How Much Do I Need To Earn For A 100000 250000 Or 500000 Mortgage

Our calculator shows that for a £100,000 mortgage you will need to earn at least £22,500 as a single applicant or between you if youre applying for a joint mortgage. Bear in mind that a £100,000 mortgage can result in different LTVs and therefore different rates, depending on the amount of deposit you have and the overall value of the property.

For a £250,000 mortgage you will need to earn at least £56,000 as a single applicant or between you if applying as a couple, while for a £500,000 mortgage you will need a earn at least £111,500 as a single applicant or as joint income for a shared mortgage.

The Interest Rate On Your Home Loan

When you get a mortgage through a lender, you’ll pay interest on that loan.

Interest rates fluctuate every day, and the rate you qualify for will depend on a number of factors including timing, your credit score, and your debt-to-income ratio.

As of today, rates for a 30-year fixed mortgage are 5.46000%.

Whatâs the difference between an interest rate and APR?

An annual percentage rate includes the extra fees you will need to get the loan, such as broker fees, discounts, and closing costs. The interest rate, on the other hand, only refers tothe interest on the loan.

Because it includes the extra fees, an APR will almost always be higher than the interest rate.

» MORE: What is the mortgage interest rate?

Loan To Value And The Size Of Your Deposit

All mortgages require some form of deposit, but they are not directly linked to how much you could borrow. The loan to value or LTV of your mortgage, means how much the mortgage is in relation to the value of the property. So, if you have a £50,000 deposit for a £200,000 property, the mortgage you need would be £150,000 75% of the property’s worth, or 75% loan-to-value.

Don’t Miss: How Quickly Can You Get Pre Approved For A Mortgage

Summary Of Moneys Guide To Home Affordability

How much house you can afford depends mainly on two factors: your eligibility for a mortgage loan and your actual budget when it comes to paying a monthly bill, along with taxes and insurance. Remember these steps when youre getting ready to make your home purchase:

- Calculate your monthly debt and compare it to your gross income to get an idea of your DTI.

- Take into account other monthly expenses such as utilities and groceries.

- Save up for a down payment.

- Consider all your loan options, such as FHA and VA loans.

- Use a mortgage calculator to avoid any surprises.

How Much Would A 30 Year Mortgage Be On 200 000

On a $200,000, 30-year mortgage with a 4% fixed interest rate, your monthly payment would come out to $954.83 not including taxes or insurance. Monthly payments for a $200,000 mortgage.

| Interest rate |

|---|

| $1,073.64 |

Jan 4, 2022

How much mortgage can I get with a 650 credit score? With a credit score of 650, your mortgage interest rate would be approximately 3.805%, which would cost you about $203,541 in interest on a $300,000, 30-year loan. If you could increase your credit score by even 30 points, you stand to save over $25,000.

How much income do you need to buy a $800000 house?

For homes in the $800,000 range, which is in the medium-high range for most housing markets, DollarTimess calculator recommends buyers bring in $119,371 before tax, assuming a 30-year loan with a 3.25% interest rate. The monthly mortgage payment is estimated at $2,785.

What house can I buy with 90k salary? I make $90,000 a year. How much house can I afford? You can afford a $306,000 house.

Don’t Miss: Does Prequalifying For A Mortgage Hurt Your Credit

Increase Your Down Payment

If you have the cash, you may want to up your down payment to 10 or 20 percent. A down payment raises your maximum home price, which may be enough to buy a home that you want.

If you dont have the cash, keep in mind that you can ask relatives for gift money.

You can also apply for homebuyer assistance programs from state and local government programs that provide down payment and closing cost funds. Your eligibility for these programs may vary based on your personal finances.

How Much House Can I Afford 70k Salary

How much should you be spending on a mortgage? According to Brown, you should spend between 28% to 36% of your take-home income on your housing payment. If you make $70,000 a year, your monthly take-home pay, including tax deductions, will be approximately $4,328.

What mortgage can I afford on 75k salary?

