Definition And Examples Of A Mortgage Forbearance Agreement

A mortgage forbearance agreement is an agreement between a mortgage lender and a delinquent borrower.

In the contract, the lender may reduce the borrower’s monthly payments or even suspend them entirely for a set period. Through a plan set by the lender, the borrower promises to get up to date on their monthly payments by the end of that timeframe. In exchange, the lender agrees not to foreclose on the home, which is its legal right in the event of a delinquent mortgage loan.

A Mortgage Agreement In Principle: Everything You Need To Know

Sometimes referred to as a decision in principle, an agreement in principle sees a lender state what they might be prepared to loan you based on specific information you supply.

Providing certain information to the lender, including details on income, will enable them to decide if you are ‘mortgageable’ and for how much.

When requesting an agreement in principle from a mortgage lender, youll need to provide:

Details on your income, including payslips or accounts if youre self-employed

Information on your debt and spending

Details on any credit agreements you have

Three years of previous addresses

What Is A Mortgage Loan Agreement

A mortgage loan agreement sets the terms of the contract between a lender and a borrower. Once signed, the agreement gives the borrower access to the money. Such an agreement also grants the lender the right to take possession of the mortgaged property if the borrower does not pay the loan’s installments.

Read Also: What Is Usda Mortgage Insurance

Examples Of Mortgage Agreement In A Sentence

-

However, notification to the holder of any security interest of account status of Member/mortgagor will be provided only upon satisfactory completion of requirements for such conditions under the Membership Mortgage Agreement.

-

The real property should be free of pledge, liens, claims or any other encumbrances with clear and registered ownership otherwise it is not considered as eligible.Conditions under which the mortgage and the restraint on alienation and encumbrance are established shall be specified in the relating Mortgage Agreement entered into between the Client as mortgagor and the Bank as mortgagee.

Can Estate Agents Use A Mortgage In Principle To Raise The Price

A propertys purchase price is only legally binding once contracts have been exchanged. This means that sellers can choose to raise their price at any time, whether theyre aware of what you can afford or not. Still, you can always haggle the price down again with the help of our home-buying tips.

Whether the maximum amount youre able to afford is visible to the estate agent depends on the type of mortgage in principle certificate youve been given.

Recommended Reading: Is Pnc Bank A Good Mortgage Lender

What If The Borrower Prepays

If a borrower makes early payments in addition to their monthly payments, they may have to pay penalties. These penalties can vary among states. People choose to prepay so that they can pay off their mortgage early or make lower interest payments.

Be sure to investigate your state and local laws to understand if there are laws prohibiting loan prepayment penalties. It may not make financial sense to make early payments or prepay your mortgage.

How Does A Mortgage Forbearance Agreement Work

A mortgage forbearance agreement is designed for homeowners who are struggling to keep up with their monthly payments. The borrower can contact the lender and discuss a forbearance agreement in which the monthly payment is reduced or suspended, depending on the borrower’s financial situation.

During that time, the lender agrees not to foreclose on the home, which would involve the lender repossessing the home and selling it to recoup the amount of the loan. A foreclosure can have a significant negative impact on the borrower’s credit score.

After the forbearance period is over, the borrower will continue to make regular monthly payments plus a lump sum or an additional monthly amount to get caught up on their loan repayment schedule. That includes both principal and interest, as well as property taxes, homeowner’s insurance, and mortgage insurance, if applicable.

For example, lets say your monthly payment is $1,000 and you get on a six-month forbearance plan. You may need to pay the $6,000 in payments you missed in a lump sum at the end of the forbearance period or over several installments as determined by your lender. For instance, you might pay $200 more per month over 30 months or $100 per month over 60 months.

Also Check: Does Mortgage Insurance Decrease Over Time

What Does A Mortgage Note Look Like

A mortgage note is a legal document that sets out all the terms of the mortgage between a borrower and their lending institution. It includes terms such as:

- The total amount of the home loan

- Whether monthly or bimonthly payments are required

- Whether the mortgage is fixed or adjustable interest rate

- If there is a prepayment penalty

It can be helpful to look at a mortgage note example like the one available on the Department of Housing and Urban Development .

