Forbes Advisors Insight On The Housing Market

Predictions indicate that home prices will continue to rise and new home construction will continue to lag behind, putting buyers in tight housing situations for the foreseeable future.

To cut costs, that could mean some buyers would need to move further away from higher-priced cities into more affordable metros. For others, it could mean downsizing, or foregoing amenities or important contingencies like a home inspection. However, be careful about giving up contingencies because it could cost more in the long run if the house has major problems not fixed by the seller upon inspection.

Another important consideration in this market is determining how long you plan to stay in the home. People who are buying their âforever homeâ have less to fear if the market reverses as they can ride the wave of ups and downs. But buyers who plan on moving in a few years are in a riskier position if the market plummets. Thatâs why itâs so important to shop at the outset for a realtor and lender who are experienced housing experts in your market of interest and who you trust to give sound advice.

How Much Of A Mortgage Can I Afford Based On My Salary

The amount of a mortgage you can afford based on your salary often comes down to a rule of thumb. For example, some experts say you should spend no more than 2x to 2.5x your gross annual income on a mortgage . Other rules suggest you shouldn’t spend more than 28-29% of your gross income per month on housing.

Average Total Cost Including Interest Of A Mortgage

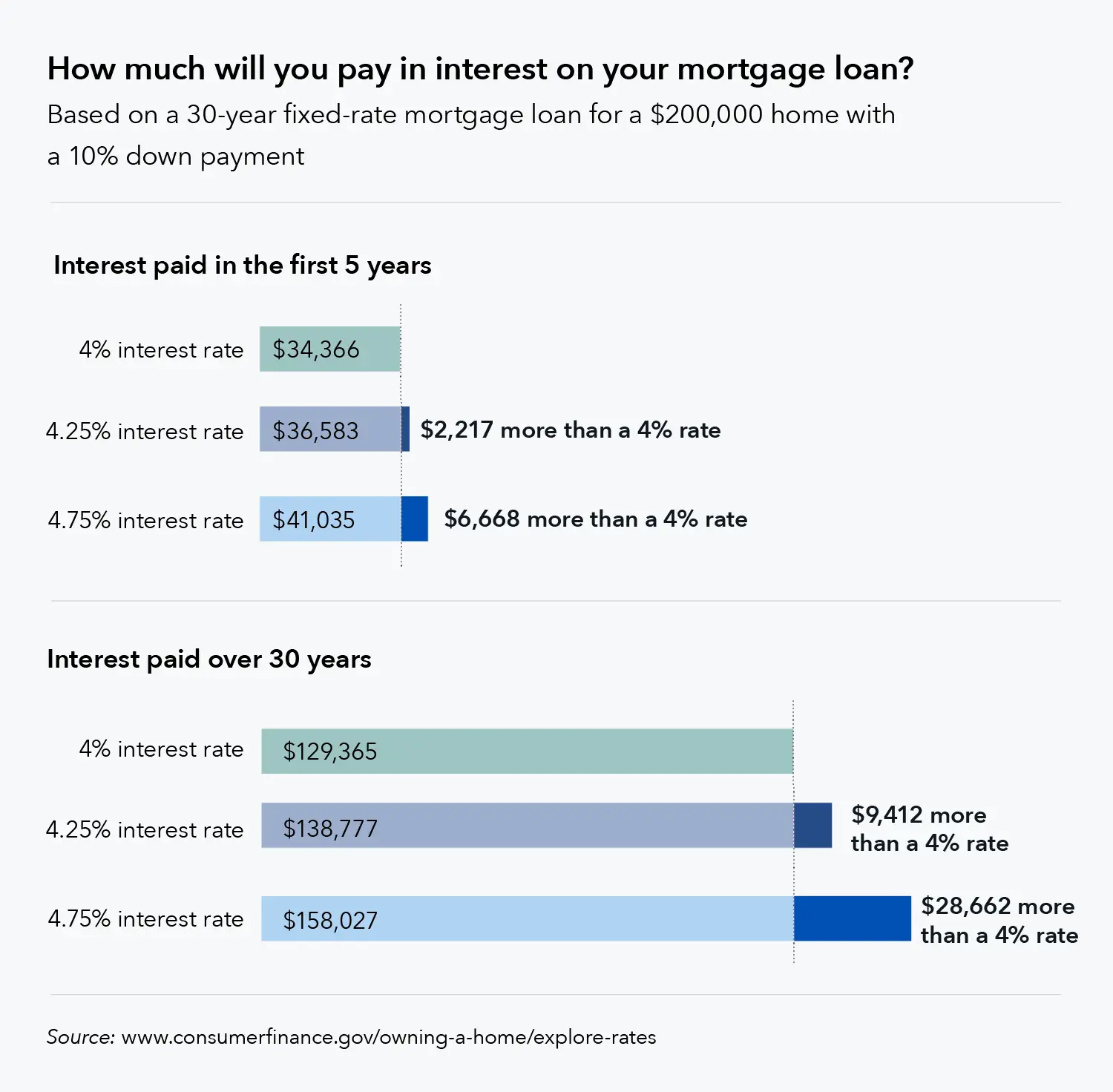

When you think about your mortgage repayments, youll probably see it as paying for your home. But actually a lot of the money goes towards paying the interest.

This is for two reasons.

One, mortgages are for large sums of money, so the interest charges, especially when you first take out a mortgage, are large. For the same interest percentage rate, larger sums of money get higher interest charges than smaller sums.

Two, mortgages last for many years, so the interest has a long time to grow.

Thats why the interest rate is so important, and why a shorter mortgage can be better. But, no matter the deal you get, lots of your money will be spent on the interest on your mortgage.

Heres an example.

The average UK house price is ££255,535 according to HM Land Registry. If you had one of the average interest rates, say 3.53% for a Standard Variable Rate , heres how your mortgage costs would work out over a 25-year mortgage.

House price: £255,535

Total amount repaid: £327,570Total paid in interest: £72,035

In these examples, the interest totals are worked out as if the interest stays the same. In real life, the interest rates on your mortgage could go up every time you remortgage so every 2, 3 or 5 years, depending on when you change. If you dont get a new mortgage, the interest rate will reset to the Standard Variable Rate. All this means that in real life, the total amount you repay on your mortgage could be tens of thousands of pounds higher.