I make $75,000 a year. How much house can I afford? You can afford a $255,000 house.

What house can you afford with 40k salary? 5. The Dave Ramsey Mortgage

| Gross Income | |

|---|---|

| $3,750 | $937 |

Is 50k a year middle class? Statisticians say middle class is a household income between $25,000 and $100,000 a year. Anything above $100,000 is deemed upper middle class.

Don’t Miss: Can I Get A Mortgage On A Foreclosed Home

How Much Mortgage Can I Get If I Earn 30000 A Year

If you were to use the 28% rule, you could afford a monthly mortgage payment of $700 a month on a yearly income of $30,000. Another guideline to follow is your home should cost no more than 2.5 to 3 times your yearly salary, which means if you make $30,000 a year, your maximum budget should be $90,000.

Bottom Line: Home Affordability Begins With These Key Factors

Dont let rising home prices automatically scare you away. Being able to purchase a property starts with these questions:

Do you pay your bills on time? A history of no late payments will make you look good in the eyes of any lender. Theyll know that they can expect to receive your mortgage payment each month when its due.

Do you have proof of steady income? If you have a steady job that deposits a similar amount into your checking account every two weeks, youre in good shape. Lenders will evaluate your bank accounts, review recent pay stubs and look at your tax forms. If youre self-employed or earn irregular income, youll need to show even more evidence of your earnings likely the past two years of tax returns.

Do you have a low debt-to-income ratio? If youre earning a lot more money than youre paying back for other debt, youre in a good position.

Whats the best mortgage rate you can get? The lower your rate, the more youll save on interest payments. The good news: If you answered yes to the previous three questions, youll likely qualify for the lowest rates a lender can offer.

You May Like: What Do I Need To Know About Refinancing My Mortgage

Can I Buy A Home On $60000 A Year

Yes! You can most definitely buy a house on $60,000 a year. There are so many ways to buy a house so nothing should be stopping you, even the current housing prices. I would recommend not spending more than one-third of your monthly income on housing expenses, which in this case would be $1400.

There is an assortment of loan products currently available to people looking to buy a house. Using an FHA loan for example you can put down as low as 3.5% of the purchase price. Plus there are strategies like house hacking that can help bring your housing costs down, and some people can make a profit!

Recommended Reading: Overview of Real Estate Investing

Ugh This Is Making My Head Hurt

Yup. Mortgages arent fun. Still, a house is one of, if not the, most expensive thing youll ever spend money on so its best to give it a ton of consideration. Being saddled with an unruly mortgage will affect you for years and years. To that end, the more thought you give it now, the less worry youll have later. So remember, the question isnt just How much mortgage can I afford? but How much mortgage do I want? for the long term.

More from SmartAsset

You May Like: Does Applying For Mortgage Hurt Credit

How Much Rent Can I Afford On A $60000 Salary

If you are making $60k a year, you will be making around $4,250 a month after taxes. Most people, me included, recommend spending no more than one-third of your income on housing. That would mean that you can afford $4,250 / 3 = $1,400.