Get approved to see what you can afford.

Rocket Mortgage® lets you do it all online.

Know What You Are Signing

Before receiving the full mortgage contract, you will receive a letter of commitment . It signifies that financing has been officially approved and represents a formal, binding contract between you and the lender once signed. This letter outlines the terms and conditions of the loan. It serves as the contract that initiates an official loan borrowing process.

Preapproval vs. Mortgage contract

When a lender preapproves you for a mortgage, it is not a guarantee that they will enter into a mortgage contract with you. A preapproval means the lender is interested in offering you a mortgage. A lender might choose not to offer you the mortgage after closely assessing you or the property.

Read this letter carefully since it will contain information about terms and conditions of the mortgage contract. It will also contain information about fees and charges payable by you as the borrower. Important mortgage terms could include and not limited to:

Amount of the loan

Any fees incurred in the transaction

Closing conditions

Also Check: What Is The Best Company To Refinance My Mortgage

What Is A Mortgage Note And Why Is It Important

A mortgage is a type of contract. What makes it special is that its a loan secured by real estate. A mortgage note is the document that you sign at the end of your home closing. It should accurately reflect all the terms of the agreement between the borrower and the lender or be corrected immediately if it doesnt.

Read on for more information on what a mortgage note is and how your repayment plan affects who owns it.

Can You Get More Than One Mortgage In Principle

If you receive a mortgage in principle from one lender that is below what you expected, you can seek out other lenders to try and get an improved offer.

However, before seeking out multiple potential offers, make sure youre aware which lenders will perform a hard check on your credit score, as multiple hard credit checks can damage your score.

Recommended Reading: Should I Add My Spouse To My Mortgage

Court Approves $6 Billion In Student Loan Forgiveness For 200000 Borrowers To Resolve Lawsuit

Secretary of Education Miguel Cardona testifies before a Senate Health, Education, Labor, and … Pensions Committee hearing, Thursday, Sept. 30, 2021 on Capitol Hill in Washington.

Associated Press

A federal court has approved a landmark settlement that will lead to an estimated $6 billion in student loan forgiveness for over 200,000 borrowers.

The settlement between the Biden administration and a class of student loan borrowers to resolve claims of delayed or unprocessed loan forgiveness applications is one of the most sweeping agreements to date to resolve disputed student debt. The victory for borrowers follows recent legal setbacks over other, unrelated federal student loan forgiveness initiatives.

Heres what borrowers should know.

What Is A Mortgage In Principle

A mortgage in principle also called an agreement in principle or decision in principle is a written indication from a bank or building society stating how much it might be prepared to lend you. Its not binding but its a very useful indicator of what you can probably borrow, and estate agents take them seriously.

Also Check: What Kind Of Mortgage Can I Afford

Deglobalization Is A Climate Threat

Over the last decade, China has become the worlds largest single creditor, with loans to lower- and middle-income countries tripling in this period, to $170 billion at the end of 2020. Its outstanding foreign loans now exceed 6% of global GDP, making China competitive with the International Monetary Fund as a global creditor. And through loans extended under its $838-billion Belt and Road Initiative , China has overtaken the World Bank as the worlds largest funder of infrastructure projects.

To be sure, since the start of the made-in-China COVID-19 pandemic, Chinas overseas lending for infrastructure projects has been on the decline . This is partly because the pandemic left partner countries in dire economic straits, though growing international criticism of Chinas predatory lending has likely also contributed.

One might hope that this downward trend augurs the end of colonial-style lending by China. But the decline has been offset by an increase in bailout lending, mostly to BRI partner countries including Kenya which were already weighed down by debts owed to China.

The scale of the bailout lending is massive. The top three borrowers alone Argentina, Pakistan, and Sri Lanka have received $32.8 billion in rescue lending from China since 2017. Pakistan has been the biggest borrower by far, receiving a staggering $21.9 billion in Chinese emergency lending since 2018.