Also Check: How To Calculate Upfront Mortgage Insurance Premium

Your Monthly Overpayment Amount

Overpayments are not affected by the base rate because they’re a separate amount you set yourself.

When you make a regular monthly overpayment, it’s just an extra amount on top of whatever your contractual monthly mortgage payment is at the time.

If your monthly mortgage payments are increasing because of the base rate change, we won’t use your overpayments to pay the difference. So, you may want to tell us to reduce your overpayments so you can put the money towards your monthly mortgage payment instead.

Make overpayments, change your regular overpayments, or manage your preferences by logging in to Mortgage Manager with your mortgage account number. You can also access Mortgage Manager through our Banking App.

When Mortgage Payments Start

The first mortgage payment is due one full month after the last day of the month in which the home purchase closed. Unlike rent, due on the first day of the month for that month, mortgage payments are paid in arrears, on the first day of the month but for the previous month.

Say a closing occurs on Jan. 25. The closing costs will include the accrued interest until the end of January. The first full mortgage payment, which is for February, is then due March 1. For example, lets assume you take an initial mortgage of $240,000 on a $300,000 purchase with a 20% down payment. Your monthly payment is $1,077.71 under a 30-year fixed-rate mortgage with a 3.5% interest rate. This calculation only includes principal and interest but does not include property taxes and insurance.

Your daily interest is $23.01. This is calculated by first multiplying the $240,000 loan by the 3.5% interest rate, then dividing by 365. If the mortgage closes on Jan. 25, you owe $161.10 for the seven days of accrued interest for the remainder of the month. The next monthly payment, the full monthly payment of $1,077.71, is due on March 1 and covers the February mortgage payment.

Read Also: How Are Mortgage Approvals Calculated

How Many Years Can You Rent Your House Out To Avoid Capital Gains Uk

When you sell your main home , you are entitled to Private Residence Relief . PRR means you wont pay Capital Gains Tax. However, as a landlord, you can also claim PRR for a rental property you decide to sell if it was ever used as your main residence.

This means you can claim PRR for the length of time you lived there, in addition to the final 9 months of property ownership, regardless of whether it was rented out during this time. As an example, if you owned a property for 10 years and lived in it for 3 years, you could claim PRR for 45 months .