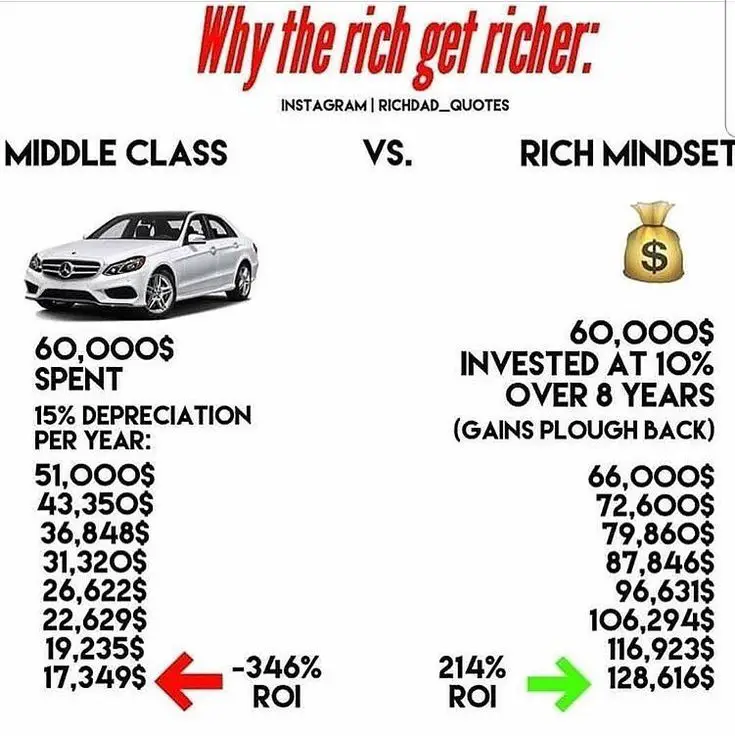

Personally, if your life circumstances allow it and you are comfortable with it I would look into buying over renting. Now I know that all the digital nomads and the majority of the Financial Independence community will squawk at this. However, Real Estate is a solid investment strategy that has stood the test of time. According to Andrew Carnegie, Ninety percent of all millionaires became so through owning real estate. More money has been made in real estate than in all industrial investments combined.

I also know that your primary residence shouldnt count as an investment, but owning one home makes it much easier to buy another and another and another.

Have A Question About Our Mortgage Calculators

What is a mortgage calculator?

Its a tool that gives you an estimate of how much you could borrow from us or what your monthly repayments and other costs might be, for a mortgage in the UK.

We have different calculators that can help you in different ways each calculator does something slightly different.

Who is a mortgage calculator for?

Its for you if youre a first time buyer, youre looking to remortgage, move or buy an additional home, or youre a buy-to-let landlord.

What information do I need to use a calculator and how do you decide what I can afford?

When you apply for a mortgage or use our calculator, well ask you for information like

- How many people are applying

- How much you regularly spend on things like your credit or store cards, loans, overdrafts, maintenance and pension

- Why youre applying for example, buying your first home, moving home, or buying a second home

We wont ask about groceries, utility bills or travel.

How much can I afford to borrow?

Our calculators give you a idea of what you might be able to borrow from us to buy a home, and what your monthly and total mortgage payments could be, for different types of mortgages.

Which mortgage calculator is right for me?

The most popular place to start is our borrowing calculator or our affordability calculator.

Recommended Reading: How To Qualify For More Money For A Mortgage

How Do Lenders Decide How Much I Can Borrow

Your salary will have a big impact on the amount you can borrow for a mortgage.

Usually, banks and building societies will offer up to four-and-a-half times the annual income of you and anyone you are buying with. This means if you’re buying alone and earn £30,000 a year, you could be offered up to £135,000.

There are exceptions to this, however. Some banks offer bigger home loans to borrowers who have higher earnings, bigger deposits, or work in specific professions. If you qualify, you may be able to borrow up to five-and-a-half times your income.

Qualifying For A Mortgage With A $60k Income

Lets imagine a family of three, the Smiths, with a total annual household income of $60,000. Their combined income will help them qualify for a mortgage.

-

Terry works in a department store and makes $25,000/year.

To keep matters simple, lets assume the Smiths have no other regular sources of income such as investment income or commissions. They are W2 employees receiving paychecks on a bimonthly basis.

Also Check: How To Go About Getting A Mortgage

What Is Property Tax

As a homeowner, youll pay property tax either twice a year or as part of your monthly home payment. This tax is a percentage of a homes assessed value and varies by area. For example, a $500,000 home in San Francisco, taxed at a rate of 1.159%, translates to a payment of $5,795 annually.Its important to consider taxes when deciding how much house you can afford. When you buy a home, you will typically have to pay some property tax back to the seller, as part of closing costs. Because property tax is calculated on the homes assessed value, the amount typically can change drastically once a home is sold, depending on how much the value of the home has increased or decreased.