How Mortgages Work

Individuals and businesses use mortgages to buy real estate without paying the entire purchase price up front. The borrower repays the loan plus interest over a specified number of years until they own the property free and clear. Most traditional mortgages are fully-amortizing. This means that the regular payment amount will stay the same, but different proportions of principal vs. interest will be paid over the life of the loan with each payment. Typical mortgage terms are for 30 or 15 years.

Mortgages are also known as liens against property or claims on property. If the borrower stops paying the mortgage, the lender can foreclose on the property.

For example, a residential homebuyer pledges their house to their lender, which then has a claim on the property. This ensures the lenders interest in the property should the buyer default on their financial obligation. In the case of a foreclosure, the lender may evict the residents, sell the property, and use the money from the sale to pay off the mortgage debt.

Also Check: What Is The Typical Closing Costs For A Mortgage

How We Make Money

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

At Bankrate we strive to help you make smarter financial decisions. While we adhere to stricteditorial integrity,this post may contain references to products from our partners. Here’s an explanation for how we make money

Length Of The Contract

The life of a loan agreement is usually dependent on what is known as an amortization schedule , which determines a borrower’s monthly payments. The amortization schedule works by dividing the amount of money being loaned by the number of payments that would need to be made for the loan to be paid back in full. After that, interest is added to each monthly payment. Though each monthly payment is the same, a majority of the payments made early in the schedule go toward interest, while most of the payment goes toward the principal later in the schedule.

Unless there are early repayment penalties associated with the loan, it’s typically in a borrower’s best interest to pay back the loan as quickly as possible because it reduces the amount of interest owed.