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Also Check: Why Is My Mortgage So High

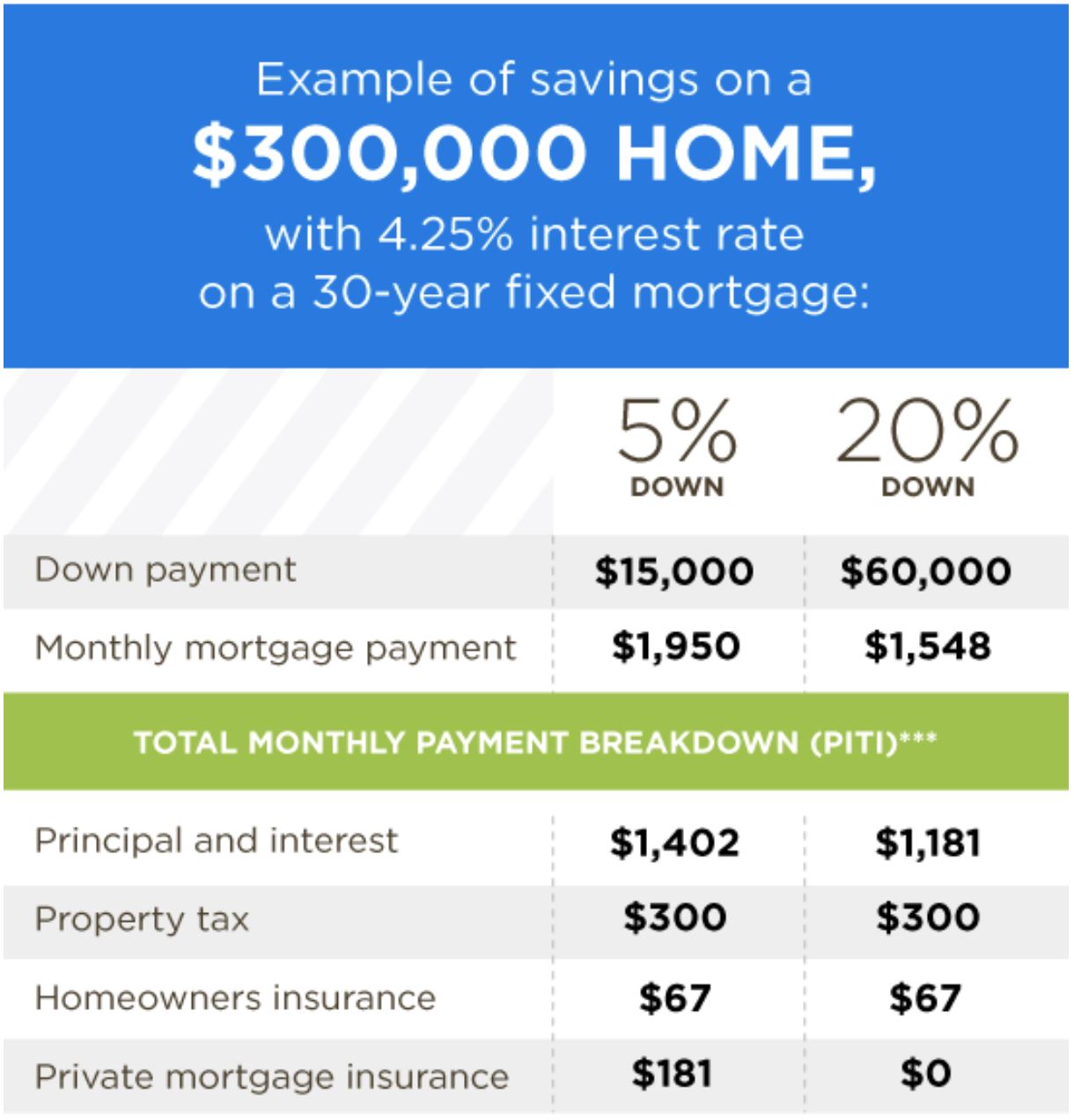

What Is The Standard Down Payment On A House

Down payment: Ask most people what is an acceptable down payment on a house, and nine times out 10 theyll tell you its 20% of a homes selling price.

So you do the math, and realize youd have to put down $50,000 on a $250,000 house! How will you ever scrounge together that much cash?

Well chin up, buckaroo. That 20% figure is common, but its not set in stone. In fact, according to the National Association of Realtor®s Profile of Home Buyers and Sellers report, in 2019, the median down payment on a house amounted to only 12% of the sales price.