A Higher Credit Score Could Increase What You Can Borrow

Your has a big part to play in how much you can borrow. In the most extreme cases a low credit score could prevent a mortgage lender from even considering you or, more likely, a low score could mean that the lender uses a lower multiple of your income to decide how much you can borrow.

Thats why youll want to make sure your credit score is up to scratch before you even consider applying for anything. Our guide on improving your credit rating will be able to help you with this.

Don’t Miss: What Is A Second Lien Mortgage

What Are The Income Requirements For Refinancing A Mortgage

Mortgage refinancing options are reserved for qualified borrowers, just like new mortgages. As an existing homeowner, youll need to prove your steady income, have good credit, and be able to prove at least 20 percent equity in your home.

Just like borrowers must prove creditworthiness to initially qualify for a mortgage loan approval, borrowers have to do the same for mortgage refinancing.

$60000 A Year Is How Much Biweekly

If you get paid on a biweekly schedule you will have roughly 26 pay periods throughout the year. That means the following equation will help you determine how much $60,000 a year is biweekly.

$60,000 / 26 = $2307.69

If you are not liable for any taxes your biweekly paycheck would be $2307.69. However, if you are liable for taxes like the rest of us your check will most likely be $1,807 – $1,961 like we calculated above.

Recommended Reading: How To Find A Cosigner For A Mortgage

Most Affordable Markets For Homebuyers

According to 2020 data fromZillow Research, record low mortgage rates have helped to boost affordability for potential homeowners. The table below shows the top 10 most affordable markets to live in for December 2020 and is based on a typical home value of no more than $300,000 . The market and share of income spent on a mortgage may fluctuate based on the current mortgage rate, the typical local homeowner’s income and the typical local home value.

Should I Speak To A Mortgage Broker

Mortgage brokers remove a lot of the paperwork and hassle of getting a mortgage, as well as helping you access exclusive products and rates that arent available to the public. Mortgage brokers are regulated by the Financial Conduct Authority and are required to pass specific qualifications before they can give you advice.

Call or request a callback

Mortgage Advice Bureau offers fee free mortgage advice for Moneyfacts visitors that call on 0808 149 9177. If you contact Mortgage Advice Bureau outside of these channels you may incur a fee of up to 1%. Lines are open Monday to Friday 8am to 8pm and Saturday 9am to 1pm excluding bank holidays. Calls may be recorded.

Your home may be repossessed if you do not keep up repayments on your mortgage.

You May Like: What Is The Current National Mortgage Interest Rate

How To Make Extra Money With Side Hustles Along With Your $60k Job

There are many side-hustles you can try to earn a passive income along with your full-time $60k salaried job. Start influencer marketing, sell homemade art or food, invest in bonds, rent out your extra space, etc. You can also get involved in various referral marketing programs and start earning cash, discounts, and free products. For example, Yottleds referral program pays $40 to $1,000 for each referral and anybody can be part of it without any investment or commitment.

How Much Should I Spend On A House

Anaffordability calculatoris a great first step to determine how much house you can afford, but ultimately you have the final say in what youre comfortable spending on your next home. When deciding how much to spend on a house, take into consideration your monthly spending habits and personal savings goals. You want to have some cash reserved in your savings account after purchasing a home. Typically, a cash reserve should include three months worth of house payments and enough money to cover other monthly debts. Here are some questions you can ask yourself to start planning out your housing budget:

Don’t Miss: What Is The Monthly Payment On A 400 000 Mortgage

How Much Can I Borrow For A Mortgage Based On My Income

Lenders need to show that the mortgage is affordable and that you could continue to pay your mortgage should there be a rise in interest rates, or you have a significant change in circumstances such as losing your job or having a child.

Lenders also have regulatory restrictions that limit their new lending above 4.5x salary to a maximum of 15% of all new mortgage loans. This means lenders can be very specific in deciding exactly which borrowers they want for these mortgage deals.

To find out more take a look at our What are mortgage affordability checks guide.