copies of 1099 forms, and other financial documents about your business. If your income includes alimony or child support, we might ask for the court order as well as bank statements or other documents that show these payments. Reveal alimony or child support ONLY IF you want it considered in determining your qualification for a loan.

- For debt verification, well want to know all your monthly debt payments for things like car loans, student loans, credit cards, mortgage payments, and other debts. We may ask you for documents that confirm these debt payments.

- For asset verification, we often look at bank, retirement account, and investment account statements. If you are using money given to you by a relative to make your down payment, we may ask you for a gift letter that confirms you are not expected to repay this gift.

- For , we typically get your credit information directly from the credit reporting agencies. Well just need your permission to request this information.

Current Minimum Mortgage Requirements For A Usda Loan

Down payment. Borrowers that meet the USDA income limits can purchase a home with no down payment. Money needed for closing costs can come from your own funds or from a gift.

USDA guarantee fees. The USDA requires two types of guarantee fees instead of mortgage insurance. The fees are charged to offset the costs of the rural loan program to taxpayers. The first is a guarantee fee of 1% of the loan amount and is typically financed. The second is an annual guarantee fee equal to 0.35% of the loan amount, which is divided by 12 and added to the monthly payment.

. Although the USDA doesnt set a minimum score, USDA-approved lenders typically require a minimum credit score of 640.

Employment. USDA borrowers must have 12 months of stable income. If youre self-employed, a two-year history is required.

Income limits. The USDA counts the income of all adult household members to ensure the household income doesnt exceed the program limits in your area. Total household income for a USDA loan must be at or below 115% of the median household in the area youre buying. Use the income eligibility search tool to check on the limits in your state.

DTI ratio. The front-end DTI ratio maximum is 29%, while the back-end DTI ratio maximum is 41%. USDA borrowers with a credit score of 680 or higher may qualify with higher front- and back-end DTI ratios of 32% and 44%, respectively, with proof of steady income and extra cash reserves.

Occupancy. USDA financing is for primary residences only.

Also Check: What Is The Mortgage On A 1.5 Million Dollar House

What Do You Need To Know About Fannie Mae Form 1003

Fannie Mae and its sibling, the Federal Home Loan Mortgage Corp ., or Freddie Mac, are lending enterprises created by U.S. Congress to maintain liquidity in the mortgage market. Form 1003 is the standard form completed by borrowers when applying for a mortgage loan.

When does the 1003 form need to be completed?

Generally, the 1003 form is completed twice during a mortgage transaction: once during the initial application and again at closing to confirm the terms of the loan.

About Your Mortgage Loan Application

The first step when you are applying for a mortgage is to choose a lender like Freedom Mortgage who will help you select the loan thats right for you.

If you are buying a house, youll likely want to wait until your offer as been accepted before you apply for a mortgage. If you are refinancing, you can apply for a new mortgage any time when it makes sense for you. Homeowners often think about refinancing when current interest rates are significantly lower than the rate on the mortgage they have now.

Once you have made your decision, you are ready to start the mortgage application process. This process begins with filling out a Uniform Residential Loan Application with your lender.

Also Check: How Difficult Is It To Refinance A Mortgage

Current Minimum Mortgage Requirements For An Fha Loan

Down payment. FHA loans require a 3.5% down payment with a 580 or higher credit score, and funds can come from employers, close friends, family members or charitable organizations. The down payment requirement jumps to 10% with a credit score of 500 to 579.

Mortgage insurance. FHA borrowers are required to pay two types of FHA mortgage insurance. The first is an upfront mortgage insurance premium of 1.75% of the loan amount, typically financed into the mortgage. The second is the annual mortgage insurance premium that ranges from 0.45% to 1.05% of the loan amount, and is divided by 12 and added to your monthly payment.

. You can have a credit score as low as 500 up to 579 with a 10% down payment. Homebuyers making a minimum 3.5% down payment will need a score of at least 580.

Employment. FHA loan income requirements look at the borrowers stability of income and employment for the past two years. Job-hoppers need to explain changes or gaps in employment.

Income. There are no income limits for FHA loans. However, borrowing power is limited to the FHA maximum loan limit cap of $356,362 in 2021, compared to $548,250 for conventional loans in most parts of the country.

Cash reserves. FHA loan qualifications dont usually require cash reserves unless youre buying a two- to four-unit home, or trying to qualify with a lower credit score.

Occupancy. A one- to four-unit home financed with an FHA loan must be your primary residence for at least the first year after buying it.

Understanding Form : Mortgage Application Basics

When you apply for a mortgage, dozens of documents are involved in the process. From paycheck stubs and previous years tax returns to bank statements and copies of your credit report, theres quite a collection of information youll need to provide to your lender. In addition to that, youll also need to fill out more than a few forms to start and finish the process of obtaining your loan.

One form that youre almost certain to see no matter where you apply for a mortgage is called Form 1003. Its a standard application for getting a home loan, but you might also need to fill it out if youre refinancing an existing loan. If youre planning to start the homebuying or refinancing process soon, take a look at more about Form 1003, including what it is, what its purpose is and how youll fill it out.

Don’t Miss: Should I Use A Mortgage Broker To Refinance

What Information Do Borrowers Need For The 1003 Mortgage Application

Completing form 1003 can be time-consuming, so its important that borrowers know what they will need to provide ahead of time.

Loan seekers should plan to report:

- General borrower information. This might include income, place of work, and personal information.

- Financial information. Borrowers will be asked to list details of their investments, savings, and debts.

- Property information. Here, they will describe the property that they would like to purchase or refinance.

- Loan applicants should detail how they plan to pay for the transaction and other relevant financial data.

- Acknowledgements and agreements. Clients must carefully review the provided information before signing.

- Military service. They should explain any relevant service.

- Borrowers can choose whether to answer some general questions about their identity. If the loan application is taken in person, the mortgage professional will be required to make a best guess answering the demographics questions if the consumer elects not to answer them.

Borrowers should keep in mind that the loan originator information section should be left blank, as it must be filled out by their mortgage professional.