Plus, thats the down payment among all home buyers, but if you look at first-time home buyers in particular, they typically make a down payment amounting to only 6% of a homes price .

Sure, there are many reasons why you should make a 20% down payment on a house, but most banks will allow you to put down lessand yes, you can put down even more if youre feeling flush.

Lets take a look at the pros and cons of making a number of different down payments on a house.

When Your Down Payment Is Over 20%

People who inherit a windfall sometimes choose to put more than 20% down, so their payments will be lower and they can avoid mortgage insurance payments. But others, with very low credit ratings, are required by the lender to put more than 20% down. According to Robert Berger in U.S. News & World Report, if your credit score is under 620, youll probably have to put more than 20% down to get a conventional loan.

You May Like: Are Closing Costs On A Reverse Mortgage Deductible

What Is A Zestimate

The Zestimate® home valuation model is Zillows estimate of a homes market value. A Zestimate incorporates public, MLS and user-submitted data into Zillows proprietary formula, also taking into account home facts, location and market trends. It is not an appraisal and cant be used in place of an appraisal.

Why Do People Need Mortgages

The price of a home is often far greater than the amount of money that most households save. As a result, mortgages allow individuals and families to purchase a home by putting down only a relatively small down payment, such as 20% of the purchase price, and obtaining a loan for the balance. The loan is then secured by the value of the property in case the borrower defaults.

Read Also: What Is A 30 Year Fixed Jumbo Mortgage Rate

What Are My Options If The Result Is Less Than I Need

In this case, you may find that adjusting the loan term enables you to meet your requirements. Although it will mean repaying more in total over the course of your loan, the lower monthly repayments could help you to afford more than your initial result suggests.

Alternatively, you can experiment with different interest rates â to get the best options delivered directly to you, click the Get the FREE Quote button to get in touch with lenders who will be able to assist you.

Which Mortgages Come With The Lowest Interest Rates

Generally, the interest rates on fixed-rate mortgages will be higher than those on offer from variable deals.

This is because you’re paying a bit more for the security of knowing what your repayments will look like every month.

The same thinking applies with longer fixed-rate deals of five years or more. The lender is taking on a bigger risk by offering these deals as rates in the wider market might rise during that time, so a longer-term fixed rate will often be higher than a shorter-term one.

Don’t Miss: How Do I Find Out Who Owns My Mortgage Loan

Years With Interest Rate Of 433% = 381018

As you can see from these calculations, the high-interest rate of 4.33% that is typical for someone with bad credit, would result in paying nearly £100,000 more over a 25-year period. Based on the 1.70% interest rate, by choosing a 30-year term rather than a 25-year term, there would be over £10,000 more interest to be paid.

Many homebuyers do not fully consider how much interest they will be paying off on a mortgage, as the interest rate seems quite small. However, a mortgage is a huge sum of money and 25 or 30 years is a long time to pay interest on a loan, which is why the interest accumulates to such a significant amount.

So, that gives you an insight into how critical it is to find the lowest mortgage rate possible and that it is often a better option to spend some time improving your credit score in order to ensure you are not paying much higher amounts of interest over the term.

Before applying for a mortgage, you should check your credit score to look for any issues that may impact the interest rates that you are eligible for. Saving up a bigger deposit and choosing a smaller loan term will also help to ensure that you are not paying as high a total amount of interest.

How Much Standard Mortgage Can I Borrow

The amount of mortgage you can borrow will be based on an affordability assessment.

There are mortgage calculators available online which can estimate how much you can borrow. However, every lender has different criteria they apply to work this out. As such the best way to accurately calculate how much you can borrow is to speak to a mortgage advisor.

The most important factors in deciding how much you can borrow are:

- Your credit profile

The above areas are essentially used to work out your household income and outgoings, inclusive of basic salary, benefits and bonuses.

Trying to ascertain affordability, can be a complex process. Taking into account household bills, along with any debts, such as credit cards and loans. With the result that you have enough money to cover monthly mortgage repayments.

A mortgage calculator can only work out your basic information and therefore can only give you an estimation. Having a mortgage broker can help you get specific personal advice.

Recommended Reading: What To Know About Getting A Mortgage

How Much Is The Average Monthly Mortgage Cost

Most residential mortgages are repayment products, and that means you pay a proportion of the capital back each month, plus the interest.