Read Also: How To Refinance A Mortgage For Home Improvements

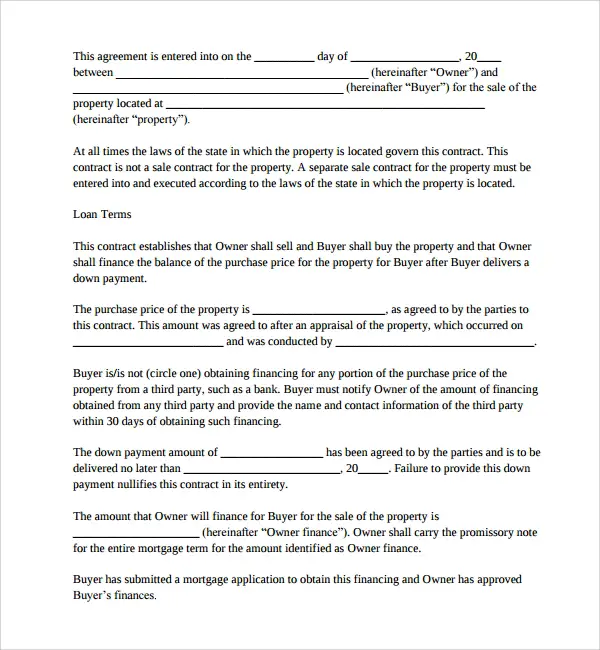

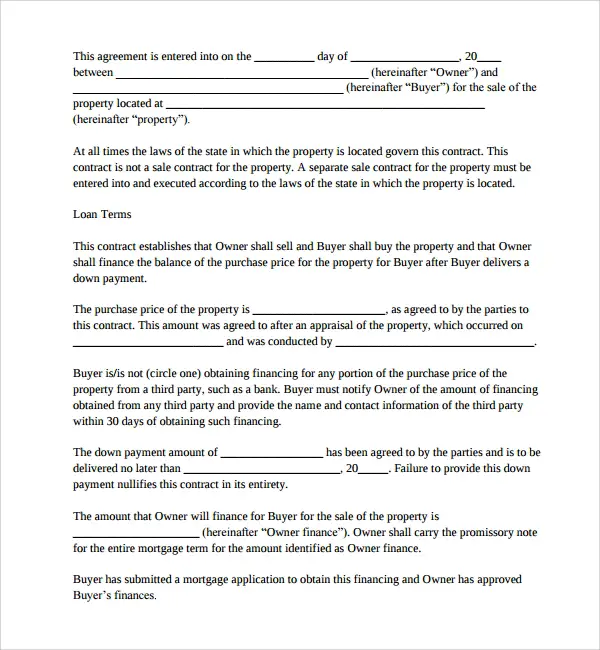

Securing The Loan And Dealing With A Violation

You have the option of requiring collateral in exchange for your loan. If you wish to do this, then you need to make sure you include sections that address this. For collateral, if you are requiring it to secure the loan, you will need to have a specific section. Collateral would be an asset that is used as a guarantee of repayment. Examples of assets that can be used include real estate, vehicles, or other valuable goods. If you are requiring collateral, you will need to identify all collateral that is needed to secure the agreement. Another section you need for this is one regarding the security agreement. If you are not requiring collateral, then you can omit this from your loan agreement.

Loan Agreements: Everything You Need To Know

A loan agreement is a very complex document that can protect the two parties involved. In most cases the lender creates the loan agreement, which means the burden of including all of the terms for the agreement falls on the lending party. Unless you have created loan agreements before, you will likely want to make sure that you completely understand all of the components so you do not leave out anything that can protect you during the lifetime of the loan. This guide can help you create a solid loan agreement and understand more about the mechanics behind it.

Recommended Reading: What Is A Point For Mortgage

How Are Interest Rates Set By Lenders

Interest rates are the charges for the mortgage youre seeking. Mortgage rates are determined by analyzing a wide variety of factors, some of which have nothing to do with either the lender or the borrower.

Theinterest rate is determined by two factors: current market rates and the level of risk the lender takes to lend you money. You cant control current market rates, but you can have some control over how the lender views you as a borrower. The higher your credit score and the fewer red flags you have on your credit report, the more youll look like a responsible borrower. In the same sense, the lower your debt-to-income ratio , the more money youll have available to make your mortgage payment. These all show the lender that you are less of a risk, which will benefit you by lowering your interest rate.

If youre shopping around Freddie Macs research shows that soliciting even one additional offer can save borrowers $1500 on average youll want to get the best rate possible for your mortgage. But lenders sometimes offer very low rates but charge a number of fees. To meaningfully compare mortgage offers, youll need to look at their annual percentage rate .

The amount of money you can borrow will depend on what you can reasonably afford and, most importantly, the fair market value of the home, determined through an appraisal. This is important because the lender cannot lend an amount higher than the appraised value of the home.

Why Apply For A Mortgage In Principle

You may be wondering why you might go for a mortgage in principle first, rather than just go ahead and apply for an actual mortgage. The simple answer is that its quicker and less effort to get a mortgage in principle. You can often get one sorted in under an hour if there are no hitches, and at most it should take only a few days. This frees you up to go house-hunting in earnest, putting you in a position to make a firm offer on a home you like the look of.

Also Check: What Do You Need To Get A Second Mortgage

The Specific Loan Details

Once you have the information about the people involved in the loan agreement, you will need to outline the specifics surrounding the loan including the transaction information, payment information, and interest information. In the transaction section, you will detail the exact amount that will be owed to the lender once the agreement has been executed. The amount will not include any interest that will accrue during the lifetime of the loan. You will also detail what the borrower is getting in return for this sum of money that they are promising to pay to the lender. In the payment section, you will detail how the loan amount will be repaid, the frequency of the payments , and information on the acceptable payment methods . You will need to include exactly what you will accept as a form of payment so there is no question on the forms of payment allowed.

What Does An Aip Mean

AiP stands for agreement in principle for a mortgage. Some lenders call it a mortgage in principle. Its an indication that we could lend a specified amount, based on details youve provided about your income, spending and debts. If you decide to apply for a mortgage, well ask you more detailed questions about your finances to see how much you can borrow from us. Then, with your consent, well check your full credit history with credit reference agencies.

Recommended Reading: Do Mortgage Lenders Verify Tax Returns