An interest-only loan is primarily used in rental property mortgages, so we will focus on repayment mortgages.

As of March 2022, Lloyds Banking Group reports that:

- The average UK monthly mortgage repayment is £759, up 2% year-on-year .

- Renting a property costs £874 on average, up 6% YoY.

- Monthly mortgage costs have increased 31% in the last ten years.

- The average first time buyer deposit is now £62,415.

While buying a home will cost an average of £759 a month, these statistics show that it remains more affordable in terms of regular, monthly, expenditure than renting. However this does not take into account equity tied up in the property or maintenance costs.

Statista compares the monthly averages between regions, although these most recent metrics refer to 2021:

| Region | Average Monthly Mortgage Cost – 2021 |

|---|---|

| Greater London | |

| £476 |

Rules Of Thumb For How Much To Spend On A Mortgage

There are many ways to use your DTI ratio to figure out how much to spend on a mortgage payment. For example, there are maximum limits in place, but it’s often a better choice to err on the conservative side so that you don’t wind up house poormeaning your mortgage payments are so big, you struggle to meet other expenses.

Only you and your financial advisor can determine what the best rule of thumb is for you. Here are the ones that people commonly use:

Recommended Reading: What Is A Bad Mortgage Rate

What Is An Origination Fee And How Much Does It Cost

In the seemingly never-ending mortgage lexicon of home buying and selling, one term in particular stands out as a source of confusion: the origination fee. What is an origination fee? Its something every homeowner needs to understand. And the good news is that its not actually that complicated.

In basic terms, an origination feesometimes referred to as a discount feeis money that a lender or bank charges a client to complete a loan transaction. An origination fee can encompass a variety of different fees added together, says , owner and broker with ABLEnding, based in California and Arizona. It can include underwriting fees, administrative fees, processing fees, discount fees , and any other fee charged by the lender and/or broker to the borrower.

How To Claim The Mortgage Interest Deduction

Youll need to take the following steps.

1. Look in your mailbox for Form 1098. Your mortgage lender sends you a Form 1098 in January or early February. It details how much you paid in mortgage interest and points during the tax year. Your lender sends a copy of that 1098 to the IRS, which will try to match it up to what you report on your tax return.

You will get a 1098 if you paid $600 or more of mortgage interest during the year to the lender. You may also be able to get year-to-date mortgage interest information from your lenders monthly bank statements.

2. Keep good records. The good news is that you may be able to deduct mortgage interest in the situations below under certain circumstances:

-

You were a co-op apartment owner.

-

You rented out part of your home.

-

The home was a timeshare.

-

Part of the house was under construction during the year.

-

You used part of the mortgage proceeds to pay down debt, invest in a business or do something unrelated to buying a house.

-

Your home was destroyed during the year.

-

You were divorced or separated and you or your ex has to pay the mortgage on a home you both own .

-

You and someone who is not your spouse were liable for and paid mortgage interest on your house

The bad news is that the rules get more complex. Check IRS Publication 936 for the details, or consult a qualified tax pro. Be sure to keep records of the square footage involved, as well as what income and expenses are attributable to certain parts of the house.

You May Like: Can My Wife Get A First Time Buyer Mortgage

Ways To Reduce Your Monthly Mortgage Repayments

We mentioned interest-only mortgages earlier, and this type of product is certainly much more affordable when comparing the monthly payments.

However, the issue is that interest-only mortgages do not include any element of the original amount borrowed. When you arrive at the end of the term, you still owe the lender the full amount and need to demonstrate how you plan to pay this back at the point of application.

Exit strategies can include selling the home or refinancing.

An interest-only mortgage might reduce your monthly mortgage payment, but is usually more expensive when you add the interest payments made over the term and the final balance payable.

A larger deposit will immediately decrease your interest rate because the lenders risk is mitigated, as they are considering a lower LTV on the property.

Options to boost your deposit value include:

- Gifted deposits or contributions from family members.

- Applying for a equity loan scheme.

- Delaying your purchase to enable you to save more.

Extending the loan term is another option, which means that the monthly repayments will drop the longer the mortgage remains active.

Some mortgage lenders offer flexibility with repayments, so you can overpay or underpay, although there may be restrictions on how often you can do so per year.

If you have this option and can overpay, you will chip away at the total interest payable and bring down your monthly cost.